Professional Documents

Culture Documents

Reflection Paper 2 - Financial Management Plan

Reflection Paper 2 - Financial Management Plan

Uploaded by

Roger VirayOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reflection Paper 2 - Financial Management Plan

Reflection Paper 2 - Financial Management Plan

Uploaded by

Roger VirayCopyright:

Available Formats

Reflection Paper 2: Financial Management Plan 1

Name: Mark Jay D. Viray Date: 27/11/2023

Instruction: Answer the questions indicated in each number.

Financial Management Plan

1. Describe the kind of lifestyle and setup that you are planning to have after graduation.

• What kind of lifestyle do you plan to have?

• Where will you live? With your parents? Rent an apartment?

• Will you be commuting to places or driving a car?

1. Health and Well-Being and Career Lifestyle

2. I will be living with my parents.

3. Commuting and Driving

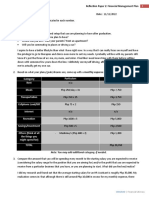

2. Based on what your plans/goals/dreams are, come up with a monthly expense list using the table below.

Category Particulars Total

Rent 10,000 / a month 120,000 (1 year)

Meals 500 / a day 182,500 (1 year)

Transportation 200 / a day 73,000 (1 year)

Cellphone Load/Bill 400 / every 2 months 2,400 (1 year)

Internet 1500 / a month 18,000 (1 year)

Recreation 3000 / a month 36,000 (1 year)

Savings/Investment 2000 / a month 24,000 (1 year)

Others (think of all 2000 / a month 24,000 (1 year)

the things you

might spend for)

TOTAL 479,900 (1 year)

Note: You may add additional category, if needed.

3. Compare the amount that you will be spending every month to the starting salary you are expected to receive

(considering the salary range for the position that you are aiming for) and/or the profit that you are expected to

receive from a particular business that you have, or you are planning to start. What did you find out/realize?

As I worked on my financial management plan and learned the base salaries for junior architects, it hit me that

my upcoming salary won't quite cover all my daily expenses. This realization has made me realize how important

budgeting and planning my finances are as I move into the working world. It has made me rethink how I spend

my money and make a more thoughtful approach to handling my money a priority.

CSBGRAD | Financial Literacy

Reflection Paper 2: Financial Management Plan 2

4. In our previous activities, you have already identified your career and vocation plans and goals. This time

identify 3-5 financial goals and the financial/money management strategies that you would like to try to be able

to meet your financial goals by filling out the table below. Please note that financial goals may be in the form of

purchases that you want to make someday, or a savings fund you wish to put up or the need to pay up debts

(Madura, 2007).

FINANCIAL GOALS WHEN DO YOU WANT ESTIMATED MONEY MANAGEMENT STRATEGIES TO

TO ACHIEVE IT TOTAL COST MEET YOUR FINANCIAL GOAL

2024 500,000 Php Savings, Investment, Building Budget

Personal Office Setup

2035 10,000,000 Php Savings, Investment, Building Budget

Own House

2040 5,000,000 Php Savings, Investment, Building Budget

Own Car

5. What new information was added to your knowledge on financial management?

My realization in financial management added the understanding that my anticipated salary may not sufficiently

cover my daily expenses, emphasizing the importance of thorough budgeting.

6. What old beliefs about financial management were altered?

This realization altered my old belief that a fixed salary would effortlessly meet all my financial needs without

detailed planning.

7. What personal perceptions about financial management were affirmed?

It affirmed my personal perception that financial management is a critical skill, requiring proactive planning and

careful budgeting to navigate the challenges of adulting and professional life.

8. Why is financial planning and management important?

Financial planning and management are crucial because they ensure that one's income aligns with expenses,

allowing for a sustainable and secure financial future, especially when faced with the reality of potential budget

shortfalls.

