Professional Documents

Culture Documents

Commerce CC3 (2.2CH) 2019

Commerce CC3 (2.2CH) 2019

Uploaded by

tsyrlwbye0 ratings0% found this document useful (0 votes)

13 views4 pagesOriginal Title

Commerce_CC3(2.2CH)_2019

Copyright

© © All Rights Reserved

Available Formats

PDF or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

0 ratings0% found this document useful (0 votes)

13 views4 pagesCommerce CC3 (2.2CH) 2019

Commerce CC3 (2.2CH) 2019

Uploaded by

tsyrlwbyeCopyright:

© All Rights Reserved

Available Formats

Download as PDF or read online from Scribd

Download as pdf

You are on page 1of 4

CH-I/Cost Accounting-CC-3/2.2CH/19

B.Com. II Semester (Honours) Examination, 2019 (CBCS)

Subject : Cost Accounting

Paper : CC-3 (2.2CH)

‘Time: 3 Hours Full Marks: 60

14221

The figures in the margin indicate full marks.

Candidates are required to give their answers in their own words:

as far as practicable.

| _sftes aree ran eae 54 Fee

Asatte ae Face era Be fice eA!

Answer any fen from the following questions: 2%10=20

‘Ria eee cae a CHICA Pm ere eR AS ¢

(2) What is cost unit? Give an example.

an awe Sr cas Baer Ms |

(b) What is opportunity cost?

yaaa - a

(©) What d6 you mean by chargeable expenses?

Sere ta ACSF carat?

(@ What is Goods Received Note?

ares anita fea ai Sore He

(©) What is meant by Bin Card?

fern ae A carer?

(@) What is perpetual inventory system?

wien Rarwa ere aia eta em Be

(g) Mention the names of any two manual inethods of time bookis

aaa erecta Yb conire tata am tome wat

(h) What is the main theme of Taylor's Differential wage rate?

ciara onderaae xeht waa a reree Se

(@ What is the formula applied ia measuring production overhead absorption rate by using

percentage of prime cost?” z

Be aE ToL ect Bola aie ra Mee aft ad Ae

G) What is the basic assumption underlying the step method of redistribution of service

department costs?

rat arin Recs AE Ce sha ae SERA Ae

Please Turn Over

1282

CH-L/Cost Accounting-CC-3/2.2CHI19 (2)

(k) What is “Retention Money’ in the context of contract costing?

feet ofan fia sraten afacetace ‘ataw wet Se

(Name four types of business where job costing would be appropriate,

Brn Aaa STATA a ERT COC aE ata Fae S|

(m) What is Integral Accounting? :\

edge fener A \

(n) Name any two expenses which are not included in Cost Accounting,

often Rarer SEGS a a aR Cx CONT AB MAIDA A CATA

(0) What do you mean by ‘By-Product"?

“Crisis ace @ carat?

2. Answer any four from the following questions 5x4=20

iba SRT cas cl CeCaT ors acRa Sea Het

(@) What is Cost Accounting? Mention the objectives of Cost Accounting, 14d=5

ofr Roraae sce aint? aa Rorerecra Boerels Beat eat

(b)_ Whats labour turnover? State the methods used to measure labour turnover, Iedes

anlanés Se ae oeey oars dame ele el qe aT

(©) Distinguish between Process Costing and Job Costi

oifaear afters reir e axfefe atin fata aces ones Pret cat

(@) From the following information, compute the raw material purchased: S290

Flood Cea ar Care SOMA wx Hane wats

Rs.

Opening stock of raw materials 2,000

Closing stock of raw materials 30,000

Direct wages 2.104

Factory overhead 60% of direct wages (26000

General overhead 10% of works cost [2600

Cost of produetion : 6,88,600

Rar enzeay)

(6) From the following particulars in respect of the use of material, compute 341415

Heer aes AMASS Acs Hen Fra cece faela Scat s

(@ Economic order quan

(ii) Frequency of orders during the year and

Gif) Time interval between orders:

Annual usage Rs. 3,60,000

Ordering cost per order Rs. 100

(Carrying cost per annum 8%

(RaSh on zB |]

@)

(f) Calculate the comprehensive Machine Hour Rate from the following particulars:

Fiewa creat Peat ceca Farge ae wT ae ALA

Cost of Machine Rs. 1,50,000

Estimated scrap value Rs. 24,000

Estimated life 1O years

Nuynber of working hours per annum 1,900

Vain 100 hours for repairs)

sel oil consumption per hour forrun 2 liters at Rs. 3 per liter

JaSurance 1% pa. capital cost

Repairs and maintenance Rs. 5,400 pa,

| SiaGes of operator Rs. 4 per hour of working

1 AGneral overheads related to the machine Rs. 3,900 pa.

4 Ioan of Rs, 90,000@ 10% pa. interest was taken to meet the purchase price of the

machine, party.

(Bert eet Pa)

Answer any awo from the following questio

‘Aiba enele colee CL cercaien ais Seams ¢

10%2=20

(a) What is process costing? In which cases the use of process costing is considered suitable?

