Professional Documents

Culture Documents

Qau Memo 2019-03. Pfrs 16 Leases Annex A Entries

Qau Memo 2019-03. Pfrs 16 Leases Annex A Entries

Uploaded by

Mikx LeeCopyright:

Available Formats

You might also like

- Final Accounts SumDocument2 pagesFinal Accounts SumRohit Aswani25% (4)

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- This Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Document8 pagesThis Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Kin LeeNo ratings yet

- Business Examples 2021Document12 pagesBusiness Examples 2021Faizan HyderNo ratings yet

- Topic 3 Tutorial Questions PDFDocument15 pagesTopic 3 Tutorial Questions PDFKim FloresNo ratings yet

- Running Head: Problems and Solutions For Nike Inc. 1Document31 pagesRunning Head: Problems and Solutions For Nike Inc. 1LattaNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- QateelDocument6 pagesQateelmaham rasheedNo ratings yet

- Ast 2.1Document5 pagesAst 2.1Patrick Alvin100% (1)

- AssignmentDocument39 pagesAssignmentralph yapNo ratings yet

- Far Module 1 ApolDocument7 pagesFar Module 1 ApolJeraldine DejanNo ratings yet

- Advanced Taxation: Page 1 of 8Document8 pagesAdvanced Taxation: Page 1 of 8Muhammad Usama SheikhNo ratings yet

- Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedDocument6 pagesAssets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedMehul Gupta100% (1)

- Assignment-5-Single-Entry-Method-students-DAVID FinalDocument11 pagesAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATONo ratings yet

- Answers, Solutions and ClarificationsDocument4 pagesAnswers, Solutions and ClarificationsAnnie Lind100% (2)

- Far - Module 1 (Apol)Document10 pagesFar - Module 1 (Apol)Patricia may RiveraNo ratings yet

- Jawab Latihan Soal Akt Keu 2Document5 pagesJawab Latihan Soal Akt Keu 2221210061No ratings yet

- Sol Man 18Document3 pagesSol Man 18samsungacerNo ratings yet

- Quiz 2 - MemoDocument2 pagesQuiz 2 - MemoThikundeko EdwardNo ratings yet

- Ass in Ia 3 Act. 3Document7 pagesAss in Ia 3 Act. 3Resty VillaroelNo ratings yet

- 1 Accounting For Taxation: Section OverviewDocument36 pages1 Accounting For Taxation: Section Overviewsimran jeswaniNo ratings yet

- Adjusting Entries - ProblemDocument1 pageAdjusting Entries - ProblemRianne NavidadNo ratings yet

- 514 50456 Fall061aanswersDocument4 pages514 50456 Fall061aanswersVki BffNo ratings yet

- MTP 3 20 Answers 1681284184Document13 pagesMTP 3 20 Answers 1681284184Sunil YadavNo ratings yet

- CamEd Business School - (Revised) Exam Paper For Dec 2023 (Answers) - 19 December 2023Document9 pagesCamEd Business School - (Revised) Exam Paper For Dec 2023 (Answers) - 19 December 2023Soeung SereyvanttanaNo ratings yet

- Bab VII - Soal2 Dan Solusi No. 7.07 N 7.08Document8 pagesBab VII - Soal2 Dan Solusi No. 7.07 N 7.08Adilla KhulaidahNo ratings yet

- For 2Document2 pagesFor 2Antonio SuárezNo ratings yet

- Screenshot 2023-03-28 at 9.42.11 AMDocument38 pagesScreenshot 2023-03-28 at 9.42.11 AMKinza NawazNo ratings yet

- Mellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Document3 pagesMellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Debbie DebzNo ratings yet

- Profits Tax Computation Illustration 2023S - Suggested Answers Ver2Document2 pagesProfits Tax Computation Illustration 2023S - Suggested Answers Ver2何健珩No ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- Date Transactions Dr. CRDocument16 pagesDate Transactions Dr. CRClyde Ian Brett PeñaNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Seat Foodie Financial StatementsDocument6 pagesSeat Foodie Financial Statementsapi-542433757No ratings yet

- Lease - LessorDocument8 pagesLease - LessorMonique ElineNo ratings yet

- Tin: Taxpayer'S Name: Trade Name: Registered AddressDocument16 pagesTin: Taxpayer'S Name: Trade Name: Registered AddressArah OpalecNo ratings yet

