Professional Documents

Culture Documents

Questionnaire and Supporting Documentation Form 1040 Schedule C (Profit or Loss From Business)

Questionnaire and Supporting Documentation Form 1040 Schedule C (Profit or Loss From Business)

Uploaded by

troubledcutie1987Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Questionnaire and Supporting Documentation Form 1040 Schedule C (Profit or Loss From Business)

Questionnaire and Supporting Documentation Form 1040 Schedule C (Profit or Loss From Business)

Uploaded by

troubledcutie1987Copyright:

Available Formats

Department of the Treasury - Internal Revenue Service

Form 11652 Questionnaire and Supporting Documentation

(January 2021)

Form 1040 Schedule C (Profit or Loss from Business)

This questionnaire lists the types of records you need to send us to prove your Schedule C income and expenses. The law requires you

to keep adequate records to complete your Schedule C. Please review each line of this questionnaire and answer every question.

Return the questionnaire along with copies of your supporting documents.

Note: Failure to complete all parts of this questionnaire and submit the supporting documentation can delay the examination of your

return and the final determination of your tax liability.

Name Social Security Number

Business address Year business started

Telephone Number Business website (if applicable)

1. Provide a description of your business (type of work, product sold, service provided, hours of operation, where business is conducted, etc.)

2. Provide a copy of your business license or permit if applicable

3. How do you advertise your business? If you pay for advertisement, submit copies of receipts or other proof of payment

4. Did you file state or local sales tax returns for the year

Yes (provide copies) No Not applicable

5. Did you receive Forms 1099-MISC, 1099-NEC or 1099-K for the income reported

Yes (provide copies) No

6. Provide copies of records to support the business income reported for any income you received not included on a Form 1099. Check

all boxes that apply (below references are intended to be illustrative and don’t constitute government endorsement of any private product, service,

entity, or enterprise)

Business/Personal bank account statements with business income highlighted

Accounting records (e.g., QuickBooks, Peachtree)

Electronic payment records (e.g., Apple Pay, PayPal, Zelle, Cash App)

Logbooks/Ledgers

Invoices/Receipts issued to customers for goods and services

Other

7. Provide copies of records to support the business expenses reported. Check all boxes that apply (below references are intended to be

illustrative and don’t constitute government endorsement of any private product, service, entity, or enterprise)

Invoices/Receipts received from suppliers for goods and services purchased

Rental Contracts

Business insurance contracts

Electronic payment records (e.g., Apple Pay, PayPal, Zelle, Cash App) with expenses highlighted

Mileage log and receipts for actual car/truck expenses

Bank/Credit card statements with expenses highlighted

Other

Information about Schedule C can be found in IRS Publication 334, Tax Guide for Small Business, and Publication 583, Starting a

Business and Keeping Records. These publications can be downloaded from www.irs.gov/forms or can be requested by calling

800-TAX-FORM (800-829-3676).

For Paperwork Reduction Act Notice, see the Schedule C Instructions.

Catalog Number 25988D www.irs.gov Form 11652 (Rev. 1-2021)

You might also like

- Taxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCFrom EverandTaxes for Small Businesses QuickStart Guide: Understanding Taxes for Your Sole Proprietorship, StartUp & LLCRating: 4 out of 5 stars4/5 (5)

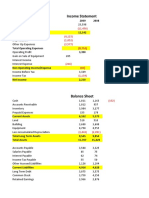

- Cash Flow SolvedDocument3 pagesCash Flow SolvedRahul BindrooNo ratings yet

- What Is and Is Not Reportable On 1099Document9 pagesWhat Is and Is Not Reportable On 1099joy100% (3)

- Tin IndividualDocument60 pagesTin IndividualrajdeeppawarNo ratings yet

- Inf FormDocument15 pagesInf Formxanixe2435No ratings yet

- Verification of Reported IncomeDocument3 pagesVerification of Reported IncomepdizypdizyNo ratings yet

- SQS Supplier Qualification System Stage 1 Registration OverviewDocument3 pagesSQS Supplier Qualification System Stage 1 Registration OverviewSayed AbbasNo ratings yet

