Professional Documents

Culture Documents

Spma ICMD 2009

Spma ICMD 2009

Uploaded by

abdillahtantowyjauhariCopyright:

Available Formats

You might also like

- 2022 ArDocument144 pages2022 ArCNBC.com88% (16)

- PT Gozco Plantations TBK.: Summary of Financial StatementDocument2 pagesPT Gozco Plantations TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Kbri ICMD 2009Document2 pagesKbri ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Pelat Timah Nusantara TBK.: Summary of Financial StatementDocument2 pagesPT Pelat Timah Nusantara TBK.: Summary of Financial StatementTarigan SalmanNo ratings yet

- Saip ICMD 2009Document2 pagesSaip ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Astra Agro Lestari TBK.: Summary of Financial Statementkurnia murni utamiNo ratings yet

- PT Inti Agri ResourcestbkDocument2 pagesPT Inti Agri ResourcestbkmeilindaNo ratings yet

- Akku PDFDocument2 pagesAkku PDFMaradewiNo ratings yet

- Inru ICMD 2009Document2 pagesInru ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Tri Banyan Tirta TBK.: Summary of Financial StatementDocument2 pagesPT Tri Banyan Tirta TBK.: Summary of Financial StatementAndre Bayu SaputraNo ratings yet

- PT Alkindo Naratama TBK.: Summary of Financial StatementDocument2 pagesPT Alkindo Naratama TBK.: Summary of Financial StatementRahayu RahmadhaniNo ratings yet

- PT Saraswati Griya Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Saraswati Griya Lestari TBK.: Summary of Financial StatementMaradewiNo ratings yet

- KrenDocument2 pagesKrenMaradewiNo ratings yet

- Abba PDFDocument2 pagesAbba PDFAndriPigeonNo ratings yet

- Abda PDFDocument2 pagesAbda PDFTRI HASTUTINo ratings yet

- PT Hotel Mandarine Regency TBK.: Summary of Financial StatementDocument2 pagesPT Hotel Mandarine Regency TBK.: Summary of Financial StatementMaradewiNo ratings yet

- PT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementDocument2 pagesPT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementKhaerudin RangersNo ratings yet

- GGRM - Icmd 2011 (B02)Document2 pagesGGRM - Icmd 2011 (B02)annisa lahjieNo ratings yet

- Ain 20201025074Document8 pagesAin 20201025074HAMMADHRNo ratings yet

- PT. Unilever Indonesia TBK.: Head OfficeDocument1 pagePT. Unilever Indonesia TBK.: Head OfficeLinaNo ratings yet

- Abda ICMD 2009Document2 pagesAbda ICMD 2009abdillahtantowyjauhariNo ratings yet

- FI Sep 2018 PDFDocument19 pagesFI Sep 2018 PDFsheeraz ali khuhroNo ratings yet

- Icmd 2010Document2 pagesIcmd 2010meilindaNo ratings yet

- Fasw ICMD 2009Document2 pagesFasw ICMD 2009abdillahtantowyjauhariNo ratings yet

- Bengal Windsor Thermoplastics Limited Statement of Cash Flows For The Year Ended 30 June 2016Document2 pagesBengal Windsor Thermoplastics Limited Statement of Cash Flows For The Year Ended 30 June 2016TabassumNo ratings yet

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Astra Agro Lestari TBK.: Summary of Financial StatementIntan Maulida Suryaningsih100% (1)

- Different Touch LTD.: Trading AccountsDocument8 pagesDifferent Touch LTD.: Trading AccountsMd. JubarajNo ratings yet

- Hade PDFDocument2 pagesHade PDFMaradewiNo ratings yet

- Balance Sheet: 2016 2017 2018 Assets Non-Current AssetsDocument6 pagesBalance Sheet: 2016 2017 2018 Assets Non-Current AssetsAhsan KamranNo ratings yet

- HMSP - Icmd 2011 (B02)Document2 pagesHMSP - Icmd 2011 (B02)annisa lahjieNo ratings yet

