Professional Documents

Culture Documents

2ND Quarter Review Materials - Baaccen

2ND Quarter Review Materials - Baaccen

Uploaded by

Joielyn CabiltesCopyright:

Available Formats

You might also like

- Partnership FormationDocument13 pagesPartnership FormationPhilip Dan Jayson LarozaNo ratings yet

- Assets Liabilities + Equity + Income - Expenses: Oct. TransactionsDocument4 pagesAssets Liabilities + Equity + Income - Expenses: Oct. Transactionsalford sery Cammayo0% (1)

- Test Bank Paccounting Information Systems Test Bank Paccounting Information SystemsDocument23 pagesTest Bank Paccounting Information Systems Test Bank Paccounting Information SystemsFrylle Kanz Harani PocsonNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Accounting Paper-Zoom 2Document7 pagesAccounting Paper-Zoom 2Sufyan SheikhNo ratings yet

- UCU Audit ProblemsDocument9 pagesUCU Audit ProblemsTCC FreezeNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Practice Set For Intermediate AccountingDocument2 pagesPractice Set For Intermediate AccountingmddddddNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- (LAB) Activity - 3Document1 page(LAB) Activity - 3Laarnie PantinoNo ratings yet

- Tugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Document3 pagesTugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Adifa Shofiya ZulfaNo ratings yet

- AP-Correction of Error Straight Problems Problem 1: RequiredDocument6 pagesAP-Correction of Error Straight Problems Problem 1: RequiredAldrin LiwanagNo ratings yet

- Corporate Liquidation (Integration) PDFDocument5 pagesCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Accounting From Incomplete RecordsDocument8 pagesAccounting From Incomplete RecordsVisha JainNo ratings yet

- 11 QP Final (2021-22)Document4 pages11 QP Final (2021-22)Flick OPNo ratings yet

- Foreign Branch As 12Document8 pagesForeign Branch As 12Sakshi NagotkarNo ratings yet

- Ngli Ke ToanDocument121 pagesNgli Ke ToanJF FNo ratings yet

- Investment of The OwnerDocument17 pagesInvestment of The OwnerChrisron CasanoNo ratings yet

- Merchandising Comprrehensive ProblemDocument3 pagesMerchandising Comprrehensive ProblemJalod Hadji AmerNo ratings yet

- Acctg CycleDocument13 pagesAcctg Cyclefer maNo ratings yet

- MBA I Semester Supplementary Examinations December/January 2018/19Document2 pagesMBA I Semester Supplementary Examinations December/January 2018/19Chandra SekharNo ratings yet

- Cash and Cash Equivalent Tutorial PDFDocument3 pagesCash and Cash Equivalent Tutorial PDFClara San MiguelNo ratings yet

- Maf 5101 Financial AccountingDocument2 pagesMaf 5101 Financial Accountingahimbisibwe lamedNo ratings yet

- Tutorial 9-1: Ratio AnalysisDocument16 pagesTutorial 9-1: Ratio AnalysisShivati Singh KahlonNo ratings yet

- Financial StatementDocument24 pagesFinancial StatementARABELLA CLARICE JIMENEZNo ratings yet

- ReviewerDocument15 pagesReviewerALMA MORENANo ratings yet

- Auditing Problem ExercisesDocument13 pagesAuditing Problem ExercisesJasmine Nouvel Soriaga CruzNo ratings yet

- Statement of Cash Flows - Homework - Finacc5Document1 pageStatement of Cash Flows - Homework - Finacc5CRISZA MAE BERINo ratings yet

- Practice Questions FADocument13 pagesPractice Questions FApeacegracie140% (1)

- Comprehensive ProblemDocument17 pagesComprehensive ProblemVianca FernilleNo ratings yet

- Accounting CycleDocument28 pagesAccounting Cycleyram shinNo ratings yet

- Aud Prob RecDocument21 pagesAud Prob RecRNo ratings yet

- Part Ia Journal Entries - FarDocument5 pagesPart Ia Journal Entries - Farshe kioraNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- Name: - ScoreDocument2 pagesName: - ScoreFucio, Mark JeroldNo ratings yet

