Professional Documents

Culture Documents

AURORABANK (A RURAL BANK) INC - HTM

AURORABANK (A RURAL BANK) INC - HTM

Uploaded by

Jim De VegaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

AURORABANK (A RURAL BANK) INC - HTM

AURORABANK (A RURAL BANK) INC - HTM

Uploaded by

Jim De VegaCopyright:

Available Formats

26/01/2024, 12:11 AURORABANK (A RURAL BANK) INC.

htm

`

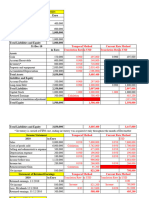

AURORABANK (A RURAL BANK) INC

Published Balance Sheet

Amounts in Philippine Pesos

As of 31 December 2022

ASSETS

Current Quarter Previous Quarter

Cash and Cash Items 1,950,792.90 4,451,659.46

Due from Bangko Sentral ng Pilipinas 1,303,029.54 1,303,029.54

Due from Other Banks 35,277,215.79 36,849,479.71

Financial Assets at Fair Value through Profit or Loss 0.00 0.00

Available-for-Sale Financial Assets-Net 0.00 0.00

Held-to-Maturity (HTM) Financial Assets-Net 0.00 0.00

Unquoted Debt Securities Classified as Loans-Net 0.00 0.00

Investments in Non-Marketable Equity Security-Net 0.00 0.00

Loans and Receivables - Net 54,843,345.39 57,947,280.94

Loans to Bangko Sentral ng Pilipinas 0.00 0.00

Interbank Loans Receivable 0.00 0.00

Loans and Receivables - Others 55,377,107.34 58,477,755.99

Loans and Receivables Arising from RA/CA/PR/SLB 0.00 0.00

General Loan Loss Provision 533,761.95 530,475.05

Other Financial Assets 555,354.19 585,063.13

Equity Investment in Subsidiaries, Associates and Joint Ventures-Net 0.00 0.00

Bank Premises, Furniture, Fixture and Equipment-Net 1,064,944.81 1,144,915.24

Real and Other Properties Acquired-Net 1,996,483.46 0.00

Non-Current Assets Held for Sale 0.00 0.00

Other Assets-Net 363,268.57 290,725.32

Net Due from Head Office/Branches/Agencies, if any (Philippine branch of a foreign bank) 0.00 0.00

TOTAL ASSETS 97,354,434.65 102,572,153.34

LIABILITIES

Financial Liabilities at Fair Value through Profit or Loss 0.00 0.00

Deposit Liabilities 61,075,567.72 65,210,156.40

Due to Other Banks 0.00 0.00

Bills Payable 3,052,924.14 3,052,924.14

a) BSP (Rediscounting and Other Advances) 0.00 0.00

b) Interbank Loans Payable 0.00 0.00

c) Other Deposit Substitutes 0.00 0.00

d) Others 3,052,924.14 3,052,924.14

Bonds Payable-Net 0.00 0.00

Unsecured Subordinated Debt-Net 0.00 0.00

Redeemable Preferred Shares 0.00 0.00

Special Time Deposit 0.00 0.00

Due to Bangko Sentral ng Pilipinas 0.00 0.00

Other Financial Liabilities 237,631.50 344,524.30

Other Liabilities 2,094,261.25 2,477,183.54

Net Due to Head Office/Branches/Agencies (Philippine branch of a foreign bank) 0.00 0.00

TOTAL LIABILITIES 66,460,384.61 71,084,788.38

STOCKHOLDERS' EQUITY

Capital Stock 66,731,100.00 66,731,100.00

Other Capital Accounts 0.00 0.00

Retained Earnings (35,837,049.96) (35,243,735.04)