- M202952, M202042 IndividualDocument9 pagesM202952, M202042 IndividualbhebhurabNo ratings yet

- Tampoa Ae211 Unit 1 Assessment ProblemsDocument12 pagesTampoa Ae211 Unit 1 Assessment ProblemsJahna Kay TampoaNo ratings yet

- JE, GL, TB - Mutual ServicesDocument17 pagesJE, GL, TB - Mutual ServicesJasmine Acta100% (1)

- June 2009 Fa4a1Document9 pagesJune 2009 Fa4a1ksakala58No ratings yet

- Compass CompanyDocument3 pagesCompass CompanyKanishka KartikeyaNo ratings yet

- Net SalesDocument8 pagesNet SalesKara Sophia BatucanNo ratings yet

- Week11 Example QuestionDocument2 pagesWeek11 Example Questiongohhs_aaron100% (1)

- Trial Balance To FSDocument9 pagesTrial Balance To FSYếnNo ratings yet

- Model Solution Solution To The Question No. 1Document5 pagesModel Solution Solution To The Question No. 1HossainNo ratings yet

- Final 2017 ReconcilationDocument3 pagesFinal 2017 Reconcilationlovellev.ev3No ratings yet

- CFAB Chapter12 Full GuidanceDocument74 pagesCFAB Chapter12 Full GuidanceNgân Lê Trần BảoNo ratings yet

- Bayar Di Awal - Annuity DUE Vs Bayar Di Akhir - ANNUITY ORDINARYDocument5 pagesBayar Di Awal - Annuity DUE Vs Bayar Di Akhir - ANNUITY ORDINARYEriko Timothy GintingNo ratings yet

- Tidak Boleh Diakui Sama Sekali: Dicatat Sebagai Deferred TaxDocument7 pagesTidak Boleh Diakui Sama Sekali: Dicatat Sebagai Deferred TaxAlfatih 1453No ratings yet

- Net Income 17,000: Account Receivable - 45,000Document3 pagesNet Income 17,000: Account Receivable - 45,000Rock RoseNo ratings yet

- Chap 16 AitDocument26 pagesChap 16 AitLawrence NarvaezNo ratings yet

- Thormyon Publication Pvt. LTD.: Battishputali, Kathmandu Balance - Sheet As at End of 32nd Ashadh, 2077Document8 pagesThormyon Publication Pvt. LTD.: Battishputali, Kathmandu Balance - Sheet As at End of 32nd Ashadh, 2077sudhakar ShakyaNo ratings yet

- 05 Task Performance 1-BADocument3 pages05 Task Performance 1-BATyron Franz AnoricoNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document14 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- Retained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Document21 pagesRetained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Umar Razi QasimNo ratings yet

- Taxation Solution 2018 SeptemberDocument9 pagesTaxation Solution 2018 SeptemberIffah NasuhaaNo ratings yet

- Court of Tax AppealsDocument47 pagesCourt of Tax AppealsLady Paul SyNo ratings yet

- Simple Final Accounts Past Paper Solutions Q # 1 & 3 & 7Document11 pagesSimple Final Accounts Past Paper Solutions Q # 1 & 3 & 7Masood Ahmad AadamNo ratings yet

- A211 MC 2 - StudentDocument6 pagesA211 MC 2 - StudentWon HaNo ratings yet

- Addendum - Amendments To FRS 2Document8 pagesAddendum - Amendments To FRS 2Mikx LeeNo ratings yet

- E3sconf Ersme2020 07015Document8 pagesE3sconf Ersme2020 07015Mikx LeeNo ratings yet

- SSSSSDocument19 pagesSSSSSMikx LeeNo ratings yet

- Detailed Balance Sheet 2022 1st QuarterDocument3 pagesDetailed Balance Sheet 2022 1st QuarterMikx LeeNo ratings yet

- Sec1 Chrtacct 2013Document23 pagesSec1 Chrtacct 2013Mikx LeeNo ratings yet

- Chapter 8 9 Part 2 1Document17 pagesChapter 8 9 Part 2 1Mikx LeeNo ratings yet

- Chart Accts ForprofitDocument1 pageChart Accts ForprofitMikx LeeNo ratings yet

- Project On Brand LoyaltyDocument85 pagesProject On Brand LoyaltyabhiramNo ratings yet

