Professional Documents

Culture Documents

Sosc Credit Cards

Sosc Credit Cards

Uploaded by

totayuvrajOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Sosc Credit Cards

Sosc Credit Cards

Uploaded by

totayuvrajCopyright:

Available Formats

Key Fact Sheet

The Key Fact Sheet is updated as on 11th January 2024 and circulated by Axis Bank Ltd. in compliance with Master Circular on Credit Card Operations of Banks issued by the

Reserve Bank of India.

Retail Cards

PRIDE PLATINUM PRIDE SIGNATURE NEO MY ZONE INDIAN OIL AURA

Product Name KWIK Credit Card

Credit Card Credit Card Credit Card Credit Card Credit Card Credit Card

Joining Fee INR 0 INR 0 INR 250 INR 500*** INR 500*** INR 749 Nil

Annual Fee INR 250 INR 500 INR 250 INR 500*** INR 500*** INR 749 Nil

Spends of INR 20,000 Spends of INR 40,000 Spends of INR 50,000

Annual Fee Waiver - - - NA

in the preceding year in the preceding year in the preceding year

Interest Rate (p.a.) 41.75% 41.75% 52.86% 52.86% 52.86% 52.86% 52.86%

2.5% of cash

Cash Withdrawal 2.5% of cash amount 2.5% of cash amount 2.5% of cash amount 2.5% of cash amount 2.5% of cash amount 2.5% of cash amount

amount (Minimum

Fee (Minimum INR 500) (Minimum INR 500) (Minimum INR 500) (Minimum INR 500) (Minimum INR 500) (Minimum INR 500)

INR 500)

Partnership Cards

SPICEJET SPICEJET

LIC FREECHARGE FREECHARGE FLIPKART ACE AIRTEL

Product Name VOYAGE VOYAGE BLACK

Credit Cards Credit Card PLUS Credit Card Credit Card Credit Card Credit Card

Credit Card Credit Card

INR 499

(Waived on spends of INR 750 INR 2,000

Joining Fee INR 0 INR 250 INR 350 INR 500* INR 500

Rs. 10,000 within 45

days from Issuance)

Annual Fee INR 0 INR 250 INR 350 INR 500 INR 499 INR 500 INR 750 INR 2,000

Spends of Spends of Spends of Spends of

Annual Fee

- - INR 50,000 in the INR 3,50,000 in the INR 2,00,000 in the INR 2,00,000 in - -

Waiver**

preceding year preceding year preceding year the preceding year

Interest Rate (p.a.) 52.86% 52.86% 52.86% 52.86% 52.86% 52.86% 52.86% 52.86%

2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash

Cash Withdrawal 2.5% of cash amount

amount (Minimum amount (Minimum amount (Minimum amount (Minimum amount (Minimum amount (Min. amount (Minimum

Fee (Minimum INR 500)

INR 500) INR 500) INR 500) INR 500) INR 500) INR 500) INR 500)

Partnership & Affluent Cards

SAMSUNG SAMSUNG FLIPKART BURGUNDY

Fibe Credit MAGNUS MAGNUS for RESERVE Credit

Product Name SIGNATURE INFINITE Credit SUPER ELITE PRIVATE REWARDS

Card Credit Card Burgundy Card

Credit Card Card Credit Card Credit Card Credit Card

INR 50,000

INR 12,500

Joining Fee INR 500 INR 5000 INR 500 INR 0 Nil* (Nil for Burgundy INR 50,000

Private Clients) INR 1,000

INR 50,000

INR 12,500

Annual Fee INR 500 INR 5000 INR 500 INR 0 Nil* (Nil for Burgundy INR 50,000

Private Clients) INR 1,000

Spends of

Waived on spends Waived on spends Waived on spends

INR 25,00,000 Spends of Spends of INR

Annual Fee of of of

- in the - - INR 35,00,000 in 2,00,000 in the in

Waiver** INR 2,00,000 in INR 7,00,000 in INR 2,00,000 in

preceding the preceding year the preceding

the preceding year the preceding year the preceding year

year year

Interest Rate (p.a.) 52.86% 52.86% 52.86%

52.86% 42.58% 42.58% 19.56% 42.58% 52.86%

2.5% of cash 2.5% of cash

2.5% of cash 2.5% of cash 2.5% of cash

Cash Withdrawal amount amount (Minimum

amount (Minimum amount (Minimum amount (Minimum Nil Nil Nil Nil

Fee (Minimum INR 500)

