Professional Documents

Culture Documents

LM01 Fixed-Income Instrument Features IFT Notes

LM01 Fixed-Income Instrument Features IFT Notes

Uploaded by

ClaptrapjackCopyright:

Available Formats

You might also like

- LM03 Analyzing Balance Sheets IFT NotesDocument11 pagesLM03 Analyzing Balance Sheets IFT NotesClaptrapjackNo ratings yet

- K J Somaiya Institute of Management Studies and Research, HostelDocument3 pagesK J Somaiya Institute of Management Studies and Research, HostelsanketNo ratings yet

- Topic 1 ExercisesDocument5 pagesTopic 1 ExercisesChristian Alain Ndzie BitunduNo ratings yet

- Sample Problem Statement and Research QuestionsDocument3 pagesSample Problem Statement and Research QuestionsSheer LockNo ratings yet

- L1 R39 Fixed Income Securities Defining Elements Lecture - Study Notes (2022)Document27 pagesL1 R39 Fixed Income Securities Defining Elements Lecture - Study Notes (2022)sumralatifNo ratings yet

- L1 01 Fixed Income Securities Defining Elements Lecture - Study Notes (2023)Document21 pagesL1 01 Fixed Income Securities Defining Elements Lecture - Study Notes (2023)Sumair ChughtaiNo ratings yet

- Chapter Two: Non - Current LiabilitiesDocument10 pagesChapter Two: Non - Current LiabilitiesJuan KermaNo ratings yet

- LN 06 Fixed Income NotesDocument59 pagesLN 06 Fixed Income NoteshersanyNo ratings yet

- Are Securities That Promise To Make Fixed Payments According ToDocument26 pagesAre Securities That Promise To Make Fixed Payments According Toaddisyawkal18No ratings yet

- FM I - 3 P1Document11 pagesFM I - 3 P1Henok FikaduNo ratings yet

- Fixed Income Securities - SIGFi - Finance HandbookDocument15 pagesFixed Income Securities - SIGFi - Finance HandbookSneha TatiNo ratings yet

- Basics of Bond With Types & FeaturesDocument10 pagesBasics of Bond With Types & FeaturesradhikaNo ratings yet

- Bonds CH08Document16 pagesBonds CH08Hendrickson Cruz SaludNo ratings yet

- Unit 4Document16 pagesUnit 4hassan19951996hNo ratings yet

- To Bonds: by Cristina Resetnic, Asem, FB 29 GDocument12 pagesTo Bonds: by Cristina Resetnic, Asem, FB 29 GShapthami Manokar100% (3)

- Valuation of Debt and EquityDocument8 pagesValuation of Debt and EquityhelloNo ratings yet

- Corporate BondsDocument4 pagesCorporate BondsWaseem ManshaNo ratings yet

- Project in Acctg4 For Pre-FinalsDocument12 pagesProject in Acctg4 For Pre-FinalsJohn Kenneth Escober BentirNo ratings yet

- Project in Acctg4 For Pre-FinalsDocument12 pagesProject in Acctg4 For Pre-FinalsJohn Kenneth Escober BentirNo ratings yet

- LM03 Fixed-Income Issuance and Trading IFT NotesDocument9 pagesLM03 Fixed-Income Issuance and Trading IFT NotesClaptrapjackNo ratings yet

- Lecture 4_Bond MarketsDocument50 pagesLecture 4_Bond MarketsTonie NascentNo ratings yet

- Fixed Income Securities - 8Document24 pagesFixed Income Securities - 8SHRIRAJ LIGADENo ratings yet

- Bond Valuation Final FinalDocument40 pagesBond Valuation Final FinalkafiNo ratings yet

- Finals Week 1Document6 pagesFinals Week 1Mark Angelo BustosNo ratings yet

- Aditya Ajit - BondDocument21 pagesAditya Ajit - BondAachal JaiswalNo ratings yet

- 4 RM AssignmentDocument4 pages4 RM Assignmentaryangedam121No ratings yet

- Debt MarketsDocument17 pagesDebt MarketsHONEST PASCHALNo ratings yet

- Chapter 8 Fixed Income SecuritiesDocument35 pagesChapter 8 Fixed Income SecuritiesCezarene Fernando100% (1)

- Chapter Three FA II DawudDocument11 pagesChapter Three FA II DawudHussen AbdulkadirNo ratings yet

- Chapter Three 3. Fixed Income Securities 3.1. What Are Fixed Income Securities?Document11 pagesChapter Three 3. Fixed Income Securities 3.1. What Are Fixed Income Securities?Seid KassawNo ratings yet

- Chapter 12 Senior SecurityDocument23 pagesChapter 12 Senior SecuritySumonNo ratings yet

- FM I Bond ValuationDocument16 pagesFM I Bond Valuationdanielnebeyat7No ratings yet

- Finmar Week 12Document8 pagesFinmar Week 12Joleen DoniegoNo ratings yet

- Faii Chapter Vi - 0Document16 pagesFaii Chapter Vi - 0chuchuNo ratings yet

- Long-Term Financial Liabilities: Chapter Topics Cross Referenced With CicaDocument10 pagesLong-Term Financial Liabilities: Chapter Topics Cross Referenced With CicaghostbooNo ratings yet

- Corporate Debt Markets The Debt MarketDocument7 pagesCorporate Debt Markets The Debt MarketYashwanth Naik SNo ratings yet

- Notes 3 - Bond ValuationDocument5 pagesNotes 3 - Bond Valuationyousra kadiriNo ratings yet

- Chapter 9-Bond and Stock Valuation (Revised)Document51 pagesChapter 9-Bond and Stock Valuation (Revised)Md. Nazmul Kabir100% (2)

- Debentures - Meaning, Types, Features, Accounting ExamplesDocument6 pagesDebentures - Meaning, Types, Features, Accounting Examplesfarhadcse30No ratings yet

