Professional Documents

Culture Documents

Part 1

Part 1

Uploaded by

Silvia SlavkovaOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Part 1

Part 1

Uploaded by

Silvia SlavkovaCopyright:

Available Formats

ECONOMIC ENVIRONMENT

AND FINANCIAL MARKETS

INTERNATIONAL FINANCIAL MANAGEMENT

PART 1

CONTENTS

➔ Economic Policy Objectives

➔ Fiscal Policy

➔ Monetary Policy

➔ Financial Markets

➔ Exchange Rates

➔ Interest Rates

➔ Money Market Instruments

➔ ESG

Understanding Economic Policy Objectives

Real Economic Growth (per Capita)

● Economic growth is a way to track how much a country's production of goods and services

increases over time. When we talk about "real" economic growth, we're focusing on actual

improvements, without considering the effect of rising prices. A good way to gauge changes in

wealth and the standard of living in a country is to look at the Real GDP per capita.

Maintaining Price Stability

● The changes in the price levels of goods and services can have a big impact on a country's economic

growth. When prices fluctuate, it can influence when and how much people choose to spend, save,

or borrow. These changes in prices can also affect the value of investments, so maintaining a stable

price level is essential.

Achieving Full Employment (It's not the same as zero unemployment!)

● A healthy economy aims to have low levels of unemployment, where most people who want to work

can find work. However, it's normal to have some level of voluntary (people choosing not to work)

and short-term involuntary unemployment (people temporarily between jobs).

Ensuring Balance of Payments Stability

● A country's financial health, its standing as a borrower, and its relationships with other countries

can all be influenced by its trade balance - that is, the difference between what it imports and what

it exports. Maintaining a balance here is important; consistently importing more than exporting can

hinder economic growth in the long run.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 3

Exploring Fiscal Policy

Fiscal policy involves adjusting government spending and tax policies to either

stimulate a sluggish economy or cool down an overly busy one. Here's how the

government might step in:

Kick-starting the Economy with Expansionary Fiscal Policy

● Imagine the government decides to build new hospitals, roads, and sewers but

doesn't increase taxes to fund these projects. Instead, it borrows more money.

This increased spending can give the economy a boost by raising the overall

demand for goods and services.

Cooling Down with Contractionary Fiscal Policy

● On the other hand, if the economy is running too hot or the country's debt is

getting too high, the government might choose to either increase taxes without

upping its spending, or maintain the current tax rate but reduce its spending. This

can help reduce the total demand in the economy, preventing it from overheating

and keeping the debt in check.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 4

Fiscal Policy and Its Impact on Business

Fiscal policy has a ripple effect on various industries, including those in the service and

manufacturing sectors. Here are some ways businesses might be affected:

Navigating Changes in Demand

● Fiscal policy can shape the overall demand for goods and services. Businesses

need to anticipate these shifts to plan effectively for future sales growth. When

the government's approach is stable, it's easier for companies to plan accordingly.

Adapting to Tax Modifications

The fiscal policy can usher in changes in tax structures, influencing business

operations. For instance:

● Alterations in employer's national insurance contributions can affect labor costs.

● If taxes like sales tax or excise duty increase, businesses might need to decide

whether to absorb the extra costs or pass them onto consumers through higher

prices.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 5

Understanding Monetary Policy

● Monetary policy refers to central bank (or other monetary authority) activities that are

directed toward influencing the money supply (the amount of money in circulation)

and credit (the amount of money available for borrowing and at what cost or interest

rate) in an economy. The ultimate goal is to influence key macroeconomic targets:

○ Price stability

○ Economic output or GDP

○ Employment

● Most central banks have a mandate of maintaining price stability (controlling inflation

while avoiding deflation), which has indirect effects on other macroeconomic targets,

such as employment and output.

● European Central Bank: “Our job is to maintain price stability. This is the best

contribution monetary policy can make to economic growth and job creation. We keep

prices stable by making sure that inflation – the rate at which the overall prices for

goods and services change over time – remains low, stable and predictable. We are

targeting an inflation rate of 2% over the medium term.”

