Professional Documents

Culture Documents

Optus Laminates Private Limited-04!02!2018 2

Optus Laminates Private Limited-04!02!2018 2

Uploaded by

jainam.gargCopyright:

Available Formats

You might also like

- Jake Bernstein's Seasonal Trader's Bible - The Best of The Best in Seasonal Trades - Jake Bernstein (1996) PDFDocument561 pagesJake Bernstein's Seasonal Trader's Bible - The Best of The Best in Seasonal Trades - Jake Bernstein (1996) PDF林耀明100% (4)

- Grennell Farm SolutionDocument6 pagesGrennell Farm SolutionMichael TorresNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Rating Definitions - 19 July 2018Document4 pagesRating Definitions - 19 July 2018SushantNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Press Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1tejasNo ratings yet

- Divis Laboratories LimitedDocument7 pagesDivis Laboratories Limiteddivygupta198No ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Arya Steels Rolling (India) LimiteDocument4 pagesArya Steels Rolling (India) LimiteData CentrumNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Press Release Nahar Poly Films LimitedDocument5 pagesPress Release Nahar Poly Films LimitedHarshit SinghNo ratings yet

- Press Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Data CentrumNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Servotech Power Systems Limited-12-21-2018Document5 pagesServotech Power Systems Limited-12-21-2018Sarthak SharmaNo ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Myra Hygiene Products Private LimitedDocument7 pagesMyra Hygiene Products Private Limitedanuj7729No ratings yet

- Rating Rationale: Facility Amount ( CR) Tenure RatingDocument4 pagesRating Rationale: Facility Amount ( CR) Tenure RatingNalla ThambiNo ratings yet

- Ultramarine & Pigments LTD: Summary of Rated InstrumentsDocument7 pagesUltramarine & Pigments LTD: Summary of Rated Instrumentsjanmejay26No ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Piramal Pharma LimitedDocument6 pagesPiramal Pharma Limitedsoumyadwip samantaNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Ankit Pulps and Boards - R-25102018Document6 pagesAnkit Pulps and Boards - R-25102018HEMANT GURJARNo ratings yet

- SMFG India Credit Company LimitedDocument9 pagesSMFG India Credit Company Limitedvatsal sinhaNo ratings yet

- Press Release India Belt Company: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release India Belt Company: Details of Instruments/facilities in Annexure-1ANUBHAVCFANo ratings yet

- Housing Development Finance Corporation LimitedDocument6 pagesHousing Development Finance Corporation LimitedTejpal SainiNo ratings yet

- Bharat Hotels LimitedDocument7 pagesBharat Hotels LimitedjagadeeshNo ratings yet

- Press Release: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release: Details of Instruments/facilities in Annexure-1Aman DubeyNo ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- Shree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020Document3 pagesShree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020YUVRAJ YADAVNo ratings yet

- Ramani Cars Private Limited 2023Document6 pagesRamani Cars Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- Vinati Organics Limited CARE Rating July 2017Document5 pagesVinati Organics Limited CARE Rating July 2017mgrreddyNo ratings yet

- 3F Oil Palm Agrotech Private Limited-02-27-2020 PDFDocument4 pages3F Oil Palm Agrotech Private Limited-02-27-2020 PDFData CentrumNo ratings yet

- Press Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionDocument4 pagesPress Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionData CentrumNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- HDB Financial Services LimitedDocument14 pagesHDB Financial Services Limitedshahdhruv18062No ratings yet

- Press Release: R B Construction CompanyDocument4 pagesPress Release: R B Construction CompanyRavi BabuNo ratings yet

- Ganesh Benzoplast LTD (GBL)Document7 pagesGanesh Benzoplast LTD (GBL)Positive ThinkerNo ratings yet

- D&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsDocument6 pagesD&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsMahee MahemaaNo ratings yet

- Santkrupa Milk and Milk Products-05!27!2020Document4 pagesSantkrupa Milk and Milk Products-05!27!2020Sanket PawarNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Jodhani Papers Private LimitedDocument5 pagesJodhani Papers Private LimitedPunit PansariNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Rajendra Singh Bhamboo Infra Private LimitedDocument5 pagesRajendra Singh Bhamboo Infra Private LimitedBABU LAL CHOUDHARYNo ratings yet

- Pump DesignDocument4 pagesPump Designmarathasanatani6No ratings yet

- Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Radha MohanNo ratings yet

- Press Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1Document3 pagesPress Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1surprise MFNo ratings yet

- Continental Carbon India LimitedDocument4 pagesContinental Carbon India LimitedKamaldeep MaanNo ratings yet

