Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

16 viewsTax Computation 12 2023

Tax Computation 12 2023

Uploaded by

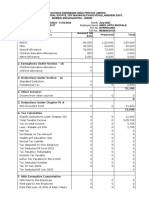

Rajib ChowdhuryThis document contains Rajib Chowdhury's projected income tax computation for December 2023. It shows his gross salary is INR 1,434,168 along with various exemptions totaling INR 49,464. His taxable income is INR 1,112,204. The total tax liability is INR 152,007, of which INR 12,868 will be recovered through TDS each month for the remaining 3 months of the year. The document provides a breakdown of salary, exemptions, deductions, and tax calculations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- Vat Receipt: MR Kyle BoydDocument1 pageVat Receipt: MR Kyle BoydNovak Brodsky83% (6)

- Cox-Murray - Apollo The Race of The MoonDocument329 pagesCox-Murray - Apollo The Race of The MoonHipatia50% (2)

- Concept Note For Trade FairDocument5 pagesConcept Note For Trade FairRalph Aldrin F. VallesterosNo ratings yet

- Salary Slip XLXDocument2 pagesSalary Slip XLXDeepak50% (4)

- Paystub 02.28.2019 PDFDocument1 pagePaystub 02.28.2019 PDFAnonymous dDiu2yq2KNo ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- Shrey Payslip Apr 2023Document4 pagesShrey Payslip Apr 2023Shrey EducationNo ratings yet

- Ta Comion 3 2023Document2 pagesTa Comion 3 2023kjsdkjadNo ratings yet

- Tax Computation 5 2023Document3 pagesTax Computation 5 2023Shivnath RaidasNo ratings yet

- Projected Income Tax Computation Statement For The Month of Apr 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Apr 2021Lady KillerNo ratings yet

- Projected Income Tax Computation Statement For The Month of Feb 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Feb 2021LokeswaraRaoNo ratings yet

- Tax Computation 10 2021Document2 pagesTax Computation 10 2021prashanth kumarNo ratings yet

- Concentrix Daksh Services India Private Limited: Income Tax Calculation For The PeriodDocument5 pagesConcentrix Daksh Services India Private Limited: Income Tax Calculation For The Periodgthapliyal31No ratings yet

- 12 2022 Salary Slip SintexDocument1 page12 2022 Salary Slip SintexpathyashisNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Wa0005Document1 pageWa0005Ravi KumarNo ratings yet

- ComputationDocument1 pageComputationPritam RoyNo ratings yet

- Taxcomp T15038Document1 pageTaxcomp T15038victor.savioNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Jun 2021 NikDocument2 pagesJun 2021 NikNikhil KumarNo ratings yet

- UntitledDocument1 pageUntitledAnkush SinghNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- Jul 2022Document2 pagesJul 2022Nikhil KumarNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- HCL Technologies Ltd.Document76 pagesHCL Technologies Ltd.Hemendra GuptaNo ratings yet

- Salary SleepDocument1 pageSalary Sleepdk_2k2002No ratings yet

- Deloitte Consulting India Private LimitedDocument2 pagesDeloitte Consulting India Private LimitedChinni SreenivasNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- TaxComputation SYEDL PUN0157 2023 2024Document2 pagesTaxComputation SYEDL PUN0157 2023 2024nitin patilNo ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- PDF&Rendition 1Document2 pagesPDF&Rendition 1vijaybhaskar damireddyNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Income Tax Calculation For The Period 01/04/2021 To 07/07/2021Document4 pagesIncome Tax Calculation For The Period 01/04/2021 To 07/07/2021Srinath AllaNo ratings yet

- Sampangi Sowbhagya (POL11622)Document1 pageSampangi Sowbhagya (POL11622)Sowbhagya VaderaNo ratings yet

- May 2019Document2 pagesMay 2019Vinodhkumar ShanmugamNo ratings yet

- May 2019 PDFDocument2 pagesMay 2019 PDFVinodhkumar ShanmugamNo ratings yet

- Zamil Information Technology Global Private Limited Pay Slip For The Month of SEP-2018Document1 pageZamil Information Technology Global Private Limited Pay Slip For The Month of SEP-2018vishalNo ratings yet

