Professional Documents

Culture Documents

Profitability Analysis

Profitability Analysis

Uploaded by

THE TERMINATOROriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Profitability Analysis

Profitability Analysis

Uploaded by

THE TERMINATORCopyright:

Available Formats

Profitability Analysis

Different methods for economic evaluation of different proje

1 Rate of return or Return on Investment (ROI)

2 Payment Period/Payout Time

3 Discounted Cash Flow Rate of Return (DCFR)

4 Net Present Value and Present Value Index

Analysis

f different project are

Rate of return or Return on Investment (R

ROI = avg Annual Profit

× 100

Total Capital Investment

𝐴𝑣𝑒𝑟𝑎𝑔𝑒 𝑅𝑎𝑡𝑒 𝑜𝑓 𝑅𝑒𝑡𝑢𝑟𝑛 =((∑24_𝑖^𝑛▒ 〖𝐴𝑛𝑛

𝑠〗 )/𝑛)/(𝑇𝑜𝑡𝑎𝑙 𝐶𝑎𝑝𝑖𝑡𝑎𝑙 𝐼𝑛𝑣𝑒𝑠𝑡𝑚𝑒𝑛𝑡)×100

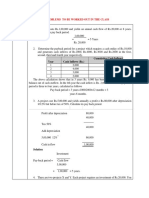

Q. A company wants to install a heater treater unit. There are two available units ina mark

requires a capital investment of 5m$. The life of two units are 8 and 10 years respectively

from the two units are given in the following table. Calculate the rate of return for both u

Projected Profit$

year

Unit-1 Unit-2

1 500,000 40,000

2 500,000 100,000

3 1,500,000 1,000,000

4 2,000,000 1,000,000

5 2,000,000 3,000,000

6 3,000,000 3,000,000

7 3,000,000 3,000,000

8 3,000,000 3,000,000

9 3,000,000

10 3,000,000

Total 15,500,000 20,140,000

Unit -1

Total Capital Investment = 5,000,000$

Average Annual Profit = 15,500,000/8

= 1,937,500 $

Average Rate of return = Average Annual Profit/Total Capital Investment

= (1,937,500 /5,000,000)*100

= 38.75%

n Investment (ROI)

24_𝑖^𝑛▒ 〖𝐴𝑛𝑛𝑢𝑎𝑙 𝑃𝑟𝑜𝑓𝑖𝑡

𝑚𝑒𝑛𝑡)×100

available units ina market and each of them

and 10 years respectively. The projected earning

e rate of return for both units.

Unit-2

Total Capital Investment =5,000,000$

Average Annual Profit = 20,140,100/10

= 2,014,010$

nvestment Average Rate of return = Average Annual Profit/Total Capital Investment

= (2,014,010 /5,000,000)*100

= 40.28%

Payback Period/ Payback Time

Payback period is defined as the time required to recover the total depreciable capital in

in the terms of cash flow of the project.

𝑷𝑷=(𝑻𝒐𝒕𝒂𝒍 𝑫𝒆𝒑𝒓𝒊𝒄𝒊𝒂𝒃𝒍𝒆 𝑪𝒂𝒑𝒊𝒕𝒂𝒍 𝑰𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕)/(𝑨𝒗𝒆𝒓𝒂𝒈𝒆 𝑨𝒏𝒏𝒖𝒂𝒍 𝑪𝒂𝒔𝒉 𝑭𝒍𝒐

Cash Flow = Total Income (After Tax)+ Depreciation

Q. Calculate the Pay out period for the two alternatives of capital expenditures involving an

each for a sulfur removal plant, as given in the following table. The life of project 1 and pr

respectively. Also give reason for selection one and no the other.