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 6

Tools of monetary policy

Conventional

● Open Market Operations: the central bank buys and sells government securities like

notes and bonds. For instance, to spur the economy, the central bank might buy these

securities from commercial banks. This transaction infuses more cash into the banking

system, increasing the overall money supply and credit available in the economy.

● Adjusting the Central Bank Lending Rate: this is the rate at which commercial banks

borrow from the central bank. Adjusting this rate can influence both short-term and,

indirectly, long-term interest rates. When the central bank raises its lending rate,

commercial banks often follow suit, which slows down borrowing.

● Modifying Reserve Requirements for Commercial Banks: reserve requirements

dictate the fraction of deposits that banks need to hold back at their account with the

central bank, instead of lending out. By increasing these requirements, the central

bank can restrict the credit availability in the economy.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 7

Tools of monetary policy

Unconventional

● Quantitative Easing (QE), initiated primarily post the 2008 financial crisis, QE

resembles open market operations but is conducted on a grander scale. It includes

the purchase of a variety of financial instruments, not limited to short-term

government securities. This might encompass long-term government debts and

corporate debts with differing maturities, helping to inject a large amount of

money into the economy to stimulate growth.

● Forward guidance is verbal assurance from a country’s central bank to the public

about its intended monetary policy. The central bank shares its plans and

expectations regarding future monetary policies with the public. It's a way to

influence economic behavior based on the predicted paths of interest rates and

other economic indicators, aiming to instill confidence and predictability in

financial markets.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 8

Policy Limitations

The effectiveness of monetary and fiscal policy will vary over time and among countries. For

example, in a recession with rising unemployment, cuts in the income tax will not always

raise consumer spending because consumers may want to increase their savings in

anticipation of further deterioration. The policy effectiveness is limited by the following:

● Time Lags: policies take time to implement and to start showing effects on the

economy. Often, the economic landscape might change before the policy's impact

becomes visible, possibly requiring adjustments or new strategies.

● Unpredictable Responses: the reactions of consumers and businesses to policy shifts

can be unpredictable. For instance, despite low-interest rates intending to boost

spending, individuals and firms might hoard cash, anticipating economic slowdowns or

waiting for better buying opportunities later.

● Unintended Consequences: sometimes, policies might lead to unintended outcomes. A

rise in government spending to boost demand and GDP could, paradoxically, lead to a

spike in inflation due to increased employment and subsequent wage and price hikes.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 9

Understanding Financial Markets

Think of financial markets as dynamic meeting places where people with extra money

come to lend to those who need funds. This process is facilitated by various

middlemen, such as banks and insurance firms. These markets can be classified into:

● Capital Markets (for long-term investments, like buying a factory) and

Money Markets (for short-term needs, such as business operating expenses)

● Primary Markets (where new securities are issued for the first time) and

Secondary Markets (where existing securities are bought and sold)

● Exchange Markets (organized platforms where securities are traded) and

OTC Markets (a decentralized market for trading directly between two parties)

Securitization is a creative financial process that converts illiquid assets, like loans,

into tradable securities. This innovative evolution has paved the way for direct

connections between those lending money and those borrowing, reducing the reliance

on middlemen. Nonetheless, it was a contributing factor to the Global Financial Crisis.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 10

Financial Markets

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 11

Money and Capital Markets

Focusing mainly on short-term financial tenors, money markets are platforms where

short-term lending and borrowing take place. Here's how they operate:

● Trading of short-term financial instruments that will mature in one year or less.

● Banks and other financial institutions primarily operate on these markets, with

big corporations and most governments also taking part.

On the other hand, capital markets assist companies in securing the funding they need

for the long term. Here are the two primary routes through which companies can

obtain long-term financing:

● Raising Share Capital (Equity): Companies invite investors to buy new shares or

increase their current stake. It's a way to become a part-owner of the company.

● Raising Loan Capital (Debt): Companies can turn to several tools like loan notes,

corporate bonds, and debentures to secure long-term debt. These instruments

can either be secured or convertible, offering diverse options for raising capital.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 12

Primary and Secondary Markets

Primary markets are the venues where issuers (like companies or governments) offer

their securities directly to investors. Think of this as the "birthplace" for securities.

