Professional Documents

Culture Documents

RBC Formula Comparison II

RBC Formula Comparison II

Uploaded by

isabellelyyOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

RBC Formula Comparison II

RBC Formula Comparison II

Uploaded by

isabellelyyCopyright:

Available Formats

Article from:

The Financial Reporter

December 2012 – Issue 91

A Tale of Two Formulas: Solvency II SCR and RBC

By Mary Pat Campbell

F

or the past decade, Solvency II has been devel- that have their results aggregated as noted in the for-

oping in Europe to update approaches to insur- mula above.

er capital requirements, amongst other issues

with respect to insurance regulation. In July 2008, in On the other hand, U.S. RBC is more of a bottom-up

response to Solvency II (and then reacting to other calculation in its core concept. There is no specific

regulatory developments in the wake of the finan- time horizon or risk metric that is specified, much less

cial crisis), the National Association of Insurance a specified confidence level. As the RBC formula has

Mary Pat Campbell, FSA,

MAAA, is VP, insurance

Commissioners (NAIC) kicked off its Solvency been updated, it has been at the component level, with

research at Conning in Modernization Initiative (SMI). As the end of 2012 various pieces having their own calibration points, not

Hartford, Conn. She can approaches, most major decisions surrounding calcula- necessarily in conjunction with any other factors seen

be reached at marypat. tions for required capital have been finalized, though in the equation. The method for updating RBC has

campbell@gmail.com. some details are still open for development. Below, been one of incrementalism, with new factors being

I will examine the central formulas and look at their targeted to very specific risks and/or lines of busi-

underlying assumptions. ness. The projects have involved targeting missing

risks or outdated factors. For example, the C3 Phase II

The Capital Formulas project to determine C3 (asset-liability mismatch risk)

The core life authorized control level risk-based capital for variable annuities with guarantees, was intended

(ACL RBC) formula is as follows: to recognize risks that had been poorly captured by

prior factors. To that end, as part of the SMI, the

The core formula for the Solvency Capital Requirement NAIC has already designated certain areas of the for-

mula needing updating, such as the need for an explicit

catastrophe risk charge in the P&C RBC formula and

The core formula for the Solvency Capital Requirement also to recalibrate asset risk factors and provide a

(SCR) under Solvency II is: different granularity than that which existed before.

Risk Metric and Confidence

Level

Let us first consider the risk metrics used in these

The more complete SCR requirement includes a sepa- formulas. As noted above, Solvency II SCR uses the

rate operational risk charge, but I will not deal with that VaR metric, which gives the potential loss in value

issue here. Let us ignore what the individual compo- over a defined period for a given confidence level. In

nents mean, other than the various C amounts are risk this case, the confidence level is 99.5 percent, so it is

charges for particular risk categories, such as credit risk expected that there would only be a 0.5 percent chance

or mortality risk. We can see from the forms that there for capital set at this level to be fully depleted.

are similarities between the two types of formulas.

Considering that last sentence, one can see the primary

However, the surface similarities go away when one strength of the VaR metric: It is easy to interpret and

looks into the assumptions that have gone into devel- has a clear connection to probability of insolvency

oping the various components and the formulas them- (defined as capital depletion). In addition, a lot of math-

selves. To begin with, there is a top-down vision of the ematical and computational machinery has been built

Solvency II SCR: It is defined as being the one-year to calculate VaR speedily. Much of this was originally

value at risk (VaR) at the 99.5 percent confidence level. developed for banking risk management.

One starts at this high-level concept and then drills

down to modules and submodules of risk that conform However, there is a glaring problem with VaR, espe-

to this vision. One could have a full internal model to cially if one is a regulator concerned with what hap-

simulate the losses to get a multivariate VaR, but, in pens when insurers fail. The VaR metric only looks at

general, one would have separate individual models how bad it can get up to a certain failure probability;