- CRISIL Rating Metro April18Document3 pagesCRISIL Rating Metro April18pankaj_xaviersNo ratings yet

- Tehri Pulp and Paper 5feb2021Document6 pagesTehri Pulp and Paper 5feb2021Ck WilliumNo ratings yet

- Antony Waste Handling Cell LimitedDocument5 pagesAntony Waste Handling Cell Limitedsoumyadwip samantaNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- Coral AssociatesDocument5 pagesCoral AssociatesFunny CloudsNo ratings yet

- Ganesha Ecosphere Limited-01-29-2019Document6 pagesGanesha Ecosphere Limited-01-29-2019gangashaharNo ratings yet

- Model answer: Launching a new business in Networking for entrepreneursFrom EverandModel answer: Launching a new business in Networking for entrepreneursNo ratings yet

- The Trilight - Cost Sheet To MR Satyendra Kumar Pasalapudi & Vanitha Devi PasalapudiDocument1 pageThe Trilight - Cost Sheet To MR Satyendra Kumar Pasalapudi & Vanitha Devi Pasalapudithetrilight2023No ratings yet

- 7876C.10.1 Opening Balance and Comparative ChecklistDocument2 pages7876C.10.1 Opening Balance and Comparative ChecklistMohiuddin Rafsun12No ratings yet

- Brocure ITADocument6 pagesBrocure ITAeliiiiiiNo ratings yet

- Bed Discounts Top Students Sy 2021 2022Document12 pagesBed Discounts Top Students Sy 2021 2022Renen Millo BantilloNo ratings yet

- Toyo - Soal Dasar Akuntansi UTS - Gasal 2122Document2 pagesToyo - Soal Dasar Akuntansi UTS - Gasal 2122Dita nNo ratings yet

- Iron Condor Spreadsheet TrackerDocument34 pagesIron Condor Spreadsheet TrackerbobthereaderNo ratings yet

- Pneumatic ConveyorDocument11 pagesPneumatic ConveyorJarin AnanNo ratings yet

- Classwork Practice Cases: Case 1Document3 pagesClasswork Practice Cases: Case 1Yash DedhiaNo ratings yet

- Warehouses and Headquarters Addresses and Price List TemplateDocument22 pagesWarehouses and Headquarters Addresses and Price List TemplateTudor FlorinNo ratings yet

- Journal Entries and Ledger Accounts - FinalDocument6 pagesJournal Entries and Ledger Accounts - FinalMukul SinhaNo ratings yet

- Important Safety NoticeDocument22 pagesImportant Safety NoticeDennis CanasNo ratings yet

- BM&M ScreenDocument6 pagesBM&M Screenpatricio wachtendorffNo ratings yet

- ACBF EVALUATION Ghana Final Report v4Document22 pagesACBF EVALUATION Ghana Final Report v4Daniel Kofi AndohNo ratings yet

- The Sharpe Corporation's ProjectedDocument3 pagesThe Sharpe Corporation's Projectedmadnansajid8765No ratings yet

- MS Finance Fall 2022Document1 pageMS Finance Fall 2022Kabeer QureshiNo ratings yet

- CA Foundation - MCQ's - 1Document97 pagesCA Foundation - MCQ's - 1Harshit GulatiNo ratings yet

- Your Energy Statement: BalanceDocument4 pagesYour Energy Statement: BalancePawelNo ratings yet

- Mindstone-Creating Change That Matters - HyperRevelanceDocument9 pagesMindstone-Creating Change That Matters - HyperRevelanceMoksh SharmaNo ratings yet

- Standard Costing 8Document12 pagesStandard Costing 8suraj banNo ratings yet

- TM Iatf 16949Document2 pagesTM Iatf 16949storymaple94No ratings yet

- Akuntansi Keuangan 2 - Semester 4Document13 pagesAkuntansi Keuangan 2 - Semester 4Andrew AlamsyahNo ratings yet

- Khalifa CityDocument1 pageKhalifa CityMoidutty NuchiyadNo ratings yet

- Week 8 Media and The AudienceDocument3 pagesWeek 8 Media and The AudienceADMATEZA UNGGUINo ratings yet

- تأثير الأزمات المالية على عائد ومخاطر المحفظة المالية الدولية - - حالة مجموعة من بورصات الأسهم المتطورة والناشئة 2007-2012 -Document16 pagesتأثير الأزمات المالية على عائد ومخاطر المحفظة المالية الدولية - - حالة مجموعة من بورصات الأسهم المتطورة والناشئة 2007-2012 -MohamedNo ratings yet

