Professional Documents

Culture Documents

Via Electronic Mail: Federal Register 62718, October 13, 2010

Via Electronic Mail: Federal Register 62718, October 13, 2010

Uploaded by

MarketsWikiOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Via Electronic Mail: Federal Register 62718, October 13, 2010

Via Electronic Mail: Federal Register 62718, October 13, 2010

Uploaded by

MarketsWikiCopyright:

Available Formats

Cristeena Naser Associate General Counsel ABASA 202-663-5332 cnaser@aba.

com

November 16, 2010 VIA ELECTRONIC MAIL

Ms. Elizabeth Murphy, Secretary Securities and Exchange Commission 100 F Street, NE Washington, DC 20549-1090

RE:

Disclosure for Asset-Backed Securities Required by Section 943 of the Dodd-Frank Wall Street Reform and Consumer Protection Act Release Nos. 33-9148; 34-63029, File No. S7-24-10 75 Federal Register 62718, October 13, 2010

Dear Ms. Murphy: The American Bankers Association (ABA)1 and the ABA Securities Association (ABASA)2 appreciate the opportunity to respond to the request for comment by the Securities and Exchange Commission (Commission) on the above-referenced release (Proposing Release). Our members serve as originators, issuers, sponsors, underwriters and trustees across the broad spectrum of securitization transactions. The Proposing Release would implement Section 943(2) of the Dodd-Frank Wall Street Reform and Consumer Protection Act3 (Dodd-Frank Act), that requires securitizers of asset-backed securities (ABS) issuances to disclose demands for repurchase of assets across all trusts aggregated by the securitizer and whether such assets were, in fact, repurchased, so that investors may identify asset originators with clear underwriting deficiencies. Section 943(2) was enacted in response to a perceived lack of effectiveness of the buy-back covenants in ABS transaction documents where breaches of underlying asset-level representations and warranties were alleged. At the outset, ABA generally supports the need for appropriate disclosure with respect to repurchase requests, and we suggest modifications which we believe will provide investors with more useful information about such requests.

The American Bankers Association represents banks of all sizes and charters and is the voice for the nations $13 trillion banking industry and its 2 million employees. ABAs extensive resources enhance the success of the nations banks and strengthen Americas economy and communities. Learn more at www.aba.com. 2 ABASA is a separately chartered affiliate of the ABA that represents those holding company members of the ABA that are actively engaged in capital markets, investment banking, and broker-dealer activities. 3 Pub. L. No. 111-203 (July 21, 2010). The Proposing Release would also implement the requirement of Section 943(1) to require rating agencies to provide descriptions of representations, warranties and enforcement mechanisms in ABS transactions and how these compare to other transactions. This comment letter does not address this requirement of Section 943.

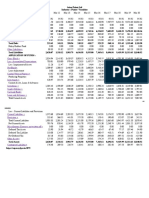

Discussion The Proposing Release would implement this requirement by proposing new Rule 15Ga-1 that would require disclosure on new Form ABS-15G of repurchase requests on all ABS transactions, whether or not publicly and privately issued, in which transaction documents provide a covenant to repurchase or replace an underlying asset for breach of a representation or warranty. Initially, a securitizer would be required to provide the repurchase history for the last five years by filing Form ABS-15G at the time the securitizer or its affiliate first offers or organizes an offering of ABS after the rules effective date. Thereafter, the form would be required to be updated and filed monthly, until the last payment has been made on the last ABS outstanding and held by a non-affiliate of the securitizer. The data required by Form ABS-15G would not be limited to successful demands for repurchase, but also would include disclosure of both pending and unfulfilled repurchase requests by the trustee, as well as repurchase requests made by any securityholder even if the trustee did not make a demand. Form ABS-15G would require disclosure in a single table of repurchase requests by asset class, listing the names of all of the relevant issuing entities and detailing for each issuing entity the repurchase statistics for each originator of underlying assets. For each originator and for each issuing entity, Form ABS-15G would require disclosure of the number, outstanding principal balance and percentage by principal balance of: Assets that were the subject of a repurchase demand for breach of representations and warranties; Assets that were actually repurchased or replaced; Assets that were not repurchased or replaced; and Assets that are pending repurchase or replacement (including a footnote that provides narrative disclosure as to why the repurchase or replacement is pending). 1. Disclosures Should Be Required Prospectively The Proposing Release would require a five-year look-back period for repurchase demands, based on the Commissions belief that Section 943(2) requires retroactive application. ABA and ABASA strongly disagree with that interpretation. To the contrary, we believe that nothing in the statutory language requires retroactive application. Neither are we aware of anything in the legislative history that would require retroactive effect. Rather, as discussed below, we believe that retroactive application could serve to mislead rather than provide transparency for investors. To date there has been no requirement either under transaction documents or by regulation for parties involved in securitization transactions to track information on repurchase demands. As a result, any information to be disclosed in a five-year look back period will almost certainly be incomplete and may well not provide a reasonably accurate picture of repurchase demands. Our trustee members have indicated that they could not even determine what percentage of the information they could provide. Moreover, we believe it would be extremely burdensome for trustees and other parties authorized in securitization transactions, to compile the data from thousands of paper document files. This would be a very time-consuming and costly exercise 2