10 | DECEMBER 2012 | The Financial Reporter

it does not reveal anything about the shape of the loss lent to using a Gaussian copula for modeling the

distribution beyond that point. This is akin to a black dependencies of the separate risk modules. Copulas are

hole’s event horizon—one can observe the effect of a a method for combining single-dimensional probability

black hole outside that range, but, once inside, there is distribution into a multidimensional distribution by

no clue what is going on. using arbitrary marginals (the individual risks inde-

pendently modeled) and using the structure from some

The issue of “risk blindness” past the confidence level standard distributions. Gaussian copulas are particu-

specified has caused problems in the financial world larly popular in risk modeling, but they have a pitfall:

before, most notably with collateralized debt obliga- tail independence. Tail independence shows up as a

tions (CDOs). “Fat-tailed” risks means that, when measure of probability that two extreme events occur

things go bad, they can go catastrophically bad. If simultaneously (in the case of a two-variable copula);

one is a regulator, one wants to make sure that, in the as you’re pushed out further and further into the tail,

case of insolvency, policyholders are relatively well Gaussian copulas show these extreme events to be

protected. A catastrophic insolvency whereby other independent. One can see how this might underestimate

insurers could not assume the liabilities in question the “true” VaR.

is the almost-worst-case scenario for regulators. The

worst-case scenario would be a catastrophic collapse of The NAIC RBC formula is a bit more extreme,

the entire insurance industry. in that the implied correlations in the formula are

either 0 (total independence) or 1 (perfect corre-

On the NAIC RBC side, there is no single risk metric lation). Assuming total independence may under-

that has been used. In some of the cases, a VaR metric estimate the impact of combined risk and assum-

was used to develop factors; in other cases, there was ing perfect correlation may overestimate it.

no specific metric per se. Recent projects to update life

RBC calculations have used a conditional tail expecta- Time Horizon

tion (CTE) approach that looks at the expected value U.S. RBC does not specify a time horizon for its risk

past the VaR loss. While this metric does address charges, while Solvency II SCR has a time horizon of

the risk blindness problem, the interpretation of the one year for all risks. In commenting on this as part of

result is more difficult to convey. That said, the CTE RBC reviews in the SMI, NAIC working groups have

metric has other nice properties, such as subadditivity noted that different time horizons may be appropriate

(where two separate risks do not become more risky for different risks as they develop over time. A Conning

simply from combining them together; VaR fails with analysis of capital adequacy models commented on

respect to subadditivity) as well as smaller confidence the importance of the time horizon with respect to risk

intervals for the same number of scenarios when one capital measures:

is estimating the metric using Monte Carlo techniques. Risk can look very different over time. A risk that

can dominate the risk landscape over a short time

Risk Aggregation horizon can be more benign over a longer time

Though theoretically the SCR is a top-down measure, horizon. For example, small unanticipated changes

generally modeling all risks at the same time and deter- in medical inflation might require only a small por-

mining the loss at the proper percentile is untenable. tion of the total required capital over a short time

Thus, many would use the BSCR formula as noted horizon. Over a longer time horizon, the impact

above, where module or submodule VaR is calcu- of unanticipated changes in medical inflation will

lated, and then aggregate using correlation coefficients compound while other risks, such as catastrophe

(whether developed on their own or using standard frequency, will diversify. Therefore, a single eco-

correlations). nomic capital metric is a current-point-in-time

measure that does not consider how risks interact

This approach is sometimes called the variance-covari- over many different time horizons. They view risk

ance approach to capital calculations, and it is equiva- over a single time horizon. It is important to under-

CONTINUED ON PAGE 12

The Financial Reporter | DECEMBER 2012 | 11

A Tale of Two Formulas: Solvency II SCR and RBC | from page 11

stand how these risks interact and aggregate over capital backing a particular line of business. Perhaps an

different time horizons to understand the appropri- intermediate time horizon, such as a five-year period,

ate level of capital to hold. (Painter and Isaac, “A may help bridge the gap between the multiyear devel-

Stakeholder Approach to Capital Adequacy”) opment of trouble as well as the practical problems

with overly long horizons.

