Professional Documents

Culture Documents

Reflection Paper 3 - Bordadora

Reflection Paper 3 - Bordadora

Uploaded by

Bea BordadoraCopyright:

Available Formats

You might also like

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (19)

- Luis Barragán, de Antonio RiggenDocument83 pagesLuis Barragán, de Antonio RiggenJorge Octavio Ocaranza VelascoNo ratings yet

- Budgeting 101: From Getting Out of Debt and Tracking Expenses to Setting Financial Goals and Building Your Savings, Your Essential Guide to BudgetingFrom EverandBudgeting 101: From Getting Out of Debt and Tracking Expenses to Setting Financial Goals and Building Your Savings, Your Essential Guide to BudgetingRating: 4 out of 5 stars4/5 (11)

- Reading Exercise 1Document5 pagesReading Exercise 1Ghazy Muammar Fawwaz Fawwaz67% (3)

- The Cost of Money: How to Manage Expenses Without Sacrificing Your HappinessFrom EverandThe Cost of Money: How to Manage Expenses Without Sacrificing Your HappinessNo ratings yet

- The Forex Scalping Beginner Book - The Easy, High Profit Probability Secret Trading System Explained In Simple TermsFrom EverandThe Forex Scalping Beginner Book - The Easy, High Profit Probability Secret Trading System Explained In Simple TermsRating: 2.5 out of 5 stars2.5/5 (2)

- Knowledge Creation in Public Administrations PDFDocument348 pagesKnowledge Creation in Public Administrations PDFPreciosaAngelaMaiquezNo ratings yet

- Financial Budgeting Learn How To Manage Your Money, Spending, Savings, Credit Card Debt And Strategies To Increase Your WealthFrom EverandFinancial Budgeting Learn How To Manage Your Money, Spending, Savings, Credit Card Debt And Strategies To Increase Your WealthRating: 5 out of 5 stars5/5 (103)

- Minimalist Budget: Everything You Need To Know About Saving Money, Spending Less And Decluttering Your Finances With Smart Money Management Strategies: Declutter Your Life 3From EverandMinimalist Budget: Everything You Need To Know About Saving Money, Spending Less And Decluttering Your Finances With Smart Money Management Strategies: Declutter Your Life 3Rating: 5 out of 5 stars5/5 (1)

- How to Create a Family Budget in 48Hrs or Less: Discover the Simple Steps of Planning Your Money to Save Your Home from Financial CrisesFrom EverandHow to Create a Family Budget in 48Hrs or Less: Discover the Simple Steps of Planning Your Money to Save Your Home from Financial CrisesNo ratings yet

- Minimalist Budget: Everything You Need To Know About Saving Money, Spending Less And Decluttering Your Finances With Smart Money Management StrategiesFrom EverandMinimalist Budget: Everything You Need To Know About Saving Money, Spending Less And Decluttering Your Finances With Smart Money Management StrategiesRating: 5 out of 5 stars5/5 (1)

- Count The CostDocument5 pagesCount The CostciprianNo ratings yet

- SURVIVING ON A DIET HOME BUDGET: Practical Tips and Delicious Recipes for Eating Healthy on a Tight Budget (2023 Guide for Beginners)From EverandSURVIVING ON A DIET HOME BUDGET: Practical Tips and Delicious Recipes for Eating Healthy on a Tight Budget (2023 Guide for Beginners)No ratings yet

- What Steps Can Be Taken To Ensure Financial Well 2Document3 pagesWhat Steps Can Be Taken To Ensure Financial Well 2sim zhenzheNo ratings yet

- A Complete Guide To Your Personal Finance How to Use Your Money and Other Resources to Achieve The Happiness You Want In Your LifeFrom EverandA Complete Guide To Your Personal Finance How to Use Your Money and Other Resources to Achieve The Happiness You Want In Your LifeNo ratings yet

- Living Well, Spending Wisely: Maximizing Happiness with Less IncomeFrom EverandLiving Well, Spending Wisely: Maximizing Happiness with Less IncomeNo ratings yet

- Your Money Mind: Setting Financial Goals to Manage Money BetterFrom EverandYour Money Mind: Setting Financial Goals to Manage Money BetterNo ratings yet

- BudgetDocument3 pagesBudgetChatter SinghNo ratings yet

- Financial Independence For Life After RetirementDocument2 pagesFinancial Independence For Life After RetirementSweeny DiasNo ratings yet