- KLBFDocument2 pagesKLBFKhaerudin RangersNo ratings yet

- PT Radana Bhaskara Finance Tbk. (Formerly PT HD Finance TBK)Document2 pagesPT Radana Bhaskara Finance Tbk. (Formerly PT HD Finance TBK)MaradewiNo ratings yet

- SIRA1H11Document8 pagesSIRA1H11Inde Pendent LkNo ratings yet

- PT Aqua Golden Mississippi TBK.: (Million Rupiah) 2005 2006 2007Document2 pagesPT Aqua Golden Mississippi TBK.: (Million Rupiah) 2005 2006 2007Mila DiasNo ratings yet

- PT Panasia Indo Resources TBKDocument2 pagesPT Panasia Indo Resources TBKMaradewiNo ratings yet

- 4th Quarter Unaudited Report 2076-2077Document25 pages4th Quarter Unaudited Report 2076-2077Srijana DhunganaNo ratings yet

- PT Aqua Golden Mississippi TBK.: (Million Rupiah) 2004 2005 2006Document2 pagesPT Aqua Golden Mississippi TBK.: (Million Rupiah) 2004 2005 2006Mhd FadilNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document3 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Upendra GuptaNo ratings yet

- PT Mustika Ratu TBK.: Summary of Financial StatementDocument2 pagesPT Mustika Ratu TBK.: Summary of Financial StatementdennyaikiNo ratings yet

- 2018 Quarter 1 Financials PDFDocument1 page2018 Quarter 1 Financials PDFKaystain Chris IhemeNo ratings yet

- Quarterly Report 20200930Document18 pagesQuarterly Report 20200930Ang SHNo ratings yet

- Tesla Inc ModelDocument57 pagesTesla Inc ModelRachel GreeneNo ratings yet

- Tesla Inc Unsolved Model 330PMDocument61 pagesTesla Inc Unsolved Model 330PMAYUSH SHARMANo ratings yet

- Different Touch LTD.: Trading AccountsDocument6 pagesDifferent Touch LTD.: Trading AccountsMd. JubarajNo ratings yet

- BPPL Holdings PLCDocument15 pagesBPPL Holdings PLCkasun witharanaNo ratings yet

- Second Quarter Financial ResultDocument8 pagesSecond Quarter Financial Resultminitashakya70No ratings yet

- Rmba - Icmd 2011 (B02)Document2 pagesRmba - Icmd 2011 (B02)annisa lahjieNo ratings yet

- English Q3 2018 Financials For Galfar WebsiteDocument24 pagesEnglish Q3 2018 Financials For Galfar WebsiteMOORTHYNo ratings yet

- PT Sawit Sumbermas Sarana TBK.: (Million Rupia ### ### ### Total AssetsDocument2 pagesPT Sawit Sumbermas Sarana TBK.: (Million Rupia ### ### ### Total AssetsAgil MahendraNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- 03 Steppe Cement - Simple Spread - 2018Document1 page03 Steppe Cement - Simple Spread - 2018Phạm Thanh HuyềnNo ratings yet

- Rangpur Foundry Limited 105-Middle Badda, Dhaka-1212Document4 pagesRangpur Foundry Limited 105-Middle Badda, Dhaka-1212anup dasNo ratings yet

- Fin AnalysisDocument16 pagesFin AnalysisMakuna NatsvlishviliNo ratings yet

- Bangladesh q2 Report 2020 Tcm244 553471 enDocument8 pagesBangladesh q2 Report 2020 Tcm244 553471 entdebnath_3No ratings yet

- Robinsons-1DY (Recovered)Document19 pagesRobinsons-1DY (Recovered)Dyrelle ReyesNo ratings yet

- Tesla, Inc. (TSLA) : Cash FlowDocument239 pagesTesla, Inc. (TSLA) : Cash FlowAngelllaNo ratings yet

- Quarterly Report 20191231Document21 pagesQuarterly Report 20191231Ang SHNo ratings yet

- Income Statement: in ThousandsDocument29 pagesIncome Statement: in ThousandsDaviti LabadzeNo ratings yet