Assigned Capital 0.00 0.00

TOTAL STOCKHOLDERS' EQUITY 30,894,050.04 31,487,364.96

TOTAL LIABILITIES AND STOCKHOLDERS' EQUITY 97,354,434.65 102,572,153.34

CONTINGENT ACCOUNTS

Guarantees Issued 0.00 0.00

Financial Standby Letters of Credit 0.00 0.00

Performance Standby Letters of Credit 0.00 0.00

Commercial Letters of Credit 0.00 0.00

Trade Related Guarantees 0.00 0.00

Commitments 0.00 0.00

Spot Foreign Exchange Contracts 0.00 0.00

Securities Held Under Custodianship by Bank Proper 0.00 0.00

Trust Department Accounts 0.00 0.00

a) Trust and Other Fiduciary Accounts 0.00 0.00

b) Agency Accounts 0.00 0.00

c) Advisory/Consultancy 0.00 0.00

Derivatives 0.00 0.00

Others 0.00 0.00

TOTAL CONTINGENT ACCOUNTS 0.00 0.00

OTHER INFORMATION

Gross Total Loan Portfolio (TLP) 59,246,300.60 63,919,106.65

Specific provision for loan losses 3,869,193.26 5,441,350.66

Non-Performing Loans (NPLs)

a. Gross NPLs 5,144,977.29 9,626,514.71

b. Ratio of gross NPLs to gross TLP (%) 8.68 15.06

c. Net NPLs 1,275,784.03 4,185,164.05

d. Ratio of Net NPLs to gross TLP (%) 2.15 6.55

e. Ratio of total allowance for credit losses to gross NPLs (%) 85.58 62.03

f. Ratio of specific allowance for credit losses on the gross TLP to gross NPLs (%) 75.20 56.52

Classified Loans & Other Risk Assets, gross of allowance for credit losses 0.00 0.00

DOSRI Loans and receivables, gross of allowance for credit losses 0.00 0.00

Ratio of DOSRI loans and receivables, gross of allowance for credit losses, to gross TLP (%) 0.00 0.00

Gross non-performing DOSRI loans and receivables 0.00 0.00

Ratio of gross non-performing DOSRI loans and receivables to TLP (%) 0.00 0.00

Percent Compliance with Magna Carta (%)

a. 8% Micro and Small Enterprises 3,894,668.50 3,619,245.11

b. 2% for Medium Enterprises 973,667.12 904,811.27

Return on Equity (ROE) (%) 9.04 14.80

Capital Adequacy Ratio (CAR) on Solo Basis, as prescribed under existing regulations

a. Total CAR 28.49 28.16

b. Tier 1 CAR 28.00 27.69

c. Common Tier 1 Ratio (%) 1/ 0.00 0.00

file:///C:/Users/ASMAI.Employee/Downloads/Rural Bank List/december2022(Rural_and_Cooperative_Group)/AURORABANK (A RURAL BANK) INC.… 1/2

26/01/2024, 12:11 AURORABANK (A RURAL BANK) INC.htm

Deferred Charges not yet Written Down 0.00 0.00

Unbooked Allowance for Probable Losses on Financial Instruments Received 0.00 0.00

Newspaper Published in: Posted in the most conspicuous area of its premises: in the municipal

building / municipal public market / barangay hall / barangay public market, where the head office

and all its branches are located.

Newspaper Published on: 20-Jan-23 to 19-Feb-23

file:///C:/Users/ASMAI.Employee/Downloads/Rural Bank List/december2022(Rural_and_Cooperative_Group)/AURORABANK (A RURAL BANK) INC.… 2/2

You might also like

- Metropolitan Commercial Bank StatementDocument2 pagesMetropolitan Commercial Bank Statement邱建华17% (6)

- Mt103 Home Energy 280221Document2 pagesMt103 Home Energy 280221ismail saltan100% (2)

- TSPI MBAI 2020 MTPP ManualDocument61 pagesTSPI MBAI 2020 MTPP ManualJhoey Castillo Bueno100% (2)

- ABE L4 - Introduction To BusinessDocument164 pagesABE L4 - Introduction To BusinessEbooks Prints91% (35)

- Balance Sheet: Larry's Landscaping & Garden SupplyDocument2 pagesBalance Sheet: Larry's Landscaping & Garden SupplyBelle B.No ratings yet