- IRS Publication Form 8919Document2 pagesIRS Publication Form 8919Francis Wolfgang UrbanNo ratings yet

- Form 1099Document6 pagesForm 1099Joe LongNo ratings yet

- New Supplier FormDocument3 pagesNew Supplier Formirma wahyuniNo ratings yet

- Document Checklist: Joint Venture / Sole-Proprietor / Unincorporated BodyDocument20 pagesDocument Checklist: Joint Venture / Sole-Proprietor / Unincorporated BodyEDWARD LEENo ratings yet

- Form 1023.non ProfitDocument28 pagesForm 1023.non ProfitLawrence BolindNo ratings yet

- Form R-1 - VA Department of Taxation Business Registration ApplicationDocument4 pagesForm R-1 - VA Department of Taxation Business Registration ApplicationRichie DonaldsonNo ratings yet

- The Numbers Refer To Section A-B Sheet, Section A DetailDocument41 pagesThe Numbers Refer To Section A-B Sheet, Section A DetailenyonyoziNo ratings yet

- Chart of AccountsDocument5 pagesChart of AccountsMonroe P ZosaNo ratings yet

- New Vendor Info FormDocument11 pagesNew Vendor Info FormRoseNPrinceNo ratings yet

- Application For Enrollment To Practice Before The Internal Revenue Service 23Document4 pagesApplication For Enrollment To Practice Before The Internal Revenue Service 23IRSNo ratings yet

- Project Veritas Tax Exemption ApplicationDocument22 pagesProject Veritas Tax Exemption ApplicationLachlan MarkayNo ratings yet

- Fss 4Document2 pagesFss 4craz8gtNo ratings yet

- RUSTEL CISFORM OkDocument3 pagesRUSTEL CISFORM OkUMKM 24No ratings yet

- Furqan 21Document15 pagesFurqan 21Furqan HaiderNo ratings yet

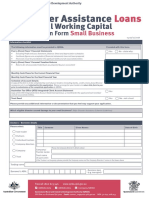

- Disaster Assistance EWC Loan Application Small BusinessDocument9 pagesDisaster Assistance EWC Loan Application Small BusinessMichael MckeownNo ratings yet

- 3911 Taxpayer Statement Regarding Refund: Section IDocument2 pages3911 Taxpayer Statement Regarding Refund: Section IWanda NesbethNo ratings yet

- Avoid IRS Backup Withholding Your Card Sales Settlement at A Rate of 28%Document2 pagesAvoid IRS Backup Withholding Your Card Sales Settlement at A Rate of 28%James LeeNo ratings yet

- Schedule D (Form 941) :: Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or ConsolidationsDocument2 pagesSchedule D (Form 941) :: Report of Discrepancies Caused by Acquisitions, Statutory Mergers, or ConsolidationsBilboDBagginsNo ratings yet

- California Excise Taxes Permit Application: Boe 400 Eti Rev. 7 (1 10)Document8 pagesCalifornia Excise Taxes Permit Application: Boe 400 Eti Rev. 7 (1 10)Anonymous UUUcrNNo ratings yet

- Irs Tax ExemptDocument59 pagesIrs Tax ExemptPopeye2112100% (1)

- S-Corp 1120S Tax Filing Checklist - 2014Document3 pagesS-Corp 1120S Tax Filing Checklist - 2014Anonymous ruUxJt7lxNo ratings yet

- 433-D Installment Agreement: (Taxpayer) (Spouse) (Including Area Code) (Home) (Work, Cell or Business)Document4 pages433-D Installment Agreement: (Taxpayer) (Spouse) (Including Area Code) (Home) (Work, Cell or Business)douglas jonesNo ratings yet

- GEN-PEN-05-G02 - How To Submit An Objection or Appeal Via Efiling - External GuideDocument16 pagesGEN-PEN-05-G02 - How To Submit An Objection or Appeal Via Efiling - External GuideiadhiaNo ratings yet

- 2012 Building Intl Bridges (03!28!2013)Document17 pages2012 Building Intl Bridges (03!28!2013)Jk McCreaNo ratings yet