● Each type of security has its unique primary market. For instance, there are

dedicated markets for company shares and government bonds.

● Eligibility: Typically, in most nations, only public companies can raise funds in the

primary market, ensuring transparency and accountability.

Secondary markets involve trading these securities among investors.

● Besides securities like shares and bonds, secondary markets also host trading of

derivative contracts like futures and options.

● Investors often lean on trading service providers, like brokers or dealers, to

navigate the complexities of these trades.

● Secondary markets are attractive to investors, because of their liquidity. After all,

it's comforting to know you can quickly sell an asset if the need arises.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 13

International Financial Markets

● The eurocurrency market is the money market for currency outside of the country

where it is legal tender. It is used by banks, multinational corporations, mutual funds,

pension funds and hedge funds.

● The term eurocurrency should not be confused with the EU currency, the euro.

● There is also a eurobond market for countries, companies, and financial institutions to

borrow in currencies outside of their domestic market. Eurobonds may be the most

suitable source of finance for a large organization with an excellent credit rating, such

as a big multinational company, which requires a long-term loan to finance capital

expansion.

● Eurocurrency markets can offer better rates for both borrowers and lenders, but they

also have higher risks. A borrower who is contemplating a Eurobond issue must

consider the exchange risk of a long-term foreign currency loan. A crucial aspect to

consider, especially if revenues generated are in a different currency than the loan,

potentially leading to exchange losses.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 14

Understanding Exchange Rates

Exchange rates dictate the value at which one currency can be exchanged for another.

Essentially, it tells you how much of one currency is needed to purchase a unit of another. FX

dealers exploit the differences in exchange rates to make profits, establishing bid (buying

price) and ask (selling price) rates in the process.

● Floating rate - the currency value fluctuates based on market forces of supply and

demand, without intervention from the central bank.

● Fixed rate – mitigates currency risk but erode the economic competitiveness of a

nation over time. A less competitive economy may face a deteriorating current account

balance due to overvaluation of its currency, making its exports pricey and imports

cheaper. If this happens, the only course of action is an official devaluation of the

currency.

● Managed (dirty) floating rate – a middle-ground approach where the central bank

occasionally intervenes using its foreign currency reserves to maintain the value of the

domestic currency within a predetermined range, ensuring stability and

competitiveness.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 15

Exchange Rates and Business

Variable exchange rates bring a lot uncertainty upon businesses engaged in international

trade. As we delve deeper into this course, we will explore various strategies

multinational corporations employ to hedge their risk and prevent potential losses

arising from foreign exchange transactions.…

A lower exchange rate… A higher exchange rate…

Imported raw materials are more Imported raw materials are cheaper so

expensive so costs of production rise. costs of production fall.

Domestic goods are cheaper in foreign Domestic goods are more expensive in

markets so demand for exports increases. foreign markets so demand for exports

falls.

Foreign goods are more expensive so Foreign goods are cheaper so demand for

demand for imports falls. imports rises.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 16

Understanding Interest Rates

Interest rates serve as the 'price tags' attached to borrowing funds. In simple

terms, they are the percentage of the principal amount that borrowers pay to

lenders as a fee for using their money. The fluctuation in interest rates on financial

assets is primarily influenced by:

● Risk and Return: Higher risk necessitates higher returns. Therefore,

borrowers perceived to be of higher risk are charged higher interest rates to

compensate the lenders for taking the increased risk.

● Creditworthiness: Banks gauge the ability of the borrower to repay, setting

the interest rate accordingly, often adding a markup to their base rate for

higher risk borrowers.

● Loan Term: Generally, the term of the loan influences the interest rate, with

longer-term assets potentially earning a higher yield compared to short-term

ones. However, this isn't a strict rule.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 17

The risk-return trade-off

There is a trade-off between risk and return. Investors in riskier assets expect to be compensated

for the risk with additional return. This return can be decomposed into: current income (dividend or

interest) and expected capital gain. The main financial instruments in ascending order of risk are:

● government bills / notes / bonds - the risk of default is negligible. The only uncertainty

concerns the movement of interest rates over time, and longer dated bonds tend to carry a

higher interest.