- Income StatementDocument44 pagesIncome Statementyariyevyusif07No ratings yet

- ABS CBN CorporationDocument16 pagesABS CBN CorporationAlyssa BeatriceNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- REVIEWER - Basic MERCHANDISING Accounting2023Document9 pagesREVIEWER - Basic MERCHANDISING Accounting2023hello hayaNo ratings yet

- AIKODocument9 pagesAIKOJessel Andria CañebaNo ratings yet

- Far 1ST Sem AllDocument85 pagesFar 1ST Sem AllMichole chin MallariNo ratings yet

- EXAMDocument15 pagesEXAMAngela AquinoNo ratings yet

- Financial EconomicsDocument19 pagesFinancial Economicsseifeldin374No ratings yet

- ch1 Slides Students - ANDocument24 pagesch1 Slides Students - ANakshitnagpal9119No ratings yet

- IAS 16 - Property Plant and EquipmentDocument35 pagesIAS 16 - Property Plant and EquipmentlaaybaNo ratings yet

- INTERMEDIATE ACCOUNTING 1 EditedDocument18 pagesINTERMEDIATE ACCOUNTING 1 EditedApril Mae LomboyNo ratings yet

- Real OptionsDocument9 pagesReal OptionsYUWAN SIDHARTH I MBA Delhi 2022-24No ratings yet

- Problems CF2Document7 pagesProblems CF2TrinhNo ratings yet

- Full Download Advanced Accounting 13th Edition Beams Solutions ManualDocument36 pagesFull Download Advanced Accounting 13th Edition Beams Solutions Manualjacksongubmor100% (39)

- Chapter 11 Sources of CapitalDocument32 pagesChapter 11 Sources of Capitalmkahnum12No ratings yet

- FC3 (3 Files Merged)Document9 pagesFC3 (3 Files Merged)Jatin SarnaNo ratings yet

- MODULE 16 Share Based PaymentDocument7 pagesMODULE 16 Share Based PaymentMonica mangobaNo ratings yet

- Main Exam 2015Document7 pagesMain Exam 2015Diego AguirreNo ratings yet

- College Accounting A Practical Approach Canadian 12th Edition Slater Test BankDocument26 pagesCollege Accounting A Practical Approach Canadian 12th Edition Slater Test BankMaryBalljswt100% (56)

- 0452 Accounting: MARK SCHEME For The May/June 2015 SeriesDocument9 pages0452 Accounting: MARK SCHEME For The May/June 2015 SeriesEn DimunNo ratings yet

- Asset 2Document151 pagesAsset 2Abhijeet ZawareNo ratings yet

- Rek Koran PT HAI Mandiri 2022Document115 pagesRek Koran PT HAI Mandiri 2022wahyu suhartono100% (1)

- Chapter 10 Fin430 Intro To Capital StructureDocument20 pagesChapter 10 Fin430 Intro To Capital StructureSiti Nur Aisya Bt GhazaliNo ratings yet

- Endole Company Report - 09519832Document31 pagesEndole Company Report - 09519832lchenhan94No ratings yet

- My Trading StrategyDocument2 pagesMy Trading StrategypradeephdNo ratings yet

- Chapter-Four Financial InstrumentsDocument15 pagesChapter-Four Financial InstrumentsAbdiNo ratings yet

- 11 Oct 2022Document3 pages11 Oct 2022Maestro ProsperNo ratings yet

- Mudarabah and Its Application in Islamic BankingDocument26 pagesMudarabah and Its Application in Islamic Bankingsaif khanNo ratings yet

- INTERMEDIATE ACCOUNTING I Bank ReconciliationDocument3 pagesINTERMEDIATE ACCOUNTING I Bank ReconciliationMark Navida AgunaNo ratings yet

- Ola Electric Mobility Limited Financials June-23Document61 pagesOla Electric Mobility Limited Financials June-23Abhijeet KumawatNo ratings yet

- Accounting Volume 1 Canadian 9th Edition Horngren Test BankDocument99 pagesAccounting Volume 1 Canadian 9th Edition Horngren Test Bankbacksideanywheremrifn100% (33)

- Compound Financial InstrumentDocument14 pagesCompound Financial InstrumentEUNICE LAYNE AGCONo ratings yet

Spma ICMD 2009

Spma ICMD 2009

Uploaded by

abdillahtantowyjauhariOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Spma ICMD 2009

Spma ICMD 2009

Uploaded by

abdillahtantowyjauhariCopyright:

Available Formats

PT Suparma Tbk.