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- Quiz-Lets FARDocument5 pagesQuiz-Lets FARSherlock HolmesNo ratings yet

- Finalterm Examination: Unfair Means in Completing ItDocument4 pagesFinalterm Examination: Unfair Means in Completing ItMuhammad Abdullah SaniNo ratings yet

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- Mid-Term Revision 2023.finalDocument8 pagesMid-Term Revision 2023.finalRabie HarounNo ratings yet

- Unadjusted Trial Balance ProblemsDocument7 pagesUnadjusted Trial Balance ProblemssheenacgacitaNo ratings yet

- CE Principles of Accounts 2001 PaperDocument8 pagesCE Principles of Accounts 2001 PaperdicktkloNo ratings yet

- Banking Final Accounts: Practical ProblemsDocument2 pagesBanking Final Accounts: Practical ProblemsShubakar ReddyNo ratings yet

- ACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2Document14 pagesACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2727822TPMB005 ARAVINTHAN.SNo ratings yet

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDocument2 pagesIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNo ratings yet

- Closing and Post-Closing EntriesDocument13 pagesClosing and Post-Closing EntriesBrian Reyes GangcaNo ratings yet

- Financial Accounting Unit 2 Practice QuestionsDocument4 pagesFinancial Accounting Unit 2 Practice Questionskbarrett20No ratings yet

- A. Cash and Cash EquivalentsDocument24 pagesA. Cash and Cash EquivalentskimkimNo ratings yet

- Debtors SystemDocument4 pagesDebtors SystemRohit ShrivastavNo ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationMae100% (1)

- Accounting CycleDocument17 pagesAccounting CycleAnonymous 1P4Me8680% (1)

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Document2 pagesLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresNo ratings yet

- Control Account QuestionsDocument6 pagesControl Account QuestionsJaneth Patrick100% (2)

- Chapter 7 LiabilitiesDocument54 pagesChapter 7 LiabilitiesVip BigbangNo ratings yet

- Fundamentals of Accounting Model Question PaperDocument3 pagesFundamentals of Accounting Model Question Paperabhishek509.pNo ratings yet

- ACC 100 Partnership FormationDocument3 pagesACC 100 Partnership FormationAlfred DalaganNo ratings yet

- Financial Accounting Past Paper 2019Document3 pagesFinancial Accounting Past Paper 2019Rana Hanzila TahirNo ratings yet

- Trial BalDocument1 pageTrial BalRameena NiyasNo ratings yet

- BlawregDocument3 pagesBlawregJoielyn CabiltesNo ratings yet

- Orient 2 Part Ii Leadership StylesDocument2 pagesOrient 2 Part Ii Leadership StylesJoielyn CabiltesNo ratings yet

- Language RegistersDocument15 pagesLanguage RegistersJoielyn CabiltesNo ratings yet

- Script AccsysDocument3 pagesScript AccsysJoielyn CabiltesNo ratings yet

- 01 Purrcomm PresentationDocument14 pages01 Purrcomm PresentationJoielyn CabiltesNo ratings yet

- UNIT 3 Rizal's Travels and EducationDocument13 pagesUNIT 3 Rizal's Travels and EducationJoielyn CabiltesNo ratings yet

- Chapter 1 FinanceDocument12 pagesChapter 1 FinanceJoielyn CabiltesNo ratings yet

- Registration FormDocument1 pageRegistration FormJoielyn CabiltesNo ratings yet

- ACCTSYS Unit 2Document10 pagesACCTSYS Unit 2Joielyn CabiltesNo ratings yet

- CABILTES 504 WorksheetDocument4 pagesCABILTES 504 WorksheetJoielyn CabiltesNo ratings yet

- JOIE Case DigestDocument2 pagesJOIE Case DigestJoielyn CabiltesNo ratings yet

- CABILTES 504 Reflection (Poverty)Document1 pageCABILTES 504 Reflection (Poverty)Joielyn CabiltesNo ratings yet

