Professional Documents

Culture Documents

Indian Stock Market Predictive Efficiency Using

Indian Stock Market Predictive Efficiency Using

Uploaded by

Dipak KumarCopyright:

Available Formats

You might also like

- (IJETA-V11I3P17) :vikash Kumar, Khushbu Jain, Arin Joshi, Ayush Mishra, Manvi SharmaDocument4 pages(IJETA-V11I3P17) :vikash Kumar, Khushbu Jain, Arin Joshi, Ayush Mishra, Manvi SharmaeditorijetaNo ratings yet

- (IJETA-V11I3P50) :vikash Kumar, Khushbu Jain, Arin Joshi, Ayush Mishra, Manvi SharmaDocument5 pages(IJETA-V11I3P50) :vikash Kumar, Khushbu Jain, Arin Joshi, Ayush Mishra, Manvi SharmaeditorijetaNo ratings yet

- ARIMAOJCDocument14 pagesARIMAOJCNishant AhujaNo ratings yet

- Stock Market Prediction Using Time Series Analysis: N Viswam and G Satyanarayana ReddyDocument5 pagesStock Market Prediction Using Time Series Analysis: N Viswam and G Satyanarayana ReddyPRABHASH SINGHNo ratings yet

- Times Series Modeling of Monthly Share Prices of Nigerian Stock MarketDocument16 pagesTimes Series Modeling of Monthly Share Prices of Nigerian Stock MarketIJMSRTNo ratings yet

- 07.empirical Study On Stock Market Prediction UsingDocument5 pages07.empirical Study On Stock Market Prediction Usingkamran raiysatNo ratings yet

- Time Series Analysis Project in R On Stock Market ForecastingDocument22 pagesTime Series Analysis Project in R On Stock Market ForecastingAnanya BohareNo ratings yet

- Time Series Forecasting For The Adobe Software Company's Stock Prices Using ARIMA (BOX-JENKIN') ModelDocument11 pagesTime Series Forecasting For The Adobe Software Company's Stock Prices Using ARIMA (BOX-JENKIN') Modelgiangdang.31211021621No ratings yet

- Machine LearningDocument8 pagesMachine Learningkudabank815No ratings yet

- 2022-Front. in Env. Sci - Stock Market Forecasting Using Machine Learning ModelsDocument10 pages2022-Front. in Env. Sci - Stock Market Forecasting Using Machine Learning ModelsAbdullah Bin OmarNo ratings yet

- 235-Article Text-705-1-10-20210430Document10 pages235-Article Text-705-1-10-20210430Cheryl AdaraNo ratings yet

- Forecasting Zambia's Gross Domestic Product Using Time Series Autoregressive Integrated Moving Average (ARIMA) ModelDocument8 pagesForecasting Zambia's Gross Domestic Product Using Time Series Autoregressive Integrated Moving Average (ARIMA) ModelInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- ArimaDocument8 pagesArimaMarija MiljkovicNo ratings yet

- ANALYSIS of DAILY STOCK TREND Prediction by Usning Time SeriesDocument21 pagesANALYSIS of DAILY STOCK TREND Prediction by Usning Time SeriesGazi Mohammad JamilNo ratings yet

- 2 14 1644302189 8ijcseitrjun20228Document12 pages2 14 1644302189 8ijcseitrjun20228TJPRC PublicationsNo ratings yet

- Financial Forecasting: An Empirical Study On Box - Jenkins Methodology With Reference To The Indian Stock MarketDocument9 pagesFinancial Forecasting: An Empirical Study On Box - Jenkins Methodology With Reference To The Indian Stock MarketVinaiya AnanthiNo ratings yet

- 62 Ijcse 07430 25 PDFDocument11 pages62 Ijcse 07430 25 PDFAditya JambagiNo ratings yet

- Stock Market Research PaperDocument9 pagesStock Market Research Papersouparnikasubhash20No ratings yet

- Stock Price Prediction Using Deep Learning Algorithm and Its Comparison With Machine Learning AlgorithmsDocument11 pagesStock Price Prediction Using Deep Learning Algorithm and Its Comparison With Machine Learning AlgorithmsnotkurusboyNo ratings yet

- Establishment and Analysis of Multi-Factor Stock Selection Model Based On Support Vector Machine in CSI 300 Index Constituent Stocks MarketDocument9 pagesEstablishment and Analysis of Multi-Factor Stock Selection Model Based On Support Vector Machine in CSI 300 Index Constituent Stocks Market岳佳No ratings yet

- Stock Price Prediction Using Machine Learning Algorithms: ARIMA, LSTM & Linear RegressionDocument7 pagesStock Price Prediction Using Machine Learning Algorithms: ARIMA, LSTM & Linear RegressiontechieNo ratings yet

- Prediction of Stock Market Using Machine Learning AlgorithmsDocument12 pagesPrediction of Stock Market Using Machine Learning AlgorithmsterranceNo ratings yet

- Expert Systems With Applications: Jigar Patel, Sahil Shah, Priyank Thakkar, K KotechaDocument10 pagesExpert Systems With Applications: Jigar Patel, Sahil Shah, Priyank Thakkar, K KotechaVijayNo ratings yet

- Exponential Smoothing Model and Evaluation of Rice Price PredictionDocument6 pagesExponential Smoothing Model and Evaluation of Rice Price PredictionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Paper 3Document11 pagesPaper 3ashwinNo ratings yet

- An ANFIS Model For Stock Price Prediction: The Case of Tehran Stock ExchangeDocument7 pagesAn ANFIS Model For Stock Price Prediction: The Case of Tehran Stock ExchangeAnita AndrianiNo ratings yet

- Stock Price Prediction Research PaperDocument7 pagesStock Price Prediction Research Paperpankajchhonker28No ratings yet

- Forecasting of Maruti Suzuki Returns Using ARCH/GARCH Model: RamitaDocument4 pagesForecasting of Maruti Suzuki Returns Using ARCH/GARCH Model: RamitaSachindra PandiNo ratings yet