- Entrep Course OutlineDocument2 pagesEntrep Course OutlineMand GamsNo ratings yet

- MADMDocument5 pagesMADMjuhi.dang8131No ratings yet

- Car InovationDocument3 pagesCar InovationClaudiu KLodNo ratings yet

- 6d25add230 7bab8cc98f PDFDocument140 pages6d25add230 7bab8cc98f PDFRiskaAprilliaNo ratings yet

- Strategic Cost Management ACCO 20113: College of Accountancy and Finance Department of AccountancyDocument9 pagesStrategic Cost Management ACCO 20113: College of Accountancy and Finance Department of AccountancyglcpaNo ratings yet

- Business Ledger Notes PDFDocument16 pagesBusiness Ledger Notes PDFmark njeru ngigi100% (1)

- Project Guide Lines For Sem. VI HonsDocument3 pagesProject Guide Lines For Sem. VI HonsMohan ShahNo ratings yet

- Workshop No. Basic Accounting Conceptscommercial Documents - Vocabulary Cost AccountingDocument13 pagesWorkshop No. Basic Accounting Conceptscommercial Documents - Vocabulary Cost AccountingSara Cruz villamilNo ratings yet

- Invoice Number FOB Terms Date Shipped Date Recorded Estimated Date of Delivery Sales InventoryDocument2 pagesInvoice Number FOB Terms Date Shipped Date Recorded Estimated Date of Delivery Sales InventoryLunaNo ratings yet

- AURORABANK (A RURAL BANK) INC - HTMDocument2 pagesAURORABANK (A RURAL BANK) INC - HTMJim De VegaNo ratings yet

- Introduction: The Impact of The Digital Revolution On Consumer BehaviorDocument27 pagesIntroduction: The Impact of The Digital Revolution On Consumer Behaviorjugnu4selfNo ratings yet

- Grade 12 Abm Research Paper (S.y. 2019-2020)Document105 pagesGrade 12 Abm Research Paper (S.y. 2019-2020)Mary Jane LubricoNo ratings yet

- Job Costing Multiple Choice QuestionsDocument15 pagesJob Costing Multiple Choice Questionswer zul0% (2)

- Fall 2018 Microeconomics MITx MidTerm Exam QuestionsDocument16 pagesFall 2018 Microeconomics MITx MidTerm Exam QuestionsdguheliosNo ratings yet

- Oligopoly and Strategic BehaviorDocument58 pagesOligopoly and Strategic BehaviorJaninelara100% (1)

- Saregama India Ltd. Repositioning The Value Proposition: Group 10Document6 pagesSaregama India Ltd. Repositioning The Value Proposition: Group 10jyothiNo ratings yet

- QMS THR FORM09 TEST QUESTIONNAIRE FINalsDocument7 pagesQMS THR FORM09 TEST QUESTIONNAIRE FINalsRoselle Rocafort NepomucenoNo ratings yet

- Machine Shop Business PlanDocument50 pagesMachine Shop Business PlanJoseph QuillNo ratings yet

- 8.2 Test 2a Revision Questions Part 1 - CVP and Standard CostDocument4 pages8.2 Test 2a Revision Questions Part 1 - CVP and Standard Costđặng nguyệt minhNo ratings yet

- 655eda81374b680018b844d6 ## E-Books Accounting StandardsDocument376 pages655eda81374b680018b844d6 ## E-Books Accounting Standardspavangaming2811No ratings yet

- Bol EntrepreneurshipDocument2 pagesBol EntrepreneurshipEaea OjorpNo ratings yet

- Reading 28 Business Models - AnswersDocument5 pagesReading 28 Business Models - AnswersdibatonmoyNo ratings yet

- Finance ControllerDocument2 pagesFinance Controllerალექსანდრე ტაბუცაძეNo ratings yet

- Porters 5 ForcesDocument3 pagesPorters 5 ForcesSahildeep Singh Kohli100% (2)

- Part1 Topic 4 Reconstitution of PartnershipDocument21 pagesPart1 Topic 4 Reconstitution of PartnershipShivani ChoudhariNo ratings yet