- CAPR Page - AFSDocument15 pagesCAPR Page - AFSEdgardo Pajo CulturaNo ratings yet

- Chart of Account (Sample Co.,)Document20 pagesChart of Account (Sample Co.,)hassan TariqNo ratings yet

- Competing International Financial Centers-A Comparative Study Between Hong Kong and SingaporeDocument92 pagesCompeting International Financial Centers-A Comparative Study Between Hong Kong and SingaporeTimothy Teo0% (1)

- ALIAGA FARMERS RURAL BANK INC - HTMDocument2 pagesALIAGA FARMERS RURAL BANK INC - HTMJim De VegaNo ratings yet

- ARDCIBANK INC A RURAL BANK - HTMDocument2 pagesARDCIBANK INC A RURAL BANK - HTMJim De VegaNo ratings yet

- AGRIBUSINESS RURAL BANK INC - HTMDocument2 pagesAGRIBUSINESS RURAL BANK INC - HTMJim De VegaNo ratings yet

- ADVANCE CREDIT BANK (A RURAL BANK) CORP - HTMDocument2 pagesADVANCE CREDIT BANK (A RURAL BANK) CORP - HTMJim De VegaNo ratings yet

- ANILAO BANK (RURAL BANK OF ANILAO (ILOILO) INC - HTMDocument2 pagesANILAO BANK (RURAL BANK OF ANILAO (ILOILO) INC - HTMJim De VegaNo ratings yet

- ASENSO RURAL BANK OF BAUTISTA INC - HTMDocument2 pagesASENSO RURAL BANK OF BAUTISTA INC - HTMJim De VegaNo ratings yet

- BACLARAN RB INC - HTMDocument2 pagesBACLARAN RB INC - HTMJim De VegaNo ratings yet

- AGRICULTURAL BANK OF THE PHILIPPINES INC (A RURAL BANK) .HTMDocument2 pagesAGRICULTURAL BANK OF THE PHILIPPINES INC (A RURAL BANK) .HTMJim De VegaNo ratings yet

- Luzon Development Bank: Published Balance SheetDocument2 pagesLuzon Development Bank: Published Balance SheetThinkingPinoyNo ratings yet

- LDB FS End of 2012Document2 pagesLDB FS End of 2012ThinkingPinoyNo ratings yet

- 03-Mambusao2018 AnnexesDocument21 pages03-Mambusao2018 AnnexesAndrew AdanielNo ratings yet

- British American Tobacco Bangladesh: Internal Credit Risk Scoring SystemDocument4 pagesBritish American Tobacco Bangladesh: Internal Credit Risk Scoring SystemSadia HossainNo ratings yet

- Adani Green Energy Limited: PrintDocument3 pagesAdani Green Energy Limited: PrintBijal DanichaNo ratings yet

- Credit Summary ReportDocument6 pagesCredit Summary Reportmkmohit991No ratings yet

- Frespac Ginger (Fiji) Pte Limited Audited Financials 30.6.23 8.9.23Document135 pagesFrespac Ginger (Fiji) Pte Limited Audited Financials 30.6.23 8.9.23Augustine SamiNo ratings yet

- Meghmani Organics: PrintDocument3 pagesMeghmani Organics: PrintmilanNo ratings yet

- Bureau of Local Government Finance Department of FinanceDocument4 pagesBureau of Local Government Finance Department of FinanceAnn LiNo ratings yet

- Financial Statement For PcabDocument5 pagesFinancial Statement For Pcabma ana hiponiaNo ratings yet

- UntitledDocument4 pagesUntitledAnn LiNo ratings yet

- WABAG Output Sheet FY22 13032023Document8 pagesWABAG Output Sheet FY22 13032023Shashank RaoNo ratings yet

- General LedgerDocument3 pagesGeneral LedgerKrishna 11No ratings yet

- Credit Summary ReportDocument4 pagesCredit Summary Reportmkmohit991No ratings yet

