Professional Documents

Culture Documents

Banking Companies Financial Statements in India

Banking Companies Financial Statements in India

Uploaded by

Vinay GoyalOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Banking Companies Financial Statements in India

Banking Companies Financial Statements in India

Uploaded by

Vinay GoyalCopyright:

Available Formats

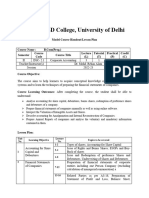

Financial Statements of Banking Companies 6.

19

New Revised Formats

The Third Schedule

(See Section 29)

Form ‘A’

Form of Balance Sheet

Balance Sheet of ______________________ (here enter name of the Banking company)

Balance Sheet as on 31st March (Year) (000’s omitted)

Schedule As on 31.3.... As on 31.3......

(Current year) (Previous year)

Capital & Liabilities

Capital 1

Reserve & Surplus 2

Deposits 3

Borrowings 4

Other liabilities and provisions 5

Total

Assets

Cash and balances with

Reserve Bank of India 6

Balance with banks and Money at call

and short notice 7

Investments 8

Advances 9

Fixed Assets 10

Other Assets 11

Total

Contingent liabilities 12

Bills for collection

Refer Annexure I for detailed break up of the Balance Sheet schedules at the end of the

chapter

© The Institute of Chartered Accountants of India

6.20 Advanced Accounting

Form ‘B’

Form of Profit & Loss Account

for the year ended 31st March

(’000 omitted)

Schedule Year ended Year ended

As on 31.3.... As on 31.3....

(Current year) (Previous year)

I. Income

Interest earned 13

Other income 14

Total

II. Expenditure

Interest expended 15

Operating expenses 16

Provisions and contingencies

Total

III. Profit/Loss

Net profit/loss (—) for the year

Profit/Loss (—) brought forward

Total

IV. Appropriations

Transfer to statutory reserves

Transfer to other reserves

Transfer to Government/Proposed dividends

Balance carried over to balance sheet

Total

Refer Annexure II for detailed break up of the Profit and Loss Account schedules at the

end of the chapter. Also detail guidelines of RBI for compilation of Financial

Statements has been given in Annexure III.

Note: The Banking Regulations Act, 1949 prescribes Schedules 1 to 16 only. Any other

schedule prepared by a Banking company besides what is specified in the Third schedule of

the Banking Regulations Act, 1949, is only for better understanding of their financial

statements. Accordingly, banks in addition to the above 16 schedules, may prepare Schedule

17 for Notes on Accounts and Schedule 18 for Disclosure of Accounting Policies.

© The Institute of Chartered Accountants of India

Financial Statements of Banking Companies 6.21

2.9 Notes on Accounts

Capital adequacy ratio The sum of Tier I and Tier II capital should be taken as

the numerator while the denominator should be arrived

at by converting the minimum capital charge for open

exchange position stipulated by the Exchange Control

Department of the ‘notional risk assets’ by multiplying it

by 12.5 (the reciprocal of the minimum capital to risk-

weighted assets ratio of 8%) and then adding the

resulting figure to the weighted assets, compiled for

credit risk purposes.

Capital adequacy ratio – Tier I Tier I capital should be taken as the numerator while the

Capital denominator should be arrived at by converting the

minimum capital charge for open exchange position

stipulated by the Exchange Control Department of the

RBI into ‘notional risk assets’ by multiplying it by 25 (the

reciprocal of the minimum capital to risk-weighted assets

ratio of 4%) and then adding the resulting figure to the

weighted assets, compiled for credit risk purposes.

Capital adequacy ratio-Tier II This item should be shown by way of explanatory

Capital Amount of notes/remarks in the balance sheet as well as in

subordinated debt raised as Schedule 5 relating to ‘Other Liabilities and Provisions’.

Tier II capital

Percentage of shareholding of

the Government of India in the

nationalized banks

Gross value of investments in

India and outside India, the

aggregate of provisions for

depreciation separately on

investments in India and

outside India and the net value

of investments in India and

outside India

Percentage of net NPAs to net Net NPAs mean gross NPAs minus (balance in Interest

advances Suspense Account plus ECGC claims received and held

pending adjustment plus part payment received and kept

in Suspense Account plus provisions held for loan

losses).

© The Institute of Chartered Accountants of India

6.22 Advanced Accounting

Movements in NPAs The disclosures should include the opening balances of

Gross NPAs (after deducting provisions held, interest

suspense account, ECGC claims received and part

payments received and kept in suspense account) at the

beginning of the year, reductions/additions to the NPAs

during the year and the balances at the end of the year.