The time horizon is really only relevant for solvency

measurements that use cash flow modeling. The RBC Internal Models

approach offers only a point-in-time assessment of Finally, one major distinction between the approaches

capital levels and is essentially a retrospective view to capital requirements is the use of internal models.

of capital. The Solvency II approach uses a one-year While there has been recent development of principles-

capitalization time horizon. based approaches for determining life RBC, on the

whole, the set of factors being used are the same across

While an improvement over the retrospective view of the industry.

capitalization, the models focused on a one-year hori-

zon, by definition, are not designed to view the busi- While understanding the need to modernize approaches

ness on a multiyear/going-concern basis. The problem to risk capital for complicated products, which involves

with the one-year view is that it misses latent, develop- the use of fairly sophisticated models, regulators in the

ing risks that build over time to affect capital. NAIC have hesitated to grant free rein to insurers. In

addition to stochastic simulation to capture tail risks,

As the NAIC has been adding projection elements to regulators have required standard scenarios to be run,

the RBC calculation for life products, the time horizon in order to provide a floor for the results. In standard

used for calculations have taken longer-term points of scenarios thus prescribed, there are no choices allowed

view, usually running out the liability model until the on the part of the insurer; for many insurers, these stan-

entire liability has essentially run off. There are issues dard scenarios have been found to dominate over the

with this approach as well, as one needs to project out stochastic risk measure.

many life liabilities for decades before run-off is com-

plete. This means that one must also be able to model In a 2009 Networks Financial Institute policy brief by

very long-term reinvestment strategies in addition to Therese M. Vaughan, the wariness toward the use of

projecting mortality and policyholder behavior trends. internal models was stated:

There is a lot of model uncertainty with such long-term

projections and, of course, certain company actions— A second feature of the U.S. system is the sig-

such as changing investment or dividend strategy—will nificant safeguards that have been built into the

be influenced by actual developments that may be dif- introduction of internal models. A healthy skepti-

ficult to incorporate into a cash flow projection model. cism of internal models by some states resulted in

the NAIC’s incorporating a standard scenario into

That said, while having a theoretically infinite time its capital requirement and reserving standards

horizon is troublesome, in practical terms, nearer-term for variable annuities. The standard scenario is a

cash flows generally dominate should the company single scenario with specified assumptions inde-

be in a weakened position with regard to reserves and pendent of a specific company’s experience. That

is, while the insurer is permitted to calculate its

required capital and reserves using internal models

The time horizon is really only relevant for with its own inputs, it must also calculate them

solvency measurements that use cash flow using a standard deterministic scenario provided

by the regulators. This scenario serves as a floor

modeling. for the reserves and required capital. According to

the NAIC’s Life and Health Actuarial Task Force,

12 | DECEMBER 2012 | The Financial Reporter

the standard scenario assumptions are not intended already seen the exit of Canadian insurers from par-

to produce requirements that would be adequate ticular lines due to Canadian requirements being more

most of the time. Rather, they are to ensure that the stringent than those of the United States.

requirements are not unreasonably low, particular-

ly given the lack of experience in applying internal As of the writing of this article (September 2012), there

models in this context. Regulators see the standard have only been three regulatory regimes evaluated by

scenario as providing reasonable constraints to the the European Insurance and Occupational Pensions

flexibility given to actuarial judgment when doing Authority (EIOPA), the EU parallel to the NAIC:

stochastic modeling. (Vaughan, “The Implications Bermuda, Japan and Switzerland. The U.S. system has

of Solvency II for U.S. Insurance Regulation,” not been reviewed in the same manner, partly because

Networks Financial Institute, February 2009.) there had been no formal request, but also because the

reality of how the U.S. market is regulated, on the state

On the other hand, the ability to use internal models, level, does not fit within the national-level supervision

or even be required to use internal models, has been a envisioned under Solvency II.

notable feature of Solvency II. The European insurance

industry has conducted a series of five quantitative As noted in the head-to-head comparison above, there

impact assessments (QIS1-QIS5) to gauge the adequacy are substantial differences between the approaches.

of insurer capital levels under the new rules. The fifth The papers cited in the “Further Reading” section

and most recent of these showed that just under 5 per- below illustrate that the numerical results can also be

cent of participating firms did not meet the minimum substantially different. Ultimately, the determination of

capital requirement (MCR) and 15 percent did not meet “equivalence” under Solvency II is a political one, as it

the SCR. (The MCR is the level at which there will be will be the various political bodies (as opposed to regu-

aggressive supervisory intervention and is defined to be latory bodies) that will make the final call. Individual

the 85 percent one-year VaR amount. There is a further countries within the EU may make separate determina-

constraint that the MCR must be between 25 percent tions. It will be interesting to see whether Solvency II,

and 45 percent of the SCR.) The concern is that large, a project intended to produce regulatory convergence,

diversified groups with advanced internal modeling provides impetus for regulatory arbitrage.

capabilities—using their own models—will find their

capital requirement improved relative to Solvency I, Further Reading

but small insurers applying the standard formula will Herzog, Thomas N. “Summary of CEIOPS Calibration Work on Standard

Formula.” Jan. 5, 2011. http://naic.org/documents/index_smi_solvency_ii_cali-

face a requirement for a capital increase. bration.pdf.

