Professional Documents

Culture Documents

DIVESTURES

DIVESTURES

Uploaded by

Angela DucusinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

DIVESTURES

DIVESTURES

Uploaded by

Angela DucusinCopyright:

Available Formats

ASSIGNMENT

1) MOTIVES FOR MERGERS AND ACQUISITIONS

a) Value Creation: Companies may engage in mergers to enhance shareholder wealth. This often

results in synergies that elevate the value of the combined entity beyond the sum of the individual

companies. There are two main types of synergies:

o Revenue synergies: Improving revenue-generating capabilities through factors like market

expansion and R&D activities.

o Cost synergies: Reducing costs through economies of scale, access to new technologies, and

eliminating certain expenses.

b) Diversification: Mergers are frequently pursued for diversification purposes, allowing companies to

enter new markets or offer new products and services. Managers may seek mergers to diversify

operational risks, though shareholders may not always favor this if it adds complexity and risk

compared to simpler risk-diversification methods.

c) Acquisition of Assets: Mergers can be driven by the desire to acquire unique or time-consuming

assets. Access to new technologies is a common objective in such transactions.

d) Increase in Financial Capacity: Companies may merge to overcome financial limitations,

enabling a consolidated entity to have a higher financial capacity for future business development.

e) Tax Purposes: Merging with a company holding substantial carry-forward tax losses can

significantly reduce the total tax liability of the consolidated entity compared to operating

independently.

f) Incentives for Managers: Managers may pursue mergers based on personal interests and goals.

This could involve seeking more power, and prestige, or engaging in "empire building" to create the

largest company in the industry. Additionally, larger companies can offer higher salaries and

bonuses, which may be appealing to managers as their compensation is often correlated with the

size of the company.

Mergers and acquisitions serve various strategic purposes, and the motives behind them can be

multifaceted. Shareholder value creation is a fundamental driver, with synergies playing a crucial role.

Diversification and the acquisition of unique assets or technologies contribute to the strategic positioning

of the merged entity. Financial considerations, such as overcoming limitations and achieving tax

efficiency, provide additional rationale.

Notably, the role of managerial incentives adds a human dimension to mergers. Managerial interests, ego,

and a desire for industry dominance can influence strategic decisions. The correlation between company

size and managerial compensation underscores the importance of considering not only financial but also

personal motivations when analyzing mergers and acquisitions.

In essence, mergers are complex transactions influenced by a combination of financial, strategic, and

personal factors. Understanding these diverse motives is crucial for stakeholders, as it provides insights

into the potential benefits and challenges associated with mergers and acquisitions.

2) DEFENSIVE MECHANISMS FOR MERGERS AND ACQUISITIONS

In the context of mergers and acquisitions (M&A), various defensive mechanisms are employed to

safeguard target companies from hostile takeovers and to increase the overall cost of acquisition for

potential acquirers.

POISION PILL a tactic used by a target company to make its stock less attractive to potential

acquirers. This is typically achieved by issuing additional shares of stock to existing shareholders,

diluting the value of the stock and making it more expensive for the acquirer to gain a controlling

stake. It can be an effective way for a target company to protect itself from hostile takeovers, they

can also make it more difficult for acquirers to negotiate a deal, ultimately prolonging the M&A

process.

DIVESTURES wherein a firm sells assets or a division to the highest bidder on the sale it

receives cash which is reinvested in new assets or returned to stockholders as dividends or go for

stock buy backs. By doing so the target firm creates value for the shareholders and makes the

company less attractive for the acquirer.

SPIN-OFFS a firm separates assets or a division and creates new shares with a claim on this

portion of the business. Existing stockholders in the firm receive these shares in proportion to

their original holdings they can choose to retain these shares or they can sell them in market.

