Professional Documents

Culture Documents

Tally - CCE

Tally - CCE

Uploaded by

pradhyumnasoni5Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Tally - CCE

Tally - CCE

Uploaded by

pradhyumnasoni5Copyright:

Available Formats

Tally - CCE for B.

Com - 1st Year, 2nd Year and Final Year

All Questions is Mandatory

Question 01:

Arun is a trader dealing in automobiles. For the following transactions, pass journal entries for the

month of January, 2018

1 Commenced business with cash 90,000

2 Purchased goods from X and Co. on credit 40,000

3 Accepted bill drawn by X and Co. 20,000

4 Sold goods to D and Co. on credit 10,000

5 Paid by cash the bill drawn by X and Co.

6 Received cheque from D and Co. in full settlement and deposited the same in bank 9,000

7 Commission received in cash 5,000

8 Goods costing Rs. 40,000 was sold and cash received 50,000

9 Salaries paid in cash 4,000

10 Building purchased from Kumar and Co. for Rs. 1,00,000 and an advance of Rs. 20,000 is

given in cash. 10 Marks

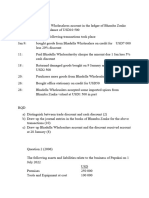

Question 02: On 1st April 2017, Tulsian Ltd. purchased a second-hand machine for Rs. 80,000

and spent Rs. 20,000 on its cartage, repairs and installation. The residual value at the end of its

expected useful life of 4 years is estimated at Rs. 40,000. On 30th Sept. 2018, repairs & renewals

amounted to © 2,000. On 30th Sept. 2019, this machine is sold for 7 50,000. Depreciation is to be

provided according to Straight Line Method.

Required: Prepare Journal, Machinery Account and Depreciation Account for the first three years

assuming that the accounts are closed on 31st March each year. 8 Marks

Prepared By: CA Abhinay Namdev

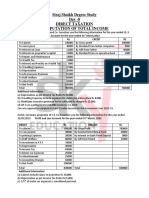

Question 3: Prepare Trading and profit and loss Account for year ending 31 st mar 2023 from the

following information

Raw Material as on 1st Apr 15,000 Sales Commission 1% of

2022 sales

Finished Goods as on 1st Apr 18,200 Printing and Stationary 3200

2022

Purchase made during the year 1,30,400 Courier 780

Direct Wages 24,600 Bad debts 3000

Freight inwards 9,000 Loss by fire 6500

Sale made 3,40,200 Lottery wining 30000

Stock of Raw material as on 10,000 Accounting Charges 5300

31st Mar 2023

Stock of Finished Goods as on 12790 Traveling Expenses 3690

31st Mar 2023

School fees of son 15370 Loan received from friend 50000

Salary 5060 Internet Charges 560

Interest paid on long term 3600 Audit Fees 7000

loans

Rent, rates and taxes 3937 Drawing 15000

12 Marks

Prepared By: CA Abhinay Namdev

You might also like

- Final Accounts Without Adjustments: Debit Balances: Debit Balances (Contd.)Document7 pagesFinal Accounts Without Adjustments: Debit Balances: Debit Balances (Contd.)Sarath SarathkumarNo ratings yet

- PaperDocument4 pagesPaperamirNo ratings yet

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- Mid SemDocument4 pagesMid Semf20220077No ratings yet

- Institute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartDocument3 pagesInstitute of Business Management: Lms Based Finalexaminations-Summer 2020 Analytical PartSafi SheikhNo ratings yet

- ACC 281 SEMINAR QUESTIONS Version 2Document8 pagesACC 281 SEMINAR QUESTIONS Version 2Joel SimonNo ratings yet

- Bcom TaxDocument6 pagesBcom TaxAditya .cNo ratings yet

- XI AccountancyDocument5 pagesXI Accountancytechnical hackerNo ratings yet

- Human Resources 3Document104 pagesHuman Resources 3Harsh 21COM1555No ratings yet

- 11 Com Pre-ExamDocument4 pages11 Com Pre-ExamObaid Khan50% (2)

- 185 Mid Term Exam 2020Document2 pages185 Mid Term Exam 2020khushali goharNo ratings yet

- (ACC 2023) Xii Target Paper by Sir Irfan JanDocument36 pages(ACC 2023) Xii Target Paper by Sir Irfan JanmohsinbeforwardNo ratings yet

- XDocument5 pagesXSAI KISHORENo ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- II PUC Accountancy Paper 2Document6 pagesII PUC Accountancy Paper 2Tarannum KNo ratings yet

- 18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Document3 pages18.01.2022 11 ACCOUNTS POST MID TERM 2021-22 CC Post Mid Acc 11Jr.No ratings yet

- S1 BookKeep 2nd Sem Final ExamDocument3 pagesS1 BookKeep 2nd Sem Final ExamTan Shu YuinNo ratings yet

- Accounting Question 1st PaperDocument3 pagesAccounting Question 1st Paperakber62No ratings yet

- GAT AssociatesDocument5 pagesGAT Associatessaviosharand94No ratings yet

- MBA (E), Part-I, 1st Semester-2Document27 pagesMBA (E), Part-I, 1st Semester-2Rubab MirzaNo ratings yet

