Professional Documents

Culture Documents

SUPER ENERGY CORPORATION PUBLIC COMPANY LIMITED ESG Ratings Report

SUPER ENERGY CORPORATION PUBLIC COMPANY LIMITED ESG Ratings Report

Uploaded by

mrids177Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

SUPER ENERGY CORPORATION PUBLIC COMPANY LIMITED ESG Ratings Report

SUPER ENERGY CORPORATION PUBLIC COMPANY LIMITED ESG Ratings Report

Uploaded by

mrids177Copyright:

Available Formats

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

Utilities | TH

RA

RATING

TING A

ACCTION D

DAATE: March 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

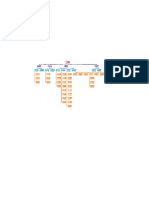

Score attribution by key issue ESG Rating history

This chart highlights the company's positioning relative to the industry average for each Key Issue that contributed

to its ESG Rating as of September 26, 2023.

Positive

Industr

Industryy ESG Rating history shows five most recent rating actions

Aver

erage

age

ESG Rating distribution

Universe: MSCI ACWI Index constituents, Utilities, n=141

Negative

ns

gy

abl ies in

sio

pm pital

ner

mis

ent

eE

e

it

a

anc

Ren ortun

Dev an C

nE

n

ew

elo

rbo

ver

m

p

Hu

Op

Go

Ca

Key scores

Last ESG Rating action

Weight Scor

Scoree (0-10)

Rating action date: Mar

March

ch 28, 2023 Industry-Adjusted Score 4.1

(Last Updated: Mar

March

ch 28, 2023)

We initiate coverage of SUPER at 'BB'.

◤ Weighted-Average Key Issue Score 5.2

Focus on renewable energy (RE) operations (FY 2021: ~88% of assets) lowers SUPER’s exposure to (Last updated: June 30, 2023)

environmental risks, particularly related to carbon, compared with peers with more substantial fossil fuel-

based assets. However, the company lags industry peers in talent management and global peers on ◤ Environmental Pillar Score 36% 8.4

business ethics. ◤ Social Pillar Score 23% 1.6

Thailand (FY 2021: ~61% of assets, domicile) and Vietnam (~35%) set RE targets of 30% of ◤ Governance Pillar Score 41% 4.4

◥

energy consumption by 2037 and 47% of electricity generation by 2030, respectively. As of March

2023, SUPER has ~460 MW of ongoing RE projects in both countries that may support their Report table of contents

respective targets. Thus, the company appears well positioned to capitalize on opportunities in

the RE space.

ESG Rating tearsheet Data rrepor

eportt

Based on our model, utility companies rely on skilled professionals and are thus exposed to

◥

Rating model details P02 Corporate governance P07

potential talent management challenges. However, we found no evidence of robust programs

data

to identify new talent, or engagement surveys to gauge workplace satisfaction by SUPER. In

addition, we found no disclosure on its turnover rates; this impedes comparison with peers. Recent developments P03 Key issue details P29

Our model indicates utilities are perceived to have high exposure to corruption-related risks. Corporate governance P04 Appendix P40

◥

However, SUPER’s business ethics framework lags that of global peers: we found no evidence of summary

regular audits of ethics programs and mechanisms or of a policy protecting whistleblowers from ESG Rating drill down P05 Glossary P55

retaliation.

Analysts: Joseph Benjamin De la Torre, Nilesh Nagdev What is an ESG Rating? MSCI ESG Ratings aim to measure a

company's resilience to long-term ESG risks. Companies are

scored on an industry-relative AAA-CCC scale across the most

relevant Key Issues based on a company's business model.

Page 1 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

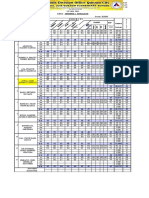

ESG Rating scorecard

As of September 26, 2023

KEY ISSUE WEIGHT INDUSTRY SCORE CHANGE EXPLANATION

AVERAGE (0-10)

Weighted-Average Key Issue 5.8 5.2

Score

ENVIRONMENT 36% 6.6 8.4

Opportunities in Renewable 24% 6.0 8.0 ● 97% of revenues derived from power generation

● Relatively large proportion of renewable energy capacity compared to peers

Energy

Carbon Emissions 12% 7.4 9.3 ● 83% of operations from less carbon-intensive business lines relative to

peers

SOCIAL 23% 5.7 1.6

Human Capital Development 23% 5.5 1.6 ● Disclosed compensation practices are poor relative to peers; in particular

our research found limited to no evidence of stock-based awards

GOVERNANCE 41% 5.0 4.4 ▲1.1

Corporate Governance 6.0 6.3 ▲1.4 ● The company falls into the average scoring range relative to global peers,

reflecting relatively few areas of concern.

Corporate Behavior 5.3 3.1 ● No evidence of employee trainings on ethical standards

* denotes company-specific Key Issue

This table shows the Key Issue scores and weights contributing to the company's ESG Rating and any changes to those scores since the last ESG Rating action. The range of possible scores is

0-10, where 10 is best and 0 is worst.

Rating model details Company Data Feedback response

SUPER was rated based on a standard version of the Utilities Industry Data feedback in last 12 months? No

ESG Rating Model.

Date of last feedback N/A

MODEL VERSION: 4.1.1 This section only captures inputs provided by companies through our online issuer portal that may have an

impact on the weighted Key Issues for the company

Represents the MSCI ESG Ratings model version used to assess the

company. Please refer to the “ESG Ratings Methodology” document for more

details on the model versions.

Key documents used for updates, as of September 26, 2023

Company Fiscal Filing Release Incorpor

Incorporated

ated in data and Incorpor

Incorporated

ated in ESG

Filing Year Date scor

scores

es Rating

Key document types reflected here include Annual Reports (AR), CSR, Sustainability or ESG reports. Partially

Incorporated = some but not all of the underlying data and related scores reflect the latest filing; Pending =

Not yet incorporated; Fully Incorporated = All relevant data from filing has been incorporated into the

underlying data and scores. Updates related to Carbon data are not included here. Please refer to "Recent

developments affecting ESG scores" for more information.

Page 2 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Recent developments affecting ESG scores

This table shows the last 10 score changes* and rating actions that have occurred in the past 12 months.

Date ▲ Type Scor

Scoree (0-10) Change Explanation

Curr

Current

ent W

Weighted-A

eighted-Avver

erage

age K

Keey Issue 5.2

Scor

Scoree

Jun 30, 2023 Data Update: Corporate Governance ▲0.4 Flags Added

Added: Related Party Transactions

Flags Remo

Removved

ed: Audit Committee Industry Expert, CEO Equity

Changes, Entrenched Board

Mar 28, 2023 ESG Rating action 4.8 ▲4.8 We initiate coverage of SUPER at 'BB'.

Mar 28, 2023 Data Update: Corporate Governance Flags Added

Added: CEO Equity Changes, Say on Pay Policy, Voting

Rights Limits Residency, Executives on Board

Flags Remo

Removved

ed: Dilution Concerns, Fair Bid Treatment Provisions

Go

Govvernance Scor

Scoree changed based on the listed Key Metric(s):

Entrenched Board

Mar 28, 2023 Data Update: Exposure Change in exposure score for the following Key Issue(s): Human

Capital Development, Opportunities in Renewable Energy,

Corporate Behavior, Corporate Behavior

Mar 28, 2023 Data Update: Carbon Increase in practices score, performance score, management

score, exposure score

This table outlines the latest changes to specific data points that have occurred, the trigger for change (e.g. issuer feedback, data update or methodology enhancements) and the overall impact

on the company's Weighted Average Key Issue Score.

Most recent controversies

There are no recent new controversies or updates to ongoing controversies for this company.