- Manual de Operação XZ40K - 1Document34 pagesManual de Operação XZ40K - 1DORIVAN JÚNIORNo ratings yet

- 491 TechdataDocument11 pages491 Techdatahugo.vicenteNo ratings yet

- OchigboDocument3 pagesOchigboyusuf jimohNo ratings yet

- Paper 3 Chapter 4 PractiseDocument11 pagesPaper 3 Chapter 4 PractiseAryan GuptaNo ratings yet

Optus Laminates Private Limited-04!02!2018 2

Optus Laminates Private Limited-04!02!2018 2

Uploaded by

jainam.gargOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Optus Laminates Private Limited-04!02!2018 2

Optus Laminates Private Limited-04!02!2018 2

Uploaded by

jainam.gargCopyright:

Available Formats

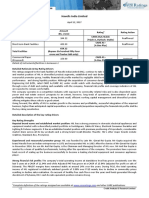

Press Release

Optus Laminates Private Limited

April 02, 2018

Ratings

Amount Rating Action

Facilities Ratings

(Rs. crore)

CARE BB; Stable

Long-term Bank Facilities 9.00 Assigned

(Double B; Outlook: Stable)

CARE BB; Stable/ CARE A4

Long-term/Short-term

11.50 (Double B; Outlook: Stable Assigned

Bank Facilities

/ A Four)

CARE A4

Short-term Bank Facilities 4.00 Assigned

(A Four)

24.50

Total (Rupees Twenty Four Crore and Fifty

lakh only)

Details of instruments/facilities in Annexure -1

Detailed Rationale & Key Rating Drivers

The ratings assigned to the bank facilities of Optus Laminates Private Limited (OLPL) are constrained on account of its

moderate scale of operations, moderate capital structure, moderate debt coverage indicators and working capital

intensive nature of operations leading to high operating cycle during FY17 (refers to the period April 1 to March 31).

Further, the ratings are also constrained due to its presence into highly fragmented and competitive industry, cyclical

nature of the industry and susceptibility of profit margins to volatility in raw material prices and foreign exchange

fluctuations.

The ratings, however, derives comfort from vast experience of promoters, location advantage of presence in Gujarat and

moderate profit margins.

OLPL’s ability to increase its scale of operations with improvement in profitability, capital structure and debt coverage

indicators along with better working capital management will be the key rating sensitivity.

Detailed description of the key rating drivers

Key Rating Weaknesses

Moderate scale of operations

The scale of operations stood moderate at Rs.45.25 crore as against Rs.44.46 crore during FY16. However, OLPL’s TOI has

reported CAGR of 8.43% for the past two years ended FY17 on the back of gradual increase in demand from its

customers.

Moderate capital structure and debt coverage indicators

As on March 31, 2017 overall gearing ratio stood at 1.30x (Including creditors on LC of Rs.3.13crore) as against 1.38x

(Including creditors on LC of Rs.3.55crore) as on March 31, 2016, the improvement was on account of increase in the

tangible net worth base.

As on March 31, 2017 total debt to GCA stood at 10.33 times which improved as compared to 16.21 times as on March

31, 2016 on account of increase in GCA level. Further, interest coverage ratio stood moderate at 2.28 times during FY17

as compared to 1.64 times during FY16.

Working capital intensive nature of operations leading to elongated operating cycle

Operating cycle of OLPL has remained elongated at 146 days during FY17 on account of higher level of inventory

maintained by the company in order to execute orders in timely manner thereby leading to higher utilization of its

working capital bank borrowing.

Presence into fragmented and competitive industry

OLPL operates in highly fragmented and competitive laminate industry marked by presence of large number of medium

sized players. The industry is characterized by low entry barrier due to negligible government policy restrictions, no

inherent resource requirement constraints and easy access to customers and suppliers. Also, the presence of big sized

players with established marketing & distribution network results into intense competition in the industry.

Susceptibility of profit margins to volatility in raw material price and foreign exchange fluctuations

Major raw material for the company are design paper, kraft paper, melamine, phenol, methanol etc. whose price are

volatile in nature. Hence, any adverse movement in their price can put pressure on the profit margins of the company.

The company imports design paper and melamine from China. Furthermore, OLPL keeps its payments un-hedged which

exposes it to foreign currency fluctuation risk.

1 CARE Ratings Limited

Press Release

Cyclical nature of the industry

Again, the fortune of the industry is linked to the real estate industry which is inherently cyclical in nature. This factor

limits the pricing flexibility and bargaining power of OLPL and put pressure on profitability. However, the company has

geographically diversified presence in the domestic market which helps in maintaining the steady growth in revenue.