Cash Flow ($)

YearProject 1 Project 2

1 1,000,000 200,000

2 500,000 200,000

3 400,000 400,000

4 350,000 400,000

5 250,000 400,000

6 200,000 400,000

7 100,000 400,000

8 400,000

9 400,000

10 400,000

Project-1 Project -2

Total Cash Flow = 2,800,000 3,600,000

Avg. Annual Cash Flow = 2,8000,000/7 3600000/10

= 400000 360000

𝑷𝑷=(𝑻𝒐𝒕𝒂𝒍 𝑫𝒆𝒑𝒓𝒊𝒄𝒊𝒂𝒃𝒍𝒆 𝑪𝒂𝒑𝒊𝒕𝒂𝒍 𝑰𝒏𝒗𝒆𝒔𝒕𝒎𝒆𝒏𝒕)/(𝑨𝒗𝒆𝒓𝒂𝒈𝒆 𝑨𝒏𝒏𝒖𝒂𝒍 𝑪𝒂𝒔𝒉 𝑭𝒍𝒐𝒘

Pay Out Period = 2,000,000/400,000 2,000,000/360,000

= 5 5.55555555555556

k Time

preciable capital investment

𝒏𝒏𝒖𝒂𝒍 𝑪𝒂𝒔𝒉 𝑭𝒍𝒐𝒘 )

ditures involving an investment of 2m$

e of project 1 and project is 7 and 10 year

Capital Investment for = 2,000,000 $

Both Plant

$

$

𝒖𝒂𝒍 𝑪𝒂𝒔𝒉 𝑭𝒍𝒐𝒘 )

years

You might also like

- Tally Practice QuestionsDocument68 pagesTally Practice Questionspranav tomar50% (4)

- Questions For Decision Tree AnalysisDocument2 pagesQuestions For Decision Tree AnalysisTHE TERMINATORNo ratings yet

- Practice ProblemsDocument12 pagesPractice ProblemsJonathan BohbotNo ratings yet

- PETR 3310 Homework 02 SolutionDocument6 pagesPETR 3310 Homework 02 SolutionBrian AndersonNo ratings yet

- Q No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyDocument3 pagesQ No. 1 Assume That You Are Given Assignment To Evaluate The Capital Budgeting Projects of The CompanyMuneeb Qureshi0% (1)

- HHLL Trading StrategyDocument15 pagesHHLL Trading Strategyachiro0707100% (2)

- Discounted Cash Flow of ReturnDocument12 pagesDiscounted Cash Flow of ReturnTHE TERMINATORNo ratings yet

- ARR Practice QuestionsDocument6 pagesARR Practice QuestionsAnanya VasishthaNo ratings yet

- KIX2002 Tutorial 6 Evaluating A Single Project Part 2 and SolutionsDocument3 pagesKIX2002 Tutorial 6 Evaluating A Single Project Part 2 and SolutionsWen HanNo ratings yet

- KIX2002 Tutorial 6 Evaluating A Single Project Part 2Document1 pageKIX2002 Tutorial 6 Evaluating A Single Project Part 2Wen HanNo ratings yet

- CF Assignment 2Document8 pagesCF Assignment 2saravanan.ANo ratings yet

- Girum Tsega PerfectDocument13 pagesGirum Tsega PerfectMesi YE GINo ratings yet

- Bajaj Finserv Investor Presentation - Q2 FY2018-19Document19 pagesBajaj Finserv Investor Presentation - Q2 FY2018-19AmarNo ratings yet

- Financial Management - Capital Budgeting Answer KeyDocument5 pagesFinancial Management - Capital Budgeting Answer KeyRed Velvet100% (1)

- Investment Appraisal TutorialDocument6 pagesInvestment Appraisal TutorialQin Yi NgNo ratings yet

- 2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalDocument93 pages2 - CH 16 (ICAP Book) - Introduction To Project Appraisal - FinalArslanNo ratings yet

- Investment Appraisal CasesDocument4 pagesInvestment Appraisal CasesmatheussNo ratings yet

- CAPITAL BUDGETING TECHNIQUES-TRIAL QUESTIONS - NsDocument3 pagesCAPITAL BUDGETING TECHNIQUES-TRIAL QUESTIONS - NsPrince AgyeiNo ratings yet

- Mini Case Capital Budgeting ProcessDocument6 pagesMini Case Capital Budgeting Process032179253460% (1)

- TutDocument2 pagesTutElzubair EljaaliNo ratings yet

- Earned Value ChartDocument4 pagesEarned Value ChartRanda S JowaNo ratings yet

- Cap Buget ProblemsDocument8 pagesCap Buget ProblemsramakrishnanNo ratings yet

- HBS Case LockheedDocument6 pagesHBS Case LockheedEd Ward100% (2)