Page 3 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Corporate governance summary

53r

53rdd global per

percentile

centile Ownership summar

summaryy

Capital Single Equity Class; Top shar

shareholders

eholders

89th home mark

market

et per

percentile

centile structur

structuree Foreign SUWINTHAWAONG GOLD

shareholder ASSET CO., LTD.-18.18% Mr.

restrictions Jormsup Lochaya 18.06%

Boar

Boardd of dir

direct

ectors

ors

Board type: Unitary Board Ownership Principal

classification Shareholder

● Non-executive and ● Non-executive with ● Executive

independent of links to

management management

CEO

62.5% 37.5%

Name: Jormsup Lochaya Total rrealiz

ealized

ed pa

pay*:

y*:

Tenur

enure:

e: 18 Years USD 8,315.29

Total summar

summaryy pa

pay*:

y*:

Board diversity

Male Female USD 8,315.29

50% 50%

*CEO pay figures are sourced from listed company annual reports and proxy filings. When a new CEO is named the pay figures for the previous CEO will be displayed until this information has

been updated for the new CEO

Peer benchmarking

Carbon Oppor

Opportunities

tunities in Renewable Human Capital Corpor

Corporate

ate Corpor

Corporate

ate Rating &

Emissions Ener

Energy

gy De

Devvelopment Go

Govvernance Beha

Behaviour

viour Trend

CEZ, a.s. ●●●● ●● ●● ●●●● ●● AA ◄►

Fortis Inc. ●●● ●● ●●● ●●●● ●●●● AA ◄►

Fortum Oyj ●●● ● ●● ●● ●● BBB ◄ ►

CENTERPOINT ENERGY, INC. ●● ● ●● ●●● ●● BBB ◄ ►

SUPER ENERGY CORPORATION PUBLIC ●●● ●●●● ● ●● ● BB ◄►

COMPANY LIMITED

Tokyo Electric Power Company Holdings, ● ●● ● ● ● CCC ◄ ►

Incorporated

QUARTILE KEY : Bottom Quartile ● Top Quartile ●●●●

RATING TREND KEY : Maintain ◄► Upgrade ▲ Upgrade by two or more notches ▲▲ Downgrade ▼ Downgrade by two or more notches ▼▼

The five industry peers are companies in the Utilities ESG Rating Industry, as of September 26, 2023, selected based on similarities in four attributes (ESG Key Issue weights, industry

classification, region, and size), sorted by ESG Rating (best to worst).

Page 4 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

ESG Rating drill down

As of prior rating action date: As of last rating action date: As of last report update date: Difference

Mar 28, 2023 Sep 26, 2023

Description Score Weight Score Weight Score Weight Score Weight

ESG Rating Letter Gr

Grade

ade BB BB - -

Industr

Industryy Adjusted Scor

Scoree 4.1 4.1 - -

Industr

Industryy Minimum Scor

Scoree 2.6 2.6 - -

Industr

Industryy Maximum Scor

Scoree 8.0 8.1 0.1 -

Weighted A

Avver

erage

age K

Keey Issue Scor

Scoree 4.8 5.2 0.4 -

Envir

Environmental

onmental Pillar Scor

Scoree 8.4 36.0% 8.4 36.0% - -

Carbon Emissions K

Keey Issue Scor

Scoree 9.3 12.0% 9.3 12.0% - -

Exposure Score 1.2 1.2 - -

Business Segment Exposure Score 1.2 1.2 - -

Geographic Exposure Score 4.6 4.6 - -

Management Score 4.3 4.3 - -

Management Score - Excluding 4.3 4.3 - -

Controversies

Practices Score 5.0 5.0 - -

Performance Score 3.0 3.0 - -

Oppor

Opportunities

tunities in Renewable Ener

Energy

gy K

Keey Issue 8.0 24.0% 8.0 24.0% - -

Scor

Scoree

Exposure Score 8.4 8.4 - -

Business Segment Exposure Score 9.7 9.7 - -

Geographic Exposure Score 3.7 3.7 - -

Management Score 8.3 8.3 - -

Management Score - Excluding 8.3 8.3 - -

Controversies

Practices Score 7.5 7.5 - -

Performance Score 10.0 10.0 - -

Controversy Deduction 0.0 0.0 - -

Social Pillar Scor

Scoree 1.6 23.0% 1.6 23.0% - -

Human Capital De

Devvelopment K

Keey Issue Scor

Scoree 1.6 23.0% 1.6 23.0% - -

Exposure Score 7.3 7.3 - -

Business Segment Exposure Score 7.3 7.3 - -

Company-Specific Exposure Score 0.0 0.0 - -

Management Score 1.9 1.9 - -

Management Score - Excluding 1.9 1.9 - -

Controversies

Practices Score 1.4 1.4 - -

Performance Score 3.0 3.0 - -

Controversy Deduction 0.0 0.0 - -

Go

Govvernance Pillar Scor

Score*

e* 3.3 41.0% 4.4 41.0% 1.1 -

Go

Govvernance Pillar Deductions** -6.7 -5.6 1.1 -

Corpor

Corporate

ate Go

Govvernance Deductions -4.0 -2.9 1.1 -

Page 5 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

As of prior rating action date: As of last rating action date: As of last report update date: Difference

Mar 28, 2023 Sep 26, 2023

Description Score Weight Score Weight Score Weight Score Weight

Board -2.0 -1.1 0.9 -

Pay -1.5 -1.3 0.2 -

Ownership & Control -0.4 -0.4 - -

Accounting -0.1 -0.1 - -

Corpor

Corporate

ate Beha

Behavior

vior Deductions -2.7 -2.7 - -

Business Ethics -2.7 -2.7 - -

Tax Transparency 0.0 0.0 - -

**Beginning November 2020, the Environmental Pillar Score and Social Pillar Score are calculated based on the weighted average of underlying Key Issue Scores, while the

Governance Pillar Score is calculated based on 10 minus the sum of Corporate Governance and Corporate Behavior deductions. In the ESG Rating drill-down, deductions are

scaled to indicate impact on the overall Governance Pillar Score. In subsequent sections of the report, deductions are scaled to show impact on the Corporate Behavior and

Corporate Governance Theme Scores.

Page 6 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Corporate Governance Score Change

(since rating)

Quartile Last score change date

6.3 ▲ 1.4 ●● May 09, 2023

Market Cap: 339,424,191 USD Home Market: Thailand Last Data Update: Aug 07, 2023

GOVERNANCE THEMES AND RANKINGS KEY DATES

100 Financial Year End December 31

74

75 89 61 89 62

53 81 83 Annual Filing Date Mar 25, 2023

50 43

26 AGM Date Apr 25, 2023

25

0

Overall Board Pay Ownership & Accounting

Control

WEBSITE

■ Global Percentile Rank ■ Home Market Percentile Rank

https://www.supercorp.co.th/

SUMMARY *Key areas of concern include flagged key metrics within the three sub-

issues that represent the largest scoring deductions. Please review the

full report to see the complete set of flagged key metrics.

SUPER ENERGY CORPORATION PUBLIC falls into the average scoring range for all the

companies we assess relative to global peers and reflects a relatively low level of governance

risk in most areas.

KEY AREAS OF CONCERN* SCORING DEDUCTIONS

Pay Figures (-1.18)

Executive Pay Disclosure

Pay Oversight (-0.59)

No Pay Committee and Execs on Board

Pay Performance Alignment (-0.40)

Clawbacks & Malus

Pay Linked to Sustainability

Page 7 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

CORPORATE GOVERNANCE SCORE HISTORY

10

0

Apr 2021 Feb 2023 Mar 2023 Apr 2023 Aug 2023

SUPER ENERGY CORPORATION PUBLIC COMPANY LIMITED

CHANGES TO FLAGGED KEY METRICS (SINCE JUNE 2022)

Key Metric Key Metric Change Date Score Change* Change Notes

Related Party Transactions Flag Added Jun 26, 2023 -0.10

Entrenched Board Flag Removed Jun 26, 2023 1.19

CEO Equity Changes Flag Removed Jun 26, 2023 0.20

Audit Committee Industry Expert Flag Removed Jun 26, 2023 0.10

Pay Linked to Sustainability Flag Added Nov 22, 2022 -0.20

Executives on Board Flag Added Aug 19, 2022 -0.20

No Nomination Committee Flag Added Jun 12, 2022 -0.30 Methodology enhancements

BOARD OVERVIEW PAY OVERVIEW

Board Type: Unitary Board Highest Paid Executive - Jormsup Lochaya

Board of Directors 100%

90%

CEO Jormsup Lochaya Since: Sep 29, 2004 80%

Deputy Chair Jormsup Lochaya Since: Mar 01, 2021

70%

CFO Kulchalee Nuntasukkasem Since: Jun 01, 2022

Chair Kamthorn Udomritthiruj Since: Mar 01, 2021 60%

50% 288 000 (THB)

40%

30%

37.5%

20%

62.5% 10%

0%

2022 - 288,000 (THB)

■ Long Term Incentives Awarded 0 (THB)

■Executive ■Links to Management ■Independent of Management ■ Short Term Incentives Awarded 0 (THB)

■ Fixed Pay 288,000 (THB)

Page 8 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

BOARD

The policies and practices of the SUPER ENERGY CORPORATION PUBLIC board fall Global Home Market

within the average scoring range relative to global peers. We have flagged this board 0-10 Score Percentile Rank Percentile Rank

for potential concerns regarding the presence of certain related party transactions

and the absence of a pay committee. 61st (Average) 81st (Above

7.6

Average)

KEY METRICS SCORING BOARD PERFORMANCE VS.

