Professional Documents

Culture Documents

Notice To The Taxpayers: Change of Value Added Tax Rate Income Tax

Notice To The Taxpayers: Change of Value Added Tax Rate Income Tax

Uploaded by

amicoindustries984Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Notice To The Taxpayers: Change of Value Added Tax Rate Income Tax

Notice To The Taxpayers: Change of Value Added Tax Rate Income Tax

Uploaded by

amicoindustries984Copyright:

Available Formats

INLAND REVENUE DEPARTMENT

Notice to the Taxpayers

Implementation of TaxAdded

Change of Value Proposals

Tax made

Ratefor

Income Tax

on the Instruction of the Ministry of Finance

As instructed by the Ministry of Finance, new tax proposals made for Income Tax

and approved by the Cabinet of Ministers, will be implemented subject to formal

amendments to relevant legislation.

1) Income from Agriculture, Fisheries and Livestock shall be exempted from

income tax, with effect from the year of Assessment 2019/2020.

2) Income Tax Rate applicable on construction industry shall be reduced from

28% to 14%, with effect from the year of Assessment 2019/2020.

3) Religious institutions shall fully be exempted from income tax, with effect from

December 01, 2019.

4) Tax free threshold of the employment income of all public and private sector

employees for the purpose of the Pay-As-You-Earn (PAYEE) shall be

increased from Rs. 100,000 to Rs. 250,000 per month and the excessive

personal income shall be liable for income tax at the progressive rate of 06%,

12% and 18% for each tax slab of Rs. 250,000, with effect from January 01,

2020.

5) Interest income up to Rs. 250,000 per month shall be exempted from the

Withholding Tax (WHT), with effect from January 01, 2020.

6) Income of an individual up to Rs. 3,000,000 per annum from any source of

income shall be exempted from income tax and the excess income to that

amount shall be liable for income tax at the progressive rates of 06%, 12% and

18% for each tax slab of Rs. 250,000, with effect from January 01, 2020.

7) Income earned from the supply of services for the receipt of foreign currency

shall be exempted from income tax, with effect from December 01, 2019.

8) Income from the Information Technology and enabling services shall be

exempted from all taxes, with effect from the year of Assessment 2019/2020.

For any further clarification, please contact:

Secretariat - Tel: 011 - 2135412, 011 - 2135413, 011 - 2135411

Deputy Commissioner General – Tax Policy - Tel: 011-2135402

Visit - www.ird.gov.lk

Commissioner General of Inland Revenue

TAXES - FOR A BETTER FUTURE

You might also like

- Tax Amendment Boolet Final 2020-2021-CompressedDocument40 pagesTax Amendment Boolet Final 2020-2021-CompressedCaesarKamanziNo ratings yet

- Finance Bill 2014Document18 pagesFinance Bill 2014Tanvir Ahmed SyedNo ratings yet

- Budget 2010 Highlights Income TaxDocument8 pagesBudget 2010 Highlights Income TaxparthsomaiyaNo ratings yet

- Fiscal Policy of BangladeshDocument12 pagesFiscal Policy of BangladeshMd HarunNo ratings yet

- Ammendments Made by Finance Bill 2068 in All ActsDocument14 pagesAmmendments Made by Finance Bill 2068 in All ActsNiraj ShresthaNo ratings yet

- Budget Proposals 2021 (Kreston Sri Lanka)Document45 pagesBudget Proposals 2021 (Kreston Sri Lanka)Sri Lankan Travel BlogNo ratings yet

- Special Updates For Prihatin Tambahan and Income Tax Matter During Movement Control Order PeriodDocument4 pagesSpecial Updates For Prihatin Tambahan and Income Tax Matter During Movement Control Order Periodshah7592No ratings yet

- Income Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentDocument5 pagesIncome Tax - Major Highlights of Union Budget - 2011-12: Prasad V Sawant Roll No:96 Tax AssignmentJohn DoinNo ratings yet

- Chapter 4 enDocument13 pagesChapter 4 enS. M. Hasan ZidnyNo ratings yet

- Tax PlanningDocument7 pagesTax PlanningCharan AdharNo ratings yet

- Finance Act Era Critical Evaluation 1 1Document22 pagesFinance Act Era Critical Evaluation 1 1Folawiyo AgbokeNo ratings yet

- TaXavvy Budget 2020 Part 1Document29 pagesTaXavvy Budget 2020 Part 1Anonymous gMgeQl1SndNo ratings yet

- Bangladesh Tax Handbook 2008-2009 PDFDocument53 pagesBangladesh Tax Handbook 2008-2009 PDFNur Md Al HossainNo ratings yet

- Ryhuqphqwri, QGLD 0Lqlvwu/Ri) LQDQFH 'Hsduwphqwri5Hyhqxh &Hqwudo%Rdugri'Luhfw7D (HVDocument24 pagesRyhuqphqwri, QGLD 0Lqlvwu/Ri) LQDQFH 'Hsduwphqwri5Hyhqxh &Hqwudo%Rdugri'Luhfw7D (HVNiraj JainNo ratings yet

- Budget Chemistry 2010Document44 pagesBudget Chemistry 2010Aq SalmanNo ratings yet

- Finance Budget 2023Document4 pagesFinance Budget 2023SakshamNo ratings yet

- Salient Features: Company-Confidential 26.02.2010Document9 pagesSalient Features: Company-Confidential 26.02.2010Coolvishal AgnihotriNo ratings yet

- Quarterly Income A5 EngDocument4 pagesQuarterly Income A5 EngKasendereNo ratings yet

- Tax Reforms in PakistanDocument53 pagesTax Reforms in PakistanMübashir Khan100% (2)

- Bangladesh Income Tax Guide 2020 EYDocument60 pagesBangladesh Income Tax Guide 2020 EYAsif Assistant Manager100% (1)

