Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

14 viewsChapter 11 Equity Investment

Chapter 11 Equity Investment

Uploaded by

Dorothy Jeanne1. The document discusses equity investments, including owning shares of another entity and classifications of equity investments.

2. Equity investments can be classified as either fair value through profit or loss (FVTPL), where changes in fair value are recorded in profit or loss, or fair value through other comprehensive income (FVTOCI), where changes in fair value are recorded in other comprehensive income.

3. Examples are provided of accounting entries for equity investments classified as FVTPL and FVTOCI, including initial recognition, subsequent remeasurement, dividend recording, disposal, and impairment testing.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- New York-Presbyterian Q1 2020 Financial StatementsDocument57 pagesNew York-Presbyterian Q1 2020 Financial StatementsJonathan LaMantia100% (1)

- Employee Benefit 1 PDFDocument34 pagesEmployee Benefit 1 PDFbobo kaNo ratings yet

- The Financial Reporting Standards CouncilDocument15 pagesThe Financial Reporting Standards CouncilPrincess Joy VillaNo ratings yet

- Chap 6Document54 pagesChap 6Jose Martin Castillo Patiño100% (1)

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- Illustration 1 & 2Document5 pagesIllustration 1 & 2faith olaNo ratings yet

- Accounting 15 Investment SolutionsDocument18 pagesAccounting 15 Investment Solutionskhyla Marie NooraNo ratings yet

- S Man1 2008-2Document9 pagesS Man1 2008-2ExequielCamisaCrusperoNo ratings yet

- Adv Acc 2 Sol Man 2008 BaysaDocument8 pagesAdv Acc 2 Sol Man 2008 BaysaNorman DelirioNo ratings yet

- Ae 17 Midterms Assignment 1Document6 pagesAe 17 Midterms Assignment 1Ronald YNo ratings yet

- A3 Example NotesDocument8 pagesA3 Example NotesMuyano, Mira Joy M.No ratings yet

- 2076 - Varias, Aizel Ann B - Module 2Document20 pages2076 - Varias, Aizel Ann B - Module 2Aizel Ann VariasNo ratings yet

- CHP 4Document16 pagesCHP 4Beenish JafriNo ratings yet

- Final PB FAR Batch 7 Sept 2023Document38 pagesFinal PB FAR Batch 7 Sept 2023Leo M. SalibioNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Lets Try This 4Document2 pagesLets Try This 4syramaebillones26No ratings yet

- Liabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Document3 pagesLiabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Amit GodaraNo ratings yet

- AFE3871 Assingment 2 Memo 1Document45 pagesAFE3871 Assingment 2 Memo 1SoblessedNo ratings yet

- 3jun24 - Intercompany Transaction - EquipmentDocument16 pages3jun24 - Intercompany Transaction - Equipmentsisilia rachelNo ratings yet

- Lape - ACP312 - ULOa - Let's Analyze Week6Document3 pagesLape - ACP312 - ULOa - Let's Analyze Week6Bryle Jay LapeNo ratings yet

- Tutorial 11 Interco TransactionsDocument15 pagesTutorial 11 Interco TransactionsBình QuốcNo ratings yet

- Unit VI CashFlowStatementDocument32 pagesUnit VI CashFlowStatementSmiti RupaNo ratings yet

- 4BSA2 GROUP2 GroupActivityNo.1Document4 pages4BSA2 GROUP2 GroupActivityNo.1Lizerie Joy Kristine CristobalNo ratings yet

- Business Combination Part 2Document7 pagesBusiness Combination Part 2딈밍No ratings yet

- Batch 93 FAR First Preboard February 2023 - SolutionDocument5 pagesBatch 93 FAR First Preboard February 2023 - SolutionlorenzNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Task Performance I. Horizontal AnalysisDocument3 pagesTask Performance I. Horizontal AnalysisarisuNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Batch 95 FAR First Preboard SolutionDocument7 pagesBatch 95 FAR First Preboard Solutionssslll2No ratings yet

- Cai Acc. Imp Questions (Part 1)Document100 pagesCai Acc. Imp Questions (Part 1)SheenaNo ratings yet

- 950k X 1/2 X 15 Per ShareDocument5 pages950k X 1/2 X 15 Per ShareNickey DickeyNo ratings yet