- Money Management Skills: A Beginners Guide On Personal Finance And Living Debt FreeFrom EverandMoney Management Skills: A Beginners Guide On Personal Finance And Living Debt FreeNo ratings yet

- La Guía del Dinero: 2 Libros en 1 - Cómo Administrar tu Dinero y Cómo Invertir tu DineroFrom EverandLa Guía del Dinero: 2 Libros en 1 - Cómo Administrar tu Dinero y Cómo Invertir tu DineroNo ratings yet

- Explanation Spending - Is An Act of Disbursing Money or Paglalabas Mo NG Pera Sa Mga Bagay Na Gusto MoDocument3 pagesExplanation Spending - Is An Act of Disbursing Money or Paglalabas Mo NG Pera Sa Mga Bagay Na Gusto MoKurt Russelle PelinioNo ratings yet

- Financial Freedom Discover How To Organize Your Finances To Create Healthy Financial HabitsFrom EverandFinancial Freedom Discover How To Organize Your Finances To Create Healthy Financial HabitsNo ratings yet

- Pfinance ReflectionDocument2 pagesPfinance ReflectionRaizamae ArizoNo ratings yet

- Research Paper Personal Financial ManagementDocument5 pagesResearch Paper Personal Financial Managementpoojagopwani3413No ratings yet

- Money Management: Managing Your Money The Correct WayFrom EverandMoney Management: Managing Your Money The Correct WayRating: 3 out of 5 stars3/5 (1)

- 3Document3 pages3Arfan b. Abu YazidNo ratings yet

- How to Stop Living Paycheck to Paycheck: How to take control of your money and your financial freedom starting today Volume 1From EverandHow to Stop Living Paycheck to Paycheck: How to take control of your money and your financial freedom starting today Volume 1No ratings yet

- HOW TO LIVE ON MINIMUM WAGE: Practical Tips and Strategies for Surviving on a Tight Budget (2023 Guide for Beginners)From EverandHOW TO LIVE ON MINIMUM WAGE: Practical Tips and Strategies for Surviving on a Tight Budget (2023 Guide for Beginners)No ratings yet

- Revised Debate SpeechDocument2 pagesRevised Debate SpeechJay Guiyab UmacamNo ratings yet

- The Power of Positive Thinking: A Guide to Using the Law of Attraction in Everyday LifeFrom EverandThe Power of Positive Thinking: A Guide to Using the Law of Attraction in Everyday LifeNo ratings yet

- Ifp 1 Introduction To Financial PlanningDocument5 pagesIfp 1 Introduction To Financial PlanningSukumarNo ratings yet

- Ifp 1 Introduction To Financial Planning PDFDocument5 pagesIfp 1 Introduction To Financial Planning PDFIMS ProschoolNo ratings yet

- Financial Planning & Investment Management - ItmDocument128 pagesFinancial Planning & Investment Management - ItmNaishrati SoniNo ratings yet

- Setting Achieving: Financial Goal$Document8 pagesSetting Achieving: Financial Goal$anandpurushothamanNo ratings yet

- Personal Budget Guide: Creating a Budget and Sticking to ItFrom EverandPersonal Budget Guide: Creating a Budget and Sticking to ItRating: 3 out of 5 stars3/5 (1)

- Untitled DocumentDocument2 pagesUntitled DocumentNatalie CruzNo ratings yet

- The Money Blueprint: Uncovering the Secrets to Building WealthFrom EverandThe Money Blueprint: Uncovering the Secrets to Building WealthNo ratings yet

- BE - Module 13Document18 pagesBE - Module 13Rifna SulistyaniNo ratings yet

- Budget Like a Boss: Take Control of Your Finances with Simple Budgeting and Saving StrategiesFrom EverandBudget Like a Boss: Take Control of Your Finances with Simple Budgeting and Saving StrategiesNo ratings yet

- Un curso de finanzas personales: Descubre Como ser más Frutal y a Ahorrar y a Invertir tu Dinero, Incluso si estás Empezando desde Cero. Incluye 2 Libros- Cómo Lograr el Control Absoluto sobre tus Gastos y Dinero, La Guía para Invertir que Cualquiera pueda UsarFrom EverandUn curso de finanzas personales: Descubre Como ser más Frutal y a Ahorrar y a Invertir tu Dinero, Incluso si estás Empezando desde Cero. Incluye 2 Libros- Cómo Lograr el Control Absoluto sobre tus Gastos y Dinero, La Guía para Invertir que Cualquiera pueda UsarRating: 4.5 out of 5 stars4.5/5 (2)

