Professional Documents

Culture Documents

Sa302 2021

Sa302 2021

Uploaded by

Umt Kaya0 ratings0% found this document useful (0 votes)

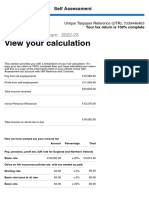

46 views1 pageMR H ZENCIRKIRAN earned £70,414 in total income in the 2020-21 tax year from employment pay, property profits, and other sources. After deducting his personal allowance of £12,500, his taxable income was £57,914. He was charged £15,665.60 in income tax on the first £37,500 at the basic rate of 20% and income between £37,500-£57,914 at the higher rate of 40%. An additional High Income Child Benefit Charge of £1,010 was also charged. His total income tax due was £12,854.60 after deducting £3,821 that was already taxed from his employments.

Original Description:

Original Title

SA302 2021

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentMR H ZENCIRKIRAN earned £70,414 in total income in the 2020-21 tax year from employment pay, property profits, and other sources. After deducting his personal allowance of £12,500, his taxable income was £57,914. He was charged £15,665.60 in income tax on the first £37,500 at the basic rate of 20% and income between £37,500-£57,914 at the higher rate of 40%. An additional High Income Child Benefit Charge of £1,010 was also charged. His total income tax due was £12,854.60 after deducting £3,821 that was already taxed from his employments.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

46 views1 pageSa302 2021

Sa302 2021

Uploaded by

Umt KayaMR H ZENCIRKIRAN earned £70,414 in total income in the 2020-21 tax year from employment pay, property profits, and other sources. After deducting his personal allowance of £12,500, his taxable income was £57,914. He was charged £15,665.60 in income tax on the first £37,500 at the basic rate of 20% and income between £37,500-£57,914 at the higher rate of 40%. An additional High Income Child Benefit Charge of £1,010 was also charged. His total income tax due was £12,854.60 after deducting £3,821 that was already taxed from his employments.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 1

Ref: 54008 51920

Year: 2021

OUID: 226701

Name: MR H ZENCIRKIRAN

Tax Calculation for 2020-21 (year ended 5 April 2021)

Income received (before tax taken off)

Pay from all employments £ 31,611.00

Profit from UK land and property £ 38,803.00

Total income received £ 70,414.00

minus Personal Allowance £ 12,500.00

Total income on which tax is due £ 57,914.00

How I have worked out your Income Tax

Pay, pensions, profit etc. (Welsh income tax rate)

Basic rate £ 37,500.00 x 20% = £ 7,500.00

Higher rate £ 20,414.00 x 40% = £ 8,165.60

Total income on which tax has been charged £ 57,914.00

Income Tax charged after allowances and reliefs £ 15,665.60

plus High Income Child Benefit Charge £ 1,010.00

Income Tax due £ 16,675.60

minus Tax deducted

From all employments, UK pensions and state benefits £ 3,821.00

Total tax deducted £ 3,821.00

Total Income Tax due £ 12,854.60

Page 1 of 1 Printed 27/07/2022

You might also like

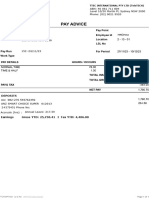

- Pay Stub Portal3Document1 pagePay Stub Portal3cwhite2150No ratings yet

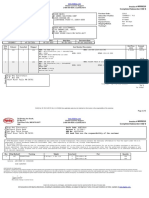

- S0-0341082251141 InvoiceDocument1 pageS0-0341082251141 InvoicemontajesbildexNo ratings yet

- LKQ Pick Your Parts-3.pdf - 20230919 - 035439 - 0000Document2 pagesLKQ Pick Your Parts-3.pdf - 20230919 - 035439 - 0000Ajmal FareedNo ratings yet

- Xero Payslip Template NZDocument1 pageXero Payslip Template NZTejNo ratings yet

- Fit NoteDocument1 pageFit NoteSammy RobertsNo ratings yet

- Annexure 1B PDFDocument1 pageAnnexure 1B PDFFolaNo ratings yet

- MYOB Payslip TemplateDocument1 pageMYOB Payslip Templatejack smith100% (1)

- Pay SlipDocument1 pagePay SlipSaiful IslamNo ratings yet

- Costel Mitrofan, SA Tax Return 1Document2 pagesCostel Mitrofan, SA Tax Return 1Flutur GavrilNo ratings yet

- Tax Return Rauol Moraru 22 23Document2 pagesTax Return Rauol Moraru 22 23severinco2017No ratings yet

- Payslip Mar 2024Document1 pagePayslip Mar 2024simplycreated931No ratings yet

- Sample Arlington Eversource Bill - Direct Energy RDocument2 pagesSample Arlington Eversource Bill - Direct Energy RtaiffourmohamedNo ratings yet

- Payslip Airen ObenzaDocument1 pagePayslip Airen Obenzamiss_airenNo ratings yet

- Agl BillDocument2 pagesAgl Billpeck.visperasNo ratings yet

- Get NoticeDocument3 pagesGet NoticeJo anne Jo anneNo ratings yet

- Lumo EnergyDocument3 pagesLumo Energychristos111999No ratings yet

- Epayslip 2024-01-26 11319801Document1 pageEpayslip 2024-01-26 11319801Anthony Balaba MabaoNo ratings yet

- Uk PayslipDocument1 pageUk PayslipEsidor PalushiNo ratings yet

- Salary Slip JulyDocument1 pageSalary Slip Julyankurrawat693No ratings yet

- Pay SlipDocument1 pagePay SlipAzhari NugrahaNo ratings yet

- Statement2023 PDFDocument2 pagesStatement2023 PDFkayrincoddington2424No ratings yet