- Solutions For Capital Budgeting QuestionsDocument7 pagesSolutions For Capital Budgeting QuestionscaroNo ratings yet

- Binder 1Document105 pagesBinder 1prineetu143No ratings yet

- Same Questions - F303 - 1st MidDocument5 pagesSame Questions - F303 - 1st MidRafid Al Abid SpondonNo ratings yet

- M 4 Cap BudgetingDocument21 pagesM 4 Cap BudgetingNitin DNo ratings yet

- FADocument3 pagesFAYukta GoelNo ratings yet

- Financial Management: Methods of Capital Budgeting EvaluationDocument21 pagesFinancial Management: Methods of Capital Budgeting EvaluationHawazin Al-wasilaNo ratings yet

- Concepts and Techniques: Capital BudgetingDocument66 pagesConcepts and Techniques: Capital BudgetingAMJAD ALINo ratings yet

- Solved Answers For Payback PeriodDocument9 pagesSolved Answers For Payback Periodwihanga100% (2)

- Bcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Document5 pagesBcom 6 Sem Business Finance 2 Foundation Group 2 5511 Summer 2019Shrikant AvzekarNo ratings yet

- Stock Shares Price ($) Market Value of AssetsDocument34 pagesStock Shares Price ($) Market Value of AssetsRADHIKA BANSALNo ratings yet

- Unit III-PROBLEMSDocument6 pagesUnit III-PROBLEMSPranav GaikwadNo ratings yet

- Solution: Year Cash Inflows Present Value Factor Present Value $ @10% $Document10 pagesSolution: Year Cash Inflows Present Value Factor Present Value $ @10% $Waylee CheroNo ratings yet

- Capital Investment Appraisal MethodsDocument13 pagesCapital Investment Appraisal MethodsBwami Vieira PatrickNo ratings yet

- Chapter 3 Lesson 1 - DepreciationDocument13 pagesChapter 3 Lesson 1 - DepreciationLeojhun PalisocNo ratings yet

- Capital BudgetingDocument9 pagesCapital BudgetingAnoop SinghNo ratings yet

- FINA 3330 - Notes CH 9Document2 pagesFINA 3330 - Notes CH 9fische100% (1)

- Homework Chapter 8Document2 pagesHomework Chapter 8simonasalNo ratings yet

- Accounts Paper Answer 24.06.2020Document17 pagesAccounts Paper Answer 24.06.2020Prathmesh JambhulkarNo ratings yet

- Furniture Investment Plan-010615Document12 pagesFurniture Investment Plan-010615arash saberianNo ratings yet

- Basic Accounting EquationDocument4 pagesBasic Accounting EquationArienayaNo ratings yet

- Capital Budgeting: Even Cash Flow Uneven Cash FlowDocument2 pagesCapital Budgeting: Even Cash Flow Uneven Cash FlowKeno OcampoNo ratings yet

- PaybackDocument14 pagesPaybackHema LathaNo ratings yet

- Chapter 9-1Document5 pagesChapter 9-1jou20220354No ratings yet

- Solution CF Cash Flow Practice Problem 2Document12 pagesSolution CF Cash Flow Practice Problem 2Zarieq EricNo ratings yet

- Information System - Assignment (Project Cost and Benefit Analysis)Document7 pagesInformation System - Assignment (Project Cost and Benefit Analysis)olayemimariamoyindamolaNo ratings yet

- Mahmoud Megahed - Str. Fin. Mgmt. - Assginment 2Document20 pagesMahmoud Megahed - Str. Fin. Mgmt. - Assginment 2Mahmoud MegahedNo ratings yet

- Capital Budgeting With Inflation QestionsDocument9 pagesCapital Budgeting With Inflation QestionsM. Ekhtisham Tariq MustafaiNo ratings yet

- Financial Position Report & Cash Flow Statement Analyze Transactions To The AccountDocument32 pagesFinancial Position Report & Cash Flow Statement Analyze Transactions To The AccountRafi EffendyNo ratings yet