● sovereign, supranational and agency bonds - the risk of default is small as usually there is

some explicit or implicit government or other guarantee. The interest rate risk is higher

compared to government bonds.

● corporate bonds – corporate bonds bear some risk of default, they can be secured (against

corporate assets) or unsecured. The unsecured corporate bonds are generally riskier.

● preferred shares - riskier than bonds since they rank behind debt in the event of a liquidation,

although they rank ahead of ordinary shares. The return usually takes the form of a fixed

percentage dividend based on the par value.

● ordinary / common shares – they carry the highest level of risk. Dividends are paid out of

profits after all other liabilities have been paid and can be subject to large fluctuations from

year to year. However, there is potential for significant capital appreciation in times of growth

or significant capital loss in recession.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 18

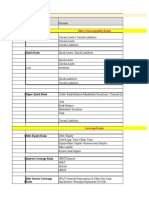

Money Market Instruments

Money market instruments are traded over the counter between institutional investors.

They include interest-bearing instruments, discount instruments and derivatives.

Interest-bearing Discount Instruments Derivatives

Instruments

Money market deposits Treasury bills (T-bill) Forwards and Futures

Certification of deposit Banker’s acceptance Options

(CD)

Repurchase agreement Commercial paper (CP) Swaps

(Repo)

We will explore derivatives thoroughly in a later chapter of the course…

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 19

Interest-bearing Instruments

Money market deposits are short-term loans that take place between banks or other

entities including governments. These deposits come in two main forms: fixed deposits and

call deposits. Fixed deposits are characterized by predetermined interest rates and maturity

dates agreed upon at the time of the transaction. Call deposits feature variable interest

rates and allow the deposit to be terminated given prior notice, offering more flexibility

compared to their fixed counterparts.

A Certificate of Deposit (CD) is a certificate of receipt for funds deposited at a bank or other

financial institution for a specified term and paying interest at a specified rate. Certificates

of deposit can be either negotiable or non-negotiable. The holder of a negotiable CD has

two options: to hold it until maturity, receiving the interest and the principal or to sell it

before maturity at the prevalent market price.

Repurchase agreements, commonly referred to as repos, are loans that are secured by

marketable instruments, most often a treasury bill. These agreements are flexible, with

terms ranging from 1 to 180 days. A repo consists of two primary transactions: initially, the

dealer sells the security in exchange for cash, and upon reaching maturity, the dealer repays

the cash amount along with the interest, reclaiming the security in the process.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 20

Practice Problems: Interest-bearing Instruments

Useful Formula:

Value of deposit (CD) at maturity =

Face Value x [1 + Interest Rate x ( Days to Maturity / Days in the Year)]

1. For your liquidity portfolio you consider a EUR-denominated overnight deposit with

a face value of EUR 25,000,000. The prevalent EUR O/N market interest rate is 1.08%.

Calculate the amount you expect to receive on maturity if the day count convention is

Actual/360.

2. Consider a US Dollar CD with a face value of $10,000,000 issued on 1st March 2022

maturing on 1st September 2022. The interest rate is 7% per annum. Calculate the

amount you expect to receive on maturity if the day count convention is Actual/360.

(Hint: There are 184 days between the issue date and the maturity date.)

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 21

Discount Instruments

Treasury bills are short-term debt instruments issued by the government to raise funds.

These have varying maturities ranging from a month to a year. Being backed by the

government, they are considered a safe investment choice for investors looking for

short-term investment opportunities with reliable returns.

Commercial paper is short-term unsecured corporate debt with maturity up to 1 year. The

typical term of this debt is about 30 days. Commercial paper is issued by governments,

agencies or other large organizations with high credit ratings, normally to finance

short-term expenditure. The debt is issued at a discount that reflects the prevailing market

interest rates.