INR 500) INR 500) INR 500)

INR 500)

Affluent Cards

VISTARA MILES & MORE MILES & MORE VISTARA

PRIVILEGE Credit VISTARA SELECT ATLAS

Product Name SIGNATURE World World Select INFINITE Credit

Card Credit Card Credit Card Credit Card

Credit Card Credit Card Credit Card Card

INR 3,000

INR 1,500

(Waived for

Joining Fee (Waived for Priority INR 1,500 INR 3,000 INR 3,500 INR 5,000 INR 10,000 INR 10,000

Burgundy Account

Account Holders)

holders)

INR 3,000

(Waived for

Annual Fee INR 1,500 INR 1,500 INR 3,000 INR 3,500 INR 5,000 INR 4,500 INR 10,000

Burgundy Account

holders)

Spends of Spends of

Annual Fee HON and SEN HON and SEN

INR 2,50,000 in the - INR 6,00,000 in - - -

Waiver** status members* status members*

preceding year the preceding year

Interest Rate (p.a.) 52.86% 52.86% 52.86% 52.86% 52.86% 52.86% 52.86% 52.86%

2.5% of cash amount 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash

Cash Withdrawal

(Minimum amount (Minimum amount (Minimum amount (Minimum amount (Minimum amount (Minimum amount (Minimum amount (Minimum

Fee

INR 500) INR 500) INR 500) INR 500) INR 500) INR 500) INR 500) INR 500)

Legacy Cards

VISA GOLD VISA SILVER BUZZ Credit MY WINGS MY CHOICE TITANIUM PLATINUM SIGNATURE INFINITE

Product Name

Credit Card Credit Card Card Credit Card Credit Card Credit Card Credit Card Credit Card Credit Card

Annual Fee INR 0 INR 0 INR 750 INR 500 INR 250 INR 100 INR 200 INR 1,000 INR 0

Spends of Spends of

Annual Fee INR 50,000 in INR 1,00,000 in

- - - - - - -

Waiver** the preceding the preceding

year year

Interest Rate

52.86% 52.86% 52.86% 52.86% 52.86% 52.86% 52.86% 52.86% 52.86%

(p.a.)

2.5% of cash

2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash

amount

amount amount amount amount amount amount amount amount

(Minimum

Cash Withdrawal (Minimum (Minimum (Minimum (Minimum (Minimum (Minimum (Minimum (Minimum

INR

Fee INR 500) INR 500) INR 500) INR 500) INR 500) INR 500) INR 500) INR 500)

500)

Secured Cards

SECURED SECURED PLATINUM INDIAN OIL FLIPKART

INSTA EASY MY ZONE EASY PRIVILEGE EASY

Product Name GOLD SILVER SECURED AXIS BANK EASY SECURED Credit

Credit Card Credit Card Credit Card

Credit Card Credit Card Credit Card Credit Card Card

Joining Fee - - - - INR 500 INR 500*** INR 500 INR 1,500

Annual Fee INR 0 INR 0 INR 200 INR 0 INR 500 INR 500*** INR 500 INR 1,500

Spends of INR Spends of INR Spends of INR Spends of INR

Annual Fee

- - 1,00,000 in the - - 50,000 in the 2,00,000 in the 2,50,000 in the

Waiver**

preceding year preceding year preceding year preceding year

Interest Rate

49.36% 49.36% 49.36% 49.36% 49.36% 49.36% 49.36% 49.36%

(p.a.)

2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash 2.5% of cash

Cash 2.5% of cash amount

amount (Minimum amount (Minimum amount (Minimum amount (Minimum amount (Minimum amount (Minimum amount (Minimum

Withdrawal Fee (Minimum INR 500)

INR 500) INR 500) INR 500) INR 500) INR 500) INR 500) INR 500)

*Not Applicable if Life Time Free is given to the customers | **Rent transactions and Wallet load transactions will not be eligible for spends counted in availing annual fee

waiver | *** Not Applicable if the customer is given a Life Time Free card

MAGNUS for Burgundy - Applicable only for Burgundy customers maintaining the requisite individual Burgundy relationship (www.axisbank.com/Magnus)

Version No: O0011108922_06_2022

Burgundy Private CC: Applicable only for Burgundy Private clients maintaining the requisite individual Burgundy Private relationship

(https://www.axisbank.com/burgundyprivate/eligibility)

Late Payment Fees: Waived for BURGUNDY PRIVATE Credit Card. For all other credit cards, it is as per the tables below.