CSBGRAD | Financial Literacy

You might also like

- Solution Manual For Personal Finance 7th Edition Jeff MaduraDocument24 pagesSolution Manual For Personal Finance 7th Edition Jeff MaduraToddNovakiqzmg100% (39)

- 632b1ae42f70d INSIDE LVMH FAQ Promotion October 2022Document16 pages632b1ae42f70d INSIDE LVMH FAQ Promotion October 2022mariaNo ratings yet

- Solution Manual For Personal Finance 6th Edition by MaduraDocument9 pagesSolution Manual For Personal Finance 6th Edition by Maduraa846866853No ratings yet

- Oil Skimmer Project Report FinalDocument22 pagesOil Skimmer Project Report FinalGC C100% (1)

- 1 TRN Tawa 100326845300003Document1 page1 TRN Tawa 100326845300003Roopesh ReddyNo ratings yet

- Gundan - Reflection Paper 2 - Financial Management PlanDocument2 pagesGundan - Reflection Paper 2 - Financial Management PlanMARY ATHENA GUNDANNo ratings yet

- Introduction of Financial PlannningDocument27 pagesIntroduction of Financial Plannningvarkha nayarNo ratings yet

- Math'S Project-Home Budget: Advaith Praveen Shetty XTH Roll - No - 02Document21 pagesMath'S Project-Home Budget: Advaith Praveen Shetty XTH Roll - No - 02Technology StudyNo ratings yet

- Cerberus Wireline PDFDocument6 pagesCerberus Wireline PDFLeudys PalmaNo ratings yet

- En VALORANT Champions Tour Global Competition PolicyDocument38 pagesEn VALORANT Champions Tour Global Competition PolicyMamang GamingNo ratings yet

- Reading File 1Document2 pagesReading File 1Luciano Augusto Silveira FernandesNo ratings yet

- Reflection Paper 2 - Financial Management PlanDocument3 pagesReflection Paper 2 - Financial Management PlanANGEL JIYAZMIN DELA CRUZNo ratings yet

- Financial Planning Participant Guide 2019-2020 Writeable PDFDocument104 pagesFinancial Planning Participant Guide 2019-2020 Writeable PDFTung TaNo ratings yet

- Project in Business FinanceDocument10 pagesProject in Business FinanceKOUJI N. MARQUEZNo ratings yet

- Reflection Paper 2 - Financial Management PlanDocument2 pagesReflection Paper 2 - Financial Management PlanrefferNo ratings yet

- Personal Financial Planning Statement and Investment Policy StatementDocument21 pagesPersonal Financial Planning Statement and Investment Policy Statementcollins KimaiyoNo ratings yet

- M ' - Home Budget: ATH S ProjectDocument21 pagesM ' - Home Budget: ATH S ProjectmuizzNo ratings yet

- Essay Basic Macro EconomicsDocument4 pagesEssay Basic Macro Economicsnhungtobe1No ratings yet

- Idoc - Pub - Icse X Maths Project On Home BudgetDocument21 pagesIdoc - Pub - Icse X Maths Project On Home BudgetLinga Alex75% (4)

- Introduction To Financial Planning and BudgetingDocument8 pagesIntroduction To Financial Planning and Budgetingarmyk5991No ratings yet

- Module 1 Introd. To PFDocument35 pagesModule 1 Introd. To PFPrisha SinghaniaNo ratings yet

- Case Study On Planning FinanceDocument4 pagesCase Study On Planning FinanceShivNo ratings yet

- Creating A Personal Financial PlanDocument10 pagesCreating A Personal Financial PlanMH DevNo ratings yet

- Introduction To Financial Planning Unit 1Document57 pagesIntroduction To Financial Planning Unit 1Joshua GeddamNo ratings yet

- Case Study On Planning FinanceDocument4 pagesCase Study On Planning FinanceShivNo ratings yet

- Wealth ManagementDocument67 pagesWealth ManagementShera BhaiNo ratings yet

- Wealth IntroDocument133 pagesWealth Introdinakar sNo ratings yet

- FINANCEDocument1 pageFINANCEmae salingbayNo ratings yet

- I. Let's Know: Learning Activity SheetDocument14 pagesI. Let's Know: Learning Activity SheetYuri GalloNo ratings yet