- Growth Strategy Ansoff MatrixDocument4 pagesGrowth Strategy Ansoff MatrixAndrea Demos StylesNo ratings yet

- Module 1 Ias 16 & Ias 38Document6 pagesModule 1 Ias 16 & Ias 38Muhammad Zulqarnain NainNo ratings yet

- Freelance ProjectDocument62 pagesFreelance ProjectamoghvkiniNo ratings yet

Qau Memo 2019-03. Pfrs 16 Leases Annex A Entries

Qau Memo 2019-03. Pfrs 16 Leases Annex A Entries

Uploaded by

Mikx LeeOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Qau Memo 2019-03. Pfrs 16 Leases Annex A Entries

Qau Memo 2019-03. Pfrs 16 Leases Annex A Entries

Uploaded by

Mikx LeeCopyright:

Available Formats

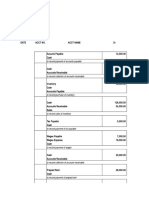

PFRS 16 LEASES

Proforma Journal Entries and Restatement Entries

Option 1: Full Retrospective Approach

#### Entry Made: DR CR Should be entry: DR CR Restatement in January 1, 2018: DR CR

Rent expense 100,000.00 ROU Asset 457,970.72 ROU Asset 366,376.57

Input VAT 12,000.00 Deferred input VAT (12,000 VAT x 5 years) 60,000.00 Deferred input VAT 48,000.00

Lease Liability 107,000.00 Lease Liability 492,970.72 RE, beg. 3,733.29

Withholding tax payable - expanded 5,000.00 Deferred withholding tax payable - expanded (5,000 x 5 years) 25,000.00 Deferred tax asset 1,599.98

To record rent expense To record ROU asset and lease liability Lease Liability 399,709.84

Deferred withholding tax payable - expanded 20,000.00

Lease Liability 107,000.00 Depreciation 91,594.14 To record the effect of adoption of PFRS 16

Expanded withholding tax payable 5,000.00 Accum. dep'n-ROU Asset 91,594.14

Cash 112,000.00 To record depreciation of ROU Asset

To record payment made in 2017

Input VAT 12,000.00

Deferred input VAT 12,000.00

Note: Payment should be equal to To record reversal of deferred input VAT upon payment

Deferred withholding tax payable - expanded 5,000.00

Withholding tax payable - expanded 5,000.00

To record reversal of deferred WT upon payment

Lease Liability 93,260.88

Interest Exp. 13,739.12

Expanded withholding tax payable 5,000.00

Cash 112,000.00

To record payment made in 2017

Deferred tax asset 1,599.98

Provision for income tax - deferred 1,599.98

To record provision for DTA on the difference per PAS 17 vs PFRS 16

#### Entry Made: DR CR Should be entry: DR CR Restatement of comparative period (2018)

Rent expense 100,000.00 Depreciation 91,594.14 Lease liability 95,848.70

Input VAT 12,000.00 Accum. dep'n-ROU Asset 91,594.14 Interest Expense 11,151.30

Lease Liability 107,000.00 To record depreciation of ROU Asset Deferred withholding tax payable - expanded 5,000.00

Withholding tax payable - expanded 5,000.00 Operating expense 100,000.00

To record rent expense Input VAT 12,000.00 Deferred input VAT 12,000.00

Deferred input VAT 12,000.00 To record retatement of comparative year

Lease Liability 107,000.00 To record reversal of deferred input VAT upon payment

Expanded withholding tax payable 5,000.00 Deferred tax asset 823.63

Cash 112,000.00 Deferred withholding tax payable - expanded 5,000.00 Provision for income tax - deferred 823.63

To record payment made in 2018 Withholding tax payable - expanded 5,000.00 To record provision for DTA on the difference per PAS 17 vs PFRS 16