- Sentire 2018 WangDocument6 pagesSentire 2018 Wangnurdi afriantoNo ratings yet

- A New Forecasting Framework For Stock Market Index Value With An Overfitting Prevention LSTM ModelDocument24 pagesA New Forecasting Framework For Stock Market Index Value With An Overfitting Prevention LSTM ModelFei LiuNo ratings yet

- Hybrid Models For Intraday Stock Price Forecasting Based On ArtificialDocument10 pagesHybrid Models For Intraday Stock Price Forecasting Based On Artificialmscdatascience3No ratings yet

- Ic3 2019 8844891Document5 pagesIc3 2019 8844891thumuvsreddyNo ratings yet

- Comparison Between ARIMA and VAR Model Regarding The Forecasting of The Price of Jute Goods in BangladeshDocument4 pagesComparison Between ARIMA and VAR Model Regarding The Forecasting of The Price of Jute Goods in BangladeshSuzume YosanoNo ratings yet

- ProjectDocument10 pagesProjectsandy santhoshNo ratings yet

- Machine Learning On Stock Price Movement Forecast: The Sample of The Taiwan Stock ExchangeDocument13 pagesMachine Learning On Stock Price Movement Forecast: The Sample of The Taiwan Stock ExchangeDaniel Martínez RodríguezNo ratings yet

- Article 4. 41Document14 pagesArticle 4. 41ricardoloureirosoareNo ratings yet

- Stock Market Analysis Using Classification Algorithm PDFDocument6 pagesStock Market Analysis Using Classification Algorithm PDFResearch Journal of Engineering Technology and Medical Sciences (RJETM)No ratings yet

- 05.stock Market Prediction UsingDocument4 pages05.stock Market Prediction Usingkamran raiysatNo ratings yet

- Clustering-Classification Based Prediction of Stock Market Future PredictionDocument4 pagesClustering-Classification Based Prediction of Stock Market Future PredictionAnkitNo ratings yet

- An Empirical Testing of Capital Asset Pricing Model in IndiaDocument7 pagesAn Empirical Testing of Capital Asset Pricing Model in Indialetagemechu29No ratings yet

- A Time Series Analysis-Based Stock Price Prediction Using Machine Learning and Deep Learning ModelsDocument46 pagesA Time Series Analysis-Based Stock Price Prediction Using Machine Learning and Deep Learning ModelsYONG POH YEN STUDENTNo ratings yet

- Real-Time Stock Forecasting: Leveraging Live Data and Advanced Algorithms For Accurate PredictionsDocument8 pagesReal-Time Stock Forecasting: Leveraging Live Data and Advanced Algorithms For Accurate PredictionsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 139-Article Text-201-3-10-20200903Document8 pages139-Article Text-201-3-10-20200903PhilipNo ratings yet

- Emehss2022 231 242Document12 pagesEmehss2022 231 242nutirabiskaNo ratings yet

- ARIMA Vs SARIMA Vs LSTMDocument13 pagesARIMA Vs SARIMA Vs LSTMsahilgdwnNo ratings yet

- Predicting Stock Market Index Using Fusion of Machine Learning TechniquesDocument28 pagesPredicting Stock Market Index Using Fusion of Machine Learning TechniquesLoulou DePanamNo ratings yet

- Market Trend PredictionDocument11 pagesMarket Trend Predictionali kartalNo ratings yet

- 1 Annual Earnings Analysis With Arima For Future Earnings Prediction-1Document11 pages1 Annual Earnings Analysis With Arima For Future Earnings Prediction-1junaidiNo ratings yet

- Comparative Analysis of Different Forecasting Techniques For Ford Mustang Sales DataDocument11 pagesComparative Analysis of Different Forecasting Techniques For Ford Mustang Sales DataSiva MohanNo ratings yet

- 19 Stock Price Trend Predictionusing Multiple Linear RegressionDocument6 pages19 Stock Price Trend Predictionusing Multiple Linear Regressionnhoxsock8642No ratings yet

- Arima Arimax Muslim ClothesDocument8 pagesArima Arimax Muslim ClothesUp ToyouNo ratings yet

- Stock Market Prediction Using Hidden Markov ModelDocument4 pagesStock Market Prediction Using Hidden Markov ModelEd SheeranNo ratings yet

- A Hybrid Forecasting Model For Prediction of Stock Value of Tata Steel Using Support Vector Regression and Particle Swarm OptimizationDocument10 pagesA Hybrid Forecasting Model For Prediction of Stock Value of Tata Steel Using Support Vector Regression and Particle Swarm OptimizationImad Ud Din AkbarNo ratings yet

- Stock Market Time Series AnalysisDocument12 pagesStock Market Time Series AnalysisTanay JainNo ratings yet

- 08.forecasting Method of Stock Market Volatility in TimeDocument17 pages08.forecasting Method of Stock Market Volatility in Timekamran raiysatNo ratings yet

- F A LSTM: Inancial Series Prediction Using TtentionDocument10 pagesF A LSTM: Inancial Series Prediction Using TtentionfkdlfsNo ratings yet

- Zhou - 2021 - J. - Phys. - Conf. - Ser. - 1941 - 012064Document7 pagesZhou - 2021 - J. - Phys. - Conf. - Ser. - 1941 - 012064Cheryl AdaraNo ratings yet

- Proposal (1)Document9 pagesProposal (1)ibrex29No ratings yet

- Short-Term Forecasting of Greenhouse Tomato Price Before Supply To The Market: Isfahan-IranDocument5 pagesShort-Term Forecasting of Greenhouse Tomato Price Before Supply To The Market: Isfahan-IranShailendra RajanNo ratings yet

- M.Phil CoursesDocument14 pagesM.Phil CoursesAman KhanNo ratings yet

- Evaluation Methodologies - The European Network For Rural Development (ENRD)Document6 pagesEvaluation Methodologies - The European Network For Rural Development (ENRD)George MgendiNo ratings yet

