Professional Documents

Culture Documents

Communication and Insurance

Communication and Insurance

Uploaded by

Samwel PoncianCopyright:

Available Formats

You might also like

- Business CommunicationDocument48 pagesBusiness Communicationsandhya_mohan_990% (29)

- Company Vehicle Policy Download 20171023Document2 pagesCompany Vehicle Policy Download 20171023Inean Tolentino100% (2)

- Wayne I Newton's Affidavit of Commercial Lien - Great Template Document ExampleDocument6 pagesWayne I Newton's Affidavit of Commercial Lien - Great Template Document ExampleOriginal Prouve Antony Chair for Sale92% (12)

- Introduction To CommunicationDocument38 pagesIntroduction To Communicationricha singhNo ratings yet

- Purpose of CommunicationDocument6 pagesPurpose of CommunicationSimbarashe Marisa0% (3)

- Managerial CommunicationDocument24 pagesManagerial CommunicationSai KiranNo ratings yet

- Business Communication AssignmentDocument5 pagesBusiness Communication AssignmentAnup SharmaNo ratings yet

- Unit 1 Fundamentals of CommunicationDocument4 pagesUnit 1 Fundamentals of CommunicationRishiraj singh5697No ratings yet

- Business Communication: Assignment OnDocument22 pagesBusiness Communication: Assignment OnSoumya BanerjeeNo ratings yet

- Business Comm NotesDocument49 pagesBusiness Comm NotesGaurav MaruNo ratings yet

- Commonly". Therefore, The Word Communication Means Sharing of Ideas, Messages and WordsDocument50 pagesCommonly". Therefore, The Word Communication Means Sharing of Ideas, Messages and WordsMohammed Demssie MohammedNo ratings yet

- Business Communication: Submitted By:-Submitted ToDocument17 pagesBusiness Communication: Submitted By:-Submitted ToApurv BajpaiNo ratings yet

- Defining Communication-: Sender Message Receiver MessageDocument9 pagesDefining Communication-: Sender Message Receiver MessagedushuheerloNo ratings yet

- Business Communication in EnglishDocument20 pagesBusiness Communication in EnglishAndriesNo ratings yet

- Complete Week Two NoteDocument16 pagesComplete Week Two NoteadeyemiNo ratings yet

- Meaning, Objectives and Forms of Business CommunicationDocument12 pagesMeaning, Objectives and Forms of Business CommunicationPriyanka RanaNo ratings yet

- Communication Skills IIDocument16 pagesCommunication Skills IIAjay Singh GurjarNo ratings yet

- PC Sem-5 NotesDocument61 pagesPC Sem-5 NotesDivyamNo ratings yet

- Communications Skills For Buisiness ArticleDocument11 pagesCommunications Skills For Buisiness ArticlevanessajageshwarNo ratings yet

- Purpose of CommunicationDocument6 pagesPurpose of CommunicationSimbarashe MarisaNo ratings yet

- Business Communication - NotesDocument27 pagesBusiness Communication - NotesChetan Shetty100% (2)

- Business CommunicationDocument18 pagesBusiness CommunicationAni Bh'sNo ratings yet

- Clarify The Idea Before CommunicationDocument8 pagesClarify The Idea Before CommunicationYusuf MonafNo ratings yet

- General Elective Psychology Assignment (Original)Document18 pagesGeneral Elective Psychology Assignment (Original)yuktaNo ratings yet

- City& Guilds 401Document7 pagesCity& Guilds 401johnNo ratings yet

- Curs EnglezaDocument119 pagesCurs EnglezaRobert TintaNo ratings yet

- Smaw 11 Module 1Document18 pagesSmaw 11 Module 1Francis Rico Mutia RufonNo ratings yet

- BUSINESS COMMUNICATION Lecture 1Document32 pagesBUSINESS COMMUNICATION Lecture 1Rajja RashadNo ratings yet

- BC Unit 1 & 2Document13 pagesBC Unit 1 & 2iamdhanush017No ratings yet

- What Is Communication ReportDocument9 pagesWhat Is Communication ReportKris LabayogNo ratings yet

- Coma 100 - M8Document10 pagesComa 100 - M8Emmanuel D. MalongaNo ratings yet

- Unit - 2 For BBA First YearDocument33 pagesUnit - 2 For BBA First YearwankhedemiditNo ratings yet

- Business Communication - NotesDocument43 pagesBusiness Communication - NotesBittu VermaNo ratings yet

- Business Communication - Unit 1 - 2020-2021Document98 pagesBusiness Communication - Unit 1 - 2020-2021Milan JainNo ratings yet

- Communication SkillsDocument27 pagesCommunication Skillsharsh7777No ratings yet

- Principles of Effective CommunicationDocument36 pagesPrinciples of Effective CommunicationSiddharth BajpaiNo ratings yet

- Blue and Yellow Playful Doodle Digital Brainstorm Presentation - 20240210 - 181611 - 0000Document30 pagesBlue and Yellow Playful Doodle Digital Brainstorm Presentation - 20240210 - 181611 - 0000Vidal Angel Glory Borj A.No ratings yet

- Effective Communication in BusinessDocument44 pagesEffective Communication in BusinessKamran Ali AbbasiNo ratings yet

- Effective Communication in BusinessDocument44 pagesEffective Communication in BusinessRizwan Ali100% (1)