- Advance Financial Accounting and ReportingDocument25 pagesAdvance Financial Accounting and ReportingEmma Mariz GarciaNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- Step AcquisitionDocument2 pagesStep AcquisitionJamaica DavidNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- CA India Financial ManagementDocument30 pagesCA India Financial Managementomkumardepani070805No ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument6 pagesCpa Review School of The Philippines Mani LaSophia PerezNo ratings yet

- Issues For Discussion: Day 3: Determing Cash Flows When BS and IS Given Pat and CfoDocument29 pagesIssues For Discussion: Day 3: Determing Cash Flows When BS and IS Given Pat and Cfosayan duttaNo ratings yet

- AFAR 2 NotesDocument157 pagesAFAR 2 NotesAlexandria EvangelistaNo ratings yet

- Ans m2 PaperDocument6 pagesAns m2 Paperbigab31327No ratings yet

- Advanced Financial Individual Project - Keating FinalDocument36 pagesAdvanced Financial Individual Project - Keating FinalAshleyNo ratings yet

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersElaine Fiona Villafuerte100% (1)

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersLenny Ramos VillafuerteNo ratings yet

- Pembahasan Kuiz Indirect HoldingsDocument3 pagesPembahasan Kuiz Indirect HoldingsAdara KiranaNo ratings yet

- SolMan Chapter 4 (Partial)Document9 pagesSolMan Chapter 4 (Partial)zaounxosakubNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- Business Combination Subsequent To Date of Acquisition SolutionDocument3 pagesBusiness Combination Subsequent To Date of Acquisition SolutionGelliza Mae MontallaNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- 21 Financial - Asset - FV - Reclassification - Sample - ProblemsDocument4 pages21 Financial - Asset - FV - Reclassification - Sample - ProblemsSheila Grace BajaNo ratings yet

- FAR First Preboard Batch 89 SolutionDocument6 pagesFAR First Preboard Batch 89 SolutionZiee00No ratings yet

- Intermediate Accounting Chapter 4 ProblemsDocument18 pagesIntermediate Accounting Chapter 4 ProblemsPattraniteNo ratings yet

- Intermediate Accounting Unit4 - Topic4Document8 pagesIntermediate Accounting Unit4 - Topic4Lea Polinar100% (1)

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Chapter 14Document10 pagesChapter 14Nikki GarciaNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- IFRS Vs US GAAP - 2024Document8 pagesIFRS Vs US GAAP - 2024AMARTYA KUMAR DAS PGP 2023-25 BatchNo ratings yet

- Consolidated Statement ORGDocument8 pagesConsolidated Statement ORGPak_4everNo ratings yet

- Resolving NPL Report - enDocument61 pagesResolving NPL Report - enlidia012No ratings yet

- Module 06business Combination PDF FreeDocument19 pagesModule 06business Combination PDF FreeCaptain ObviousNo ratings yet

- Financial Statements of BMW AgDocument32 pagesFinancial Statements of BMW AgGate Bennet4No ratings yet

- University of Caloocan City Bachelor of Science in AccountancyDocument5 pagesUniversity of Caloocan City Bachelor of Science in AccountancyLumingNo ratings yet

- MFRS 121 - Foreign Currency Lecture Notes 2022 - UploadDocument38 pagesMFRS 121 - Foreign Currency Lecture Notes 2022 - UploadZhaoYing TanNo ratings yet

- Zaverecna PraceDocument109 pagesZaverecna PracenicolescuaNo ratings yet

- Biological Assets Activity 7Document9 pagesBiological Assets Activity 7Jazzriel Dave BocoboNo ratings yet

- Principles of Accounting: Week 2Document56 pagesPrinciples of Accounting: Week 2pinkyNo ratings yet

- Pas 32 PFRS 9Document110 pagesPas 32 PFRS 9Katzkie Montemayor GodinezNo ratings yet

- Accounting For Leases of Aircraft Fleet Assets in The Global Airline IndustryDocument20 pagesAccounting For Leases of Aircraft Fleet Assets in The Global Airline Industrynanduru_jagan100% (2)