- EMP23 Tax Sheet Report202311152219Document2 pagesEMP23 Tax Sheet Report202311152219SoumyaranjanNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- Draft ReportDocument8 pagesDraft Report0264192238No ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- ITCertificate PDFDocument2 pagesITCertificate PDFkumar praweenNo ratings yet

- It 2023 2024 7Document2 pagesIt 2023 2024 7luciferangellordNo ratings yet

- UntitledDocument4 pagesUntitledAnn LiNo ratings yet

- Statement of Salary As of 2019-08-2: Earnings DeductionsDocument1 pageStatement of Salary As of 2019-08-2: Earnings DeductionsHenry CagaNo ratings yet

- Irp0000006225 1Document1 pageIrp0000006225 1Devender RajuNo ratings yet

- Antony Alex A (V12112) - SeptemberDocument1 pageAntony Alex A (V12112) - SeptemberindianoxygenltdNo ratings yet

- Earning Heads (+) Eads Amount: Gross Salary: Deduction: Net SalaryDocument1 pageEarning Heads (+) Eads Amount: Gross Salary: Deduction: Net SalaryNeeraj BharadwajNo ratings yet

- Confidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerDocument1 pageConfidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerAbdul Nayeem100% (1)

- JAN Payslip India-UnlockedDocument2 pagesJAN Payslip India-Unlockedbskapoor68No ratings yet

- 0 GPIND TMCGOFFOCT2022 V2 Gpinit01Document2 pages0 GPIND TMCGOFFOCT2022 V2 Gpinit01lakb5304No ratings yet

- Bose Payslip FebDocument1 pageBose Payslip FebThammineni Vishwanath Naidu100% (1)

- Cdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipDocument1 pageCdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipHenry CagaNo ratings yet

- HCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Document1 pageHCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Kittu SinghNo ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- ViewPDF Aspx PDFDocument1 pageViewPDF Aspx PDFSIBAPRASAD BHUNIANo ratings yet

- June 2022 - AjithkumarDocument1 pageJune 2022 - AjithkumarDharshan RajNo ratings yet

- Anwar Group of IndustriesDocument1 pageAnwar Group of IndustriesMoment RevealersNo ratings yet

- Presentación de Stefanini PDFDocument24 pagesPresentación de Stefanini PDFramontxu06No ratings yet

- Procedure For HORCM and RAIDCOMDocument4 pagesProcedure For HORCM and RAIDCOMdennisNo ratings yet

- Power Homes vs. SECDocument22 pagesPower Homes vs. SEChaileyraincloudNo ratings yet

- Sine Bar'Document6 pagesSine Bar'Jonathan PereiraNo ratings yet

- Practical Research 1 5Document36 pagesPractical Research 1 5Maria Cristina AldasNo ratings yet

- The Vivago Watch A Telecare Solution For Cost-Efficient CareDocument1 pageThe Vivago Watch A Telecare Solution For Cost-Efficient CareGeronTechnoPlatformNo ratings yet

- Robert Walters Salary SurveyDocument5 pagesRobert Walters Salary SurveySyaiful BahriNo ratings yet

- Download: Mosaic TechniquesDocument2 pagesDownload: Mosaic TechniquesJohnny LaounNo ratings yet

- Tugas GinjalDocument22 pagesTugas GinjalAnastasia MargaretNo ratings yet

- Tectonic Evolution of Mogok Metamorphic BeltDocument21 pagesTectonic Evolution of Mogok Metamorphic BeltOak KarNo ratings yet

- Name: Waguma Leticia: Jomo Kenyatta University of Agriculture and Technology Nakuru CampusDocument9 pagesName: Waguma Leticia: Jomo Kenyatta University of Agriculture and Technology Nakuru CampusWaguma LeticiaNo ratings yet

- SIP DAR Report SampleDocument150 pagesSIP DAR Report SampleSunil DixitNo ratings yet

- Democratic Life Skill 1Document1 pageDemocratic Life Skill 1andinurzamzamNo ratings yet