- The Atlantic - January-February 2018Document100 pagesThe Atlantic - January-February 2018Anthony Thomas100% (9)

- Wafubwa2022 2Document21 pagesWafubwa2022 2PVA170001 STUDENTNo ratings yet

- Introduction To Research in Education 9th Edition Ary Test Bank DownloadDocument19 pagesIntroduction To Research in Education 9th Edition Ary Test Bank DownloadPaul Kelley100% (27)

- Jurnal 1Document8 pagesJurnal 1Rizki Aulia FitriNo ratings yet

- GEOG 4110/5100 Advanced Remote Sensing: - Classification (Supervised and Unsupervised) Spectral UnmixingDocument28 pagesGEOG 4110/5100 Advanced Remote Sensing: - Classification (Supervised and Unsupervised) Spectral UnmixingBelex ManNo ratings yet

- The Impact of The Pandemic On Grade 8 Academic Performance - A Comprehensive Analysis (RESEARCH)Document22 pagesThe Impact of The Pandemic On Grade 8 Academic Performance - A Comprehensive Analysis (RESEARCH)Jia TabioloNo ratings yet

- Quantitative Research MethodologyDocument27 pagesQuantitative Research MethodologyJelly SagunNo ratings yet

- Demographic ResearchDocument90 pagesDemographic Researchsalarr2001No ratings yet

- Principles and Procedures of Exploratory Data Analysis: John T. BehrensDocument30 pagesPrinciples and Procedures of Exploratory Data Analysis: John T. BehrensRijalnur HidayatullahNo ratings yet

- Problem Based Learning Final Examination, Midterm Exam, Class Activity (Portfolio, Performance, Homework) NoDocument90 pagesProblem Based Learning Final Examination, Midterm Exam, Class Activity (Portfolio, Performance, Homework) NoAnam SarangeNo ratings yet

- The Effect of Peer Relation and Peer Pressure On TDocument9 pagesThe Effect of Peer Relation and Peer Pressure On Tkurtrusselsoriano24No ratings yet

- Normal Probability DistributionDocument15 pagesNormal Probability DistributionIshikaNo ratings yet

- Chapter 8 - BRMDocument11 pagesChapter 8 - BRMKalkidan TerefeNo ratings yet

- Normal Approximation To The Binomial and PoissonDocument11 pagesNormal Approximation To The Binomial and PoissonJoshua BautistaNo ratings yet

- Book1 Machine Learning Prob MLDocument858 pagesBook1 Machine Learning Prob MLVijay SharmaNo ratings yet

- King - Restructuring The Social Sciences. Reflections From Harvard's Institute For Quantitative Social Science - 2014Document8 pagesKing - Restructuring The Social Sciences. Reflections From Harvard's Institute For Quantitative Social Science - 2014gerryNo ratings yet

- 3 PBDocument10 pages3 PBWinda Annisha BertiliyaNo ratings yet

- BKM 10e Ch07 Two Security ModelDocument2 pagesBKM 10e Ch07 Two Security ModelJoe IammarinoNo ratings yet

- Assignment 6 - Edfn 7303Document13 pagesAssignment 6 - Edfn 7303api-241202266No ratings yet

- Lesson 3: Measures of Central Tendency: Total Number of Scores Population N Sample NDocument12 pagesLesson 3: Measures of Central Tendency: Total Number of Scores Population N Sample NTracy Blair Napa-egNo ratings yet

- Assignment 4.1. CorrelationDocument3 pagesAssignment 4.1. Correlationmeri janNo ratings yet

- MCQ Random ProcessDocument11 pagesMCQ Random ProcessNitin Mittal57% (7)

- Statistics For MathematicianDocument190 pagesStatistics For MathematicianGermán Toxqui Colula100% (1)

- Chapter 12Document17 pagesChapter 12Faisal SiddiquiNo ratings yet

- Applying Principles of Professional Practice To Work in The FinancialDocument22 pagesApplying Principles of Professional Practice To Work in The Financialeliyas mohammed100% (1)

- 07 RegularizationDocument7 pages07 RegularizationJuan Salvador Sánchez BonnínNo ratings yet

- Crosstabs: Nama: Cahyani S. Napu Kelas: Keperawatan C/2016 Tugas: Analisa DataDocument3 pagesCrosstabs: Nama: Cahyani S. Napu Kelas: Keperawatan C/2016 Tugas: Analisa DataFhera MonoarfaNo ratings yet

- Tune RangerDocument7 pagesTune RangerE RNo ratings yet

Indian Stock Market Predictive Efficiency Using

Indian Stock Market Predictive Efficiency Using

Uploaded by

Dipak KumarOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Indian Stock Market Predictive Efficiency Using

Indian Stock Market Predictive Efficiency Using

Uploaded by

Dipak KumarCopyright:

Available Formats

Indian Stock Market Predictive Efficiency using

the ARIMA Model

Manish R Pathak

Asst.Professor

Head Vidyabharti College of MCA (MBA),Umrakh

Jimmy. M. Kapadia

Professor and Director

S.R.Luthra Institute of Management, Surat

Abstract: Stock Market prediction is an important topic in finance and economics which has

encouraged the interest of researchers over the years to develop better predictive models. The

autoregressive integrated moving average (ARIMA) models have been explored in literature for time

series prediction. This paper presents extensive process of building stock indices predictive model

using the ARIMA model. Published stock indices data obtained from National Stock Exchange (NSE)

are used with stock indices price predictive model developed. At first the stationarity condition of

the data series are observed by ACF and PACF plots, then checked using the statistics such as

Ljung-Box-Pierce Q-statistic and Dickey-Fuller test statistic. Results obtained revealed that the ARIMA

(1,1,2) model has a strong potential for short-term prediction and Adjusted ARIMA gives more

accurate forecasting compare to ARIMA.

