Professional Documents

Culture Documents

Arrow Accounting Services

Arrow Accounting Services

Uploaded by

Trisha Mae CorpuzOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Arrow Accounting Services

Arrow Accounting Services

Uploaded by

Trisha Mae CorpuzCopyright:

Available Formats

General Journal Page 1

Dec. 1 Cash 101 16,000

Common Stock, $1 Par Value 301 100

Paid in Capital in Excess of Par Value - Common 302 15,900

To record the issuance of 100 shares of stock for

cash.

Cash is increased (debit) by the issue price. The journal entry would also include a credit to both Common Stock

(increased) and Paid-In Capital in Excess of Par--Common Stock (increased). For example, 1,000 shares of $5 par

value stock issued for $8 per share, the journal entry would be; Debit Cash $8,000 (1,000 shares x $8); Credit Common

Stock $5,000 (1,000 shares x $5); and Credit Paid-In Capital in Excess of Par--Common Stock $3,000 ($8,000-$5,000).

Accounts Receivable 111 2,000

Equipment 141 15,000

Cash 101 100

Common Stock, $1 Par Value 301 100

H. Fowl, Capital 17,000

2 Supplies 121 1,500

Cash 101 1,500

to record purchase of supplies.

7 Cash 101 55,800

Accounts Receivable 111 745

Fees Income 401 56,545

To record services rendered for cash and on

account.

9 Prepaid Insurance 134 3,600

Cash 101 3,600

To record payment of insurance in advance.

11 Cash 101 395

Accounts Receivable 111 395

To record collection of accounts.

12 Advertising Expense 529 395

Cash 101 395

To record payment of local radio advertising.

13 Cash 101 500

Accounts Receivable 111 500

To record collection of accounts.

14 Cash 101 40

Supplies 121 40

To record damaged supplies returned.

15 Cash 101 8,500

Accounts Receivable 111 400

Fees Income 401 8,900

To record services rendered for cash and on

account.

18 Supplies 121 800

Accounts Payable 202 800

General Journal Page 2

To record supplies purchased on account.

19 Cash 101 3,890

Accounts Receivable 111 2,560

Fees Income 401 6,450

To record services rendered for cash and on

account.

20 Cash 101 750

Accounts Receivable 111 750

To record collection of accounts.

21 Maintenance Expense 535 1,275

Cash 101 1,275

To record payment of maintenance for office

equipment.

22 Advertising Expense 529 150

Cash 101 150

To record payment of advertisements in the local

newspapers.

23 Telephone Expense 532 215

Cash 101 215

To record payment of monthly telephone bill.

Cash 101 1,560

Accounts Receivable 111 1,560

To record collection of accounts.

26 Accounts Receivable 111 500

Fees Income 401 500

To record services rendered on account.

28 Utilities Expense 514 235

Cash 101 235

To record payment of utilities for cash.

29 Cash 101 5,890

Accounts Receivable 111 675

Fees Income 401 6,565

To record services rendered for cash and on

account.

30 Salaries Expense 511 5,400

Cash 101 5,400

To record payment of monthly salaries.

31 Maintenance Expense 535 415

Cash 101 415

To record payment for cleaning services.

Equipment 141 6,000

Cash 101 1,250

General Journal Page 3

Accounts Payable 202 4,750

To record purchased of equipment for cash and on

account.

Cash 101 2,500

Customer Deposits 211 2,500

To record advance payment received for tax work.

Cash 101 545

Accounts Receivable 111 325

Fees Income 401 870

To record services rendered for cash and on

account.