- CABILTES - 159 - SummaryReportDocument2 pagesCABILTES - 159 - SummaryReportJoielyn CabiltesNo ratings yet

- CD KimmyDocument2 pagesCD KimmyJoielyn CabiltesNo ratings yet

2ND Quarter Review Materials - Baaccen

2ND Quarter Review Materials - Baaccen

Uploaded by

Joielyn CabiltesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

2ND Quarter Review Materials - Baaccen

2ND Quarter Review Materials - Baaccen

Uploaded by

Joielyn CabiltesCopyright:

Available Formats

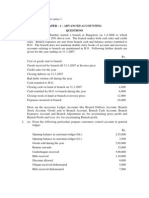

The following is the post-closing trial balance of HAYAHAY dated March 31, 200A.

Debit Credit

Cash 70,000

Accounts Receivable 140,000

Allowance for doubtful accounts 1,400

Unused shop supplies 400

Shop equipment 120,000

Accum. Depreciation-shop equipment 24,000

Accounts payable 44,400

Notes payable 50,000

Accrued interest payable 600

HAYAHAY, Capital 210,000

Totals 330,400 330,400

For the month of April, the following are the transactions of HAYAHAYshop:

1. HAYAHAYwithdrew P10,000 cash from the business for his personal use.

2. Paid P16,000 insurance premium.

3. Paid P10,000 rent.

4. Total service rendered to various customers, P70,000. 40% of total sales are on cash basis and the

balance on open account.

5. Received promissory note from customer to replace P50,000 accounts receivable.

6. Collected in cash P90,000 of accounts receivable.

7. Paid the notes payable of P50,000 plus the P1,200 interest.

8. Purchased P1,200 shop supplies on cash basis.

9. Paid salaries, P12,000.

At the end of the month, the following information are available to effect adjustments:

a. The insurance in number 2 for P16,000 is applicable for six months starting April 1.

b. The rent of P10,000 paid in number 3 is for 3 months, starting April 1.

c. The notes receivable in number 5 is earning 10% interest per year. The note is dated April 1, and

is due on June 30.

d. Bad debt expense is estimated at 3% of accounts receivable balance.

e. The annual depreciation is P24,000.

f. The unused supplies balance is P100.

g. HAYAHAY failed to record cash sales of P5,000.

Required:

1. Prepare the journal entries to record the transactions.

You might also like

- Partnership FormationDocument13 pagesPartnership FormationPhilip Dan Jayson LarozaNo ratings yet

- Assets Liabilities + Equity + Income - Expenses: Oct. TransactionsDocument4 pagesAssets Liabilities + Equity + Income - Expenses: Oct. Transactionsalford sery Cammayo0% (1)

- Test Bank Paccounting Information Systems Test Bank Paccounting Information SystemsDocument23 pagesTest Bank Paccounting Information Systems Test Bank Paccounting Information SystemsFrylle Kanz Harani PocsonNo ratings yet

- Business Cup Level 1 Quiz BeeDocument28 pagesBusiness Cup Level 1 Quiz BeeRowellPaneloSalapareNo ratings yet

- Accounting Paper-Zoom 2Document7 pagesAccounting Paper-Zoom 2Sufyan SheikhNo ratings yet

- UCU Audit ProblemsDocument9 pagesUCU Audit ProblemsTCC FreezeNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Entry Level: Australian EditionNo ratings yet

- Practice Set For Intermediate AccountingDocument2 pagesPractice Set For Intermediate AccountingmddddddNo ratings yet

- Problem #1: Adjusting EntriesDocument5 pagesProblem #1: Adjusting EntriesShahzad AsifNo ratings yet

- Test PaperDocument27 pagesTest PaperAnand BandhuNo ratings yet

- (LAB) Activity - 3Document1 page(LAB) Activity - 3Laarnie PantinoNo ratings yet

- Tugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Document3 pagesTugas Minggu Ke-6 Adifa Shofiya Zulfa 454777Adifa Shofiya ZulfaNo ratings yet