Deduction ▼ Global ▼ Home Market

BOARD INDEPENDENCE ▼ ▼

Executives on Board -0.20

Related Party Transactions -0.10

BOARD SKILLS & DIVERSITY

Risk Management Expertise -0.20

NOMINATION PROCESS OVERSIGHT

No Nomination Committee -0.30

PAY OVERSIGHT

No Pay Committee and Execs on Board -0.59

LEADERSHIP

CHIEF EXECUTIVE OFFICER

History CEO Since Until Name Gender Age

Current Sep 2004 Jormsup Lochaya M 53

CHIEF FINANCIAL OFFICER

History CFO Since Until Name Gender Age

Current Jun 2022 Kulchalee Nuntasukkasem F 57

Former May 2013 Jun 2022 Warinthip Chaisangha F 55

CHAIR

History Chair Since Until Name Gender Age

Current Mar 2021 Kamthorn Udomritthiruj M 91

Former Sep 2004 Mar 2021 Jormsup Lochaya M 53

Page 9 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

BOARD OF DIRECTORS

The SUPER ENERGY CORPORATION PUBLIC board currently has an independent majority, which enables it to more effectively fulfill its critical function of

overseeing management on behalf of shareholders. The board includes at least one executive director in addition to the CEO, characteristic of 47% of

companies in this market. Multiple inside directors may increase management’s influence within the boardroom. Additionally, the company has split the

roles of CEO and chair and has named a fully independent chairman. An independent chairman is characteristic of 44% of companies in the home market.

Number of Board Meetings: 10

Non-executives meet in absence of Executives: No

Tenure Independent Management Link/

Name M/F Age (Years) Boards of Mgmt of Other Designation Reason Nationality

Interests

Jormsup Lochaya CEO DC I M 53 18 1 No Yes Executive Not Disclosed

Kamthorn Udomritthiruj COB M 91 17 1 Yes Yes Not Disclosed

Kulchalee Nuntasukkasem F 57 1 1 No Yes Executive Thailand

CFO I $

Piya Sorntrakul M 67 5 1 Yes Yes Not Disclosed

Sunsiri Chaijareonpat F 53 5 1 Yes Yes Not Disclosed

Trithip Sivakriskul I $ F 56 5 2 Yes Yes Thailand

Virasak Sutanthavibul M 65 <1 2 Yes Yes Not Disclosed

Warinthip Chaisangha F 55 10 1 No Yes Executive Thailand

I $

F # >= 70 # >= 15 yrs # >= 4

Total (of 8) 4 1 2 0 5 8

Percentage 50% 12.5% 25% 0% 62.5% 100%

Note: Board count includes the membership of this board.

$ - Financial Expert (3) I - Industry Expert (4) CEO - Chief Executive Officer COB - Chair of the Board

CFO - Chief Financial Officer DC - Deputy Chair

RELATED PARTY TRANSACTIONS

The risk to minority shareholders arising from related party transactions is a function of the nature of the related party, the relative size of the transaction

and the pricing of the transaction. The board, and in particular the independent directors or audit committee, play a key role in the protection of minority

shareholders’ interests, and monitoring and managing potential conflicts of interest of management, board members and shareholders.

Reported Transactions

The Group has transactions with related parties. These parties are related through common

shareholders The significant transactions with related parties as includes Electricity expense and parking fee.

For the two most recently reported fiscal years, these value of these transactions can be summarised as follows :

Page 10 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Aggregate Transaction Value

Fiscal Year Related Party Types Value (CUR) % of Total Type

Dec 31, Other 1,011,000 THB 0.012% of Expenses Recurring purchases from related party

2022

Dec 31, Other 1,228,000 THB 0.020% of Expenses Purchases from related party

2021

Sources : 2022 FS p. 39-41 Note 6, 2021 FS p. 36-39 Note 6

BOARD EFFECTIVENESS

Nomination Committee

No details on this committee has been identified

BOARD SKILLS & DIVERSITY

The company's 'Below Average' rating for pay may be an indication of a management-friendly board because of the presence of one or more active CEO's

on the board.

AUDIT OVERSIGHT

Audit Committee - Number Of Meetings: 4

The SUPER ENERGY CORPORATION PUBLIC board of directors includes a fully independent audit committee and at least one member of that committee

meets our standards for financial expertise.

Independent

Name M/F Age Board Tenure (Years) Boards of Mgmt of Other Committee Status

Interests

Kamthorn Udomritthiruj M 91 17 1 Yes Yes Chair

Trithip Sivakriskul I $ F 56 5 2 Yes Yes Member

Virasak Sutanthavibul M 65 <1 2 Yes Yes Member

$ - Financial Expert I - Industry Expert

Risk Committee - Number Of Meetings: 8

Independent

Name M/F Age Board Tenure (Years) of Mgmt of Other Committee Status

Interests

Jormsup Lochaya I M 53 18 No Yes Member

Piya Sorntrakul M 67 5 Yes Yes Chair

Sunsiri Chaijareonpat F 53 5 Yes Yes Member

I - Industry Expert

Page 11 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

PAY OVERSIGHT

Pay Committee

No details on this committee has been identified

CONTROVERSIES & EVENTS

No major relevant controversies have been uncovered.

Page 12 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

PAY

Executive pay practices at SUPER ENERGY CORPORATION PUBLIC fall into the average Global Home Market

scoring range relative to global peers. Areas of particular concern include poor 0-10 Score Percentile Rank Percentile Rank

disclosure in relation to executive pay.

26th (Below 89th (Above

2.3

Average) Average)

KEY METRICS SCORING

PAY PERFORMANCE VS.

Deduction

▼ Global ▼ Home Market

NON-EXECUTIVE DIRECTOR PAY

▼ ▼

Director Equity Policy -0.10

PAY FIGURES

Executive Pay Disclosure -1.18

PAY PERFORMANCE ALIGNMENT

Clawbacks & Malus -0.20

Pay Linked to Sustainability -0.20

ANALYSIS

Pay values of the executives only reflect their remuneration as directors of the company.

PAY FIGURES

DISCLOSURE

Disclosure should include, at minimum, pay for each executive member of the Board of Directors (or Management Board for companies with a two-tier

board structure) on an individualized basis or in cases where there are no executive members, the CEO. The individualized disclosure should include

separate information on the amount of each of the following (where such a component is provided): salary, short-term Incentives, long-term Incentives,

pensions, benefits, and any one-off payments (such as recruitment or retention awards).

EXECUTIVE PAY - 2022

Executive Title Tenure Total Awarded Pay (USD) Total Realized Pay (USD)

(Years)

Jormsup Lochaya I CEO 18 8,315 8,315

Kulchalee Nuntasukkasem I $ CFO 1 3,032 3,032

Warinthip Chaisangha I $ Director 10 4,331 4,331

$ - Financial Expert (2) I - Industry Expert (3)

Page 13 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

CEO PAY DETAILS - Jormsup Lochaya

Pay Awarded 2022 Pay Realized

Fixed Pay Fixed Pay

Salary Salary

Fees 0 THB Fees 0 THB

Pension Pension

Perks & Other Pay 288,000 THB Perks & Other Pay 288,000 THB

Variable Pay Variable Pay

Short-term incentives Short-term incentives

Annual Bonus 0 THB Annual Bonus 0 THB

Other Non-equity Incentive Plan Other Non-equity Incentive Plan

Long-term incentives Long-term incentives

Grant date value of Stock Options Options Exercised

Grant date value of Stock Awards Stock Awards Vested

Total Awarded Pay 288,000 THB Total Realized Pay 288,000 THB

Page 14 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

PAY PEER GROUP

SMALLCAP - EMERGING - INDEPENDENT POWER AND RENEWABLE ELECTRICITY PRODUCERS (33 COMPANIES)

Page 15 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Company Home Market Market Pay 1 Yr Total CEO CEO Name CEO

Cap Year TSR Annual Since

(USD m) Pay (USD)

CONCORD NEW ENERGY GROUP LIMITED China 699 2022 -0.13% 572,666 Gui Aug 2020

MALAKOFF CORPORATION BERHAD Malaysia 651 2022 -0.08% 550,390 Abdul Ajib Dec 2020

TERNA ENERGY S.A. Other EMEA 1,912 2022 0.44% 362,471 Maragoudakis Jan 1997

Emerging

CECEP Wind-Power Corporation China 2,892 2021 0.00% 359,670 Liu Jun 2013

CANVEST ENVIRONMENTAL PROTECTION GROUP COMPANY China 1,294 2022 0.05% 337,350 Yuan Sep 2014

LIMITED

..........