Key Rating Strengths

Vast Experience of Promoters

OLPL is promoted and managed by Mr. Bharat R. Choksi, Mr. Shalin B. Choksi, Mr. Saumil B. Choksi, Mr. Ramjibhai P. Patel

and Mr. Dharmendra R. Patel and all the promoters has vast experience in the same industry.

Location advantage of presence in Gujarat

The factory is situated in Sabarkantha District at North Gujarat, where raw materials are easily available along with

transportation and labour. Furthermore, location of the company is near to Ahmedabad which is the industrial hub of

Gujarat with very large number of industries with urban residential area.

Moderate profit margins

During FY17, PBILDT margin stood at 7.52% as compared to 5.78% during FY16 while PAT margin stood at 2.30%

duringFY17 as against 0.95% in FY16.

Analytical Approach: Standalone

Applicable Criteria

Criteria on assigning Outlook to Credit Ratings

CARE’s Policy on Default Recognition

Rating Methodology-Manufacturing Companies

Financial ratios – Non-Financial Sector

Criteria for Short Term Instruments

About the Company

Sabarkantha (Gujarat)-based, OLPL was incorporated in October 26, 2004 as private limited company by Mr. Bharat R.

Choksi, Mr. Shalin B. Choksi, Mr. Saumil B. Choksi, Mr. Ramjibhai P. Patel and Mr. Dharmendra R. Patel. OLPL is engaged

into manufacturing of decorative laminate sheets. OLPL has established its manufacturing unit at Sabarkantha with

installed capacity of 120000 sheets per month as on March 31, 2017.

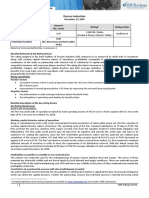

Brief Financials (Rs. crore) FY16 (A) FY17 (A)

Total operating income 44.46 45.25

PBILDT 2.57 3.40

PAT 0.42 1.04

Overall gearing (times) 1.38 1.30

Interest coverage (times) 1.64 2.28

A: Audited

During 11MFY18 (Provisional),OLPL has achieved TOI of Rs.50.43crore.

Status of non-cooperation with previous CRA: Not Applicable

Any other information: Not Applicable

Rating History (Last three years): Please refer Annexure-2

Note on complexity levels of the rated instrument: CARE has classified instruments rated by it on the basis of complexity.

This classification is available at www.careratings.com. Investors/market intermediaries/regulators or others are welcome

to write to care@careratings.com for any clarifications.

Analyst Contact

Name: Mr Chintan Soni

Tel: (079) 40265634

Mobile: +91-8511190016

Email: chintan.soni@careratings.com

About CARE Ratings:

CARE Ratings commenced operations in April 1993 and over nearly two decades, it has established itself as one of the

leading credit rating agencies in India. CARE is registered with the Securities and Exchange Board of India (SEBI) and also

2 CARE Ratings Limited

Press Release

recognized as an External Credit Assessment Institution (ECAI) by the Reserve Bank of India (RBI). CARE Ratings is proud of

its rightful place in the Indian capital market built around investor confidence. CARE Ratings provides the entire spectrum

of credit rating that helps the corporates to raise capital for their various requirements and assists the investors to form

an informed investment decision based on the credit risk and their own risk-return expectations. Our rating and grading

service offerings leverage our domain and analytical expertise backed by the methodologies congruent with the

international best practices.

Disclaimer

CARE’s ratings are opinions on credit quality and are not recommendations to sanction, renew, disburse or recall the

concerned bank facilities or to buy, sell or hold any security. CARE has based its ratings/outlooks on information obtained

from sources believed by it to be accurate and reliable. CARE does not, however, guarantee the accuracy, adequacy or

completeness of any information and is not responsible for any errors or omissions or for the results obtained from the

use of such information. Most entities whose bank facilities/instruments are rated by CARE have paid a credit rating fee,

based on the amount and type of bank facilities/instruments.

In case of partnership/proprietary concerns, the rating /outlook assigned by CARE is based on the capital deployed by the

partners/proprietor and the financial strength of the firm at present. The rating/outlook may undergo change in case of

withdrawal of capital or the unsecured loans brought in by the partners/proprietor in addition to the financial

performance and other relevant factors.