- Inbound 7587795701079229226Document10 pagesInbound 7587795701079229226aftabkkhan1202No ratings yet

- Exam 1 - Final AccountsDocument2 pagesExam 1 - Final Accountscaphoenix mvpaNo ratings yet

- Lecture 4 Part 2 - QuestionDocument4 pagesLecture 4 Part 2 - QuestionIsyraf Hatim Mohd TamizamNo ratings yet

- Accounts Mock - 29178435Document6 pagesAccounts Mock - 29178435mopibam555No ratings yet

- Chartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalDocument81 pagesChartered Accountancy Professional Ii (CAP-II) : Education Division The Institute of Chartered Accountants of NepalPrashant Sagar GautamNo ratings yet

- RTP Dec 2020 QnsDocument13 pagesRTP Dec 2020 QnsbinuNo ratings yet

- ACCOUNTANCYDocument2 pagesACCOUNTANCYIshika GautamNo ratings yet

- Test 3Document8 pagesTest 3govarthan1976No ratings yet

- Accounts Xerox Wala Question Paper 08-Jan-2022Document16 pagesAccounts Xerox Wala Question Paper 08-Jan-2022Aquila GodaboleNo ratings yet

- Sharada Mandir ISC 12 Accounts Term1 2017Document3 pagesSharada Mandir ISC 12 Accounts Term1 2017Manish SainiNo ratings yet

- FINANCIAL ACCOUNTING I 2019 MinDocument6 pagesFINANCIAL ACCOUNTING I 2019 MinKedarNo ratings yet

- 12 Ut 1,2Document7 pages12 Ut 1,2Soni soniyaNo ratings yet

- 11th BK Final Exam Quesiton Paper March 2021Document5 pages11th BK Final Exam Quesiton Paper March 2021Harendra Prajapati100% (1)

- Acc May 2023-Past YearDocument7 pagesAcc May 2023-Past Yearcandywy0719No ratings yet

- Topic 3 TutorialDocument10 pagesTopic 3 TutorialMimi ArniNo ratings yet

- Financial Accounting (CBCS Hons)Document7 pagesFinancial Accounting (CBCS Hons)Devil GamerNo ratings yet

- Assignment 1Document3 pagesAssignment 1pranaylanjewar644No ratings yet

- Day 8 TaxationDocument2 pagesDay 8 TaxationKhan Shadab -27No ratings yet

- Revision Questions-1Document6 pagesRevision Questions-1stanleymudzamiri8No ratings yet

- 12 BK Question Bank Group C 2020 21Document6 pages12 BK Question Bank Group C 2020 21PuranNo ratings yet

- +1 Accountancy ONLINE Final Examination 2021Document5 pages+1 Accountancy ONLINE Final Examination 2021Rajwinder BansalNo ratings yet

- Acc407 Test 2 Feb 2022 QQ (1) EpjjDocument6 pagesAcc407 Test 2 Feb 2022 QQ (1) EpjjShahrillNo ratings yet

- Tutorial Single Entry and Incomplete Records 2023-2024Document6 pagesTutorial Single Entry and Incomplete Records 2023-2024Nassir JumaNo ratings yet

- FMA Assignment 01Document5 pagesFMA Assignment 01Dejen TagelewNo ratings yet

- Accounts - Full Test 1Document6 pagesAccounts - Full Test 1Shushaanth SanthoshNo ratings yet

- 211447Document2 pages211447ASHIFNo ratings yet

- Sum No.: 3: Debit Balances Rs. Credit Balances RsDocument3 pagesSum No.: 3: Debit Balances Rs. Credit Balances Rsdeepak7393No ratings yet

- Class XI Acc SM Arya Annual 2023-24Document5 pagesClass XI Acc SM Arya Annual 2023-24pandeyansh962No ratings yet

- FDN J22 - TS 2 - P1 Account - QueDocument5 pagesFDN J22 - TS 2 - P1 Account - QueShantanu JadhavNo ratings yet

- 2019-04 ICMAB FL 001 PAC Year Question April 2019Document3 pages2019-04 ICMAB FL 001 PAC Year Question April 2019Mohammad ShahidNo ratings yet

- DocumentDocument2 pagesDocumentShivaansh VatsNo ratings yet

- Xi Accounting Set 3Document6 pagesXi Accounting Set 3aashirwad2076No ratings yet

- Accrual & Prepaid HW QDocument4 pagesAccrual & Prepaid HW Q小仙女哈哈哈No ratings yet

- Financial Accounting 2019Document8 pagesFinancial Accounting 2019Ivy NinjaNo ratings yet

- FR HandoutDocument67 pagesFR Handoutrolandamuh2023No ratings yet

- TAXATION 2B Past PaperDocument8 pagesTAXATION 2B Past PaperAmithNo ratings yet

- ISC Accounts 11Document2 pagesISC Accounts 11Sriyaa SunkuNo ratings yet

- Basic Principles of Accounting: National Law University Odisha, CuttackDocument2 pagesBasic Principles of Accounting: National Law University Odisha, CuttackAnanya SonakiyaNo ratings yet