- Kombis Chap 1Document23 pagesKombis Chap 1irsantiNo ratings yet

- 11-Workplace Communication SkillsDocument4 pages11-Workplace Communication SkillsS.m. ChandrashekarNo ratings yet

- (B) Types, Directions, ChallengesDocument17 pages(B) Types, Directions, Challengesstudy dNo ratings yet

- Business Communication Module (Repaired)Document117 pagesBusiness Communication Module (Repaired)tagay mengeshaNo ratings yet

- Business CommunicationDocument51 pagesBusiness CommunicationRohit BhandariNo ratings yet

- Managerial Communication Question BankDocument14 pagesManagerial Communication Question BankAnonymous uxd1yd100% (2)

- Communication 1st Unit - CompleteDocument17 pagesCommunication 1st Unit - CompleteAnuj SaxenaNo ratings yet

- UntitledDocument2 pagesUntitledGrace JeresaNo ratings yet

- Corporate Communication Final For MidtermDocument25 pagesCorporate Communication Final For Midtermdinar aimcNo ratings yet

- NotesDocument38 pagesNotesSumeet NayakNo ratings yet

- Communication For Work Lesson 6 NotesDocument12 pagesCommunication For Work Lesson 6 NotesJoy Bernadine TibonNo ratings yet

- CH 1 Introduction To Business CommunicationDocument36 pagesCH 1 Introduction To Business CommunicationHossain Uzzal100% (1)

- Bba101 SLM Unit 01Document11 pagesBba101 SLM Unit 01Jani AmitkumarNo ratings yet

- What Are The Benefits of Effective CommunicationDocument4 pagesWhat Are The Benefits of Effective CommunicationAnsari Mustak50% (2)

- II Yr BBA UNIT I - CommunicationsDocument16 pagesII Yr BBA UNIT I - CommunicationsAlba PeaceNo ratings yet

- Ug-Skill Development Course: Business CommunicationDocument94 pagesUg-Skill Development Course: Business CommunicationYamini KumarNo ratings yet

- Knowlege TestDocument3 pagesKnowlege Testinfo UnitNo ratings yet

- Importance & Benefits of Effective Communication: Client RelationsDocument3 pagesImportance & Benefits of Effective Communication: Client RelationsMя śДmŶ ܤ㋡No ratings yet

- Communication Skills - UNIT IDocument37 pagesCommunication Skills - UNIT IrakeshparthasarathyNo ratings yet

- Business Communication Lesson 1Document4 pagesBusiness Communication Lesson 1Kryzelle Angela OnianaNo ratings yet

- College of Business Education (CBE)Document7 pagesCollege of Business Education (CBE)Samwel PoncianNo ratings yet

- Re: An Application For Any Job VacancyDocument2 pagesRe: An Application For Any Job VacancySamwel PoncianNo ratings yet

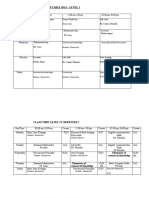

- Class Timetable Boa - Level IDocument6 pagesClass Timetable Boa - Level ISamwel PoncianNo ratings yet

- Dawasa Historical BackgroundDocument5 pagesDawasa Historical BackgroundSamwel Poncian100% (1)

- The Development of DryDocument1 pageThe Development of DrySamwel PoncianNo ratings yet

- The Development of DryDocument1 pageThe Development of DrySamwel PoncianNo ratings yet

- Chapter One Organization BackgroundDocument18 pagesChapter One Organization BackgroundSamwel Poncian100% (1)

- Marine Crafts/navigation AidsDocument2 pagesMarine Crafts/navigation AidsSamwel PoncianNo ratings yet

- TPADocument5 pagesTPASamwel PoncianNo ratings yet

- Chapter One Introduction and BackgroundDocument19 pagesChapter One Introduction and BackgroundSamwel PoncianNo ratings yet

- IlalaDocument27 pagesIlalaSamwel Poncian100% (5)

- Part One About PolytraDocument21 pagesPart One About PolytraSamwel PoncianNo ratings yet

- IlalaDocument27 pagesIlalaSamwel Poncian100% (5)

- Ejercito v. Sandiganbayan, G.R. Nos. 157294-95. November 30, 2006.Document2 pagesEjercito v. Sandiganbayan, G.R. Nos. 157294-95. November 30, 2006.Pamela Camille Barredo100% (4)

- JDF 252B Motion For Interrog - LONGDocument6 pagesJDF 252B Motion For Interrog - LONGAntoinette MoederNo ratings yet

- Andrew Palermo VsDocument2 pagesAndrew Palermo VsAliyah SandersNo ratings yet

- Householders Insurance Policy: Proposal FormDocument5 pagesHouseholders Insurance Policy: Proposal Formm_dattaiasNo ratings yet

- Article On Recovery or Execution - G NaiduDocument68 pagesArticle On Recovery or Execution - G NaiduDiveenaNo ratings yet

- Contract Law - IllegalityDocument9 pagesContract Law - IllegalityNicholas AnthonyNo ratings yet

- Social Dialogue in MontenegroDocument15 pagesSocial Dialogue in MontenegroKristine MontenegroNo ratings yet

- List of Standardized Documentary Checklist FormsDocument1 pageList of Standardized Documentary Checklist Formsarfica zainal abidinNo ratings yet

- Enrollment Card For Group Insurance: Member InformationDocument1 pageEnrollment Card For Group Insurance: Member Informationsue anneNo ratings yet