SPLITUPS which can be considered as an expanded version of a spin-off the firm splits into

different lines of businesses and distributes shares in these business lines to the original

stockholders in proportion to their original ownership in the firm. It is similar to spin-off in so far

as it creates new shares in the undervalued business line in this case however the existing

stockholders are given the option to exchange their parent company stock for these new shares

which change the proportional ownership in the new structure making it difficult for acquirer.

GOLDEN PARACHUTES where target firms make large payments to the managers of a firm if

it is acquired which in turn will lead to Cash drain from these payments would render the

acquisition or merger in feasible which if acquired will leave the acquirer with a huge debt level

CROWN JEWELS a target firm sells major assets (crown jewels) when faced with a takeover

threat this is sometimes referred to as the Scorched earth strategy by doing so the target firm

again makes the deal unattractive

WHITE SQUIRE an individual or company who is friendly to the current management is asked

to buy enough of the target firm shares to block a hostile takeover making it almost impossible

for the acquirer. Other methods include trying to convince the target firm's shareholders that the

price offered is too low.

Defensive mechanisms are an important aspect of the M&A process and can have a significant impact on

the outcome of a deal. While these mechanisms can be effective in protecting a target company from

hostile takeovers and preserving the interests of its shareholders, they can also have the unintended

consequence of deterring potential acquirers and prolonging the M&A process.

In navigating the complex landscape of M&A, companies must carefully consider the deployment of

defensive mechanisms, weighing the benefits of protection against the potential drawbacks of deterring

acquirers and prolonging the deal process. Striking a balance between safeguarding shareholder interests

and facilitating a smooth M&A process is crucial for maximizing the positive outcomes of these strategic

maneuvers. Ultimately, the effectiveness of defensive mechanisms lies in their ability to secure favorable

terms for all stakeholders involved.

You might also like

- HBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)From EverandHBR's 10 Must Reads on Strategy (including featured article "What Is Strategy?" by Michael E. Porter)Rating: 4.5 out of 5 stars4.5/5 (25)

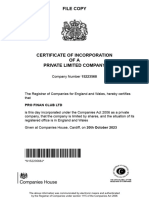

- CertificateDocument10 pagesCertificateremotepro47No ratings yet

- School - of - Finance - - - 101 - Questions ответыDocument98 pagesSchool - of - Finance - - - 101 - Questions ответыКирик ЕвченкоNo ratings yet

- Instructor's Manual Chapter 1Document43 pagesInstructor's Manual Chapter 1revanthNo ratings yet

- Mergers and AcquisitionDocument71 pagesMergers and AcquisitionAnonymous k2ZXzsNo ratings yet

- Giddy Introduction To Mergers & Acquisitions PDFDocument14 pagesGiddy Introduction To Mergers & Acquisitions PDFCharles GarrettNo ratings yet

- AFM NotesDocument26 pagesAFM NotesNikko AhmedNo ratings yet

- Chapter 1: Introduction To Mergers, Acquisitions, and Other Restructuring Activities Answers To End of Chapter Discussion QuestionsDocument38 pagesChapter 1: Introduction To Mergers, Acquisitions, and Other Restructuring Activities Answers To End of Chapter Discussion QuestionsAditya SharmaNo ratings yet

- Merger TheoriesDocument18 pagesMerger TheoriesKrishna MishraNo ratings yet

- Mgt368 Chap 14 Assignment.Document11 pagesMgt368 Chap 14 Assignment.রুবাইয়াত নিবিড়No ratings yet

- What Is Mergers & Acquisitions?: Process of Merger and AcquisitionDocument7 pagesWhat Is Mergers & Acquisitions?: Process of Merger and Acquisitionmoza salimNo ratings yet

- Chapter 5 FM NotesDocument14 pagesChapter 5 FM NotesVina DoraiNo ratings yet

- Chapter 1-Introductory To Mergers and AcquisitionsDocument10 pagesChapter 1-Introductory To Mergers and Acquisitions1954032027cucNo ratings yet