- Financial AccountingDocument5 pagesFinancial Accountinghisarahhh4No ratings yet

- Principles of Accounting 2 ExamDocument6 pagesPrinciples of Accounting 2 ExamYus LindaNo ratings yet

- Role of Commercial BanksDocument10 pagesRole of Commercial BanksKAAVIYAPRIYA K (RA1953001011009)No ratings yet

- 1 Pledge of EDCF LoanDocument3 pages1 Pledge of EDCF Loanyongju2182No ratings yet

- Interest and Commission: Mr. Christian Rae D. Bernales, LPTDocument16 pagesInterest and Commission: Mr. Christian Rae D. Bernales, LPTAlissa MayNo ratings yet

- LRN Format - BRDocument2 pagesLRN Format - BRADR LAW FIRM CHENNAINo ratings yet

- Math Shortcut Math by MaHBuB or RashidDocument100 pagesMath Shortcut Math by MaHBuB or RashidIjaj AhmedNo ratings yet

- Assignment 3Document1 pageAssignment 3Ridhwan AfiffNo ratings yet

- Written Assignment Unit4: XYZ Bank Balance SheetDocument4 pagesWritten Assignment Unit4: XYZ Bank Balance SheetMarcusNo ratings yet

- FM213 - AT - Problem Set 2Document9 pagesFM213 - AT - Problem Set 2Guido MaiaNo ratings yet

- RgiptulluDocument25 pagesRgiptulluHelloNo ratings yet

- Crónica Gai1-240202501-Aa4-Ev01Document3 pagesCrónica Gai1-240202501-Aa4-Ev01Ricardo padilla AcostaNo ratings yet

- L7 Financial Intermediaries - Banks & NBFCsDocument32 pagesL7 Financial Intermediaries - Banks & NBFCssonamsri76No ratings yet

- IDFC Loan ClosureDocument1 pageIDFC Loan ClosureDipra DasNo ratings yet

- Ra Bis FormDocument8 pagesRa Bis Formfranciscojr.tranceNo ratings yet

- Amortization MethodDocument6 pagesAmortization MethodCy BathanNo ratings yet

- Fundamentals of Engineering EconomicsDocument138 pagesFundamentals of Engineering EconomicsAmna JabbarNo ratings yet

- (Yas Center) - Tài Liệu Đào Tạo Anh Văn Pháp Lý Hợp ĐồngDocument27 pages(Yas Center) - Tài Liệu Đào Tạo Anh Văn Pháp Lý Hợp ĐồngTrãi NguyễnNo ratings yet

- FAR 6.2MC - Noncurrent Liabilities (Part 1) Notes and Loans PayableDocument4 pagesFAR 6.2MC - Noncurrent Liabilities (Part 1) Notes and Loans Payablekateangel ellesoNo ratings yet

- SCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - RedactedDocument1 pageSCHNEIDERS (00102) Peridic Billing Statement Ending 03.15.2017 - Redactedlarry-612445No ratings yet

- 8.5 Annuities Present ValueDocument3 pages8.5 Annuities Present Valueanzt888No ratings yet

- Basic of Accounts Tally Is A Package: AccountingDocument9 pagesBasic of Accounts Tally Is A Package: AccountingArista TechnologiesNo ratings yet

- Act ch01 l02 EnglishDocument3 pagesAct ch01 l02 EnglishLinds RiveraNo ratings yet

- FHC Fee Schedule 2023Document7 pagesFHC Fee Schedule 2023Darren RobinsonNo ratings yet

- Licensing and Supervision of Banking Business Consolidated National Bank DirectivesDocument119 pagesLicensing and Supervision of Banking Business Consolidated National Bank DirectivesAmanuel TesfayeNo ratings yet

- Afar - Partnership, Corporate Liquadation & Home Office and BranchDocument31 pagesAfar - Partnership, Corporate Liquadation & Home Office and BranchMitch MinglanaNo ratings yet

- 1 Industrywise Thrust Area, Sensetive, Resrictive & BannedDocument7 pages1 Industrywise Thrust Area, Sensetive, Resrictive & BannedKiran DarwatkarNo ratings yet

- Can Fin Homes Ltd. at A Glance: Information To InvestorsDocument21 pagesCan Fin Homes Ltd. at A Glance: Information To InvestorsDhrubajyoti DattaNo ratings yet

- FM - Lecture 2 - Time Value of Money PDFDocument82 pagesFM - Lecture 2 - Time Value of Money PDFMi ThưNo ratings yet

- Final ListDocument32 pagesFinal ListabhiadroitNo ratings yet

- Barerra V Lorenzo - ValixDocument2 pagesBarerra V Lorenzo - ValixVon Lee De LunaNo ratings yet

- Tata AIG Bharat Griha Raksha - Axis Bank Mortgage Loans: Total Premium Including Taxes 14090Document2 pagesTata AIG Bharat Griha Raksha - Axis Bank Mortgage Loans: Total Premium Including Taxes 14090kishan bhalodiyaNo ratings yet