- FAQ's On Ombudsman SchemeDocument3 pagesFAQ's On Ombudsman SchemeSaba SaleemNo ratings yet

- SFA Twirling Camp BrochureDocument5 pagesSFA Twirling Camp BrochuretimelesstojsNo ratings yet

- What Is Assignment and Nomination in Life InsuranceDocument4 pagesWhat Is Assignment and Nomination in Life InsuranceDivanshu DhingraNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2019-02Document25 pagesGlobe Life - AIL - Spotlight Magazine - 2019-02Fuzzy PandaNo ratings yet

- Fullerton ReportDocument59 pagesFullerton ReportbittugolumoluNo ratings yet

- Abc Analysis To Crack Cs ExamDocument1 pageAbc Analysis To Crack Cs ExamSARANYA LAKSHMINo ratings yet

- Documentation, Export Documentation, Transportation Documentation Custom Documentation, Marine Insurance EtcDocument1 pageDocumentation, Export Documentation, Transportation Documentation Custom Documentation, Marine Insurance EtcVivek GusaniNo ratings yet

- Law 1101Document5 pagesLaw 1101Steph GonzagaNo ratings yet

- Need For Adjusting EntriesDocument21 pagesNeed For Adjusting EntriesKyle Monique PondoNo ratings yet

- Bill Would Bring Transparency To Michigan No-Fault SystemDocument1 pageBill Would Bring Transparency To Michigan No-Fault SystemJoshHoveyNo ratings yet

- Insurance - Rate MakingDocument78 pagesInsurance - Rate Makingthefactorbook100% (1)

- Banking & Finance Awareness 2016 (Jan-August) by AffairsCloudDocument124 pagesBanking & Finance Awareness 2016 (Jan-August) by AffairsCloudShlaghaNo ratings yet

- Template Letter Post DoctoralDocument3 pagesTemplate Letter Post DoctoralPamela Grace AnzuresNo ratings yet

- Malayan Insurance Vs CA March 20,1997Document2 pagesMalayan Insurance Vs CA March 20,1997Alvin-Evelyn GuloyNo ratings yet

- Gmail - Allstate Claim 0411061054 Your Recent Property Insurance Claim Has Been Successfully Submitted April 26, 2016Document73 pagesGmail - Allstate Claim 0411061054 Your Recent Property Insurance Claim Has Been Successfully Submitted April 26, 2016Stan J. CaterboneNo ratings yet

- The Economic RevolutionDocument8 pagesThe Economic RevolutionsandeshNo ratings yet

- P L I Premium ReceiptDocument4 pagesP L I Premium Receiptapi-3810632No ratings yet

- AgencyDocument54 pagesAgencyAsha RaiNo ratings yet

- Hull War, Strikes, Terrorism and Related Perils Notice of Cancellation Administration ClauseDocument3 pagesHull War, Strikes, Terrorism and Related Perils Notice of Cancellation Administration ClauseDannn GNo ratings yet

Communication and Insurance

Communication and Insurance

Uploaded by

Samwel PoncianOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Communication and Insurance

Communication and Insurance

Uploaded by

Samwel PoncianCopyright:

Available Formats

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

COMMUNICATION

Communication is the transmission of information from one point or person

to another point or person. Involves two-way process of reaching mutual

understanding, in which participants not only exchange (encode-decode)

information, news, ideas and feelings but also create and share meaning. In

general, communication is a means of connecting people or places. In

business, it is a key function of management--an organization cannot operate

without communication between levels, departments and employees. See also

communications.

Communication is a function that is indispensable for commerce. All types of

trade transactions, receiving of trade inquiries, sending of information about

dispatch of goods, receiving of payment, etc.” Communication is a function

that is indispensable for commerce. All types of trade transactions, receiving

of trade inquiries, sending of information about dispatch of goods, receiving

of payment, etc. are possible with the help of Communication

Trade business cannot function efficiently if the buyers and sellers do not

make proper use of communication channels. It is through communication

that all formalities of transaction are completed. An efficient communication

system brings businessman close to each other not only in one country but

in the whole world.

Management and supervision also remain incomplete and shabby in the

absence of proper communication. Communication means sharing of ideas in

common. When we communicate, we are trying to establish a rationale with

someone. We are trying to share information, ideas or attitudes.

Communication is basically the fine-tuning of the receiver and the sender,

aimed at affecting a particular message.

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

ELEMENTS OF COMMUNICATIONS

Seven major elements of communication process are: (1) sender (2) ideas (3)

encoding (4) communication channel (5) receiver (6) decoding and (7)

feedback.

Communication may be defined as a process concerning exchange of facts or

ideas between persons holding different positions in an organisation to

achieve mutual harmony. The communication process is dynamic in nature

rather than a static phenomenon.

Communication process as such must be considered a continuous and

dynamic inter-action, both affecting and being affected by many variables.

1. Sender: The person who intends to convey the message with the

intention of passing information and ideas to others is known as sender

or communicator.

2. Ideas: This is the subject matter of the communication. This may be an

opinion, attitude, feelings, views, orders, or suggestions.

3. Encoding: Since the subject matter of communication is theoretical

and intangible, its further passing requires use of certain symbols such

as words, actions or pictures etc. Conversion of subject matter into

these symbols is the process of encoding.

4. Communication Channel: The person who is interested in

communicating has to choose the channel for sending the required

information, ideas etc. This information is transmitted to the receiver

through certain channels which may be either formal or informal.