- (FM02) - Chapter 6 Valuation of Future Cash Flows Bond and Equity ValuationDocument13 pages(FM02) - Chapter 6 Valuation of Future Cash Flows Bond and Equity ValuationKenneth John TomasNo ratings yet

- CFA Level1 - Fixed Income - SS14 v2021Document154 pagesCFA Level1 - Fixed Income - SS14 v2021Carl Anthony FabicNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Lecture 3Document33 pagesLecture 3hafsaNo ratings yet

- Bonds: Here Are Some Benefits They Can ProvideDocument7 pagesBonds: Here Are Some Benefits They Can ProvidefaqehaNo ratings yet

- Investment and Portfolio Management: ACFN 3201Document13 pagesInvestment and Portfolio Management: ACFN 3201Bantamkak FikaduNo ratings yet

- 07 The Valuation of SecurityDocument23 pages07 The Valuation of SecurityAidil IdzhamNo ratings yet

- Chapter IV Suplimentary 2Document25 pagesChapter IV Suplimentary 2henokal99No ratings yet

- FinQuiz - Smart Summary - Study Session 15 - Reading 51Document4 pagesFinQuiz - Smart Summary - Study Session 15 - Reading 51RafaelNo ratings yet

- Chap 3 Fixed Income SecuritiesDocument45 pagesChap 3 Fixed Income SecuritiesHABTAMU TULU0% (1)

- Financial Markets and Investments: Valuation of SecuritiesDocument21 pagesFinancial Markets and Investments: Valuation of SecuritiesLipika haldarNo ratings yet

- Reading 39 - Fixed Income Securities - Defining ElementsDocument36 pagesReading 39 - Fixed Income Securities - Defining ElementsAllen AravindanNo ratings yet

- Investment ManagementDocument4 pagesInvestment ManagementCaroline B CodinoNo ratings yet

- Portfolio Management Module 4Document7 pagesPortfolio Management Module 4Ayush kashyapNo ratings yet

- Non Non Non Non - Current Liabilities Current Liabilities Current Liabilities Current LiabilitiesDocument93 pagesNon Non Non Non - Current Liabilities Current Liabilities Current Liabilities Current LiabilitiesBantamkak FikaduNo ratings yet

- Bonds and Their Valuation: Dr. Rakesh Kumar SharmaDocument43 pagesBonds and Their Valuation: Dr. Rakesh Kumar Sharmaswastik guptaNo ratings yet

- Investment Alternatives of Capital MarketDocument4 pagesInvestment Alternatives of Capital MarketMuhammad RizwanNo ratings yet

- Fin Eco 9 PDFDocument8 pagesFin Eco 9 PDFRajesh GargNo ratings yet

- Long-Term FinancingDocument15 pagesLong-Term FinancingMir MusadiqNo ratings yet

- Chapter 6Document9 pagesChapter 6bobby brownNo ratings yet

- Understanding Debentures: Key TakeawaysDocument8 pagesUnderstanding Debentures: Key TakeawaysRichard DuniganNo ratings yet

- FinQuiz - Smart Summary - Study Session 15 - Reading 52Document5 pagesFinQuiz - Smart Summary - Study Session 15 - Reading 52RafaelNo ratings yet

- Fixed in Come NotesDocument30 pagesFixed in Come NotesmechedceNo ratings yet

- 2.international FinanceDocument81 pages2.international FinanceDhawal RajNo ratings yet

- Digital Enrollments 04.02.2023Document1 pageDigital Enrollments 04.02.2023ClaptrapjackNo ratings yet

- FRM 2021 Gpa ReportDocument21 pagesFRM 2021 Gpa ReportClaptrapjackNo ratings yet

- Mitres 18 001 f17 Guide ch09Document14 pagesMitres 18 001 f17 Guide ch09ClaptrapjackNo ratings yet

- Holiday Home Reservation Letter 000193157ggDocument2 pagesHoliday Home Reservation Letter 000193157ggClaptrapjackNo ratings yet

- Holiday Home Reservation Letter 000193698Document1 pageHoliday Home Reservation Letter 000193698ClaptrapjackNo ratings yet

- Pre Mfe Prob Feb2024 SyllabusDocument3 pagesPre Mfe Prob Feb2024 SyllabusClaptrapjackNo ratings yet

- W4w2hyxcjws0ctst5yal3pscDocument2 pagesW4w2hyxcjws0ctst5yal3pscClaptrapjackNo ratings yet

- Mitres 18 001 f17 Manual ch12Document9 pagesMitres 18 001 f17 Manual ch12ClaptrapjackNo ratings yet

- ResultsDocument2 pagesResultsClaptrapjackNo ratings yet

- 5.09 Analysis of Income TaxesDocument10 pages5.09 Analysis of Income TaxesClaptrapjackNo ratings yet

- Cash Flow StatementDocument8 pagesCash Flow StatementClaptrapjackNo ratings yet

- LM05 Analyzing Statements of Cash Flows II IFT NotesDocument7 pagesLM05 Analyzing Statements of Cash Flows II IFT NotesClaptrapjackNo ratings yet

- BIWS Excel ShortcutsDocument3 pagesBIWS Excel ShortcutsClaptrapjackNo ratings yet

- LM02 Fixed-Income Cash Flows and Types IFT NotesDocument13 pagesLM02 Fixed-Income Cash Flows and Types IFT NotesClaptrapjackNo ratings yet

- LM08 Equity Valuation Concepts and Basic Tools IFT NotesDocument19 pagesLM08 Equity Valuation Concepts and Basic Tools IFT NotesClaptrapjackNo ratings yet

- LM04 Analyzing Statements of Cash Flows I IFT NotesDocument11 pagesLM04 Analyzing Statements of Cash Flows I IFT NotesClaptrapjackNo ratings yet

- Lecture 3 Dual Curve StrippingDocument9 pagesLecture 3 Dual Curve StrippingClaptrapjackNo ratings yet

