Professional Documents

Culture Documents

Comedero RL Prelim Assignment 2

Comedero RL Prelim Assignment 2

Uploaded by

qrlmcomederoOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Comedero RL Prelim Assignment 2

Comedero RL Prelim Assignment 2

Uploaded by

qrlmcomederoCopyright:

Available Formats

Assignment # 2 PRELIM

AR 542 – ARCH52S3

COMEDERO, RACHELLE LUZ M.

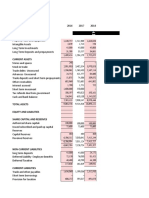

Profit-Loss Statement Current Year-to-

Budget

Revenue Month Date

Fees billed (excl. markup) 93,599 1,422,220 1,113,654

Reimbursable Billed (incl. markup) 13,248 201,309 164,981

Miscellaneous Revenue 613 7,465 0

Direct Expenses

Direct Labor Salary Expense 557 135,529 174,176

Direct Labor Benefits 7,950 96,760 95,000

Direct Labor Professional/Technical Staff 9,995 125,022 126,834

Direct Labor Admin Staff 724 9,988 10,920

Total Salary Expense 2,100 28,000 30,000

Total Direct Expenses 20,826 295,299 336,930

Indirect Expenses

Advertising/Labor Risk Insurance 7,590 93,240 95,000

Admin (excl. Accrued Bonus) 2,740 31,623 29,811

Office Lease 3,325 39,900 39,900

Office Expense 2,120 26,495 30,000

Professional Business Consultants 1,000 10,891 12,736

Local Property/Franchise Tax 0 9,940 9,940

Depreciation/Amortization 6,372 7,987 7,987

Marketing/Business Development 974 19,679 21,524

Total Indirect Expenses 24,121 237,755 257,898

Gross Profit 83,339 947,346 1,075,251

Operating Expenses

Administrative Accrued Bonus 250 3,000 4,000

Temporary Accrued Bonus 0 0 0

Principal: Paid Bonus & Draws 150,000 (110,000) (140,000)

Professional/Technical: Paid Bonus 9,500 (15,000) (20,000)

Administrative Paid Bonus (1,500) 13,000 10,481

Temporary: Paid Bonus (500) 0 0

Provision for Income Tax*** 0 (1,054) (1,525)

Current Earnings (G-H) 5,975 8,650 10,455

Total Operating Expenses 164,725 (94,394) (114,446)

Net Profit/Loss Before Tax -81,386 852,952 960,805

You might also like

- Lady Case Exhibit SBR 1Document7 pagesLady Case Exhibit SBR 1Kanchan GuptaNo ratings yet

- P and L PDFDocument2 pagesP and L PDFjigar jainNo ratings yet

- 2003 Annual ReportDocument19 pages2003 Annual ReportThe Aspen InstituteNo ratings yet

- Tire City-Spread SheetDocument6 pagesTire City-Spread SheetVibhusha SinghNo ratings yet

- Assignment 2 BMDocument1 pageAssignment 2 BMqrlmcomederoNo ratings yet

- UploadDocument83 pagesUploadAli BMSNo ratings yet

- IndusDocument5 pagesIndusFateen HabibNo ratings yet

- WAPO 2019 Final Draft XXXDocument229 pagesWAPO 2019 Final Draft XXXRenatus shijaNo ratings yet

- Assignment FSADocument15 pagesAssignment FSAJaveria KhanNo ratings yet

- UNVR Forecasting and Valuation 091121-TemplateDocument31 pagesUNVR Forecasting and Valuation 091121-TemplateSyskiaNo ratings yet

- Trial BalanceDocument9 pagesTrial BalanceoluwafunmilolaabiolaNo ratings yet

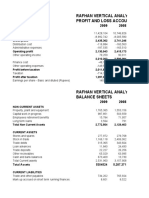

- Rafhan Vertical Analysis Profit and Loss Accounts: Total Assets 5304524 5,287,371Document30 pagesRafhan Vertical Analysis Profit and Loss Accounts: Total Assets 5304524 5,287,371usmanazizbhattiNo ratings yet

- Financial Statements and Ratios Flashcards QuizletDocument14 pagesFinancial Statements and Ratios Flashcards QuizletDanish HameedNo ratings yet

- National Foods Balance Sheet: 2013 2014 Assets Non-Current AssetsDocument8 pagesNational Foods Balance Sheet: 2013 2014 Assets Non-Current Assetsbakhoo12No ratings yet

- Activity ExcelDocument1 pageActivity ExcelJoshua GuinauliNo ratings yet

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Document5 pagesStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderNo ratings yet

- Sir Sarwar AFSDocument41 pagesSir Sarwar AFSawaischeemaNo ratings yet

- Answer To The Question No 1 (I) ACI Group of Company Balance Sheet (Vertical Analysis) For The Years Ended June 30, 2019Document4 pagesAnswer To The Question No 1 (I) ACI Group of Company Balance Sheet (Vertical Analysis) For The Years Ended June 30, 2019Estiyak JahanNo ratings yet

- Unaudited FS - 2nd QuarterDocument37 pagesUnaudited FS - 2nd Quarterprasenjitpandit4No ratings yet

- Horizontal AnalysisDocument1 pageHorizontal AnalysisnazreenNo ratings yet

- Sonali Bank Balancesheet 2019Document9 pagesSonali Bank Balancesheet 2019DHAKA COLLEGENo ratings yet