5. Receiver: Receiver is the person who receives the message or for whom

the message is meant for. It is the receiver who tries to understand the

message in the best possible manner in achieving the desired objectives.

6. Decoding: The person who receives the message or symbol from the

communicator tries to convert the same in such a way so that he may

extract its meaning to his complete understanding.

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

7. Feedback: Feedback is the process of ensuring that the receiver has

received the message and understood in the same sense as sender

meant it.

THE IMPORTANCE OF COMMUNICATION IN BUSINESS

Unity

A company that works to develop strong communication with each other is a

united company. Each team member shares the same goals in this case, and

everyone knows what their co-workers have on their plate. By simply keeping

in touch on a regular basis, everyone remains united and working together.

This instils a cooperative atmosphere rather than encouraging the idea of

having a bunch of individual people only looking out for themselves. All

companies have a vision for their success, and through communication, that

vision spreads to everyone. The result is a happier, healthier workplace where

things get done more efficiently and a bigger likelihood of retaining the top

talent.

Feedback

When communication is stressed, it creates an open environment where

everyone feels comfortable talking with each other. When that level of comfort

is present in a business, employees feel confident that they can express their

ideas about the work process to each other and even to management.

Feedback is a vital component of communication, and it works both ways.

Management give feedback to the employees in regards to how well they’re

faring at their duties, and employees feel safe giving feedback on how well the

company’s policies and procedures are working. Communication is not

communication if it only comes from one direction.

Improves Customer Relationships

No business would succeed without customers, and every company exists to

serve them. Communicating with customers is every bit as important as

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

communication within the workplace. Thankfully, this is easier today that it’s

ever been, as there are a wide variety of ways to keep in touch with your

customer base. Consider this course on connecting with your customer base

through blogging for one method, but no matter what method you use to reach

out to your customers, keeping constant communication going will bring your

company much closer with the ones that spend the money on your products

or services.

Improves Employee Relationships

No friendship is ever formed without a good level of communication. The more

a company’s employees communicate with each other, the closer they will

become naturally over time. Bear in mind that much of communication takes

place without the need for words, so it’s important to master both verbal and

non-verbal communication, both in the written form as well as body language.

Enforcing Rules

Every business must have a code of policies and procedures that must be

followed in order for everyone to succeed. Maybe there is a specific process for

a task, for example, or maybe there are certain consequences for

underperforming. Either way, you want to make all this very clear to your

employees, or it isn’t possible to do this without strong communication skills.

Enhanced Innovation

No matter how skilled and talented the people at the top of your company are,

you can never have too many ideas. By encouraging everyone at your

business, whether big or small, to openly share their thoughts without fear of

being shut down, you will quickly notice the employees that have the most to

add. Your best employees have ideas on how you can make your business run

even better, and it’s wise to give them a chance to speak. A business can

become more innovative overnight just by working together to be good

communicators, and that’s bad news for your competition and good news for

your revenue.

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

TYPES OF COMMUNICATION

1. Oral communication is the process of verbally transmitting

information and ideas from one individual or group to another. Oral

communication can be either Formal or Informal. Examples of informal

oral communication include:

▪ Face-to-face conversations

▪ Telephone conversations

▪ Discussions that take place at business meetings

2. Written communication involves any type of message that makes use

of the written word. Written communication is the most important and

the most effective of any mode of business communication.

Examples of written communications generally used with clients or other

businesses include:

▪ Internet websites

▪ Letters

▪ Proposals

▪ Telegrams,

▪ Faxes

▪ Postcards

▪ Contracts

▪ Advertisements

▪ Brochures and

▪ News releases.

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

3. Visual communication is the transmission of information and ideas

using symbols and imagery. It is one of three main types of

communication, along with verbal communication (speaking) and non-

verbal communication (tone, body language, etc.). Visual

communication is believed to be the type that people rely on most, and

it includes signs, graphic designs, films, typography, and countless

other examples.

FACTORS WHICH SHOULD BE CONSIDERED IN CHOOSING A MEDIUM

OF COMMUNICATION.

▪ Quickness/Speed There are many types of transactions conducted

during the business hours. One must speed up the transmission of

message on the basis of importance and urgency of transaction. If the

party is available in the transacted place, oral communication is

enough. If the party is residing in the same city, telephonic message is

good: if outside the city, message through Subscribers' Trunk Dialing

(STD). If much distance is there, then telegram can also be sent. If the

matter is not urgent, a mere letter will be sufficient.

▪ Accuracy If the accuracy of the message is the prime motive, a letter

will serve the purpose Telephonic conversation might be misheard by

the other party. Even telegrams, sometimes lead to wrong conclusion.

Therefore, success can be reaped by a letter, provided the letter is

properly written. Therefore, the communication medium which is

selected should ensure accuracy in the transmission of messages.

▪ Safety There is always risk when valuables are sent by post. Therefore,

for safety purposes, important documents may be sent by registered

post; for further safety by registered and insured post.

▪ Secrecy In business field, certain transactions have to be kept

confidential. When one aims at secrecy, letter will achieve the aim. In

other communication systems, secrecy may leak out to unwanted

persons.

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

▪ Record Record of the message is essential and is possible only if it is in

writing. For this purpose, duplicate copies of the letters can be

preserved and they are good proof against disputes, relating to the

transaction, in future. There is no record for oral communication.