- Retirement Planning for Beginners: A Comprehensive Guide to Building Savings, Maximizing Income, and Achieving Financial Security for Your Golden Years: Financial Planning Essentials, #1From EverandRetirement Planning for Beginners: A Comprehensive Guide to Building Savings, Maximizing Income, and Achieving Financial Security for Your Golden Years: Financial Planning Essentials, #1No ratings yet

- Ingilis Dili Serbest MovzuDocument11 pagesIngilis Dili Serbest MovzuAsim NovruzovNo ratings yet

- Act 1 - Personal Finance - Rica S MendozaDocument2 pagesAct 1 - Personal Finance - Rica S Mendozariri mNo ratings yet

- Enjoy The Journey: Successful Retirement Strategies and StoriesFrom EverandEnjoy The Journey: Successful Retirement Strategies and StoriesNo ratings yet

- The Art of Extreme Budgeting: How to Live on Almost Nothing and ThriveFrom EverandThe Art of Extreme Budgeting: How to Live on Almost Nothing and ThriveNo ratings yet

- Budgeting 101: Expert Strategies to Manage Your Personal FinancesFrom EverandBudgeting 101: Expert Strategies to Manage Your Personal FinancesNo ratings yet

- A Joosr Guide to... Living Forward by Michael Hyatt and Daniel Harkavy: A Proven Plan to Stop Drifting and Get the Life You WantFrom EverandA Joosr Guide to... Living Forward by Michael Hyatt and Daniel Harkavy: A Proven Plan to Stop Drifting and Get the Life You WantRating: 5 out of 5 stars5/5 (1)

- Mastering Family Finances: The Family Budgeting Crash CourseFrom EverandMastering Family Finances: The Family Budgeting Crash CourseRating: 4 out of 5 stars4/5 (1)

- PFP Retirement Planning Unit 3 Bba IIIDocument13 pagesPFP Retirement Planning Unit 3 Bba IIIRaghuNo ratings yet

- TN Rana Kar Mmhoa Research Statistics Sundays 30jul2023Document2 pagesTN Rana Kar Mmhoa Research Statistics Sundays 30jul2023Bea BordadoraNo ratings yet

- Migrats DraftDocument9 pagesMigrats DraftBea BordadoraNo ratings yet

- BORDADORA-Assignment 3Document3 pagesBORDADORA-Assignment 3Bea BordadoraNo ratings yet

- Bordadora - Current EventsDocument3 pagesBordadora - Current EventsBea BordadoraNo ratings yet

- Human Rights Abuses of The Marcos DictatorshipDocument4 pagesHuman Rights Abuses of The Marcos DictatorshipBea BordadoraNo ratings yet

- Martial Law ImpositionDocument3 pagesMartial Law ImpositionBea BordadoraNo ratings yet

- MigrationDocument13 pagesMigrationBea BordadoraNo ratings yet

- The Historical Context of US Foreign Policy (Raw Outline)Document18 pagesThe Historical Context of US Foreign Policy (Raw Outline)Bea BordadoraNo ratings yet

- Environmental ProtectionDocument1 pageEnvironmental ProtectionBea BordadoraNo ratings yet

- Crochet Bikini AdriaDocument5 pagesCrochet Bikini AdriaSera Le-Jimmne100% (2)

- المؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةDocument16 pagesالمؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةoussama bekhitNo ratings yet

- City of Tampa Disparity Study Report 050206 - Vol - 1Document102 pagesCity of Tampa Disparity Study Report 050206 - Vol - 1AsanijNo ratings yet

- (With Script) June 2021 Saturday WSF Teaching GuideDocument3 pages(With Script) June 2021 Saturday WSF Teaching GuideMichael T. BelloNo ratings yet

- Frank Lloyd WrightDocument16 pagesFrank Lloyd WrightKhiZra ShahZadNo ratings yet

- ResearchGate PDFDocument3 pagesResearchGate PDFAmrinder SharmaNo ratings yet

- Bromberger & Halle 89 - Why Phonology Is DifferentDocument20 pagesBromberger & Halle 89 - Why Phonology Is DifferentamirzetzNo ratings yet