that trustees could not undertake without adequate compensation. Finally, because so many of the originators of residential mortgage securitizations (which represent the focus of most investor discontent with repurchases) have gone out of business in the last five years, we believe the lookback provision will not effectuate Congressional intent to illuminate those originators that have poor underwriting practices. Although the Commission would permit securitizers to indicate in a footnote that complete information is not available, we strongly believe that the footnote cannot serve to undo misperceptions resulting from incomplete data. Such footnote disclosures are likely to create issues that are unrelated to the performance of the assets and that will take time and resources to address, without leading to the disclosure of useful information. In addition, because there has been no requirement to report the data, securitizers and trustees may have widely differing practices for retaining such data. As a result, the fragmented information that is available may well not be amenable to the standardization and comparability that would permit investors to discern those originators with clear underwriting deficiencies as intended by Congress. However, applying the rule prospectively would enable securitization parties to develop the systems and procedures to track data on repurchase demands so that the information on Form ABS-15G will be relevant and useful to investors and act as an incentive to good performance on the part of originators. Finally, the disclosure requirement in the Proposing Release is not limited to demands made by the trustee or other parties authorized by transaction documents to make repurchase demands. Rather, the disclosure requirement would encompass requests by any party that made a repurchase demand of a securitizer, regardless of the legal standing of the party or the validity of the request. We note that during the past several years of disruption in the mortgage markets in particular, some investors have demanded the repurchase of whole pools of mortgages based on poor performance rather than as a function of the breach of specific representations and warranties with supporting information. Because the Proposing Release does not define a repurchase demand, we believe the disclosures would likely reflect repurchase requests that would not be valid demands under the transaction documents. As such, we believe the inclusion of this type of information could well skew the data to be reported and again provide misleading information to investors. For the above reasons, ABA and ABASA strongly urge the Commission to revise the proposal to make the reporting requirement prospective and to narrow appropriately the definition of the demands to be reported under the proposal (as discussed below). 2. Definition of Repurchase Demand As noted above, the Proposing Release does not currently define a repurchase demand. We believe that the only demands that should be required to be disclosed are those that comport with the procedures specified in the transaction documents. We do not dispute that the recent economic turmoil revealed that the existing process relating to repurchase demands was flawed. We believe, however, that the industry has made significant progress toward remedying those flaws. As a result, new ABS transaction documents will 3

contain effective procedures for appropriate parties to make allegations of breaches of specific representations and warranties. Accordingly, ABA and ABASA strongly believe that only demands for repurchases made in accordance with the specified procedures should be reportable. 3. Timing, Content of Form ABS-15G Under the Proposing Release, Form ABS-15G would be required to be filed monthly with updated information. Although ABS issuers often make monthly distributions to investors, repurchase demands are wholly unrelated to that schedule, and the process may move slowly. As a result, there would be many months with nothing to report. Thus, a monthly reporting schedule would provide little beneficial information to investors but could impose significant burdens on securitizers. Accordingly, ABA and ABASA urge the Commission to revise its proposal to require reporting no more frequently than on a quarterly basis. Finally, ABA and ABASA urge the Commission to permit securitizers to file separate forms per asset class. Although investors in residential mortgage-backed securities have expressed significant and repeated concerns with the repurchase process, investors in some other asset classes have not had such experiences. To avoid overwhelming investors with information that may not be relevant, we believe filing Form ABS-15G by asset class is appropriate and would let investors readily find the information in which they are specifically interested. Conclusion For the reasons stated above, ABA and ABASA strongly urge the Commission to implement Rule 15Ga-1 prospectively and define the repurchase demands to be reported as only those that conform to the procedures specified in the transaction documents. We further believe the Commission should require reporting on Form ABS-15G no more frequently than on a quarterly basis and that filing by asset class should be permitted. If you have any questions about the foregoing, please do not hesitate to contact the undersigned. Sincerely,