Banker's acceptances are unique financial instruments issued by companies to finance

specific commercial transactions, including imports or the procurement of goods. The term

stems from the assurance given by banks that guarantee the payment to the holder,

essentially accepting the responsibility for the payment on behalf of the issuing firm, for a

specified fee. This underscores the secure nature of this financial instrument.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 22

Practice Problems: Discount Instruments

Useful Formulae:

Yield to maturity = [(Face value - Purchase Price) / Purchase Price] x (Days in the Year / Days to Maturity )

Discount yield = [(Face value - Purchase Price) / Face Value] x ( Days in the Year / Days to Maturity )

3. A 180-day US T-Bill (US government treasury bill) with a face value of $100.00 is issued for $98.50.

What is the discount rate? (Hint: The day count convention is Actual/360.)

4. The Korean Development Bank (KDB) issues EUR-denominated commercial paper with a selling price of

EUR 100 for a purchase price of EUR 99 and 60 days to maturity. Calculate the yield to maturity.

(Hint: The day count convention is Actual/360.)

5. A Bubill (German government bill) with remaining maturity of 90 days is quoted on the market for 99.5

EUR per 100 EUR par value. An institutional investor buys the bond. (Assume Actual/360)

A. Calculate the yield to maturity.

30 days later the same bill is quoted by a market maker at yield to maturity of 1.5%.

B. Calculate the price of the bond at that moment.

C. Calculate the capital gain/loss of the investor if they sell at the price derived in B.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 23

A Quick Glimpse Into ESG

The Environmental, Social, and Corporate Governance (ESG) criteria encompass the three

central factors that investors scrutinize to gauge a company's ethical stance and commitment

to sustainable operations.

● Environmental Criteria evaluate a company's ecological footprint, scrutinizing aspects

such as energy consumption, pollution levels, conservation of natural resources, and

humane treatment of animals. It reflects the company's dedication to minimizing its

negative impact on the environment.

● Social Criteria delve into a company's relationships with its stakeholders - including

customers and suppliers - and its contributions to the community. It assesses the firm's

initiatives in areas like volunteerism, philanthropy, and the safeguarding of employee

health and welfare. It also critically examines potentially unethical practices like the

utilization of child labor.

● Governance Criteria mandate firms to adhere to transparent and accurate accounting

methods, steering clear of conflicts of interest or unlawful activities. It ensures that

companies abstain from leveraging political contributions to secure favorable treatment,

promoting a culture of ethical business conduct.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 24

Why ESG?

Adhering to ESG regulations or even taking a step further with voluntary initiatives can

offer several benefits to businesses. Here are some of the potential gains:

● Customer Preference: an ESG-friendly image can attract customers who prioritize

responsible and sustainable business practices, potentially boosting sales and brand

loyalty.

● Enhanced Public Relations: a proactive approach to ESG policies can foster better

relationships with the general public and local communities, building a favorable

corporate image that resonates well with stakeholders.

● Talent Attraction: Many individuals prefer to be associated with companies

demonstrating strong ESG commitments, making it easier for businesses to attract

and retain high-caliber talent.

● Investment Opportunities: Businesses with a solid ESG stance may find themselves

more appealing to responsible investment funds, possibly enhancing their stock

value and attracting more investment opportunities.

INTERNATIONAL FINANCIAL MANAGEMENT :: LECTURE 1 :: ECONOMIC ENVIRONMENT AND FINANCIAL MARKETS 25

THANK YOU!

You might also like

- SCSLA Multi 2014 - BlankDocument3 pagesSCSLA Multi 2014 - BlankElden Cunanan Bonilla88% (8)

- Consumer Math: Ledyard High School Math CurriculumDocument24 pagesConsumer Math: Ledyard High School Math CurriculumYAP JIN LING MoeNo ratings yet

- Dang Thuy Huong - 1704040049 - HW Tut 6Document19 pagesDang Thuy Huong - 1704040049 - HW Tut 6Đặng Thuỳ HươngNo ratings yet

- Fiscal and Monetary PolicyDocument11 pagesFiscal and Monetary PolicyNahidul IslamNo ratings yet

- Economic Policy - Monetary PolicyDocument17 pagesEconomic Policy - Monetary PolicyNikol Vladislavova NinkovaNo ratings yet