To record reversal of deferred WT upon payment

Lease Liability 95,848.70

Interest Exp. 11,151.30

Expanded withholding tax payable 5,000.00

Cash 112,000.00

To record payment made in 2017

#### Entry Made: DR CR Should be entry: DR CR Restatement of comparative period (2018)

Deferred tax asset 823.63

Provision for income tax - deferred 823.63

To record provision for DTA on the difference per PAS 17 vs PFRS 16

Option 2: Modified Retrospective Approach

#### Equity adjustment in January 1, 2019 DR CR

ROU Asset 274,782.43

RE, Beg. 5,655.09

Deferred input VAT 36,000.00

Deferred tax asset 2,423.61

Lease Liability 303,861.14

Deferred withholding tax payable - expanded 15,000.00

To record the effect of adoption of PFRS 16

Entry for 2019: DR CR Entry for 2020: DR CR Entry for 2021: DR CR

Depreciation 91,594.14 Depreciation 91,594.14 Depreciation 91,594.14

Accum. dep'n-ROU Asset 91,594.14 Accum. dep'n-ROU Asset 91,594.14 Accum. dep'n-ROU Asset 91,594.14

Depreciation of ROU Asset Depreciation of ROU Asset Depreciation of ROU Asset

Input VAT 12,000.00 Input VAT 12,000.00 Input VAT 12,000.00

Deferred input VAT 12,000.00 Deferred input VAT 12,000.00 Deferred input VAT 12,000.00

Reversal of deferred input VAT upon payment Reversal of deferred input VAT upon payment Reversal of deferred input VAT upon payment

Deferred withholding tax payable - expanded 5,000.00 Deferred withholding tax payable - expanded 5,000.00 Deferred withholding tax payable - expanded 5,000.00

Withholding tax payable - expanded 5,000.00 Withholding tax payable - expanded 5,000.00 Withholding tax payable - expanded 5,000.00

Reversal of deferred WT upon payment Reversal of deferred WT upon payment Reversal of deferred WT upon payment

Lease Liability 98,514.17 Lease Liability 101,259.59 Lease Liability 104,087.38

Interest Exp. 8,485.83 Interest Exp. 5,740.41 Interest Exp. 2,912.62

Expanded withholding tax payable 5,000.00 Expanded withholding tax payable 5,000.00 Expanded withholding tax payable 5,000.00

Cash 112,000.00 Cash 112,000.00 Cash 112,000.00

To record payment made in 2019 To record payment made in 2019 To record payment made in 2019

Deferred tax asset 23.99 Provision for income tax - deferred 799.63 Provision for income tax - deferred 1,647.97

Provision for income tax - deferred 23.99 Deferred tax asset 799.63 Deferred tax asset 1,647.97

To record provision for DTA on the difference per PAS 17 vs PFRS 16 To record reversal of DTA on the difference per PAS 17 vs PFRS 16 To record reversal of DTA on the difference per PAS 17 vs PFRS 16

Note: As of year 5 (2021), ROU asset, Lease liability and DTA should be equal to nil.

You might also like

- Final Accounts SumDocument2 pagesFinal Accounts SumRohit Aswani25% (4)

- Chapter-21 (Solved Past Papers of CA Mod CDocument67 pagesChapter-21 (Solved Past Papers of CA Mod CJer Rama100% (4)

- This Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Document8 pagesThis Study Resource Was: Determine The Following 1. Deductible Interest Expense For The Year P129,500.00Kin LeeNo ratings yet

- Business Examples 2021Document12 pagesBusiness Examples 2021Faizan HyderNo ratings yet

- Topic 3 Tutorial Questions PDFDocument15 pagesTopic 3 Tutorial Questions PDFKim FloresNo ratings yet

- Running Head: Problems and Solutions For Nike Inc. 1Document31 pagesRunning Head: Problems and Solutions For Nike Inc. 1LattaNo ratings yet

- CAF 06 - TaxationDocument7 pagesCAF 06 - TaxationKhurram ShahzadNo ratings yet

- Advanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Document23 pagesAdvanced Taxation - Solutions To Pilot Questions Suggested Solution To Question 1Oyebisi OpeyemiNo ratings yet

- QateelDocument6 pagesQateelmaham rasheedNo ratings yet

- Ast 2.1Document5 pagesAst 2.1Patrick Alvin100% (1)

- AssignmentDocument39 pagesAssignmentralph yapNo ratings yet

- Far Module 1 ApolDocument7 pagesFar Module 1 ApolJeraldine DejanNo ratings yet

- Advanced Taxation: Page 1 of 8Document8 pagesAdvanced Taxation: Page 1 of 8Muhammad Usama SheikhNo ratings yet

- Assets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedDocument6 pagesAssets.: (Vi) Due To Lack of Information, Depreciation Has Not Been Provided On FixedMehul Gupta100% (1)

- Assignment-5-Single-Entry-Method-students-DAVID FinalDocument11 pagesAssignment-5-Single-Entry-Method-students-DAVID FinalJOY MARIE RONATONo ratings yet

- Answers, Solutions and ClarificationsDocument4 pagesAnswers, Solutions and ClarificationsAnnie Lind100% (2)

- Far - Module 1 (Apol)Document10 pagesFar - Module 1 (Apol)Patricia may RiveraNo ratings yet

- Jawab Latihan Soal Akt Keu 2Document5 pagesJawab Latihan Soal Akt Keu 2221210061No ratings yet

- Sol Man 18Document3 pagesSol Man 18samsungacerNo ratings yet

- Quiz 2 - MemoDocument2 pagesQuiz 2 - MemoThikundeko EdwardNo ratings yet

- Ass in Ia 3 Act. 3Document7 pagesAss in Ia 3 Act. 3Resty VillaroelNo ratings yet

- 1 Accounting For Taxation: Section OverviewDocument36 pages1 Accounting For Taxation: Section Overviewsimran jeswaniNo ratings yet

- Adjusting Entries - ProblemDocument1 pageAdjusting Entries - ProblemRianne NavidadNo ratings yet

- 514 50456 Fall061aanswersDocument4 pages514 50456 Fall061aanswersVki BffNo ratings yet

- MTP 3 20 Answers 1681284184Document13 pagesMTP 3 20 Answers 1681284184Sunil YadavNo ratings yet

- CamEd Business School - (Revised) Exam Paper For Dec 2023 (Answers) - 19 December 2023Document9 pagesCamEd Business School - (Revised) Exam Paper For Dec 2023 (Answers) - 19 December 2023Soeung SereyvanttanaNo ratings yet

- Bab VII - Soal2 Dan Solusi No. 7.07 N 7.08Document8 pagesBab VII - Soal2 Dan Solusi No. 7.07 N 7.08Adilla KhulaidahNo ratings yet

- For 2Document2 pagesFor 2Antonio SuárezNo ratings yet

- Screenshot 2023-03-28 at 9.42.11 AMDocument38 pagesScreenshot 2023-03-28 at 9.42.11 AMKinza NawazNo ratings yet

- Mellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Document3 pagesMellisa O'Connor Statement of Profit or Loss For Year Ended March 31, 2016 $ $ $Debbie DebzNo ratings yet

- Profits Tax Computation Illustration 2023S - Suggested Answers Ver2Document2 pagesProfits Tax Computation Illustration 2023S - Suggested Answers Ver2何健珩No ratings yet

- Formal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDocument3 pagesFormal Letter of Demand: Republic of The Philippines Department of Finance Bureau of Internal RevenueDominic Dela VegaNo ratings yet

- Date Transactions Dr. CRDocument16 pagesDate Transactions Dr. CRClyde Ian Brett PeñaNo ratings yet

- Hasil Abnormal ReturnDocument1 pageHasil Abnormal ReturnSurya KeceNo ratings yet

- Seat Foodie Financial StatementsDocument6 pagesSeat Foodie Financial Statementsapi-542433757No ratings yet

- Lease - LessorDocument8 pagesLease - LessorMonique ElineNo ratings yet

- Tin: Taxpayer'S Name: Trade Name: Registered AddressDocument16 pagesTin: Taxpayer'S Name: Trade Name: Registered AddressArah OpalecNo ratings yet

- M202952, M202042 IndividualDocument9 pagesM202952, M202042 IndividualbhebhurabNo ratings yet

- Tampoa Ae211 Unit 1 Assessment ProblemsDocument12 pagesTampoa Ae211 Unit 1 Assessment ProblemsJahna Kay TampoaNo ratings yet

- JE, GL, TB - Mutual ServicesDocument17 pagesJE, GL, TB - Mutual ServicesJasmine Acta100% (1)