- AK RevaluationDocument6 pagesAK RevaluationClaire Labiste IINo ratings yet

- Financial ManagerDocument4 pagesFinancial Managerpavetran raviNo ratings yet

- Ass. Chapter 11 Shareholders Equity (Part 2)Document12 pagesAss. Chapter 11 Shareholders Equity (Part 2)Jea Ann CariñozaNo ratings yet

- Financial Management 25.11.2013 Sem5 PDFDocument4 pagesFinancial Management 25.11.2013 Sem5 PDFAlena TonyNo ratings yet

- Chapter 8 Activity 1Document21 pagesChapter 8 Activity 1Jane Hzel Lopez Militar100% (1)

- Solutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As IsDocument5 pagesSolutions Guide: Please Reword The Answers To Essay Type Parts So As To Guarantee That Your Answer Is An Original. Do Not Submit As IsSri SardiyantiNo ratings yet

- Assignment 4 - Contemporary Engineering BookDocument9 pagesAssignment 4 - Contemporary Engineering BookDhiraj NayakNo ratings yet

- Question #1: Jordan Enterprises Raw MaterialDocument35 pagesQuestion #1: Jordan Enterprises Raw MaterialAimen sakimdadNo ratings yet

- Cap Evaluation Methods QuestionsDocument4 pagesCap Evaluation Methods QuestionsSrijan AcharyaNo ratings yet

- Chapter 11Document10 pagesChapter 11Syed Sheraz AliNo ratings yet

- Assignment 5Document6 pagesAssignment 5Anupama BiswasNo ratings yet

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet

- 1a. Introduction to Petroleum Production - Well Head EquipmentDocument38 pages1a. Introduction to Petroleum Production - Well Head EquipmentTHE TERMINATORNo ratings yet

- Lecture_12_Aerated_Drilling_1714621295171259412766330b6f2a52cDocument7 pagesLecture_12_Aerated_Drilling_1714621295171259412766330b6f2a52cTHE TERMINATORNo ratings yet

- Underground Natural Gas StorageDocument5 pagesUnderground Natural Gas StorageTHE TERMINATORNo ratings yet

- PRMS ClassificationDocument71 pagesPRMS ClassificationTHE TERMINATORNo ratings yet

- Presentation 1Document30 pagesPresentation 1THE TERMINATORNo ratings yet

- Discounted Cash Flow of ReturnDocument12 pagesDiscounted Cash Flow of ReturnTHE TERMINATORNo ratings yet

- O - G Marketing by MohitDocument9 pagesO - G Marketing by MohitTHE TERMINATORNo ratings yet

- About Natural Gas - Ministry of Petroleum and Natural Gas - Government of IndiaDocument5 pagesAbout Natural Gas - Ministry of Petroleum and Natural Gas - Government of IndiaTHE TERMINATORNo ratings yet

- Liquefied Natural Gas PlantDocument5 pagesLiquefied Natural Gas PlantTHE TERMINATORNo ratings yet

- Crude Oil TransportationDocument7 pagesCrude Oil TransportationTHE TERMINATORNo ratings yet

- Reservoir Fluid 5Document42 pagesReservoir Fluid 5THE TERMINATORNo ratings yet

- Economic Analysis of Gas Lift WellsDocument6 pagesEconomic Analysis of Gas Lift WellsTHE TERMINATORNo ratings yet

- 12.L35 36 CarboncycleDocument40 pages12.L35 36 CarboncycleTHE TERMINATORNo ratings yet

- Phase Rule 9Document52 pagesPhase Rule 9THE TERMINATORNo ratings yet

- 3a - Effective and Relative Permeability and MeasurementDocument9 pages3a - Effective and Relative Permeability and MeasurementTHE TERMINATORNo ratings yet

- 15.L 39 Cenozoic Climate Part 2Document22 pages15.L 39 Cenozoic Climate Part 2THE TERMINATORNo ratings yet

- Gas Compression 3Document45 pagesGas Compression 3THE TERMINATOR100% (1)

- SOCIAL SEMIOTICS - Principles and ResourcesDocument2 pagesSOCIAL SEMIOTICS - Principles and ResourcesHanz Christian PadiosNo ratings yet

- Belt Conveyors For Bulk Materials Conveyor: Traducir Esta PáginaDocument4 pagesBelt Conveyors For Bulk Materials Conveyor: Traducir Esta PáginaDIEGO FERNANDO CADENA ARANGONo ratings yet