Outstanding Amount Late Payment Fee

< INR 500 Nil

INR 501 – INR 5000 INR 500

INR 5001 – INR 10,000 INR 750

> INR 10,000 INR 1200

Over-limit Fees: 2.5% of Over-limit Amount (Min INR 500). Waived for BURGUNDY PRIVATE Credit Card.

Fees for Cash Payment at Branches: INR 100. Waived for BURGUNDY PRIVATE Credit Card and INSTA EASY Credit Card

Cheque Return or Dishonour Fee or Auto Debit Reversal: 2% of payment amount. Minimum INR 450; Maximum – INR 1500. Waived For BURGUNDY PRIVATE Credit Card.

Credit Limit: Applicable as per the bank’s policy and terms and conditions.

Cash Withdrawal Limit: 30% of the Credit Limit assigned to the customer.

Foreign Transaction Fee: Nil for Burgundy Private Credit Card, 1.5% of Transaction Amount for RESERVE Credit Card, 2% of Transaction Amount for MAGNUS Credit Card &

Magnus for Burgundy, 3.5% of Transaction Amount for all other Axis Bank Credit Cards.

Dynamic Currency Conversion markup: Nil for Burgundy Private Credit Card, 1% of Transaction Amount for all other Axis Bank Credit Cards.

Rent Transaction fee: 1% of each Rental Transaction Amount capped at INR 1,500 for all Axis Bank Credit Cards.

Surcharge on Purchase or Cancellation of Railway Tickets: As prescribed by IRCTC / Indian Railways.

Fuel Transaction Surcharge: 1% of transaction amount (Refunded for fuel transactions Between Rs. 400 to Rs. 4,000. Maximum benefits up to Rs. 400 per Statement Cycle;

up to Rs 500 for ACE Credit Card; SAMSUNG AXIS BANK SIGNATURE Credit Card and AIRTEL AXIS BANK Credit Card; up to Rs. 250 for PRIDE PLATINUM Credit Card and

AXIS BANK AURA CREDIT CARD only. Refund not applicable on MY CHOICE Credit Card, NEO Credit Card, AXIS BANK BUZZ Credit Card, AXIS BANK VISTARA Credit Card

& AXIS BANK VISTARA SIGNATURE Credit Card, AXIS BANK FREECHARGE Credit Card, AXIS BANK FREECHARGE PLUS Credit Card, MILES & MORE AXIS BANK

WORLD SELECT CREDIT CARD and MILES & MORE AXIS BANK WORLD CREDIT CARD.

1% of transaction amount (Refunded for fuel transactions between Rs. 400 to Rs. 5,000. Maximum benefits up to Rs. 400 per Statement Cycle for REWARDS Credit Card; up to

Rs 500 for SAMSUNG AXIS BANK INFINITE Credit Card.

EDGE REWARD Points Redemption Fee:

EDGE REWARD points redeemed Redemption Fee

< 300 Nil

301 – 1000 INR 49

> 1,000 INR 99

Reward Redemption Charges will not be applicable for customers holding -

SELECT Credit Card, Axis Bank ATLAS Credit Card, Axis Bank SIGNATURE Credit Card, Axis Bank Infinite Credit Card, PRIVILEGE Credit Card, MAGNUS Credit Card,

MAGNUS Credit Card for BURGUNDY, RESERVE Credit Card, BURGUNDY PRIVATE Credit Card, PRIORITY PLATINUM Debit Card, BURGUNDY Debit Card, BURGUNDY

PRIVATE Debit Card, RUPAY PLATINUM NRO Debit Card, BURGUNDY NRO Debit Card or BURGUNDY PRIVATE NRO Debit Card.

Please Note: GST or any other applicable taxes: Any charges mentioned anywhere in this Schedule of Fees and Charges are exclusive of the GST or any other applicable taxes

which is billed along with the fee that appears on the billing statement and is levied as per the applicable GST or any other applicable taxes.

Interest Free Grace Period – The interest - free grace period could range from 20 to 50 days, depending on the date of transaction.

Finance Charges Calculation

Assume that you have paid all previous dues in full, and do not have any amount outstanding in your Credit Card Account, and your monthly statement is generated on the

20th of every month. You have purchased household goods for INR 25000 on 12th June and withdrawn cash from an ATM for INR 5,000 on 15th June.