The amount of provisions These provisions along with other provisions and

made towards NPA, toward contingencies should tally with the aggregate of the

depreciation in the value of amount held under ‘Provisions and income-

investments and the contingencies’ in the profit and loss account.

provisions towards tax during

the year

Maturity pattern of investment Banks may follow the maturity buckets prescribed in the

securities guidelines on Assets-Liability Management System for

disclosure of maturity pattern.

Maturity pattern of loans and Banks may follow the maturity buckets prescribed in the

advances guidelines on Assets-Liability Management System for

disclosure of maturity pattern.

Foreign currency assets and In respect of this item, the maturity profile of the bank’s

liabilities foreign currency liabilities should be given.

Maturity pattern of deposits Banks may follow the maturity buckets prescribed in the

guidelines on Asset-Liability Management System for

disclosure of maturity pattern.

Maturity pattern of borrowings Banks may follow the maturity buckets prescribed in the

guidelines on Asset-Liability Management System for

disclosure of maturity pattern.

Lending to sensitive sectors Banks should disclose lending to sectors which are

sensitive to asset price fluctuations. These should

include advances to sectors such as capital market,

estate, etc. and such other sectors to be defined as

‘sensitive’ by the RBI from time to time.

Interest income as a Working funds mean total assets as on the date of

percentage to working funds balance sheet (excluding accumulated losses, if any).

Non-interest income as a

percentage to working funds

Operating profit as a Operating profit means total income minus expenses

percentage to (interest plus operating expenses etc.)

working funds

© The Institute of Chartered Accountants of India

Financial Statements of Banking Companies 6.23

Return on assets Return on assets means net profit divided by average of

total assets as at the beginning and end of the year.

Business (deposits plus This means fortnightly average of deposits (excluding

advances) per employee inter-bank deposits) and advances divided by number of

employees as on the date of balance sheet.

Profit per employee

Depreciation on As per RBI Circular, bank should make disclosure on the

Investments provision for depreciation on investments in the following

formats.

Opening Balance (as on April, 01) ……………………

Add: Provisions made during the year: ……………….

Less: Write-off/back of excess provisions during the year …….

Closing balance (as on March 31) ………………

Corporate Debut Banks should disclose in their published annual Balance Sheets,

Restructured Accounts under “Notes on Accounts”, the following information in respect

of corporate debt restructuring undertaken during the year.

a. Total amount of loan assets subjected to restructuring

under CDR.

[(a) = (b)+(c) +(d)]

b. The amount of standard assets subjected to CDR.

c. The amount of sub-standard assets subjected to CDR.

d. The amount of doubtful assets subjected to CDR.

Disclosures in the Notes on Account to the Balance Sheet

pertaining to restructured / rescheduled accounts apply to all

accounts restructured/rescheduled during the year. While banks

should ensure that they comply with the minimum disclosures

prescribed, they may make more disclosures than the minimum

prescribed.

Non SLR Investment Banks should make the following disclosures in the ‘Notes on

Accounts’ of the balance sheet in respect of their non SLR

investment portfolio.

© The Institute of Chartered Accountants of India

6.24 Advanced Accounting

Issuer Composition of Non SLR Investments

No. Issuer Amount Extent of Extent of Extent of Extent of

private ‘below ‘unrated ‘unlisted

placement investment Securities securities

grade’

securities

(1) (2) (3) (4) (5) (6) (7)

1. PSUs

2. FIs

3. Banks

4. Private corporate

5. Subsidiaries/Joint

Ventures

6. Others

7. Provision held towards XXX XXX XXX XXX

depreciation

Total

Note:

1. Total under column 3 should tally with the total of investments included under the

following categories in Schedule 8 to the balance sheet:

a. Shares

b. Debentures & Bonds

c. Subsidiaries/Joint Ventures

d. Others

2. Amounts reported under columns 4,5,6 and 7 above may not be mutually exclusive.

Non performing non-SLR investments

Particulars Amount

(` Crore)

Opening balance

Additions during the year since 1st April

Reductions during the above period

Closing balance

Total provisions held

The bank should make appropriate disclosures in the “Notes on Account” to the annual

financial statements in respect of the exposures where the bank had exceeded the

prudential exposure limits during the year.

© The Institute of Chartered Accountants of India

Financial Statements of Banking Companies 6.25

Notes and Instructions for Compilation

General instructions

1. Formats of Balance Sheet and Profit and Loss Account cover all items likely to appear in

the statements. In case a bank does not have any particular item to report, it may be

omitted from the formats.

2. Corresponding comparative figures for the previous year are to be disclosed as indicated

in the format. The words “current year” and “previous year” used in the format are only to

indicate the order of presentation and may appear in the accounts.