- ThesisDocument13 pagesThesiszavia_02No ratings yet

- MCQ-Environmental StudiesDocument45 pagesMCQ-Environmental StudiesShabana Yasmin67% (6)

- Corporate Tax - UAEDocument48 pagesCorporate Tax - UAEUmair BaigNo ratings yet

- Group 2 (Money Market)Document28 pagesGroup 2 (Money Market)Abdullah Al NomanNo ratings yet

- ITE403 Information Security Worksheet T-2 PUBLIC KEY ENCRYPTION With RSA SPRING2020Document5 pagesITE403 Information Security Worksheet T-2 PUBLIC KEY ENCRYPTION With RSA SPRING2020Aws FaeqNo ratings yet

- Cell Discovery & Cell TheoryDocument24 pagesCell Discovery & Cell TheoryFIGHTING TAYKINo ratings yet

- A Concept Paper About LoveDocument5 pagesA Concept Paper About LoveStephen Rivera100% (1)

- DB (04.2013) HiromiDocument7 pagesDB (04.2013) HiromiLew Quzmic Baltiysky75% (4)

- SpencerDocument34 pagesSpencervenkatteja75No ratings yet

- Ingles De, I PaaaaaaaaaaaaaaaDocument20 pagesIngles De, I PaaaaaaaaaaaaaaaJaz PintoNo ratings yet

- Celebrating The Third Place Inspiring Stories About The Great Good Places at The Heart of Our Communities (Oldenburg, Ray) (Z-Library)Document210 pagesCelebrating The Third Place Inspiring Stories About The Great Good Places at The Heart of Our Communities (Oldenburg, Ray) (Z-Library)ferialNo ratings yet

- Sew Infrastructure 1 Ebs Case Study 214465Document6 pagesSew Infrastructure 1 Ebs Case Study 214465Arun BatraNo ratings yet

- Banking Law On Secrecy of Bank DepositsDocument29 pagesBanking Law On Secrecy of Bank DepositsbrendamanganaanNo ratings yet

- PROCEEDINGS of The Numismatic and Antiquarian Society of PhiladelphiaDocument304 pagesPROCEEDINGS of The Numismatic and Antiquarian Society of PhiladelphiaRichard CastorNo ratings yet

- Soal Kalimat Prohibition SMP Kelas 7Document3 pagesSoal Kalimat Prohibition SMP Kelas 7yura chanNo ratings yet

- Moyang 2007Document11 pagesMoyang 2007Clarina TitusNo ratings yet

- Evaluating Tilting Pad - PaperDocument10 pagesEvaluating Tilting Pad - PaperAsit SuyalNo ratings yet

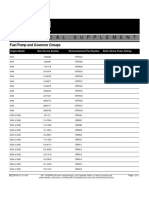

- FuelPump&GovernorGroups SELD0135 11Document11 pagesFuelPump&GovernorGroups SELD0135 11narit00007No ratings yet

- PHD Thesis Library Science DownloadDocument8 pagesPHD Thesis Library Science Downloadyvrpugvcf100% (2)

- AppsDocument6 pagesAppsxxres4lifexxNo ratings yet

Reflection Paper 3 - Bordadora

Reflection Paper 3 - Bordadora

Uploaded by

Bea BordadoraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Reflection Paper 3 - Bordadora

Reflection Paper 3 - Bordadora

Uploaded by

Bea BordadoraCopyright:

Available Formats

BORDADORA, Ma. Kristina Beatrice T.

OTGE3

The things that we want in life are oftentimes too out of reach or too much for our current

status in life. We tend to dream too much and oftentimes be disappointed when we do not reach

the things that we want to buy or own. It is important to keep our financial goals realistic so as to

not reach for the stars when we want to buy certain things that may not be part of our needs, but

only on our wants. The reason for this is because having goals and planning the right way for us

to reach them is a major factor of having a successful financial plan. It is imperative that we are

able to distinguish what our aspirations are from our fantasies. These are not only regarding the

things that we want to buy, but also include our future life, may it be when we start to work,

continue to pursue further education, start having a family and many more.