Jean, Steeve, Seong-min Eom, and Patricio Henriquez. “Solvency II Update—

Equivalence? QIS5 Results.” The Financial Reporter June 2011. http://www.soa.org/library/

newsletters/financial-reporter/2011/june/frn-2011-iss85.pdf.

While the features noted above are rather set, there

is one large, looming issue surrounding SMI and Painter, Robert A., and Dan Isaac. “A Stakeholder Approach to Capital

Adequacy.” Actuarial Practice Forum May 2007. http://www.soa.org/library/

Solvency II: How will the U.S. regulatory system be journals/actuarial-practice-forum/2007/may/APF0705_01.pdf.

considered under the new regime?

Sharara, Ishmael, Mary Hardy, and David Saunders. “A Comparative Analysis

of U.S., Canadian and Solvency II Capital Adequacy Requirements in Life

The issue ranges much farther than just capital require- Insurance.” November 2010. Society of Actuaries research. http://www.soa.org/

research/research-projects/risk-management/research-study-intl-regimes.aspx.

ments, but capital (and reserving) requirements may

have the most immediate effect. If capital requirements ———. “Regulatory Capital Standards for Property and Casualty Insurers under

the U.S., Canadian and Proposed Solvency II (Standard) Formulas.” November

for European Union-domiciled insurers with U.S. 2010. Society of Actuaries research http://www.soa.org/research/research-

subsidiaries are much higher than that for their U.S. projects/risk-management/research-study-intl-regimes.aspx.

competitors, they may need to exit particular lines of Vaughan, Therese M. “The Implications of Solvency II for U.S. Insurance

business or consider redomiciling in a country with a Regulation.” Networks Financial Institute Policy Brief 2009-PB-03, February 2009.

more salutary regulatory regime. The U.S. market has http://www.naic.org/Releases/2009_docs/090305_vaughan_resentation.pdf.

The Financial Reporter | DECEMBER 2012 | 13

You might also like

- The Essentials of Risk Management, Second EditionFrom EverandThe Essentials of Risk Management, Second EditionRating: 2 out of 5 stars2/5 (7)

- CMA+Part+2+Formula+Guide+ +CMA+Exam+AcademyDocument57 pagesCMA+Part+2+Formula+Guide+ +CMA+Exam+AcademyMonica D’SilvaNo ratings yet

- Certificate PDFDocument1 pageCertificate PDFAnonymous 1WLPUF0No ratings yet

- BF Activity-sheet-Q2 Week 3 and 4 Risk-Return-Trade-OffDocument12 pagesBF Activity-sheet-Q2 Week 3 and 4 Risk-Return-Trade-OffSamantha Beatriz B Chua100% (1)

- Basel IV Calculating Ead According To The New Standardizes Approach For Counterparty Credit Risk Sa CCRDocument48 pagesBasel IV Calculating Ead According To The New Standardizes Approach For Counterparty Credit Risk Sa CCRmrinal aditya100% (1)

- WK Credit Risk Management Under Basel IV A4 FINALDocument4 pagesWK Credit Risk Management Under Basel IV A4 FINALyogeshthakkerNo ratings yet

- Solvency IIDocument28 pagesSolvency IIamingwaniNo ratings yet

- QS 01 Cva Dva Fva 1709841617Document5 pagesQS 01 Cva Dva Fva 1709841617walid.ncirNo ratings yet

- 22 June 2012 Review On Risk Based Capital Framework For Insurers in Singapore RBC2 ReviewDocument33 pages22 June 2012 Review On Risk Based Capital Framework For Insurers in Singapore RBC2 ReviewKotchapornJirapadchayaropNo ratings yet

- Operations Research Perspectives: SciencedirectDocument10 pagesOperations Research Perspectives: SciencedirectGabrielaNo ratings yet