▪ Cost The cost of communication is also important. Before adopting any

system, the expenses in different means may also be considered. The

material cost (stationery) and labour cost in preparing the letter will

also be considered.

▪ Distance Distance between the persons who are parties to

communication is an important factor. If distance is too short, face to

face communication is suitable. If there is distance, message can be

transmitted through phone or telegram or letter.

BARRIERS OF COMMUNICATION

▪ Lack of skilled personnel in communication

▪ Lack of modern communication equipment

▪ increased in costs in communication

▪ bad weather condition affects communication adversely.

▪ remoteness of some areas makes them not easily accessible.

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

TOPIC: INSURANCE

Insurance: is an agreement in which a person makes regular payments to a

company and the company promises to pay money if the person is injured or

dies, or to pay money equal to the value of something (such as a house or car)

if it is damaged, lost, or stolen. Or is the Risk-transfer mechanism that

ensures full or partial financial compensation for the loss or damage caused

by event(s) beyond the control of the insured party. Under an insurance

contract, a party (the insurer) indemnifies the other party (the insured)

against a specified amount of loss, occurring from specified eventualities

within a specified period, provided a fee called premium is paid. In general

insurance, compensation is normally proportionate to the loss incurred.

Insurance police: is a contract whereby the insurer will pay the insured (the

person whom benefits would be paid to, or on behalf of), if certain defined

events occur. Subject to the "fortuity principle", the event must be uncertain.

The uncertainty can be either as to when the event will happen (e.g. in a life

insurance policy, the time of the insured's death is uncertain) or as to if it will

happen at all (e.g. in a fire insurance policy, whether or not a fire will occur

at all).

INSURANCE COMPONENTS

Premium; is the amount of money that an individual or business must pay

for an insurance policy. The insurance premium is considered income by the

insurance company once it is earned, and also represents a liability in that

the insurer must provide coverage for claims being made against the

policy. The amount of insurance premium that is required for insurance

coverage depends on a variety of factors. Insurance companies examine the

type of coverage, the likelihood of a claim being made, the area where the

policyholder lives or operates a business, the behaviour of the person or

business being covered, and the amount of competition that the insurer.

Risk: is the event against which insurance is taken out e.g. fire, theft etc.The

insured is compensated on the actual risk insured in case the loss happens.

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

Sum insured: This is the price of the property insured as declared by the

proprietor at the time of applying for insurance.

Insurer: Insurance company that issues a particular insurance policy to an

insured. In case of a very large risk, several insurance companies may

combine to issue one policy. after its insured driver caused a three-car

accident on the interstate, the driver's insurer was forced to settle the property

damage claims of the two non-liable drive.

Insured: a person or entity whose interests are protected by an insurance

policy; a person who contracts for an insurance policy that indemnifies him

against loss of property or life or health etc.

The policy holder who agrees to pay a premium against the insurers promise

to pay a certain sum in case certain event should happens.

INSURANCE AND ASSURANCE

Insurance refers to the events or incidents which may or may happen e.g

fire,theft etc while

Assurance refers to incidents which bound to happen or that must happens

e.g death and old age.

The following point shows the ROLE AND IMPORTANCE OF INSURANCE:

Insurance has evolved as a process of safeguarding the interest of people from

loss and uncertainty. It may be described as a social device to reduce or

eliminate risk of loss to life and property.

Insurance contributes a lot to the general economic growth of the society by

provides stability to the functioning of process. The insurance industries

develop financial institutions and reduce uncertainties by improving financial

resources.

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

1. Provide safety and security: Insurance provide financial support and

reduce uncertainties in business and human life. It provides safety and

security against particular event. There is always a fear of sudden loss.

Insurance provides a cover against any sudden loss. For example, in

case of life insurance financial assistance is provided to the family of

the insured on his death. In case of other insurance security is provided

against the loss due to fire, marine, accidents etc.

2. Generates financial resources: Insurance generate funds by collecting

premium. These funds are invested in government securities and stock.

These funds are gainfully employed in industrial development of a

country for generating more funds and utilised for the economic

development of the country. Employment opportunities are increased

by big investments leading to capital formation.

3. Life insurance encourages savings: Insurance does not only protect

against risks and uncertainties, but also provides an investment

channel too. Life insurance enables systematic savings due to payment

of regular premium. Life insurance provides a mode of investment. It

develops a habit of saving money by paying premium. The insured get

the lump sum amount at the maturity of the contract. Thus life

insurance encourages savings.

4. Promotes economic growth: Insurance generates significant impact

on the economy by mobilizing domestic savings. Insurance turn

accumulated capital into productive investments. Insurance enables to

mitigate loss, financial stability and promotes trade and commerce

activities those results into economic growth and development. Thus,

insurance plays a crucial role in sustainable growth of an economy.

5. Medical support: A medical insurance considered essential in

managing risk in health. Anyone can be a victim of critical illness

unexpectedly. And rising medical expense is of great concern. Medical

Insurance is one of the insurance policies that cater for different type

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

of health risks. The insured gets a medical support in case of medical

insurance policy.

6. Spreading of risk: Insurance facilitates spreading of risk from the

insured to the insurer. The basic principle of insurance is to spread risk

among a large number of people. A large number of persons get

insurance policies and pay premium to the insurer. Whenever a loss

occurs, it is compensated out of funds of the insurer.

7. Source of collecting funds: Large funds are collected by the way of

premium. These funds are utilised in the industrial development of a

country, which accelerates the economic growth. Employment

opportunities are increased by such big investments. Thus, insurance

has become an important source of capital formation.