- Qa edexcel6EC02Document7 pagesQa edexcel6EC02SaChibvuri JeremiahNo ratings yet

- Introduction To Monetary PolicyDocument6 pagesIntroduction To Monetary Policykim byunooNo ratings yet

- Hpsaccf102 Lecture 3 NotesDocument40 pagesHpsaccf102 Lecture 3 NotestrishlrnyakabauNo ratings yet

- Finance Pre-Read 2023Document30 pagesFinance Pre-Read 2023Kshitij SinghalNo ratings yet

- Krugman Unit 6 Modules 30-36Document112 pagesKrugman Unit 6 Modules 30-36derengungorNo ratings yet

- Fiscal and Monetary PolicyDocument16 pagesFiscal and Monetary PolicyBezalel OLUSHAKINNo ratings yet

- Financial MarketDocument3 pagesFinancial MarketKumaingking Daniell AnthoineNo ratings yet

- ACCA BT Topic 4 NotesDocument5 pagesACCA BT Topic 4 Notesعمر اعظمNo ratings yet

- Tugas 2 - ADBI4201Document1 pageTugas 2 - ADBI4201ilhamg0810No ratings yet

- The Evaluation of Monetary and Fiscal Policy in Close and Open EconomyDocument39 pagesThe Evaluation of Monetary and Fiscal Policy in Close and Open EconomyAndrea Marie O. JadraqueNo ratings yet

- Monetary and Fiscal PolicyDocument18 pagesMonetary and Fiscal PolicyEmuyeNo ratings yet

- Link Between Monetary Policy and Aggregate DemandDocument4 pagesLink Between Monetary Policy and Aggregate DemandEman ShafqatNo ratings yet

- Monetary and Fiscal Policy As Tools For Higher Growth Rate: By: Dr. Neelam TandonDocument37 pagesMonetary and Fiscal Policy As Tools For Higher Growth Rate: By: Dr. Neelam TandonSachin DhimanNo ratings yet

- Note Monitary PolicyDocument7 pagesNote Monitary PolicyPark Min YoungNo ratings yet

- The Instruments of Macroeconomic Policy.Document10 pagesThe Instruments of Macroeconomic Policy.Haisam Abbas IINo ratings yet

- The Importance of MacroeconomicsDocument17 pagesThe Importance of MacroeconomicsHisham JawharNo ratings yet

- Chapter 02 Power PointDocument36 pagesChapter 02 Power PointmuluNo ratings yet

- Policy Responses To Ease Credit CrisisDocument13 pagesPolicy Responses To Ease Credit CrisisAmitNo ratings yet

- EconomicsDocument13 pagesEconomicsMark HughesNo ratings yet

- Assignment 1 Basic MacroeconomicsDocument3 pagesAssignment 1 Basic MacroeconomicsQuienilyn SanchezNo ratings yet

- BUS251 Macro Final Spring 2023bDocument9 pagesBUS251 Macro Final Spring 2023bΙΩΑΝΝΗΣ ΘΕΟΦΑΝΟΥΣNo ratings yet

- LBE-Class Activity29-30-31-32 Dated-30.04.2020Document3 pagesLBE-Class Activity29-30-31-32 Dated-30.04.2020Shafiulla BaigNo ratings yet

- Rbi Monetary PolicyDocument5 pagesRbi Monetary Policy87 TYA Rajak VivekKumarNo ratings yet

- Monetary and Fiscal PolicyDocument2 pagesMonetary and Fiscal PolicyNavin KoshyNo ratings yet

- FRSE 2022-23 Topic 2Document26 pagesFRSE 2022-23 Topic 2Ali Al RostamaniNo ratings yet

- Business Economics: Business Strategy & Competitive AdvantageFrom EverandBusiness Economics: Business Strategy & Competitive AdvantageNo ratings yet

- Monetary Policy - Friday ClassDocument38 pagesMonetary Policy - Friday Classvickys_5No ratings yet

- Monetary Policy and Fiscal PolicyDocument13 pagesMonetary Policy and Fiscal PolicyAAMIR IBRAHIMNo ratings yet