- Application For A Practising Certificate: ACCA's WebsiteDocument18 pagesApplication For A Practising Certificate: ACCA's Websitepatrick holdenNo ratings yet

- 2011 National Pavilions Application FormDocument7 pages2011 National Pavilions Application FormDurban Chamber of Commerce and IndustryNo ratings yet

- MSME HelpDocument10 pagesMSME HelpAjay MehtaNo ratings yet

- Instructions For Completing This Form 13.1 Financial StatementDocument33 pagesInstructions For Completing This Form 13.1 Financial StatementMy Support CalculatorNo ratings yet

- Attention Limit of One (1) Employer Identification Number (EIN) Issuance Per Business DayDocument3 pagesAttention Limit of One (1) Employer Identification Number (EIN) Issuance Per Business Daypreston_40200350% (2)

- TaxExemptWorld 329525 459c06d60Document1 pageTaxExemptWorld 329525 459c06d60Sarah SportingNo ratings yet

- Department of The Treasury Internal Revenue Service Notice 1382Document30 pagesDepartment of The Treasury Internal Revenue Service Notice 1382peterjohannes100% (1)

- 2012 Instructions For Schedule C: Profit or Loss From BusinessDocument13 pages2012 Instructions For Schedule C: Profit or Loss From BusinessDunk7No ratings yet

- National Pavilions - Manufacturing Application Form - Oct'13Document6 pagesNational Pavilions - Manufacturing Application Form - Oct'13Durban Chamber of Commerce and IndustryNo ratings yet

- DBE Certification ApplicationDocument14 pagesDBE Certification ApplicationAaron AdamsNo ratings yet

- Form 46G: Return of Third Party Information For The Year 2010Document4 pagesForm 46G: Return of Third Party Information For The Year 2010billyhorganNo ratings yet

- Request For A Business Number and Certain Program AccountsDocument13 pagesRequest For A Business Number and Certain Program AccountsDattadharmawardhaneNo ratings yet

- 215f3 Index of Statements DocumentsDocument6 pages215f3 Index of Statements DocumentsIngole j pNo ratings yet

- Cra (2) DddaDocument14 pagesCra (2) DddadulmasterNo ratings yet

- IRS Reporting Requirements Under The Affordable Care Act Is Your Business Ready?Document8 pagesIRS Reporting Requirements Under The Affordable Care Act Is Your Business Ready?api-284589375No ratings yet

- Employer Identification Number (EIN) Application / RegistrationDocument3 pagesEmployer Identification Number (EIN) Application / RegistrationLedger Domains LLC100% (1)

- SDFDocument3 pagesSDFShantsmackayNo ratings yet

- 2018 EldDocument3 pages2018 Eldmuhammad afiqNo ratings yet

- Ethiopian Government Business Registration ProcessDocument6 pagesEthiopian Government Business Registration ProcesseliasNo ratings yet

- Employer's Annual Federal Unemployment (FUTA) Tax ReturnDocument4 pagesEmployer's Annual Federal Unemployment (FUTA) Tax ReturnKaradi KuttiNo ratings yet

- IRS Form 1023 - 501c3 Application For Recognition of Non ExemptionDocument30 pagesIRS Form 1023 - 501c3 Application For Recognition of Non ExemptioneleanorawardNo ratings yet

- Hat Is This FormDocument7 pagesHat Is This FormJoydev GangulyNo ratings yet

- ContactOne Bookkeeping Fee Quote Preparatory Form ClientDocument2 pagesContactOne Bookkeeping Fee Quote Preparatory Form Clientmappu08No ratings yet

- Corporate Tax Instructions - FinalDocument15 pagesCorporate Tax Instructions - Finalapi-306226330No ratings yet

- 6330 - PC (Uk) 2023Document14 pages6330 - PC (Uk) 2023Jabbar HassanNo ratings yet

- Guidelines Tax Related DeclarationsDocument16 pagesGuidelines Tax Related DeclarationsRaghul MuthuNo ratings yet

- Bloomberg 2012Document316 pagesBloomberg 2012josephlordNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Capital DepreciationDocument10 pagesCapital DepreciationRakesh RawtNo ratings yet