PRINCIPLES OF INSURANCE.

1. Nature of contract: Nature of contract is a fundamental principle of

insurance contract. An insurance contract comes into existence when

one party makes an offer or proposal of a contract and the other party

accepts the proposal. A contract should be simple to be a valid contract.

The person entering into a contract should enter with his free consent.

2. Principal of utmost good faith: Under this insurance contract both

the parties should have faith over each other. As a client it is the duty

of the insured to disclose all the facts to the insurance company. Any

fraud or misrepresentation of facts can result into cancellation of the

contract.

3. Principle of Insurable interest: Under this principle of insurance, the

insured must have interest in the subject matter of the insurance.

Absence of insurance makes the contract null and void. If there is no

insurable interest, an insurance company will not issue a policy. An

insurable interest must exist at the time of the purchase of the

insurance. For example, a creditor has an insurable interest in the life

of a debtor, A person is considered to have an unlimited interest in the

life of their spouse etc.

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

WEST EVAN COLLEGE OF BUSINESS, HEALTH AND ALLIED SCIENCE

4. Principle of indemnity: Indemnity means security or compensation

against loss or damage. The principle of indemnity is such principle of

insurance stating that an insured may not be compensated by the

insurance company in an amount exceeding the insured’s economic

loss. In type of insurance the insured would be compensation with the

amount equivalent to the actual loss and not the amount exceeding the

loss. This is a regulatory principal. This principle is observed more

strictly in property insurance than in life insurance. The purpose of this

principle is to set back the insured to the same financial position that

existed before the loss or damage occurred.

5. Principal of subrogation: The principle of subrogation enables the

insured to claim the amount from the third party responsible for the

loss. It allows the insurer to pursue legal methods to recover the

amount of loss, For example, if you get injured in a road accident, due

to reckless driving of a third party, the insurance company will

compensate your loss and will also sue the third party to recover the

money paid as claim.

6. Double insurance: Double insurance denotes insurance of same

subject matter with two different companies or with the same company

under two different policies. Insurance is possible in case of indemnity

contract like fire, marine and property insurance. Double insurance

policy is adopted where the financial position of the insurer is doubtful.

The insured cannot recover more than the actual loss and cannot claim

the whole amount from both the insurers.

7. Principle of proximate cause: Proximate cause literally means the

‘nearest cause’ or ‘direct cause’. This principle is applicable when the

loss is the result of two or more causes. The proximate cause means;

the most dominant and most effective cause of loss is considered. This

principle is applicable when there are series of causes of damage or loss.

ELEMENTARY OF COMERCIAL KNOWLEDGE - LEVEL 4 BY, MR: PONCIAN

You might also like

- Business CommunicationDocument48 pagesBusiness Communicationsandhya_mohan_990% (29)

- Company Vehicle Policy Download 20171023Document2 pagesCompany Vehicle Policy Download 20171023Inean Tolentino100% (2)

- Wayne I Newton's Affidavit of Commercial Lien - Great Template Document ExampleDocument6 pagesWayne I Newton's Affidavit of Commercial Lien - Great Template Document ExampleOriginal Prouve Antony Chair for Sale92% (12)

- Introduction To CommunicationDocument38 pagesIntroduction To Communicationricha singhNo ratings yet

- Purpose of CommunicationDocument6 pagesPurpose of CommunicationSimbarashe Marisa0% (3)

- Managerial CommunicationDocument24 pagesManagerial CommunicationSai KiranNo ratings yet

- Business Communication AssignmentDocument5 pagesBusiness Communication AssignmentAnup SharmaNo ratings yet

- Unit 1 Fundamentals of CommunicationDocument4 pagesUnit 1 Fundamentals of CommunicationRishiraj singh5697No ratings yet

- Business Communication: Assignment OnDocument22 pagesBusiness Communication: Assignment OnSoumya BanerjeeNo ratings yet

- Business Comm NotesDocument49 pagesBusiness Comm NotesGaurav MaruNo ratings yet

- Commonly". Therefore, The Word Communication Means Sharing of Ideas, Messages and WordsDocument50 pagesCommonly". Therefore, The Word Communication Means Sharing of Ideas, Messages and WordsMohammed Demssie MohammedNo ratings yet

- Business Communication: Submitted By:-Submitted ToDocument17 pagesBusiness Communication: Submitted By:-Submitted ToApurv BajpaiNo ratings yet

- Defining Communication-: Sender Message Receiver MessageDocument9 pagesDefining Communication-: Sender Message Receiver MessagedushuheerloNo ratings yet

- Business Communication in EnglishDocument20 pagesBusiness Communication in EnglishAndriesNo ratings yet

- Complete Week Two NoteDocument16 pagesComplete Week Two NoteadeyemiNo ratings yet

- Meaning, Objectives and Forms of Business CommunicationDocument12 pagesMeaning, Objectives and Forms of Business CommunicationPriyanka RanaNo ratings yet

- Communication Skills IIDocument16 pagesCommunication Skills IIAjay Singh GurjarNo ratings yet

- PC Sem-5 NotesDocument61 pagesPC Sem-5 NotesDivyamNo ratings yet

- Communications Skills For Buisiness ArticleDocument11 pagesCommunications Skills For Buisiness ArticlevanessajageshwarNo ratings yet