- 6 - Telephone and Cable Networks For Data TransmissionDocument31 pages6 - Telephone and Cable Networks For Data TransmissionpranjalcrackuNo ratings yet

- PO Lifecycle in SAPDocument76 pagesPO Lifecycle in SAPadwankarparagNo ratings yet

- Afn 2 PDFDocument5 pagesAfn 2 PDFLovely Ann ReyesNo ratings yet

- BBRIP - Monitoring ToolDocument2 pagesBBRIP - Monitoring ToolGeraldine N. VitoNo ratings yet

- Making Your Career Plan: Integration of Life Goals, Values, Personality, Skills and AptitudeDocument18 pagesMaking Your Career Plan: Integration of Life Goals, Values, Personality, Skills and AptitudeRoella Mae MalinaoNo ratings yet

- Extended Abstract Comparison of Effectiveness of The Various Species of Citrus' Peels As Styrofoam DecomposerDocument3 pagesExtended Abstract Comparison of Effectiveness of The Various Species of Citrus' Peels As Styrofoam DecomposerKen EzekielNo ratings yet

- Correlation 1Document9 pagesCorrelation 1Bharat ChaudharyNo ratings yet

- Melt Shop Ventilation Upgrade 2Document1 pageMelt Shop Ventilation Upgrade 2mshahNo ratings yet

- Curriculum Vitae of Supramaniyan KumarDocument4 pagesCurriculum Vitae of Supramaniyan KumarSupramaniyan kumarNo ratings yet

- Epidemiology Of: Milk-Borne DiseasesDocument13 pagesEpidemiology Of: Milk-Borne Diseasesabdulqudus abdulakeemNo ratings yet

- Rman Standby Copy-2Document8 pagesRman Standby Copy-2SHAHID FAROOQNo ratings yet

- Okra Group 3Document34 pagesOkra Group 3Vanessa Marie AgnerNo ratings yet

- Yanbu: Export Refinery ProjectDocument5 pagesYanbu: Export Refinery ProjectJanakiraman MalligaNo ratings yet

- SAARC Geophysics Course - KhalidDocument106 pagesSAARC Geophysics Course - KhalidWaqar Ahmed100% (2)

Tax Computation 12 2023

Tax Computation 12 2023

Uploaded by

Rajib Chowdhury0 ratings0% found this document useful (0 votes)

16 views3 pagesThis document contains Rajib Chowdhury's projected income tax computation for December 2023. It shows his gross salary is INR 1,434,168 along with various exemptions totaling INR 49,464. His taxable income is INR 1,112,204. The total tax liability is INR 152,007, of which INR 12,868 will be recovered through TDS each month for the remaining 3 months of the year. The document provides a breakdown of salary, exemptions, deductions, and tax calculations.

Original Description:

Tax computation

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document contains Rajib Chowdhury's projected income tax computation for December 2023. It shows his gross salary is INR 1,434,168 along with various exemptions totaling INR 49,464. His taxable income is INR 1,112,204. The total tax liability is INR 152,007, of which INR 12,868 will be recovered through TDS each month for the remaining 3 months of the year. The document provides a breakdown of salary, exemptions, deductions, and tax calculations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

16 views3 pagesTax Computation 12 2023

Tax Computation 12 2023

Uploaded by

Rajib ChowdhuryThis document contains Rajib Chowdhury's projected income tax computation for December 2023. It shows his gross salary is INR 1,434,168 along with various exemptions totaling INR 49,464. His taxable income is INR 1,112,204. The total tax liability is INR 152,007, of which INR 12,868 will be recovered through TDS each month for the remaining 3 months of the year. The document provides a breakdown of salary, exemptions, deductions, and tax calculations.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 3

FRIGORIFICO ALLANA PRIVATE LIMITED

Employee Code 11020623 Employee Name RAJIB CHOWDHURY

Date Of Birth 30/12/1984 Date of Joining 02/12/2022

PAN NO AOSPC2519N Tax Regime Old Tax Regime

Projected income tax computation statement for the month of Dec 2023

Tax Computation Amount (INR)