- Dharan Valuation Issues in The Coming Wave of Goodwill and Asset ImpairmentsDocument4 pagesDharan Valuation Issues in The Coming Wave of Goodwill and Asset ImpairmentsDhaval JobanputraNo ratings yet

- Has The Entity Transferred Its Rights To Receive The Cash Flows From The Asset?Document9 pagesHas The Entity Transferred Its Rights To Receive The Cash Flows From The Asset?Nico RobinNo ratings yet

- PPT2-Accounting For Business CombinationsDocument62 pagesPPT2-Accounting For Business CombinationsRifdah SaphiraNo ratings yet

- F7 - C5 (IAS36), C6 (IAS 2 & 41) FullDocument69 pagesF7 - C5 (IAS36), C6 (IAS 2 & 41) FullK59 Vo Doan Hoang AnhNo ratings yet

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDocument12 pagesGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Assignment 3 Consolidation. Subsequent To The Date of AcquisitionDocument4 pagesAssignment 3 Consolidation. Subsequent To The Date of AcquisitionAivan De LeonNo ratings yet

- IFRS 3 Business CombinationDocument15 pagesIFRS 3 Business CombinationAquino KimalexerNo ratings yet

- Disclaimer: Paper 6E: Global Financial Reporting Standards 1Document34 pagesDisclaimer: Paper 6E: Global Financial Reporting Standards 1Shashank 45No ratings yet

- Syllabus Intermediate Accounting 1 2021Document21 pagesSyllabus Intermediate Accounting 1 2021John Lucky MacalaladNo ratings yet

- Unit 7: Investment in Associates & Joint Ventures: Financial ReportingDocument11 pagesUnit 7: Investment in Associates & Joint Ventures: Financial ReportingSiva DineshNo ratings yet

- Farm Stocktaking Valuations 2nd Edition RicsDocument22 pagesFarm Stocktaking Valuations 2nd Edition RicsKien NguyenNo ratings yet

- Corporate Reporting Answers: Foundation Level Examination 2019 Mock ExamDocument18 pagesCorporate Reporting Answers: Foundation Level Examination 2019 Mock ExamOyeleye TofunmiNo ratings yet

- IFRS 2 - Share Based Payment1Document7 pagesIFRS 2 - Share Based Payment1EmmaNo ratings yet

- Financial Accounting and Reporting: Small and Medium-Sized EntitiesDocument19 pagesFinancial Accounting and Reporting: Small and Medium-Sized EntitiesDan DiNo ratings yet

Chapter 11 Equity Investment

Chapter 11 Equity Investment

Uploaded by

Dorothy Jeanne0 ratings0% found this document useful (0 votes)

14 views3 pages1. The document discusses equity investments, including owning shares of another entity and classifications of equity investments.

2. Equity investments can be classified as either fair value through profit or loss (FVTPL), where changes in fair value are recorded in profit or loss, or fair value through other comprehensive income (FVTOCI), where changes in fair value are recorded in other comprehensive income.

3. Examples are provided of accounting entries for equity investments classified as FVTPL and FVTOCI, including initial recognition, subsequent remeasurement, dividend recording, disposal, and impairment testing.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this Document1. The document discusses equity investments, including owning shares of another entity and classifications of equity investments.

2. Equity investments can be classified as either fair value through profit or loss (FVTPL), where changes in fair value are recorded in profit or loss, or fair value through other comprehensive income (FVTOCI), where changes in fair value are recorded in other comprehensive income.

3. Examples are provided of accounting entries for equity investments classified as FVTPL and FVTOCI, including initial recognition, subsequent remeasurement, dividend recording, disposal, and impairment testing.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

14 views3 pagesChapter 11 Equity Investment

Chapter 11 Equity Investment

Uploaded by

Dorothy Jeanne1. The document discusses equity investments, including owning shares of another entity and classifications of equity investments.

2. Equity investments can be classified as either fair value through profit or loss (FVTPL), where changes in fair value are recorded in profit or loss, or fair value through other comprehensive income (FVTOCI), where changes in fair value are recorded in other comprehensive income.