GLOBAL POWER SYNERGY PUBLIC COMPANY LIMITED Thailand 3,696 2022 -0.19% 102,506 Pitayasiri Dec 2020

SHANGHAI ELECTRIC POWER CO., LTD. China 3,524 2022 -0.28% 102,277 Wei Jun 2020

TPI Polene Power Public Company Limited Thailand 774 2022 -0.16% 51,558 Leopairut Jan 2007

CK Power Public Company Limited Thailand 776 2022 -0.11% 24,542 Trivisvavet Jul 2015

Gunkul Engineering Public Company Limited Thailand 848 2022 -0.07% 24,109 Aueatchasai Mar

2021

Banpu Power Public Company Limited Thailand 1,184 2022 -0.04% 14,898 Limpaphayom Apr 2020

ABSOLUTE CLEAN ENERGY PUBLIC COMPANY LIMITED Thailand 454 2022 -0.25% 10,972 Bunditvorapoom May

2017

RATCH GROUP PUBLIC COMPANY LIMITED Thailand 1,931 2022 0.05% 10,266 Kietkajornkul Oct 2021

SUPER ENERGY CORPORATION PUBLIC COMPANY LIMITED Thailand 372 2022 -0.33% 8,315 Lochaya Sep 2004

SPCG PUBLIC COMPANY LIMITED Thailand 360 2022 -0.20% 3,898 Khunchornyakong Apr 2011

Juljarern

China Datang Corporation Renewable Power Co., Limited China 1,748 2022 -0.35% 0 Liu Mar

2019

ELECTRICITY GENERATING PUBLIC COMPANY LIMITED Thailand 1,833 2022 -0.02% 0 Theppitak Jul 2020

ACEN CORPORATION Philippines 3,283 2022 -0.36% 0 Francia May

2019

MEGA FIRST CORPORATION BERHAD Malaysia 692 2022 -0.08% 0 Goh Jul 2011

B.GRIMM POWER PUBLIC COMPANY LIMITED Thailand 2,280 2022 -0.04% 0 Link Dec 2020

TAQA MOROCCO SA Frontier 2,259 2022 -0.05% Houssaini Mar

2009

FIRST GEN CORPORATION Philippines 1,228 2022 -0.39% Lopez Feb 2008

..........

PT Cikarang Listrindo Tbk Indonesia 805 2022 0.08% Labbaika Jan 2015

Shamal Az-Zour Al-Oula Power and Water Company KSCP Other EMEA 681 2021 -0.11% Frain Nov

Emerging 2017

Omega Energia S.A. Brazil 1,198 2021 -0.20% de Bastos Filho May

2015

SHINFOX ENERGY CO., LTD. Taiwan 649 2022 0.00% Huisen Dec 2012

AKSA ENERJI URETIM ANONIM SIRKETI Turkey 1,701 2020 0.00% Kazanci Jul 2019

Due to the large size of this peer group, only a subset of companies is displayed in this table.

Page 16 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

CEO TOTAL AWARDED PAY VERSUS PAY PEER GROUP

0.5

0.25

TSR - 1yr

-0.25

SUPER ENERGY CORPORATION PUBLIC COMPANY LIMITED

-0.5

-100k 0 100k 200k 300k 400k 500k 600k 700k 800k 900k

Total Awarded Pay (USD)

Pay Peers (♦) are used in the calculation of the Key Metric CEO Pay Total Summary and selected as set out in the MSCI Governance Metrics Methodology Document.

CEO TOTAL REALIZED PAY VERSUS PAY PEER GROUP

7.5

5

TSR - 5yr

2.5

0 SUPER ENERGY CORPORATION PUBLIC COMPANY LIMITED

-2.5

-100k 0 100k 200k 300k 400k 500k 600k 700k 800k 900k

Total Realized Pay (USD)

Pay Peers (♦) are used in the calculation of the Key Metric CEO Pay Total Summary and selected as set out in the MSCI Governance Metrics Methodology Document.

PAY PERFORMANCE ALIGNMENT

CEO & EXECUTIVE EQUITY

No effective stock ownership guidelines have been identified.

Page 17 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

No CEO equity policy found.

Executive Tenure Shares Held YoY % Shareholding

(Years) Change As % of

Salary

Jormsup Lochaya I 18 4,888,380,123 4.15%

Kulchalee Nuntasukkasem I $ 1 0

Warinthip Chaisangha I $ 10 0

$ - Financial Expert (2) I - Industry Expert (3)

PAY LINKED TO SUSTAINABILITY

The company has failed to incorporate links to sustainability performance in its current incentive pay policies.

CLAWBACK & MALUS

No clawback or malus provisions have been identified.

NON-EXECUTIVE DIRECTOR PAY

NON-EXECUTIVE EQUITY

Director Tenure (Years) Shares Held

Kamthorn Udomritthiruj 17 0

Piya Sorntrakul 5 0

Sunsiri Chaijareonpat 5 0

Trithip Sivakriskul I $ 5 0

Wanida Machimanon N/A (Resigned) 0

$ - Financial Expert I - Industry Expert

NON-EXECUTIVE PAY TABLES

Director Tenure (Years) Cash Fees Other Comp Total Pay Total Pay (USD)

Kamthorn Udomritthiruj 17 840,000 THB 424,000 THB 1,514,000 THB 43,713

Piya Sorntrakul 5 840,000 THB 398,000 THB 1,488,000 THB 42,962

Sunsiri Chaijareonpat 5 720,000 THB 282,000 THB 1,152,000 THB 33,261

Trithip Sivakriskul I $ 5 720,000 THB 168,000 THB 1,088,000 THB 31,413

Wanida Machimanon N/A (Resigned) 720,000 THB 209,000 THB 1,079,000 THB 31,153

$ - Financial Expert I - Industry Expert

Page 18 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

CONTROVERSIES & EVENTS

No major relevant controversies have been uncovered.

Page 19 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

OWNERSHIP & CONTROL

The company's ownership structure and shareholder rights at SUPER ENERGY Global Home Market

CORPORATION PUBLIC fall within the average scoring relative to global peers. 0-10 Score Percentile Rank Percentile Rank

62nd (Average) 83rd (Above

8.1

Average)

KEY METRICS SCORING

Deduction OWNERSHIP & CONTROL PERFORMANCE VS.

DIRECTOR ELECTIONS ▼ Global ▼ Home Market

Strong Classified Board Combination -0.20 ▼ ▼

Annual Director Elections -0.10

ONE SHARE ONE VOTE

Voting Rights Limits Residency -0.15

OWNERSHIP STRUCTURE

SHAREHOLDER RIGHTS

Say on Pay Policy -0.10

CORPORATE STRUCTURE

Public Company

CAPITAL STRUCTURE

Capital Type Votes Per Share Shares Outstanding

Ordinary share 1.0 27,349,473,107

OWNERSHIP STRUCTURE

OWNERSHIP CATEGORIES

• Principal Shareholder

NOTABLE SHAREHOLDERS

SUWINTHAWAONG GOLD ASSET CO., LTD.-18.18% Mr. Jormsup Lochaya 18.2%

18.06%

5%+ shareholders - Aggregate Voting Power 18.2%

Insider Voting Power 18.1%

Even in the absence of a controlling shareholder, differential voting rights mean that the economic exposure of certain shareholders is higher than their

voting power.

Page 20 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

CONTROL MECHANISMS

Strong Classified Board Combination

Director Removal for Cause Only No

Director Removal without Cause Vote % 75.0

Shareholders can Fill Board Vacancies No

Effective Classified Board Yes

Bylaw Vote Percent 75.0

Country Law Mandate Of Thailand.

TAKEOVER PROVISIONS

Fair Price Provision Mandatory Bid Provision Mandatory Bid Ownership Threshold

Yes Yes 25.0

% of Votes to Approve a Merger

75%

GOVERNING DOCUMENTS

MAJORITY REQUIREMENTS

Bylaws Charter

Default percentage of votes required to amend a provision 75% 75%

Country Law Mandate Of Thailand.

Country Law Mandate Of Thailand.