Cristeena G. Naser Senior Counsel, Center for Securities, Trust & Investment Associate General Counsel ABA Securities Association

You might also like

- FAS 140 Setoff Isolation Letter 51004Document15 pagesFAS 140 Setoff Isolation Letter 51004Madu El Musa Bey91% (11)

- AWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-PreviewDocument4 pagesAWESOME ATTACK OUTLINE Securities Regulation - Haft 2005-Previewscottshear1No ratings yet

- FAS 140 Setoff Isolation Letter 51004 PDFDocument15 pagesFAS 140 Setoff Isolation Letter 51004 PDFMikhael Yah-Shah Dean: Veilour100% (1)

- Bookmap MasterclassDocument378 pagesBookmap MasterclassThierry100% (5)

- CombinepdfDocument129 pagesCombinepdfMary Jane G. FACERONDANo ratings yet

- Magazine Publishing Business PlanDocument60 pagesMagazine Publishing Business PlanChuck Achberger100% (4)

- Bankofamerica: November 15, 2010Document12 pagesBankofamerica: November 15, 2010MarketsWikiNo ratings yet

- By Electronic MailDocument10 pagesBy Electronic MailMarketsWikiNo ratings yet

- VIA ELECTRONIC MAIL (Rule-Comments@sec - Gov) : New YorkDocument16 pagesVIA ELECTRONIC MAIL (Rule-Comments@sec - Gov) : New YorkMarketsWikiNo ratings yet

- Corporate Trust Services MAC N2702-011 9062 Old Annapolis Road Columbia, MD 21045 410884-2000 410715-2380 FaxDocument4 pagesCorporate Trust Services MAC N2702-011 9062 Old Annapolis Road Columbia, MD 21045 410884-2000 410715-2380 FaxMarketsWikiNo ratings yet

- Via Email:: Rule-Comments@sec - GovDocument25 pagesVia Email:: Rule-Comments@sec - GovMarketsWikiNo ratings yet

- Sec Corr 2006 To PNC DBA Natuonal City Mortgage Affiliates Must Be CurrentDocument5 pagesSec Corr 2006 To PNC DBA Natuonal City Mortgage Affiliates Must Be Currentmaria-bellaNo ratings yet

- Crowdfunding Regulation SummaryDocument25 pagesCrowdfunding Regulation SummaryAnonymous ukqEbKTNo ratings yet

- By E-Mail: Rule-Comments@sec - GovDocument12 pagesBy E-Mail: Rule-Comments@sec - GovMarketsWikiNo ratings yet

- Better M Rkets: Transparency Acco NtabilityDocument15 pagesBetter M Rkets: Transparency Acco NtabilityMarketsWikiNo ratings yet

- Timothy J. Sloan Wells Fargo & CompanyDocument39 pagesTimothy J. Sloan Wells Fargo & CompanyMarketsWikiNo ratings yet

- Federal Register / Vol. 72, No. 52 / Monday, March 19, 2007 / Proposed RulesDocument38 pagesFederal Register / Vol. 72, No. 52 / Monday, March 19, 2007 / Proposed RulesMarketsWikiNo ratings yet

- Metropark Usa, Inc.Document20 pagesMetropark Usa, Inc.Chapter 11 DocketsNo ratings yet

- VIA ELECTRONIC MAIL (Rule-Comments@sec - Gov)Document19 pagesVIA ELECTRONIC MAIL (Rule-Comments@sec - Gov)MarketsWikiNo ratings yet

- Via Electronic SubmissionDocument15 pagesVia Electronic SubmissionMarketsWikiNo ratings yet

- Pickard An D Inis LLP: Attorneys at Law 1990 M Street, N.W., Suite 660 WASHINGTON, D.C. 20036Document15 pagesPickard An D Inis LLP: Attorneys at Law 1990 M Street, N.W., Suite 660 WASHINGTON, D.C. 20036MarketsWikiNo ratings yet