- M & A Assignment Defense Strategies Adopted by Companies Facing The Threat of TakeoverDocument18 pagesM & A Assignment Defense Strategies Adopted by Companies Facing The Threat of Takeoverhimank89No ratings yet

- Corporate Restructuring Mergers and Acquisitions/ Take OverDocument34 pagesCorporate Restructuring Mergers and Acquisitions/ Take OverWilsonNo ratings yet

- Mergers & ADocument9 pagesMergers & Avinayak1scribdNo ratings yet

- Mergers and Acquisitions, Answer Sheet MF0011Document5 pagesMergers and Acquisitions, Answer Sheet MF0011Ganesh ShindeNo ratings yet

- Definition: The Corporate Restructuring Is The Process ofDocument8 pagesDefinition: The Corporate Restructuring Is The Process ofHARSHITA SOANNo ratings yet

- Cho 5Document28 pagesCho 5Tariku KolchaNo ratings yet

- Chapter 8 of BBS 3rd YearDocument26 pagesChapter 8 of BBS 3rd YearAmar Singh SaudNo ratings yet

- Mergers and AquisitionsDocument76 pagesMergers and AquisitionsRahul BhatnagarNo ratings yet

- Project Report On Mergers and AcquisitionsDocument48 pagesProject Report On Mergers and AcquisitionsAvtaar SinghNo ratings yet

- MACR Assignment 1Document5 pagesMACR Assignment 1Srinidhi RangarajanNo ratings yet

- GRAND STRATEGIES AssignmentDocument5 pagesGRAND STRATEGIES Assignmentabayomi abayomiNo ratings yet

- 11 - Chapter 2 PDFDocument19 pages11 - Chapter 2 PDFUday MishraNo ratings yet

- DocxDocument6 pagesDocxSIM SpeaksNo ratings yet

- Mergers and AcquisitionDocument53 pagesMergers and Acquisitiontanviraje80% (5)

- Sarwanti Purwandari Conceptual QuestionsDocument5 pagesSarwanti Purwandari Conceptual QuestionsSarwanti PurwandariNo ratings yet

- Project On ICICI and BOR Merger and AcquistionsDocument32 pagesProject On ICICI and BOR Merger and Acquistionssourbh_brahma100% (1)

- Conceptual QuestionsDocument5 pagesConceptual QuestionsSarwanti PurwandariNo ratings yet

- Lesson 10 Mergers and AcquisitionsDocument12 pagesLesson 10 Mergers and Acquisitionsman ibeNo ratings yet

- Corporate RestructuringDocument13 pagesCorporate RestructuringSubrahmanya SringeriNo ratings yet

- Chapter-1 Concept of MergerDocument58 pagesChapter-1 Concept of MergerKamal JoshiNo ratings yet

- M&a in Indian BanksDocument48 pagesM&a in Indian Banksvikas_kumar820No ratings yet

- Mergers and AcquisitionDocument14 pagesMergers and Acquisitionmanita_usmsNo ratings yet

- 02 IFRS 3 Business CombinationDocument15 pages02 IFRS 3 Business CombinationtsionNo ratings yet

- Mergers and AcquisitionDocument56 pagesMergers and AcquisitionRakhwinderSinghNo ratings yet

- Mergers and Acquistions of Banking SectorDocument58 pagesMergers and Acquistions of Banking Sector૧ઉ karan Dadlani80% (10)

- Acquisition and MergingDocument19 pagesAcquisition and MergingTeerraNo ratings yet

- Mergers & AcquisitionsDocument62 pagesMergers & AcquisitionsJermaine Weiss100% (1)

- M&a 1Document34 pagesM&a 1shirkeoviNo ratings yet

- 1CR NotesDocument30 pages1CR NotesYASHIRA PATELNo ratings yet

- Financial Strategies For Value Creation (IIP)Document8 pagesFinancial Strategies For Value Creation (IIP)Sayed Fareed HasanNo ratings yet