Keywords: ARIMA model, Stock Price prediction, Adjusted ARIMA model, Short-term prediction

Introduction Trend Prediction Using ARIMA Model for Nifty

Midcap-50. Top four companies having max

Predicting index price in stock market is quite a

Midcap value have been chosen for analysis. The

challenging task due to the uncertain factors

historical stock data for the past five years has

involved that influence the market price on each

been collected and trained using ARIMA model

day like economic conditions, investor’s

with different parameters. The test criterions like

sentiment, political events, pandemic, etc. The

Akaike Information Criterion & Bayesian

National Stock Exchange (NSE) was set up in

Information Criterion (AIC/BIC) were applied to

November 1992. NSE is the first exchange in India

predict the accuracy of the model. The

to provide an automated screen-based electronic

performance of the trained model is analyzed and

trading structure. NSE was set up by a group of

tested to find the trend and the market behavior

leading Indian financial institutions at the request

of the Government of India to bring precision to for future forecast.

the national capital market. The Nifty_50 (NSE) Jiban Chandra Paul. S Hoque and Mohammad

is an indicator of several sectors like Automobiles, Rahma (2013) did the research on selection of

Bank, Realty, Media, Pharmaceuticals, Best ARIMA Model for Forecasting Average

Information Technology, Energy, etc. Daily Share Price Index of Pharmaceutical

Literature Review Companies in Bangladesh. They Found that

ARIMA (2, 1, 2) is found as the best model for

Uma Devi, Sundar and Alli (2013) did the research forecasting the SPL data series. PREETHI and

on An Effective Time Series Analysis for Stock

Sr u s t i Management R e v i e w , Vo l - XIV, I s s u e - I , Jan - Jun. 20 21, PP 10 - 15 10

Indian Stock Market Predictive Efficiency using the ARIMA Model

SANTHI (2014) studied Neural Networks and that the model could be utilized to model and

Neuro-Fuzzy systems that are identified to be the forecast the future demand in food

leading machine learning techniques in stock manufacturing.

market index prediction area. They set algorithm

Swapnil Jadhav et al (2015), Vijay Pandey and

and find out that ARIMA forecasting method

Abhishek Bajpai (2019) attempt to identify

provides a better accuracy than traditional

superior combinations in ARIMA model as well

methods.

as ANN model for predicting Indian Stock Market

Ayodele, Aderemi and Charles (2014) present namely NSE Nifty 50 daily data of 10 years period.

extensive process of building stock price Through the simultaneous use of AAE, RMSE,

predictive model using the ARIMA model. Stock MAPE and MSPE statistical tools, the predictive

data obtained from publication of New York Stock accuracy of ARIMA (p d q) and ANN model have

Exchange (NYSE) and Nigeria Stock Exchange been compared. The results indicate ARIMA

(NSE) are used with stock price predictive model (2,1,2) and ANN ( 4-10-1) with both train functions

developed. Results obtained revealed that the GDX and BFG are best predictors with ANN

ARIMA model (1, 0, 1) has a strong potential for dominating over ARIMA model.

short-term prediction and can compete favourably

Research Gap

with existing techniques for stock price prediction.

The literature review shows a gap that ARIMA

(Madhu, 2014) studied A time series modeling

model used for forecasting of stock price and

approach (Box-Jenkins’ ARIMA model) has been

Market Index. It has been observed that when

used in this study to forecast sugarcane

time frame and market had changed, findings are

production in India. The order of the best ARIMA

not consisteit with past studies. Therefore

model is (2,1,0). Further, efforts were made to

prediction ability of ARIMA model also changes.

forecast, as accurately as possible, the future

Therefore, there is a scope that Adjusted ARIMA

sugarcane production for a period up to five years

model can be used for increased forecasting

by fitting ARIMA (2,1,0) model to our time series

ability.

data. The results showed that the annual

sugarcane production will grow in 2013, then will Research Methodology

take a sharp dip in 2014 and in subsequent years

2015 through 2017, it will continuously grow with An important objective of the time series analysis

an average growth rate of approximately 3% year- is to study the past behaviour of the available

on-year. data and then forecast with fitting a suitable model

with the help of econometric or statistical

(K, 2017) did forecasting of National Stock Price techniques.

using ARIMA model. The Nifty_50 stock market

prices were analysed, and predicted the trend of The objective of study is to forecast the National

upcoming trading days stock market fluctuations Stock Exchange closing stock price of Nifty 50

using Box-Jenkins methodology. They observed using ARIMA model in Time Series Analysis.

that influence of R-Square value is (94%) high To achieve this descriptive research, secondary

and Mean Absolute Percentage Error is very small financial data of Nifty 50 for the past five years

for the Fitted model [ARIMA (0, 1, 1)]. Therefore, from 1st Sept-2015 to 1st Sept-2020 has been used.

the forcasting accuracy is more suitable of Nifty The tool used for implementation is Eviews

50 closing stock price in ARIMA (0, 1, 1). They software version 9.

concluded that decreasing fluctuations trend for

To determine the best ARIMA model the criteria

upcoming trading days. (Fattah, 2018) and Bijesh

used in this study include Relatively small of

Dhyani et al (2020) have done the research on

BIC (Bayesian or Schwarz Information Criterion),

Stock Market Forecasting Technique using Arima

Relatively small standard error of regression (S.E.

Model. They found ARIMA (1,0,1) model proves

of regression), Relatively high of adjusted R2 and

Sr u s t i Management R e v i e w , Vo l - XIV, I s s u e - I , Jan - Jun. 20 21, PP 10 - 15 11

Indian Stock Market Predictive Efficiency using the ARIMA Model

Q-statistics and correlogram show that there is • Identification: Determine the appropriate

no significant pattern left in the autocorrelation values of p & q using the ACF, PACF, and

functions (ACFs) and partial autocorrelation unit root tests and p is the AR order, d is the

functions (PACFs) of the residuals, it means the integration order, q is the MA order

residual of the selected model is white noise.

• Estimation: Estimate an ARIMA model using

ARIMA models values of p, d, & q you think are appropriate.

ARIMA models provide approach to time series

forecasting. Its aim is to describe the

• Diagnostic checking: Check residuals of

autocorrelations in the data. It is a “stochastic” estimated ARIMA model(s) to see if they are

modeling approach that can be used to calculate white noise; pick best model with well

the probability of a future value lying between behaved residuals.

two specified limits. • Forecasting: Produce out of sample forecasts

Overall Time series Analysis and Forecasting or set aside last few data points for in-sample

Process forecasting.

To build a time series model issuing ARIMA, we ARIMA is also known as Box-Jenkins approach.

need to study the time series and identify p,d,q It is popular because of its generality; It can

handle any series, with or without seasonal

• Ensuring Stationarity:Determine the elements, and it has well-documented computer

appropriate values of d programs

Result and Discussion

Figure 1: Source : Eviews Ouput Figure 2 : Source: Eviews Output

Figure 1 shows original pattern of Nifty_50 series stationary. If the series is not-stationary, it is

from 2015 to 2020, whether the time series is converted to a stationary series by differencing.

stationary or not. From the graph we can interpret Figure 2 shows 1st difference of Nifty_50 series.

that time series have random walk pattern. From After the first difference, the series “DNifty_50”

the graph, the ACF dies down extremely slowly of Nifty_50 becomes stationary.

which simply means that the time series is non-

Sr u s t i Management R e v i e w , Vo l - XIV, I s s u e - I , Jan - Jun. 20 21, PP 10 - 15 12

Indian Stock Market Predictive Efficiency using the ARIMA Model

Source : Eviews Output

Sr u s t i Management R e v i e w , Vo l - XIV, I s s u e - I , Jan - Jun. 20 21, PP 10 - 15 13

Indian Stock Market Predictive Efficiency using the ARIMA Model

The correlogram view of the residuals (forecast Here If they die off more or less geometrically

errors) shows the autocorrelations of the with increasing lag, k, it is a sign that the series

residuals. These are the correlation coefficients obeys a low-order autoregressive process. After

of values of the residuals k periods apart. taking Lag 1 we found low autoregressive process

Nonzero values of these autocorrelations indicate in Nifty_50 Series.

omitted predictability in the dependent variable.

Null Hypothesis: D(NIFTY_50) has a unit root

Exogenous: Constant

Lag Length: 6 (Automatic - based on SIC, maxlag=22)

t-Statistic Prob.*

Augmented Dickey-Fuller test statistic -11.95593 0.0000

Test critical values: 1% level -3.435514

5% level -2.863708

10% level -2.567974

The fundamental requirement of ARIMA model can see from the ADF t value, all are less than

is to know the integration of the series under ADF 5% critical value that means we reject the

study. The table number 1 represents unit root null hypothesis and interpret that unit root does

test results for Augmented Dickey Fuller test of not exists. This can be confirmed from respective

DNifty_50 under study from 2015 to 2020. We probability value of less than 0.05.

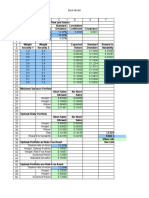

STATISTICAL RESULTS OF DIFFERENT ARIMA PARAMETERS FOR Nifty_50

ARIMA BIC Adjusted R2 S.E. of Regression

(1,1,1) 12.21866 0.000629 108.7179

(1,1,2) 12.21524 0.004042 108.5321

(2,1,1) 12.21528 0.004007 108.534

(2,1,2) 12.21714 0.002147 108.6353

Here, we checked whether the association of the autoregressive (p=1) and moving average

between the response and each term in the model (q=2). Parameters used to select best model is

is statistically significant or not. If the p-value is the AIC and BIC together with the adj-R2 of the

less than 0.05 in model (1,1,2), we can conclude estimated models to detect which model is the

that the coefficient is statistically significant. In parsimonious one (i.e. the one that minimizes AIC

this case, ARIMA (1,1,2) was selected as the best and BIC and has the highest adj-Rz) and

model for Nifty50 index after several adjustment Minimizes S.E of Regression.

Sr u s t i Management R e v i e w , Vo l - XIV, I s s u e - I , Jan - Jun. 20 21, PP 10 - 15 14

Indian Stock Market Predictive Efficiency using the ARIMA Model

As we discussed, ARIMA (1,1,2) model is Sugarcane Production In India. Studies in

selected as the best model for Nifty50 index after Business and Economics , 9, 81 - 94

several adjustments of the autoregressive (p=1) Devi Uma Sundar and P. Alli (January 2013) An

and moving average (q=2) . In the figure of Effective Time Series Analysis for Stock Trend

correlogram, (ACF and PACG) shows lag 6 plays Prediction Using ARIMA Model for Nifty

an important role in forecasting Nifty50 index Midcap-50. International Journal of Data

because lag 6 peak is higher than any other lags. Mining & Knowledge Management Process

So we applied Adjusted ARIMA using (IJDKP) Vol.3, No.1, PP 65-78

D(Nifty_50) C AR(1) MA(1) MA(6) estimation. Adebiyi A , Aderemi & Charles Ayo (2014) Stock

The above result shows adjusted ARIMA (1,6) Price Prediction Using the ARIMA Model.

provides accurate result compared to UKSim-AMSS 16th International Conference on

ARIMA(1,1,2). Adjusted ARIMA increased. Computer Modelling and Simulation- 978-1-4799-

Adjusted R2, BIC and decreased S.E of regression 4923-6 PP 105-111

so we can increase forecasting ability using

adjusted ARIMA in Box-Jenkins approach. Dhyani B et al (March 2020) Stock Market

Forecasting Technique using Arima Model,

Conclusion International Journal of Recent Technology and

As described above in the paper , we have Engineering (IJRTE) Volume-8 Issue-6

analysed the data of the time series in the stock Jun Zhang, Rui Shan and Wenfang Su, (2009),

market using the ARIMA Model. Results “Applying Time Series Analysis Builds Stock

obtained revealed that the ARIMA model has a Price Forecast Model”, Modern Applied Science,

strong potential for short-term prediction and can 3(5), 152-157

compete favourably with existing techniques for

Mohamed Ashik. A and Senthamarai Kannan. K

stock price prediction. We would like to propose

(2017), “Forecasting National Stock Price

an optimized ARIMA (1,1,2) model for forecasting

Using ARIMA Model”, Global and Stochastic

Nifty_50 index price in short term. Adjusted

Analysis, 4(1), 77-81

ARIMA gives more accurate forecasting

compared to ARIMA using Box-Jenkins Datta K. (2011) “ARIMA forecasting of Inflation

approach. in the Bangladesh Economy”, The IUP journal

of bank management, voI.X, No.4, pp-7-15

Bibliography

Swapnil Jadhav et al (2015) Indian Share Market

Fattah, J. a. (2018, 10). Forecasting of demand

Forecasting with ARIMA Model, International

using ARIMA model. International Journal of

Journal of Advanced Research in Computer and

Engineering Business Management,

Communication Engineering. Vol. 4, Issue 11,

184797901880867

PP 334-336

K, M. A. (2017, January). FORECASTING

Bijesh Dhyani et al (2020) Stock Market

NATIONAL STOCK PRICE USING ARIMA

Forecasting Technique using Arima Model, Jain

MODEL. Global and Stochastic Analysis , 77-81

International Journal of Recent Technology and

Madhu, K. M. (2014). An Application Of Time Engineering (IJRTE) ISSN: 2277-3878, Volume-

Series Arima Forecasting Model For Predicting 8, Issue-6, PP 2694-2697

Sr u s t i Management R e v i e w , Vo l - XIV, I s s u e - I , Jan - Jun. 20 21, PP 10 - 15 15

You might also like

- (IJETA-V11I3P17) :vikash Kumar, Khushbu Jain, Arin Joshi, Ayush Mishra, Manvi SharmaDocument4 pages(IJETA-V11I3P17) :vikash Kumar, Khushbu Jain, Arin Joshi, Ayush Mishra, Manvi SharmaeditorijetaNo ratings yet

- (IJETA-V11I3P50) :vikash Kumar, Khushbu Jain, Arin Joshi, Ayush Mishra, Manvi SharmaDocument5 pages(IJETA-V11I3P50) :vikash Kumar, Khushbu Jain, Arin Joshi, Ayush Mishra, Manvi SharmaeditorijetaNo ratings yet

- ARIMAOJCDocument14 pagesARIMAOJCNishant AhujaNo ratings yet

- Stock Market Prediction Using Time Series Analysis: N Viswam and G Satyanarayana ReddyDocument5 pagesStock Market Prediction Using Time Series Analysis: N Viswam and G Satyanarayana ReddyPRABHASH SINGHNo ratings yet

- Times Series Modeling of Monthly Share Prices of Nigerian Stock MarketDocument16 pagesTimes Series Modeling of Monthly Share Prices of Nigerian Stock MarketIJMSRTNo ratings yet

- 07.empirical Study On Stock Market Prediction UsingDocument5 pages07.empirical Study On Stock Market Prediction Usingkamran raiysatNo ratings yet

- Time Series Analysis Project in R On Stock Market ForecastingDocument22 pagesTime Series Analysis Project in R On Stock Market ForecastingAnanya BohareNo ratings yet

- Time Series Forecasting For The Adobe Software Company's Stock Prices Using ARIMA (BOX-JENKIN') ModelDocument11 pagesTime Series Forecasting For The Adobe Software Company's Stock Prices Using ARIMA (BOX-JENKIN') Modelgiangdang.31211021621No ratings yet

- Machine LearningDocument8 pagesMachine Learningkudabank815No ratings yet

- 2022-Front. in Env. Sci - Stock Market Forecasting Using Machine Learning ModelsDocument10 pages2022-Front. in Env. Sci - Stock Market Forecasting Using Machine Learning ModelsAbdullah Bin OmarNo ratings yet

- 235-Article Text-705-1-10-20210430Document10 pages235-Article Text-705-1-10-20210430Cheryl AdaraNo ratings yet

- Forecasting Zambia's Gross Domestic Product Using Time Series Autoregressive Integrated Moving Average (ARIMA) ModelDocument8 pagesForecasting Zambia's Gross Domestic Product Using Time Series Autoregressive Integrated Moving Average (ARIMA) ModelInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- ArimaDocument8 pagesArimaMarija MiljkovicNo ratings yet

- ANALYSIS of DAILY STOCK TREND Prediction by Usning Time SeriesDocument21 pagesANALYSIS of DAILY STOCK TREND Prediction by Usning Time SeriesGazi Mohammad JamilNo ratings yet

- 2 14 1644302189 8ijcseitrjun20228Document12 pages2 14 1644302189 8ijcseitrjun20228TJPRC PublicationsNo ratings yet

- Financial Forecasting: An Empirical Study On Box - Jenkins Methodology With Reference To The Indian Stock MarketDocument9 pagesFinancial Forecasting: An Empirical Study On Box - Jenkins Methodology With Reference To The Indian Stock MarketVinaiya AnanthiNo ratings yet

- 62 Ijcse 07430 25 PDFDocument11 pages62 Ijcse 07430 25 PDFAditya JambagiNo ratings yet

- Stock Market Research PaperDocument9 pagesStock Market Research Papersouparnikasubhash20No ratings yet

- Stock Price Prediction Using Deep Learning Algorithm and Its Comparison With Machine Learning AlgorithmsDocument11 pagesStock Price Prediction Using Deep Learning Algorithm and Its Comparison With Machine Learning AlgorithmsnotkurusboyNo ratings yet

- Establishment and Analysis of Multi-Factor Stock Selection Model Based On Support Vector Machine in CSI 300 Index Constituent Stocks MarketDocument9 pagesEstablishment and Analysis of Multi-Factor Stock Selection Model Based On Support Vector Machine in CSI 300 Index Constituent Stocks Market岳佳No ratings yet

- Stock Price Prediction Using Machine Learning Algorithms: ARIMA, LSTM & Linear RegressionDocument7 pagesStock Price Prediction Using Machine Learning Algorithms: ARIMA, LSTM & Linear RegressiontechieNo ratings yet

- Prediction of Stock Market Using Machine Learning AlgorithmsDocument12 pagesPrediction of Stock Market Using Machine Learning AlgorithmsterranceNo ratings yet

- Expert Systems With Applications: Jigar Patel, Sahil Shah, Priyank Thakkar, K KotechaDocument10 pagesExpert Systems With Applications: Jigar Patel, Sahil Shah, Priyank Thakkar, K KotechaVijayNo ratings yet

- Exponential Smoothing Model and Evaluation of Rice Price PredictionDocument6 pagesExponential Smoothing Model and Evaluation of Rice Price PredictionInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- Paper 3Document11 pagesPaper 3ashwinNo ratings yet

- An ANFIS Model For Stock Price Prediction: The Case of Tehran Stock ExchangeDocument7 pagesAn ANFIS Model For Stock Price Prediction: The Case of Tehran Stock ExchangeAnita AndrianiNo ratings yet

- Stock Price Prediction Research PaperDocument7 pagesStock Price Prediction Research Paperpankajchhonker28No ratings yet

- Forecasting of Maruti Suzuki Returns Using ARCH/GARCH Model: RamitaDocument4 pagesForecasting of Maruti Suzuki Returns Using ARCH/GARCH Model: RamitaSachindra PandiNo ratings yet

- Sentire 2018 WangDocument6 pagesSentire 2018 Wangnurdi afriantoNo ratings yet

- A New Forecasting Framework For Stock Market Index Value With An Overfitting Prevention LSTM ModelDocument24 pagesA New Forecasting Framework For Stock Market Index Value With An Overfitting Prevention LSTM ModelFei LiuNo ratings yet

- Hybrid Models For Intraday Stock Price Forecasting Based On ArtificialDocument10 pagesHybrid Models For Intraday Stock Price Forecasting Based On Artificialmscdatascience3No ratings yet

- Ic3 2019 8844891Document5 pagesIc3 2019 8844891thumuvsreddyNo ratings yet

- Comparison Between ARIMA and VAR Model Regarding The Forecasting of The Price of Jute Goods in BangladeshDocument4 pagesComparison Between ARIMA and VAR Model Regarding The Forecasting of The Price of Jute Goods in BangladeshSuzume YosanoNo ratings yet

- ProjectDocument10 pagesProjectsandy santhoshNo ratings yet

- Machine Learning On Stock Price Movement Forecast: The Sample of The Taiwan Stock ExchangeDocument13 pagesMachine Learning On Stock Price Movement Forecast: The Sample of The Taiwan Stock ExchangeDaniel Martínez RodríguezNo ratings yet

- Article 4. 41Document14 pagesArticle 4. 41ricardoloureirosoareNo ratings yet

- Stock Market Analysis Using Classification Algorithm PDFDocument6 pagesStock Market Analysis Using Classification Algorithm PDFResearch Journal of Engineering Technology and Medical Sciences (RJETM)No ratings yet

- 05.stock Market Prediction UsingDocument4 pages05.stock Market Prediction Usingkamran raiysatNo ratings yet

- Clustering-Classification Based Prediction of Stock Market Future PredictionDocument4 pagesClustering-Classification Based Prediction of Stock Market Future PredictionAnkitNo ratings yet

- An Empirical Testing of Capital Asset Pricing Model in IndiaDocument7 pagesAn Empirical Testing of Capital Asset Pricing Model in Indialetagemechu29No ratings yet

- A Time Series Analysis-Based Stock Price Prediction Using Machine Learning and Deep Learning ModelsDocument46 pagesA Time Series Analysis-Based Stock Price Prediction Using Machine Learning and Deep Learning ModelsYONG POH YEN STUDENTNo ratings yet

- Real-Time Stock Forecasting: Leveraging Live Data and Advanced Algorithms For Accurate PredictionsDocument8 pagesReal-Time Stock Forecasting: Leveraging Live Data and Advanced Algorithms For Accurate PredictionsInternational Journal of Innovative Science and Research TechnologyNo ratings yet

- 139-Article Text-201-3-10-20200903Document8 pages139-Article Text-201-3-10-20200903PhilipNo ratings yet

- Emehss2022 231 242Document12 pagesEmehss2022 231 242nutirabiskaNo ratings yet

- ARIMA Vs SARIMA Vs LSTMDocument13 pagesARIMA Vs SARIMA Vs LSTMsahilgdwnNo ratings yet

- Predicting Stock Market Index Using Fusion of Machine Learning TechniquesDocument28 pagesPredicting Stock Market Index Using Fusion of Machine Learning TechniquesLoulou DePanamNo ratings yet

- Market Trend PredictionDocument11 pagesMarket Trend Predictionali kartalNo ratings yet

- 1 Annual Earnings Analysis With Arima For Future Earnings Prediction-1Document11 pages1 Annual Earnings Analysis With Arima For Future Earnings Prediction-1junaidiNo ratings yet

- Comparative Analysis of Different Forecasting Techniques For Ford Mustang Sales DataDocument11 pagesComparative Analysis of Different Forecasting Techniques For Ford Mustang Sales DataSiva MohanNo ratings yet

- 19 Stock Price Trend Predictionusing Multiple Linear RegressionDocument6 pages19 Stock Price Trend Predictionusing Multiple Linear Regressionnhoxsock8642No ratings yet

- Arima Arimax Muslim ClothesDocument8 pagesArima Arimax Muslim ClothesUp ToyouNo ratings yet

- Stock Market Prediction Using Hidden Markov ModelDocument4 pagesStock Market Prediction Using Hidden Markov ModelEd SheeranNo ratings yet

- A Hybrid Forecasting Model For Prediction of Stock Value of Tata Steel Using Support Vector Regression and Particle Swarm OptimizationDocument10 pagesA Hybrid Forecasting Model For Prediction of Stock Value of Tata Steel Using Support Vector Regression and Particle Swarm OptimizationImad Ud Din AkbarNo ratings yet

- Stock Market Time Series AnalysisDocument12 pagesStock Market Time Series AnalysisTanay JainNo ratings yet

- 08.forecasting Method of Stock Market Volatility in TimeDocument17 pages08.forecasting Method of Stock Market Volatility in Timekamran raiysatNo ratings yet

- F A LSTM: Inancial Series Prediction Using TtentionDocument10 pagesF A LSTM: Inancial Series Prediction Using TtentionfkdlfsNo ratings yet

- Zhou - 2021 - J. - Phys. - Conf. - Ser. - 1941 - 012064Document7 pagesZhou - 2021 - J. - Phys. - Conf. - Ser. - 1941 - 012064Cheryl AdaraNo ratings yet

- Proposal (1)Document9 pagesProposal (1)ibrex29No ratings yet

- Short-Term Forecasting of Greenhouse Tomato Price Before Supply To The Market: Isfahan-IranDocument5 pagesShort-Term Forecasting of Greenhouse Tomato Price Before Supply To The Market: Isfahan-IranShailendra RajanNo ratings yet

- M.Phil CoursesDocument14 pagesM.Phil CoursesAman KhanNo ratings yet

- Evaluation Methodologies - The European Network For Rural Development (ENRD)Document6 pagesEvaluation Methodologies - The European Network For Rural Development (ENRD)George MgendiNo ratings yet

- The Atlantic - January-February 2018Document100 pagesThe Atlantic - January-February 2018Anthony Thomas100% (9)

- Wafubwa2022 2Document21 pagesWafubwa2022 2PVA170001 STUDENTNo ratings yet

- Introduction To Research in Education 9th Edition Ary Test Bank DownloadDocument19 pagesIntroduction To Research in Education 9th Edition Ary Test Bank DownloadPaul Kelley100% (27)

- Jurnal 1Document8 pagesJurnal 1Rizki Aulia FitriNo ratings yet

- GEOG 4110/5100 Advanced Remote Sensing: - Classification (Supervised and Unsupervised) Spectral UnmixingDocument28 pagesGEOG 4110/5100 Advanced Remote Sensing: - Classification (Supervised and Unsupervised) Spectral UnmixingBelex ManNo ratings yet

- The Impact of The Pandemic On Grade 8 Academic Performance - A Comprehensive Analysis (RESEARCH)Document22 pagesThe Impact of The Pandemic On Grade 8 Academic Performance - A Comprehensive Analysis (RESEARCH)Jia TabioloNo ratings yet

- Quantitative Research MethodologyDocument27 pagesQuantitative Research MethodologyJelly SagunNo ratings yet

- Demographic ResearchDocument90 pagesDemographic Researchsalarr2001No ratings yet

- Principles and Procedures of Exploratory Data Analysis: John T. BehrensDocument30 pagesPrinciples and Procedures of Exploratory Data Analysis: John T. BehrensRijalnur HidayatullahNo ratings yet

- Problem Based Learning Final Examination, Midterm Exam, Class Activity (Portfolio, Performance, Homework) NoDocument90 pagesProblem Based Learning Final Examination, Midterm Exam, Class Activity (Portfolio, Performance, Homework) NoAnam SarangeNo ratings yet

- The Effect of Peer Relation and Peer Pressure On TDocument9 pagesThe Effect of Peer Relation and Peer Pressure On Tkurtrusselsoriano24No ratings yet

- Normal Probability DistributionDocument15 pagesNormal Probability DistributionIshikaNo ratings yet

- Chapter 8 - BRMDocument11 pagesChapter 8 - BRMKalkidan TerefeNo ratings yet

- Normal Approximation To The Binomial and PoissonDocument11 pagesNormal Approximation To The Binomial and PoissonJoshua BautistaNo ratings yet

- Book1 Machine Learning Prob MLDocument858 pagesBook1 Machine Learning Prob MLVijay SharmaNo ratings yet

- King - Restructuring The Social Sciences. Reflections From Harvard's Institute For Quantitative Social Science - 2014Document8 pagesKing - Restructuring The Social Sciences. Reflections From Harvard's Institute For Quantitative Social Science - 2014gerryNo ratings yet

- 3 PBDocument10 pages3 PBWinda Annisha BertiliyaNo ratings yet

- BKM 10e Ch07 Two Security ModelDocument2 pagesBKM 10e Ch07 Two Security ModelJoe IammarinoNo ratings yet

- Assignment 6 - Edfn 7303Document13 pagesAssignment 6 - Edfn 7303api-241202266No ratings yet

- Lesson 3: Measures of Central Tendency: Total Number of Scores Population N Sample NDocument12 pagesLesson 3: Measures of Central Tendency: Total Number of Scores Population N Sample NTracy Blair Napa-egNo ratings yet

- Assignment 4.1. CorrelationDocument3 pagesAssignment 4.1. Correlationmeri janNo ratings yet

- MCQ Random ProcessDocument11 pagesMCQ Random ProcessNitin Mittal57% (7)

- Statistics For MathematicianDocument190 pagesStatistics For MathematicianGermán Toxqui Colula100% (1)

- Chapter 12Document17 pagesChapter 12Faisal SiddiquiNo ratings yet

- Applying Principles of Professional Practice To Work in The FinancialDocument22 pagesApplying Principles of Professional Practice To Work in The Financialeliyas mohammed100% (1)

- 07 RegularizationDocument7 pages07 RegularizationJuan Salvador Sánchez BonnínNo ratings yet

- Crosstabs: Nama: Cahyani S. Napu Kelas: Keperawatan C/2016 Tugas: Analisa DataDocument3 pagesCrosstabs: Nama: Cahyani S. Napu Kelas: Keperawatan C/2016 Tugas: Analisa DataFhera MonoarfaNo ratings yet

- Tune RangerDocument7 pagesTune RangerE RNo ratings yet