- Sifma 120920 17a8Document10 pagesSifma 120920 17a8EC KingNo ratings yet

- RIN 1557-AD43 Docket ID OCC-2011-0008 RIN 2590-AA43: Financing America's EconomyDocument14 pagesRIN 1557-AD43 Docket ID OCC-2011-0008 RIN 2590-AA43: Financing America's EconomyMarketsWikiNo ratings yet

- Uestion: 55 Water Street New York, NY 10041 Tel 212-438-5600Document7 pagesUestion: 55 Water Street New York, NY 10041 Tel 212-438-5600MarketsWikiNo ratings yet

- Form 211 - SEC Rule 15c2-11 Proposal - Brenda Hamilton Esq.Document5 pagesForm 211 - SEC Rule 15c2-11 Proposal - Brenda Hamilton Esq.BrendaHamiltonNo ratings yet

- William HenleyDocument3 pagesWilliam HenleyMarketsWikiNo ratings yet

- The Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Document24 pagesThe Last Four Digits of The Debtor's Federal Tax Identification Number Are 6659Chapter 11 DocketsNo ratings yet

- Hearing Date and Time: May 23, 2011 at 10:00 A.M. ET Objection Deadline: May 19, 2011 at 4:00 P.M. ETDocument12 pagesHearing Date and Time: May 23, 2011 at 10:00 A.M. ET Objection Deadline: May 19, 2011 at 4:00 P.M. ETChapter 11 DocketsNo ratings yet

- VIA ELECTRONIC MAIL (Rule-Comments@sec - Gov)Document16 pagesVIA ELECTRONIC MAIL (Rule-Comments@sec - Gov)MarketsWikiNo ratings yet

- 1615 H Street NW - Washington, DC - 20062Document11 pages1615 H Street NW - Washington, DC - 20062api-249785899No ratings yet

- International Swaps and Derivatives Association, IncDocument24 pagesInternational Swaps and Derivatives Association, IncMarketsWikiNo ratings yet

- Diana PrestonDocument9 pagesDiana PrestonMarketsWikiNo ratings yet

- Counsel For Cotton On USA, Inc.: United States Bankruptcy Court Southern District of New YorkDocument16 pagesCounsel For Cotton On USA, Inc.: United States Bankruptcy Court Southern District of New YorkChapter 11 DocketsNo ratings yet

- CUSIP Guidelines 2011Document15 pagesCUSIP Guidelines 2011Delwayne Mills100% (1)

- Via Electronic MailDocument3 pagesVia Electronic MailMarketsWikiNo ratings yet

- Securities and Exchange Commission (SEC) - Formt-3Document5 pagesSecurities and Exchange Commission (SEC) - Formt-3highfinanceNo ratings yet

- Hearing Date and Time: May 31, 2011 at 2:30 P.M. ET Objection Deadline: May 31, 2011 at 12:00 P.M. ETDocument12 pagesHearing Date and Time: May 31, 2011 at 2:30 P.M. ET Objection Deadline: May 31, 2011 at 12:00 P.M. ETChapter 11 DocketsNo ratings yet

- Michael BoppDocument4 pagesMichael BoppMarketsWikiNo ratings yet

- Washington: New York 1101 New York Avenue, NW 8th Floor Washington, DC 20005-4269 P: 202.962.7300 F: 202.962.7305Document10 pagesWashington: New York 1101 New York Avenue, NW 8th Floor Washington, DC 20005-4269 P: 202.962.7300 F: 202.962.7305ABC DEFNo ratings yet

- Re: Docket No. OCC-2011-0008/RIN 1557-AD43 Docket No. R-1415 /RIN 7100 AD74 RIN 3064-AD79 RIN 3052-AC69 RIN 2590-AA45Document42 pagesRe: Docket No. OCC-2011-0008/RIN 1557-AD43 Docket No. R-1415 /RIN 7100 AD74 RIN 3064-AD79 RIN 3052-AC69 RIN 2590-AA45MarketsWikiNo ratings yet

- ManagedfundsDocument5 pagesManagedfundsMarketsWikiNo ratings yet

- O Max Gardner - Top Reasons For Wanting A PSADocument2 pagesO Max Gardner - Top Reasons For Wanting A PSAStopGovt WasteNo ratings yet