- Purpose of CommunicationDocument6 pagesPurpose of CommunicationSimbarashe MarisaNo ratings yet

- Business Communication - NotesDocument27 pagesBusiness Communication - NotesChetan Shetty100% (2)

- Business CommunicationDocument18 pagesBusiness CommunicationAni Bh'sNo ratings yet

- Clarify The Idea Before CommunicationDocument8 pagesClarify The Idea Before CommunicationYusuf MonafNo ratings yet

- General Elective Psychology Assignment (Original)Document18 pagesGeneral Elective Psychology Assignment (Original)yuktaNo ratings yet

- City& Guilds 401Document7 pagesCity& Guilds 401johnNo ratings yet

- Curs EnglezaDocument119 pagesCurs EnglezaRobert TintaNo ratings yet

- Smaw 11 Module 1Document18 pagesSmaw 11 Module 1Francis Rico Mutia RufonNo ratings yet

- BUSINESS COMMUNICATION Lecture 1Document32 pagesBUSINESS COMMUNICATION Lecture 1Rajja RashadNo ratings yet

- BC Unit 1 & 2Document13 pagesBC Unit 1 & 2iamdhanush017No ratings yet

- What Is Communication ReportDocument9 pagesWhat Is Communication ReportKris LabayogNo ratings yet

- Coma 100 - M8Document10 pagesComa 100 - M8Emmanuel D. MalongaNo ratings yet

- Unit - 2 For BBA First YearDocument33 pagesUnit - 2 For BBA First YearwankhedemiditNo ratings yet

- Business Communication - NotesDocument43 pagesBusiness Communication - NotesBittu VermaNo ratings yet

- Business Communication - Unit 1 - 2020-2021Document98 pagesBusiness Communication - Unit 1 - 2020-2021Milan JainNo ratings yet

- Communication SkillsDocument27 pagesCommunication Skillsharsh7777No ratings yet

- Principles of Effective CommunicationDocument36 pagesPrinciples of Effective CommunicationSiddharth BajpaiNo ratings yet

- Blue and Yellow Playful Doodle Digital Brainstorm Presentation - 20240210 - 181611 - 0000Document30 pagesBlue and Yellow Playful Doodle Digital Brainstorm Presentation - 20240210 - 181611 - 0000Vidal Angel Glory Borj A.No ratings yet

- Effective Communication in BusinessDocument44 pagesEffective Communication in BusinessKamran Ali AbbasiNo ratings yet

- Effective Communication in BusinessDocument44 pagesEffective Communication in BusinessRizwan Ali100% (1)

- Kombis Chap 1Document23 pagesKombis Chap 1irsantiNo ratings yet

- 11-Workplace Communication SkillsDocument4 pages11-Workplace Communication SkillsS.m. ChandrashekarNo ratings yet

- (B) Types, Directions, ChallengesDocument17 pages(B) Types, Directions, Challengesstudy dNo ratings yet

- Business Communication Module (Repaired)Document117 pagesBusiness Communication Module (Repaired)tagay mengeshaNo ratings yet

- Business CommunicationDocument51 pagesBusiness CommunicationRohit BhandariNo ratings yet

- Managerial Communication Question BankDocument14 pagesManagerial Communication Question BankAnonymous uxd1yd100% (2)

- Communication 1st Unit - CompleteDocument17 pagesCommunication 1st Unit - CompleteAnuj SaxenaNo ratings yet

- UntitledDocument2 pagesUntitledGrace JeresaNo ratings yet

- Corporate Communication Final For MidtermDocument25 pagesCorporate Communication Final For Midtermdinar aimcNo ratings yet

- NotesDocument38 pagesNotesSumeet NayakNo ratings yet

- Communication For Work Lesson 6 NotesDocument12 pagesCommunication For Work Lesson 6 NotesJoy Bernadine TibonNo ratings yet

- CH 1 Introduction To Business CommunicationDocument36 pagesCH 1 Introduction To Business CommunicationHossain Uzzal100% (1)

- Bba101 SLM Unit 01Document11 pagesBba101 SLM Unit 01Jani AmitkumarNo ratings yet

- What Are The Benefits of Effective CommunicationDocument4 pagesWhat Are The Benefits of Effective CommunicationAnsari Mustak50% (2)

- II Yr BBA UNIT I - CommunicationsDocument16 pagesII Yr BBA UNIT I - CommunicationsAlba PeaceNo ratings yet

- Ug-Skill Development Course: Business CommunicationDocument94 pagesUg-Skill Development Course: Business CommunicationYamini KumarNo ratings yet

- Knowlege TestDocument3 pagesKnowlege Testinfo UnitNo ratings yet

- Importance & Benefits of Effective Communication: Client RelationsDocument3 pagesImportance & Benefits of Effective Communication: Client RelationsMя śДmŶ ܤ㋡No ratings yet

- Communication Skills - UNIT IDocument37 pagesCommunication Skills - UNIT IrakeshparthasarathyNo ratings yet

- Business Communication Lesson 1Document4 pagesBusiness Communication Lesson 1Kryzelle Angela OnianaNo ratings yet

- College of Business Education (CBE)Document7 pagesCollege of Business Education (CBE)Samwel PoncianNo ratings yet

- Re: An Application For Any Job VacancyDocument2 pagesRe: An Application For Any Job VacancySamwel PoncianNo ratings yet

- Class Timetable Boa - Level IDocument6 pagesClass Timetable Boa - Level ISamwel PoncianNo ratings yet