- AP-Correction of Error Straight Problems Problem 1: RequiredDocument6 pagesAP-Correction of Error Straight Problems Problem 1: RequiredAldrin LiwanagNo ratings yet

- Corporate Liquidation (Integration) PDFDocument5 pagesCorporate Liquidation (Integration) PDFCatherine Simeon100% (1)

- Accounting From Incomplete RecordsDocument8 pagesAccounting From Incomplete RecordsVisha JainNo ratings yet

- 11 QP Final (2021-22)Document4 pages11 QP Final (2021-22)Flick OPNo ratings yet

- Foreign Branch As 12Document8 pagesForeign Branch As 12Sakshi NagotkarNo ratings yet

- Ngli Ke ToanDocument121 pagesNgli Ke ToanJF FNo ratings yet

- Investment of The OwnerDocument17 pagesInvestment of The OwnerChrisron CasanoNo ratings yet

- Merchandising Comprrehensive ProblemDocument3 pagesMerchandising Comprrehensive ProblemJalod Hadji AmerNo ratings yet

- Acctg CycleDocument13 pagesAcctg Cyclefer maNo ratings yet

- MBA I Semester Supplementary Examinations December/January 2018/19Document2 pagesMBA I Semester Supplementary Examinations December/January 2018/19Chandra SekharNo ratings yet

- Cash and Cash Equivalent Tutorial PDFDocument3 pagesCash and Cash Equivalent Tutorial PDFClara San MiguelNo ratings yet

- Maf 5101 Financial AccountingDocument2 pagesMaf 5101 Financial Accountingahimbisibwe lamedNo ratings yet

- Tutorial 9-1: Ratio AnalysisDocument16 pagesTutorial 9-1: Ratio AnalysisShivati Singh KahlonNo ratings yet

- Financial StatementDocument24 pagesFinancial StatementARABELLA CLARICE JIMENEZNo ratings yet

- ReviewerDocument15 pagesReviewerALMA MORENANo ratings yet

- Auditing Problem ExercisesDocument13 pagesAuditing Problem ExercisesJasmine Nouvel Soriaga CruzNo ratings yet

- Statement of Cash Flows - Homework - Finacc5Document1 pageStatement of Cash Flows - Homework - Finacc5CRISZA MAE BERINo ratings yet

- Practice Questions FADocument13 pagesPractice Questions FApeacegracie140% (1)

- Comprehensive ProblemDocument17 pagesComprehensive ProblemVianca FernilleNo ratings yet

- Accounting CycleDocument28 pagesAccounting Cycleyram shinNo ratings yet

- Aud Prob RecDocument21 pagesAud Prob RecRNo ratings yet

- Part Ia Journal Entries - FarDocument5 pagesPart Ia Journal Entries - Farshe kioraNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- Name: - ScoreDocument2 pagesName: - ScoreFucio, Mark JeroldNo ratings yet

- Accounts HomeworkDocument9 pagesAccounts HomeworkSasha KingNo ratings yet

- Quiz-Lets FARDocument5 pagesQuiz-Lets FARSherlock HolmesNo ratings yet

- Finalterm Examination: Unfair Means in Completing ItDocument4 pagesFinalterm Examination: Unfair Means in Completing ItMuhammad Abdullah SaniNo ratings yet

- Name: - Date: - Grade Level & SectionDocument11 pagesName: - Date: - Grade Level & SectionCynthia Santos100% (1)

- Mid-Term Revision 2023.finalDocument8 pagesMid-Term Revision 2023.finalRabie HarounNo ratings yet

- Unadjusted Trial Balance ProblemsDocument7 pagesUnadjusted Trial Balance ProblemssheenacgacitaNo ratings yet

- CE Principles of Accounts 2001 PaperDocument8 pagesCE Principles of Accounts 2001 PaperdicktkloNo ratings yet

- Banking Final Accounts: Practical ProblemsDocument2 pagesBanking Final Accounts: Practical ProblemsShubakar ReddyNo ratings yet

- ACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2Document14 pagesACFrOgAqiiJXkh6qPT06Dyr92wNqM 7FUlP7UX0J4bfQdyRnaPEgZzNDquQKGbpgOqe8gQtLHnzilftiJfPGb ph6jXhCfSJ - bTZ9eIoIXcm9JypVLjHwd0K7fOWt0nJlptBa Yas8vHz03v1z2727822TPMB005 ARAVINTHAN.SNo ratings yet

- Intermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreDocument2 pagesIntermediate Accounting 3 Second Grading Quiz: Name: Date: Professor: Section: ScoreGrezel NiceNo ratings yet

- Closing and Post-Closing EntriesDocument13 pagesClosing and Post-Closing EntriesBrian Reyes GangcaNo ratings yet

- Financial Accounting Unit 2 Practice QuestionsDocument4 pagesFinancial Accounting Unit 2 Practice Questionskbarrett20No ratings yet

- A. Cash and Cash EquivalentsDocument24 pagesA. Cash and Cash EquivalentskimkimNo ratings yet

- Debtors SystemDocument4 pagesDebtors SystemRohit ShrivastavNo ratings yet

- Corporate LiquidationDocument4 pagesCorporate LiquidationMae100% (1)

- Accounting CycleDocument17 pagesAccounting CycleAnonymous 1P4Me8680% (1)

- LEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Document2 pagesLEC09A - BSA 2201 - 022021-Single Entry Accounting (P)Kim FloresNo ratings yet

- Control Account QuestionsDocument6 pagesControl Account QuestionsJaneth Patrick100% (2)

- Chapter 7 LiabilitiesDocument54 pagesChapter 7 LiabilitiesVip BigbangNo ratings yet

- Fundamentals of Accounting Model Question PaperDocument3 pagesFundamentals of Accounting Model Question Paperabhishek509.pNo ratings yet

- ACC 100 Partnership FormationDocument3 pagesACC 100 Partnership FormationAlfred DalaganNo ratings yet

- Financial Accounting Past Paper 2019Document3 pagesFinancial Accounting Past Paper 2019Rana Hanzila TahirNo ratings yet

- Trial BalDocument1 pageTrial BalRameena NiyasNo ratings yet

- BlawregDocument3 pagesBlawregJoielyn CabiltesNo ratings yet

- Orient 2 Part Ii Leadership StylesDocument2 pagesOrient 2 Part Ii Leadership StylesJoielyn CabiltesNo ratings yet

- Language RegistersDocument15 pagesLanguage RegistersJoielyn CabiltesNo ratings yet

- Script AccsysDocument3 pagesScript AccsysJoielyn CabiltesNo ratings yet

- 01 Purrcomm PresentationDocument14 pages01 Purrcomm PresentationJoielyn CabiltesNo ratings yet

- UNIT 3 Rizal's Travels and EducationDocument13 pagesUNIT 3 Rizal's Travels and EducationJoielyn CabiltesNo ratings yet

- Chapter 1 FinanceDocument12 pagesChapter 1 FinanceJoielyn CabiltesNo ratings yet

- Registration FormDocument1 pageRegistration FormJoielyn CabiltesNo ratings yet

- ACCTSYS Unit 2Document10 pagesACCTSYS Unit 2Joielyn CabiltesNo ratings yet

- CABILTES 504 WorksheetDocument4 pagesCABILTES 504 WorksheetJoielyn CabiltesNo ratings yet

- JOIE Case DigestDocument2 pagesJOIE Case DigestJoielyn CabiltesNo ratings yet

- CABILTES 504 Reflection (Poverty)Document1 pageCABILTES 504 Reflection (Poverty)Joielyn CabiltesNo ratings yet

- CABILTES - 159 - SummaryReportDocument2 pagesCABILTES - 159 - SummaryReportJoielyn CabiltesNo ratings yet

- CD KimmyDocument2 pagesCD KimmyJoielyn CabiltesNo ratings yet