- LECTURE 8 - Mergers - AcquisitionDocument34 pagesLECTURE 8 - Mergers - AcquisitionYvonneNo ratings yet

- Introduction To Corporate RestructuringDocument17 pagesIntroduction To Corporate RestructuringkigenNo ratings yet

- corpoRTE RESTRUCTURING OD DELL COMPUTERSDocument32 pagescorpoRTE RESTRUCTURING OD DELL COMPUTERSsarvaianNo ratings yet

- Lecture 8 Revised Seminar QDocument12 pagesLecture 8 Revised Seminar Qailiwork worksNo ratings yet

- Session 11Document24 pagesSession 11Yash MayekarNo ratings yet

- Failures of International Mergers and AcquisitionsDocument20 pagesFailures of International Mergers and AcquisitionsTojobdNo ratings yet

- Chapter 01 - Introductory To Mergers and AcquisitionsDocument10 pagesChapter 01 - Introductory To Mergers and AcquisitionsSom DasNo ratings yet

- Mergers and AcquisitionsDocument79 pagesMergers and Acquisitions匿匿100% (1)

- Topic 5. Mergers & Acquisitions: Corporate Finance: Cfi 311Document14 pagesTopic 5. Mergers & Acquisitions: Corporate Finance: Cfi 311Veneranda vedastusNo ratings yet

- Corporate Restructuring - Meaning, Types, and CharacteristicsDocument6 pagesCorporate Restructuring - Meaning, Types, and CharacteristicsPrajwalNo ratings yet

- DRITA RATKOCERI Mergers & Acquisitions TestDocument5 pagesDRITA RATKOCERI Mergers & Acquisitions TestDrita RatkoceriNo ratings yet

- Unit 1Document10 pagesUnit 1Anwar KhanNo ratings yet

- Diversification Strategy: Group No. 9Document15 pagesDiversification Strategy: Group No. 9Mandeep Singh Birdi100% (1)

- Summary Mergers & Acquisitions (25!11!2021)Document5 pagesSummary Mergers & Acquisitions (25!11!2021)Shafa ENo ratings yet

- Capital Market-Investment Special Situation and AnomaliesDocument3 pagesCapital Market-Investment Special Situation and AnomaliesPrincess Joy Andayan BorangNo ratings yet

- Business Opportunity Thinking: Building a Sustainable, Diversified BusinessFrom EverandBusiness Opportunity Thinking: Building a Sustainable, Diversified BusinessNo ratings yet

- Analytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationFrom EverandAnalytical Corporate Valuation: Fundamental Analysis, Asset Pricing, and Company ValuationNo ratings yet

- Dividend Investing: Passive Income and Growth Investing for BeginnersFrom EverandDividend Investing: Passive Income and Growth Investing for BeginnersNo ratings yet

- Module 9Document5 pagesModule 9Angela DucusinNo ratings yet

- A 1 FormationDocument6 pagesA 1 FormationJenine LeonarDoNo ratings yet

- ExternalitiesDocument53 pagesExternalitiesAngela DucusinNo ratings yet

- Press ReleaseDocument1 pagePress ReleaseAngela DucusinNo ratings yet

- Lesson 2 - Learning AssessmentDocument5 pagesLesson 2 - Learning AssessmentAngela DucusinNo ratings yet

- Ba SolverDocument1 pageBa SolverAngela DucusinNo ratings yet

- Kuliah 5 - Kitaran Perakaunan LengkapDocument29 pagesKuliah 5 - Kitaran Perakaunan LengkapDHARANIYA A/P SUBRAMANIAMNo ratings yet

- E 000382112005 Rev0Document2 pagesE 000382112005 Rev0bhaaNo ratings yet

- SMMT - Fs Consolidated q2 2022Document67 pagesSMMT - Fs Consolidated q2 2022Merlyn SariNo ratings yet