- Dawasa Historical BackgroundDocument5 pagesDawasa Historical BackgroundSamwel Poncian100% (1)

- The Development of DryDocument1 pageThe Development of DrySamwel PoncianNo ratings yet

- The Development of DryDocument1 pageThe Development of DrySamwel PoncianNo ratings yet

- Chapter One Organization BackgroundDocument18 pagesChapter One Organization BackgroundSamwel Poncian100% (1)

- Marine Crafts/navigation AidsDocument2 pagesMarine Crafts/navigation AidsSamwel PoncianNo ratings yet

- TPADocument5 pagesTPASamwel PoncianNo ratings yet

- Chapter One Introduction and BackgroundDocument19 pagesChapter One Introduction and BackgroundSamwel PoncianNo ratings yet

- IlalaDocument27 pagesIlalaSamwel Poncian100% (5)

- Part One About PolytraDocument21 pagesPart One About PolytraSamwel PoncianNo ratings yet

- IlalaDocument27 pagesIlalaSamwel Poncian100% (5)

- Ejercito v. Sandiganbayan, G.R. Nos. 157294-95. November 30, 2006.Document2 pagesEjercito v. Sandiganbayan, G.R. Nos. 157294-95. November 30, 2006.Pamela Camille Barredo100% (4)

- JDF 252B Motion For Interrog - LONGDocument6 pagesJDF 252B Motion For Interrog - LONGAntoinette MoederNo ratings yet

- Andrew Palermo VsDocument2 pagesAndrew Palermo VsAliyah SandersNo ratings yet

- Householders Insurance Policy: Proposal FormDocument5 pagesHouseholders Insurance Policy: Proposal Formm_dattaiasNo ratings yet

- Article On Recovery or Execution - G NaiduDocument68 pagesArticle On Recovery or Execution - G NaiduDiveenaNo ratings yet

- Contract Law - IllegalityDocument9 pagesContract Law - IllegalityNicholas AnthonyNo ratings yet

- Social Dialogue in MontenegroDocument15 pagesSocial Dialogue in MontenegroKristine MontenegroNo ratings yet

- List of Standardized Documentary Checklist FormsDocument1 pageList of Standardized Documentary Checklist Formsarfica zainal abidinNo ratings yet

- Enrollment Card For Group Insurance: Member InformationDocument1 pageEnrollment Card For Group Insurance: Member Informationsue anneNo ratings yet

- FAQ's On Ombudsman SchemeDocument3 pagesFAQ's On Ombudsman SchemeSaba SaleemNo ratings yet

- SFA Twirling Camp BrochureDocument5 pagesSFA Twirling Camp BrochuretimelesstojsNo ratings yet

- What Is Assignment and Nomination in Life InsuranceDocument4 pagesWhat Is Assignment and Nomination in Life InsuranceDivanshu DhingraNo ratings yet

- Globe Life - AIL - Spotlight Magazine - 2019-02Document25 pagesGlobe Life - AIL - Spotlight Magazine - 2019-02Fuzzy PandaNo ratings yet

- Fullerton ReportDocument59 pagesFullerton ReportbittugolumoluNo ratings yet

- Abc Analysis To Crack Cs ExamDocument1 pageAbc Analysis To Crack Cs ExamSARANYA LAKSHMINo ratings yet

- Documentation, Export Documentation, Transportation Documentation Custom Documentation, Marine Insurance EtcDocument1 pageDocumentation, Export Documentation, Transportation Documentation Custom Documentation, Marine Insurance EtcVivek GusaniNo ratings yet

- Law 1101Document5 pagesLaw 1101Steph GonzagaNo ratings yet

- Need For Adjusting EntriesDocument21 pagesNeed For Adjusting EntriesKyle Monique PondoNo ratings yet

- Bill Would Bring Transparency To Michigan No-Fault SystemDocument1 pageBill Would Bring Transparency To Michigan No-Fault SystemJoshHoveyNo ratings yet

- Insurance - Rate MakingDocument78 pagesInsurance - Rate Makingthefactorbook100% (1)

- Banking & Finance Awareness 2016 (Jan-August) by AffairsCloudDocument124 pagesBanking & Finance Awareness 2016 (Jan-August) by AffairsCloudShlaghaNo ratings yet

- Template Letter Post DoctoralDocument3 pagesTemplate Letter Post DoctoralPamela Grace AnzuresNo ratings yet

- Malayan Insurance Vs CA March 20,1997Document2 pagesMalayan Insurance Vs CA March 20,1997Alvin-Evelyn GuloyNo ratings yet

- Gmail - Allstate Claim 0411061054 Your Recent Property Insurance Claim Has Been Successfully Submitted April 26, 2016Document73 pagesGmail - Allstate Claim 0411061054 Your Recent Property Insurance Claim Has Been Successfully Submitted April 26, 2016Stan J. CaterboneNo ratings yet

- The Economic RevolutionDocument8 pagesThe Economic RevolutionsandeshNo ratings yet

- P L I Premium ReceiptDocument4 pagesP L I Premium Receiptapi-3810632No ratings yet

- AgencyDocument54 pagesAgencyAsha RaiNo ratings yet

- Hull War, Strikes, Terrorism and Related Perils Notice of Cancellation Administration ClauseDocument3 pagesHull War, Strikes, Terrorism and Related Perils Notice of Cancellation Administration ClauseDannn GNo ratings yet