Date Transaction Type Amount Explanation

12th June Purchase INR 25,000 Dr Purchase made on Credit Card

15th June Cash Withdrawal INR 5,000 Dr Cash withdrawn on Credit Card

20th June Interest INR 35.50 Dr Cash withdrawal done INR 5,000* 6 days* 3.6%*12 months/365 days = INR 35.50

20th June Cash Transaction Fee INR 500 Dr 5000*2.5% = INR 125, which is less than INR 500

20th June GST on Interest INR 6.39 Dr 35.50*18% = INR 6.39

20th June GST on Fee INR 90.00 Dr 500*18% = INR 90

Closing Balance INR 30,631.89 Dr Total Payment Due

Actual interest calculation would vary based on the individual purchase and revolve behaviour and the applicable interest rate. Your due date for a 20th June statement is

10th July. If you pay INR 5000 on 10th July and you also make a fresh purchase of INR 10,000 on 11th July, your monthly statement generated on 20th July should have the

following entries:

Date Transaction Type Amount Explanation

Opening Balance INR 30,631.89 Dr Balance carried forward from previous statement

10th July Payment INR 5,000 Cr Payment towards previous statement dues

11th July Purchases INR 10,000 Dr Purchases made on Credit Card

20th July Interest INR 1,478.43 Dr Break up of INR 1,413.85 given below

Fees and Charges levied by the Bank is not included in Interest Calculation. Hence, Interest is not charged on cash Transaction Fee & GST on this Fee.

a) Interest on INR 25000 @ 3.6% p.m. from 12th June to 20th July (39 days) [INR 25,000 x 3.6% x 39 days x 12 months / 365 days = INR 1153.97]

b) Interest on INR 5000 @ 3.6% p.m. from 16th June to 10th July (25 days) [5000 x 3.6% x 25 days x 12 months / 365 days = INR 147.94]

c) Interest on INR 4368 @ 3.6% p.m. from 10th July to 20th July (11 days) [4368 x 3.6% x 11 days x 12 months / 365 days = INR 56.86]

d) Interest on INR 10,000 @ 3.6% p.m. from 11th July to 20th July (10 days) [INR 10,000 x 3.6% x 10 days x 12 months / 365 days = INR 118.36]

e) Interest on INR 35.5 (Interest + Transaction Fee + Tax levied in last statement) @ 3.6% p.m. from 20th June to 20th July (31 days) [INR 35.50 x 3.6% x 31 days x 12

months / 365 days = INR 1.30 ].

20th July GST INR 254.49 Dr INR 1,478.43 *18% = INR 266.11

Closing Balance INR 37300.23 Dr Total Payment Due

Effective 01-04-2023, Interest will be levied on all transactions that were carried out during the time the customer uses the revolving facility (has revolving credit and has paid

less than Total Amount Due in previous month). For more details on finance charges, refer the terms and conditions document.

To know the further terms and conditions, view MITC document at https://axisbank.com/mitnc

Billing Details

Billing Statement - Periodicity & mode of sending: The Bank will send the billing statement at your mailing address / email address, as per Bank's records, a statement / e-

statement once a month for there is any transaction or outstanding of more than INR 100 on the Card Account.

Minimum amount payable (MAD) = 100% of Principal and Interest of EMI + 5% of the remaining outstanding amount.

MAD = 100% of (Interest/Finance Charge, All Fees, loans, taxes) + 2% of (Purchases/ Cash Withdrawals) (effective 10th Nov 2023)

Method of payment – Cheque / Draft, Click to Pay/ NEFT/ VMT, RTGS, Cash, Auto Debit, Internet payment through Axis Bank Savings Account, ATMs, IMPS, 3rd Party

Channels.

Billing disputes resolution - In case of any billing dispute notified to Axis Bank, we will suspend reporting to the Credit Bureau till the dispute is resolved.

All contents of the statement shall be deemed to be correct and accepted by the customer, unless the customer inform us of any discrepancies within 21 days of the date of

the statement. On receipt of such information, Axis Bank may reverse the charges on a temporary basis. If on completion of subsequent investigation, the bank is satisfied

that the liability of such charge is customer’s account, we will reinstate the charge in a subsequent statement.