How do you treat ‘Abnormal Loss’ and “Abnormal Gain’ in process costing? 24+3+5=10,

ae fftos fit ae Ce TA GHIA GH CHL ee fae SE tafe TAIN BEE

fate are ofeat afzars Ret omPECE GR Seta TatSleT AE “aateihe ae’ Rein

aude watt

©

From the following information, calculate production bour rate of recovery of overhead for

Departments A, B and C using Simultaneous Equation Method:

eaten wae Tees Fs As Crem wT CATH A, Bek C freiraa Belts SICH Bt

frets scat

Particulars | 1 Production Depts. _ | Service Depts.

| Toul [A] B ] Cul Pama

Rs | Rs | Rs. | Rs. | Rs. | Rs.

Rent 12,000 2.400 | 4,800| 2,000 | 2,000 _ 800

Electricity 4,000] 800] 2,000] s00| 400] 300

Indirect Labour | 6,000) 1,200 2.000] 1,000] 800 | 1,000 |

Depreciation 5,000] 2,500] 1,600] 200] 500] 200

| Sundries 4500/910[2143| 47] 300] 300

ae | | 1,000 | 2,500 1,400

CH-I/Cost Accounting-CC-3/2.2CH/I9 (es)

Expenses of Service Departments P and Q are apportioned as:

A B ¢ P Q

iF. 30% 40% 20% — 10%

Q 10% 20% = 50% = 0H

Rests eg a

(©) A company commenced the work on a particular contract on Ist April, 2018. They close

their books of accounts for the year on 31st December each year. The following information

is available from their costing records on 31st December, 2018:

Materials sent to site Rs, 50,000,

Foreman’s salary Rs. 12,000

‘Wages paid Rs. 1,00,000

‘A machine costing Rs. 32,000 remained in use on site for 1/5th of the year. Its working life

was estimated at 5 years and-scrap value at Rs. 2,000, A supervisor is paid Rs. 2,000 per

‘month and he had devoted one-half of his time on the contract.

All other expenses were Rs, 15,000, The materials on site were Rs. 9,000. The contract price

was Rs, 4,00,000 on 31st December, 2018, 2/3rd of the contract was completed, however.

the architect gave certificate only for Rs. 2,00,000 on which 75% was paid. Prepare the

Contract Account.

<< caret 2018 ITA Ist April ae Ger plea ata ca sun) GAG af ee

31st December eid PNRMIE sa Sal wie vie aa ces 31st December, 2018-

You might also like

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeFrom EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeRating: 4 out of 5 stars4/5 (5824)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreFrom EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreRating: 4 out of 5 stars4/5 (1093)

- Never Split the Difference: Negotiating As If Your Life Depended On ItFrom EverandNever Split the Difference: Negotiating As If Your Life Depended On ItRating: 4.5 out of 5 stars4.5/5 (852)

- Grit: The Power of Passion and PerseveranceFrom EverandGrit: The Power of Passion and PerseveranceRating: 4 out of 5 stars4/5 (590)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceFrom EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceRating: 4 out of 5 stars4/5 (903)

- Shoe Dog: A Memoir by the Creator of NikeFrom EverandShoe Dog: A Memoir by the Creator of NikeRating: 4.5 out of 5 stars4.5/5 (541)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersFrom EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersRating: 4.5 out of 5 stars4.5/5 (349)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureFrom EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureRating: 4.5 out of 5 stars4.5/5 (474)

- Her Body and Other Parties: StoriesFrom EverandHer Body and Other Parties: StoriesRating: 4 out of 5 stars4/5 (823)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)From EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Rating: 4.5 out of 5 stars4.5/5 (122)

- The Emperor of All Maladies: A Biography of CancerFrom EverandThe Emperor of All Maladies: A Biography of CancerRating: 4.5 out of 5 stars4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingFrom EverandThe Little Book of Hygge: Danish Secrets to Happy LivingRating: 3.5 out of 5 stars3.5/5 (403)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyFrom EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyRating: 3.5 out of 5 stars3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)From EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Rating: 4 out of 5 stars4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaFrom EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaRating: 4.5 out of 5 stars4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryFrom EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryRating: 3.5 out of 5 stars3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnFrom EverandTeam of Rivals: The Political Genius of Abraham LincolnRating: 4.5 out of 5 stars4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealFrom EverandOn Fire: The (Burning) Case for a Green New DealRating: 4 out of 5 stars4/5 (74)

- The Unwinding: An Inner History of the New AmericaFrom EverandThe Unwinding: An Inner History of the New AmericaRating: 4 out of 5 stars4/5 (45)

- Notice 16102023 281Document1 pageNotice 16102023 281tsyrlwbyeNo ratings yet

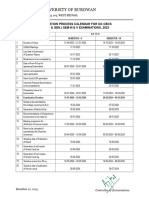

- UG Examination Calendar For Sem-V & Sem-III Exam-2 - 231222 - 162626Document1 pageUG Examination Calendar For Sem-V & Sem-III Exam-2 - 231222 - 162626tsyrlwbyeNo ratings yet

- Program 0003Document2 pagesProgram 0003tsyrlwbyeNo ratings yet

- Bcomh CC2 2017Document3 pagesBcomh CC2 2017tsyrlwbyeNo ratings yet