- June 2009 Fa4a1Document9 pagesJune 2009 Fa4a1ksakala58No ratings yet

- Compass CompanyDocument3 pagesCompass CompanyKanishka KartikeyaNo ratings yet

- Net SalesDocument8 pagesNet SalesKara Sophia BatucanNo ratings yet

- Week11 Example QuestionDocument2 pagesWeek11 Example Questiongohhs_aaron100% (1)

- Trial Balance To FSDocument9 pagesTrial Balance To FSYếnNo ratings yet

- Model Solution Solution To The Question No. 1Document5 pagesModel Solution Solution To The Question No. 1HossainNo ratings yet

- Final 2017 ReconcilationDocument3 pagesFinal 2017 Reconcilationlovellev.ev3No ratings yet

- CFAB Chapter12 Full GuidanceDocument74 pagesCFAB Chapter12 Full GuidanceNgân Lê Trần BảoNo ratings yet

- Bayar Di Awal - Annuity DUE Vs Bayar Di Akhir - ANNUITY ORDINARYDocument5 pagesBayar Di Awal - Annuity DUE Vs Bayar Di Akhir - ANNUITY ORDINARYEriko Timothy GintingNo ratings yet

- Tidak Boleh Diakui Sama Sekali: Dicatat Sebagai Deferred TaxDocument7 pagesTidak Boleh Diakui Sama Sekali: Dicatat Sebagai Deferred TaxAlfatih 1453No ratings yet

- Net Income 17,000: Account Receivable - 45,000Document3 pagesNet Income 17,000: Account Receivable - 45,000Rock RoseNo ratings yet

- Chap 16 AitDocument26 pagesChap 16 AitLawrence NarvaezNo ratings yet

- Thormyon Publication Pvt. LTD.: Battishputali, Kathmandu Balance - Sheet As at End of 32nd Ashadh, 2077Document8 pagesThormyon Publication Pvt. LTD.: Battishputali, Kathmandu Balance - Sheet As at End of 32nd Ashadh, 2077sudhakar ShakyaNo ratings yet

- 05 Task Performance 1-BADocument3 pages05 Task Performance 1-BATyron Franz AnoricoNo ratings yet

- ACCT 4200 Project Solution - Final Posting 2022Document14 pagesACCT 4200 Project Solution - Final Posting 2022Jaspal SinghNo ratings yet

- Retained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Document21 pagesRetained Earning Opening Balance - Net Income For The Year Ended 2017 2370 Dividend Paid (2,500)Umar Razi QasimNo ratings yet

- Taxation Solution 2018 SeptemberDocument9 pagesTaxation Solution 2018 SeptemberIffah NasuhaaNo ratings yet

- Court of Tax AppealsDocument47 pagesCourt of Tax AppealsLady Paul SyNo ratings yet

- Simple Final Accounts Past Paper Solutions Q # 1 & 3 & 7Document11 pagesSimple Final Accounts Past Paper Solutions Q # 1 & 3 & 7Masood Ahmad AadamNo ratings yet

- A211 MC 2 - StudentDocument6 pagesA211 MC 2 - StudentWon HaNo ratings yet

- Addendum - Amendments To FRS 2Document8 pagesAddendum - Amendments To FRS 2Mikx LeeNo ratings yet

- E3sconf Ersme2020 07015Document8 pagesE3sconf Ersme2020 07015Mikx LeeNo ratings yet

- SSSSSDocument19 pagesSSSSSMikx LeeNo ratings yet

- Detailed Balance Sheet 2022 1st QuarterDocument3 pagesDetailed Balance Sheet 2022 1st QuarterMikx LeeNo ratings yet

- Sec1 Chrtacct 2013Document23 pagesSec1 Chrtacct 2013Mikx LeeNo ratings yet

- Chapter 8 9 Part 2 1Document17 pagesChapter 8 9 Part 2 1Mikx LeeNo ratings yet

- Chart Accts ForprofitDocument1 pageChart Accts ForprofitMikx LeeNo ratings yet

- Project On Brand LoyaltyDocument85 pagesProject On Brand LoyaltyabhiramNo ratings yet

- Entrep Course OutlineDocument2 pagesEntrep Course OutlineMand GamsNo ratings yet

- MADMDocument5 pagesMADMjuhi.dang8131No ratings yet

- Car InovationDocument3 pagesCar InovationClaudiu KLodNo ratings yet

- 6d25add230 7bab8cc98f PDFDocument140 pages6d25add230 7bab8cc98f PDFRiskaAprilliaNo ratings yet