- Financial Statements - GOOD LEATHER SHOES PRIVATE LIMITEDDocument3 pagesFinancial Statements - GOOD LEATHER SHOES PRIVATE LIMITEDJas AyyapakkamNo ratings yet

- Lap Arus KasDocument1 pageLap Arus Kassri riyantiNo ratings yet

- Treasurer Report - LA022 Glasgow 2021 22Document2 pagesTreasurer Report - LA022 Glasgow 2021 22InnesNo ratings yet

- Laporan Keuangan 2023Document21 pagesLaporan Keuangan 2023Pascal FelimNo ratings yet

- GLOBAL DILDAR Payslip KotakDocument1 pageGLOBAL DILDAR Payslip KotakAnkit GuptaNo ratings yet

- NeracaDocument1 pageNeracaPascal FelimNo ratings yet

- Liabilities 2.1.current Liabilities I. Borrowings From IOB From Other Banks Commercial Paper Sub-TotalDocument11 pagesLiabilities 2.1.current Liabilities I. Borrowings From IOB From Other Banks Commercial Paper Sub-TotalsethigaganNo ratings yet

- Fs April 2017 Kristamlg (Akun 1)Document2 pagesFs April 2017 Kristamlg (Akun 1)Donny Mochammad NurzehaNo ratings yet

- Jalib Industruies QDocument2 pagesJalib Industruies Qmichealcorleone1923No ratings yet

- CMA DATA (Bhargav Roadways)Document7 pagesCMA DATA (Bhargav Roadways)Mahim DangiNo ratings yet

- Exceltemplate Company Inc. Balance Sheet: Assets Current AssetsDocument8 pagesExceltemplate Company Inc. Balance Sheet: Assets Current AssetsAlex100% (1)

- Noim LPCDocument1 pageNoim LPCmdnoim25No ratings yet

- Bagh 2022Document282 pagesBagh 2022Farooq MaqboolNo ratings yet

- Fs March 2017 Kristamlg (Akun 1)Document2 pagesFs March 2017 Kristamlg (Akun 1)Donny Mochammad NurzehaNo ratings yet

- Bureau of Local Government Finance Department of FinanceDocument3 pagesBureau of Local Government Finance Department of FinanceAnn LiNo ratings yet

- Irma4 104904Document2 pagesIrma4 104904Al QadriNo ratings yet

- Lap Arus KasDocument1 pageLap Arus Kas21Dwi Athaya SalsabilaNo ratings yet

- Neraca: Pemerintah Kabupaten TeboDocument6 pagesNeraca: Pemerintah Kabupaten TeboRifanda Adi PratamaNo ratings yet

- 12-22 Financial ReportDocument6 pages12-22 Financial Reportapi-201129963No ratings yet

- Fs Juni 2017 Kristamlg (Akun 1)Document2 pagesFs Juni 2017 Kristamlg (Akun 1)Donny Mochammad NurzehaNo ratings yet

- Forecloser - MUKESHBHAI MAYABHAI SINDHAV - LVSRD01918-190235769Document1 pageForecloser - MUKESHBHAI MAYABHAI SINDHAV - LVSRD01918-190235769KALAKRUTI ART100% (1)

- Evi4 104957Document2 pagesEvi4 104957Al QadriNo ratings yet

- Cma DataDocument28 pagesCma Datasaorabh13No ratings yet

- Icrrs 2Document3 pagesIcrrs 2Sadia HossainNo ratings yet

- Bank Reconciled KBZ MMKDocument2 pagesBank Reconciled KBZ MMKMgKAGNo ratings yet

- Suryapunja Saving & Credit Co-Operative LTD.: Group Balance Sheet As On 2074/03/31 (Details)Document2 pagesSuryapunja Saving & Credit Co-Operative LTD.: Group Balance Sheet As On 2074/03/31 (Details)BimalNo ratings yet

- Balance GeneralDocument2 pagesBalance GeneralKarol WendyNo ratings yet

- Threebays Capital Master Fund LP: Balancesheet As On Jun 26, 2016Document14 pagesThreebays Capital Master Fund LP: Balancesheet As On Jun 26, 2016Arun Santhosh VenkatesanNo ratings yet