- Capsule On BankingDocument208 pagesCapsule On BankinghanupagadalaNo ratings yet

- BQSPS0080B 2019 PDFDocument4 pagesBQSPS0080B 2019 PDFsaiNo ratings yet

- InternationalStudentHealthFee Ish Ish X37003194374 Invoice 2024 01 05Document2 pagesInternationalStudentHealthFee Ish Ish X37003194374 Invoice 2024 01 05manmeetbirring2344No ratings yet

- Memorandum of Law On WarrantsDocument9 pagesMemorandum of Law On WarrantsDUTCH5514No ratings yet

- BE63 363069933808 CA EUR 20231031 From 20231001 Requested On 20231113 193510 MRS MARINELLA ISOVADocument11 pagesBE63 363069933808 CA EUR 20231031 From 20231001 Requested On 20231113 193510 MRS MARINELLA ISOVAvgeorgiev183No ratings yet

- AmalgamationDocument15 pagesAmalgamationTejasree SaiNo ratings yet

- Calcutta TelephonesDocument3 pagesCalcutta TelephonessudipNo ratings yet

- Acct Statement - XX9446 - 27102022Document6 pagesAcct Statement - XX9446 - 27102022Naman KhtriNo ratings yet

- Solution Long Quiz Proof of CashDocument2 pagesSolution Long Quiz Proof of Casheia aieNo ratings yet

- Egyptian International Pharmaceutical Industries Company (EIPICO)Document1 pageEgyptian International Pharmaceutical Industries Company (EIPICO)yasser massryNo ratings yet

- Fusões e Aquisições - Artigo 1Document14 pagesFusões e Aquisições - Artigo 1Vitor GoulartNo ratings yet

- 7 Af 301 FaDocument4 pages7 Af 301 FaAleenaSheikhNo ratings yet

- Dominic StatementDocument97 pagesDominic StatementnavabharathsrinivasanNo ratings yet

- Lesson 4Document12 pagesLesson 4Fredmelson Apolo GasparNo ratings yet

- Name and Address of Branch/ Office in Which The Deposit Is HeldDocument7 pagesName and Address of Branch/ Office in Which The Deposit Is Heldvvnrao123No ratings yet

- Business Combination Q4Document2 pagesBusiness Combination Q4Sweet EmmeNo ratings yet

- Instant Download Ebook PDF Financial Management For Decision Makers 9th Edition PDF ScribdDocument51 pagesInstant Download Ebook PDF Financial Management For Decision Makers 9th Edition PDF Scribdcheryl.morgan378100% (45)

- Math and The Stock MarketDocument3 pagesMath and The Stock MarketKim Nicole ObelNo ratings yet

- Financial - Application & ...Document18 pagesFinancial - Application & ...Asja AvdićNo ratings yet

- Fintech and Credit MarketsDocument5 pagesFintech and Credit MarketsFizza Zainab JatoiNo ratings yet

- CAMason Feb 2024Document603 pagesCAMason Feb 2024Prabhaskar JhaNo ratings yet

- Final AccountsDocument15 pagesFinal AccountsVaishnavi VyapariNo ratings yet

- Section A: Multiple Choice Questions - Single OptionDocument25 pagesSection A: Multiple Choice Questions - Single OptionKenny HoNo ratings yet

- CS Executive Capital Market and Securities Laws Important Topics CSCARTINDIADocument10 pagesCS Executive Capital Market and Securities Laws Important Topics CSCARTINDIAjesurajajosephNo ratings yet

- Vanguard FTSE All-World UCITS ETF: (USD) Accumulating - An Exchange-Traded FundDocument4 pagesVanguard FTSE All-World UCITS ETF: (USD) Accumulating - An Exchange-Traded FundYanto TanNo ratings yet

- Hindustan Unilever Limited: CapitalisationDocument9 pagesHindustan Unilever Limited: CapitalisationRohit GoyalNo ratings yet

- Concept of BookkeepingDocument2 pagesConcept of BookkeepingGhost DemonNo ratings yet

- Macrotech Developers 3R Oct06 2022Document7 pagesMacrotech Developers 3R Oct06 2022Kdp03No ratings yet