- Strategic Cost Management ACCO 20113: College of Accountancy and Finance Department of AccountancyDocument9 pagesStrategic Cost Management ACCO 20113: College of Accountancy and Finance Department of AccountancyglcpaNo ratings yet

- Business Ledger Notes PDFDocument16 pagesBusiness Ledger Notes PDFmark njeru ngigi100% (1)

- Project Guide Lines For Sem. VI HonsDocument3 pagesProject Guide Lines For Sem. VI HonsMohan ShahNo ratings yet

- Workshop No. Basic Accounting Conceptscommercial Documents - Vocabulary Cost AccountingDocument13 pagesWorkshop No. Basic Accounting Conceptscommercial Documents - Vocabulary Cost AccountingSara Cruz villamilNo ratings yet

- Invoice Number FOB Terms Date Shipped Date Recorded Estimated Date of Delivery Sales InventoryDocument2 pagesInvoice Number FOB Terms Date Shipped Date Recorded Estimated Date of Delivery Sales InventoryLunaNo ratings yet

- AURORABANK (A RURAL BANK) INC - HTMDocument2 pagesAURORABANK (A RURAL BANK) INC - HTMJim De VegaNo ratings yet

- Introduction: The Impact of The Digital Revolution On Consumer BehaviorDocument27 pagesIntroduction: The Impact of The Digital Revolution On Consumer Behaviorjugnu4selfNo ratings yet

- Grade 12 Abm Research Paper (S.y. 2019-2020)Document105 pagesGrade 12 Abm Research Paper (S.y. 2019-2020)Mary Jane LubricoNo ratings yet

- Job Costing Multiple Choice QuestionsDocument15 pagesJob Costing Multiple Choice Questionswer zul0% (2)

- Fall 2018 Microeconomics MITx MidTerm Exam QuestionsDocument16 pagesFall 2018 Microeconomics MITx MidTerm Exam QuestionsdguheliosNo ratings yet

- Oligopoly and Strategic BehaviorDocument58 pagesOligopoly and Strategic BehaviorJaninelara100% (1)

- Saregama India Ltd. Repositioning The Value Proposition: Group 10Document6 pagesSaregama India Ltd. Repositioning The Value Proposition: Group 10jyothiNo ratings yet

- QMS THR FORM09 TEST QUESTIONNAIRE FINalsDocument7 pagesQMS THR FORM09 TEST QUESTIONNAIRE FINalsRoselle Rocafort NepomucenoNo ratings yet

- Machine Shop Business PlanDocument50 pagesMachine Shop Business PlanJoseph QuillNo ratings yet

- 8.2 Test 2a Revision Questions Part 1 - CVP and Standard CostDocument4 pages8.2 Test 2a Revision Questions Part 1 - CVP and Standard Costđặng nguyệt minhNo ratings yet

- 655eda81374b680018b844d6 ## E-Books Accounting StandardsDocument376 pages655eda81374b680018b844d6 ## E-Books Accounting Standardspavangaming2811No ratings yet

- Bol EntrepreneurshipDocument2 pagesBol EntrepreneurshipEaea OjorpNo ratings yet

- Reading 28 Business Models - AnswersDocument5 pagesReading 28 Business Models - AnswersdibatonmoyNo ratings yet

- Finance ControllerDocument2 pagesFinance Controllerალექსანდრე ტაბუცაძეNo ratings yet

- Porters 5 ForcesDocument3 pagesPorters 5 ForcesSahildeep Singh Kohli100% (2)

- Part1 Topic 4 Reconstitution of PartnershipDocument21 pagesPart1 Topic 4 Reconstitution of PartnershipShivani ChoudhariNo ratings yet

- Growth Strategy Ansoff MatrixDocument4 pagesGrowth Strategy Ansoff MatrixAndrea Demos StylesNo ratings yet

- Module 1 Ias 16 & Ias 38Document6 pagesModule 1 Ias 16 & Ias 38Muhammad Zulqarnain NainNo ratings yet

- Freelance ProjectDocument62 pagesFreelance ProjectamoghvkiniNo ratings yet