SHAREHOLDER RIGHTS

There may be governance risks for investors in relation to shareholder rights and management-controlled takeover defense mechanisms at SUPER ENERGY

CORPORATION PUBLIC including:

• Limits on the right of shareholders to take action by written consent

• Voting rights limitations based on the shareholder’s country of residence

SHAREHOLDER MEETINGS & RESOLUTIONS

Call Special Meeting Requisition a Resolution at AGM Act by Written Consent

Percentage of shares required 10%

Page 21 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

RESTRICTIONS ON LEGAL ACTION BY SHAREHOLDERS

No exclusive forum provision has been identified.

SAY ON PAY

Despite a global trend towards providing shareholders with the ability to review and approve executive pay practices, the company does not operate in a

market which requires regular 'say on pay' votes nor has it extended this right to shareholders.

DIRECTOR ELECTIONS

BOARD RE-ELECTION PROVISIONS

Not all board members are subject to annual re-election. While considered by some governance experts as a means of ensuring board continuity, a

classified board structure may limit the ability of shareholders to hold directors accountable and serve as a takeover defense. The combined effect of these

mechanisms may reduce board accountability to shareholders.

Board Re-election Provisions

Board Re-election Frequency (Years) 3

% of Board subject to re-election 100%

DIRECTOR ELECTION STANDARD

The company has a majority standard for director elections (with immediate resignation if the director does not receive a majority of the votes cast), which

enables shareholders to hold directors accountable in uncontested elections.

Director Election Rules

Vote Standard Majority

Immediate Binding Resignation Yes

The directors are divided in three parts. And at every AGM one third of directors retire and stand for re-election.

The resolution is passed by simple majority of votes.

Page 22 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

ACCOUNTING

Based on the company's disclosures and other public information, accounting and Global Home Market

financial reporting practices at SUPER ENERGY CORPORATION PUBLIC appear to be 0-10 Score Percentile Rank Percentile Rank

generally appropriate and effective relative to global peers.

9.4 43rd (Average) 74th (Average)

KEY METRICS SCORING ACCOUNTING PERFORMANCE VS.

Deduction ▼ Global ▼ Home Market

AUDITOR INDEPENDENCE ▼ ▼

Auditor Tenure -0.10

EXTERNAL AUDITORS

Type Since Firm Most Recent Fiscal Year Auditor Vote

End Signed Off 1%

Primary Deloitte Touche Tohmatsu 2022

00 00 00

0%

2020 2022 2023

■Against ■Abstain/Withhold

Page 23 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

AUDITOR FEES

Fees paid to: Deloitte Touche Tohmatsu (Primary)

Dec 31, 2022 Dec 31, 2021 Dec 31, 2020

Fee (THB) (THB) (THB)

Audit

Audit 1,440,000 17,610,000 28,813,000

Related

Related:: 0.0 %

Audit

Related Non-audit

Tax

ax:: 0.0 %

Total Audit + 1,440,000 17,610,000 28,813,000

Audit Related Non-audit

Other

Other:: 0.0 %

Tax Audit

Audit:: 100.0 %

Compliance/

Advice

Other Non-

audit

Services

Total Non- 0 0 0

audit Fees

Total Fees 1,440,000 17,610,000 28,813,000

AUDITOR'S REPORT

Dec 31, 2022 Dec 31, 2021 Dec 31, 2020

Report Disclosed Yes Yes Yes

Opinion Unqualified Opinion Unqualified Opinion Unqualified Opinion

Emphasis of Matter No No No

CONTROVERSIES & EVENTS

No major relevant controversies have been uncovered.

Page 24 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Corporate Behavior 0-10 Change

Score (since rating)

Quartile Last score change date

3.1 0.0 ● Mar 28, 2023

CORPORATE BEHAVIOR THEME AND KEY ISSUE RANKINGS METHODOLOGY NOTE

This theme evaluates the extent to which companies

100 may face ethics issues such as fraud, executive

100 100 misconduct, corruption scandals, money laundering,

75 anti-trust violations, or tax-related controversies.

50 *

[ For symbols and terms used in this report, refer to

25 the Glossary section at the end of the report ]

9 4 8 4

0

Overall Business Ethics Tax Transparency

■ Global Percentile Rank ■ Home Market Percentile Rank

KEY AREAS OF CONCERN* SCORING DEDUCTIONS

Business Ethics Policies & Practices (-4.90)

Bribery and Anti-Corruption Policy

Regular Audits of Ethical Standards

Whistleblower Protection

Employee Training on Ethical Standards

Business Ethics Risk & Controversies (-2.00)

Corruption Risk Exposure & Controversies

*Key areas of concern include flagged key metrics that represent the largest scoring deductions. Please review the full report to see a

complete set of flagged key metrics.

CORPORATE BEHAVIOR SCORE HISTORY

10

0

Mar 2023

SUPER ENERGY CORPORATION PUBLIC COMPANY LIMITED

Page 25 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

BUSINESS ETHICS

Global Home

KEY METRICS SCORING 0-10 Score Change Percentile Market

(since rating) Rank Percentile

Rank

Deduction

0.0 8th (Below 4th (Worst

BUSINESS ETHICS POLICIES & PRACTICES -4.90 3.0

Average) In Class)

Bribery and Anti-Corruption Policy -0.70

Regular Audits of Ethical Standards -1.40 METHODOLOGY NOTE

Whistleblower Protection -1.40 Companies are evaluated on their oversight and management of business

Employee Training on Ethical Standards -1.40 ethics issues such as fraud, executive misconduct, corrupt practices,

money laundering, or anti-trust violations.

BUSINESS ETHICS RISK & CONTROVERSIES -2.00 *[ For symbols and terms used in this report, refer to the Glossary

Corruption Risk Exposure & Controversies -2.00 section at the end of the report ]

Note: Business Ethics Policies & Practices deductions as well as Business Ethics Risk & Controversies are capped BUSINESS ETHICS VS.

at a maximum of -7.0. Cumulative deductions are capped at 10.

▼ Global ▼ Home Market

▼▼

BUSINESS ETHICS POLICIES & PRACTICES

Indicators Company Practice Best Practice Deduction

Oversight for Ethics Issues Board-level committee Board-level committee or C-suite or Executive committee 0.00

Bribery and Anti-Corruption General statements of commitment to address bribery Detailed formal policy on bribery and anti-corruption -0.70

Policy and corruption issues

Regular Audits of Ethical No evidence Audits of all operations at least once every three years -1.40

Standards

Whistleblower Protection No evidence Policy provides whistleblowers with protection from retaliation -1.40

Employee Training on Ethical No evidence Programs covering all employees (including part-time) and -1.40

Standards contractors

Anti-Corruption Policy for NA All suppliers are required to have anti-corruption policies and 0.00

Suppliers programs to verify compliance

Policies Related to Anti-Money NA Policy and implementation strategy articulated 0.00

Laundering

*Business Ethics Policies & Practices deductions are capped at a maximum of -7.0.

Page 26 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

CORRUPTION RISK EXPOSURE

Exposure to: Regulatory risks or lost market access due to corruption scandals or political and social instability

Business Types : Percentage of operations in business segments perceived most likely to pay or receive bribes

■ High Risk ■ Medium Risk ■ Low Risk

0%

■ Electric power generation, Solar power

generation , Wind power generation,

Biomass power generation, Non-irrigation

water supply Source: Bribe Payers Index (Transparency International); State

■ Integrated systems design (0.11%) Capture Index (Transparency International); Refinitiv; MSCI ESG

100%

■ No exposure to low risk segments Research; company disclosures

Business Locations : Percentage of operations in countries with high/moderate/low level of corruption and political instability, violence or terrorism

■ No operations in markets with high risks Source: Corruption Perceptions Index (Transparency International);

■ Vietnam, other countries, Thailand World Governance Indicators (World Bank); Refinitiv; MSCI ESG

100%

■ No operations in markets with low risks Research; company disclosures

CORRUPTION RISK EXPOSURE SCORING DEDUCTION KEY

% of operations in medium and high risk % of operations in high risk business >=20% government <20% government No evidence of government

geographies segments ownership ownership ownership

20% or more 50% or more -4.00 -2.60 -2.00

Less than 50% -1.20 -1.20 -1.20

Less than 20% 50% or more -0.60 -0.60 -0.60

Less than 50% 0.00 0.00 0.00

*The Corruption Risk and Controversies Deduction is based on the maximum of deductions from the corruption risk exposure and corruption controversies category listed below

BUSINESS ETHICS CONTROVERSIES

Controversy Cases

Category Assessment Headline Status Last Updated Deduction

Business Ethics & Fraud -- No ongoing controversies. -- -- --

Anticompetitive Practices -- No ongoing controversies. -- -- --

Corruption -- No ongoing controversies. -- -- --

*The maximum deductions from the Anticompetitive Practices and Business Ethics & Fraud categories are summed to arrive at the overall Business Ethics Controversies deduction, which is capped at a maximum

of -7.0.

