Professional Documents

Culture Documents

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Uploaded by

aadi.klj.mahindra1998Copyright:

Available Formats

You might also like

- The Seven Festivals of The Messiah by Eddie ChumneyDocument146 pagesThe Seven Festivals of The Messiah by Eddie ChumneyJoh1v15to17100% (4)

- Odu Ifa Discussion From Owonrin To OturuponDocument66 pagesOdu Ifa Discussion From Owonrin To OturuponGiovanni Giomar Olivares100% (7)

- It 18-19Document1 pageIt 18-19mohdmoin0493No ratings yet

- 2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - ItrvDocument1 page2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - Itrvdibyan dasNo ratings yet

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDocument1 page2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALNo ratings yet

- Soumyadeep Chanda Itr Ay 2018Document1 pageSoumyadeep Chanda Itr Ay 2018Cajonized Guy DeepNo ratings yet

- Itr5 271352350310818$Document1 pageItr5 271352350310818$Ajay DiwanNo ratings yet

- 2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvDocument1 page2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvSooraj KanojiyaNo ratings yet

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDocument1 page2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaNo ratings yet

- 2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - ItrvDocument1 page2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - Itrvdibyan dasNo ratings yet

- 2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFDocument1 page2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFShivshankar RNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- Maadhavan Chandhiran 16-Mar-2018 454072340Document1 pageMaadhavan Chandhiran 16-Mar-2018 454072340samaadhuNo ratings yet

- Ack FY 17-18-Ramesh BDocument1 pageAck FY 17-18-Ramesh BMurthy KarumuriNo ratings yet

- PDF 759518980120718Document1 pagePDF 759518980120718HARDIK BANSALNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)santoshkumarNo ratings yet

- Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVDocument1 pageMeghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVYunusShaikhNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- Itr-V Indian Income Tax Return VerificatDocument1 pageItr-V Indian Income Tax Return VerificatMOHD AslamNo ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Nida KhanNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagehemakumarsNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document3 pagesItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriNo ratings yet

- 17 18 SaleemDocument1 page17 18 Saleembalaji xeroxNo ratings yet

- 102 1500880491102 XXXPP4297X ItrvDocument1 page102 1500880491102 XXXPP4297X Itrvramarao_pandNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- MANI SIVASANKAR - 28-Feb-2019 - 427477180Document1 pageMANI SIVASANKAR - 28-Feb-2019 - 427477180samaadhuNo ratings yet

- 2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFDocument1 page2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFakshay guptaNo ratings yet

- .Archivetemp2018 10 10 08 02 00 482 - 1539138720482 - XXXPR8391X - ITRVDocument1 page.Archivetemp2018 10 10 08 02 00 482 - 1539138720482 - XXXPR8391X - ITRVUday RayapudiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Itr-V Ajqpy0100n 2017-18 775756550170517Document1 pageItr-V Ajqpy0100n 2017-18 775756550170517Raj RajNo ratings yet

- 2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFDocument1 page2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFJayanta Sur RoyNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageARK EXPORT AND IMPORTNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSheila George SorkarNo ratings yet

- 2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFDocument1 page2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFKrishnaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageApoorva MoonatNo ratings yet

- 2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDocument1 page2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDhananjay JaiswalNo ratings yet

- 2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - ItrvDocument1 page2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - Itrvrohit sNo ratings yet

- 2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFDocument1 page2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFHarshal A ShahNo ratings yet

- 2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFDocument1 page2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFGanesh DasaraNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .Balkar BhullerNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageO P TulsyanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSuraj Dev MahatoNo ratings yet

- 2019-09-12 - XXXPB6273X - ItrvDocument1 page2019-09-12 - XXXPB6273X - ItrvDeb Kumar BhaumikNo ratings yet

- 2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvDocument1 page2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvsantoshkumarNo ratings yet

- Sellakkili Ramaiah 31-Jul-2018 969570370Document1 pageSellakkili Ramaiah 31-Jul-2018 969570370samaadhuNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageIshani ShahNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagechinna rajaNo ratings yet

- 2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - AcknowledgementDocument1 page2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - Acknowledgementanusha.veldandiNo ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageCA Jitu DashNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSunil PeerojiNo ratings yet

- Ack F.y.2017-18Document1 pageAck F.y.2017-18NishantNo ratings yet

- Lower Division ClerkDocument5 pagesLower Division Clerkkola0123No ratings yet

- Jordan Grubiss ResearchDocument8 pagesJordan Grubiss Researchapi-300434451No ratings yet

- Tenders For The Work ofDocument31 pagesTenders For The Work ofNasir AhmedNo ratings yet

- Organisation Behaviour ConflictDocument14 pagesOrganisation Behaviour Conflictshubham singhNo ratings yet

- Public Transport Interchange Design Guidelines PDFDocument89 pagesPublic Transport Interchange Design Guidelines PDFaprilia nurul hanissaNo ratings yet

- Case Report UnpriDocument17 pagesCase Report UnpriChandra SusantoNo ratings yet

- Pinpara Dialog AP MBL-RQ-050998Document1 pagePinpara Dialog AP MBL-RQ-050998dumindu1No ratings yet

- Language Test 9A : GrammarDocument3 pagesLanguage Test 9A : GrammarMaridzeNo ratings yet

- Eastern Philosophy in Understanding One's SelfDocument2 pagesEastern Philosophy in Understanding One's SelfRaiseter AlvarezNo ratings yet

- Notice of DefaultDocument1 pageNotice of DefaultS Pablo AugustNo ratings yet

- UGD-D00131 - Netspan Installation and Upgrade Guide - SR15.20 - Rev 22.0Document44 pagesUGD-D00131 - Netspan Installation and Upgrade Guide - SR15.20 - Rev 22.0br 55No ratings yet

- Math 1050 Mortgage ProjectDocument5 pagesMath 1050 Mortgage Projectapi-2740249620% (1)

- Biagtan V Insular LifeDocument2 pagesBiagtan V Insular LifemendozaimeeNo ratings yet

- 01 The Rough Guide Pharsebook PolishDocument292 pages01 The Rough Guide Pharsebook Polishamaliab100% (6)

- Unit 4 - Food and DrinkDocument36 pagesUnit 4 - Food and DrinkPaula RivasNo ratings yet

- Live Stock, Index, Futures, Forex and Bitcoin Charts On TradingViewDocument1 pageLive Stock, Index, Futures, Forex and Bitcoin Charts On TradingViewJoe Boby SoegiartoNo ratings yet

- G.R. No. 143993 McDonalds v. LC Big MakDocument16 pagesG.R. No. 143993 McDonalds v. LC Big MakNat ImperialNo ratings yet

- Curry Club MenuDocument2 pagesCurry Club MenuCurryClub0% (1)

- Disaster Management PeeksDocument27 pagesDisaster Management Peekspkzone1No ratings yet

- Industrial and Visual Communication Design Internship Opportunity at The Design Studio, Center For Technology Innovation, LVPEIDocument2 pagesIndustrial and Visual Communication Design Internship Opportunity at The Design Studio, Center For Technology Innovation, LVPEIKarthik SridharNo ratings yet

- Screenshot 2023-01-19 at 8.11.06 PM PDFDocument1 pageScreenshot 2023-01-19 at 8.11.06 PM PDFTaima AbuRmielehNo ratings yet

- Financial Management Research Paper Financial Ratios of BritanniaDocument15 pagesFinancial Management Research Paper Financial Ratios of BritanniaShaik Noor Mohammed Ali Jinnah 19DBLAW036No ratings yet

- Ignou Bece 002 Solved Assignment 2018-19Document16 pagesIgnou Bece 002 Solved Assignment 2018-19NEW THINK CLASSESNo ratings yet

- Case Study 6 - Team 3 - Diversity in Global OrganizationDocument13 pagesCase Study 6 - Team 3 - Diversity in Global OrganizationWalker SkyNo ratings yet

- Pint and Focused InquiryDocument5 pagesPint and Focused Inquiryjacintocolmenarez7582No ratings yet

- Vision Sociology Optional Test 1Document31 pagesVision Sociology Optional Test 1uttamNo ratings yet

- Iroquois ConfederacyDocument12 pagesIroquois ConfederacyrideauparkNo ratings yet

- Mayor of Casterbridge LIT PlanDocument42 pagesMayor of Casterbridge LIT Plankennycarlos25No ratings yet

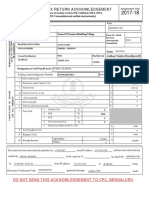

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Uploaded by

aadi.klj.mahindra1998Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

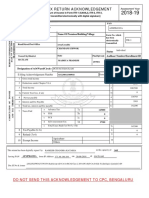

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)

Uploaded by

aadi.klj.mahindra1998Copyright:

Available Formats

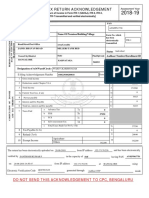

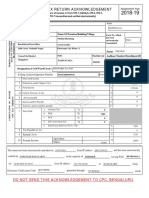

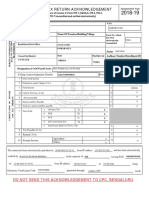

INDIAN INCOME TAX RETURN VERIFICATION FORM Assessment Year

FORM 2019-20

ITR-V [Where the data of the Return of Income in Form ITR-1 (SAHAJ), ITR-2, ITR-3,

ITR-4(SUGAM), ITR-5, ITR-7 transmitted electronically without digital signature] .

(Please see Rule 12 of the Income-tax Rules, 1962)

Name PAN

AMIT GUPTA

PERSONAL INFORMATION AND THE

ATIPG2890B

Form No. which

DATE OF ELECTRONIC

Flat/Door/Block No Name Of Premises/Building/Village

has been ITR-1

TRANSMISSION

62/188

electronically

transmitted

Road/Street/Post Office Area/Locality

HARBANSH MOHAL Status Individual

Town/City/District State Pin/ZipCode Aadhaar Number/ Enrollment ID

KANPUR

UTTAR PRADESH 208001 XXXX XXXX 4228

Designation of AO (Ward / Circle) WARD 1(1)(1), KANPUR Original or Revised ORIGINAL

E-filing Acknowledgement Number 463670985210120 Date(DD-MM-YYYY) 21-01-2020

1 Gross Total Income 1 499740

2 Deductions under Chapter-VI-A 2 151050

3 Total Income 3 348690

COMPUTATION OF INCOME

a Current Year loss, if any 3a 0

4 2531

AND TAX THEREON

4 Net Tax Payable

5 Interest Payable 5 1075

6 Total Tax and Interest Payable 6 3606

7 Taxes Paid

a Advance Tax 7a 0

b TDS 7b 0

c TCS 7c 0

d Self Assessment Tax 7d 3608

e Total Taxes Paid (7a+7b+7c +7d) 7e 3608

8 Tax Payable (6-7e) 8 0

9 Refund (7e-6) 9 0

10 Exempt Income Agriculture

10

Others 0

VERIFICATION

I, AMIT GUPTA son/ daughter of JAGESHWAR PRASAD GUP , holding Permanent Account Number ATIPG2890B

solemnly declare to the best of my knowledge and belief, the information given in the return and the schedules thereto which have been transmitted

electronically by me vide acknowledgement number mentioned above is correct and complete and that the amount of total income and other particulars

shown therein are truly stated and are in accordance with the provisions of the Income-tax Act, 1961, in respect of income chargeable to income-tax for

the previous year relevant to the assessment year 2019-20. I further declare that I am making this return in my capacity as

and I am also competent to make this return and verify it.

Sign here Date 21-01-2020 Place Kanpur

If the return has been prepared by a Tax Return Preparer (TRP) give further details as below:

Identification No. of TRP Name of TRP Counter Signature of TRP

For Office Use Only

Receipt No Filed from IP address 112.196.129.44

Date

Seal and signature of ATIPG2890B0346364008021012021BBB7525EE25EB9418D5C5E64E1B6D67B9F4E98

receiving official

Please send the duly signed Form ITR-V to “Centralized Processing Centre, Income Tax Department, Bengaluru 560500”, by ORDINARY

POST OR SPEED POST ONLY, within 120 days from date of transmitting the data electronically. Form ITR-V shall not be received in any other

office of the Income-tax Department or in any other manner. The confirmation of receipt of this Form ITR-V at ITD-CPC will be sent to the e-mail

address prakashpal_raju@yahoo.co.in

You might also like

- The Seven Festivals of The Messiah by Eddie ChumneyDocument146 pagesThe Seven Festivals of The Messiah by Eddie ChumneyJoh1v15to17100% (4)

- Odu Ifa Discussion From Owonrin To OturuponDocument66 pagesOdu Ifa Discussion From Owonrin To OturuponGiovanni Giomar Olivares100% (7)

- It 18-19Document1 pageIt 18-19mohdmoin0493No ratings yet

- 2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - ItrvDocument1 page2018 08 31 18 26 34 022 - 1535720194022 - XXXPB3542X - Itrvdibyan dasNo ratings yet

- 2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvDocument1 page2020 12 20 20 11 24 733 - 1608475284733 - XXXPP4894X - ItrvHARI KRISHAN PALNo ratings yet

- Soumyadeep Chanda Itr Ay 2018Document1 pageSoumyadeep Chanda Itr Ay 2018Cajonized Guy DeepNo ratings yet

- Itr5 271352350310818$Document1 pageItr5 271352350310818$Ajay DiwanNo ratings yet

- 2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvDocument1 page2018 08 22 17 18 09 004 - 1534938489004 - XXXPK5111X - ItrvSooraj KanojiyaNo ratings yet

- 2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvDocument1 page2019 03 29 18 20 50 494 - 1553863850494 - XXXPC3953X - ItrvIshaan ChawlaNo ratings yet

- 2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - ItrvDocument1 page2018 08 08 18 04 19 838 - 1533731659838 - XXXPG1329X - Itrvdibyan dasNo ratings yet

- 2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFDocument1 page2019 03 31 15 05 10 049 - 1554024910049 - XXXPJ4090X - Itrv PDFShivshankar RNo ratings yet

- Sukhjeet Singh 2018-19 (Itr) PDFDocument1 pageSukhjeet Singh 2018-19 (Itr) PDFAnonymous XgLFw9IcQNo ratings yet

- Maadhavan Chandhiran 16-Mar-2018 454072340Document1 pageMaadhavan Chandhiran 16-Mar-2018 454072340samaadhuNo ratings yet

- Ack FY 17-18-Ramesh BDocument1 pageAck FY 17-18-Ramesh BMurthy KarumuriNo ratings yet

- PDF 759518980120718Document1 pagePDF 759518980120718HARDIK BANSALNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)santoshkumarNo ratings yet

- Meghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVDocument1 pageMeghana - 2019 04 10 19 45 08 336 - 1554905708336 - XXXPM8241X - ITRVYunusShaikhNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagesanthosh kumarNo ratings yet

- 2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFDocument1 page2018 08 16 16 36 49 755 - 1534417609755 - XXXPB8989X - Acknowledgement PDFAkshya BhoiNo ratings yet

- 2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - ItrvDocument1 page2019 05 28 11 48 40 077 - 1559024320077 - XXXPP0859X - Itrvpoluri vinayNo ratings yet

- Itr-V Indian Income Tax Return VerificatDocument1 pageItr-V Indian Income Tax Return VerificatMOHD AslamNo ratings yet

- Itr 2018-19 S B Mishra PDFDocument1 pageItr 2018-19 S B Mishra PDFJITENDRA DUBEBYNo ratings yet

- Edjpb0287g Itrv PDFDocument1 pageEdjpb0287g Itrv PDFArun BhatnagarNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Nida KhanNo ratings yet

- Letsgettin Fraud CompanyDocument1 pageLetsgettin Fraud CompanyAnonymous A3CiCzvNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillagehemakumarsNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document3 pagesItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriNo ratings yet