3. Figures should be rounded off to the nearest thousand rupees.

4. Unless otherwise indicated, the banks in these statements will include banking

companies, nationalised banks, State Bank of India, Associate Banks and all other

institutions including co-operatives carrying on the business of banking whether or not

incorporated or operating in India.

5. The Hindi version of the balance sheet will be part of the annual report.

2.10 Disclosure of Accounting Policies

In order to bring the true financial position of banks to pointed focus and enable the users of

financial statements to study and have a meaningful comparison of their positions, the banks

should disclose the accounting policies regarding key areas of operation at one place along

with notes on accounting in their financial statements. The RBI has taken several steps from

time to time to enhance the transparency in the operations of banks by stipulating

comprehensive disclosures in tune with international best practices. RBI has prescribed the

following additional disclosures in the ‘Notes to accounts’ in the banks’ balance sheets, from

the year ending March, 2010:

(i) Concentration of Deposits, Advanced, Exposures and NPAs;

(ii) Sector-wise NPAs;

(iii) Movement of NPAs;

(iv) Overseas assets, NPAs and revenue;

(v) Off-balance sheet SPVs sponsored by banks.

© The Institute of Chartered Accountants of India

You might also like

- Statements Made by The Roman Catholic Church About The SabbathDocument7 pagesStatements Made by The Roman Catholic Church About The Sabbathzoran-888No ratings yet

- ScheduleDocument6 pagesSchedulekaserahk11No ratings yet

- Financial Anaylsis 1Document27 pagesFinancial Anaylsis 1Nitika DhatwaliaNo ratings yet

- C A UnitDocument6 pagesC A UnitshakuttiNo ratings yet

- Teamwork Assignment - Financial Statement AnalysisDocument3 pagesTeamwork Assignment - Financial Statement Analysisthuqta22410No ratings yet

- Companies Act, 2013 PDFDocument25 pagesCompanies Act, 2013 PDFshivam vermaNo ratings yet

- Bfm-Mod - D PDFDocument18 pagesBfm-Mod - D PDFparul yadavNo ratings yet

- 3 - Understanding & Preparation of Corporate Financial StatementsDocument7 pages3 - Understanding & Preparation of Corporate Financial Statementskeval.dave120812No ratings yet

- 74931bos60524 m1 AnnexureDocument38 pages74931bos60524 m1 AnnexureBala Guru Prasad TadikamallaNo ratings yet

- R.Kanchanamala: Faculty Member IibfDocument74 pagesR.Kanchanamala: Faculty Member Iibfmithilesh tabhaneNo ratings yet

- Com203 - Final Accounts of Banking CompaniesDocument8 pagesCom203 - Final Accounts of Banking Companiesvedant kedarNo ratings yet

- Published AccountsDocument31 pagesPublished AccountsGraceii Mecayer CuizonNo ratings yet

- Unit 4 Understanding Financial Statements: StructureDocument32 pagesUnit 4 Understanding Financial Statements: StructureTushar SharmaNo ratings yet

- Pengungkapan Permodalan BMRI - Q IV 2017Document6 pagesPengungkapan Permodalan BMRI - Q IV 2017RS Delicious FoodsNo ratings yet

- Format & ProblemsDocument13 pagesFormat & ProblemsRohit BhagatNo ratings yet

- Com203 - Final Accounts of Insurance CompaniesDocument23 pagesCom203 - Final Accounts of Insurance CompaniesSanaullah M SultanpurNo ratings yet

- Annexure A Form of Consolidated Balance Sheet of A Bank and Its Subsidiaries Engaged in Financial ActivitiesDocument10 pagesAnnexure A Form of Consolidated Balance Sheet of A Bank and Its Subsidiaries Engaged in Financial ActivitiesHARDIK1001No ratings yet

- 1 Financial Statement of CompaniesDocument27 pages1 Financial Statement of CompaniessmartshivenduNo ratings yet

- 1 Financial Statement of CompaniesDocument27 pages1 Financial Statement of CompaniesGAMING ROADNo ratings yet

- Financial Statements and Disclosure of InformationDocument7 pagesFinancial Statements and Disclosure of InformationAjit PatilNo ratings yet

- Informal Financial Statements - Accounting-Workbook - Zaheer-SwatiDocument8 pagesInformal Financial Statements - Accounting-Workbook - Zaheer-SwatiZaheer SwatiNo ratings yet

- Accounting Resource 2019Document20 pagesAccounting Resource 2019simphiwemotaung671No ratings yet