Paper and Allied Products

Head Office Jl. Sulung Sekolahan No. 6A Summary of Financial Statement

PO BOX 448, Surabaya 60174 (Million Rupiah)

Phone (031) 353-9888, 353-3799 (Hunting) 2007 2008 2009

Fax (031) 353-3827 Telex 31916 SPM SB IA

Total Assets 1,501,892 1,564,902 1,432,637

E-mail: corp.sec@ptsuparmatbk.com Current Assets 364,529 405,862 348,790

Website: www.ptsuparmatbk.com of which

Cash and cash equivalents 5,550 7,683 7,393

Factory Jl. Mastrip No. 856 Trade receivables 115,137 139,978 129,536

Karangpilang, Surabaya 60221 Inventories 237,772 252,540 200,416

Phone (031) 766-6666 (Hunting) Non-Current Assets 1,137,362 1,159,039 1,083,847

of which

Fax (031) 766-3287 Fixed Assets-Net 1,055,583 1,072,580 1,037,309

E-mail: corp.sec@ptsuparmatbk.com Deffered Tax Assets-Net 81,432 76,303 33,664

Website: www.ptsuparmatbk.com

Liabilities 825,757 903,069 743,873

Business Paper and Packaging Current Liabilities 90,239 136,023 251,561

Company Status PMDN of which

Accrued Expenses 10,770 27,898 17,936

Trade payables 35,229 48,903 22,573

Financial Performance: The Company successfully booked Taxes payable 3,789 3,429 5,358

net income at IDR26.932 billion in 2009, while in previous year Non-Current Liabilities 735,518 767,047 492,312

suffered net loss at IDR14.302 billion. Shareholders' Equity 676,135 661,832 688,765

Brief History: Established in 1976 under the name of PT Paid-up capital 596,819 596,819 596,819

Paid-up capital

Supar Inpama. In 1978 the name was changed to its current in excess of par value 598 598 598

form. The product of the company consists of HVS, carton and Retained earnings (accumulated loss) 78,718 64,416 91,348

craft liner under the trademarks of Suparma, Calculator Com- Net Sales 815,410 1,037,542 1,019,726

Cost of Goods Sold 663,201 887,967 900,410

puter, Telephone, Green Label Paper Cap Gajah and Elephant. Gross Profit 152,209 149,575 119,316

The main raw materials used by the company are pulp and re- Operating Expenses 39,320 51,643 55,169

Operating Profit 112,889 97,932 64,147

cycled paper. Other Income (Expenses) (73,544) (107,105) 8,964

Products are marketed directly to consumers, the major- Profit (Loss) before Taxes 39,346 (9,173) 73,111

ity being printing businesses and paper wholesalers. Profit (Loss) after Taxes 27,397 (14,302) 26,932

Per Share Data (Rp)

Earnings (Loss) per Share 18 (10) 18

Equity per Share 453 444 462

Dividend per Share n.a n.a n.a

Closing Price 270 87 205

Financial Ratios

PER (x) 14.70 (9.08) 11.36

PBV (x) 0.60 0.20 0.44

Dividend Payout (%) n.a n.a n.a

Dividend Yield (%) n.a n.a n.a

Current Ratio (x) 4.04 2.98 1.39

Debt to Equity (x) 1.22 1.36 1.08

Leverage Ratio (x) 0.55 0.58 0.52

Gross Profit Margin (x) 0.19 0.14 0.12

Operating Profit Margin (x) 0.14 0.09 0.06

Net Profit Margin (x) 0.03 n.a 0.03

Inventory Turnover (x) 2.79 3.52 4.49

Total Assets Turnover (x) 0.54 0.66 0.71

ROI (%) 1.82 (0.91) 1.88

ROE (%) 4.05 (2.16) 3.91

PER = 11.39x ; PBV = 0.51x (June 2010)

