Professional Documents

Culture Documents

2

2

Uploaded by

Vajnerie Sitchon0 ratings0% found this document useful (0 votes)

8 views2 pagesNorth Company acquired machinery for $750,000 cash but paid $1,000,000. It paid $200,000 upfront and signed a 4-year noninterest bearing note for $800,000. On January 1, 2021 it recorded the machinery asset, discount on the note, cash payment, and note payable. On December 31, 2021 it recorded a $200,000 note payment and amortized $100,000 of the discount.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

XLSX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentNorth Company acquired machinery for $750,000 cash but paid $1,000,000. It paid $200,000 upfront and signed a 4-year noninterest bearing note for $800,000. On January 1, 2021 it recorded the machinery asset, discount on the note, cash payment, and note payable. On December 31, 2021 it recorded a $200,000 note payment and amortized $100,000 of the discount.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

0 ratings0% found this document useful (0 votes)

8 views2 pages2

2

Uploaded by

Vajnerie SitchonNorth Company acquired machinery for $750,000 cash but paid $1,000,000. It paid $200,000 upfront and signed a 4-year noninterest bearing note for $800,000. On January 1, 2021 it recorded the machinery asset, discount on the note, cash payment, and note payable. On December 31, 2021 it recorded a $200,000 note payment and amortized $100,000 of the discount.

Copyright:

© All Rights Reserved

Available Formats

Download as XLSX, PDF, TXT or read online from Scribd

Download as xlsx, pdf, or txt

You are on page 1of 2

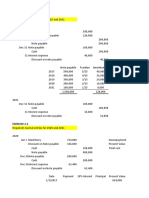

Problem 8-6

On January 1, 2021, North Company acquired a machinery with a cash price of P750,000 for P1,000,000.

The entity paid P200,000 and signed a noninterest bearing promissory note for the balance which is payable in 4 equal installm

Required:

Prepare journal entries for 2021.

Account Title Debit Credit

Jan. 1 Machinery 750,000

Discount on note payable 250,000

Cash 200,000

Note Payable 800,000

Dec. 31 Note Payable 200,000

Cash 200,000

Interest Expense 100,000

Discount on note payable 100,000

Year Note Payable Fraction Amortization

2021 800,000 8/20 100,000 (250,000 x 8/20)

2022 600,000 6/20 75,000 (250,000 x 6/20)

2023 400,000 4/20 50,000 (250,000 x 4/20)

2024 200,000 2/20 25,000 (250,000 x 2/20)

2,000,000 250,000

ch is payable in 4 equal installments every December 31 of each year.

(250,000 x 8/20)

(250,000 x 6/20)

(250,000 x 4/20)

(250,000 x 2/20)

You might also like

- Final Grading Exam - Key AnswersDocument35 pagesFinal Grading Exam - Key AnswersJEFFERSON CUTE97% (32)

- (Chapter 1) Sol Man Intermediate Accounting 2 by Zeus MillanDocument8 pages(Chapter 1) Sol Man Intermediate Accounting 2 by Zeus MillanJonathan Villazon Rosales67% (3)

- Intermediate Accounting 2 Millan 221013 124345Document233 pagesIntermediate Accounting 2 Millan 221013 124345Krazy Butterfly100% (1)

- Exercises Finalaccounts ExDocument2 pagesExercises Finalaccounts ExSounak NathNo ratings yet

- Bonds Payable Quiz Part 2Document5 pagesBonds Payable Quiz Part 2justine reine cornico100% (1)

- Chapter 1 - Current LiabilitiesDocument6 pagesChapter 1 - Current LiabilitiesXiena100% (1)

- Answers - Chapter 4 Vol 2 RvsedDocument15 pagesAnswers - Chapter 4 Vol 2 Rvsedjamflox50% (2)

- PPE1&2Document3 pagesPPE1&2Kailah CalinogNo ratings yet

- Exercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostDocument5 pagesExercise 1.1: Downpayment Present Value of Note (200,000 X 3.17 Pvoa) Total CostKailah CalinogNo ratings yet

- Assignment - Operating Lease & Direct Financing LeaseDocument8 pagesAssignment - Operating Lease & Direct Financing Leaseangelian bagadiongNo ratings yet

- AE 16 Solutions To Chapter 5 2 1Document10 pagesAE 16 Solutions To Chapter 5 2 1Miles CastilloNo ratings yet

- Leases (Part 2) : Problem 1: True or FalseDocument23 pagesLeases (Part 2) : Problem 1: True or FalseKim Hanbin100% (1)

- Ia2 Final Exam A Test Bank - CompressDocument32 pagesIa2 Final Exam A Test Bank - CompressFiona MiralpesNo ratings yet

- Acctg Lab 4Document3 pagesAcctg Lab 4AngieNo ratings yet

- Problem 6-1: Interest Expense Present ValueDocument3 pagesProblem 6-1: Interest Expense Present ValueAngieNo ratings yet

- Foreign Currency Transactions and DerivativesDocument4 pagesForeign Currency Transactions and Derivativesmartinfaith958No ratings yet

- Problem 2Document9 pagesProblem 2Caila Nicole ReyesNo ratings yet

- 07 Receivable Financing 2 SolvingDocument3 pages07 Receivable Financing 2 Solvingkyle mandaresioNo ratings yet