- Praveen Sagar Project ReportDocument12 pagesPraveen Sagar Project Reportbhuvana uppalaNo ratings yet

- Chitral 2021Document8 pagesChitral 2021Farooq MaqboolNo ratings yet

- Standard Balance Sheet JirjizDocument1 pageStandard Balance Sheet JirjizJirjiz RasheedNo ratings yet

- T09759191021024401 SoadDocument8 pagesT09759191021024401 Soadkaushikajay.officialNo ratings yet

- Trial Balance@ Akshita BhattDocument1 pageTrial Balance@ Akshita BhattAkshita BhattNo ratings yet

- Accounts Payable: A Guide to Running an Efficient DepartmentFrom EverandAccounts Payable: A Guide to Running an Efficient DepartmentNo ratings yet

- CIET Conference Proceedings 2014Document887 pagesCIET Conference Proceedings 2014Florida UniversitariaNo ratings yet

- ProjectDocument56 pagesProjectMridula SolankiNo ratings yet

- ACM Research Paper - Tonyong-Bayawak-04-03-2023 REVISEDDocument5 pagesACM Research Paper - Tonyong-Bayawak-04-03-2023 REVISEDkiryusetsuna9No ratings yet

- A Study On Awareness and Satisfaction Level of GoldDocument3 pagesA Study On Awareness and Satisfaction Level of Goldjay.kum50% (2)

- Access Devices Regulation CodeDocument56 pagesAccess Devices Regulation CodeDwrd GBNo ratings yet

- Current Acc NEWDocument4 pagesCurrent Acc NEWSonu F1No ratings yet

- Investment Management Term PaperDocument13 pagesInvestment Management Term PaperAbubbakarr JallohNo ratings yet

- Receivables ManagementDocument37 pagesReceivables Managementchanky_kool8782% (11)

- Immidiate Annuity Options Business Line June 25, 2023Document1 pageImmidiate Annuity Options Business Line June 25, 2023Madhupam KrishnaNo ratings yet

- Boys Hostel Mess RulesDocument2 pagesBoys Hostel Mess RulesAYUSH SHUKLANo ratings yet

- This Month's Summary: Total 1178.82Document4 pagesThis Month's Summary: Total 1178.82it proNo ratings yet

- Banking Operations by Pooja KadamDocument12 pagesBanking Operations by Pooja KadamSomnath KhandagaleNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Chapter 20Document31 pagesChapter 20risnaNo ratings yet

- Maths Mania # 053: DIRECTIONS: For The Following Questions, Four Options Are Given. Choose The Correct OptionDocument3 pagesMaths Mania # 053: DIRECTIONS: For The Following Questions, Four Options Are Given. Choose The Correct OptionTUSHAR JALANNo ratings yet

- D6Document11 pagesD6neo14No ratings yet

- Same Borrowers, Same Lenders, Same Problems - But India's Two Public Credit Platforms Won't Join HandDocument2 pagesSame Borrowers, Same Lenders, Same Problems - But India's Two Public Credit Platforms Won't Join HandVignesh RaghunathanNo ratings yet

- Cost AccountingDocument6 pagesCost AccountingDorianne BorgNo ratings yet

- Indian Money MarketDocument79 pagesIndian Money MarketParth Shah100% (5)

- 203report On Asset Quality (RAQ)Document98 pages203report On Asset Quality (RAQ)Abhishek RastogiNo ratings yet

- Final RevisionDocument100 pagesFinal RevisionhuongtratranthibnNo ratings yet

- Principles of Accounting College MaeDocument115 pagesPrinciples of Accounting College Maesuzaneasiado0825No ratings yet

- Nikhat ParveenDocument87 pagesNikhat ParveenHarshit KashyapNo ratings yet

- Errors in Trial BalanceDocument8 pagesErrors in Trial BalanceBipin BhanushaliNo ratings yet

- Gaming ControllerDocument1 pageGaming ControllerMOBILE FOXNo ratings yet