Gross Salary 1,434,168.00

Total Perquisite 0.00

Total Gross Salary 1,434,168.00

Income received from previous employer salary 0.00

HRA Exemption (Sec 10 (13A)) 49,464.00

Transport Exemption (Sec 10(14)) 0.00

Gratuity Exemption (Sec 10(10)) 0.00

Uniform Exemption (Sec 10(14)) 0.00

Education Exemption (Sec 10(14)) 0.00

Leave Encashment (Sec 10(10AA)(ii)) 0.00

LTA exemption (Sec 10(5)) 0.00

Other exemptions under Sec 10 0.00

Exemptions Under Section 10 & 17 49,464.00

Net Salary 1,384,704.00

Standard Deduction under section 16 (I) 50,000.00

Total deduction under section 16(ii) 0.00

Professional Tax recovered by previous employer 0.00

Professional Tax recovered by Current Employer 2,500.00

Professional Tax 2,500.00

Income chargeable under the head Salaries 1,332,204.00

House property income or loss 0.00

Other income 0.00

Gross Total Income 1,332,204.00

80C Total Limited to 1.5 Lakh Excluding NPS 150,000.00

Deduction in respect of certain pension funds U/s 80CCC 0.00

Deduction in respect of notified pension scheme under section 80CCD(1) 0.00

Employees contribution towards NPS 80CCD (1B) 50,000.00

Employers contribution toward NPS (up to 10%)(u/s 80CCD (2)) 0.00

Medical Insurance Premium (Sec 80D) 20,000.00

Interest Paid on Higher Education Loan (Sec 80E) 0.00

Donation for Approved Fund and Charities (Sec 80G) 0.00

Savings account U/s 80TTA 0.00

Amount deductible under any other provision(s) of Chapter VIA 0.00

Total amount deductible under Chapter VI-A 220,000.00

Net Taxable Income 1,112,204.00

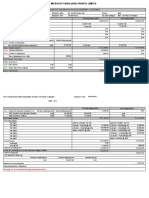

FRIGORIFICO ALLANA PRIVATE LIMITED

Tax on Net Income 146,161.00

Income Tax payable 146,161.00

Surcharge on Income Tax 0.00

Health and Education Cess 5,846.00

Total Tax Liability 152,007.00

Income Tax Per Month 0.00

Marginal Tax to be Recovered for this Month 0.00

Tax to be Recovered for the Current Month 12,868.00

Total Income tax paid from salary till date 113,403.00

Tax paid outside salary / Tax recovered by previous employer 0.00

Income Tax due 38,604.00

Remaining months in the current Year 3.00

TDS to be recovered per month 12,868.00

Breakup of exemptions under Section 10 & 17 Applied amount Amount exempted

HRA Exemption (Sec 10 (13A)) 98,400.00 49,464.00

Total Exempted Allowance 0.00 49,464.00

Other Deduction under chapter VI-A 0.00 0.00

Medical Insurance Premium (Sec 80D) 20,000.00 20,000.00

Total Deductibles 0.00 20,000.00

Deductions Under Chapter VI-A - 80C 0.00 0.00

Employees Provident Fund 58,727.00 58,727.00

Public Provident Fund 80,000.00 80,000.00

National Savings Certificate (NSC) 50,000.00 50,000.00

Insurance Premium 25,323.00 25,323.00

Employees contribution towards NPS 50,000.00 50,000.00

80C Total Limited to 1.5 Lakh Excluding NPS 0.00 150,000.00

Total 80C limit to be capped 2 lakh 0.00 200,000.00

TAX CALCULATION 0.00 0.00

Tax Calculation on Taxable Income 0.00 1,112,204.00

0 - 250000 : 0% 0.00 0.00

250001 - 500000 : 5% 0.00 12,500.00

500001 - 1000000 : 20% 0.00 100,000.00

1000001 - 9999999999 : 30% 0.00 33,661.00

Tax Rebate 0.00 0.00

Tax (After Tax Rebate) 0.00 146,161.00

Surcharge 0.00 0.00

Health and Education Cess 0.00 5,846.00

Total Tax Liability 0.00 152,007.00

OTHER TDS DETAILS 0.00 0.00

Previous Company TDS 0.00 0.00

FRIGORIFICO ALLANA PRIVATE LIMITED

OUTSITE TDS 0.00 0.00

You might also like

- Vat Receipt: MR Kyle BoydDocument1 pageVat Receipt: MR Kyle BoydNovak Brodsky83% (6)