- Probs 22Document3 pagesProbs 22kyle GNo ratings yet

- Sol. Man. - Chapter 8 Leases Part 2Document9 pagesSol. Man. - Chapter 8 Leases Part 2Miguel Amihan100% (1)

- Notes ReceivableDocument17 pagesNotes ReceivableMichael JimNo ratings yet

- 158 715 Test2bDocument16 pages158 715 Test2blisa lheneNo ratings yet

- Installment Sales MethodDocument25 pagesInstallment Sales MethodAngerica BongalingNo ratings yet

- Pa4-Chapter-3.Garcia J John Vincent DDocument5 pagesPa4-Chapter-3.Garcia J John Vincent DJohn Vincent GarciaNo ratings yet

- Chapter 8 - Notes Payable and Debt Restructuring: Problem 8-7Document3 pagesChapter 8 - Notes Payable and Debt Restructuring: Problem 8-7Pau LaguertaNo ratings yet

- Quiz 102 Cash and Cash Equivalents To Loan Impairment PDF FreeDocument13 pagesQuiz 102 Cash and Cash Equivalents To Loan Impairment PDF FreeNashaNo ratings yet

- Quiz 1.02 Cash and Cash Equivalents To Loan ImpairmentDocument13 pagesQuiz 1.02 Cash and Cash Equivalents To Loan ImpairmentJohn Lexter MacalberNo ratings yet

- Chapter 8 Leases Part 2Document9 pagesChapter 8 Leases Part 2Thalia Rhine AberteNo ratings yet

- Midterm - Quiz SolutionDocument4 pagesMidterm - Quiz SolutionANSLEY CATE C. GUEVARRANo ratings yet

- Problem 5-3 Requirement 1 2020Document7 pagesProblem 5-3 Requirement 1 2020Adyagila Ecarg NelehNo ratings yet

- Module 2 - Notes Payable Debt RestructuringDocument39 pagesModule 2 - Notes Payable Debt RestructuringJoshua Cabinas100% (1)

- Exercise 7.7 (2023)Document1 pageExercise 7.7 (2023)Clarisha fritzNo ratings yet

- Answers - Chapter 1 - Current LiabilitiesDocument5 pagesAnswers - Chapter 1 - Current LiabilitiesLhica EsterasNo ratings yet

- Gov't Grant, Depreciation, Revaluation and ImpairmentDocument6 pagesGov't Grant, Depreciation, Revaluation and Impairment夜晨曦No ratings yet

- Fin Acc 2 Assigns 2023Document6 pagesFin Acc 2 Assigns 2023Vinancio ZungundeNo ratings yet

- Far Situational Solution-1Document6 pagesFar Situational Solution-1Baby BearNo ratings yet

- FIRST PB FAR Solutions PDFDocument6 pagesFIRST PB FAR Solutions PDFStephanie Joy NogollosNo ratings yet

- Acctg Lab 2.Document110 pagesAcctg Lab 2.AngieNo ratings yet

- Working Papers in PPEDocument22 pagesWorking Papers in PPETrisha VillegasNo ratings yet

- Lobrigas Unit3 Topic1 AssessmentDocument9 pagesLobrigas Unit3 Topic1 AssessmentClaudine LobrigasNo ratings yet

- Module 2 - Notes Payable & Debt Restructuring - Rev2Document44 pagesModule 2 - Notes Payable & Debt Restructuring - Rev2Bea Angelle CamongayNo ratings yet

- Accounting 1 - PPEDocument38 pagesAccounting 1 - PPEPortia TurianoNo ratings yet

- Notes Payable & Debt Restructuring - Valix 2020Document6 pagesNotes Payable & Debt Restructuring - Valix 2020Shinny Jewel VingnoNo ratings yet

- Intermediate Accounting Chapter 23 To 35Document101 pagesIntermediate Accounting Chapter 23 To 35Blue SkyNo ratings yet

- Fabm2 QuizDocument2 pagesFabm2 QuizXin LouNo ratings yet

- Pre Unit TestDocument2 pagesPre Unit Testrichieco.saichi.studentNo ratings yet

- Assignment On LiabilitiesDocument7 pagesAssignment On LiabilitiesVixen Aaron EnriquezNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document12 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Shane KimNo ratings yet

- Week 3 Tutorial SolutionsDocument6 pagesWeek 3 Tutorial SolutionsataseskiNo ratings yet

- Wellness Massage General Journal For The Period Ended December 31, 20x1Document26 pagesWellness Massage General Journal For The Period Ended December 31, 20x1John Paul TomasNo ratings yet

- Forda Reviewer IA - MidtermDocument18 pagesForda Reviewer IA - MidtermAltessa Lyn ContigaNo ratings yet

- Chapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Document11 pagesChapter 22 Financial Reporting in Hyperinflationary Eco Afar Part 2Kathrina RoxasNo ratings yet

- Depreciation Allowance (Parts 1 & 2) Tutorial Questions 1Document4 pagesDepreciation Allowance (Parts 1 & 2) Tutorial Questions 1ting ting shihNo ratings yet

- Module 2 Answer Key On Property Plant and EquipmentDocument7 pagesModule 2 Answer Key On Property Plant and EquipmentLoven BoadoNo ratings yet

- Pangakun UAS 2018 - JawabanDocument16 pagesPangakun UAS 2018 - Jawabansepuluh 10No ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Visual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsFrom EverandVisual Financial Accounting for You: Greatly Modified Chess Positions as Financial and Accounting ConceptsNo ratings yet