- 17 18 SaleemDocument1 page17 18 Saleembalaji xeroxNo ratings yet

- 102 1500880491102 XXXPP4297X ItrvDocument1 page102 1500880491102 XXXPP4297X Itrvramarao_pandNo ratings yet

- Itr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)Document1 pageItr-V: (Please See Rule 12 of The Income-Tax Rules, 1962)srinivas maguluriNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .KumarNo ratings yet

- MANI SIVASANKAR - 28-Feb-2019 - 427477180Document1 pageMANI SIVASANKAR - 28-Feb-2019 - 427477180samaadhuNo ratings yet

- 2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFDocument1 page2018 07 22 16 36 36 674 - 1532257596674 - XXXPK4739X - Itrv PDFakshay guptaNo ratings yet

- .Archivetemp2018 10 10 08 02 00 482 - 1539138720482 - XXXPR8391X - ITRVDocument1 page.Archivetemp2018 10 10 08 02 00 482 - 1539138720482 - XXXPR8391X - ITRVUday RayapudiNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagehealth with wealthNo ratings yet

- Itr-V Ajqpy0100n 2017-18 775756550170517Document1 pageItr-V Ajqpy0100n 2017-18 775756550170517Raj RajNo ratings yet

- 2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFDocument1 page2018 12 16 12 25 37 908 - 1544943337908 - XXXPR1749X - Itrv PDFJayanta Sur RoyNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageARK EXPORT AND IMPORTNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSheila George SorkarNo ratings yet

- 2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFDocument1 page2018 08 08 14 20 22 467 - 1533718222467 - XXXPP1510X - Itrv PDFKrishnaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageTaiyabaNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageApoorva MoonatNo ratings yet

- 2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDocument1 page2019 03 12 17 56 10 874 - 1552393570874 - XXXPS8275X - ItrvDhananjay JaiswalNo ratings yet

- 2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - ItrvDocument1 page2018 03 04 21 10 37 424 - 1520178037424 - XXXPS9207X - Itrvrohit sNo ratings yet

- 2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFDocument1 page2018 07 19 12 06 41 640 - 1531982201640 - XXXPS3223X - Acknowledgement PDFHarshal A ShahNo ratings yet

- 2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFDocument1 page2018 07 20 11 14 23 177 - 1532065463177 - XXXPC3536X - Acknowledgement PDFGanesh DasaraNo ratings yet

- Itr-V: Indian Income Tax Return Verification Form - .Document1 pageItr-V: Indian Income Tax Return Verification Form - .Balkar BhullerNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageO P TulsyanNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageSuraj Dev MahatoNo ratings yet

- 2019-09-12 - XXXPB6273X - ItrvDocument1 page2019-09-12 - XXXPB6273X - ItrvDeb Kumar BhaumikNo ratings yet

- 2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvDocument1 page2019 07 17 12 05 41 184 - 1563345341184 - XXXPG9565X - ItrvsantoshkumarNo ratings yet

- Sellakkili Ramaiah 31-Jul-2018 969570370Document1 pageSellakkili Ramaiah 31-Jul-2018 969570370samaadhuNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageamitNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageIshani ShahNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/Villagechinna rajaNo ratings yet

- 2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - AcknowledgementDocument1 page2018 08 25 21 26 43 822 - 1535212603822 - XXXPV9294X - Acknowledgementanusha.veldandiNo ratings yet

- 2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFDocument1 page2018 08 31 20 46 27 108 - 1535728587108 - XXXPG5982X - Acknowledgement PDFAnupam GauravNo ratings yet

- Indian Income Tax Return Acknowledgement: Name of Premises/Building/VillageDocument1 pageIndian Income Tax Return Acknowledgement: Name of Premises/Building/VillageCA Jitu DashNo ratings yet

- Itr-V: Indian Income Tax Return Verification FormDocument1 pageItr-V: Indian Income Tax Return Verification FormSunil PeerojiNo ratings yet

- Ack F.y.2017-18Document1 pageAck F.y.2017-18NishantNo ratings yet

- Lower Division ClerkDocument5 pagesLower Division Clerkkola0123No ratings yet

- Jordan Grubiss ResearchDocument8 pagesJordan Grubiss Researchapi-300434451No ratings yet