- Hazard Rates PENA Teaching NoteDocument3 pagesHazard Rates PENA Teaching NoteClaptrapjackNo ratings yet

- Lecture 1 Delta RiskDocument9 pagesLecture 1 Delta RiskClaptrapjackNo ratings yet

- Lecture 4 Smile Risk NewDocument28 pagesLecture 4 Smile Risk NewClaptrapjackNo ratings yet

- CQF January 2016 M5S8 Workings AnnotatedDocument7 pagesCQF January 2016 M5S8 Workings AnnotatedClaptrapjackNo ratings yet

- Branch Batch 02022023 03022023Document2 pagesBranch Batch 02022023 03022023ClaptrapjackNo ratings yet

- Digital Enrollment 27.01.2023.Document2 pagesDigital Enrollment 27.01.2023.ClaptrapjackNo ratings yet

- Atm Bna Hits 02022023Document3 pagesAtm Bna Hits 02022023ClaptrapjackNo ratings yet

- Long Lived AssetsDocument1 pageLong Lived AssetsClaptrapjackNo ratings yet

- Digital Enrolments 02022023Document1 pageDigital Enrolments 02022023ClaptrapjackNo ratings yet

- Otc Escalation MatrixDocument2 pagesOtc Escalation MatrixClaptrapjackNo ratings yet

- Atm Bna Hits 03022023Document3 pagesAtm Bna Hits 03022023ClaptrapjackNo ratings yet

- ICICI Securities Zomato Reinitiating Coverage NoteDocument13 pagesICICI Securities Zomato Reinitiating Coverage NoteClaptrapjackNo ratings yet

- 1.1 Demand and Supply For PostingDocument24 pages1.1 Demand and Supply For PostingLeo Marbeda FeigenbaumNo ratings yet

- Bonds PayableDocument10 pagesBonds Payablenot funny didn't laughNo ratings yet

- Fixed Exchange Rate and Flexible Exchange RateDocument10 pagesFixed Exchange Rate and Flexible Exchange RateAnanya456No ratings yet

- Youth Employment and Employability in MalaysiaDocument15 pagesYouth Employment and Employability in MalaysiaAbe Alias Syed HamidNo ratings yet

- Buy Back AssingmentDocument5 pagesBuy Back AssingmentDARK KING GamersNo ratings yet

- Cova and Salle (2008)Document9 pagesCova and Salle (2008)Uzma NaumanNo ratings yet

- Sales Director in Charlotte NC Resume Richard HammondDocument3 pagesSales Director in Charlotte NC Resume Richard HammondRichardHammondNo ratings yet

- Forecasting & Demand MeasurementDocument17 pagesForecasting & Demand MeasurementMaan91No ratings yet

- Sample Exam PM Questions PDFDocument11 pagesSample Exam PM Questions PDFBirat SharmaNo ratings yet

- Wealth-Lab Developer 6.9 Performance: Strategy: Channel Breakout VT Dataset/Symbol: AALDocument1 pageWealth-Lab Developer 6.9 Performance: Strategy: Channel Breakout VT Dataset/Symbol: AALHamahid pourNo ratings yet

- Advertising Case NescafeDocument6 pagesAdvertising Case NescafeKhurram HamidNo ratings yet

- The Social Order of Markets - BeckertDocument32 pagesThe Social Order of Markets - BeckertVictor N. UrzuaNo ratings yet

- Course Outline - International Marketing. PDFDocument3 pagesCourse Outline - International Marketing. PDFabraamNo ratings yet

- CementDocument7 pagesCementannisa lahjieNo ratings yet

- Adam SmithDocument5 pagesAdam SmithamnanaveedNo ratings yet

- Marketing MyopiaDocument13 pagesMarketing Myopiaswapnil_jadhav08No ratings yet

- Dissertation Report A Study On The Marke PDFDocument69 pagesDissertation Report A Study On The Marke PDFNEWKHALSA ENTNo ratings yet

- Notes On Competition ActDocument19 pagesNotes On Competition Actdhruvsharma88No ratings yet

- Placement Class - 2 (Math) Dharmendra SirDocument10 pagesPlacement Class - 2 (Math) Dharmendra SirJason WestNo ratings yet

- Debt PolicyDocument30 pagesDebt PolicyMai Phạm100% (1)

- Dynamic Asset Allocation in A Changing WorldDocument3 pagesDynamic Asset Allocation in A Changing WorldAnna WheelerNo ratings yet

- USA Dropshipping PDFDocument15 pagesUSA Dropshipping PDFHaryadi AlvaroNo ratings yet

- Aspects of The Tax Efficient Supply ChainDocument4 pagesAspects of The Tax Efficient Supply ChainMalik AhmedNo ratings yet

- Auctions and The Price of ArtDocument25 pagesAuctions and The Price of ArtJonathan FeldmanNo ratings yet

- Website Satisfaction Role of User and Website CharDocument338 pagesWebsite Satisfaction Role of User and Website Charrazor75apNo ratings yet

- Internship Presentation On Work Done in MORE Supermarket Marappalam, TVMDocument7 pagesInternship Presentation On Work Done in MORE Supermarket Marappalam, TVMBeema ShajahanNo ratings yet

- RSM392 Lecture2 PDFDocument71 pagesRSM392 Lecture2 PDFJanice JingNo ratings yet

LM01 Fixed-Income Instrument Features IFT Notes

LM01 Fixed-Income Instrument Features IFT Notes

Uploaded by

ClaptrapjackOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

LM01 Fixed-Income Instrument Features IFT Notes

LM01 Fixed-Income Instrument Features IFT Notes

Uploaded by

ClaptrapjackCopyright:

Available Formats

LM01 Fixed-Income Instrument Features 2024 Level I Notes

LM01 Fixed-Income Instrument Features

1. Introduction ...........................................................................................................................................................2

2. Features of Fixed-Income Securities ............................................................................................................2

3. Bond Indentures and Covenants ...................................................................................................................5

Summary......................................................................................................................................................................8

This document should be read in conjunction with the corresponding learning module in the 2024

Level I CFA® Program curriculum. Some of the graphs, charts, tables, examples, and figures are

copyright 2023, CFA Institute. Reproduced and republished with permission from CFA Institute. All

rights reserved.