- Distribution LessonDocument20 pagesDistribution LessonHoney amayaoNo ratings yet

- Ch.12 - 13ed Fin Planning & ForecastingMasterDocument47 pagesCh.12 - 13ed Fin Planning & ForecastingMasterKelly HermanNo ratings yet

- In Late 2020, The Nicklaus Corporation Was Formed. The Corporate Charter Authorizes The Issuance ofDocument5 pagesIn Late 2020, The Nicklaus Corporation Was Formed. The Corporate Charter Authorizes The Issuance ofkrishna aroraNo ratings yet

- Inter-Paper-8-RTPs, MTPs and Past PapersDocument249 pagesInter-Paper-8-RTPs, MTPs and Past PapersKarthik100% (1)

- Porters Value Chain Divides The Structure of An Organization Into Activities and Does Not Consider The Traditional Departments and FunctionsDocument26 pagesPorters Value Chain Divides The Structure of An Organization Into Activities and Does Not Consider The Traditional Departments and FunctionsMd FerozNo ratings yet

- FA Practice 2 - QuestionsDocument10 pagesFA Practice 2 - QuestionsZhen WuNo ratings yet

- IAS 34 - Interim ReportingDocument9 pagesIAS 34 - Interim Reportingsayed tarikat ullahNo ratings yet

- Guas Inc A Major Retailer of Bicycles and Accessories Operates PDFDocument3 pagesGuas Inc A Major Retailer of Bicycles and Accessories Operates PDFTaimur TechnologistNo ratings yet

- Igcse May 2022 Paper 2 QPDocument12 pagesIgcse May 2022 Paper 2 QPThihan MgmgNo ratings yet

- Description: - TXN Date ValueDocument25 pagesDescription: - TXN Date ValueUday GurijalaNo ratings yet

- Digital Lending InnovationDocument60 pagesDigital Lending InnovationMiguel Vega OtinianoNo ratings yet

- MGFC10 Assg1 MTW17 W2018 PDFDocument3 pagesMGFC10 Assg1 MTW17 W2018 PDFAmyNo ratings yet

- Mfa2023 - Group AssignmentDocument66 pagesMfa2023 - Group AssignmentadlinfarhanahhhhNo ratings yet

- Zee Entertainment Detailed Financial Analysis - Part 2Document13 pagesZee Entertainment Detailed Financial Analysis - Part 2Nikhil GuptaNo ratings yet

- Class 5 Project Selection ExerciseDocument18 pagesClass 5 Project Selection ExerciseVinodshankar BhatNo ratings yet

- Term 1 91406 (3.3) Questions 2020Document10 pagesTerm 1 91406 (3.3) Questions 2020Rico RicoNo ratings yet

- Us Aers Roadmap Noncontrolling Interest 2019 PDFDocument194 pagesUs Aers Roadmap Noncontrolling Interest 2019 PDFUlii PntNo ratings yet

- CRA Journal Entries Internal ReconstructionDocument6 pagesCRA Journal Entries Internal Reconstructioncharmi vaghelaNo ratings yet

- Calculation - General Mills - PillsburyDocument10 pagesCalculation - General Mills - PillsburyAryan AnandNo ratings yet

- Equity Securities:Article IIIDocument37 pagesEquity Securities:Article IIIsherwin pulidoNo ratings yet

- Audit of Investments May 2028Document8 pagesAudit of Investments May 2028glcpaNo ratings yet

- BINI General Merchandise Answer Key 2Document19 pagesBINI General Merchandise Answer Key 2workwithericajaneNo ratings yet

- Tutorial 1Document2 pagesTutorial 1musicslave96No ratings yet

- 5A505F39-7628-4780-AA44-8BA68EC203FBDocument1 page5A505F39-7628-4780-AA44-8BA68EC203FBalfianjuniorNo ratings yet

- Global Business - Unit 4Document86 pagesGlobal Business - Unit 4GauravTiwariNo ratings yet