- Tutorial PFPDocument20 pagesTutorial PFPGAW KAH YAN KITTYNo ratings yet

- Financial Education Facilitator ManualDocument12 pagesFinancial Education Facilitator ManualNicholas MundiaNo ratings yet

- Business Finance Week 2 2Document14 pagesBusiness Finance Week 2 2Phoebe Rafunsel Sumbongan Juyad100% (1)

- 10 Steps To Financial Success HandoutDocument13 pages10 Steps To Financial Success Handoutheldergourgel30No ratings yet

- Financial Empowerment: Master Your Money and Transform Your LifeFrom EverandFinancial Empowerment: Master Your Money and Transform Your LifeRating: 5 out of 5 stars5/5 (1)

- Essential Life Skills: An Inclusive Guide to What Everyone Should LearnFrom EverandEssential Life Skills: An Inclusive Guide to What Everyone Should LearnNo ratings yet

- Gupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementDocument11 pagesGupta'S - Personal Financial Statements and Plans: IMG-3 Personal Wealth ManagementAnand YadavNo ratings yet

- English For Finance and Banking Case Study 1Document9 pagesEnglish For Finance and Banking Case Study 1qainparis77No ratings yet

- Case InstructionsDocument4 pagesCase InstructionsHw SolutionNo ratings yet

- Personal Finance IncomeDocument83 pagesPersonal Finance Income35.អ៊ាន សមកិត្យាNo ratings yet

- Lesson 3 in ConsumerDocument10 pagesLesson 3 in ConsumerLynner Anne Deyta0% (1)

- Retirement PlanningDocument11 pagesRetirement PlanningIan Miles TakawiraNo ratings yet

- 4: Above Average KnowledgeDocument5 pages4: Above Average KnowledgeReyjane ArzaNo ratings yet

- Money Matters 101 - Financial Planning Essentials: Finance 4 Everyone, #1From EverandMoney Matters 101 - Financial Planning Essentials: Finance 4 Everyone, #1No ratings yet

- Financial PlanningDocument6 pagesFinancial PlanningSheikh NadeemNo ratings yet

- TaskDocument2 pagesTaskshereen.mNo ratings yet

- FE Handbook EngDocument24 pagesFE Handbook EngRajeshkanna PNo ratings yet

- Budget Preparation: Lesson 3.2Document24 pagesBudget Preparation: Lesson 3.2JOSHUA GABATERONo ratings yet

- Financial Literacy Cum Planning & BudgettingDocument20 pagesFinancial Literacy Cum Planning & BudgettingginaNo ratings yet

- IBK - Personal Finance and BudgetingDocument18 pagesIBK - Personal Finance and Budgetingisaackwegyir2No ratings yet

- Financial Planning Made Easy: A Beginner's Handbook to Financial SecurityFrom EverandFinancial Planning Made Easy: A Beginner's Handbook to Financial SecurityNo ratings yet

- Overview of Financial Plan: Lesson 1: FIN101Document17 pagesOverview of Financial Plan: Lesson 1: FIN101Antonette HugoNo ratings yet

- Financial Planning For Young InvestorsDocument44 pagesFinancial Planning For Young InvestorsMateen QadriNo ratings yet

- Play Smart with Your Money: A Comprehensive Approach to Securing Your FinancesFrom EverandPlay Smart with Your Money: A Comprehensive Approach to Securing Your FinancesNo ratings yet

- Finance - Financial Planning ProcessDocument9 pagesFinance - Financial Planning ProcessTrishia Lynn MartinezNo ratings yet

- Solution Manual For Pfin 6Th Edition Billingsley Gitman Joehnk 9781337117005 9781337117005 Full Chapter PDFDocument36 pagesSolution Manual For Pfin 6Th Edition Billingsley Gitman Joehnk 9781337117005 9781337117005 Full Chapter PDFrobert.fields414100% (19)