Required disclaimer: CFA Institute does not endorse, promote, or warrant the accuracy or quality of

the products or services offered by IFT. CFA Institute, CFA®, and Chartered Financial Analyst® are

trademarks owned by CFA Institute.

Version 1.0

© IFT. All rights reserved 1

LM01 Fixed-Income Instrument Features 2024 Level I Notes

1. Introduction

This learning module introduces the features of fixed income instruments and the legal

contracts that govern them.

2. Features of Fixed-Income Securities

Fixed-income instruments, such as loans and bonds, are debt instruments that represent a

contractual agreement in which an issuer borrows money from investors in exchange for

interest and future repayment of principal.

Basic Features of a Bond

The basic features of a fixed-income security include:

Issuer:

Issuer is the entity that has issued the bond, or the one who has borrowed money. It is

responsible for servicing the debt (paying interest and principal payments). Bonds can be

classified into the following categories based on the type of the issuer:

• Supranational organizations: Bonds issued by international organizations such as the

World Bank and IMF.

• Sovereign governments: Debt of national governments such as government of the

United States, Germany, or Italy.

• Non-sovereign governments: Bonds that are not issued by a national or central

government. Instead, these are issued by states, provinces, municipalities, etc. For

example, municipal bonds in the United States, etc.

• Quasi-government entities: Bonds issued by agencies that are financed either directly

or indirectly by the government. They are also called sub-sovereign or agency bonds.

For example, Ginnie Mae, Fannie Mae, and Freddie Mac in United States.

• Companies: Bonds issued by a corporate. A distinction is often made between

financial issuers and non-financial issuers.

All bonds are exposed to credit risk. ‘Credit risk’ is the risk that interest and principal

payments will not be made by the issuer as they come due. Credit rating agencies such as

Moody’s and S&P assign a rating to issuers based on this risk.

Bonds can be classified into two categories based on their creditworthiness:

• Investment grade.

• Non-investment grade, or high-yield or speculative bonds.

Maturity:

The maturity date is the date on which the issuer will redeem the bond by paying the

outstanding principal amount. Once a bond has been issued, the time remaining until

maturity is known as the tenor of the bond.

• If original maturity is one year or less, the bond is called money market security.

© IFT. All rights reserved 2

LM01 Fixed-Income Instrument Features 2024 Level I Notes

• If original maturity is more than a year, the bond is called capital market security.

Par value:

Also known as face value, maturity value, or redemption value.

• It is the principal amount that is repaid to bondholders at maturity.

• If market price > par value, the bond is trading at a premium.

• If market price < par value, the bond is trading at a discount.

• If market price = par value, the bond is trading at par.

Coupon rate and frequency:

Coupon rate is the percentage of par value that the issuer agrees to pay to the bondholder

annually as interest. It can be a fixed rate or a floating rate. The coupon frequency may be

annual, semi-annual, quarterly, or monthly. Based on the frequency of coupon payments, we

can classify bonds into the following:

• Plain vanilla bond: It is the most basic type of bond with periodic fixed interest

payments during the bond’s life and the principal paid on maturity.

• Floating-rate bond or floating-rate notes or floaters: Unlike vanilla bonds, the interest

rate of a floating-rate bond is not fixed. The coupon payments are based on a floating

Market reference rate (MRR) at the start of the period. Some bonds specify the

coupon rate as two components: a market reference rate, plus a spread. The coupon

rate and coupon interest paid in every period change as the reference rate changes.

• Zero-coupon bonds or pure discount bonds: Bonds that have only one payment at

maturity. These are bonds that do not make a coupon payment over a bond’s life, and

are sold at a discount (less than the par value) at issuance. At maturity, the investor

receives the par value of the bond. Think of it as interest getting accumulated during

the bond’s life and being paid at maturity for a zero-coupon bond.

Seniority:

A single borrower may issue bonds with different seniority rankings. Seniority ranking

determines who gets paid first, or who has the first claim on the cash flows of the issuer, in

the event of default/bankruptcy/restructuring. Senior debt has a priority over other debt

claims. Junior or subordinated debt has a lower priority and is paid only once the senior

claim are satisfied.

Contingency provisions:

A contingency provision is a clause in a legal document that allows for some action if the

event or circumstance does occur. It is also called an embedded option. The most common

contingency provisions for bonds are: call, put, and conversion options.

Yield Measures

There are two widely used yield measures to describe a bond: current yield and yield to

maturity.

© IFT. All rights reserved 3

LM01 Fixed-Income Instrument Features 2024 Level I Notes

Current yield or Running yield

Current yield is the annual coupon divided by the bond’s price and is expressed as a

percentage. For example, consider a three-year, annual coupon bond with a par value of

$100. The bond is issued at $95. The coupon rate is 10%, so the coupon payments are $10

10

every year. Current yield = 95 = 10.5%

Yield to Maturity (YTM)

Yield to maturity is the internal rate of return on a bond’s expected cash flows. In other

words, it is the expected annual rate of return an investor will earn if the bond is held to

maturity. It is also known as ‘yield to redemption’ or ‘redemption yield’. The IRR can be

calculated easily using the financial calculator. Let us consider the same bond as in the

current yield example:

Input these values: CF0 = -95; CF1 = 10; CF2 = 10; CF3 = 110. Computing for IRR, you should

get 12.08%. As you can see, YTM is higher than the coupon rate. For a discount bond such as

this one, the YTM is higher than the coupon rate. A bond’s price is inversely related to its

yield to maturity.