3. Examples are provided of accounting entries for equity investments classified as FVTPL and FVTOCI, including initial recognition, subsequent remeasurement, dividend recording, disposal, and impairment testing.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 3

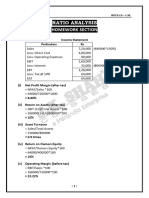

Chapter 11 Equity Investment

1. Own shares of another entity

2. “Passive Income”

a. 20%-50% of OOS – provided significant influence cannot be exercised

b. Less than 20% of OOS

c. Preference shares (regardless of % / non-voting shares

2 Classifications of Equity Investments

1. FVPL – trading, non-trading, all other quoted investments

a. Initial measurement: purchase price at transaction

b. Transaction cost: expensed immediately/outrightly

c. Subsequent measurement: fair value

Changes in fair value > P/L

d. Dividends Received income > P/L

e. On disposal:

Net Proceeds xx

CA of invest. (xx)

Gain or loss xx/(xx) . P/L

f. No impairment

2. FVOCI – nontrading irrevocably designated > FVOCI

a. Initial measurement: purchase price + transaction cost

b. Subsequent measurement: fair value

Changes in FV > OCI

c. Dividends Received: Income > P/L

d. No Impairment

e. On disposal:

Net Proceeds xx

CA of Invest. (xx)

Gain or loss xx/(xx)

No recycling to P/L

Retained Earnings

1. Proceeds > CA of Inv.

2. Cumulative OCI

Pg. 374 Straight Problems

1. 1/1/23 FA @ FVTPL (200,000 x 5) 1,000,000

Transaction Cost 9,000

Cash 1,009,000

12/31/23 FA @ FVTPL (200,000 x .75) 150,000

Unrealized Gain – P/L 150,000

12/31/24 FA @ FVTPL (200,000 x .6) 120,000

Unrealized Gain – P/L 120,000

1/10/25 Cash 1,310,000

Net Proceeds 200,000 x 6.55 = 1,310,000

FA @ FVTPL 1,270,000

Gain on Sale 40,000 CA of Invest. 200,000 x 6.35 = (1,270,000)

Transaction Cost 12,000

Gain 40,000

Cash 12,000

2. 1/1/23 FA @ FVTOCI (1,000,000+9,000)1,009,000

Cash 1,009,000

12/31/23 FA @ FVTOCI 141,000 200,000 x 5.75 = 1,160,000

Unrealized Gain – OCI 141,000 (1,009,000)

12/31/24 FA @ FVTOCI 120,000 141,000

Unrealized Gain – OCI 120,000 2023 1,150,000

1/10/25 Cash 1,310,000 2024 (1,270,000)

FA @ FVTOCi 1,270,000

120,000

Gain on Sale – OCI 40,000

Unrealized Gain 261,000

Gain on Sale 40,000

Retained Earnings 301,000

Transaction Cost 12,000

Cash 12,000

3. (pero #5 jd ni)

2022 2023 2024 2025

AAA 2,600,000 2,650,000 2,720,000 2,790,000

BBB 1,300,000 1,150,000 1,400,000 1,560,000

FA @ FVTPL 3,900,000 3,,800,000 4,120,000 4,350,000

FA @ FVTOCI 1,900,000 1,700,000 1,480,000 1,850,000

b. 2023 2024 2025

income statement (P/L) (100,000) 320,000 230,000

other comp. inc.(OCI) (200,000) (220,000) 370,000

statement of Comp. Inc (300,000) 100,000 600,000

Chapter 11a

Cash Dividend – Face Value

Property Dividend – Fair Value

Liquating Dividends – reduction to FA

Share Dividend -

You might also like

- New York-Presbyterian Q1 2020 Financial StatementsDocument57 pagesNew York-Presbyterian Q1 2020 Financial StatementsJonathan LaMantia100% (1)

- Employee Benefit 1 PDFDocument34 pagesEmployee Benefit 1 PDFbobo kaNo ratings yet

- The Financial Reporting Standards CouncilDocument15 pagesThe Financial Reporting Standards CouncilPrincess Joy VillaNo ratings yet

- Chap 6Document54 pagesChap 6Jose Martin Castillo Patiño100% (1)

- Ratio Analysis Numericals Including Reverse RatiosDocument6 pagesRatio Analysis Numericals Including Reverse RatiosFunny ManNo ratings yet