- Payslip - 2021 06 30Document1 pagePayslip - 2021 06 30mateivalentin94No ratings yet

- Statement 445Document4 pagesStatement 445yarec79954No ratings yet

- Wells FargoDocument4 pagesWells Fargoraheemtimo1No ratings yet

- 604673792 (1)Document22 pages604673792 (1)shakeyjakeycoppin93No ratings yet

- Hi Andini, Here's Your Bill: Page 1 of 3Document3 pagesHi Andini, Here's Your Bill: Page 1 of 3Sonya DindaNo ratings yet

- Epayslip 2022-11-25 25018077Document1 pageEpayslip 2022-11-25 25018077saintpalmers2012No ratings yet

- Pay Stub - 2 - 28 - 2020Document1 pagePay Stub - 2 - 28 - 2020mtjoya09No ratings yet

- Earnings Statement: Tamika S Jackson 373 S Canal Street APT K3 Canton, MS 39046Document1 pageEarnings Statement: Tamika S Jackson 373 S Canal Street APT K3 Canton, MS 39046tamika jacksonNo ratings yet

- Payslips 29 Apr 2023 PDFDocument26 pagesPayslips 29 Apr 2023 PDFJosh Johnston100% (1)

- Salary Slip (30385759 November, 2019)Document1 pageSalary Slip (30385759 November, 2019)munafNo ratings yet

- Putorik Martin: Basic Double Time Night Allowanc 631.90 184.60 61.41Document1 pagePutorik Martin: Basic Double Time Night Allowanc 631.90 184.60 61.41Martin RotupNo ratings yet

- View Payslip: Personal Information Job InformationDocument1 pageView Payslip: Personal Information Job InformationJeffreyNo ratings yet

- Payslip 2711-1012Document1 pagePayslip 2711-1012vando19081943No ratings yet

- Pay Details: 250655 First National Bank - Central Branch Code 62757691160 Current 29,444.07Document1 pagePay Details: 250655 First National Bank - Central Branch Code 62757691160 Current 29,444.07Tyelovuyo Charles JahoNo ratings yet

- 2203 PCDocument21 pages2203 PCAdvance Microsoft ExcelNo ratings yet

- Personal Current Account StatementDocument12 pagesPersonal Current Account StatementMedina SmajliNo ratings yet

- USA Electric - ORIGINALDocument1 pageUSA Electric - ORIGINALnguyen tungNo ratings yet

- Private & Confidential: Re: Your Medical Card ApplicationDocument7 pagesPrivate & Confidential: Re: Your Medical Card ApplicationjulieannagormanNo ratings yet

- Property Tax Statement Fri Oct 07 2022Document2 pagesProperty Tax Statement Fri Oct 07 2022trungNo ratings yet

- Pay SlipDocument1 pagePay Slipwilaiketngam15No ratings yet

- Description Amount Description AmountDocument3 pagesDescription Amount Description AmountlakshmikanthNo ratings yet

- Customer Service Information: Account Number: 41030472867996Document2 pagesCustomer Service Information: Account Number: 41030472867996Jam GarciaNo ratings yet

- Pay SlipDocument1 pagePay Slipraj Kumar Thapa chhetriNo ratings yet

- Declaration Page Sample Homeowners 12Document1 pageDeclaration Page Sample Homeowners 12Keller Brown JnrNo ratings yet

- SCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - RedactedDocument1 pageSCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - Redactedlarry-612445No ratings yet

- SBI Card Statement - 4977 - 18-11-2023Document7 pagesSBI Card Statement - 4977 - 18-11-2023chagusahoo170No ratings yet

- Salary Slip (31221188 June, 2019)Document1 pageSalary Slip (31221188 June, 2019)ahmed aliNo ratings yet

- Previous Salary SlipDocument4 pagesPrevious Salary Slipmadhavradha4chaldaNo ratings yet

- Frederick's Account Statement 3Document5 pagesFrederick's Account Statement 3Ardan DiazNo ratings yet

- U.S. Individual Income Tax Return: Filing StatusDocument2 pagesU.S. Individual Income Tax Return: Filing StatusCoen WalterNo ratings yet

- Tax Invoice For: Your Telstra BillDocument3 pagesTax Invoice For: Your Telstra BillPeter SmythNo ratings yet

- Signal 2023 05 20 135538Document5 pagesSignal 2023 05 20 135538Shahid NadeemNo ratings yet

- Epayslip 2023-06-26 31007704Document1 pageEpayslip 2023-06-26 31007704mtogooNo ratings yet

- UntitledDocument1 pageUntitledmateivalentin94No ratings yet

- PL1 22912 1316456 9776899 Net 30 Days XGT 561083721466Document2 pagesPL1 22912 1316456 9776899 Net 30 Days XGT 561083721466RuodNo ratings yet

- Freelancer Profile: Name Title Upwork Profile URL Active On Upwork Since AddressDocument1 pageFreelancer Profile: Name Title Upwork Profile URL Active On Upwork Since AddressEmran Khan NiloyNo ratings yet

- 6670 Alexis 12-30-2022Document1 page6670 Alexis 12-30-2022Nego da NagaNo ratings yet

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDocument1 pageFixedline and Broadband Services: Your Account Summary This Month'S ChargesMòhámêd ÑayēēmNo ratings yet

- Answers: Tuition (Course) ExaminationDocument16 pagesAnswers: Tuition (Course) ExaminationHussein SeetalNo ratings yet