- Rafhan Maize Products Company LTDDocument10 pagesRafhan Maize Products Company LTDALI SHER HaidriNo ratings yet

- XLS EngDocument5 pagesXLS EngBharat KoiralaNo ratings yet

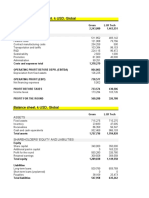

- Profit and Loss Statement, K INR, Global: Green RedDocument134 pagesProfit and Loss Statement, K INR, Global: Green Redraveendiran kanagarajanNo ratings yet

- Financial Analysis DataSheet KECDocument22 pagesFinancial Analysis DataSheet KECSuraj DasNo ratings yet

- Results r01Document48 pagesResults r01Âu Vân anhNo ratings yet

- United Commercial Bank LTD: For The Year Ended 31st December 2005Document1 pageUnited Commercial Bank LTD: For The Year Ended 31st December 2005nurul000No ratings yet

- F9 Sample ReportsDocument31 pagesF9 Sample ReportsAla K ObeigNo ratings yet

- Consolicated PL AccountDocument1 pageConsolicated PL AccountDarshan KumarNo ratings yet

- XLS EngDocument10 pagesXLS EngLIMANo ratings yet

- SSS Income StatementDocument16 pagesSSS Income StatementAriel DimalantaNo ratings yet

- Submitted By: Name: R.Akash PRN: 16020841177 Finance 2016-18 Submitted To: Prof. Pooja GuptaDocument44 pagesSubmitted By: Name: R.Akash PRN: 16020841177 Finance 2016-18 Submitted To: Prof. Pooja Guptaranjana kashyapNo ratings yet

- File 2 - Income Statement (Step 12)Document1 pageFile 2 - Income Statement (Step 12)Harold Ken de JesusNo ratings yet

- 1.0 Financial Plan: 1.1. 5-Year Profit & Loss ProjectionDocument3 pages1.0 Financial Plan: 1.1. 5-Year Profit & Loss ProjectionHana AlisaNo ratings yet

- Cash Flow Statements of GE T - D India LTD - March 2020Document1 pageCash Flow Statements of GE T - D India LTD - March 2020khurshida.hodavasiNo ratings yet

- Telchi Litel Ltda Eeff 2021Document3 pagesTelchi Litel Ltda Eeff 2021Info Riskma SolutionsNo ratings yet

- Business Valuation Cia 1 Component 1Document7 pagesBusiness Valuation Cia 1 Component 1Tanushree LamareNo ratings yet

- Presentation Group F Update T6Document21 pagesPresentation Group F Update T6Phạm Hồng SơnNo ratings yet

- 5 Cs of Credit - Caskey Trucking FinancialsDocument5 pages5 Cs of Credit - Caskey Trucking FinancialsHazem ElsherifNo ratings yet

- Attock Cement 3 Statement ModelDocument67 pagesAttock Cement 3 Statement ModelRabia HashimNo ratings yet

- Income Statement FINALDocument2 pagesIncome Statement FINALLenard TaberdoNo ratings yet

- Test and Exam Qs Topic 2 QuestionsDocument15 pagesTest and Exam Qs Topic 2 QuestionsAsadvirkNo ratings yet

- Analisa Eva Wacc SsmsDocument11 pagesAnalisa Eva Wacc SsmsAnggih Nur HamidahNo ratings yet

- Financial Statement ACIFL 31 March 2015 ConsolidatedDocument16 pagesFinancial Statement ACIFL 31 March 2015 ConsolidatedNurhan JaigirdarNo ratings yet

- Company Info - Print Financials2Document2 pagesCompany Info - Print Financials2rojaNo ratings yet

- DG Cement Financial DataDocument4 pagesDG Cement Financial DataMuneeb AhmedNo ratings yet

- PERIOD COVERED: As of August 31,: Statement of Allotment/ Obligation and BalancesDocument2 pagesPERIOD COVERED: As of August 31,: Statement of Allotment/ Obligation and Balancestesdaro12No ratings yet

- Annual Report - PadiniDocument23 pagesAnnual Report - PadiniCheng Chung leeNo ratings yet

- Asian Paints PLDocument2 pagesAsian Paints PLPriyalNo ratings yet

- HCL Technologies: PrintDocument2 pagesHCL Technologies: PrintSachin SinghNo ratings yet

- Income Statement of Mahaweli Reach HotelDocument7 pagesIncome Statement of Mahaweli Reach Hotelदेवीना गिरीNo ratings yet

- Beximco PHARMACEUTICALS LTD ISDocument2 pagesBeximco PHARMACEUTICALS LTD ISSuny ChowdhuryNo ratings yet

- DU Pont AnalysisDocument9 pagesDU Pont Analysisshani2010No ratings yet

- 2016 Management AccountsDocument6 pages2016 Management AccountsJcaldas AponteNo ratings yet

- Thế Giới Di Động 2022Document16 pagesThế Giới Di Động 2022Phạm Thu HằngNo ratings yet

- FMOD PROJECT Ouijhggfffe5Document97 pagesFMOD PROJECT Ouijhggfffe5Omer CrestianiNo ratings yet

- FIN 440 Group Task 1Document104 pagesFIN 440 Group Task 1দিপ্ত বসুNo ratings yet

- Renata Limited - Conso Accounts 2013Document139 pagesRenata Limited - Conso Accounts 2013kakoli akterNo ratings yet

- 20.20 Financial AdvisersDocument4 pages20.20 Financial AdvisersNathaniel SummersNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet