Professional Documents

Culture Documents

Signing Date: 13/12/2023 04:13:18 SGT Signed By: Ds CWT India PVT LTD 2

Signing Date: 13/12/2023 04:13:18 SGT Signed By: Ds CWT India PVT LTD 2

Uploaded by

Himanshu MishraOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Signing Date: 13/12/2023 04:13:18 SGT Signed By: Ds CWT India PVT LTD 2

Signing Date: 13/12/2023 04:13:18 SGT Signed By: Ds CWT India PVT LTD 2

Uploaded by

Himanshu MishraCopyright:

Available Formats

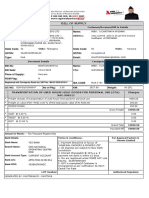

ORIGINAL FOR RECIPIENT

CWT India Pvt. Ltd. GSTN ID: 06AAACI7084H1ZI

1st Floor, Tower C, PAN: AAACI7084H

Centrum Plaza, Golf Course Acknowledge No: 132316826220697

Road, Sector 53, Acknowledge Date: 12/12/2023 8:16:00 PM

Gurgaon, Haryana, India -

122003

Bill To Invoice Number: A6134723

Customer Name : Invoice Date: 11 Dec 2023

GE Global Sourcing India Pvt. Ltd

NH-101/90 Chhapra to Mohamadpur

Rd, Opp. Hanuman Mandir, Client No: 3456000008

Saran ,, SARAN, Bihar-841418 Agent: Zillious OBT

Booking Ref: N7CNNT

Location of Supplier: Haryana

State Code of Place of Supplier: 06

Place of Supply:Bihar

State code of Place of Supply: 10

HSN of services: 998551

IRN Code: afaf01c211adc5a53e28376529101f34a7f559874fc348f02fba413b5ef2db3f

GSTN ID :10AABCG0865H1Z3

MISHRA/HIMANSHU MR

Your Account has been debited for the purchase of the following tickets

Amount (INR)

Ticket Number Flight DOT Sector Class Of Travel

1014356379 QP 01551 17 Dec 2023 20:55 PNQ-BLR Y

Service : Sales DOMNONBSP&LCC (HSN-998551)

Basic Fare 6523

Other Tax 1570

Total Fare 8093

Service : TRANSACTION FEE (HSN-998551)

TRANSACTION FEE 400

IGST of Taxable value of @ 18% 72

CGST of Taxable value of @ 0% 0

SGST of Taxable value of @ 0% 0

Service : SERVICECHARGES CCARD (HSN-998551)

SERVICECHARGES CCARD 359

IGST of Taxable value of @ 18% 65

CGST of Taxable value of @ 0% 0

SGST of Taxable value of @ 0% 0

Ticket Number Flight DOT Sector Class Of Travel

1014356380 I5 00821 20 Dec 2023 23:45 BLR-PNQ Y

Service : Sales DOMNONBSP&LCC (HSN-998551)

Basic Fare 5418

Other Tax 1841

Total Fare 7259

Service : TRANSACTION FEE (HSN-998551)

TRANSACTION FEE 400

IGST of Taxable value of @ 18% 72

CGST of Taxable value of @ 0% 0

SGST of Taxable value of @ 0% 0

Total Amount: 16511

Taxes 209

Penalty 0

Total Charges: 16720

Signed By: DS CWT INDIA PVT LTD 2

PAYMENTS:

Signing Date: 13/12/2023 04:13:18 SGT

Amount charged by CWT - Credit Card VIXXXXXXXXXXX8001 8093

Amount charged by CWT - Credit Card VIXXXXXXXXXXX8001 7259

Amount charged by CWT - Credit Card VIXXXXXXXXXXX8001 400

Amount charged by CWT - Credit Card VIXXXXXXXXXXX8001 400

Amount charged by CWT - Credit Card VIXXXXXXXXXXX8001 359

Amount charged by CWT - Credit Card VIXXXXXXXXXXX8001 72

Amount charged by CWT - Credit Card VIXXXXXXXXXXX8001 65

Amount charged by CWT - Credit Card VIXXXXXXXXXXX8001 72

Total Payments: 16720

Total Amount Charged by CWT: 16720

Amount (in words) : Rs. Sixteen Thousand Seven Hundred Twenty Rupees Only

MIS Information: 148174 EMPCode: CO:

Registered office : Raheja Centre, Ground Floor, Plot No - 214, Unit no. 2, Free Press Journal Road,

Nariman point, Mumbai - 400 021, India Tel : +91 22 40687000 Fax : +91 22 40687070, CIN U63040MH1998PTC115025

Account Name : CWT India Private Limited

Bank Name : BNP Paribas

Branch Add. : 2nd Flr, Sood Tower

Barakhamba Road,

New Delhi - 110001 Terms:

Bank Account : 09065 10076900171 1) A/C payee cheques/DD should be in favour of CWT India Pvt. Ltd.