- Modeling and Quantifying of The Global Wrong Way RDocument16 pagesModeling and Quantifying of The Global Wrong Way REric CastroNo ratings yet

- Credit Risk of An International Bond Portfolio: A Case StudyDocument22 pagesCredit Risk of An International Bond Portfolio: A Case Studysumitshanker1No ratings yet

- ROAD TO BASEL III - An International Banking Event - EgyptDocument4 pagesROAD TO BASEL III - An International Banking Event - Egyptديفولوبرز للإستشارات والتدريبNo ratings yet

- RSKMGT Assignment Analyzing Concentration RiskDocument21 pagesRSKMGT Assignment Analyzing Concentration Risksneha prakashNo ratings yet

- SA CCRPaper0718Document20 pagesSA CCRPaper0718Animesh SrivastavaNo ratings yet

- Risk Measurement For Project FinanceDocument17 pagesRisk Measurement For Project FinanceMi2MaNo ratings yet

- An Efficient, Distributable, Risk Neutral Framework For CVA CalculationDocument18 pagesAn Efficient, Distributable, Risk Neutral Framework For CVA CalculationJustine WebsterNo ratings yet

- Position Paper 58 (V 4) FinalDocument14 pagesPosition Paper 58 (V 4) Finaljeribi bacemNo ratings yet

- 10-22495 Rgcv1i3art3Document9 pages10-22495 Rgcv1i3art3Somphorn Z NambutNo ratings yet

- Risk Management Basel - IIDocument72 pagesRisk Management Basel - IITaimoorAdil100% (1)

- Credit Risk Modelling A Wheel of Risk Ma PDFDocument9 pagesCredit Risk Modelling A Wheel of Risk Ma PDFPia CallantaNo ratings yet

- Good Liquidity PieceDocument5 pagesGood Liquidity PiecekalamayaNo ratings yet

- Basel II 2010Document3 pagesBasel II 2010munyapasiNo ratings yet

- A Comparative Anatomy of Credit Risk ModelsDocument31 pagesA Comparative Anatomy of Credit Risk ModelsEfthymios RoumpisNo ratings yet

- How To Deal With Volatility Under S2Document13 pagesHow To Deal With Volatility Under S2johan oldmanNo ratings yet

- Stochastic Methods in Credit Risk Modelling, Valuation and HedgingDocument63 pagesStochastic Methods in Credit Risk Modelling, Valuation and HedgingEnkhjargal Togtokh100% (1)

- Analyst Prep VRM 2024Document425 pagesAnalyst Prep VRM 2024Useless IdNo ratings yet

- Aircraft Financing and Basel Ii: by Christophe Beaubron PK AirfinanceDocument6 pagesAircraft Financing and Basel Ii: by Christophe Beaubron PK Airfinancea_sharafiehNo ratings yet

- T1-FRM-4-Ch4-20.7-v1 - Practice QuestionsDocument5 pagesT1-FRM-4-Ch4-20.7-v1 - Practice QuestionscristianoNo ratings yet

- CitiGroup Collateral Risk Based Capital StandardsDocument38 pagesCitiGroup Collateral Risk Based Capital StandardsPropertywizzNo ratings yet

- An Integrated OTC Derivatives Risk Capital Framework: Wujiang Lou Gavin XuDocument23 pagesAn Integrated OTC Derivatives Risk Capital Framework: Wujiang Lou Gavin Xuabhiu1991No ratings yet

- Structural Credit Risk Modeling - Merton and Beyond PDFDocument5 pagesStructural Credit Risk Modeling - Merton and Beyond PDFwukamwai88No ratings yet

- Yu Wang (2009) - Structural Credit Risk Modeling - Merton and Beyond PDFDocument5 pagesYu Wang (2009) - Structural Credit Risk Modeling - Merton and Beyond PDFwukamwai88No ratings yet

- The Impossible Trio in CDO ModelingDocument12 pagesThe Impossible Trio in CDO ModelingChaudhari Abhishek AshokNo ratings yet

- Allowance For Risk in Market Consistent Embedded Value (MCEV)Document12 pagesAllowance For Risk in Market Consistent Embedded Value (MCEV)apluNo ratings yet