For any clarification on your Credit Card Statement:

Phone: 1800 103 5577; Website: www.axisbank.com/support

Send correspondence to: Manager, Customer care, Axis Bank Ltd. CPU 1st Floor, "Gigaplex", Plot No I.T.5, MIDC,Airoli Knowledge Park, Airoli, Navi Mumbai-400708

Grievance Redressal Nodal Official: Mr. Ashok Sunar (080 61865200, nodal.officer@axisbank.com)

Version No: O0011108922_06_2022

You might also like

- Binder1 PDFDocument136 pagesBinder1 PDFkashmira100% (1)

- Excel Crash CourseDocument3 pagesExcel Crash CourseAniya SharmaNo ratings yet

- Feasibility Study Excel TemplateDocument5 pagesFeasibility Study Excel TemplateARISNo ratings yet

- Us Banking Regulatory Outlook 2020Document48 pagesUs Banking Regulatory Outlook 2020Pallavi ReddyNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardsMohd NaimNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit Cardsshabbirali0963No ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit Cardsmanishasurywanshi91No ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit Cardsromola613No ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit Cardsakshayvps32No ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardsPersonal Finance GyanNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardsRahulNo ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardsbsnlriteshNo ratings yet

- Sosc Credit CardsDocument10 pagesSosc Credit Cardsvishakanksha01No ratings yet

- Sosc Credit CardsDocument2 pagesSosc Credit CardsAnkitNo ratings yet

- Schedule of Charges Current AccountDocument8 pagesSchedule of Charges Current AccountAshif RejaNo ratings yet

- American Express TariffsDocument1 pageAmerican Express TariffsSuranga GunasekaraNo ratings yet

- Act110 Requirement ExcelDocument47 pagesAct110 Requirement ExcelCydney BrianneNo ratings yet

- Screenshot 2023-06-23 at 11.12.58 AMDocument13 pagesScreenshot 2023-06-23 at 11.12.58 AMR P CNo ratings yet

- Payslip PrintDocument22 pagesPayslip PrintNiejay Arcullo LlagasNo ratings yet

- Credit Card Product Info 06-10-2022Document6 pagesCredit Card Product Info 06-10-2022umar ShabbirNo ratings yet

- Product Features and Applicable ChargesDocument4 pagesProduct Features and Applicable ChargesDesignNo ratings yet

- Credit Cards One Pager - Jan 2023Document1 pageCredit Cards One Pager - Jan 2023smalishah92No ratings yet

- Most Important: Terms and ConditionsDocument33 pagesMost Important: Terms and ConditionsaveenaNo ratings yet

- Pag-Ibig MP2 SavingsDocument15 pagesPag-Ibig MP2 SavingsblehNo ratings yet

- Coll PollDocument3 pagesColl PollMadu MetriNo ratings yet

- Mashreq SOC - Credit - Cards-EnglishDocument1 pageMashreq SOC - Credit - Cards-EnglishAlejandroNo ratings yet

- Premium Personal Monthly Budget1 - SampadaDocument2 pagesPremium Personal Monthly Budget1 - Sampadasampada.khopadeNo ratings yet

- Mahadev Fee2Document3 pagesMahadev Fee2Madu MetriNo ratings yet

- Credit CardsDocument4 pagesCredit CardsOmNo ratings yet

- ProductionReport HBKSDocument7,628 pagesProductionReport HBKSJr J. VickNo ratings yet

- Mahadev Fee1Document3 pagesMahadev Fee1Madu MetriNo ratings yet

- Ps Android 210106 2149Document1 pagePs Android 210106 2149Vidura KariyawasamNo ratings yet

- Challan #: Challan #: Challan #:: Total Total TotalDocument1 pageChallan #: Challan #: Challan #:: Total Total Totalvirkatif662No ratings yet

- Shopify Service Application Form: Particulars of SalespersonDocument3 pagesShopify Service Application Form: Particulars of SalespersonRrohit SawneyNo ratings yet

- Relife (Competitive, Financial and User Engagement)Document14 pagesRelife (Competitive, Financial and User Engagement)fitri nurul kamilaNo ratings yet

- Faysal Bank VoucherDocument1 pageFaysal Bank Voucherhira jalilNo ratings yet

- Credit Card Application FormDocument8 pagesCredit Card Application FormRamraj RamachandranNo ratings yet

- Compare Cards India - Apply Right Credit Card For You - Card InsiderDocument5 pagesCompare Cards India - Apply Right Credit Card For You - Card Insidergogineninagavalli27No ratings yet

- Credit Card BrochureDocument2 pagesCredit Card Brochureheavens.heart666No ratings yet