- FAR05 - First Pre-Board SolutionsDocument7 pagesFAR05 - First Pre-Board SolutionsMellaniNo ratings yet

- Homework Answer (Quiz 1-2 Revision)Document7 pagesHomework Answer (Quiz 1-2 Revision)Kccc siniNo ratings yet

- Illustration 1 & 2Document5 pagesIllustration 1 & 2faith olaNo ratings yet

- Accounting 15 Investment SolutionsDocument18 pagesAccounting 15 Investment Solutionskhyla Marie NooraNo ratings yet

- S Man1 2008-2Document9 pagesS Man1 2008-2ExequielCamisaCrusperoNo ratings yet

- Adv Acc 2 Sol Man 2008 BaysaDocument8 pagesAdv Acc 2 Sol Man 2008 BaysaNorman DelirioNo ratings yet

- Ae 17 Midterms Assignment 1Document6 pagesAe 17 Midterms Assignment 1Ronald YNo ratings yet

- A3 Example NotesDocument8 pagesA3 Example NotesMuyano, Mira Joy M.No ratings yet

- 2076 - Varias, Aizel Ann B - Module 2Document20 pages2076 - Varias, Aizel Ann B - Module 2Aizel Ann VariasNo ratings yet

- CHP 4Document16 pagesCHP 4Beenish JafriNo ratings yet

- Final PB FAR Batch 7 Sept 2023Document38 pagesFinal PB FAR Batch 7 Sept 2023Leo M. SalibioNo ratings yet

- Final PB Exam - Answers - SolutionsDocument10 pagesFinal PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- CPAR B94 FAR Final PB Exam - Answers - SolutionsDocument8 pagesCPAR B94 FAR Final PB Exam - Answers - SolutionsJazehl ValdezNo ratings yet

- Lets Try This 4Document2 pagesLets Try This 4syramaebillones26No ratings yet

- Liabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Document3 pagesLiabilities 31.3.20X1 Rs 31.3.20X2 Rs Assets: Course: Fac Quiz:5 Section B DATE: 02/09/2019Amit GodaraNo ratings yet

- AFE3871 Assingment 2 Memo 1Document45 pagesAFE3871 Assingment 2 Memo 1SoblessedNo ratings yet

- 3jun24 - Intercompany Transaction - EquipmentDocument16 pages3jun24 - Intercompany Transaction - Equipmentsisilia rachelNo ratings yet

- Lape - ACP312 - ULOa - Let's Analyze Week6Document3 pagesLape - ACP312 - ULOa - Let's Analyze Week6Bryle Jay LapeNo ratings yet

- Tutorial 11 Interco TransactionsDocument15 pagesTutorial 11 Interco TransactionsBình QuốcNo ratings yet

- Unit VI CashFlowStatementDocument32 pagesUnit VI CashFlowStatementSmiti RupaNo ratings yet

- 4BSA2 GROUP2 GroupActivityNo.1Document4 pages4BSA2 GROUP2 GroupActivityNo.1Lizerie Joy Kristine CristobalNo ratings yet

- Business Combination Part 2Document7 pagesBusiness Combination Part 2딈밍No ratings yet

- Batch 93 FAR First Preboard February 2023 - SolutionDocument5 pagesBatch 93 FAR First Preboard February 2023 - SolutionlorenzNo ratings yet

- FAR Final Preboard SolutionsDocument6 pagesFAR Final Preboard SolutionsVillanueva, Mariella De VeraNo ratings yet

- Task Performance I. Horizontal AnalysisDocument3 pagesTask Performance I. Horizontal AnalysisarisuNo ratings yet

- Sol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BDocument15 pagesSol. Man. - Chapter 14 - Investments in Assoc. - Ia Part 1BChristian James RiveraNo ratings yet

- Batch 95 FAR First Preboard SolutionDocument7 pagesBatch 95 FAR First Preboard Solutionssslll2No ratings yet

- Cai Acc. Imp Questions (Part 1)Document100 pagesCai Acc. Imp Questions (Part 1)SheenaNo ratings yet

- 950k X 1/2 X 15 Per ShareDocument5 pages950k X 1/2 X 15 Per ShareNickey DickeyNo ratings yet