Annexure-1: Details of Instruments/Facilities

Name of the Date of Coupon Maturity Size of the Rating assigned

Instrument Issuance Rate Date Issue along with Rating

(Rs. crore) Outlook

Fund-based - LT-Term - - Dec., 2018 3.00 CARE BB; Stable

Loan

Fund-based - LT/ ST-Cash - - - 11.50 CARE BB; Stable /

Credit CARE A4

Non-fund-based - ST- - - - 4.00 CARE A4

Letter of credit

Fund-based - LT-Cash - - - 6.00 CARE BB; Stable

Credit

Annexure-2: Rating History of last three years

Sr. Name of the Current Ratings Rating history

No. Instrument/Bank Type Amount Rating Date(s) & Date(s) & Date(s) & Date(s) &

Facilities Outstanding Rating(s) Rating(s) Rating(s) Rating(s)

(Rs. crore) assigned in assigned in assigned in assigned in

2017-2018 2016-2017 2015-2016 2014-2015

1. Fund-based - LT-Term LT 3.00 CARE BB; - - - -

Loan Stable

2. Fund-based - LT/ ST-Cash LT/ST 11.50 CARE BB; - - - -

Credit Stable /

CARE A4

3. Non-fund-based - ST- ST 4.00 CARE A4 - - - -

Letter of credit

4. Fund-based - LT-Cash LT 6.00 CARE BB; - - - -

Credit Stable

3 CARE Ratings Limited

Press Release

CONTACT

Head Office Mumbai

Ms. Meenal Sikchi Mr. Ankur Sachdeva

Cell: + 91 98190 09839 Cell: + 91 98196 98985

E-mail: meenal.sikchi@careratings.com E-mail: ankur.sachdeva@careratings.com

Ms. Rashmi Narvankar Mr. Saikat Roy

Cell: + 91 99675 70636 Cell: + 91 98209 98779

E-mail: rashmi.narvankar@careratings.com E-mail: saikat.roy@careratings.com

CARE Ratings Limited

(Formerly known as Credit Analysis & Research Ltd.)

Corporate Office: 4th Floor, Godrej Coliseum, Somaiya Hospital Road, Off Eastern Express Highway, Sion (East), Mumbai - 400 022

Tel: +91-22-6754 3456 | Fax: +91-22-6754 3457 | E-mail: care@careratings.com

AHMEDABAD JAIPUR

Mr. Deepak Prajapati Mr. Nikhil Soni

32, Titanium, Prahaladnagar Corporate Road, 304, Pashupati Akshat Heights, Plot No. D-91,

Satellite, Ahmedabad - 380 015 Madho Singh Road, Near Collectorate Circle,

Cell: +91-9099028864 Bani Park, Jaipur - 302 016.

Tel: +91-79-4026 5656 Cell: +91 – 95490 33222

E-mail: deepak.prajapati@careratings.com Tel: +91-141-402 0213 / 14

E-mail: nikhil.soni@careratings.com

BENGALURU

Mr. V Pradeep Kumar KOLKATA

Unit No. 1101-1102, 11th Floor, Prestige Meridian II, Ms. Priti Agarwal

No. 30, M.G. Road, Bangalore - 560 001. 3rd Floor, Prasad Chambers, (Shagun Mall Bldg.)

Cell: +91 98407 54521 10A, Shakespeare Sarani, Kolkata - 700 071.

Tel: +91-80-4115 0445, 4165 4529 Cell: +91-98319 67110

Email: pradeep.kumar@careratings.com Tel: +91-33- 4018 1600

E-mail: priti.agarwal@careratings.com

CHANDIGARH

Mr. Anand Jha NEW DELHI

SCF No. 54-55, Ms. Swati Agrawal

First Floor, Phase 11, 13th Floor, E-1 Block, Videocon Tower,

Sector 65, Mohali - 160062 Jhandewalan Extension, New Delhi - 110 055.

Chandigarh Cell: +91-98117 45677

Cell: + +91 85111-53511/99251-42264 Tel: +91-11-4533 3200

Tel: 91- 0172-490-4000/01 E-mail: swati.agrawal@careratings.com

Email: anand.jha@careratings.com

CHENNAI PUNE

Mr. V Pradeep Kumar Mr.Pratim Banerjee

Unit No. O-509/C, Spencer Plaza, 5th Floor, 9th Floor, Pride Kumar Senate,

No. 769, Anna Salai, Chennai - 600 002. Plot No. 970, Bhamburda, Senapati Bapat Road,

Cell: +91 98407 54521 Shivaji Nagar, Pune - 411 015.

Tel: +91-44-2849 7812 / 0811 Cell: +91-98361 07331

Email: pradeep.kumar@careratings.com Tel: +91-20- 4000 9000

E-mail: pratim.banerjee@careratings.com

COIMBATORE

Mr. V Pradeep Kumar CIN - L67190MH1993PLC071691

T-3, 3rd Floor, Manchester Square

Puliakulam Road, Coimbatore - 641 037.