- Cox-Murray - Apollo The Race of The MoonDocument329 pagesCox-Murray - Apollo The Race of The MoonHipatia50% (2)

- Concept Note For Trade FairDocument5 pagesConcept Note For Trade FairRalph Aldrin F. VallesterosNo ratings yet

- Salary Slip XLXDocument2 pagesSalary Slip XLXDeepak50% (4)

- Paystub 02.28.2019 PDFDocument1 pagePaystub 02.28.2019 PDFAnonymous dDiu2yq2KNo ratings yet

- Altruist Customer Management India PVT LTD: Personal DetailsDocument1 pageAltruist Customer Management India PVT LTD: Personal DetailsSampathKPNo ratings yet

- Shrey Payslip Apr 2023Document4 pagesShrey Payslip Apr 2023Shrey EducationNo ratings yet

- Ta Comion 3 2023Document2 pagesTa Comion 3 2023kjsdkjadNo ratings yet

- Tax Computation 5 2023Document3 pagesTax Computation 5 2023Shivnath RaidasNo ratings yet

- Projected Income Tax Computation Statement For The Month of Apr 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Apr 2021Lady KillerNo ratings yet

- Projected Income Tax Computation Statement For The Month of Feb 2021Document2 pagesProjected Income Tax Computation Statement For The Month of Feb 2021LokeswaraRaoNo ratings yet

- Tax Computation 10 2021Document2 pagesTax Computation 10 2021prashanth kumarNo ratings yet

- Concentrix Daksh Services India Private Limited: Income Tax Calculation For The PeriodDocument5 pagesConcentrix Daksh Services India Private Limited: Income Tax Calculation For The Periodgthapliyal31No ratings yet

- 12 2022 Salary Slip SintexDocument1 page12 2022 Salary Slip SintexpathyashisNo ratings yet

- Salary Slip EDIT-AUGDocument4 pagesSalary Slip EDIT-AUGpathyashisNo ratings yet

- Salary Slip EDIT-JULYDocument4 pagesSalary Slip EDIT-JULYpathyashisNo ratings yet

- Wa0005Document1 pageWa0005Ravi KumarNo ratings yet

- ComputationDocument1 pageComputationPritam RoyNo ratings yet

- Taxcomp T15038Document1 pageTaxcomp T15038victor.savioNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- Jun 2021 NikDocument2 pagesJun 2021 NikNikhil KumarNo ratings yet

- UntitledDocument1 pageUntitledAnkush SinghNo ratings yet

- Deccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095Document1 pageDeccan Chronicle Holdings Limited No. 5th Floor, B.M.T.C Commercial Comples, 80ft Road, Koramangala. Benguluru - 560 095David PenNo ratings yet

- Jul 2022Document2 pagesJul 2022Nikhil KumarNo ratings yet

- Heads of Income Monthly Actual YTD Projected TotalDocument2 pagesHeads of Income Monthly Actual YTD Projected Totalprakriti sankhlaNo ratings yet

- HCL Technologies Ltd.Document76 pagesHCL Technologies Ltd.Hemendra GuptaNo ratings yet

- Salary SleepDocument1 pageSalary Sleepdk_2k2002No ratings yet

- Deloitte Consulting India Private LimitedDocument2 pagesDeloitte Consulting India Private LimitedChinni SreenivasNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- TaxComputation SYEDL PUN0157 2023 2024Document2 pagesTaxComputation SYEDL PUN0157 2023 2024nitin patilNo ratings yet

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDocument1 page175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020No ratings yet

- PDF&Rendition 1Document2 pagesPDF&Rendition 1vijaybhaskar damireddyNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- Income Tax Calculation For The Period 01/04/2021 To 07/07/2021Document4 pagesIncome Tax Calculation For The Period 01/04/2021 To 07/07/2021Srinath AllaNo ratings yet