Page 27 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

TAX TRANSPARENCY

Global Home

Change Percentile Market

0-10 score

TAX GAP ASSESSMENT (since rating) Rank Percentile

Rank

Indicators 0.0 100th (Best In 100th (Best

10.0

Class) In Class)

Tax Gap

Estimated Effective Tax Rate 4.3% METHODOLOGY NOTE

Estimated Corporate Income Tax Rate 20.0%

Companies are evaluated on their estimated corporate tax gap (i.e. gap

Estimated Tax Gap (15.7%)

between estimated effective tax rate and estimated corporate income tax

Tax Gap Assessment High Gap

rate) and their involvement in tax-related controversies.

Revenue *[ For symbols and terms used in this report, refer to the Glossary

Foreign Revenue 34.6% section at the end of the report ]

Confidence TAX TRANSPARENCY VS.

Confidence Level of Estimation High ▼ Global ▼ Home Market

Involvement in Controversies NO ▼

▼

TAX CONTROVERSIES

Controversy Cases

Category Assessment Headline Status Last Updated Deduction

Tax Transparency -- No ongoing controversies. -- -- --

TAX CONTROVERSIES SCORING DEDUCTION KEY

Involvement in tax controversies Estimated tax gap Tax gap assessment Deduction

Yes Below 5% Low -0.80

5-10% Moderate -1.40

Above 10% High -2.00

No Below 5% Low 0.00

5-10% Moderate 0.00

Above 10% High 0.00

Tax related controversies are not considered for companies in Real Estate Management services or Mortgage REITs industries. Tax gap assessment is effectively low for companies with less than 5% of total

revenue categorized as foreign.

Page 28 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Opportunities in Score Change

(since rating)

Quartile Weight Last score change date

Renewable Energy

8.0 0.0 ●●●● 24.0% Mar 28, 2023

SUPER ENERGY

Strong Risk Management

10 CORPORATION

Top Quartile Second Quartile Third Quartile Bottom Quartile

PUBLIC COMPANY KEY ISSUE SCORE DISTRIBUTION*

9 LIMITED

8 27%

22%

7 16% 15%

6 9%

6%

3% 3%

5 0% 0% 0%

0 1 2 3 4 5 6 7 8 9 10

4

Key Issue Score

3

2 TOP 5 INDUSTRY LEADERS

1 ENGIE Brasil Energia S.A. 9.0

High Risk Exposure

0

CECEP Solar Energy Co., Ltd. 8.8

0 1 2 3 4 5 6 7 8 9 10

CHINA LONGYUAN POWER GROUP 8.8

CORPORATION LIMITED

China Three Gorges Renewables 8.6

Company 8.0 (Group) Co., Ltd.

KEY ISSUE

Industry 6.0

ASSESSMENT NATIONAL GRID PLC 8.6

0 5 10

Low Mod High

BOTTOM 5 INDUSTRY LAGGARDS

RISK EXPOSURE ASSESSMENT RISK MANAGEMENT ASSESSMENT

ENTERGY CORPORATION 2.8

Company 8.4 Company 8.3

Zhejiang Zheneng Electric Power CO., 1.2

Industry 5.8 Industry 6.3 LTD

0 5 10 0 5 10

Low Mod High Low Mod Strong Risk ADANI POWER LIMITED 1.1

Risk Management

Drivers of Risk Exposure Drivers of Risk Management WINTIME ENERGY GROUP CO.,LTD. 1.1

Business Types Practices Score CGN Power Co., Ltd. 0.5

Company 9.7 Company 7.5

0 5 10 0 5 10

METHODOLOGY NOTE

Business Locations Performance Score Companies are evaluated on their efforts to develop

Company 3.7 Company 10.0 renewable power generation capacity and/or enable

renewable power development through network

0 5 10 0 5 10

expansion and “green power” offerings.

Page 29 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

*

[ For symbols and terms used in this report, refer to

the Glossary section at the end of the report ]

EXPOSURE

RISK EXPOSURE Company 8.4

ASSESSMENT Industry 5.8

0 5 10

Low Mod High

Risk

Key Drivers of Risk Exposure

Exposure to: Opportunity to increased revenues from capturing changing consumer demand, enjoying early mover advantage or regulatory incentives

(mandates or subsidies)

Business Types : Percentage of assets in power generation business segment

3% ■ Electric power generation, Solar power

generation , Wind power generation,

Biomass power generation

■ No exposure to medium opportunity

segments

■ Non-irrigation water supply, Integrated

97%

systems design Source: MSCI ESG Research; Refinitiv; company disclosures

Business Locations : Percentage of operations in markets with government subsidies in support of renewable power production

35%

■ No operations in markets with high

65% opportunities

■ Thailand

■ Vietnam Source: Refinitiv; MSCI ESG Research; company disclosures

MANAGEMENT

RISK MANAGEMENT Company 8.3

ASSESSMENT Industry 6.3

0 5 10

Low Mod Strong Risk

Management

Renewable Capacity as Percentage of Total Capacity

Solar 98.94%

Page 30 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Other Renewable 1.06%

Total Renewable 100.00%

Renewable Capacity (MW)

Solar 836.72

Other Renewable 9

Total Renewable Capacity (MW) 845.72

Page 31 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Human Capital Score Change

(since rating)

Quartile Weight Last score change date

Development

1.6 0.0 ● 23.0% Mar 28, 2023

Strong Risk Management

10

Top Quartile Second Quartile Third Quartile Bottom Quartile

KEY ISSUE SCORE DISTRIBUTION*

9

8 20%

15% 15% 16%

7 13%

10%

6 5% 4%

1%

5 0% 0%

0 1 2 3 4 5 6 7 8 9 10

4 SUPER ENERGY

CORPORATION Key Issue Score

3 PUBLIC COMPANY

LIMITED

2 TOP 5 INDUSTRY LEADERS

1 SEVERN TRENT PLC 9.3

High Risk Exposure

0

ENTERGY CORPORATION 8.9

0 1 2 3 4 5 6 7 8 9 10

AMERICAN WATER WORKS 8.8

COMPANY, INC.

FIRSTENERGY CORP. 8.8

Company 1.6

KEY ISSUE REDEIA CORPORACION, S.A. 8.6

Industry 5.5

ASSESSMENT

0 5 10

Low Mod High BOTTOM 5 INDUSTRY LAGGARDS

RISK EXPOSURE ASSESSMENT RISK MANAGEMENT ASSESSMENT BKW AG 1.7

Zhejiang Zheneng Electric Power CO., 1.7

Company 7.3 Company 1.9

LTD

Industry 7.4 Industry 5.8

0 5 10 0 5 10 CECEP Solar Energy Co., Ltd. 1.6

Low Mod High Low Mod Strong Risk

Risk Management GD POWER DEVELOPMENT CO., LTD. 1.1

Drivers of Risk Exposure Drivers of Risk Management

Indraprastha Gas Ltd 0.9

Business Types Practices Score

Company 7.3 Company 1.4

0 5 10 0 5 10

METHODOLOGY NOTE

Companies are evaluated on their workforce talent

Performance Score requirements and their ability to attract, retain, and

Company 3.0 develop a highly skilled workforce.