- Advance Financial Accounting and ReportingDocument25 pagesAdvance Financial Accounting and ReportingEmma Mariz GarciaNo ratings yet

- Accountancy Answer Key - II Puc Annual Exam March 2019Document8 pagesAccountancy Answer Key - II Puc Annual Exam March 2019Akash kNo ratings yet

- Step AcquisitionDocument2 pagesStep AcquisitionJamaica DavidNo ratings yet

- 5.ratio Analysis SumsDocument9 pages5.ratio Analysis Sumsvinay kumar nuwalNo ratings yet

- Question No 1: A-Gross PayDocument6 pagesQuestion No 1: A-Gross PayArmaghan Ali MalikNo ratings yet

- CA India Financial ManagementDocument30 pagesCA India Financial Managementomkumardepani070805No ratings yet

- AFAR2 CH. 3 - Problem Quiz 1Document19 pagesAFAR2 CH. 3 - Problem Quiz 1Von Andrei MedinaNo ratings yet

- Cpa Review School of The Philippines Mani LaDocument6 pagesCpa Review School of The Philippines Mani LaSophia PerezNo ratings yet

- Issues For Discussion: Day 3: Determing Cash Flows When BS and IS Given Pat and CfoDocument29 pagesIssues For Discussion: Day 3: Determing Cash Flows When BS and IS Given Pat and Cfosayan duttaNo ratings yet

- AFAR 2 NotesDocument157 pagesAFAR 2 NotesAlexandria EvangelistaNo ratings yet

- Ans m2 PaperDocument6 pagesAns m2 Paperbigab31327No ratings yet

- Advanced Financial Individual Project - Keating FinalDocument36 pagesAdvanced Financial Individual Project - Keating FinalAshleyNo ratings yet

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersElaine Fiona Villafuerte100% (1)

- Quiz in Investment AnswersDocument7 pagesQuiz in Investment AnswersLenny Ramos VillafuerteNo ratings yet

- Pembahasan Kuiz Indirect HoldingsDocument3 pagesPembahasan Kuiz Indirect HoldingsAdara KiranaNo ratings yet

- SolMan Chapter 4 (Partial)Document9 pagesSolMan Chapter 4 (Partial)zaounxosakubNo ratings yet

- Intercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Document31 pagesIntercompany Sale of PPE Problem 2: Requirement: January 1, 20x4Abegail LibreaNo ratings yet

- Business Combination Subsequent To Date of Acquisition SolutionDocument3 pagesBusiness Combination Subsequent To Date of Acquisition SolutionGelliza Mae MontallaNo ratings yet

- Final Exam Far1Document4 pagesFinal Exam Far1Chloe CatalunaNo ratings yet

- Fund Flow StatementDocument41 pagesFund Flow StatementMahima SinghNo ratings yet

- Financial Analysis DashboardDocument11 pagesFinancial Analysis DashboardZidan ZaifNo ratings yet

- 21 Financial - Asset - FV - Reclassification - Sample - ProblemsDocument4 pages21 Financial - Asset - FV - Reclassification - Sample - ProblemsSheila Grace BajaNo ratings yet

- FAR First Preboard Batch 89 SolutionDocument6 pagesFAR First Preboard Batch 89 SolutionZiee00No ratings yet

- Intermediate Accounting Chapter 4 ProblemsDocument18 pagesIntermediate Accounting Chapter 4 ProblemsPattraniteNo ratings yet

- Intermediate Accounting Unit4 - Topic4Document8 pagesIntermediate Accounting Unit4 - Topic4Lea Polinar100% (1)

- AACA2 AssignmentsDocument20 pagesAACA2 AssignmentsadieNo ratings yet

- Chapter 14Document10 pagesChapter 14Nikki GarciaNo ratings yet

- Notes To AccountsDocument2 pagesNotes To Accountsnahangar113No ratings yet

- Equity Valuation: Models from Leading Investment BanksFrom EverandEquity Valuation: Models from Leading Investment BanksJan ViebigNo ratings yet

- IFRS Vs US GAAP - 2024Document8 pagesIFRS Vs US GAAP - 2024AMARTYA KUMAR DAS PGP 2023-25 BatchNo ratings yet

- Consolidated Statement ORGDocument8 pagesConsolidated Statement ORGPak_4everNo ratings yet

- Resolving NPL Report - enDocument61 pagesResolving NPL Report - enlidia012No ratings yet

- Module 06business Combination PDF FreeDocument19 pagesModule 06business Combination PDF FreeCaptain ObviousNo ratings yet

- Financial Statements of BMW AgDocument32 pagesFinancial Statements of BMW AgGate Bennet4No ratings yet

- University of Caloocan City Bachelor of Science in AccountancyDocument5 pagesUniversity of Caloocan City Bachelor of Science in AccountancyLumingNo ratings yet

- MFRS 121 - Foreign Currency Lecture Notes 2022 - UploadDocument38 pagesMFRS 121 - Foreign Currency Lecture Notes 2022 - UploadZhaoYing TanNo ratings yet

- Zaverecna PraceDocument109 pagesZaverecna PracenicolescuaNo ratings yet

- Biological Assets Activity 7Document9 pagesBiological Assets Activity 7Jazzriel Dave BocoboNo ratings yet

- Principles of Accounting: Week 2Document56 pagesPrinciples of Accounting: Week 2pinkyNo ratings yet

- Pas 32 PFRS 9Document110 pagesPas 32 PFRS 9Katzkie Montemayor GodinezNo ratings yet

- Accounting For Leases of Aircraft Fleet Assets in The Global Airline IndustryDocument20 pagesAccounting For Leases of Aircraft Fleet Assets in The Global Airline Industrynanduru_jagan100% (2)

- Dharan Valuation Issues in The Coming Wave of Goodwill and Asset ImpairmentsDocument4 pagesDharan Valuation Issues in The Coming Wave of Goodwill and Asset ImpairmentsDhaval JobanputraNo ratings yet

- Has The Entity Transferred Its Rights To Receive The Cash Flows From The Asset?Document9 pagesHas The Entity Transferred Its Rights To Receive The Cash Flows From The Asset?Nico RobinNo ratings yet

- PPT2-Accounting For Business CombinationsDocument62 pagesPPT2-Accounting For Business CombinationsRifdah SaphiraNo ratings yet

- F7 - C5 (IAS36), C6 (IAS 2 & 41) FullDocument69 pagesF7 - C5 (IAS36), C6 (IAS 2 & 41) FullK59 Vo Doan Hoang AnhNo ratings yet

- Gialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingDocument12 pagesGialogo, Jessie Lyn San Sebastian College - Recoletos Quiz: Required: Answer The FollowingMeidrick Rheeyonie Gialogo AlbaNo ratings yet

- Assignment 3 Consolidation. Subsequent To The Date of AcquisitionDocument4 pagesAssignment 3 Consolidation. Subsequent To The Date of AcquisitionAivan De LeonNo ratings yet

- IFRS 3 Business CombinationDocument15 pagesIFRS 3 Business CombinationAquino KimalexerNo ratings yet

- Disclaimer: Paper 6E: Global Financial Reporting Standards 1Document34 pagesDisclaimer: Paper 6E: Global Financial Reporting Standards 1Shashank 45No ratings yet

- Syllabus Intermediate Accounting 1 2021Document21 pagesSyllabus Intermediate Accounting 1 2021John Lucky MacalaladNo ratings yet

- Unit 7: Investment in Associates & Joint Ventures: Financial ReportingDocument11 pagesUnit 7: Investment in Associates & Joint Ventures: Financial ReportingSiva DineshNo ratings yet

- Farm Stocktaking Valuations 2nd Edition RicsDocument22 pagesFarm Stocktaking Valuations 2nd Edition RicsKien NguyenNo ratings yet

- Corporate Reporting Answers: Foundation Level Examination 2019 Mock ExamDocument18 pagesCorporate Reporting Answers: Foundation Level Examination 2019 Mock ExamOyeleye TofunmiNo ratings yet

- IFRS 2 - Share Based Payment1Document7 pagesIFRS 2 - Share Based Payment1EmmaNo ratings yet

- Financial Accounting and Reporting: Small and Medium-Sized EntitiesDocument19 pagesFinancial Accounting and Reporting: Small and Medium-Sized EntitiesDan DiNo ratings yet