- Sampangi Sowbhagya (POL11622)Document1 pageSampangi Sowbhagya (POL11622)Sowbhagya VaderaNo ratings yet

- May 2019Document2 pagesMay 2019Vinodhkumar ShanmugamNo ratings yet

- May 2019 PDFDocument2 pagesMay 2019 PDFVinodhkumar ShanmugamNo ratings yet

- Zamil Information Technology Global Private Limited Pay Slip For The Month of SEP-2018Document1 pageZamil Information Technology Global Private Limited Pay Slip For The Month of SEP-2018vishalNo ratings yet

- EMP23 Tax Sheet Report202311152219Document2 pagesEMP23 Tax Sheet Report202311152219SoumyaranjanNo ratings yet

- Luminous Power Technologies Private Limited: Earnings DeductionsDocument1 pageLuminous Power Technologies Private Limited: Earnings Deductionssathish kumar.kNo ratings yet

- Telangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaDocument1 pageTelangana State Power Generation Corporation LTD Kothagudem Thermal Power Station: PalonchaKANNE NITHINNo ratings yet

- Draft ReportDocument8 pagesDraft Report0264192238No ratings yet

- Capgemini Technology Services India LimitedDocument2 pagesCapgemini Technology Services India LimitedFlawsome FoodsNo ratings yet

- ITCertificate PDFDocument2 pagesITCertificate PDFkumar praweenNo ratings yet

- It 2023 2024 7Document2 pagesIt 2023 2024 7luciferangellordNo ratings yet

- UntitledDocument4 pagesUntitledAnn LiNo ratings yet

- Statement of Salary As of 2019-08-2: Earnings DeductionsDocument1 pageStatement of Salary As of 2019-08-2: Earnings DeductionsHenry CagaNo ratings yet

- Irp0000006225 1Document1 pageIrp0000006225 1Devender RajuNo ratings yet

- Antony Alex A (V12112) - SeptemberDocument1 pageAntony Alex A (V12112) - SeptemberindianoxygenltdNo ratings yet

- Earning Heads (+) Eads Amount: Gross Salary: Deduction: Net SalaryDocument1 pageEarning Heads (+) Eads Amount: Gross Salary: Deduction: Net SalaryNeeraj BharadwajNo ratings yet

- Confidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerDocument1 pageConfidential: Infosys 29-08-2016 JUN 9 R Anvesh Banda 0 Designation Software EngineerAbdul Nayeem100% (1)

- JAN Payslip India-UnlockedDocument2 pagesJAN Payslip India-Unlockedbskapoor68No ratings yet

- 0 GPIND TMCGOFFOCT2022 V2 Gpinit01Document2 pages0 GPIND TMCGOFFOCT2022 V2 Gpinit01lakb5304No ratings yet

- Bose Payslip FebDocument1 pageBose Payslip FebThammineni Vishwanath Naidu100% (1)

- Cdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipDocument1 pageCdadc69d Bb7c 4a3d A96a 73cdebed7ab2 4e9a8540 62f6 4bd7 9ad1 Eb878cdb0d28 PayslipHenry CagaNo ratings yet

- HCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Document1 pageHCL Tech Ltd. - Iomc: Income Tax Computation Sheet Upto July - 2021Kittu SinghNo ratings yet

- Payslip Sep 2022Document1 pagePayslip Sep 2022GloryNo ratings yet

- 5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Document1 page5338 - September 2021 - P33MK3ZQEFJQM1AFODHYA3BR5477351240762656333113912Shreyash SahayNo ratings yet

- Details of Salary Paid and Any Other Income and Tax DeductedDocument3 pagesDetails of Salary Paid and Any Other Income and Tax DeductedRajesh KharmaleNo ratings yet

- ViewPDF Aspx PDFDocument1 pageViewPDF Aspx PDFSIBAPRASAD BHUNIANo ratings yet

- June 2022 - AjithkumarDocument1 pageJune 2022 - AjithkumarDharshan RajNo ratings yet