- 10000017315Document8 pages10000017315Chapter 11 DocketsNo ratings yet

- Man U IpoDocument258 pagesMan U IpoMichael OzanianNo ratings yet

- Issue of Prospectus2023Document16 pagesIssue of Prospectus2023TasmineNo ratings yet

- SCL ReviewerDocument20 pagesSCL ReviewerAdrielle FloretesNo ratings yet

- Via Electronic Mail: Federal Register 64182, October 19, 2010Document4 pagesVia Electronic Mail: Federal Register 64182, October 19, 2010MarketsWikiNo ratings yet

- Adverse Claims Under The Uniform Commercial Code - A Survey and PR PDFDocument39 pagesAdverse Claims Under The Uniform Commercial Code - A Survey and PR PDFblcksourceNo ratings yet

- By Electronic Submission To WWW - Sec.govDocument30 pagesBy Electronic Submission To WWW - Sec.govMarketsWikiNo ratings yet

- Brian R. Leach: Citigroup Inc. Chief Risk Officer 399 Park Avenue New York, NY 10022Document10 pagesBrian R. Leach: Citigroup Inc. Chief Risk Officer 399 Park Avenue New York, NY 10022MarketsWikiNo ratings yet

- Know Before You Owe Mortgage Loan InitiativeDocument19 pagesKnow Before You Owe Mortgage Loan InitiativeLori NobleNo ratings yet

- GSRG 405 PT 2 InstrDocument14 pagesGSRG 405 PT 2 InstrLaLa BanksNo ratings yet

- Mjs and Associates V Chase 12312010 Client Lance CassinoDocument8 pagesMjs and Associates V Chase 12312010 Client Lance Cassinoapi-293779854No ratings yet

- Proposed Rules: I. BackgroundDocument18 pagesProposed Rules: I. BackgroundMarketsWikiNo ratings yet

- 33 11092Document13 pages33 11092Abdelmadjid djibrineNo ratings yet

- Stuart KaswellDocument12 pagesStuart KaswellMarketsWikiNo ratings yet

- Union Bank Vs SECDocument2 pagesUnion Bank Vs SECYgritte SnowNo ratings yet

- 10000000736Document94 pages10000000736Chapter 11 DocketsNo ratings yet

- Skype - s1 Aug 2010Document340 pagesSkype - s1 Aug 2010a_sahaiNo ratings yet

- Raising Money – Legally: A Practical Guide to Raising CapitalFrom EverandRaising Money – Legally: A Practical Guide to Raising CapitalRating: 4 out of 5 stars4/5 (1)

- Running an Effective Investor Relations Department: A Comprehensive GuideFrom EverandRunning an Effective Investor Relations Department: A Comprehensive GuideNo ratings yet

- CFTC Final RuleDocument52 pagesCFTC Final RuleMarketsWikiNo ratings yet

- Minute Entry 336Document1 pageMinute Entry 336MarketsWikiNo ratings yet

- Federal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsDocument6 pagesFederal Register / Vol. 81, No. 88 / Friday, May 6, 2016 / Rules and RegulationsMarketsWikiNo ratings yet

- 34 77617 PDFDocument783 pages34 77617 PDFMarketsWikiNo ratings yet

- Eemac022516 EemacreportDocument14 pagesEemac022516 EemacreportMarketsWikiNo ratings yet

- Federal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesDocument13 pagesFederal Register / Vol. 81, No. 55 / Tuesday, March 22, 2016 / NoticesMarketsWikiNo ratings yet

- Via Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400Document7 pagesVia Electronic Submission: Modern Markets Initiative 545 Madison Avenue New York, NY 10022 (646) 536-7400MarketsWikiNo ratings yet

- Douglas C I FuDocument4 pagesDouglas C I FuMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument2 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument3 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015Document26 pagesCommodity Futures Trading Commission: Vol. 80 Wednesday, No. 246 December 23, 2015MarketsWikiNo ratings yet

- 2015-10-22 Notice Dis A FR Final-RuleDocument281 pages2015-10-22 Notice Dis A FR Final-RuleMarketsWikiNo ratings yet

- Odrgreportg20 1115Document10 pagesOdrgreportg20 1115MarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument2 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Commodity Futures Trading Commission: Office of Public AffairsDocument5 pagesCommodity Futures Trading Commission: Office of Public AffairsMarketsWikiNo ratings yet

- Daniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostDocument97 pagesDaniel Deli, Paul Hanouna, Christof W. Stahel, Yue Tang and William YostMarketsWikiNo ratings yet