Financial Year: December 31

Public Accountant: Adi Jimmy Arthawan

(million rupiah)

2010 2009

June June

Total Assets 1,479,184 1,468,193

Current Assets 349,915 318,523

Shareholders Non-Current Assets 1,129,269 1,149,670

PT Gloriajaya Gempita 29.74% Liabilities 772,443 778,838

Shangton Finance Limited 15.58% Shareholders' Equity 706,741 689,355

PT Mahkotamutiara Mustika 14.87% Net Sales 580,868 466,711

UBS AG, Singapore 11.06% Profit after Taxes 17,976 27,523

Cashpoint Investments Limited 7.00%

Strategy Finance Limited 7.00% ROI (%) 1.22 1.87

Public 14.75% ROE (%) 2.54 3.99

214 Indonesian Capital Market Directory 2010

PT Suparma Tbk. Paper and Allied Products

Board of Commissioners Board of Directors

President Commissioner Jan Karunia Janto President Director Welly

Commissioners Paul Liputra, Suhartojo Tjandra, Directors M.B. Lanniwati, Hendro Luhur, Edward Sopanan

Joseph Sulaiman, Subiantara

Number of Employees 559

No Type of Listing Listing Date Trading Date Number of Shares Total Listed

per Listing Shares

1 First Issue 16-Nov-94 16-Nov-94 26,000,000 26,000,000

2 Company Listing 16-Nov-94 13-Jun-95 60,500,000 86,500,000

3 Bonus Shares 26-Aug-96 26-Aug-96 64,875,000 151,375,000

4 Stock Dividend 26-Aug-96 26-Aug-96 4,325,000 155,700,000

5 Stock Split 29-Dec-97 29-Dec-97 155,700,000 311,400,000

6 Bonus Shares 27-Sep-99 27-Sep-99 616,572,000 927,972,000

7 Stock Dividend 07-Aug-00 07-Aug-00 157,755,240 1,085,727,240

8 Stock Dividend 11-Oct-00 11-Oct-00 -93,680,582 992,046,658

9 Additional Listing Without

Pre-emptive Rights 23-Nov-07 23-Nov-07 500,000,000 1,492,046,658

Underwriters

PT Gadjah Tunggal, PT DBS Securities

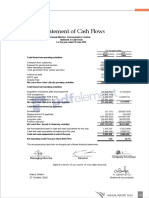

Stock Price, Frequency, Trading Days, Number and Value of Shares Traded and Market Capitalization

Stock Price and Traded Chart

Stock Price (Rp) Million Shares

350 300

300

250

250

200

200

150

150

100

100

50

50

- -

Jan-09 Feb-09 Mar-09 Apr-09 May-09 Jun-09 Jul-09 Aug-09 Sep-09 Oct-09 Nov-09 Dec-09 Jan-10 Feb-10 Mar-10 Apr-10 May-10 Jun-10

Institute for Economic and Financial Research 215

You might also like

- 2022 ArDocument144 pages2022 ArCNBC.com88% (16)

- PT Gozco Plantations TBK.: Summary of Financial StatementDocument2 pagesPT Gozco Plantations TBK.: Summary of Financial StatementMaradewiNo ratings yet

- Kbri ICMD 2009Document2 pagesKbri ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Pelat Timah Nusantara TBK.: Summary of Financial StatementDocument2 pagesPT Pelat Timah Nusantara TBK.: Summary of Financial StatementTarigan SalmanNo ratings yet

- Saip ICMD 2009Document2 pagesSaip ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Astra Agro Lestari TBK.: Summary of Financial Statementkurnia murni utamiNo ratings yet

- PT Inti Agri ResourcestbkDocument2 pagesPT Inti Agri ResourcestbkmeilindaNo ratings yet