- Smart Money BudgetsDocument24 pagesSmart Money BudgetsShreyash BardeNo ratings yet

- For Chapter 1Document36 pagesFor Chapter 1Giella MagnayeNo ratings yet

- Personal Finance ProjectDocument4 pagesPersonal Finance ProjectMoth ManNo ratings yet

- P.V Number: 125268 Buyer Code: 6600005040293: Canal Side Campus Girls, Lahore NTN 22-13-0786158-3 BCRDocument1 pageP.V Number: 125268 Buyer Code: 6600005040293: Canal Side Campus Girls, Lahore NTN 22-13-0786158-3 BCRAmbreen ZainebNo ratings yet

- Start VserverDocument129 pagesStart VserverJuan100% (1)

- CA1000 Toolroom WheelsDocument12 pagesCA1000 Toolroom WheelsX800XLNo ratings yet

- DD Katalog PDFDocument110 pagesDD Katalog PDFAnand GuptaNo ratings yet

- Office Credential & OS Activation ProcessDocument8 pagesOffice Credential & OS Activation ProcessmansoorNo ratings yet

- Resume C DardiniDocument1 pageResume C Dardiniapi-572576110No ratings yet

- Business Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsDocument2 pagesBusiness Model Canvas: Key Partners Key Activities Value Propositions Customer Relationships Customer SegmentsmangoNo ratings yet

- Landlord Lawsuit Against Governor HolcombDocument31 pagesLandlord Lawsuit Against Governor HolcombLast DayNo ratings yet

- Business Communication - ReportDocument25 pagesBusiness Communication - ReportAhmedNo ratings yet

- Flipkart Screen Damage Protection Plan - Terms and ConditionsDocument13 pagesFlipkart Screen Damage Protection Plan - Terms and Conditionsravi kumarNo ratings yet

- BPLAN 4 Food ProcessingDocument54 pagesBPLAN 4 Food ProcessingTunde AjayiNo ratings yet

- SignedDocument1 pageSignedyamkumarigalami34No ratings yet

- Asuprin Activity 4Document4 pagesAsuprin Activity 4Melvin BagasinNo ratings yet

- City Government of San Juan: Business Permits and License OfficeDocument3 pagesCity Government of San Juan: Business Permits and License Officeaihr.campNo ratings yet

- Employer Branding A New Facet of Health Care Sector IJERTV9IS110094Document5 pagesEmployer Branding A New Facet of Health Care Sector IJERTV9IS110094shahidafzalsyedNo ratings yet

- Business Finance Final Çalışma ÖrneğiDocument8 pagesBusiness Finance Final Çalışma ÖrneğiMustafa EyüboğluNo ratings yet

- 2 - Dilemma in Hiring PDFDocument5 pages2 - Dilemma in Hiring PDFmanik singhNo ratings yet

- Hindustan TimesDocument67 pagesHindustan TimesBeing Nadeem AhmedNo ratings yet

- Croatia - SBA Fact Sheet 2019Document22 pagesCroatia - SBA Fact Sheet 2019Lino LamNo ratings yet

- Requirements For Setting Suitable Marcom ObjectivesDocument1 pageRequirements For Setting Suitable Marcom ObjectivesAnshul SharmaNo ratings yet

- Project Report On "Study of Problems in Hotel Industry": Ihm MeerutDocument82 pagesProject Report On "Study of Problems in Hotel Industry": Ihm MeerutGuman Singh50% (2)

- Corporate Information: Scan To VerifyDocument7 pagesCorporate Information: Scan To VerifyALADDIN MAGIC DISHESNo ratings yet

- 03 X-Change 2018 - Digital Transformation in Oil Gas Unified Supply Chain Management - O G1.3Document24 pages03 X-Change 2018 - Digital Transformation in Oil Gas Unified Supply Chain Management - O G1.3wfenix777No ratings yet