With this being said, our life aspirations should always be anchored on our financial

goals mainly because in every thing that we do, we must make sure that it is perfectly managed

and budgeted as we do not know what may happen in our lives. In addition, we must have a

budget as a way to see which of our money would be going straightly to the bills that we are

paying, the things that we want to buy, and for the extras that we may be using for our own

personal needs and expenses. We must also make sure that we record our spending every time

we get our salaries as a way to know whether we are overspending or not. Lastly, we must

anticipate future bills that we may be needing to save up on to make sure that we do not find

ourselves in a predicament when we are not able to pay for such bills. Being able to plan our

everyday finances would allow us to make decisions that would able to help us achieve our

goals in our life, and if we continue to just spend money without worrying about the future that

would just continue to lead us to a life wherein we are not able to spend money wisely and may

lead us to bankruptcy or other situations. Having short term and long term goals are also

included in this scenario because once we have a goal that we want to achieve we can better

allocate our resources and money in making sure that it is perfectly balanced to what we need

for the future and for our present days.

In summation, being financially literate would allow us to be smart and successful in

achieving our goals because we are able to balance and manage our money without sacrificing

what is needed to be saved to make sure that we are prepared for whatever calamity may come

in our lives such as emergencies. Perfectly planning out our goals and money would make sure

that we are able to financially save and spend on our money wisely.

You might also like

- Personal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationFrom EverandPersonal Finance for Beginners - A Simple Guide to Take Control of Your Financial SituationRating: 4.5 out of 5 stars4.5/5 (19)

- Luis Barragán, de Antonio RiggenDocument83 pagesLuis Barragán, de Antonio RiggenJorge Octavio Ocaranza VelascoNo ratings yet

- Budgeting 101: From Getting Out of Debt and Tracking Expenses to Setting Financial Goals and Building Your Savings, Your Essential Guide to BudgetingFrom EverandBudgeting 101: From Getting Out of Debt and Tracking Expenses to Setting Financial Goals and Building Your Savings, Your Essential Guide to BudgetingRating: 4 out of 5 stars4/5 (11)

- Reading Exercise 1Document5 pagesReading Exercise 1Ghazy Muammar Fawwaz Fawwaz67% (3)

- The Cost of Money: How to Manage Expenses Without Sacrificing Your HappinessFrom EverandThe Cost of Money: How to Manage Expenses Without Sacrificing Your HappinessNo ratings yet

- The Forex Scalping Beginner Book - The Easy, High Profit Probability Secret Trading System Explained In Simple TermsFrom EverandThe Forex Scalping Beginner Book - The Easy, High Profit Probability Secret Trading System Explained In Simple TermsRating: 2.5 out of 5 stars2.5/5 (2)

- Knowledge Creation in Public Administrations PDFDocument348 pagesKnowledge Creation in Public Administrations PDFPreciosaAngelaMaiquezNo ratings yet

- Financial Budgeting Learn How To Manage Your Money, Spending, Savings, Credit Card Debt And Strategies To Increase Your WealthFrom EverandFinancial Budgeting Learn How To Manage Your Money, Spending, Savings, Credit Card Debt And Strategies To Increase Your WealthRating: 5 out of 5 stars5/5 (103)

- Minimalist Budget: Everything You Need To Know About Saving Money, Spending Less And Decluttering Your Finances With Smart Money Management Strategies: Declutter Your Life 3From EverandMinimalist Budget: Everything You Need To Know About Saving Money, Spending Less And Decluttering Your Finances With Smart Money Management Strategies: Declutter Your Life 3Rating: 5 out of 5 stars5/5 (1)

- How to Create a Family Budget in 48Hrs or Less: Discover the Simple Steps of Planning Your Money to Save Your Home from Financial CrisesFrom EverandHow to Create a Family Budget in 48Hrs or Less: Discover the Simple Steps of Planning Your Money to Save Your Home from Financial CrisesNo ratings yet

- Minimalist Budget: Everything You Need To Know About Saving Money, Spending Less And Decluttering Your Finances With Smart Money Management StrategiesFrom EverandMinimalist Budget: Everything You Need To Know About Saving Money, Spending Less And Decluttering Your Finances With Smart Money Management StrategiesRating: 5 out of 5 stars5/5 (1)

- Count The CostDocument5 pagesCount The CostciprianNo ratings yet

- SURVIVING ON A DIET HOME BUDGET: Practical Tips and Delicious Recipes for Eating Healthy on a Tight Budget (2023 Guide for Beginners)From EverandSURVIVING ON A DIET HOME BUDGET: Practical Tips and Delicious Recipes for Eating Healthy on a Tight Budget (2023 Guide for Beginners)No ratings yet