- MITC Credit CardDocument11 pagesMITC Credit CardAbhishek KumarNo ratings yet

- MITC CC PDFDocument11 pagesMITC CC PDFTriNo ratings yet

- Adamjee Life Assurance Company LTD.: Illustration of Benefits For Khushhali ProductDocument6 pagesAdamjee Life Assurance Company LTD.: Illustration of Benefits For Khushhali ProductHaris AliNo ratings yet

- Most Important: Terms and ConditionsDocument26 pagesMost Important: Terms and ConditionsSarkari PostNo ratings yet

- Sbiepay Sbiepay: Sbi Branch Payment Challan Sbi Branch Payment ChallanDocument1 pageSbiepay Sbiepay: Sbi Branch Payment Challan Sbi Branch Payment Challanpriyanka.rrsimtNo ratings yet

- PDFsam BankDocument1 pagePDFsam BanksMileNo ratings yet

- Hero Moto CorpDocument102 pagesHero Moto CorpMurtaza BadriNo ratings yet

- Goodwill Finance FM FinalDocument231 pagesGoodwill Finance FM Finalmeenal_smNo ratings yet

- Pag-Ibig Mp2 SavingsDocument37 pagesPag-Ibig Mp2 SavingsVanessa GestaNo ratings yet

- Amex Fees Charges Jan 2020Document3 pagesAmex Fees Charges Jan 2020Sheikh RionNo ratings yet

- Vanya ROI Sheet Dec 23Document1 pageVanya ROI Sheet Dec 23prashant.tiwariNo ratings yet

- Indus Online Savings Account SOCDocument8 pagesIndus Online Savings Account SOCrajprince26460No ratings yet

- HSBC Advance Tariff ScheduleDocument5 pagesHSBC Advance Tariff Scheduleshine1975No ratings yet

- Feasibility StudyDocument19 pagesFeasibility StudyBayu IndraaNo ratings yet

- Service Charges For Savings Bank Accounts 1Document18 pagesService Charges For Savings Bank Accounts 1K V GondiNo ratings yet

- Diesel Vs PetrolDocument21 pagesDiesel Vs PetrolShyam NettathNo ratings yet

- Mitc Credit CardsDocument27 pagesMitc Credit CardsRaj Kumar MandaNo ratings yet

- SBI Home Loans MaxGain EMI CalculatorDocument1 pageSBI Home Loans MaxGain EMI CalculatorSudarshan DKNo ratings yet

- Mitc Credit CardsDocument27 pagesMitc Credit CardsRaj Kumar MandaNo ratings yet

- Au Kids Student Senior Citizen Women Savings AccountsDocument2 pagesAu Kids Student Senior Citizen Women Savings AccountsAbhishek KumarNo ratings yet

- Mitc Credit CardsDocument26 pagesMitc Credit CardsVenkateshNo ratings yet

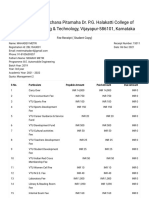

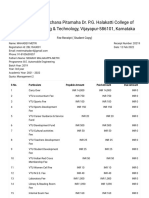

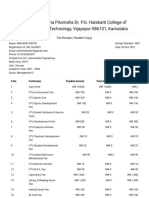

- BLDEA Vachana Pitamaha Dr. P.G. Halakatti College of Engineering & Technology, Vijayapur-586101, KarnatakaDocument3 pagesBLDEA Vachana Pitamaha Dr. P.G. Halakatti College of Engineering & Technology, Vijayapur-586101, KarnatakaMadu MetriNo ratings yet

- 3208 BankDocument1 page3208 BankIzhaan KhanNo ratings yet

- Asia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsFrom EverandAsia Small and Medium-Sized Enterprise Monitor 2021: Volume I—Country and Regional ReviewsNo ratings yet

- Gy Eycl 2 U 8 WTZ6 NW YDocument1 pageGy Eycl 2 U 8 WTZ6 NW YtotayuvrajNo ratings yet

- Dissertation (M-401)Document1 pageDissertation (M-401)totayuvrajNo ratings yet

- DevgiricollegeDocument2 pagesDevgiricollegetotayuvrajNo ratings yet

- AmezonDocument1 pageAmezontotayuvrajNo ratings yet

- Sanyu V 8327Document1 pageSanyu V 8327totayuvrajNo ratings yet

- Mitc Cred CardsDocument1 pageMitc Cred CardstotayuvrajNo ratings yet

- PDFGallery 20240122 133842Document1 pagePDFGallery 20240122 133842totayuvrajNo ratings yet