- 34 76474 PDFDocument584 pages34 76474 PDFMarketsWikiNo ratings yet

- Share Capital + Reserves Total +Document2 pagesShare Capital + Reserves Total +Pitresh KaushikNo ratings yet

- Project ReportDocument55 pagesProject Reportkushal_ghosh20009742100% (6)

- TMT Private Agreement ContractDocument25 pagesTMT Private Agreement ContractNadir Valerio Barbò100% (1)

- Project On Punjab National BankDocument84 pagesProject On Punjab National BankViPul81% (27)

- Tax Invoice: Shipping AddressDocument1 pageTax Invoice: Shipping AddressNelsy AfonsoNo ratings yet

- Treasury Cash ManagementDocument9 pagesTreasury Cash Managementvicenteferrer100% (1)

- Prelec Post TestDocument3 pagesPrelec Post TestPrince PierreNo ratings yet

- Rbi Circular On Wilful DefaultersDocument3 pagesRbi Circular On Wilful DefaultersAnshulSinghalNo ratings yet

- NIRC Amendments Up To 2016Document3 pagesNIRC Amendments Up To 2016jusang16No ratings yet

- UBL-04-Jan-2023 11 - 26 - 53Document2 pagesUBL-04-Jan-2023 11 - 26 - 53Mueen HassanNo ratings yet

- BSE Limited National Stock Exchange of India LimitedDocument390 pagesBSE Limited National Stock Exchange of India LimitedDivyank SharmaNo ratings yet

- Henri BoulangerieDocument7 pagesHenri BoulangerievietNo ratings yet

- Seminar On Retail BankingDocument28 pagesSeminar On Retail BankingIla JoshiNo ratings yet

- Core ValuesDocument80 pagesCore ValuesAcbel Rnuco100% (1)

- PTBNISecurities FixedIncomeDailyReport-29March2021 Mar 28 2021Document7 pagesPTBNISecurities FixedIncomeDailyReport-29March2021 Mar 28 2021Dylan AdrianNo ratings yet

- Japanese Guidelines For Internal Control Reporting Finalized Differences in Requirements Between The U.S. Sarbanes-Oxley Act and JDocument10 pagesJapanese Guidelines For Internal Control Reporting Finalized Differences in Requirements Between The U.S. Sarbanes-Oxley Act and JManna MahadiNo ratings yet

- Charles Ngo Reading ListDocument2 pagesCharles Ngo Reading ListCarlos Chizzini MeloNo ratings yet

- Improving Performance With Strategies That Manage Strategies - David BeanDocument13 pagesImproving Performance With Strategies That Manage Strategies - David BeanaadbosmaNo ratings yet

- INTEREST - Exception To Medel Case Jocelyn M. Toledo vs. Marilou M. HydenDocument2 pagesINTEREST - Exception To Medel Case Jocelyn M. Toledo vs. Marilou M. HydenBenjie PangosfianNo ratings yet

- Financial Terminology Definition of The Financial TermDocument36 pagesFinancial Terminology Definition of The Financial TermRajeev TripathiNo ratings yet

- 3 MYOB Basic Qualificatio Test 3 Evira Jewellery A4Document5 pages3 MYOB Basic Qualificatio Test 3 Evira Jewellery A4Arsi HazzNo ratings yet

- Chapter 19 Exercises & ProblemsDocument10 pagesChapter 19 Exercises & ProblemsRiza Mae AlceNo ratings yet

- Diploma Investment Compliance: Key FeaturesDocument4 pagesDiploma Investment Compliance: Key FeatureshamruzNo ratings yet

- PR - Order in The Matter of M/s. HBN Dairies & Allied LimitedDocument2 pagesPR - Order in The Matter of M/s. HBN Dairies & Allied LimitedShyam SunderNo ratings yet

- Financial Management Case 2: Modi Rubber vs. Financial InstitutionsDocument28 pagesFinancial Management Case 2: Modi Rubber vs. Financial InstitutionsGaurav Agarwal100% (1)

- Secrets of The Marke Wizards Reaveled - Schwager - SMWDocument16 pagesSecrets of The Marke Wizards Reaveled - Schwager - SMWaccesslines40% (5)

- Hedge Fund ResumeDocument6 pagesHedge Fund Resumec2s1s8mr100% (1)