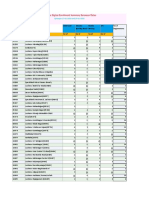

Yield Curves

The yield curve plots the YTMs of bonds on the y-axis versus maturity on the x-axis. Exhibit 4

from the curriculum shows a sample yield curve. This curve is constructed using six bonds

issued by a single corporation.

As seen in the graph, bonds with longer maturities have higher YTMs, indicating that

investors are demanding higher expected returns to compensate for higher risk associated

with longer-maturity bonds.

© IFT. All rights reserved 4

LM01 Fixed-Income Instrument Features 2024 Level I Notes

To evaluate credit risk, we can compare an issuer’s yield curve with the yield curve for

comparable sovereign bonds (which have no credit risk). Exhibit 5 from the curriculum

illustrates this.

The yield difference between the 5-year corporation bond and the 5-year US treasury bond

is 3.2% - 2.3% = 0.9%. This reflects the compensation that investors demand for taking the

additional credit risk associated with the corporation bond.

3. Bond Indentures and Covenants

Bond Indenture

A bond indenture is a written legal agreement between the bond issuer and the investor. The

indenture has the following information:

• The name of the issuer.

• All the terms of a bond issue such as the type of bond.

• Its features such as the principal value, coupon rate, dates when interest payments

will be made, and maturity date.

• Issuer’s obligations.

• Bondholders’ rights.

• If the bonds are secured or not.

• Covenants.

• Contingency provisions like call option.

Source of Repayment Proceeds

Investors need to know how the issuer intends to make interest payments and repay the

principal. The bond indenture specifies the source of revenue or how the issuer intends to

make interest and principal payments. We look at the repayment sources for each category

now.

© IFT. All rights reserved 5

LM01 Fixed-Income Instrument Features 2024 Level I Notes

• For supranational bonds: From repayment of previous loans or paid-in capital from

its members. For example, the World Bank may have given a loan to a particular

country. When the country pays back the loan, this money is used to pay the

bondholders. Paid-in capital is the amount contributed by member nations.

• For sovereign bonds: Tax revenues and printing new money. The government may

also increase taxes to service debt.

• Three sources for non-sovereign government debt issues: the taxing authority of the

issuer, cash flows of the project, special taxes or fees.

• For corporate bonds: Cash flow generated by the company’s primary operations. The

higher the credit risk, the higher the yield.

• For securitized bonds: Cash flows generated by the underlying assets such as

mortgages, credit card receivables, auto loans, etc. Securitized bonds are amortized,

i.e., the principal is paid back gradually over the bond’s life rather than in one

payment at maturity.

Asset or Collateral Backing

Collateral reduces credit risk.

• Secured vs. unsecured bonds: In a secured bond, assets are pledged as collateral to

ensure debt repayment in the case of a default. Unsecured bonds have no collateral.

• Seniority ranking: What this means is that if a company faces bankruptcy and its

assets are liquidated, the investors (or bondholders) are repaid based on seniority.

Covenants

Bond covenants are legally enforceable rules that borrowers and lenders agree on at the

time of a new bond issue. Covenants can be affirmative (positive) or negative (restrictive).

Affirmative covenants indicate what the issuer must do. These are generally administrative

in nature. They do not impose additional costs on the issuer. For example, the issuer must:

• Make interest and principal payments on time.

• Comply with all laws and regulations.

• Maintain current lines of business.

• Insure and maintain assets.

• Pay taxes on time.

• Other examples include a ‘pari pasu’ clause which ensures that a debt obligation is

treated the same as the borrower’s other senior debt instruments, or a ‘cross-default’

clause which specifies that a borrower is considered in default if they default on

another debt obligation.

Negative covenants indicate what the issuer must not do. These are frequently costlier and

materially constrain the issuer’s potential business decisions. Examples include:

• Restrictions on debt: Limits on maximum acceptable leverage ratios and minimum

acceptable interest coverage ratios.

• Negative pledges: No additional debt can be issued that is senior to existing debt.

© IFT. All rights reserved 6

LM01 Fixed-Income Instrument Features 2024 Level I Notes

• Restrictions on prior claims: The issuer cannot collateralize assets that were

previously collateralized. The objective is to protect unsecured bondholders.

• Restrictions on distribution to shareholders: Restrictions on how much money can be

spent on dividends and buy-backs.

• Restrictions on asset disposals: A limit on the total amount of assets that can be

disposed during a bond’s life. The objective is to ensure the company does not

breakup.

• Restrictions on investments: This ensures no investment is made in a speculative

business and that the capital is invested in a going-concern business.

• Restrictions on mergers and acquisitions.

© IFT. All rights reserved 7

LM01 Fixed-Income Instrument Features 2024 Level I Notes

Summary

LO: Describe the features of a fixed-income security.

The basic features of a fixed-income security include the specification of:

• Issuer: It is the entity that has issued the bond. The types of issuers include

supranational organizations, sovereign governments, non-sovereign governments,

quasi-government entities, and companies.

• Maturity: It is the date on which the last payment is made for a bond. Based on

maturity, bonds can be classified into money market security, capital market security,

and perpetual bonds.

• Par value: It is the amount an issuer agrees to pay the investor or bondholder on

maturity date. A bond is premium if sold above par, discount if sold below par, and at

par if sold at face value.

• Coupon rate and frequency: Coupon rate is the interest rate paid on a bond every year

by the issuer until its maturity date. Bonds that have only one payment at maturity

are called zero-coupon bonds.

• Seniority: Seniority ranking determines who gets paid first, or who has the first claim

on the cash flows of the issuer, in the event of default/bankruptcy/restructuring.

• Contingency provisions: Some bonds may be issued with embedded

call/put/conversion options.

LO: Describe the contents of a bond indenture and contrast affirmative and negative

covenants.

Bond indenture is a legal agreement between the bond issuer and the investor. It includes all

the terms of a bond issue such as the type of bond, its features such as principal value and

coupon rate, and maturity date. It also includes the dollar amount of issue, issuer’s

obligations, bondholders’ rights, when the coupon payments will be made, if the bonds are

secured or not, covenants, and contingency provisions.