- DiversificationDocument18 pagesDiversificationVinod PandeyNo ratings yet

- FRM PDFDocument3 pagesFRM PDFCourse HeroNo ratings yet

- DAYA AnnualReport2012Document149 pagesDAYA AnnualReport2012Khairuddin MuhamadNo ratings yet

- BK 1 CH 6 Question BankDocument27 pagesBK 1 CH 6 Question BanktrumpNo ratings yet

- It 000144384093 2024 10Document1 pageIt 000144384093 2024 10Sheeraz AhmedNo ratings yet

- Wallstreetjournal 20171102 TheWallStreetJournalDocument36 pagesWallstreetjournal 20171102 TheWallStreetJournalsadaq84No ratings yet

- SFM Past 10 Year PapersDocument450 pagesSFM Past 10 Year PapersAkash Kumar100% (1)

- IEEDDocument6 pagesIEEDrupeshdahake8586No ratings yet

- Vincent Oluoch OdhiamboDocument2 pagesVincent Oluoch OdhiamboSCHAEFFER CAPITAL ADVISORSNo ratings yet

- Top Secret - The Chinese Envoy's Briefing Paper On The Economic Outlook For The Great Southern Province of China by Satyajit DasDocument8 pagesTop Secret - The Chinese Envoy's Briefing Paper On The Economic Outlook For The Great Southern Province of China by Satyajit Dasapi-90504428No ratings yet

- Rights Issue Learning ObjectiveDocument14 pagesRights Issue Learning ObjectiveSrinivas ReddyNo ratings yet

- UT Dallas Syllabus For Fin6315.501.08f Taught by David Springate (Spring8)Document7 pagesUT Dallas Syllabus For Fin6315.501.08f Taught by David Springate (Spring8)UT Dallas Provost's Technology GroupNo ratings yet

- Strategic Pricing: Coordinating The Drivers of ProfitabilityDocument26 pagesStrategic Pricing: Coordinating The Drivers of ProfitabilityBien GolecruzNo ratings yet

- Tenant Ledger Report PTDocument1 pageTenant Ledger Report PTPhillip NehoNo ratings yet

- Koons Buick Pontiac GMC, Inc. v. Nigh, 543 U.S. 50 (2004)Document22 pagesKoons Buick Pontiac GMC, Inc. v. Nigh, 543 U.S. 50 (2004)Scribd Government DocsNo ratings yet

- Keywords For LICDocument95 pagesKeywords For LICVivek SharmaNo ratings yet

- JPM Global Equity StrategyDocument15 pagesJPM Global Equity StrategyAndres CantaNo ratings yet

- PRTC HOs ListDocument4 pagesPRTC HOs ListArianne May AmosinNo ratings yet

- Title Plan Setup Fee (RM) Annual Fee (RM) Credit Card Setup Fee Online Banking Transaction Fees Credit Card Transaction Fees Special Offer / DealDocument1 pageTitle Plan Setup Fee (RM) Annual Fee (RM) Credit Card Setup Fee Online Banking Transaction Fees Credit Card Transaction Fees Special Offer / DealPiraven KumarNo ratings yet

- Shermin Williams Offering Memorandum-2Document16 pagesShermin Williams Offering Memorandum-2paul sukholinskiyNo ratings yet

- Harristown Hockey Club HHC Maintains A Petty Cash Fund ForDocument1 pageHarristown Hockey Club HHC Maintains A Petty Cash Fund ForLet's Talk With HassanNo ratings yet

- M01 Government Budget and The Economy PPTDocument18 pagesM01 Government Budget and The Economy PPTJr.No ratings yet

- Breaking Up: Is Good To DoDocument12 pagesBreaking Up: Is Good To DoAnuroop BethuNo ratings yet

- Simple Interest PDF For Bank Exams IBPS SBI PO Clerk RRBDocument26 pagesSimple Interest PDF For Bank Exams IBPS SBI PO Clerk RRBSrini VasuluNo ratings yet

- Firm or Obligor Credit RiskDocument60 pagesFirm or Obligor Credit RiskPALLAVI DUREJANo ratings yet

- Barringer E5 PPT 03Document35 pagesBarringer E5 PPT 03Priyank PaliwalNo ratings yet