- Operation ManagementDocument35 pagesOperation ManagementJayvee Joble BigataNo ratings yet

- Three Project Managers With Distinctly Different RolesDocument12 pagesThree Project Managers With Distinctly Different RolesAmber KhalilNo ratings yet

- Assignment 2Document1 pageAssignment 2Vanya AroraNo ratings yet

- Question Paper - Mock AristoDocument33 pagesQuestion Paper - Mock AristoTONI POOH100% (1)

- ASC Nionuco - Monthly Claim Report Itel-Infinix-Tecno - Sep 2022Document50 pagesASC Nionuco - Monthly Claim Report Itel-Infinix-Tecno - Sep 2022regine vinegasNo ratings yet

- Clearlake City Council PacketDocument57 pagesClearlake City Council PacketLakeCoNewsNo ratings yet

- ASTA GMP Guide 2015 FinalWeb1Document35 pagesASTA GMP Guide 2015 FinalWeb1Kharimatul FachriahNo ratings yet

- Boarding PassDocument1 pageBoarding PassΓιωργος ΜουστακηςNo ratings yet

- KH Concept Catalogue Sep 2023Document39 pagesKH Concept Catalogue Sep 2023Jus StreamingNo ratings yet

- Grupo 3 Crucigrama ResueltoDocument2 pagesGrupo 3 Crucigrama ResueltoKevin LancherosNo ratings yet

- Terex Simplicity Vibrating Feeders: Terex Minerals Processing SystemsDocument6 pagesTerex Simplicity Vibrating Feeders: Terex Minerals Processing Systemsestramilsolution100% (1)

- Chapter 7S Learning Curve - Mar 18.pptljbDocument14 pagesChapter 7S Learning Curve - Mar 18.pptljbMichaela WongNo ratings yet

- Nguyen Thi Lan AnhDocument1 pageNguyen Thi Lan AnhLan Anh ShinesNo ratings yet

- Morgan Stanley Case LawDocument2 pagesMorgan Stanley Case LawakshNo ratings yet

- Block 1Document55 pagesBlock 1Aditya SinghNo ratings yet

- Foodrich Philippines Inc - Case-AnalysisDocument29 pagesFoodrich Philippines Inc - Case-AnalysisChiara Mari ManaloNo ratings yet

- Windproof Umbrella: Lean Start-Up Management (MGT1022) Slot: TE1 Fall Semester 2019-20Document48 pagesWindproof Umbrella: Lean Start-Up Management (MGT1022) Slot: TE1 Fall Semester 2019-20Samyak Doshi100% (1)

- Sonal Holland MW AAU of Wine Among SEC A Urban Indian Wine ConsumersDocument121 pagesSonal Holland MW AAU of Wine Among SEC A Urban Indian Wine ConsumersRohitAjvilkarNo ratings yet

- Business Plan: Performance Task # 1Document3 pagesBusiness Plan: Performance Task # 1Jan BrettNo ratings yet

- Vocab 4 2ND Bach. 2ND Term-3Document5 pagesVocab 4 2ND Bach. 2ND Term-3Matias CumbajinNo ratings yet

- Tracks Full Line Canada 01-22-2016Document15 pagesTracks Full Line Canada 01-22-2016gurcayhidayetNo ratings yet

- Diseño Chuqui SubteDocument7 pagesDiseño Chuqui SubteSebastian Gitan VergaraNo ratings yet

- Chapter-One: Introduction of The ReportDocument44 pagesChapter-One: Introduction of The ReportNafiz FahimNo ratings yet

- Riphah International University: Faculty of Management Sciences Riphah School of Leadership (Meezan Campus)Document2 pagesRiphah International University: Faculty of Management Sciences Riphah School of Leadership (Meezan Campus)SAL MANNo ratings yet

- QB DESCRIPTIVE For MockDocument3 pagesQB DESCRIPTIVE For MockSeshendra KumarNo ratings yet

- Park View Enclave (PVT) Limited.: Account StatementDocument1 pagePark View Enclave (PVT) Limited.: Account Statementamirali.bme4527No ratings yet