Bond covenants are legally enforceable rules that borrowers and lenders agree on at the

time of a new bond issue. Covenants can be affirmative (positive) or negative (restrictive).

Affirmative covenants indicate what the issuer must do. These are generally administrative

in nature. For example, issuer must make interest and principal payments on time, comply

with laws and regulations, insure and maintain assets, etc.

Negative covenants indicate what the issuer must not do. These are frequently more costly

and materially constrain the issuer’s potential business decisions. Examples include

restriction on debt, negative pledges, restrictions on prior claims, restrictions on distribution

to shareholders, etc.

© IFT. All rights reserved 8

You might also like

- LM03 Analyzing Balance Sheets IFT NotesDocument11 pagesLM03 Analyzing Balance Sheets IFT NotesClaptrapjackNo ratings yet

- K J Somaiya Institute of Management Studies and Research, HostelDocument3 pagesK J Somaiya Institute of Management Studies and Research, HostelsanketNo ratings yet

- Topic 1 ExercisesDocument5 pagesTopic 1 ExercisesChristian Alain Ndzie BitunduNo ratings yet

- Sample Problem Statement and Research QuestionsDocument3 pagesSample Problem Statement and Research QuestionsSheer LockNo ratings yet

- L1 R39 Fixed Income Securities Defining Elements Lecture - Study Notes (2022)Document27 pagesL1 R39 Fixed Income Securities Defining Elements Lecture - Study Notes (2022)sumralatifNo ratings yet

- L1 01 Fixed Income Securities Defining Elements Lecture - Study Notes (2023)Document21 pagesL1 01 Fixed Income Securities Defining Elements Lecture - Study Notes (2023)Sumair ChughtaiNo ratings yet

- Chapter Two: Non - Current LiabilitiesDocument10 pagesChapter Two: Non - Current LiabilitiesJuan KermaNo ratings yet

- LN 06 Fixed Income NotesDocument59 pagesLN 06 Fixed Income NoteshersanyNo ratings yet

- Are Securities That Promise To Make Fixed Payments According ToDocument26 pagesAre Securities That Promise To Make Fixed Payments According Toaddisyawkal18No ratings yet

- FM I - 3 P1Document11 pagesFM I - 3 P1Henok FikaduNo ratings yet

- Fixed Income Securities - SIGFi - Finance HandbookDocument15 pagesFixed Income Securities - SIGFi - Finance HandbookSneha TatiNo ratings yet

- Basics of Bond With Types & FeaturesDocument10 pagesBasics of Bond With Types & FeaturesradhikaNo ratings yet

- Bonds CH08Document16 pagesBonds CH08Hendrickson Cruz SaludNo ratings yet

- Unit 4Document16 pagesUnit 4hassan19951996hNo ratings yet

- To Bonds: by Cristina Resetnic, Asem, FB 29 GDocument12 pagesTo Bonds: by Cristina Resetnic, Asem, FB 29 GShapthami Manokar100% (3)

- Valuation of Debt and EquityDocument8 pagesValuation of Debt and EquityhelloNo ratings yet

- Corporate BondsDocument4 pagesCorporate BondsWaseem ManshaNo ratings yet

- Project in Acctg4 For Pre-FinalsDocument12 pagesProject in Acctg4 For Pre-FinalsJohn Kenneth Escober BentirNo ratings yet

- Project in Acctg4 For Pre-FinalsDocument12 pagesProject in Acctg4 For Pre-FinalsJohn Kenneth Escober BentirNo ratings yet

- LM03 Fixed-Income Issuance and Trading IFT NotesDocument9 pagesLM03 Fixed-Income Issuance and Trading IFT NotesClaptrapjackNo ratings yet

- Lecture 4_Bond MarketsDocument50 pagesLecture 4_Bond MarketsTonie NascentNo ratings yet

- Fixed Income Securities - 8Document24 pagesFixed Income Securities - 8SHRIRAJ LIGADENo ratings yet

- Bond Valuation Final FinalDocument40 pagesBond Valuation Final FinalkafiNo ratings yet

- Finals Week 1Document6 pagesFinals Week 1Mark Angelo BustosNo ratings yet

- Aditya Ajit - BondDocument21 pagesAditya Ajit - BondAachal JaiswalNo ratings yet

- 4 RM AssignmentDocument4 pages4 RM Assignmentaryangedam121No ratings yet

- Debt MarketsDocument17 pagesDebt MarketsHONEST PASCHALNo ratings yet

- Chapter 8 Fixed Income SecuritiesDocument35 pagesChapter 8 Fixed Income SecuritiesCezarene Fernando100% (1)

- Chapter Three FA II DawudDocument11 pagesChapter Three FA II DawudHussen AbdulkadirNo ratings yet

- Chapter Three 3. Fixed Income Securities 3.1. What Are Fixed Income Securities?Document11 pagesChapter Three 3. Fixed Income Securities 3.1. What Are Fixed Income Securities?Seid KassawNo ratings yet

- Chapter 12 Senior SecurityDocument23 pagesChapter 12 Senior SecuritySumonNo ratings yet

- FM I Bond ValuationDocument16 pagesFM I Bond Valuationdanielnebeyat7No ratings yet

- Finmar Week 12Document8 pagesFinmar Week 12Joleen DoniegoNo ratings yet

- Faii Chapter Vi - 0Document16 pagesFaii Chapter Vi - 0chuchuNo ratings yet

- Long-Term Financial Liabilities: Chapter Topics Cross Referenced With CicaDocument10 pagesLong-Term Financial Liabilities: Chapter Topics Cross Referenced With CicaghostbooNo ratings yet

- Corporate Debt Markets The Debt MarketDocument7 pagesCorporate Debt Markets The Debt MarketYashwanth Naik SNo ratings yet

- Notes 3 - Bond ValuationDocument5 pagesNotes 3 - Bond Valuationyousra kadiriNo ratings yet