101 Cash

Dec. 1 16,000 1,500 Dec. 2

100 3,600 9

7 55,800 395 12

11 395 1,275 21

13 500 150 22

14 40 215 23

15 8,500 235 28

19 3,890 5,400 30

20 750 415 31

23 1,560 1,250

29 5,890

31 2,500

545

Bal. 82,035

111 Accounts Receivable

Dec. 1 2,000 395 Dec. 11

7 745 500 13

15 400 750 20

19 2,560 1,560 23

26 500

29 675

31 325

Bal. 4,000

121 Supplies

Dec. 2 1,500 40 Dec. 14

18 800

Bal. 2,260

134 Prepaid Insurance

Dec. 9 3,600

Bal. 3,600

141 Equipment

Dec. 1 15,000

31 6,000

Bal. 21,000

202 Accounts Payable

800 Dec. 18

4,750 31

Bal. 5,550

211 Customer Deposits

2,500 Dec. 31

Bal. 2,500

301 Common Stock

100 Dec. 1

100

Bal. 200

302 Paid in Capital

15,900 Dec. 1

Bal. 15,900

401 Fees Income

56,545 Dec. 7

8,900 15

6,450 19

500 26

6,565 29

870 31

Bal. 79,830

511 Salaries Expense

Dec. 30 5,400

Bal. 5,400

514 Utilities Expense

Dec. 28 235

Bal. 235

529 Advertising Expense

Dec. 12 395

22 150

Bal. 545

532 Telephone Expense

Dec. 23 215

Bal. 215

535 Maintenance Expense

Dec. 21 1,275

31 415

Bal. 1,690

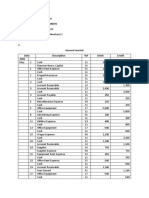

Arrow Accounting Services

Unadjusted Trial Balance

December 31, 20x1

Accounts Debit Credit

Cash 82,035

Accounts Receivable 4,000

Supplies 2,260

Prepaid Insurance 3,600

Equipment 21,000

Accounts Payable 5,550

Customer Deposits 2,500

Common Stock 200

Paid in Capital 15,900

H. Fowl, Capital 17,000

Fees Income 79,830

Salaries Expense 5,400

Utilities Expense 235

Advertising Expense 545

Telephone Expense 215

Maintenance Expense 1,690

Totals 120,980 120,980

Closing Entries

Fees Income 79,830

Income Summary 79,830

To close all income accounts to income summary.

Income Summary 12,920

Salaries Expense 5,400

Utilities Expense 235

Advertising Expense 545

Telephone Expense 215

Maintenance Expense 1,690

Supplies Expense 1,785

Rent Expense 2,500

Insurance Expense 300

Depreciation Expense 250

To close all expense accounts to income summary

Income Summary 66,910

H. Fowl, Capital 66,910

To close income summary to the appropriate

capital account.

Arrow Accounting Services

Income Statement

For the month ended December 31, 20x1

Fees Income 79,830

Less: Operating Expenses

Salaries Expense 5,400

Utilities Expense 235

Advertising Expense 545

Telephone Expense 215

Maintenance Expense 1,690

Supplies Expense 1,785

Rent Expense 2,500

Insurance Expense 300

Depreciation Expense 250 12,920

Net Income 66,910

You might also like

- TESDA NC III PERPETUAL Ans Key PDFDocument13 pagesTESDA NC III PERPETUAL Ans Key PDFMarvin Bueno93% (14)

- 0124 - Review of Accounting ProcessDocument42 pages0124 - Review of Accounting ProcessKhayceePadilla76% (17)

- Nciii Bookkeeping PDFDocument28 pagesNciii Bookkeeping PDFStephanie Cruz100% (10)

- Merchandising Problem "Periodic Inventory System (Sample Problem)Document17 pagesMerchandising Problem "Periodic Inventory System (Sample Problem)Vincent Madrid100% (3)

- Perpetual Inventory Method PDFDocument13 pagesPerpetual Inventory Method PDFthegianthony100% (1)

- Mam Karina Template Periodic 1Document21 pagesMam Karina Template Periodic 1Claudine bea NavarreteNo ratings yet

- Perpetual Inventory System: 1. Journalizing TransactionsDocument12 pagesPerpetual Inventory System: 1. Journalizing TransactionsCreate UsernaNo ratings yet

- NCIII Key To Correction PERPETUAL INVENTORY SYSTEMDocument12 pagesNCIII Key To Correction PERPETUAL INVENTORY SYSTEMŁei Silvestre100% (1)

- Final Exam Part 2 Merch.Document7 pagesFinal Exam Part 2 Merch.Maribel Ticnang100% (1)

- GJ-1 Date Account Title and Explanation PR Debit CreditDocument5 pagesGJ-1 Date Account Title and Explanation PR Debit CreditShane dela CruzNo ratings yet

- General Journal: Date Particulars PR Debit CreditDocument5 pagesGeneral Journal: Date Particulars PR Debit CreditRicky Cordova SierraNo ratings yet

- Periodic Answer KeyDocument9 pagesPeriodic Answer KeyAngel AmbrosioNo ratings yet

- Perpetual Answer KeyDocument15 pagesPerpetual Answer KeyAngel AmbrosioNo ratings yet

- Basicacctng (Journal, Taccounts, Tbalance)Document2 pagesBasicacctng (Journal, Taccounts, Tbalance)Pearl Jade YecyecNo ratings yet

- ACCOUNTING CYCLE Leonor CreationsDocument6 pagesACCOUNTING CYCLE Leonor CreationsNadzma Pawaki HashimNo ratings yet

- PS Music Journal Entries For The Month of July Date Account Title Post Ref. Debit Credit 11 31Document3 pagesPS Music Journal Entries For The Month of July Date Account Title Post Ref. Debit Credit 11 31G & E ApparelNo ratings yet

- Particulars Ref. DR CR 1 CashDocument2 pagesParticulars Ref. DR CR 1 CashPearl Jade YecyecNo ratings yet

- C Martin-JournalDocument2 pagesC Martin-JournalGenuine SmileNo ratings yet

- Sem Plang Merchandising Perpetual Problem With AnswersDocument21 pagesSem Plang Merchandising Perpetual Problem With AnswersJayson Miranda100% (1)