- Deloitte Tanzania GuideDocument13 pagesDeloitte Tanzania GuideVenkatesh GorurNo ratings yet

- FBRDocument28 pagesFBRAnonymous ykFLSpIWNo ratings yet

- Malaysia: Taxation of International ExecutivesDocument23 pagesMalaysia: Taxation of International ExecutivesPeng LimNo ratings yet

- Assignment: Taxation System in India'Document14 pagesAssignment: Taxation System in India'Devendra OjhaNo ratings yet

- Nepal TaxationDocument19 pagesNepal TaxationVijay AgrahariNo ratings yet

- Task 8Document23 pagesTask 8Anooja SajeevNo ratings yet

- Latest GST Changes 28-5-21Document5 pagesLatest GST Changes 28-5-21phani raja kumarNo ratings yet

- New Tax ReformDocument4 pagesNew Tax ReformEDISON SAGUIRERNo ratings yet

- WB State Budget 14-15Document2 pagesWB State Budget 14-15api-248243571No ratings yet

- Malawi DeloitteDocument14 pagesMalawi DeloitteMwawiNo ratings yet

- Balancing Fiscal Consolidation With Growth: Uncertainty Over GAARDocument42 pagesBalancing Fiscal Consolidation With Growth: Uncertainty Over GAARChinmay ShirsatNo ratings yet

- P&A Briefing - Income Tax Rates 2080-2081 (2023-2024 A.D.) 20.07.23Document10 pagesP&A Briefing - Income Tax Rates 2080-2081 (2023-2024 A.D.) 20.07.23alpha NEPALNo ratings yet

- Tax Reform For Acceleration and Inclusion (Train) Act (RA # 10963)Document4 pagesTax Reform For Acceleration and Inclusion (Train) Act (RA # 10963)thepoetsedgeNo ratings yet

- Taxation SlideDocument26 pagesTaxation SlidePei Jia WahNo ratings yet

- Income Tax at A Glance: Domestic Taxes DepartmentDocument16 pagesIncome Tax at A Glance: Domestic Taxes DepartmentClifton SangNo ratings yet

- Amity Global Business School, PuneDocument15 pagesAmity Global Business School, PuneChand KalraNo ratings yet

- Fiscal Policy of Pakistan: Presented By: Sumair Malik Umer MukhtarDocument30 pagesFiscal Policy of Pakistan: Presented By: Sumair Malik Umer Mukhtarumermukhtar31No ratings yet

- EY Tax Booklet, 2022Document65 pagesEY Tax Booklet, 2022Sabbir Ahmed PrimeNo ratings yet

- Current Tax Rates and Provisions NigeriaDocument6 pagesCurrent Tax Rates and Provisions NigeriaVikky MehtaNo ratings yet

- Changes in GSTDocument4 pagesChanges in GSTRanjodh KaurNo ratings yet

- Taxation-Reforms PRESENTATIONDocument17 pagesTaxation-Reforms PRESENTATIONRaman KumarNo ratings yet

- Chemexcil: Key Highlights & Provisions For Exports/ Chemicals SectorDocument6 pagesChemexcil: Key Highlights & Provisions For Exports/ Chemicals SectorRRSNo ratings yet

- Financial Budget 2013Document9 pagesFinancial Budget 2013Mitesh PanchalNo ratings yet

- Tax News January-April 2011Document15 pagesTax News January-April 2011Ravi TejaNo ratings yet

- Contemporary Tax Issues PresentationDocument38 pagesContemporary Tax Issues PresentationSamuel DwumfourNo ratings yet

- Changes in Income-Tax - 2020-21 PDFDocument32 pagesChanges in Income-Tax - 2020-21 PDFmir makarim ahsanNo ratings yet

- Philippines - Individual - Taxes On Personal IncomeDocument3 pagesPhilippines - Individual - Taxes On Personal IncomeJude SantosNo ratings yet

- Indonesian Tax Treatment For Foreign Drilling Companies FDCDocument4 pagesIndonesian Tax Treatment For Foreign Drilling Companies FDCJoko ArifiantoNo ratings yet

- 2021 Budget HighlightDocument20 pages2021 Budget HighlightNashville MuwaikaNo ratings yet

- Trabaho BillDocument14 pagesTrabaho BillAvia ColorNo ratings yet

- Tax Hand Book: Finance Bill 2016Document27 pagesTax Hand Book: Finance Bill 2016Rone garciaNo ratings yet

- Income Tax Law and PracticesDocument148 pagesIncome Tax Law and PracticesUjjwal KandhaweNo ratings yet

- Budget Snapshot 2011-12Document22 pagesBudget Snapshot 2011-12Sunil SharmaNo ratings yet

- Tax RateDocument10 pagesTax Rateusha chimariyaNo ratings yet

- GST Update06112021Document53 pagesGST Update06112021supdtconflNo ratings yet

- A Critical Review of The Tax Structure of BangladeshDocument4 pagesA Critical Review of The Tax Structure of BangladeshSumaiya IslamNo ratings yet

- 3109 - Taxation of Non-Individual TaxpayersDocument9 pages3109 - Taxation of Non-Individual TaxpayersMae Angiela TansecoNo ratings yet

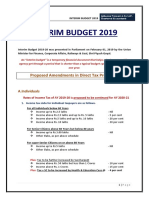

- Interim Budget 2019: Proposed Amendments in Direct Tax ProvisionsDocument4 pagesInterim Budget 2019: Proposed Amendments in Direct Tax ProvisionsaaNo ratings yet

- Income Tax - Income Tax Guide 2023, Latest NewsDocument34 pagesIncome Tax - Income Tax Guide 2023, Latest NewsnandiniNo ratings yet