Tel: +91-422-4332399 / 4502399

Email: pradeep.kumar@careratings.com

HYDERABAD

Mr. Ramesh Bob

401, Ashoka Scintilla, 3-6-502, Himayat Nagar,

Hyderabad - 500 029.

Cell : + 91 90520 00521

Tel: +91-40-4010 2030

E-mail: ramesh.bob@careratings.com

4 CARE Ratings Limited

You might also like

- Jake Bernstein's Seasonal Trader's Bible - The Best of The Best in Seasonal Trades - Jake Bernstein (1996) PDFDocument561 pagesJake Bernstein's Seasonal Trader's Bible - The Best of The Best in Seasonal Trades - Jake Bernstein (1996) PDF林耀明100% (4)

- Grennell Farm SolutionDocument6 pagesGrennell Farm SolutionMichael TorresNo ratings yet

- Regional Rural Banks of India: Evolution, Performance and ManagementFrom EverandRegional Rural Banks of India: Evolution, Performance and ManagementNo ratings yet

- Rating Definitions - 19 July 2018Document4 pagesRating Definitions - 19 July 2018SushantNo ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Shri Balaji Rollings Private LimDocument4 pagesShri Balaji Rollings Private LimData CentrumNo ratings yet

- Press Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Mehul Construction Company Private Limited: Details of Instruments/facilities in Annexure-1tejasNo ratings yet

- Divis Laboratories LimitedDocument7 pagesDivis Laboratories Limiteddivygupta198No ratings yet

- Jay Ushin Limited: Rationale-Press ReleaseDocument4 pagesJay Ushin Limited: Rationale-Press Releaseravi.youNo ratings yet

- Arya Steels Rolling (India) LimiteDocument4 pagesArya Steels Rolling (India) LimiteData CentrumNo ratings yet

- PR ARCL Organics 31jan22Document7 pagesPR ARCL Organics 31jan22anady135344No ratings yet

- Roots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionDocument4 pagesRoots Industries India Limited: Facilities/Instruments Amount (Rs. Crore) Rating Rating ActionKarthikeyan RK SwamyNo ratings yet

- Press Release Nahar Poly Films LimitedDocument5 pagesPress Release Nahar Poly Films LimitedHarshit SinghNo ratings yet

- Press Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Document5 pagesPress Release Amkette Analytics Limited: Details of Instruments/facilities in Annexure-1Data CentrumNo ratings yet

- Sunlex Fabrics Private Limited - Care RatingsDocument6 pagesSunlex Fabrics Private Limited - Care RatingsManeet GoyalNo ratings yet

- Press Release Adani Agri Logistics (Harda) LimitedDocument5 pagesPress Release Adani Agri Logistics (Harda) Limitedsurprise MFNo ratings yet

- Amarth Ifestyle RetailingDocument5 pagesAmarth Ifestyle Retailingheera lal thakurNo ratings yet

- Prayag Polymers Private LimitedDocument4 pagesPrayag Polymers Private Limitednandinimishra6168No ratings yet

- Servotech Power Systems Limited-12-21-2018Document5 pagesServotech Power Systems Limited-12-21-2018Sarthak SharmaNo ratings yet

- Filatex India Limited PDFDocument6 pagesFilatex India Limited PDFfatNo ratings yet

- Mega Steel IndustriesDocument4 pagesMega Steel IndustrieshseckalpeshNo ratings yet

- Myra Hygiene Products Private LimitedDocument7 pagesMyra Hygiene Products Private Limitedanuj7729No ratings yet

- Rating Rationale: Facility Amount ( CR) Tenure RatingDocument4 pagesRating Rationale: Facility Amount ( CR) Tenure RatingNalla ThambiNo ratings yet

- Ultramarine & Pigments LTD: Summary of Rated InstrumentsDocument7 pagesUltramarine & Pigments LTD: Summary of Rated Instrumentsjanmejay26No ratings yet

- Press Release RACL Geartech LTDDocument4 pagesPress Release RACL Geartech LTDSourav DuttaNo ratings yet

- Piramal Pharma LimitedDocument6 pagesPiramal Pharma Limitedsoumyadwip samantaNo ratings yet

- Press Release Deccan Industries: Positive FactorsDocument4 pagesPress Release Deccan Industries: Positive FactorsHARI HARANNo ratings yet

- La Opala RG LimitedDocument5 pagesLa Opala RG LimitedAshwani KesharwaniNo ratings yet