- Cred Risk 1 GGGDocument33 pagesCred Risk 1 GGGAbhijeet PatilNo ratings yet

- Basel Ii: Impact On IT Systems & Testing For ComplianceDocument6 pagesBasel Ii: Impact On IT Systems & Testing For CompliancerssarinNo ratings yet

- Riskcalc Irb ApproachDocument8 pagesRiskcalc Irb Approachzync100No ratings yet

- Is Basel Accord A Solution To Prevent Banking Failures?Document3 pagesIs Basel Accord A Solution To Prevent Banking Failures?fahimfahadNo ratings yet

- Credit Portfolio ManagementDocument5 pagesCredit Portfolio Managementmpr176No ratings yet

- ACLI To NAICDocument50 pagesACLI To NAICjitenparekhNo ratings yet

- Modelling Credit RiskDocument27 pagesModelling Credit RiskPuneet SawhneyNo ratings yet

- MAR50 With FaqDocument23 pagesMAR50 With FaqRenu MundhraNo ratings yet

- Portfolio Stress Testing: Moody'S AnalyticsDocument10 pagesPortfolio Stress Testing: Moody'S AnalyticsMazen AlbsharaNo ratings yet

- Portfolio Credit RiskDocument12 pagesPortfolio Credit RiskHassan AlJishiNo ratings yet

- A Risk-Factor Model Foundation For Ratings-Based Bank Capital RulesDocument34 pagesA Risk-Factor Model Foundation For Ratings-Based Bank Capital RulesFabrice Borel-MathurinNo ratings yet

- O SolvencyDocument101 pagesO SolvencyIoanna ZlatevaNo ratings yet

- III.B.6 Credit Risk Capital CalculationDocument28 pagesIII.B.6 Credit Risk Capital CalculationvladimirpopovicNo ratings yet

- Liquidity Risk ManagementDocument4 pagesLiquidity Risk ManagementFaisalNo ratings yet

- 3q 2022 Liquidity Coverage RatioDocument10 pages3q 2022 Liquidity Coverage RatioAkhilNo ratings yet

- Basel Ii Overview: February 2017Document35 pagesBasel Ii Overview: February 2017Venkatsubramanian R IyerNo ratings yet

- Effective Credit Risk-Rating Systems (Part 1)Document6 pagesEffective Credit Risk-Rating Systems (Part 1)ABEY EMBEZANo ratings yet

- Basel II: Will Help Prevent Crises or Worsen Them?Document5 pagesBasel II: Will Help Prevent Crises or Worsen Them?Kavindra MishraNo ratings yet

- Granularity Adjustment For Basel II - Gordy 2007Document40 pagesGranularity Adjustment For Basel II - Gordy 2007RubenNo ratings yet

- Factsheet Solvency II - Final - English - tcm47-335167Document5 pagesFactsheet Solvency II - Final - English - tcm47-335167Ioanna ZlatevaNo ratings yet

- Modelin NG Banks' ' Probabil Lity of de EfaultDocument23 pagesModelin NG Banks' ' Probabil Lity of de Efaulthoangminhson0602No ratings yet

- Dubrana CR+Document45 pagesDubrana CR+EmiliaNo ratings yet

- Introduction To Basel Iii: Implications and ConsequencesDocument26 pagesIntroduction To Basel Iii: Implications and ConsequencesAakashNo ratings yet

- In Depth Ifrs 9 ImpairmentDocument22 pagesIn Depth Ifrs 9 ImpairmentMohd Zahir Mohd RadziNo ratings yet

- RI Ito33 5Document3 pagesRI Ito33 5marvNo ratings yet

- Engle & Manganelli (2004) - CAViaR Conditional Autoregressive Value at Risk by Regression QuantilesDocument15 pagesEngle & Manganelli (2004) - CAViaR Conditional Autoregressive Value at Risk by Regression QuantilesJavier CulebrasNo ratings yet

- The Basel II Risk Parameters: Estimation, Validation, Stress Testing - with Applications to Loan Risk ManagementFrom EverandThe Basel II Risk Parameters: Estimation, Validation, Stress Testing - with Applications to Loan Risk ManagementRating: 1 out of 5 stars1/5 (1)