- Monetary Policy and Its Influence On Aggregate Demand.Document16 pagesMonetary Policy and Its Influence On Aggregate Demand.Anonymous KNo ratings yet

- Monetary and Fiscal Policy: Smoothing The Operation of The MarketDocument15 pagesMonetary and Fiscal Policy: Smoothing The Operation of The Marketasiacup105No ratings yet

- Yashasvi Sharma Public FinanceDocument18 pagesYashasvi Sharma Public FinanceYashasvi SharmaNo ratings yet

- Iem Ass4Document10 pagesIem Ass4Bhavya SinghNo ratings yet

- What Is Monetary PolicyDocument12 pagesWhat Is Monetary PolicyNain TechnicalNo ratings yet

- Macroeconomic PrinciplesDocument128 pagesMacroeconomic PrinciplesTsitsi Abigail100% (2)

- Fiscal Policy & Monetary PolicyDocument8 pagesFiscal Policy & Monetary PolicyFaisal AwanNo ratings yet

- Fiscal Policy and Monetary WorldDocument13 pagesFiscal Policy and Monetary WorldSatyam KanwarNo ratings yet

- List of ContentsDocument17 pagesList of ContentsSneha JainNo ratings yet

- Monetary and Fiscal PolicyDocument11 pagesMonetary and Fiscal PolicyKai BrightNo ratings yet

- GRP 4Document18 pagesGRP 4Tipsforchange lifeNo ratings yet

- Government PolicyDocument11 pagesGovernment Policycarter sasaNo ratings yet

- Monetary Policies Shaping Economies and Navigating ChallengesDocument2 pagesMonetary Policies Shaping Economies and Navigating ChallengesRadosavljevic Dimitrije DidiNo ratings yet

- Business EnviromentDocument19 pagesBusiness EnviromentHarshit YNo ratings yet

- Fiscal and Monetary PolicyDocument5 pagesFiscal and Monetary Policyasadasfprp2No ratings yet

- Managerial Economics MB 0042Document23 pagesManagerial Economics MB 0042Prafull VarshneyNo ratings yet

- 4.5 Monetary Fiscal Policy (Week 5)Document12 pages4.5 Monetary Fiscal Policy (Week 5)Mohsin ALINo ratings yet

- Bisma Saleem (22L-6322)Document4 pagesBisma Saleem (22L-6322)Qamar VirkNo ratings yet

- What Is Fiscal Policy?Document10 pagesWhat Is Fiscal Policy?Samad Raza KhanNo ratings yet

- Business CycleDocument8 pagesBusiness CycleANJALI SASI E VNo ratings yet

- 2229 - Lecture 7 - PolicyDocument13 pages2229 - Lecture 7 - PolicyNASIF BIN NAZRULNo ratings yet

- Name: Keval Vashi ROLL NO.: IT149 ID: 20ITUOS091Document16 pagesName: Keval Vashi ROLL NO.: IT149 ID: 20ITUOS091A BNo ratings yet

- Overview of Macroeconomics - Week01Document20 pagesOverview of Macroeconomics - Week01Dimas Andi DashNo ratings yet

- What Is Monetary Policy?: Key TakeawaysDocument5 pagesWhat Is Monetary Policy?: Key TakeawaysNaveen BhaiNo ratings yet

- Responsibility of Fiscal Policy UPDATEDDocument24 pagesResponsibility of Fiscal Policy UPDATEDFiona RamiNo ratings yet

- 2020 11economics IDocument16 pages2020 11economics IUdwipt VermaNo ratings yet

- Development Issues and The Ethiopia Situation Chapter 4Document63 pagesDevelopment Issues and The Ethiopia Situation Chapter 4miadjafar463No ratings yet

- Chapter 2Document39 pagesChapter 2arnav.gopalNo ratings yet

- Fundamentals of Business Economics Study Resource: CIMA Study ResourcesFrom EverandFundamentals of Business Economics Study Resource: CIMA Study ResourcesNo ratings yet

- Chipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentFrom EverandChipping Away at Public Debt: Sources of Failure and Keys to Success in Fiscal AdjustmentRating: 1 out of 5 stars1/5 (1)

- Chapter 18 SolutionDocument5 pagesChapter 18 SolutionSilver BulletNo ratings yet

- Vilander Carecenters Inc Provides Financing and Capital To The Health CareDocument1 pageVilander Carecenters Inc Provides Financing and Capital To The Health CareAmit PandeyNo ratings yet

- Partnership Dissolution PDFDocument8 pagesPartnership Dissolution PDFJerwin FajardoNo ratings yet

- A) The Govt. of India B) SEBI C) AMFI D) All Its InvestorsDocument34 pagesA) The Govt. of India B) SEBI C) AMFI D) All Its InvestorsAtanu SarkarNo ratings yet

- ACC314 Revision Ratio Questions - SolutionsDocument8 pagesACC314 Revision Ratio Questions - SolutionsRukshani RefaiNo ratings yet

- Investment Midterm Test PreparationDocument4 pagesInvestment Midterm Test PreparationWen Qi WongNo ratings yet

- Annuity Due - MarquezDocument23 pagesAnnuity Due - MarquezmayasNo ratings yet

- Q&ans Hw3aDocument9 pagesQ&ans Hw3aAbdulaziz FaisalNo ratings yet

- Accounting For Special Transactions First Grading ExaminationDocument22 pagesAccounting For Special Transactions First Grading ExaminationJasmine Sollestre100% (1)

- P2-Quiz 4 - Deferred Annuity and Perpetuity Answer KeyDocument8 pagesP2-Quiz 4 - Deferred Annuity and Perpetuity Answer Keyromulodumagit25No ratings yet

- Short-Term Sources For Financing Current AssetsDocument11 pagesShort-Term Sources For Financing Current AssetsAlexandra TagleNo ratings yet

- A Guide About Bank AccountsDocument6 pagesA Guide About Bank AccountsHelloprojectNo ratings yet

- Bond Convexity - Dynamic ChartDocument3 pagesBond Convexity - Dynamic Chartapi-3763138No ratings yet

- 04 Partnership LiquidationDocument10 pages04 Partnership LiquidationRoland jamesNo ratings yet

- Parco Report (FINAL)Document28 pagesParco Report (FINAL)haroonrashid00767% (3)

- Reading 39 Economics and Investment Markets - AnswersDocument16 pagesReading 39 Economics and Investment Markets - Answerstristan.riolsNo ratings yet

- An Overview of The Investment Process #1Document7 pagesAn Overview of The Investment Process #1Lea AndreleiNo ratings yet

- 103 Ratio Calc Guide BlankDocument10 pages103 Ratio Calc Guide BlankAbdu MohammedNo ratings yet

- Chapter 6Document23 pagesChapter 6Ali NawazNo ratings yet

- The Advantages-Disadvantages of Project FinancingDocument4 pagesThe Advantages-Disadvantages of Project FinancingBhagyashree Mohite67% (3)

- Full Download Evolution 1st Edition Bergstrom Test BankDocument35 pagesFull Download Evolution 1st Edition Bergstrom Test Bankalpen.logwoodp7aoer100% (38)

- Managerial Finance chp5Document13 pagesManagerial Finance chp5Linda Mohammad FarajNo ratings yet

- Aurobindo Pharma - Ratio Analysis - Anuja Vagal - SampleDocument13 pagesAurobindo Pharma - Ratio Analysis - Anuja Vagal - SampleAryan RajNo ratings yet

- ValuationDocument66 pagesValuationManideep Rapeti100% (1)

- 1935510212+tofig Dadashov+International FinanceDocument22 pages1935510212+tofig Dadashov+International FinanceTofiq DadashovNo ratings yet

- Which of The Following Terms Apply To A Bond? Face Value Principal CouponDocument15 pagesWhich of The Following Terms Apply To A Bond? Face Value Principal CouponmpkNo ratings yet

- Inform Practice Note #16: ContentDocument6 pagesInform Practice Note #16: ContentTSHEPO DIKOTLANo ratings yet