- Akku PDFDocument2 pagesAkku PDFMaradewiNo ratings yet

- Inru ICMD 2009Document2 pagesInru ICMD 2009abdillahtantowyjauhariNo ratings yet

- PT Tri Banyan Tirta TBK.: Summary of Financial StatementDocument2 pagesPT Tri Banyan Tirta TBK.: Summary of Financial StatementAndre Bayu SaputraNo ratings yet

- PT Alkindo Naratama TBK.: Summary of Financial StatementDocument2 pagesPT Alkindo Naratama TBK.: Summary of Financial StatementRahayu RahmadhaniNo ratings yet

- PT Saraswati Griya Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Saraswati Griya Lestari TBK.: Summary of Financial StatementMaradewiNo ratings yet

- KrenDocument2 pagesKrenMaradewiNo ratings yet

- Abba PDFDocument2 pagesAbba PDFAndriPigeonNo ratings yet

- Abda PDFDocument2 pagesAbda PDFTRI HASTUTINo ratings yet

- PT Hotel Mandarine Regency TBK.: Summary of Financial StatementDocument2 pagesPT Hotel Mandarine Regency TBK.: Summary of Financial StatementMaradewiNo ratings yet

- PT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementDocument2 pagesPT Indocement Tunggal Prakarsa TBK.: Summary of Financial StatementKhaerudin RangersNo ratings yet

- GGRM - Icmd 2011 (B02)Document2 pagesGGRM - Icmd 2011 (B02)annisa lahjieNo ratings yet

- Ain 20201025074Document8 pagesAin 20201025074HAMMADHRNo ratings yet

- PT. Unilever Indonesia TBK.: Head OfficeDocument1 pagePT. Unilever Indonesia TBK.: Head OfficeLinaNo ratings yet

- Abda ICMD 2009Document2 pagesAbda ICMD 2009abdillahtantowyjauhariNo ratings yet

- FI Sep 2018 PDFDocument19 pagesFI Sep 2018 PDFsheeraz ali khuhroNo ratings yet

- Icmd 2010Document2 pagesIcmd 2010meilindaNo ratings yet

- Fasw ICMD 2009Document2 pagesFasw ICMD 2009abdillahtantowyjauhariNo ratings yet

- Bengal Windsor Thermoplastics Limited Statement of Cash Flows For The Year Ended 30 June 2016Document2 pagesBengal Windsor Thermoplastics Limited Statement of Cash Flows For The Year Ended 30 June 2016TabassumNo ratings yet

- PT Astra Agro Lestari TBK.: Summary of Financial StatementDocument2 pagesPT Astra Agro Lestari TBK.: Summary of Financial StatementIntan Maulida Suryaningsih100% (1)

- Different Touch LTD.: Trading AccountsDocument8 pagesDifferent Touch LTD.: Trading AccountsMd. JubarajNo ratings yet

- Hade PDFDocument2 pagesHade PDFMaradewiNo ratings yet

- Balance Sheet: 2016 2017 2018 Assets Non-Current AssetsDocument6 pagesBalance Sheet: 2016 2017 2018 Assets Non-Current AssetsAhsan KamranNo ratings yet

- HMSP - Icmd 2011 (B02)Document2 pagesHMSP - Icmd 2011 (B02)annisa lahjieNo ratings yet

- KLBFDocument2 pagesKLBFKhaerudin RangersNo ratings yet

- PT Radana Bhaskara Finance Tbk. (Formerly PT HD Finance TBK)Document2 pagesPT Radana Bhaskara Finance Tbk. (Formerly PT HD Finance TBK)MaradewiNo ratings yet

- SIRA1H11Document8 pagesSIRA1H11Inde Pendent LkNo ratings yet

- PT Aqua Golden Mississippi TBK.: (Million Rupiah) 2005 2006 2007Document2 pagesPT Aqua Golden Mississippi TBK.: (Million Rupiah) 2005 2006 2007Mila DiasNo ratings yet

- PT Panasia Indo Resources TBKDocument2 pagesPT Panasia Indo Resources TBKMaradewiNo ratings yet