- BASIC FEATURE OF Financial StatementDocument6 pagesBASIC FEATURE OF Financial StatementmahendrabpatelNo ratings yet

- IAS 01 - Presentation of FS - SVDocument32 pagesIAS 01 - Presentation of FS - SVHồ Đan ThụcNo ratings yet

- Adoption of Schedule VI To The Companies Act 1956 Class 12Document52 pagesAdoption of Schedule VI To The Companies Act 1956 Class 12CrismonNo ratings yet

- Indian Accounting Standards All ChaptersDocument108 pagesIndian Accounting Standards All Chapterskunal100% (1)

- Format of Consolidated Balance Sheet of A Bank and Its Subsidiaries Consolidated Balance Sheet of - (Here Enter Name of The Parent Bank)Document9 pagesFormat of Consolidated Balance Sheet of A Bank and Its Subsidiaries Consolidated Balance Sheet of - (Here Enter Name of The Parent Bank)Ankita_Banka_7426No ratings yet

- Chapter-2 (Web Chapters)Document27 pagesChapter-2 (Web Chapters)g23111No ratings yet

- TYBAF Unit-1 Banking CO.Document17 pagesTYBAF Unit-1 Banking CO.sofiya syedNo ratings yet

- Master Circular On Preparation of Financial Statements General Insurance BusinessDocument38 pagesMaster Circular On Preparation of Financial Statements General Insurance BusinesslavkmNo ratings yet

- Banking CompaniesDocument68 pagesBanking CompaniesKiran100% (2)

- General Accounting Principles - PRUDocument41 pagesGeneral Accounting Principles - PRUerjuniorsanjipNo ratings yet

- Guide To IND AS Under MAT - Santosh Maller - Sept 2017 - (30 X 48) - (Pg. 340)Document9 pagesGuide To IND AS Under MAT - Santosh Maller - Sept 2017 - (30 X 48) - (Pg. 340)Jignesh DarjiNo ratings yet

- Rev SCH III - Sent PDFDocument18 pagesRev SCH III - Sent PDFAjay DesaleNo ratings yet

- Accounting 12Document140 pagesAccounting 12sainimanish170gmailc0% (2)

- AFM - Report (Group 7 MCA)Document22 pagesAFM - Report (Group 7 MCA)Satyam SajalNo ratings yet

- CBSE Class 12 Accountancy SyllabusDocument6 pagesCBSE Class 12 Accountancy Syllabusrkmobile58627No ratings yet

- Chapter 9 Jaico - SJ Edits - No TrackingDocument49 pagesChapter 9 Jaico - SJ Edits - No TrackingsakthiNo ratings yet

- Block 2Document82 pagesBlock 2Shreya PansariNo ratings yet

- Electronic Way Bill Under GSTDocument46 pagesElectronic Way Bill Under GSTDeepak WadhwaNo ratings yet

- Indian Accounting Standards (One Pager)Document29 pagesIndian Accounting Standards (One Pager)sridhartks100% (1)

- Bigeight Indian BanksDocument23 pagesBigeight Indian BanksShubham VashtaNo ratings yet

- BIGEIGHTDocument23 pagesBIGEIGHTArunNo ratings yet

- Dabur (Uk) Limited: Annual Report For The Financial Year Ended 31St March, 2009Document13 pagesDabur (Uk) Limited: Annual Report For The Financial Year Ended 31St March, 2009rishabhrockNo ratings yet

- NFRS Directive For Non Life Insurer2077Document131 pagesNFRS Directive For Non Life Insurer2077suniluraw806No ratings yet

- © The Institute of Chartered Accountants of IndiaDocument40 pages© The Institute of Chartered Accountants of Indiasri valliNo ratings yet

- Ias 1 Presentation of Financial StatementsDocument30 pagesIas 1 Presentation of Financial Statementsesulawyer2001No ratings yet

- Accounts Concise NotesDocument38 pagesAccounts Concise NotesBharat ThackerNo ratings yet

- 1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFDocument380 pages1271 XII Accountancy Study Material Supplementary Material HOTS and VBQ 2014 15 PDFBalaji TkpNo ratings yet

- MBA Finance Professional ProjectDocument84 pagesMBA Finance Professional Projectheart toucherNo ratings yet

- Weightage Inter CADocument30 pagesWeightage Inter CAadityatiwari122006No ratings yet

- Corp Acc. Unit - 5 Banking AccountsDocument40 pagesCorp Acc. Unit - 5 Banking AccountsBARATHRAJ D commerceNo ratings yet

- Corporate-Accounting-bk GoelDocument3 pagesCorporate-Accounting-bk Goeltanisha kochharNo ratings yet