- What Steps Can Be Taken To Ensure Financial Well 2Document3 pagesWhat Steps Can Be Taken To Ensure Financial Well 2sim zhenzheNo ratings yet

- A Complete Guide To Your Personal Finance How to Use Your Money and Other Resources to Achieve The Happiness You Want In Your LifeFrom EverandA Complete Guide To Your Personal Finance How to Use Your Money and Other Resources to Achieve The Happiness You Want In Your LifeNo ratings yet

- Living Well, Spending Wisely: Maximizing Happiness with Less IncomeFrom EverandLiving Well, Spending Wisely: Maximizing Happiness with Less IncomeNo ratings yet

- Your Money Mind: Setting Financial Goals to Manage Money BetterFrom EverandYour Money Mind: Setting Financial Goals to Manage Money BetterNo ratings yet

- BudgetDocument3 pagesBudgetChatter SinghNo ratings yet

- Financial Independence For Life After RetirementDocument2 pagesFinancial Independence For Life After RetirementSweeny DiasNo ratings yet

- Money Management Skills: A Beginners Guide On Personal Finance And Living Debt FreeFrom EverandMoney Management Skills: A Beginners Guide On Personal Finance And Living Debt FreeNo ratings yet

- La Guía del Dinero: 2 Libros en 1 - Cómo Administrar tu Dinero y Cómo Invertir tu DineroFrom EverandLa Guía del Dinero: 2 Libros en 1 - Cómo Administrar tu Dinero y Cómo Invertir tu DineroNo ratings yet

- Explanation Spending - Is An Act of Disbursing Money or Paglalabas Mo NG Pera Sa Mga Bagay Na Gusto MoDocument3 pagesExplanation Spending - Is An Act of Disbursing Money or Paglalabas Mo NG Pera Sa Mga Bagay Na Gusto MoKurt Russelle PelinioNo ratings yet

- Financial Freedom Discover How To Organize Your Finances To Create Healthy Financial HabitsFrom EverandFinancial Freedom Discover How To Organize Your Finances To Create Healthy Financial HabitsNo ratings yet

- Pfinance ReflectionDocument2 pagesPfinance ReflectionRaizamae ArizoNo ratings yet

- Research Paper Personal Financial ManagementDocument5 pagesResearch Paper Personal Financial Managementpoojagopwani3413No ratings yet

- Money Management: Managing Your Money The Correct WayFrom EverandMoney Management: Managing Your Money The Correct WayRating: 3 out of 5 stars3/5 (1)

- 3Document3 pages3Arfan b. Abu YazidNo ratings yet

- How to Stop Living Paycheck to Paycheck: How to take control of your money and your financial freedom starting today Volume 1From EverandHow to Stop Living Paycheck to Paycheck: How to take control of your money and your financial freedom starting today Volume 1No ratings yet

- HOW TO LIVE ON MINIMUM WAGE: Practical Tips and Strategies for Surviving on a Tight Budget (2023 Guide for Beginners)From EverandHOW TO LIVE ON MINIMUM WAGE: Practical Tips and Strategies for Surviving on a Tight Budget (2023 Guide for Beginners)No ratings yet

- Revised Debate SpeechDocument2 pagesRevised Debate SpeechJay Guiyab UmacamNo ratings yet

- The Power of Positive Thinking: A Guide to Using the Law of Attraction in Everyday LifeFrom EverandThe Power of Positive Thinking: A Guide to Using the Law of Attraction in Everyday LifeNo ratings yet

- Ifp 1 Introduction To Financial PlanningDocument5 pagesIfp 1 Introduction To Financial PlanningSukumarNo ratings yet

- Ifp 1 Introduction To Financial Planning PDFDocument5 pagesIfp 1 Introduction To Financial Planning PDFIMS ProschoolNo ratings yet

- Financial Planning & Investment Management - ItmDocument128 pagesFinancial Planning & Investment Management - ItmNaishrati SoniNo ratings yet

- Setting Achieving: Financial Goal$Document8 pagesSetting Achieving: Financial Goal$anandpurushothamanNo ratings yet