- Ankit Pulps and Boards - R-25102018Document6 pagesAnkit Pulps and Boards - R-25102018HEMANT GURJARNo ratings yet

- SMFG India Credit Company LimitedDocument9 pagesSMFG India Credit Company Limitedvatsal sinhaNo ratings yet

- Press Release India Belt Company: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release India Belt Company: Details of Instruments/facilities in Annexure-1ANUBHAVCFANo ratings yet

- Housing Development Finance Corporation LimitedDocument6 pagesHousing Development Finance Corporation LimitedTejpal SainiNo ratings yet

- Bharat Hotels LimitedDocument7 pagesBharat Hotels LimitedjagadeeshNo ratings yet

- Press Release: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release: Details of Instruments/facilities in Annexure-1Aman DubeyNo ratings yet

- Press Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Document6 pagesPress Release Om Logistics Limited: Details of Instruments/facilities in Annexure-1Sinius InfracomNo ratings yet

- Shree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020Document3 pagesShree Lakshmi Narayan Sugar Industries Private Limited-12-01-2020YUVRAJ YADAVNo ratings yet

- Ramani Cars Private Limited 2023Document6 pagesRamani Cars Private Limited 2023Karthikeyan RK SwamyNo ratings yet

- Vinati Organics Limited CARE Rating July 2017Document5 pagesVinati Organics Limited CARE Rating July 2017mgrreddyNo ratings yet

- 3F Oil Palm Agrotech Private Limited-02-27-2020 PDFDocument4 pages3F Oil Palm Agrotech Private Limited-02-27-2020 PDFData CentrumNo ratings yet

- Press Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionDocument4 pagesPress Release 3B Fibreglass SPRL: Facilities Amount (Rs. Crore) Rating Rating ActionData CentrumNo ratings yet

- Shapoorji Pallonji and Company Private LimitedDocument5 pagesShapoorji Pallonji and Company Private LimitedPrabhakar DubeyNo ratings yet

- Mehala Machines India LimitedDocument4 pagesMehala Machines India LimitedKarthikeyan RK SwamyNo ratings yet

- HDB Financial Services LimitedDocument14 pagesHDB Financial Services Limitedshahdhruv18062No ratings yet

- Press Release: R B Construction CompanyDocument4 pagesPress Release: R B Construction CompanyRavi BabuNo ratings yet

- Ganesh Benzoplast LTD (GBL)Document7 pagesGanesh Benzoplast LTD (GBL)Positive ThinkerNo ratings yet

- D&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsDocument6 pagesD&H Secheron Electrodes Private Limited: Summary of Rated InstrumentsMahee MahemaaNo ratings yet

- Santkrupa Milk and Milk Products-05!27!2020Document4 pagesSantkrupa Milk and Milk Products-05!27!2020Sanket PawarNo ratings yet

- Tarsons Products LimitedDocument5 pagesTarsons Products LimitedujjwalgoldNo ratings yet

- Jodhani Papers Private LimitedDocument5 pagesJodhani Papers Private LimitedPunit PansariNo ratings yet

- Thriveni Earthmovers Private LimitedDocument9 pagesThriveni Earthmovers Private Limitedarc14consultantNo ratings yet

- Rajendra Singh Bhamboo Infra Private LimitedDocument5 pagesRajendra Singh Bhamboo Infra Private LimitedBABU LAL CHOUDHARYNo ratings yet

- Pump DesignDocument4 pagesPump Designmarathasanatani6No ratings yet

- Press Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Document4 pagesPress Release Pennar Industries Limited: Details of Instruments/facilities in Annexure-1Radha MohanNo ratings yet

- Press Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1Document3 pagesPress Release Adani Agri Logistics (Harda) Limited: Details of Facilities in Annexure-1surprise MFNo ratings yet

- Continental Carbon India LimitedDocument4 pagesContinental Carbon India LimitedKamaldeep MaanNo ratings yet

- CRISIL Rating Metro April18Document3 pagesCRISIL Rating Metro April18pankaj_xaviersNo ratings yet

- Tehri Pulp and Paper 5feb2021Document6 pagesTehri Pulp and Paper 5feb2021Ck WilliumNo ratings yet

- Antony Waste Handling Cell LimitedDocument5 pagesAntony Waste Handling Cell Limitedsoumyadwip samantaNo ratings yet

- Press Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Document6 pagesPress Release Panoli Intermediates (India) Private Limited: Details of Instruments/ Facilities in Annexure-1Patel ZeelNo ratings yet