- 4th Quarter Unaudited Report 2076-2077Document25 pages4th Quarter Unaudited Report 2076-2077Srijana DhunganaNo ratings yet

- PT Aqua Golden Mississippi TBK.: (Million Rupiah) 2004 2005 2006Document2 pagesPT Aqua Golden Mississippi TBK.: (Million Rupiah) 2004 2005 2006Mhd FadilNo ratings yet

- Colgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Document3 pagesColgate-Palmolive (India) Limited Registered Office: Colgate Research Centre, Main Street, Hiranandani Gardens, Powai, Mumbai 400 076Upendra GuptaNo ratings yet

- PT Mustika Ratu TBK.: Summary of Financial StatementDocument2 pagesPT Mustika Ratu TBK.: Summary of Financial StatementdennyaikiNo ratings yet

- 2018 Quarter 1 Financials PDFDocument1 page2018 Quarter 1 Financials PDFKaystain Chris IhemeNo ratings yet

- Quarterly Report 20200930Document18 pagesQuarterly Report 20200930Ang SHNo ratings yet

- Tesla Inc ModelDocument57 pagesTesla Inc ModelRachel GreeneNo ratings yet

- Tesla Inc Unsolved Model 330PMDocument61 pagesTesla Inc Unsolved Model 330PMAYUSH SHARMANo ratings yet

- Different Touch LTD.: Trading AccountsDocument6 pagesDifferent Touch LTD.: Trading AccountsMd. JubarajNo ratings yet

- BPPL Holdings PLCDocument15 pagesBPPL Holdings PLCkasun witharanaNo ratings yet

- Second Quarter Financial ResultDocument8 pagesSecond Quarter Financial Resultminitashakya70No ratings yet

- Rmba - Icmd 2011 (B02)Document2 pagesRmba - Icmd 2011 (B02)annisa lahjieNo ratings yet

- English Q3 2018 Financials For Galfar WebsiteDocument24 pagesEnglish Q3 2018 Financials For Galfar WebsiteMOORTHYNo ratings yet

- PT Sawit Sumbermas Sarana TBK.: (Million Rupia ### ### ### Total AssetsDocument2 pagesPT Sawit Sumbermas Sarana TBK.: (Million Rupia ### ### ### Total AssetsAgil MahendraNo ratings yet

- Annual Financial Statement 2021Document3 pagesAnnual Financial Statement 2021kofiNo ratings yet

- 03 Steppe Cement - Simple Spread - 2018Document1 page03 Steppe Cement - Simple Spread - 2018Phạm Thanh HuyềnNo ratings yet

- Rangpur Foundry Limited 105-Middle Badda, Dhaka-1212Document4 pagesRangpur Foundry Limited 105-Middle Badda, Dhaka-1212anup dasNo ratings yet

- Fin AnalysisDocument16 pagesFin AnalysisMakuna NatsvlishviliNo ratings yet

- Bangladesh q2 Report 2020 Tcm244 553471 enDocument8 pagesBangladesh q2 Report 2020 Tcm244 553471 entdebnath_3No ratings yet

- Robinsons-1DY (Recovered)Document19 pagesRobinsons-1DY (Recovered)Dyrelle ReyesNo ratings yet

- Tesla, Inc. (TSLA) : Cash FlowDocument239 pagesTesla, Inc. (TSLA) : Cash FlowAngelllaNo ratings yet

- Quarterly Report 20191231Document21 pagesQuarterly Report 20191231Ang SHNo ratings yet

- Income Statement: in ThousandsDocument29 pagesIncome Statement: in ThousandsDaviti LabadzeNo ratings yet

- Income StatementDocument44 pagesIncome Statementyariyevyusif07No ratings yet

- ABS CBN CorporationDocument16 pagesABS CBN CorporationAlyssa BeatriceNo ratings yet

- Miscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryFrom EverandMiscellaneous Intermediation Revenues World Summary: Market Values & Financials by CountryNo ratings yet