- Chapter 9-Bond and Stock Valuation (Revised)Document51 pagesChapter 9-Bond and Stock Valuation (Revised)Md. Nazmul Kabir100% (2)

- Debentures - Meaning, Types, Features, Accounting ExamplesDocument6 pagesDebentures - Meaning, Types, Features, Accounting Examplesfarhadcse30No ratings yet

- (FM02) - Chapter 6 Valuation of Future Cash Flows Bond and Equity ValuationDocument13 pages(FM02) - Chapter 6 Valuation of Future Cash Flows Bond and Equity ValuationKenneth John TomasNo ratings yet

- CFA Level1 - Fixed Income - SS14 v2021Document154 pagesCFA Level1 - Fixed Income - SS14 v2021Carl Anthony FabicNo ratings yet

- Fixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2From EverandFixed Income Securities: A Beginner's Guide to Understand, Invest and Evaluate Fixed Income Securities: Investment series, #2No ratings yet

- Lecture 3Document33 pagesLecture 3hafsaNo ratings yet

- Bonds: Here Are Some Benefits They Can ProvideDocument7 pagesBonds: Here Are Some Benefits They Can ProvidefaqehaNo ratings yet

- Investment and Portfolio Management: ACFN 3201Document13 pagesInvestment and Portfolio Management: ACFN 3201Bantamkak FikaduNo ratings yet

- 07 The Valuation of SecurityDocument23 pages07 The Valuation of SecurityAidil IdzhamNo ratings yet

- Chapter IV Suplimentary 2Document25 pagesChapter IV Suplimentary 2henokal99No ratings yet

- FinQuiz - Smart Summary - Study Session 15 - Reading 51Document4 pagesFinQuiz - Smart Summary - Study Session 15 - Reading 51RafaelNo ratings yet

- Chap 3 Fixed Income SecuritiesDocument45 pagesChap 3 Fixed Income SecuritiesHABTAMU TULU0% (1)

- Financial Markets and Investments: Valuation of SecuritiesDocument21 pagesFinancial Markets and Investments: Valuation of SecuritiesLipika haldarNo ratings yet

- Reading 39 - Fixed Income Securities - Defining ElementsDocument36 pagesReading 39 - Fixed Income Securities - Defining ElementsAllen AravindanNo ratings yet

- Investment ManagementDocument4 pagesInvestment ManagementCaroline B CodinoNo ratings yet

- Portfolio Management Module 4Document7 pagesPortfolio Management Module 4Ayush kashyapNo ratings yet

- Non Non Non Non - Current Liabilities Current Liabilities Current Liabilities Current LiabilitiesDocument93 pagesNon Non Non Non - Current Liabilities Current Liabilities Current Liabilities Current LiabilitiesBantamkak FikaduNo ratings yet

- Bonds and Their Valuation: Dr. Rakesh Kumar SharmaDocument43 pagesBonds and Their Valuation: Dr. Rakesh Kumar Sharmaswastik guptaNo ratings yet

- Investment Alternatives of Capital MarketDocument4 pagesInvestment Alternatives of Capital MarketMuhammad RizwanNo ratings yet

- Fin Eco 9 PDFDocument8 pagesFin Eco 9 PDFRajesh GargNo ratings yet

- Long-Term FinancingDocument15 pagesLong-Term FinancingMir MusadiqNo ratings yet

- Chapter 6Document9 pagesChapter 6bobby brownNo ratings yet

- Understanding Debentures: Key TakeawaysDocument8 pagesUnderstanding Debentures: Key TakeawaysRichard DuniganNo ratings yet

- FinQuiz - Smart Summary - Study Session 15 - Reading 52Document5 pagesFinQuiz - Smart Summary - Study Session 15 - Reading 52RafaelNo ratings yet

- Fixed in Come NotesDocument30 pagesFixed in Come NotesmechedceNo ratings yet

- 2.international FinanceDocument81 pages2.international FinanceDhawal RajNo ratings yet

- Digital Enrollments 04.02.2023Document1 pageDigital Enrollments 04.02.2023ClaptrapjackNo ratings yet

- FRM 2021 Gpa ReportDocument21 pagesFRM 2021 Gpa ReportClaptrapjackNo ratings yet

- Mitres 18 001 f17 Guide ch09Document14 pagesMitres 18 001 f17 Guide ch09ClaptrapjackNo ratings yet

- Holiday Home Reservation Letter 000193157ggDocument2 pagesHoliday Home Reservation Letter 000193157ggClaptrapjackNo ratings yet

- Holiday Home Reservation Letter 000193698Document1 pageHoliday Home Reservation Letter 000193698ClaptrapjackNo ratings yet

- Pre Mfe Prob Feb2024 SyllabusDocument3 pagesPre Mfe Prob Feb2024 SyllabusClaptrapjackNo ratings yet

- W4w2hyxcjws0ctst5yal3pscDocument2 pagesW4w2hyxcjws0ctst5yal3pscClaptrapjackNo ratings yet

- Mitres 18 001 f17 Manual ch12Document9 pagesMitres 18 001 f17 Manual ch12ClaptrapjackNo ratings yet

- ResultsDocument2 pagesResultsClaptrapjackNo ratings yet

- 5.09 Analysis of Income TaxesDocument10 pages5.09 Analysis of Income TaxesClaptrapjackNo ratings yet

- Cash Flow StatementDocument8 pagesCash Flow StatementClaptrapjackNo ratings yet

- LM05 Analyzing Statements of Cash Flows II IFT NotesDocument7 pagesLM05 Analyzing Statements of Cash Flows II IFT NotesClaptrapjackNo ratings yet

- BIWS Excel ShortcutsDocument3 pagesBIWS Excel ShortcutsClaptrapjackNo ratings yet

- LM02 Fixed-Income Cash Flows and Types IFT NotesDocument13 pagesLM02 Fixed-Income Cash Flows and Types IFT NotesClaptrapjackNo ratings yet