0 5 10 *

[ For symbols and terms used in this report, refer to

the Glossary section at the end of the report ]

Page 32 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Controversy Deduction

Company 0.0

-5.0 -2.5 0

EXPOSURE

RISK EXPOSURE Company 7.3

ASSESSMENT Industry 7.4

0 5 10

Low Mod High

Risk

Key Drivers of Risk Exposure

Exposure to: Risk of increased turnover and associated costs of rehiring, loss of intellectual and human capital through attrition, reduced ability to attract

talent

Business Types : Percentage of operations in business segments with high/moderate/low levels of employee qualification needs and compensation per

employee

2%

■ Electric power generation, Solar power

generation , Wind power generation,

Biomass power generation, Integrated

systems design Source: Employment Projections, US Bureau of Labor Statistics;

■ Non-irrigation water supply Occupational Employment and Wage Statistics, US Bureau of Labor

98%

■ No exposure to low risk segments Statistics; Refinitiv; MSCI ESG Research; company disclosures

Layoffs and Restructuring Events

Major merger or acquisition in the last three years (affecting large No Evidence

proportion of staff):

Major layoffs in the last three years (affecting 10% of staff or over 1,000 No Evidence

employees):

MANAGEMENT

RISK MANAGEMENT Company 1.9

ASSESSMENT Industry 5.8

0 5 10

Low Mod Strong Risk

Management

Page 33 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Description Company Practice Best Practice Practices Score2

Practices

Scope of support for degree programs General statements on Programs covering all

- LOW MID TOP

and certifications training and development employees (including part-

time and contractors)

Strategy

Extent of grievance reporting or No evidence Formal grievance

- LOW MID TOP

escalation procedures escalation/reporting

(confidential)

Engagement surveys to monitor No evidence Surveys conducted annually

- LOW MID TOP

employee satisfaction

Talent pipeline development strategy

Formal talent pipeline development Not Disclosed Yes

- LOW TOP

strategy (forecasts hiring needs,

actively develops new pools of talent)

Graduate traineeship/apprenticeship Not Disclosed Yes

- LOW TOP

program

Partners with educational institutions Not Disclosed Yes

- LOW TOP

to develop or deliver joint training

programs for staff

Programs & Initiatives

Scope of employee stock ownership No evidence of ESOP or Sector-leading number of

- LOW MID TOP

plan (ESOP) or employee stock ESPP employees eligible for ESOP

purchase plan (ESPP) and/or ESPP

Non-salary benefits and work/life Scope not determinable Benefits cover all employees

- LOW MID TOP

balance

Regular performance appraisals and Not disclosed Sector leading programs

- LOW MID TOP

feedback processes

Job-specific development training Yes Sector leading programs

- LOW MID TOP

programs

Evidence of managerial/ leadership General statements on Comprehensive succession

- LOW MID TOP

development training leadership training with planning & development

unknown scope or achieved programs at multiple levels

results

Training

Year (YYYY) Percentage of employees receiving training Annual training hours per employee

2021

2020

Page 34 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Year (YYYY) Percentage of employees receiving training Annual training hours per employee

2019

Workforce Diversity

Year Annual employee Profit per employee Percentage of women in executive

(YYYY) turnover (USD '000) management Details

2021 50.00%

2020 36.40%

2019 KMP

1 Mr. Jormsup Lochaya Managing Director

(Acting)

2 Miss Rungnapa Prominent Moon Assistant

Managing Director

3 Mr. Phumanan Sirithanakorn, Director of

Operations

4 Mr. Apicha Sripinit, HR / Administration

Manager

CONTROVERSIES

All controversies are assessed as part of the annual review of a company's ESG rating. MSCI ESG Research tracks controversies for all companies on a regular

basis. There is no evidence of the SUPER's current involvement in prominent controversial events or alleged misconduct.

Page 35 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Carbon Emissions Score Change

(since rating)

Quartile Weight Last score change date

9.3 0.0 ●●● 12.0% Mar 28, 2023

Strong Risk Management

10

Top Quartile Second Quartile Third Quartile Bottom Quartile

KEY ISSUE SCORE DISTRIBUTION*

9

8 28%

7 16%

15%

SUPER ENERGY

11% 11%

6 CORPORATION

4% 4% 5% 4%

PUBLIC COMPANY 1% 2%

5 LIMITED 0 1 2 3 4 5 6 7 8 9 10

4

Key Issue Score

3

2 TOP 5 INDUSTRY LEADERS

1 ADANI GREEN ENERGY LIMITED 10.0

High Risk Exposure

0

ALGONQUIN POWER & UTILITIES 10.0

0 1 2 3 4 5 6 7 8 9 10

CORP.

Acciona, S.A. 10.0

BROOKFIELD RENEWABLE 10.0

Company 9.3 CORPORATION

KEY ISSUE

Industry 7.4

ASSESSMENT CENTRICA PLC 10.0

0 5 10

Low Mod High

BOTTOM 5 INDUSTRY LAGGARDS

RISK EXPOSURE ASSESSMENT RISK MANAGEMENT ASSESSMENT

Huadian Power International 0.9

Company 1.2 Company 4.3 Corporation Limited

Industry 4.9 Industry 5.8 ADANI POWER LIMITED 0.6

0 5 10 0 5 10

Low Mod High Low Mod Strong Risk HUANENG POWER INTERNATIONAL, 0.5

Risk Management

INC.

Drivers of Risk Exposure Drivers of Risk Management

WINTIME ENERGY GROUP CO.,LTD. 0.2

Business Types Practices Score

Company 1.2 Company 5.0 Datang International Power 0.0

0 5 10 0 5 10

Generation Co., Ltd.

Business Locations Performance Score

METHODOLOGY NOTE

Company 4.6 Company 3.0

Companies are evaluated on the carbon intensity of

0 5 10 0 5 10

their operations and their efforts to manage climate-

related risks and opportunities.

Page 36 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

*

[ For symbols and terms used in this report, refer to

the Glossary section at the end of the report ]

EXPOSURE

RISK EXPOSURE Company 1.2

ASSESSMENT Industry 4.9

0 5 10

Low Mod High

Risk

Key Drivers of Risk Exposure

Exposure to: Risks of having to pay increased compliance costs tied to carbon emissions regulations

Business Types : Percentage of operations in business segments with high/moderate/low carbon intensity

9%

8%

■ Electric power generation

■ Biomass power generation, Non-irrigation

water supply Source: IERS' Comprehensive Environmental Data Archive (CEDA);

83% ■ Solar power generation , Wind power Air Emissions Accounts (Eurostat); Refinitiv; MSCI ESG Research;

generation, Integrated systems design company disclosures

Business Locations : Percentage of operations in countries with strengthening or pending carbon emissions regulation

■ No operations in markets with high risks

■ Vietnam, other countries, Thailand

100%

■ No operations in markets with low risks Source: MSCI ESG Research; Refinitiv; company disclosures

MANAGEMENT

RISK MANAGEMENT Company 4.3

ASSESSMENT Industry 5.8

0 5 10

Low Mod Strong Risk

Management

Page 37 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Description Company Practice Best Practice Practices Score2

Targets

Aggressiveness of the company's No target Aggressive target with a low

- LOW MID TOP

reduction target in the context of its base

current performance

Mitigation

Strength of Greenhouse Gas Mitigation 10.00

Strategy (0-10 Score, 0=worst, 10=best)

Programs or actions to reduce the emissions intensity of core operations

Use of cleaner sources of energy Aggressive efforts Aggressive efforts

- LOW MID TOP

CDP disclosure No Yes

- LOW TOP

Performance

Carbon Emissions Performance Relative to Peers (0-10 Score, 0=worst, 10=best) 3.00

GHG Emissions - metric tons CO2e

Scope 1 Scope 2 Scope 1+2 Scope 3 Scope 3 Scope 3 Scope 1 Scope 2 Scope 1+2

Year Disclosed Scope 1 Estimate Key Disclosed Scope 2 Estimate Key Disclosed (upstream) (downstream) (undefined) Estimated Estimated Estimated Scope 1+2 Estimate Key GHG Emissions Details

2021 E.Segmt-Low E.Segmt-Moderately 5,513.0 3,859.0 9,372.0 E.Segmt-Low Mar 2023 Emissions

Low Estimation Update

2020 E.Segmt-Low E.Segmt-Moderately 12,868.0 4,306.0 17,174.0 E.Segmt-Low March 2022

Low Emissions Estimation

Update

2019 E.Segmt-Moderately E.Segmt-Moderately 436.0 2,018.0 2,454.0 E.Segmt-Moderately Mar-2021 Estimation

Low Low Low Update

2018 E.Segmt-Moderately E.Segmt-Low 4.0 903.0 907.0 E.Segmt-Low Jan-2020 Emissions

Low Estimation Update

2017 E.Segmt-Moderately E.Segmt-Moderate 4.0 729.0 733.0 E.Segmt-Moderately April 2019 Estimation

Low Low Update

2016 E.Segmt-Moderately E.Segmt-Moderately 3.0 443.0 446.0 E.Segmt-Moderately Feb-2018 Emission

Low Low Low Estimation Update

2015 E.Segmt-Low E.Segmt-Moderate 1,504.0 83.0 1,587.0 E.Segmt-Low March 2017

Estimation Update

2014 E.GICSSI - LOW E.GICSSI - LOW 1,301.0 30.0 1,331.0 E.GICSSI - LOW March 2017

Estimation Update

2013 E.GICSSI - LOW E.GICSSI - LOW 770.0 13.0 783.0 E.GICSSI - LOW March 2017

Estimation Update

2012 E.GICSSI - LOW E.GICSSI - LOW 5,042.0 70.0 5,112.0 E.GICSSI - LOW March 2017

Estimation Update

2011 E.GICSSI - LOW E.GICSSI - LOW 3,602.0 50.0 3,652.0 E.GICSSI - LOW March 2017

Estimation Update

2010 E.GICSSI - LOW E.GICSSI - LOW 2,487.0 34.0 2,521.0 E.GICSSI - LOW March 2017

Estimation Update

2009 E.GICSSI - LOW E.GICSSI - LOW 1,667.0 23.0 1,690.0 E.GICSSI - LOW March 2017

Estimation Update

GHG Emissions Intensity - metric tons CO2e / USD million sales

Year GHG Intensity GHG Intensity Details GHG Intensity - Reported GHG Intensity - Reported Details