- REVIEWER - Basic MERCHANDISING Accounting2023Document9 pagesREVIEWER - Basic MERCHANDISING Accounting2023hello hayaNo ratings yet

- AIKODocument9 pagesAIKOJessel Andria CañebaNo ratings yet

- Far 1ST Sem AllDocument85 pagesFar 1ST Sem AllMichole chin MallariNo ratings yet

- EXAMDocument15 pagesEXAMAngela AquinoNo ratings yet

- Financial EconomicsDocument19 pagesFinancial Economicsseifeldin374No ratings yet

- ch1 Slides Students - ANDocument24 pagesch1 Slides Students - ANakshitnagpal9119No ratings yet

- IAS 16 - Property Plant and EquipmentDocument35 pagesIAS 16 - Property Plant and EquipmentlaaybaNo ratings yet

- INTERMEDIATE ACCOUNTING 1 EditedDocument18 pagesINTERMEDIATE ACCOUNTING 1 EditedApril Mae LomboyNo ratings yet

- Real OptionsDocument9 pagesReal OptionsYUWAN SIDHARTH I MBA Delhi 2022-24No ratings yet

- Problems CF2Document7 pagesProblems CF2TrinhNo ratings yet

- Full Download Advanced Accounting 13th Edition Beams Solutions ManualDocument36 pagesFull Download Advanced Accounting 13th Edition Beams Solutions Manualjacksongubmor100% (39)

- Chapter 11 Sources of CapitalDocument32 pagesChapter 11 Sources of Capitalmkahnum12No ratings yet

- FC3 (3 Files Merged)Document9 pagesFC3 (3 Files Merged)Jatin SarnaNo ratings yet

- MODULE 16 Share Based PaymentDocument7 pagesMODULE 16 Share Based PaymentMonica mangobaNo ratings yet

- Main Exam 2015Document7 pagesMain Exam 2015Diego AguirreNo ratings yet

- College Accounting A Practical Approach Canadian 12th Edition Slater Test BankDocument26 pagesCollege Accounting A Practical Approach Canadian 12th Edition Slater Test BankMaryBalljswt100% (56)

- 0452 Accounting: MARK SCHEME For The May/June 2015 SeriesDocument9 pages0452 Accounting: MARK SCHEME For The May/June 2015 SeriesEn DimunNo ratings yet

- Asset 2Document151 pagesAsset 2Abhijeet ZawareNo ratings yet

- Rek Koran PT HAI Mandiri 2022Document115 pagesRek Koran PT HAI Mandiri 2022wahyu suhartono100% (1)

- Chapter 10 Fin430 Intro To Capital StructureDocument20 pagesChapter 10 Fin430 Intro To Capital StructureSiti Nur Aisya Bt GhazaliNo ratings yet

- Endole Company Report - 09519832Document31 pagesEndole Company Report - 09519832lchenhan94No ratings yet

- My Trading StrategyDocument2 pagesMy Trading StrategypradeephdNo ratings yet

- Chapter-Four Financial InstrumentsDocument15 pagesChapter-Four Financial InstrumentsAbdiNo ratings yet

- 11 Oct 2022Document3 pages11 Oct 2022Maestro ProsperNo ratings yet

- Mudarabah and Its Application in Islamic BankingDocument26 pagesMudarabah and Its Application in Islamic Bankingsaif khanNo ratings yet

- INTERMEDIATE ACCOUNTING I Bank ReconciliationDocument3 pagesINTERMEDIATE ACCOUNTING I Bank ReconciliationMark Navida AgunaNo ratings yet

- Ola Electric Mobility Limited Financials June-23Document61 pagesOla Electric Mobility Limited Financials June-23Abhijeet KumawatNo ratings yet

- Accounting Volume 1 Canadian 9th Edition Horngren Test BankDocument99 pagesAccounting Volume 1 Canadian 9th Edition Horngren Test Bankbacksideanywheremrifn100% (33)

- Compound Financial InstrumentDocument14 pagesCompound Financial InstrumentEUNICE LAYNE AGCONo ratings yet