MICR Code : 110034002 2) We reserve the rights to charge interest @18% p.a. on over due bills as per agreed terms

Swift Code : BNPAINBBDEL & conditions.

IFSC Code : BNPA0009065 3) Subject to jurisdiction of the city mentioned in the address.

Disclaimer:

In light of the GST implementation from 1st July, 2017, CWT is trying its best efforts to incorporate GSTIN number in its invoices and all invoices will continue to be due and paid in line

with the terms of your contract with CWT even if the GSTIN number is not mentioned therein.

As the GST regime now requires the principal service provider (such as airlines) to send a GST invoice to the service consumer within 30 days, CWT has sought information from all its

clients on a best effort basis.

Despite the above, the process of information collection (from clients) and reporting (to principal service providers) is presently being done manually; due to which reason CWT

disclaims all responsibility or liability or guarantee whatsoever with regards

The claims of GST tax credits by its clients; and

Any acts or omissions or inadvertent errors in the reporting process; and

Any errors or mistakes in the invoices issued by principal service suppliers

Refund and exchange transactions will now be subject to GST.

GSTN ID: 06AAACI7084H1ZI

PAN: AAACI7084H

You might also like

- Course Binder ADM3350XY S 2022Document218 pagesCourse Binder ADM3350XY S 2022Han ZhongNo ratings yet

- Bill Sample of CementDocument2 pagesBill Sample of Cementshadanjamia96No ratings yet

- BOSTS192004731Document2 pagesBOSTS192004731Chaitu Rishan100% (1)

- Samsung Refrigerator Tax InvoiceDocument1 pageSamsung Refrigerator Tax InvoiceJyoti Sarkar0% (1)

- CRM RoadmapDocument3 pagesCRM Roadmapsowmiya245100% (1)

- Tata Nano Case (Questions Answers)Document4 pagesTata Nano Case (Questions Answers)erfan441790100% (4)

- Rmit University Vietnam: Assignment 1: Argumentative EssayDocument7 pagesRmit University Vietnam: Assignment 1: Argumentative EssayTuan MinhNo ratings yet

- Signing Date: 18/10/2023 04:25:31 SGT Signed By: Ds CWT India PVT LTD 2Document3 pagesSigning Date: 18/10/2023 04:25:31 SGT Signed By: Ds CWT India PVT LTD 2Himanshu MishraNo ratings yet

- P1197534 1014570017 InvDocument3 pagesP1197534 1014570017 InvPuspa SubediNo ratings yet

- Signing Date: 19/10/2023 03:18:09 SGT Signed By: Ds CWT India PVT LTD 2Document3 pagesSigning Date: 19/10/2023 03:18:09 SGT Signed By: Ds CWT India PVT LTD 2Himanshu MishraNo ratings yet

- P0085175 1003914195 InvDocument2 pagesP0085175 1003914195 InvvarunsanghiNo ratings yet

- CTW ChargesDocument2 pagesCTW Chargespriyanka ghosalNo ratings yet

- Signing Date: 26/02/2020 07:16:35 SGT Signed By: Ds CWT India PVT LTD 02Document2 pagesSigning Date: 26/02/2020 07:16:35 SGT Signed By: Ds CWT India PVT LTD 02Vrushank KanekarNo ratings yet

- Singla Enterprises: Original For RecipientDocument2 pagesSingla Enterprises: Original For Recipientjaikishan456321No ratings yet

- Invoice No 316Document1 pageInvoice No 316Arihant AgarwalNo ratings yet

- 012-PSS - IGL - GorakhpurDocument1 page012-PSS - IGL - GorakhpurNishant KumarNo ratings yet

- InvoiceDocument1 pageInvoicedonorvicky749No ratings yet

- Shubham Kanojia Autoworld - EndorsDocument1 pageShubham Kanojia Autoworld - EndorsSahil KumarNo ratings yet

- SI - Sales SI 2023 24 0467Document2 pagesSI - Sales SI 2023 24 0467Ankur GoelNo ratings yet

- BABULIA - Sales-8780Document1 pageBABULIA - Sales-8780NI KONo ratings yet

- Mispl 1150Document2 pagesMispl 1150vipurmanNo ratings yet

- Babulia Sales-8406Document1 pageBabulia Sales-8406NI KONo ratings yet

- Calibration Lab Assessment Fee InvoiceDocument1 pageCalibration Lab Assessment Fee InvoiceSharad JainNo ratings yet

- 319 - TaxDocument2 pages319 - TaxDileep ShuklaNo ratings yet

- Ani 011Document1 pageAni 011kisaprojectsllpNo ratings yet

- 9011496693Document3 pages9011496693RITVIK ARORANo ratings yet

- Shivam EntDocument21 pagesShivam EntJatin GulsatyaNo ratings yet

- UP0925TS003730 NF1138 30-Apr-2024Document4 pagesUP0925TS003730 NF1138 30-Apr-202418063503196No ratings yet

- MP 0001Document1 pageMP 0001Design DevelopmentNo ratings yet

- Invoicef 2 K 1 Bibdfh 2 RPWKZ 2 JP 5 Nku 4Document1 pageInvoicef 2 K 1 Bibdfh 2 RPWKZ 2 JP 5 Nku 4sandeep sainiNo ratings yet

- ZEE5 Invoice 07 01 2020Document1 pageZEE5 Invoice 07 01 2020pavan KumarNo ratings yet

- Invoice No. 2404100030Document2 pagesInvoice No. 2404100030sunnyrunninginamazonNo ratings yet

- Website SoDocument3 pagesWebsite Sosharma_anshu_b_techNo ratings yet

- ZEE5 Invoice 11 03 2022Document1 pageZEE5 Invoice 11 03 2022Shajin NambiarNo ratings yet

- UP72AT2190Document4 pagesUP72AT2190Aashray JindalNo ratings yet

- Ultra Tech Bill SampleDocument2 pagesUltra Tech Bill Sampleshadanjamia96No ratings yet

- 4front BillDocument1 page4front BillImtiazNo ratings yet

- RENTGGNHHC00923-24 - Underflow GGN Deposit Invoice - Rev00 - SignedDocument1 pageRENTGGNHHC00923-24 - Underflow GGN Deposit Invoice - Rev00 - SignedSARVESH VERMANo ratings yet

- 2023 Bin VBV ListDocument1 page2023 Bin VBV ListmplanetsidsuNo ratings yet

- Axis Bank 23Document1 pageAxis Bank 23friends.technicalassociatesNo ratings yet

- Advance To PayDocument1 pageAdvance To PayMayank RathodNo ratings yet

- 2223TBS0002250Document1 page2223TBS0002250Huskee CokNo ratings yet

- Inv Parida 2488512662Document8 pagesInv Parida 2488512662Ashish ParidaNo ratings yet

- 8 MMDocument1 page8 MMnikhil23194No ratings yet

- ST SupO 2940 2022 23 183214Document1 pageST SupO 2940 2022 23 183214Rajat SharmaNo ratings yet

- Accounting Voucher 65Document8 pagesAccounting Voucher 65robin.panwar50No ratings yet

- Bill FormatDocument4 pagesBill Formatcrishevence1990No ratings yet

- D-524 BiomeriuxDocument4 pagesD-524 BiomeriuxVinay KatochNo ratings yet

- CombinepdfDocument11 pagesCombinepdfSathish KumarNo ratings yet

- INFINITI RETAIL LIMITED (Trading As Cromā) : Tax InvoiceDocument3 pagesINFINITI RETAIL LIMITED (Trading As Cromā) : Tax Invoicemarketbus12No ratings yet

- New BillDocument3 pagesNew BillGurmeet SinghNo ratings yet

- InvoiceDocument1 pageInvoice2125757csNo ratings yet

- GST 1056 2019 20. Ckecp Mohali P&M and IrDocument1 pageGST 1056 2019 20. Ckecp Mohali P&M and IrEntertainment AbhiNo ratings yet

- Tax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountDocument2 pagesTax Invoice: Description of Services HSN Code Taxable Amount Igst Rate AmountSunil PatelNo ratings yet

- Amar EnterprisesDocument2 pagesAmar EnterprisesAmit DhochakNo ratings yet

- Service Customer in VoiceDocument1 pageService Customer in VoiceRani GuptaNo ratings yet

- Morph Ser202324027 31102023 277Document6 pagesMorph Ser202324027 31102023 277gokulpics1No ratings yet

- Tax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)Document1 pageTax Invoice/Bill of Supply/Cash Memo: (Original For Recipient)suryaNo ratings yet

- 2593 GwaliorDocument2 pages2593 GwaliorUtkarsh MalhotraNo ratings yet

- CVQ23 12574Document3 pagesCVQ23 12574Pawan MishraNo ratings yet

- Tax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraDocument1 pageTax Invoice: Address: B-315, Shree Nand Dham, Sector-11, Plot.59, CBD Belapur, Navi Mumbai - 400614, MaharashtraSHANTANU PATHAKNo ratings yet

- Nakodar Jan 2023Document1 pageNakodar Jan 2023Randhir ChaubeyNo ratings yet

- User Charge Invoice5325930181Document1 pageUser Charge Invoice5325930181kumarprince5092No ratings yet

- Ohv Wheel Motor System and Part Cleanliness StandardDocument18 pagesOhv Wheel Motor System and Part Cleanliness StandardHimanshu MishraNo ratings yet

- B4E4Document3 pagesB4E4Himanshu MishraNo ratings yet

- B7A13Document5 pagesB7A13Himanshu MishraNo ratings yet

- SOP MR PackagingDocument10 pagesSOP MR PackagingHimanshu MishraNo ratings yet

- Gear Grinding Technology PresentationDocument55 pagesGear Grinding Technology PresentationHimanshu MishraNo ratings yet

- Revision HistoryDocument20 pagesRevision HistoryHimanshu MishraNo ratings yet

- View Credit Card TransactionDocument1 pageView Credit Card TransactionHimanshu MishraNo ratings yet

- CQI and IRCA Online Exam Regulations v1 (Final)Document3 pagesCQI and IRCA Online Exam Regulations v1 (Final)Himanshu MishraNo ratings yet

- Government of in IA: The Ge P)Document5 pagesGovernment of in IA: The Ge P)Himanshu MishraNo ratings yet

- BolDocument2 pagesBolHimanshu MishraNo ratings yet

- Packing Procedure - 41C642390P1Document6 pagesPacking Procedure - 41C642390P1Himanshu MishraNo ratings yet

- Hypoeutectoid Steel AISI 4150Document3 pagesHypoeutectoid Steel AISI 4150Himanshu MishraNo ratings yet

- Packing Procedure - 41C641160P1Document5 pagesPacking Procedure - 41C641160P1Himanshu MishraNo ratings yet

- Packing Procedure - 84C620815P1Document10 pagesPacking Procedure - 84C620815P1Himanshu MishraNo ratings yet

- Torque Tightening Management - Rev 3.0Document30 pagesTorque Tightening Management - Rev 3.0Himanshu MishraNo ratings yet

- Boarding Pass (PNQ-DEL)Document1 pageBoarding Pass (PNQ-DEL)Himanshu MishraNo ratings yet

- 013 1110 00 A4 0281 2Document1 page013 1110 00 A4 0281 2Himanshu MishraNo ratings yet

- Fa199726 20230516 075742Document42 pagesFa199726 20230516 075742Himanshu MishraNo ratings yet

- Mishra, Himanshu - Qualified Auditor - 2023-FebDocument1 pageMishra, Himanshu - Qualified Auditor - 2023-FebHimanshu MishraNo ratings yet

- CRN7921954130Document3 pagesCRN7921954130Himanshu MishraNo ratings yet

- Ansox Industry: XXX S.S. Jadav A4 013 8100 00 XDocument1 pageAnsox Industry: XXX S.S. Jadav A4 013 8100 00 XHimanshu MishraNo ratings yet

- HS CarrierDocument9 pagesHS CarrierHimanshu MishraNo ratings yet

- CRN7153868745Document4 pagesCRN7153868745Himanshu MishraNo ratings yet

- DSQR - RaltechDocument10 pagesDSQR - RaltechHimanshu MishraNo ratings yet

- Ansox Industry Insert: XXX S.S Jadhav A4 013 7130 00 XDocument1 pageAnsox Industry Insert: XXX S.S Jadhav A4 013 7130 00 XHimanshu MishraNo ratings yet

- 5810Document2 pages5810Himanshu MishraNo ratings yet

- Designated Supplier Quality RepresentativeDocument8 pagesDesignated Supplier Quality RepresentativeHimanshu MishraNo ratings yet