- MerchDocument10 pagesMerchWere dooomedNo ratings yet

- Prob 03-5aDocument16 pagesProb 03-5aapi-354329595No ratings yet

- Correct Periodic Inventory SystemDocument8 pagesCorrect Periodic Inventory SystemVincenzo CassanoNo ratings yet

- Answer - Quiz No. 7 (B)Document9 pagesAnswer - Quiz No. 7 (B)CPA SangcapNo ratings yet

- Book 2Document13 pagesBook 2josedvega178No ratings yet

- Pa12 Trần Khánh Vy Hw Ch2Document7 pagesPa12 Trần Khánh Vy Hw Ch2Vy Tran KhanhNo ratings yet

- Addams&Family Inc.Document5 pagesAddams&Family Inc.Trisha Mae CorpuzNo ratings yet

- General Journal Page 1 Date Description P/R Debit CreditDocument10 pagesGeneral Journal Page 1 Date Description P/R Debit CreditGonzalo FerrerNo ratings yet

- D.Sales Journal AsnswerDocument3 pagesD.Sales Journal AsnswerGenuine SmileNo ratings yet

- FA Assignment - 5 (Group 5)Document3 pagesFA Assignment - 5 (Group 5)Muskan ValbaniNo ratings yet

- Practice Exam - Set ADocument11 pagesPractice Exam - Set ATin PangilinanNo ratings yet

- Solution Manual P4-5ADocument20 pagesSolution Manual P4-5ARyan AdhitrieNo ratings yet

- Problem CAYNA No AnswerDocument6 pagesProblem CAYNA No AnswerMarian TorreonNo ratings yet

- Workbook1 PDFDocument73 pagesWorkbook1 PDFSchool FilesNo ratings yet

- Abm Prepares Journal To Trial BalanceDocument8 pagesAbm Prepares Journal To Trial BalanceCaranias FrencesNo ratings yet

- Local Media1277714689Document34 pagesLocal Media1277714689Isaac Anggana Salarda100% (1)

- FAR1 1.4BSA CASE2 Igsoc KristaNinaDocument13 pagesFAR1 1.4BSA CASE2 Igsoc KristaNinaKrishta IgsocNo ratings yet

- Fabm 21Document6 pagesFabm 21kristelNo ratings yet

- FAR1 1.4BSA CASE2 Igsoc KristaNina IrabonDocument13 pagesFAR1 1.4BSA CASE2 Igsoc KristaNina IrabonKrishta IgsocNo ratings yet

- PerpetualDocument13 pagesPerpetualEcho ClarosNo ratings yet

- Class Code:1214 Class No.: 06 Name Regienald Nolasco AE 112Document7 pagesClass Code:1214 Class No.: 06 Name Regienald Nolasco AE 112Ren NolascoNo ratings yet

- Sanchez General MerchandisingDocument3 pagesSanchez General MerchandisingRechelle Ramos100% (1)

- FINMANDocument16 pagesFINMANRonan NabloNo ratings yet

- Virtudazo Ween Trading GJDocument15 pagesVirtudazo Ween Trading GJMary Rose Ann VirtudazoNo ratings yet

- Notebook 2. Recording Transactions - Posting To The General LedgerDocument4 pagesNotebook 2. Recording Transactions - Posting To The General LedgerCherry RodriguezNo ratings yet

- A 4.1 FAR1 AngelineDocument16 pagesA 4.1 FAR1 Angelinelain slngNo ratings yet

- Goodies and Etc Answer KeyDocument7 pagesGoodies and Etc Answer KeyLorian Joyce ArataNo ratings yet

- ASEU TEACHERFILE WEB 9838997178145661950.docx 1618394464Document7 pagesASEU TEACHERFILE WEB 9838997178145661950.docx 1618394464Hikmət Rüstəmov100% (1)

- Case Problem Hanievon MerchandisingDocument20 pagesCase Problem Hanievon MerchandisingPrincessjane Largo100% (1)

- Basic Accounting - Activity #2Document2 pagesBasic Accounting - Activity #2Kathrin MagaraNo ratings yet

- General Journal - General Ledger - Trial BalanceDocument5 pagesGeneral Journal - General Ledger - Trial BalanceJasminNo ratings yet

- Fabm Performance Task PDFDocument5 pagesFabm Performance Task PDFKhiane Audrey GametNo ratings yet

- Alabang-JournalDocument1 pageAlabang-Journalaleyreyes21No ratings yet

- UTS Pengakun Smt.1Document6 pagesUTS Pengakun Smt.1Widad NadiaNo ratings yet

- Exercise JournalizingDocument2 pagesExercise JournalizingQueency RamirezNo ratings yet

- Bookkeeping NC Iii Review and Enhancement ProgramDocument17 pagesBookkeeping NC Iii Review and Enhancement ProgramDEW NASNo ratings yet

- Periodic Answer Key (Editable)Document44 pagesPeriodic Answer Key (Editable)coleenmaem.04No ratings yet

- Additional C & W NotezsDocument21 pagesAdditional C & W NotezstinoNo ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet