Professional Documents

Culture Documents

Shareholder Value Creation-2

Shareholder Value Creation-2

Uploaded by

tanadof294Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Shareholder Value Creation-2

Shareholder Value Creation-2

Uploaded by

tanadof294Copyright:

Available Formats

SHAREHOLDER VALUE CREATION

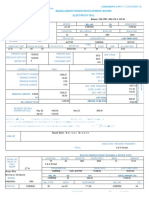

Q.1) The Income Statement and Balance Sheet of Five Star Ltd. is given below:

Income Statement

Particulars Rs. (in Lakhs) Rs. (in Lakhs)

Sales 500

Interest on investments 10

Profit on sale of old assets 5

Total Income 515

Less:

Manufacturing cost 180

Administration cost 60

Selling and distribution cost 50

Depreciation 30

Loss on sale of an old M/C 5 325

EBIT 190

Less: Interest 20

EBT 170

Less:Tax (30%) 51

PAT 119

EPS (119Lakh/5Lakh)

P/E ratio 23.8

2

Balance Sheet (Rs. in Lakh)

Liabilities Rs. Assets Rs.

Equity Capital (Rs.10 share) 50 Building 80

Retained Earnings 40 Machinery 70

Long Term Loan 60 Stock 10

Creditors 15 Debtors 12

Provisions 13 Bank 6

Total 178 Total 178

The cost of equity and cost of debt is 10% and 12% respectively. The company pays 30%

corporate tax.

From the information given you are required to calculate the EVA. Also, calculate MVA on the

basis of Market Value of equity capital.

Q.2) Calculate EVA from the following data for the year ended 31 st march 2003.

Average Debt (Crs.) 50

Average Equity (Crs.) 2766

Cost of debt (post tax) 7.72%

Cost of equity 16.54%

Profit after tax, before exceptional item (Cr.) 15.41

Interest (Cr.) 5

PROF. VIJAY VANJARE Page 1

SHAREHOLDER VALUE CREATION

Q.3) Calculate EVA from the following data for the year ended 31 st March 2010:

Average Debt Rs. 25 Crores

Average Equity Rs. 2,500 Crores

Cost of Debt 8%

Cost of Equity 15%

Profit after tax, before exceptional item Rs. 12 Crores

Interest Rs. 4 Crores

Q.4) M/s Man India Ltd. is considering a capital project for which the following information is

available.

Investment outlay 10,000

Project life 5 Years

Salvage value Zero

Annual Revenues 8,000

Annual Cost (excluding depreciation, interest & taxes) 4,000

Depreciation Straight line

Tax Rate 40%

Debt equity ratio 3:2

Cost of equity 20%

Cost of debt (post tax)

8%

Calculate EVA of the project over its life.

Q.6) The following data are of Cisco Ltd. the company’s required rate of return on invested

capital is 8%. Find the missing figures:

Sales Value (Rs.) ?

Income (Rs) ?

Capital Employed (Investment) 6,00,000

Sales Margin (%) 25%

Capital Turnover (times) ?

ROI (%) 20%

Economic Value Added (EVA) 1,20,000

Q.6) From the following data pertaining to XYZ Ltd. for the year ended 31 st March 2016, you

are required to calculate the missing figures:

Sales Value Rs. 20,00,000

Income Rs. 4,00,000

Average Investment Rs. 5,00,000

Sales Margin (%) ?

Capital Turnover (times) ?

ROI (%) ?

EVA (Rs.) ?

WACC 8%

PROF. VIJAY VANJARE Page 2

SHAREHOLDER VALUE CREATION

Q.7) The following data pertain to three divisions of M Incorporated. The company’s required

rate of return on invested capital is 8%.

Particulars Division A Division B Division C

Sales Value (Rs.) ? 1 Crore ?

Income (Rs) 4 Lacs 20 Lacs ?

Average Investment (Rs.) ? 25 Lacs ?

Sales Margin (%) 20% ? 25%

Capital Turnover (times) 1 ? ?

ROI (%) ? ? 20%

Economic Value Added (EVA) ? ? 1,20,000

Q.8) Acme Ltd. is considering a capital project for which the following information is available:

Investment Outlay 1,000 Debt Equity ratio 1:1

Project Life 10 Years Depreciation (for tax purpose) SLM

Salvage Value 0 Tax Rate 40%

Annual Revenues 2,000 Annual Cost (excluding depreciation, 1,400

Cost of equity 18% Interest and Taxes)

Cost of Debt (post tax) 10%

Calculate the EVA of the project over its life.

Q.9) The following information is available of Tata Steel Co. Ltd. Calculate EVA:

14% Debt Capital 3,000 (Rs. lakhs)

Equity Capital 800 (Rs. lakhs)

Reserve and Surplus 6,200 (Rs. lakhs)

Risk Free Rate 9%

Beta Factor 1.05

Market Rate of Return 19%

Equity (market) Risk Premium 10%

Operating Profit After Tax 2,400 (Rs. lakhs)

Tax Rate 35%

Q.10) The capital structure of BHEL Ltd. is as under:

80,00,000 Equity shares of Rs. 10 each = Rs. 800 Lakhs.

1,00,000 12% Preference Shares of Rs. 250 each = 250 Lakhs.

1,00,000 10% Debentures of Rs. 500 each = 500 Lakhs.

10% term loan from bank = 450 lakhs.

The company’s profit and loss account for the year showed a balance PAT of Rs. 110 Lakhs,

after appropriating Equity Dividend at 20%. The company is in the 40% tax bracket. Treasury

bonds carry 6.5% interest and beta factor for the company may be taken at 1.5. The long run

market rate of return may be taken at 16.5%. Calculate EVA.

PROF. VIJAY VANJARE Page 3

SHAREHOLDER VALUE CREATION

Q.11) Calculate EVA from the following information of HFC Ltd.

Capital Employed Rs. 1000 crores

Debt Equity Ratio 1:4

Cost of Equity 18%

Cost of Debt (pre tax) 15%

Tax Rate 35%

EBIT Rs. 300 crores

Q.12) Calculate EVA for Seagull Ltd.

Financial Leverage = 1.40 times

Cost of Equity = 17.50%

Income Tax Rate = 30%

Cost of Debenture (Before Tax) = 10%

Capital Structure

1) Equity Capital Rs.340 Lakhs

2) Retained Earnings Rs.260 Lakhs

3) 10% Debenture Rs.800 Lakhs

Rs.1400 Lakhs

Q.13) M. K. Industries Ltd, is engaged in textile business. Its income statement and balance sheet

are given below:

Income statement for the year ended 31-03-2016.

Particulars Rs. in Lakhs

Sales 6,000

Less: Cost of Production 4,500

PBIT 1,500

Less: Interest on loan 10

PBT 1,490

Tax @ 30% 447

EAT 1,043

Balance Sheet as on 31-03-2016

Liabilities Rs. in lakhs Assets Rs. in lakhs

Equity Share Capital (Rs.10 share) 200 Land & Building 100

Reserve and Surplus 150 Plant & Machinery 200

10% Bank Loan 100 Debtors 100

Creditors 50 Stock 75

Cash and Bank 25

Total 500 Total 500

The Weighted Average cost of capital is 15% and company is listed on BSE and has a P/E Ratio

of 6 times.

Calculate (a) value of the firm (b) EVA and (c) MVA.

PROF. VIJAY VANJARE Page 4

SHAREHOLDER VALUE CREATION

Q.14) The following data is provided by Zampa Ltd. for the year. You are required to calculate

the missing figures?

Sales value Rs. 5,00,000

Income Rs. 1,00,000

Capital Employed Rs. 1,25,000

Weighted Average Cost of Capital 8%

Sales Margin (%) ?

Capital Turnover (Times) ?

Return on Investment (%) ?

Economic Value Added (Rs.) ?

PROF. VIJAY VANJARE Page 5

You might also like

- Test Bank For Managerial Economics and Strategy 3rd Edition by PerloffDocument10 pagesTest Bank For Managerial Economics and Strategy 3rd Edition by PerloffDominic Glaze100% (40)

- Reviewer For Quiz 1Document4 pagesReviewer For Quiz 1pppppNo ratings yet

- FM Tutorial 1 - Cost of CapitalDocument5 pagesFM Tutorial 1 - Cost of CapitalAaron OforiNo ratings yet

- Case 2 Marking SchemeDocument22 pagesCase 2 Marking SchemeHello100% (1)

- CA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionDocument6 pagesCA Intermediate Mock Test Eco FM 16.10.2018 EM Only QuestionTanmayNo ratings yet

- Exam 1 Fall 19Document9 pagesExam 1 Fall 19April Grace TrinidadNo ratings yet

- Case 1 - Tutor GuideDocument3 pagesCase 1 - Tutor GuideKAR ENG QUAHNo ratings yet

- FM & Eco Grand Test 2Document8 pagesFM & Eco Grand Test 2moniNo ratings yet

- Swapnil Patni's Classes: CA Intermediate - Financial Management Total Marks - 60Document3 pagesSwapnil Patni's Classes: CA Intermediate - Financial Management Total Marks - 60Aniket PatelNo ratings yet

- 13 Chapter 6.2 - LeverageDocument12 pages13 Chapter 6.2 - Leverageatishayjjj123No ratings yet

- FM EcoDocument30 pagesFM Ecoovais kanojeNo ratings yet

- 84 Paper-8FinancialManagement&EconomicsforFinanceDocument28 pages84 Paper-8FinancialManagement&EconomicsforFinancerisavey693No ratings yet

- Strategic Financial ManagementDocument5 pagesStrategic Financial ManagementdechickeraNo ratings yet

- Additional Problems 7. The Following Is The Balance Sheet of A Corporate Firm As of March 31Document4 pagesAdditional Problems 7. The Following Is The Balance Sheet of A Corporate Firm As of March 31dharshana.segaranNo ratings yet

- Business RiskDocument4 pagesBusiness Risksneharsh2370No ratings yet

- Management Accounting - 1Document4 pagesManagement Accounting - 1amaljacobjogilinkedinNo ratings yet

- Exercise Final SECTION B 2019Document5 pagesExercise Final SECTION B 2019Arman ShahNo ratings yet

- Bos 51397 Interp 8Document30 pagesBos 51397 Interp 8Yogita SoniNo ratings yet

- © The Institute of Chartered Accountants of IndiaDocument24 pages© The Institute of Chartered Accountants of IndiaAniketNo ratings yet

- Carrier Draft ValuationDocument51 pagesCarrier Draft ValuationSergei MoshenkovNo ratings yet

- FM&EconomicsQUESTIONPAPER MAY21Document6 pagesFM&EconomicsQUESTIONPAPER MAY21Harish Palani PalaniNo ratings yet

- A PLC Financial Ratio ActivityDocument5 pagesA PLC Financial Ratio ActivityDianaCosminaNo ratings yet

- CA Inter FM ECO RTP Nov23 Castudynotes ComDocument23 pagesCA Inter FM ECO RTP Nov23 Castudynotes Comspyverse01No ratings yet

- FM Eco New MTP Inter Oct 19 QDocument6 pagesFM Eco New MTP Inter Oct 19 QBenNo ratings yet

- FM Smart WorkDocument17 pagesFM Smart WorkmaacmampadNo ratings yet

- FM QB by Yours - AmitBhai - Volume 2Document230 pagesFM QB by Yours - AmitBhai - Volume 2nnj247896No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument7 pages© The Institute of Chartered Accountants of IndiaSarvesh JoshiNo ratings yet

- Module 6 Leverage QuestionsDocument3 pagesModule 6 Leverage QuestionsJayashree ChakrapaniNo ratings yet

- Unit 3: 4. The Management of IT Limited, A Debt Free Company Desires To Determine The Economic ValueDocument2 pagesUnit 3: 4. The Management of IT Limited, A Debt Free Company Desires To Determine The Economic Valuedharshana.segaranNo ratings yet

- DBE Sem-2 Question PapersDocument16 pagesDBE Sem-2 Question PapersTanmay AroraNo ratings yet

- Capital Structure and LeverageDocument11 pagesCapital Structure and Leverageyashnagra6452yNo ratings yet

- Concepts of Financial Reporting Final OSADocument5 pagesConcepts of Financial Reporting Final OSAdamian.levendalNo ratings yet

- OLC Chap 20Document5 pagesOLC Chap 20NeelNo ratings yet

- Simsr2 Mba B III FM Quep 1Document4 pagesSimsr2 Mba B III FM Quep 1Priyanka ReddyNo ratings yet

- End-Term Paper Financial Management - 2 Set - A: SolutionDocument7 pagesEnd-Term Paper Financial Management - 2 Set - A: SolutionLakshmi NairNo ratings yet

- CU-2022 B. Com. (Honours) Financial Reporting & Financial Statement Analysis Semester-6 Paper-DSE-6.1A QPDocument5 pagesCU-2022 B. Com. (Honours) Financial Reporting & Financial Statement Analysis Semester-6 Paper-DSE-6.1A QPdivyankshaw2002No ratings yet

- FM Eco Q Mtp2 Inter Nov21Document7 pagesFM Eco Q Mtp2 Inter Nov21rridhigolchha15No ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- Adam's Learning Centre, Lahore: Interpretation of Financial StatementsDocument10 pagesAdam's Learning Centre, Lahore: Interpretation of Financial StatementsMasood Ahmad AadamNo ratings yet

- FN 200 - Financial Forecasting Seminar QuestionsDocument7 pagesFN 200 - Financial Forecasting Seminar QuestionskelvinizimburaNo ratings yet

- Management Accounitng - 104 (I)Document4 pagesManagement Accounitng - 104 (I)Rudraksh PareyNo ratings yet

- Ratio Analysis Liquidity Ratios Solvency RatiosDocument55 pagesRatio Analysis Liquidity Ratios Solvency Ratiossarika gurjarNo ratings yet

- LeverageDocument4 pagesLeverageKhushi RaniNo ratings yet

- Question and AnsDocument33 pagesQuestion and AnsHawa MudalaNo ratings yet

- Corporate Valuation Revision Copy Main FileDocument63 pagesCorporate Valuation Revision Copy Main FileRajalakshmi SNo ratings yet

- 4.2 Making Capital Investment Decisions/ Estimation of Project Cash Flows Illustration 1Document4 pages4.2 Making Capital Investment Decisions/ Estimation of Project Cash Flows Illustration 1Geetika RaniNo ratings yet

- FMECO M.test EM 30.03.2021 QuestionDocument6 pagesFMECO M.test EM 30.03.2021 Questionsujalrathi04No ratings yet

- Leverage - Financial ManagementDocument7 pagesLeverage - Financial Managementyogeshjhanwar402No ratings yet

- Valuation ProblemsDocument5 pagesValuation ProblemsAparna KalaskarNo ratings yet

- Previous Year Question Paper (F.M)Document10 pagesPrevious Year Question Paper (F.M)Alisha Shaw0% (1)

- Worldwide Paper Company: Case Solution Company BackgroundDocument4 pagesWorldwide Paper Company: Case Solution Company BackgroundJauhari WicaksonoNo ratings yet

- Return On Investment Return On Investment ComputationDocument27 pagesReturn On Investment Return On Investment ComputationARISNo ratings yet

- Tesla Jan 2020 DiyDocument64 pagesTesla Jan 2020 DiyMathew KingNo ratings yet

- 71888bos57845 Inter p8qDocument6 pages71888bos57845 Inter p8qMayank RajputNo ratings yet

- 01 Leverages FTDocument7 pages01 Leverages FT1038 Kareena SoodNo ratings yet

- Casos Analisis de PerformanceDocument4 pagesCasos Analisis de PerformanceJohan UsecheNo ratings yet

- Adobe Scan May 24, 2022Document4 pagesAdobe Scan May 24, 2022Aamod JainNo ratings yet

- Capital Budgeting Challenger SeriesDocument17 pagesCapital Budgeting Challenger SeriesDeepsikha maitiNo ratings yet

- Bazg521 Nov25 AnDocument2 pagesBazg521 Nov25 AnDheeraj RaiNo ratings yet

- Responsibility AcctngDocument5 pagesResponsibility AcctngKatherine EderosasNo ratings yet

- Capital Asset Investment: Strategy, Tactics and ToolsFrom EverandCapital Asset Investment: Strategy, Tactics and ToolsRating: 1 out of 5 stars1/5 (1)

- LECTURE 5 Role of Project Management ConsultantsDocument13 pagesLECTURE 5 Role of Project Management ConsultantsAnimesh PalNo ratings yet

- Delhi NCR Metropolitan CityDocument7 pagesDelhi NCR Metropolitan CityOnkar ChauhanNo ratings yet

- Answers 1) : The Objectives of Islamic Commercial Law AreDocument5 pagesAnswers 1) : The Objectives of Islamic Commercial Law AreMudug Primary and secondary schoolNo ratings yet

- BMO Harris - Disclosures-2Document4 pagesBMO Harris - Disclosures-2Andres GomezNo ratings yet

- Employer CostDocument753 pagesEmployer CostAlinda Gupta AbhroNo ratings yet

- Acct Statement XX1708 26082022Document4 pagesAcct Statement XX1708 26082022Firoz KhanNo ratings yet

- Preface: The 9th International Conference On Global Resource Conservation (ICGRC) and AJI From Ritsumeikan UniversityDocument2 pagesPreface: The 9th International Conference On Global Resource Conservation (ICGRC) and AJI From Ritsumeikan UniversityAdriani HasyimNo ratings yet

- Sworn Statement of Assets, Liabilities and Net WorthDocument3 pagesSworn Statement of Assets, Liabilities and Net WorthMa Elgie Rama EnglisNo ratings yet

- Relaxo Footwear-Analyst Meet Update-25 September 2014Document6 pagesRelaxo Footwear-Analyst Meet Update-25 September 2014Gogul RajaNo ratings yet

- Inoperative Account DefinitionDocument1 pageInoperative Account Definitionmkumar.itNo ratings yet

- Cost-Effective Pallet Management StrategiesDocument14 pagesCost-Effective Pallet Management StrategiesSantiago Lara MachadoNo ratings yet

- Analyzing Consumer's Behaviour in Risk and Uncertainty SituationsDocument7 pagesAnalyzing Consumer's Behaviour in Risk and Uncertainty SituationsIJEPT Journal100% (1)

- Principles of OrganizationDocument2 pagesPrinciples of OrganizationnaveenNo ratings yet

- Reaction Paper CarpDocument2 pagesReaction Paper CarpJulie Ann Gaca0% (1)

- TescoDocument5 pagesTescovipuljhaNo ratings yet

- Acknowledgement of DebtDocument2 pagesAcknowledgement of DebtvernardNo ratings yet

- Midterms Se11 Answer KeyDocument5 pagesMidterms Se11 Answer KeyALYZA ANGELA ORNEDO100% (1)

- Resume - Aditya WDocument3 pagesResume - Aditya WadityaNo ratings yet

- Agrarian SocietyDocument5 pagesAgrarian SocietyAflahaNo ratings yet

- Griffin 9e IM CH 2 - EditedDocument26 pagesGriffin 9e IM CH 2 - EditedHo Hong Duc (FU HN)No ratings yet

- Indian Institute of Materials Management: Graduate Diploma in Public Procurement Paper No.6Document3 pagesIndian Institute of Materials Management: Graduate Diploma in Public Procurement Paper No.6shivamdubey12No ratings yet

- Veer Surendra Sai University of Technology, Burla: Lesson PlanDocument2 pagesVeer Surendra Sai University of Technology, Burla: Lesson Plansanthi saranyaNo ratings yet

- Accounting TheoryDocument47 pagesAccounting Theorychoccolade100% (2)

- TED Speech - Chip ConleyDocument6 pagesTED Speech - Chip Conleyjunohcu310No ratings yet

- ExercisesDocument3 pagesExercisesrhumblineNo ratings yet

- Creating A Winning Day Trading Plan by Jay WiremanDocument43 pagesCreating A Winning Day Trading Plan by Jay WiremanlowtarhkNo ratings yet

- Classical and Modern Approaches To Public Administration: ArticlesDocument8 pagesClassical and Modern Approaches To Public Administration: ArticlesJm LanuzaNo ratings yet

- Wa0000.Document2 pagesWa0000.RifatNo ratings yet

- ENT Questions and AnswersDocument20 pagesENT Questions and AnswersDarline LwangaNo ratings yet