- Tenders For The Work ofDocument31 pagesTenders For The Work ofNasir AhmedNo ratings yet

- Organisation Behaviour ConflictDocument14 pagesOrganisation Behaviour Conflictshubham singhNo ratings yet

- Public Transport Interchange Design Guidelines PDFDocument89 pagesPublic Transport Interchange Design Guidelines PDFaprilia nurul hanissaNo ratings yet

- Case Report UnpriDocument17 pagesCase Report UnpriChandra SusantoNo ratings yet

- Pinpara Dialog AP MBL-RQ-050998Document1 pagePinpara Dialog AP MBL-RQ-050998dumindu1No ratings yet

- Language Test 9A : GrammarDocument3 pagesLanguage Test 9A : GrammarMaridzeNo ratings yet

- Eastern Philosophy in Understanding One's SelfDocument2 pagesEastern Philosophy in Understanding One's SelfRaiseter AlvarezNo ratings yet

- Notice of DefaultDocument1 pageNotice of DefaultS Pablo AugustNo ratings yet

- UGD-D00131 - Netspan Installation and Upgrade Guide - SR15.20 - Rev 22.0Document44 pagesUGD-D00131 - Netspan Installation and Upgrade Guide - SR15.20 - Rev 22.0br 55No ratings yet

- Math 1050 Mortgage ProjectDocument5 pagesMath 1050 Mortgage Projectapi-2740249620% (1)

- Biagtan V Insular LifeDocument2 pagesBiagtan V Insular LifemendozaimeeNo ratings yet

- 01 The Rough Guide Pharsebook PolishDocument292 pages01 The Rough Guide Pharsebook Polishamaliab100% (6)

- Unit 4 - Food and DrinkDocument36 pagesUnit 4 - Food and DrinkPaula RivasNo ratings yet

- Live Stock, Index, Futures, Forex and Bitcoin Charts On TradingViewDocument1 pageLive Stock, Index, Futures, Forex and Bitcoin Charts On TradingViewJoe Boby SoegiartoNo ratings yet

- G.R. No. 143993 McDonalds v. LC Big MakDocument16 pagesG.R. No. 143993 McDonalds v. LC Big MakNat ImperialNo ratings yet

- Curry Club MenuDocument2 pagesCurry Club MenuCurryClub0% (1)

- Disaster Management PeeksDocument27 pagesDisaster Management Peekspkzone1No ratings yet

- Industrial and Visual Communication Design Internship Opportunity at The Design Studio, Center For Technology Innovation, LVPEIDocument2 pagesIndustrial and Visual Communication Design Internship Opportunity at The Design Studio, Center For Technology Innovation, LVPEIKarthik SridharNo ratings yet

- Screenshot 2023-01-19 at 8.11.06 PM PDFDocument1 pageScreenshot 2023-01-19 at 8.11.06 PM PDFTaima AbuRmielehNo ratings yet

- Financial Management Research Paper Financial Ratios of BritanniaDocument15 pagesFinancial Management Research Paper Financial Ratios of BritanniaShaik Noor Mohammed Ali Jinnah 19DBLAW036No ratings yet

- Ignou Bece 002 Solved Assignment 2018-19Document16 pagesIgnou Bece 002 Solved Assignment 2018-19NEW THINK CLASSESNo ratings yet

- Case Study 6 - Team 3 - Diversity in Global OrganizationDocument13 pagesCase Study 6 - Team 3 - Diversity in Global OrganizationWalker SkyNo ratings yet

- Pint and Focused InquiryDocument5 pagesPint and Focused Inquiryjacintocolmenarez7582No ratings yet

- Vision Sociology Optional Test 1Document31 pagesVision Sociology Optional Test 1uttamNo ratings yet

- Iroquois ConfederacyDocument12 pagesIroquois ConfederacyrideauparkNo ratings yet

- Mayor of Casterbridge LIT PlanDocument42 pagesMayor of Casterbridge LIT Plankennycarlos25No ratings yet