- (Hodgin) Insurance Law Text Materials 2 e (B-Ok - CC) PDFDocument861 pages(Hodgin) Insurance Law Text Materials 2 e (B-Ok - CC) PDFdeghaNo ratings yet

- Smart Wealth Goal: Bajaj Allianz LifeDocument7 pagesSmart Wealth Goal: Bajaj Allianz LifeSoumit DeyNo ratings yet

- Professional Practice: Legal Aspects of Professional Practice: Risk Management, Insurance & BondDocument42 pagesProfessional Practice: Legal Aspects of Professional Practice: Risk Management, Insurance & BondRimon SheikhNo ratings yet

- Jurnal Tugas AkhirDocument9 pagesJurnal Tugas Akhirfauzan datasheetNo ratings yet

- Expert Report Of:: Martin Hollingsworth AssociatesDocument12 pagesExpert Report Of:: Martin Hollingsworth AssociatesclickrubyshoesNo ratings yet

- B Pension Risk TransferDocument7 pagesB Pension Risk TransferMikhail FrancisNo ratings yet

- Multifactor Models and The CapmDocument6 pagesMultifactor Models and The CapmNguyễn Dương Trọng KhôiNo ratings yet

- Subject: Insurance Law: PROJECT ON: Double Insurance & Re-Insurance - Indian PerspectiveDocument20 pagesSubject: Insurance Law: PROJECT ON: Double Insurance & Re-Insurance - Indian PerspectiveSachin PatelNo ratings yet

- Ic 33 English PDFDocument372 pagesIc 33 English PDFSaied MastanNo ratings yet

- Supervisory Declaration AML Income MismatchDocument1 pageSupervisory Declaration AML Income Mismatchakash agarwalNo ratings yet

- English (Role-Play Script)Document6 pagesEnglish (Role-Play Script)DPM 5A Siti Nurfarwizah Mohd FauziNo ratings yet

- Portfolio Management and Wealth Planning - Zell Education 2024Document91 pagesPortfolio Management and Wealth Planning - Zell Education 2024harshNo ratings yet

- 70002886268Document4 pages70002886268acme financialNo ratings yet

- Lecture01 PPT-1 NewformatDocument55 pagesLecture01 PPT-1 Newformatsarakhan0622No ratings yet

- Simplified SFM Theory Book by CA Jatin Nagpal - CompressedDocument47 pagesSimplified SFM Theory Book by CA Jatin Nagpal - CompressedSatyendraGuptaNo ratings yet

- Unit 3Document18 pagesUnit 3anas khanNo ratings yet

- Module 2 - General Principles of Insurance LawDocument60 pagesModule 2 - General Principles of Insurance Lawkumar kartikeyaNo ratings yet

- A Study of Derivatives Market in India and Its Current Position in Global Financial Derivatives MarketDocument11 pagesA Study of Derivatives Market in India and Its Current Position in Global Financial Derivatives MarketAvishekNo ratings yet

- Valerio Scacco PresentationDocument33 pagesValerio Scacco PresentationValerio ScaccoNo ratings yet

- Synchronous Insurance Code 1Document51 pagesSynchronous Insurance Code 1kecy casamayorNo ratings yet

- Karanja - The Effect of Risk Management Strategies On The Sustainable Competitive Advantage of Commercial Banks in KenyaDocument63 pagesKaranja - The Effect of Risk Management Strategies On The Sustainable Competitive Advantage of Commercial Banks in Kenyaedu mainaNo ratings yet

- Bike PapersDocument5 pagesBike PapersjamritharajNo ratings yet

- Anmol JeevanDocument13 pagesAnmol JeevanUtkarshNo ratings yet

- 750-Article Text-3228-1-10-20221101Document10 pages750-Article Text-3228-1-10-20221101SHERINA IZZATI PUTRINo ratings yet

- SP2 Syllabus 2022Document6 pagesSP2 Syllabus 2022Munjal GoelNo ratings yet

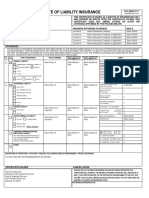

- Sample Certificate of Liability InsuranceDocument1 pageSample Certificate of Liability InsuranceDobe StepNo ratings yet

- Insurance Law Answer PaperDocument10 pagesInsurance Law Answer PaperPRAKRITI SITOULANo ratings yet