2021 36.70

Page 38 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

Year GHG Intensity GHG Intensity Details GHG Intensity - Reported GHG Intensity - Reported Details

2020 79.00

2019 11.80

2018 5.20

2017 4.30

2016 4.40

2015 144.10

2014 213.60

2013 281.70

2012 349.20

2011 349.10

2010 349.20

2009 349.20

Page 39 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

APPENDIX

CONTENTS

CONTROVERSIES DETAIL

ADDITIONAL CORPORATE GOVERNANCE CONTENT

KEY METRIC & SCORE CHANGES

CEO PAY CHARTS

DIRECTOR VOTES

SHAREHOLDER/MANAGEMENT PROPOSALS

GOVERNANCE STANDARDS

DIRECTOR PROFILES

Page 40 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

CONTROVERSIES DETAIL

Here you will find the narratives for all controversies relevant to the ESG Ratings issues covered for the company in addition to those controversies that do not map to the ESG

Ratings issues.

CONTROVERSY CARD NUMBER OF CONTROVERSIES BY PILLAR

MOST SEVERE 6

CONTROVERSY CONTROVERSY COUNT

Environment

Carbon Emissions None 0

4

Opportunities in Renewable Energy None 0

Social

Human Capital Development None 0 2

Governance

Corporate Governance None 0

0 0 0

Corporate Behavior None 0 0

Environment Social Governance

CONTROVERSIES

NUMBER OF CONTROVERSIES BY ASSESSMENT

• Very Severe: Indicates an action by a company that results in a very large

impact on society and/or the environment.

6

• Severe: Indicates an action by a company that results in a large impact on

society and/or the environment.

• Moderate: Indicates an action by a company that results in a moderate

impact on society and/or the environment. 4

• Minor: Indicates an action by a company that results in a low impact on

society and/or the environment.

• None: There is no evidence that a company is involved in any controversy. 2

0 0 0 0

0

Very Severe Severe Moderate Minor

Page 41 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

KEY METRIC & SCORE CHANGES

ALL KEY METRIC & SCORE CHANGES (SINCE JUNE 2022)

Key Metric Key Metric Change Date Score Change* Change Notes

Related Party Transactions Flag Added Jun 26, 2023 -0.10

Entrenched Board Flag Removed Jun 26, 2023 1.19

CEO Equity Changes Flag Removed Jun 26, 2023 0.20

Audit Committee Industry Expert Flag Removed Jun 26, 2023 0.10

Pay Linked to Sustainability Flag Added Nov 22, 2022 -0.20

Executives on Board Flag Added Aug 19, 2022 -0.20

Revenue Recognition Score Change Jun 12, 2022 0.20 Methodology enhancements

No Nomination Committee Flag Added Jun 12, 2022 -0.30 Methodology enhancements

Asset-Liability Valuation Score Change Jun 12, 2022 0.29 Methodology enhancements

CEO PAY CHARTS

Due to the large size of this peer group, only a subset of companies is displayed in this table.

CEO TOTAL AWARDED PAY VERSUS PAY PEER GROUP

0.5

0.25

TSR - 1yr

-0.25

SUPER ENERGY CORPORATION PUBLIC COMPANY LIMITED

-0.5

-100k 0 100k 200k 300k 400k 500k 600k 700k 800k 900k

Total Awarded Pay (USD)

Pay Peers (♦) are used in the calculation of the Key Metric CEO Pay Total Summary and selected as set out in the MSCI Governance Metrics Methodology Document.

Page 42 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

CEO TOTAL REALIZED PAY VERSUS PAY PEER GROUP

7.5

5

TSR - 5yr

2.5

0 SUPER ENERGY CORPORATION PUBLIC COMPANY LIMITED

-2.5

-100k 0 100k 200k 300k 400k 500k 600k 700k 800k 900k

Total Realized Pay (USD)

Pay Peers (♦) are used in the calculation of the Key Metric CEO Pay Total Summary and selected as set out in the MSCI Governance Metrics Methodology Document.

DIRECTOR VOTES

Proxy Year Name Age Tenure Votes For Votes Against, Withheld and / or Abstained

2023 Kamthorn Udomritthiruj 91 17 93.7% 6.3%

2023 Virasak Sutanthavibul 65 0.44901 94.9% 5.1%

2023 Warinthip Chaisangha 55 10 94.9% 5.2%

Page 43 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA

RATING

TING A

ACCTION D

DAATE: Mar

March

ch 28, 2023

LAST REPOR

REPORT T UPD

UPDAATE: September 26, 2023

SHAREHOLDER/MANAGEMENT PROPOSALS

MANAGEMENT PROPOSALS

Proxy Proposal Proposal Summary Outcome Votes Votes Abstain/

Year For Against Withheld%

2023 Other 1. The Meeting certified the Minutes of the Annual General Meeting Shareholders for the Year 2022 held on Approved 100% 0% 0%

April 22,2022, with the following voting results:

2023 Other 3. The Meeting approved the financial statements for the year ended December 31, 2022, which were Approved 99.9% 0% 0.1%

audited by the auditor, with the following voting results:

2023 Other 4. The Meeting approved the reserve funds as stipulated by the laws in the year 2022 is equal to Approved 99.6% 0.4% 0%

6,651,971.27 baht,and omissions of dividend payments the year 2022. This is because the Company needs to

reserve for workingcapital and to support the economic uncertainty in 2023, with the following […]

2023 Director 6. The Meeting approved the director’s remunerations for the year 2023, the details are as follows: Approved 98% 2% 0%

Compensation

2023 Auditor 7. The Meeting approved to appoint the auditor from Deloitte Touche Tohmatsu Chaiyos Audit Co., Ltd. as the Approved 100% 0% 0%

Ratification auditorof the year 2023as follows:

2023 Amend 8. The Meeting approved the amendment of the Company's Articles of Association in 3 items, consisting of Approved 100% 0% 0%

Certificate of Article 21,Article 25, and Article 39, to support the meetingmanagementelectronically. Keeping meetings up-

Incorporation to-date and efficient, including facilitating the shareholders with the following votes.

2022 Other 1. The Meeting certified the Minutes of the Annual General Meeting Shareholders for the Year 2021 was held Approved 100% 0% 0%

on April 30, 2021, with the following voting results:

2022 Other 3. The Meeting approved the financial statements for the year ended December 31, 2021, which were Approved 99.9% 0% 0.1%

audited by the auditor, with the following voting results:

2022 Other 4. The Meeting approved the reserve funds as stipulated by the laws in the year 2021 is equal to Approved 100% 0% 0%

16,037,118.25 baht and approve a dividend payment for the year 2021 performance operating profit as cash

dividend in amount of 0.006 Bath per share for existing shareholders. Total dividend payment not […]

2022 Board Size 6. The Meeting approve the increase in the number of directors of the Company by 1 person, from the Approved 92.2% 7.8% 0%

original 7 persons to 8 persons, and deem it appropriate to propose to appoint Mrs. Kulchalee

Nuntasukkasem ,as a new director of the Company, with the following voting results:

2022 Director 7. The Meeting approved the director’s remunerations for the year 2022, the details are as follows: Approved 100% 0% 0%

Compensation

2022 Other 9. The Meeting approved the issuance and offering of debentures with the offering value not exceeding of Approved 99.1% 0.9% 0%

Baht 20,000,000,000 (- twenty billion baht -) or equivalent. , with the following votes;

2022 Auditor 8. The Meeting approved to appoint the auditor from Deloitte Touche Tohmatsu Chaiyos Audit Co., Ltd. as the Approved 100% 0% 0%

Ratification auditor

*For Management Proposals at AGM’s held more than three years ago, please refer to the Screener tool on ESG Manager.

Page 44 of 58 ©2023 MSCI Inc. All rights reserved.

SUPER ENERGY CORPORATION

PUBLIC COMPANY LIMITED (SUPER)

RA