- LM08 Equity Valuation Concepts and Basic Tools IFT NotesDocument19 pagesLM08 Equity Valuation Concepts and Basic Tools IFT NotesClaptrapjackNo ratings yet

- LM04 Analyzing Statements of Cash Flows I IFT NotesDocument11 pagesLM04 Analyzing Statements of Cash Flows I IFT NotesClaptrapjackNo ratings yet

- Lecture 3 Dual Curve StrippingDocument9 pagesLecture 3 Dual Curve StrippingClaptrapjackNo ratings yet

- Hazard Rates PENA Teaching NoteDocument3 pagesHazard Rates PENA Teaching NoteClaptrapjackNo ratings yet

- Lecture 1 Delta RiskDocument9 pagesLecture 1 Delta RiskClaptrapjackNo ratings yet

- Lecture 4 Smile Risk NewDocument28 pagesLecture 4 Smile Risk NewClaptrapjackNo ratings yet

- CQF January 2016 M5S8 Workings AnnotatedDocument7 pagesCQF January 2016 M5S8 Workings AnnotatedClaptrapjackNo ratings yet

- Branch Batch 02022023 03022023Document2 pagesBranch Batch 02022023 03022023ClaptrapjackNo ratings yet

- Digital Enrollment 27.01.2023.Document2 pagesDigital Enrollment 27.01.2023.ClaptrapjackNo ratings yet

- Atm Bna Hits 02022023Document3 pagesAtm Bna Hits 02022023ClaptrapjackNo ratings yet

- Long Lived AssetsDocument1 pageLong Lived AssetsClaptrapjackNo ratings yet

- Digital Enrolments 02022023Document1 pageDigital Enrolments 02022023ClaptrapjackNo ratings yet

- Otc Escalation MatrixDocument2 pagesOtc Escalation MatrixClaptrapjackNo ratings yet

- Atm Bna Hits 03022023Document3 pagesAtm Bna Hits 03022023ClaptrapjackNo ratings yet

- ICICI Securities Zomato Reinitiating Coverage NoteDocument13 pagesICICI Securities Zomato Reinitiating Coverage NoteClaptrapjackNo ratings yet

- 1.1 Demand and Supply For PostingDocument24 pages1.1 Demand and Supply For PostingLeo Marbeda FeigenbaumNo ratings yet

- Bonds PayableDocument10 pagesBonds Payablenot funny didn't laughNo ratings yet

- Fixed Exchange Rate and Flexible Exchange RateDocument10 pagesFixed Exchange Rate and Flexible Exchange RateAnanya456No ratings yet

- Youth Employment and Employability in MalaysiaDocument15 pagesYouth Employment and Employability in MalaysiaAbe Alias Syed HamidNo ratings yet

- Buy Back AssingmentDocument5 pagesBuy Back AssingmentDARK KING GamersNo ratings yet

- Cova and Salle (2008)Document9 pagesCova and Salle (2008)Uzma NaumanNo ratings yet

- Sales Director in Charlotte NC Resume Richard HammondDocument3 pagesSales Director in Charlotte NC Resume Richard HammondRichardHammondNo ratings yet

- Forecasting & Demand MeasurementDocument17 pagesForecasting & Demand MeasurementMaan91No ratings yet

- Sample Exam PM Questions PDFDocument11 pagesSample Exam PM Questions PDFBirat SharmaNo ratings yet

- Wealth-Lab Developer 6.9 Performance: Strategy: Channel Breakout VT Dataset/Symbol: AALDocument1 pageWealth-Lab Developer 6.9 Performance: Strategy: Channel Breakout VT Dataset/Symbol: AALHamahid pourNo ratings yet

- Advertising Case NescafeDocument6 pagesAdvertising Case NescafeKhurram HamidNo ratings yet

- The Social Order of Markets - BeckertDocument32 pagesThe Social Order of Markets - BeckertVictor N. UrzuaNo ratings yet

- Course Outline - International Marketing. PDFDocument3 pagesCourse Outline - International Marketing. PDFabraamNo ratings yet

- CementDocument7 pagesCementannisa lahjieNo ratings yet

- Adam SmithDocument5 pagesAdam SmithamnanaveedNo ratings yet

- Marketing MyopiaDocument13 pagesMarketing Myopiaswapnil_jadhav08No ratings yet

- Dissertation Report A Study On The Marke PDFDocument69 pagesDissertation Report A Study On The Marke PDFNEWKHALSA ENTNo ratings yet

- Notes On Competition ActDocument19 pagesNotes On Competition Actdhruvsharma88No ratings yet

- Placement Class - 2 (Math) Dharmendra SirDocument10 pagesPlacement Class - 2 (Math) Dharmendra SirJason WestNo ratings yet

- Debt PolicyDocument30 pagesDebt PolicyMai Phạm100% (1)

- Dynamic Asset Allocation in A Changing WorldDocument3 pagesDynamic Asset Allocation in A Changing WorldAnna WheelerNo ratings yet

- USA Dropshipping PDFDocument15 pagesUSA Dropshipping PDFHaryadi AlvaroNo ratings yet

- Aspects of The Tax Efficient Supply ChainDocument4 pagesAspects of The Tax Efficient Supply ChainMalik AhmedNo ratings yet

- Auctions and The Price of ArtDocument25 pagesAuctions and The Price of ArtJonathan FeldmanNo ratings yet

- Website Satisfaction Role of User and Website CharDocument338 pagesWebsite Satisfaction Role of User and Website Charrazor75apNo ratings yet

- Internship Presentation On Work Done in MORE Supermarket Marappalam, TVMDocument7 pagesInternship Presentation On Work Done in MORE Supermarket Marappalam, TVMBeema ShajahanNo ratings yet

- RSM392 Lecture2 PDFDocument71 pagesRSM392 Lecture2 PDFJanice JingNo ratings yet