- Signing Date: 18/10/2023 04:25:31 SGT Signed By: Ds CWT India PVT LTD 2Document3 pagesSigning Date: 18/10/2023 04:25:31 SGT Signed By: Ds CWT India PVT LTD 2Himanshu MishraNo ratings yet

- La Classic-Attibele, Hosur: Booking VoucherDocument1 pageLa Classic-Attibele, Hosur: Booking VoucherHimanshu MishraNo ratings yet

- 09 08 2023 8,645.50 InrDocument1 page09 08 2023 8,645.50 InrHimanshu MishraNo ratings yet

- SBL s23 Examiner ReportDocument22 pagesSBL s23 Examiner ReportkudamandebvuNo ratings yet

- Updated ResumeDocument1 pageUpdated ResumeAshwath KrishnanNo ratings yet

- Module+5 1Document10 pagesModule+5 1Franco James SanpedroNo ratings yet

- Entrep - Unit 2 Assessment2Document3 pagesEntrep - Unit 2 Assessment2KaisenNo ratings yet

- Mcdonalds Literature ReviewDocument4 pagesMcdonalds Literature Reviewofahxdcnd100% (1)

- How To End Off A Cover LetterDocument7 pagesHow To End Off A Cover Lettervyp0wosyb1m3100% (2)

- FinMan Unit 7 Lecture-Cost of Capital 2021 S1Document31 pagesFinMan Unit 7 Lecture-Cost of Capital 2021 S1Debbie DebzNo ratings yet

- Regulatory Approach To Formulate Accounting Theory: Literature Study of Developed CountriesDocument6 pagesRegulatory Approach To Formulate Accounting Theory: Literature Study of Developed CountriesAchmad ArdanuNo ratings yet

- Hapso DeckDocument17 pagesHapso DeckHapso OfficialNo ratings yet

- The Entrepreneurial Magazine Aug Pub 1Document63 pagesThe Entrepreneurial Magazine Aug Pub 1Christopher S ChironzviNo ratings yet

- Agreement V0.0 16.12.2021Document2 pagesAgreement V0.0 16.12.2021Jaspergroup 15No ratings yet

- A222 BKAA3023 Individual AssignmentDocument10 pagesA222 BKAA3023 Individual Assignmentchinenhoo0425No ratings yet

- Form GST REG-06: Government of IndiaDocument3 pagesForm GST REG-06: Government of IndiaPankaj JainNo ratings yet

- Cecilia Demoski Resume 2023Document1 pageCecilia Demoski Resume 2023api-659179896No ratings yet

- Math LP NegruDocument11 pagesMath LP NegruNaomi NegruNo ratings yet

- Chapter 2 DLP 4 Sources of OpportunitiesDocument2 pagesChapter 2 DLP 4 Sources of OpportunitiesNiña Angela Bo HUMSS 10BNo ratings yet

- Phillip Tucker JR Professional ResumeDocument2 pagesPhillip Tucker JR Professional Resumeapi-716666625No ratings yet

- TAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsDocument4 pagesTAXATION 2 Chapter 14 VAT Payable and Compliance RequirementsKim Cristian MaañoNo ratings yet

- 2023-11-23 - SRB - Draft List of ESRS Data Points - Implementation GuidanceDocument31 pages2023-11-23 - SRB - Draft List of ESRS Data Points - Implementation Guidanceomarghaleb489No ratings yet

- WSWP For Hamisa Rigging of EscalatorsDocument10 pagesWSWP For Hamisa Rigging of EscalatorsVictor Thembinkosi MakhubeleNo ratings yet

- Cbleecpl 06Document6 pagesCbleecpl 06AdityaNo ratings yet

- Immunization With FuturesDocument18 pagesImmunization With FuturesNiyati ShahNo ratings yet

- General Management Programme: February - October, 2018Document6 pagesGeneral Management Programme: February - October, 2018Manikanteswara PatroNo ratings yet

- INREV NAV - INREV GuidelinesDocument1 pageINREV NAV - INREV GuidelinesLYNo ratings yet

- Airline Management: Professor Greg SchwabDocument260 pagesAirline Management: Professor Greg SchwabKrishna kurdekarNo ratings yet

- Resolutions: Meaning and Types: 1. Ordinary ResolutionDocument3 pagesResolutions: Meaning and Types: 1. Ordinary ResolutionHaji HalviNo ratings yet