- Personal Budget Guide: Creating a Budget and Sticking to ItFrom EverandPersonal Budget Guide: Creating a Budget and Sticking to ItRating: 3 out of 5 stars3/5 (1)

- Untitled DocumentDocument2 pagesUntitled DocumentNatalie CruzNo ratings yet

- The Money Blueprint: Uncovering the Secrets to Building WealthFrom EverandThe Money Blueprint: Uncovering the Secrets to Building WealthNo ratings yet

- BE - Module 13Document18 pagesBE - Module 13Rifna SulistyaniNo ratings yet

- Budget Like a Boss: Take Control of Your Finances with Simple Budgeting and Saving StrategiesFrom EverandBudget Like a Boss: Take Control of Your Finances with Simple Budgeting and Saving StrategiesNo ratings yet

- Un curso de finanzas personales: Descubre Como ser más Frutal y a Ahorrar y a Invertir tu Dinero, Incluso si estás Empezando desde Cero. Incluye 2 Libros- Cómo Lograr el Control Absoluto sobre tus Gastos y Dinero, La Guía para Invertir que Cualquiera pueda UsarFrom EverandUn curso de finanzas personales: Descubre Como ser más Frutal y a Ahorrar y a Invertir tu Dinero, Incluso si estás Empezando desde Cero. Incluye 2 Libros- Cómo Lograr el Control Absoluto sobre tus Gastos y Dinero, La Guía para Invertir que Cualquiera pueda UsarRating: 4.5 out of 5 stars4.5/5 (2)

- Retirement Planning for Beginners: A Comprehensive Guide to Building Savings, Maximizing Income, and Achieving Financial Security for Your Golden Years: Financial Planning Essentials, #1From EverandRetirement Planning for Beginners: A Comprehensive Guide to Building Savings, Maximizing Income, and Achieving Financial Security for Your Golden Years: Financial Planning Essentials, #1No ratings yet

- Ingilis Dili Serbest MovzuDocument11 pagesIngilis Dili Serbest MovzuAsim NovruzovNo ratings yet

- Act 1 - Personal Finance - Rica S MendozaDocument2 pagesAct 1 - Personal Finance - Rica S Mendozariri mNo ratings yet

- Enjoy The Journey: Successful Retirement Strategies and StoriesFrom EverandEnjoy The Journey: Successful Retirement Strategies and StoriesNo ratings yet

- The Art of Extreme Budgeting: How to Live on Almost Nothing and ThriveFrom EverandThe Art of Extreme Budgeting: How to Live on Almost Nothing and ThriveNo ratings yet

- Budgeting 101: Expert Strategies to Manage Your Personal FinancesFrom EverandBudgeting 101: Expert Strategies to Manage Your Personal FinancesNo ratings yet

- A Joosr Guide to... Living Forward by Michael Hyatt and Daniel Harkavy: A Proven Plan to Stop Drifting and Get the Life You WantFrom EverandA Joosr Guide to... Living Forward by Michael Hyatt and Daniel Harkavy: A Proven Plan to Stop Drifting and Get the Life You WantRating: 5 out of 5 stars5/5 (1)

- Mastering Family Finances: The Family Budgeting Crash CourseFrom EverandMastering Family Finances: The Family Budgeting Crash CourseRating: 4 out of 5 stars4/5 (1)

- PFP Retirement Planning Unit 3 Bba IIIDocument13 pagesPFP Retirement Planning Unit 3 Bba IIIRaghuNo ratings yet

- TN Rana Kar Mmhoa Research Statistics Sundays 30jul2023Document2 pagesTN Rana Kar Mmhoa Research Statistics Sundays 30jul2023Bea BordadoraNo ratings yet

- Migrats DraftDocument9 pagesMigrats DraftBea BordadoraNo ratings yet

- BORDADORA-Assignment 3Document3 pagesBORDADORA-Assignment 3Bea BordadoraNo ratings yet

- Bordadora - Current EventsDocument3 pagesBordadora - Current EventsBea BordadoraNo ratings yet

- Human Rights Abuses of The Marcos DictatorshipDocument4 pagesHuman Rights Abuses of The Marcos DictatorshipBea BordadoraNo ratings yet

- Martial Law ImpositionDocument3 pagesMartial Law ImpositionBea BordadoraNo ratings yet

- MigrationDocument13 pagesMigrationBea BordadoraNo ratings yet

- The Historical Context of US Foreign Policy (Raw Outline)Document18 pagesThe Historical Context of US Foreign Policy (Raw Outline)Bea BordadoraNo ratings yet