- Coral AssociatesDocument5 pagesCoral AssociatesFunny CloudsNo ratings yet

- Ganesha Ecosphere Limited-01-29-2019Document6 pagesGanesha Ecosphere Limited-01-29-2019gangashaharNo ratings yet

- Model answer: Launching a new business in Networking for entrepreneursFrom EverandModel answer: Launching a new business in Networking for entrepreneursNo ratings yet

- The Trilight - Cost Sheet To MR Satyendra Kumar Pasalapudi & Vanitha Devi PasalapudiDocument1 pageThe Trilight - Cost Sheet To MR Satyendra Kumar Pasalapudi & Vanitha Devi Pasalapudithetrilight2023No ratings yet

- 7876C.10.1 Opening Balance and Comparative ChecklistDocument2 pages7876C.10.1 Opening Balance and Comparative ChecklistMohiuddin Rafsun12No ratings yet

- Brocure ITADocument6 pagesBrocure ITAeliiiiiiNo ratings yet

- Bed Discounts Top Students Sy 2021 2022Document12 pagesBed Discounts Top Students Sy 2021 2022Renen Millo BantilloNo ratings yet

- Toyo - Soal Dasar Akuntansi UTS - Gasal 2122Document2 pagesToyo - Soal Dasar Akuntansi UTS - Gasal 2122Dita nNo ratings yet

- Iron Condor Spreadsheet TrackerDocument34 pagesIron Condor Spreadsheet TrackerbobthereaderNo ratings yet

- Pneumatic ConveyorDocument11 pagesPneumatic ConveyorJarin AnanNo ratings yet

- Classwork Practice Cases: Case 1Document3 pagesClasswork Practice Cases: Case 1Yash DedhiaNo ratings yet

- Warehouses and Headquarters Addresses and Price List TemplateDocument22 pagesWarehouses and Headquarters Addresses and Price List TemplateTudor FlorinNo ratings yet

- Journal Entries and Ledger Accounts - FinalDocument6 pagesJournal Entries and Ledger Accounts - FinalMukul SinhaNo ratings yet

- Important Safety NoticeDocument22 pagesImportant Safety NoticeDennis CanasNo ratings yet

- BM&M ScreenDocument6 pagesBM&M Screenpatricio wachtendorffNo ratings yet

- ACBF EVALUATION Ghana Final Report v4Document22 pagesACBF EVALUATION Ghana Final Report v4Daniel Kofi AndohNo ratings yet

- The Sharpe Corporation's ProjectedDocument3 pagesThe Sharpe Corporation's Projectedmadnansajid8765No ratings yet

- MS Finance Fall 2022Document1 pageMS Finance Fall 2022Kabeer QureshiNo ratings yet

- CA Foundation - MCQ's - 1Document97 pagesCA Foundation - MCQ's - 1Harshit GulatiNo ratings yet

- Your Energy Statement: BalanceDocument4 pagesYour Energy Statement: BalancePawelNo ratings yet

- Mindstone-Creating Change That Matters - HyperRevelanceDocument9 pagesMindstone-Creating Change That Matters - HyperRevelanceMoksh SharmaNo ratings yet

- Standard Costing 8Document12 pagesStandard Costing 8suraj banNo ratings yet

- TM Iatf 16949Document2 pagesTM Iatf 16949storymaple94No ratings yet

- Akuntansi Keuangan 2 - Semester 4Document13 pagesAkuntansi Keuangan 2 - Semester 4Andrew AlamsyahNo ratings yet

- Khalifa CityDocument1 pageKhalifa CityMoidutty NuchiyadNo ratings yet

- Week 8 Media and The AudienceDocument3 pagesWeek 8 Media and The AudienceADMATEZA UNGGUINo ratings yet

- تأثير الأزمات المالية على عائد ومخاطر المحفظة المالية الدولية - - حالة مجموعة من بورصات الأسهم المتطورة والناشئة 2007-2012 -Document16 pagesتأثير الأزمات المالية على عائد ومخاطر المحفظة المالية الدولية - - حالة مجموعة من بورصات الأسهم المتطورة والناشئة 2007-2012 -MohamedNo ratings yet

- Manual de Operação XZ40K - 1Document34 pagesManual de Operação XZ40K - 1DORIVAN JÚNIORNo ratings yet

- 491 TechdataDocument11 pages491 Techdatahugo.vicenteNo ratings yet

- OchigboDocument3 pagesOchigboyusuf jimohNo ratings yet

- Paper 3 Chapter 4 PractiseDocument11 pagesPaper 3 Chapter 4 PractiseAryan GuptaNo ratings yet