- Anwar Group of IndustriesDocument1 pageAnwar Group of IndustriesMoment RevealersNo ratings yet

- Presentación de Stefanini PDFDocument24 pagesPresentación de Stefanini PDFramontxu06No ratings yet

- Procedure For HORCM and RAIDCOMDocument4 pagesProcedure For HORCM and RAIDCOMdennisNo ratings yet

- Power Homes vs. SECDocument22 pagesPower Homes vs. SEChaileyraincloudNo ratings yet

- Sine Bar'Document6 pagesSine Bar'Jonathan PereiraNo ratings yet

- Practical Research 1 5Document36 pagesPractical Research 1 5Maria Cristina AldasNo ratings yet

- The Vivago Watch A Telecare Solution For Cost-Efficient CareDocument1 pageThe Vivago Watch A Telecare Solution For Cost-Efficient CareGeronTechnoPlatformNo ratings yet

- Robert Walters Salary SurveyDocument5 pagesRobert Walters Salary SurveySyaiful BahriNo ratings yet

- Download: Mosaic TechniquesDocument2 pagesDownload: Mosaic TechniquesJohnny LaounNo ratings yet

- Tugas GinjalDocument22 pagesTugas GinjalAnastasia MargaretNo ratings yet

- Tectonic Evolution of Mogok Metamorphic BeltDocument21 pagesTectonic Evolution of Mogok Metamorphic BeltOak KarNo ratings yet

- Name: Waguma Leticia: Jomo Kenyatta University of Agriculture and Technology Nakuru CampusDocument9 pagesName: Waguma Leticia: Jomo Kenyatta University of Agriculture and Technology Nakuru CampusWaguma LeticiaNo ratings yet

- SIP DAR Report SampleDocument150 pagesSIP DAR Report SampleSunil DixitNo ratings yet

- Democratic Life Skill 1Document1 pageDemocratic Life Skill 1andinurzamzamNo ratings yet

- 6 - Telephone and Cable Networks For Data TransmissionDocument31 pages6 - Telephone and Cable Networks For Data TransmissionpranjalcrackuNo ratings yet

- PO Lifecycle in SAPDocument76 pagesPO Lifecycle in SAPadwankarparagNo ratings yet

- Afn 2 PDFDocument5 pagesAfn 2 PDFLovely Ann ReyesNo ratings yet

- BBRIP - Monitoring ToolDocument2 pagesBBRIP - Monitoring ToolGeraldine N. VitoNo ratings yet

- Making Your Career Plan: Integration of Life Goals, Values, Personality, Skills and AptitudeDocument18 pagesMaking Your Career Plan: Integration of Life Goals, Values, Personality, Skills and AptitudeRoella Mae MalinaoNo ratings yet

- Extended Abstract Comparison of Effectiveness of The Various Species of Citrus' Peels As Styrofoam DecomposerDocument3 pagesExtended Abstract Comparison of Effectiveness of The Various Species of Citrus' Peels As Styrofoam DecomposerKen EzekielNo ratings yet

- Correlation 1Document9 pagesCorrelation 1Bharat ChaudharyNo ratings yet

- Melt Shop Ventilation Upgrade 2Document1 pageMelt Shop Ventilation Upgrade 2mshahNo ratings yet

- Curriculum Vitae of Supramaniyan KumarDocument4 pagesCurriculum Vitae of Supramaniyan KumarSupramaniyan kumarNo ratings yet

- Epidemiology Of: Milk-Borne DiseasesDocument13 pagesEpidemiology Of: Milk-Borne Diseasesabdulqudus abdulakeemNo ratings yet

- Rman Standby Copy-2Document8 pagesRman Standby Copy-2SHAHID FAROOQNo ratings yet

- Okra Group 3Document34 pagesOkra Group 3Vanessa Marie AgnerNo ratings yet

- Yanbu: Export Refinery ProjectDocument5 pagesYanbu: Export Refinery ProjectJanakiraman MalligaNo ratings yet

- SAARC Geophysics Course - KhalidDocument106 pagesSAARC Geophysics Course - KhalidWaqar Ahmed100% (2)