- Environmental ProtectionDocument1 pageEnvironmental ProtectionBea BordadoraNo ratings yet

- Crochet Bikini AdriaDocument5 pagesCrochet Bikini AdriaSera Le-Jimmne100% (2)

- المؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةDocument16 pagesالمؤسسات الناشئة وامكانيات النمو-دراسة في انشاء حاضنات الأعمال لمرافقة المشروعات الناشئةoussama bekhitNo ratings yet

- City of Tampa Disparity Study Report 050206 - Vol - 1Document102 pagesCity of Tampa Disparity Study Report 050206 - Vol - 1AsanijNo ratings yet

- (With Script) June 2021 Saturday WSF Teaching GuideDocument3 pages(With Script) June 2021 Saturday WSF Teaching GuideMichael T. BelloNo ratings yet

- Frank Lloyd WrightDocument16 pagesFrank Lloyd WrightKhiZra ShahZadNo ratings yet

- ResearchGate PDFDocument3 pagesResearchGate PDFAmrinder SharmaNo ratings yet

- Bromberger & Halle 89 - Why Phonology Is DifferentDocument20 pagesBromberger & Halle 89 - Why Phonology Is DifferentamirzetzNo ratings yet

- ThesisDocument13 pagesThesiszavia_02No ratings yet

- MCQ-Environmental StudiesDocument45 pagesMCQ-Environmental StudiesShabana Yasmin67% (6)

- Corporate Tax - UAEDocument48 pagesCorporate Tax - UAEUmair BaigNo ratings yet

- Group 2 (Money Market)Document28 pagesGroup 2 (Money Market)Abdullah Al NomanNo ratings yet

- ITE403 Information Security Worksheet T-2 PUBLIC KEY ENCRYPTION With RSA SPRING2020Document5 pagesITE403 Information Security Worksheet T-2 PUBLIC KEY ENCRYPTION With RSA SPRING2020Aws FaeqNo ratings yet

- Cell Discovery & Cell TheoryDocument24 pagesCell Discovery & Cell TheoryFIGHTING TAYKINo ratings yet

- A Concept Paper About LoveDocument5 pagesA Concept Paper About LoveStephen Rivera100% (1)

- DB (04.2013) HiromiDocument7 pagesDB (04.2013) HiromiLew Quzmic Baltiysky75% (4)

- SpencerDocument34 pagesSpencervenkatteja75No ratings yet

- Ingles De, I PaaaaaaaaaaaaaaaDocument20 pagesIngles De, I PaaaaaaaaaaaaaaaJaz PintoNo ratings yet

- Celebrating The Third Place Inspiring Stories About The Great Good Places at The Heart of Our Communities (Oldenburg, Ray) (Z-Library)Document210 pagesCelebrating The Third Place Inspiring Stories About The Great Good Places at The Heart of Our Communities (Oldenburg, Ray) (Z-Library)ferialNo ratings yet

- Sew Infrastructure 1 Ebs Case Study 214465Document6 pagesSew Infrastructure 1 Ebs Case Study 214465Arun BatraNo ratings yet

- Banking Law On Secrecy of Bank DepositsDocument29 pagesBanking Law On Secrecy of Bank DepositsbrendamanganaanNo ratings yet

- PROCEEDINGS of The Numismatic and Antiquarian Society of PhiladelphiaDocument304 pagesPROCEEDINGS of The Numismatic and Antiquarian Society of PhiladelphiaRichard CastorNo ratings yet

- Soal Kalimat Prohibition SMP Kelas 7Document3 pagesSoal Kalimat Prohibition SMP Kelas 7yura chanNo ratings yet

- Moyang 2007Document11 pagesMoyang 2007Clarina TitusNo ratings yet

- Evaluating Tilting Pad - PaperDocument10 pagesEvaluating Tilting Pad - PaperAsit SuyalNo ratings yet

- FuelPump&GovernorGroups SELD0135 11Document11 pagesFuelPump&GovernorGroups SELD0135 11narit00007No ratings yet

- PHD Thesis Library Science DownloadDocument8 pagesPHD Thesis Library Science Downloadyvrpugvcf100% (2)

- AppsDocument6 pagesAppsxxres4lifexxNo ratings yet