- Preparation of Company Accounts: Chapter-01Document18 pagesPreparation of Company Accounts: Chapter-01My ComputerNo ratings yet

- Financial Statements of CompaniesDocument16 pagesFinancial Statements of CompaniesKiran ChristyNo ratings yet

- Advanced AccountingDocument372 pagesAdvanced AccountingNidhi ShahNo ratings yet

- 01b-Preparation of Financial Statement-Class Work (New)Document10 pages01b-Preparation of Financial Statement-Class Work (New)Deepika SonuNo ratings yet

- Amendments in Schedule III of Companies Act, W.E.F. 1st April 2021Document16 pagesAmendments in Schedule III of Companies Act, W.E.F. 1st April 2021Selvi balanNo ratings yet

- Wiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsFrom EverandWiley GAAP for Governments 2017: Interpretation and Application of Generally Accepted Accounting Principles for State and Local GovernmentsNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- Anti Dumping DutyDocument5 pagesAnti Dumping DutyyeshanewNo ratings yet

- Chapter 4 - Test ScenarioDocument7 pagesChapter 4 - Test ScenarioAamir AfzalNo ratings yet

- 17 - SANSON vs. CADocument3 pages17 - SANSON vs. CAAkagamiNo ratings yet

- Eobi Loan RegDocument6 pagesEobi Loan RegEOBI FEDERATION100% (1)

- Navamsa and MarriageDocument2 pagesNavamsa and MarriageSriNo ratings yet

- Report Strategic Sourcing PlansDocument9 pagesReport Strategic Sourcing PlansVikram TanwarNo ratings yet

- Memorial For The DefenceDocument29 pagesMemorial For The DefenceSHAKSHINo ratings yet

- IAS 40 - Investment PropertyDocument11 pagesIAS 40 - Investment PropertyjfkdfkNo ratings yet

- Government College of Engineering Jalgaon (M.S) : Examination Form (Approved)Document2 pagesGovernment College of Engineering Jalgaon (M.S) : Examination Form (Approved)Sachin Yadorao BisenNo ratings yet

- 2018 ILS Journal Vol1No2 PDFDocument174 pages2018 ILS Journal Vol1No2 PDFjonathan quibanNo ratings yet

- Sepulveda V PelaezDocument2 pagesSepulveda V PelaezNaomi QuimpoNo ratings yet

- ZXSDR BS8900: Hardware ManualDocument155 pagesZXSDR BS8900: Hardware ManualIgor MagićNo ratings yet

- Peoria County Booking Sheet 06/02/15Document8 pagesPeoria County Booking Sheet 06/02/15Journal Star police documentsNo ratings yet

- Petition To Remove Conditions On Residence: U.S. Citizenship and Immigration ServicesDocument11 pagesPetition To Remove Conditions On Residence: U.S. Citizenship and Immigration ServicesWalls CharlyNo ratings yet

- Annex M - Moa With Proponent-MoaDocument6 pagesAnnex M - Moa With Proponent-Moalgucataingan2023No ratings yet

- NetJumper Sofware L. L. C. v. Google, Incorporated - Document No. 56Document3 pagesNetJumper Sofware L. L. C. v. Google, Incorporated - Document No. 56Justia.comNo ratings yet

- Skeleton Argument - Esso TerminalsDocument9 pagesSkeleton Argument - Esso Terminalsk awoonorNo ratings yet

- Legal Responses To Cyber Bullying and Sexting in South AfricaDocument20 pagesLegal Responses To Cyber Bullying and Sexting in South AfricaJacques HammanNo ratings yet

- Victoria Hewlett V USU Settlement Agreement and Release 062718Document8 pagesVictoria Hewlett V USU Settlement Agreement and Release 062718Utah StatesmanNo ratings yet

- High Court Visit Report1Document11 pagesHigh Court Visit Report1Nischal BhattaraiNo ratings yet

- Strategic Cost Management NMIMS AssignmentDocument7 pagesStrategic Cost Management NMIMS AssignmentN. Karthik UdupaNo ratings yet

- NSTP IiDocument24 pagesNSTP IiTimothy NapenasNo ratings yet

- Tariff Exercise With Answers enDocument6 pagesTariff Exercise With Answers enNguyen Tuan AnhNo ratings yet

- HR Policy Revised JUNE 2022Document41 pagesHR Policy Revised JUNE 2022mba2135156No ratings yet

- Employement Termination AgreementDocument2 pagesEmployement Termination AgreementElodie JeanneNo ratings yet

- Templates Joomla 1.5Document47 pagesTemplates Joomla 1.5Décio Luiz RochaNo ratings yet

- Latur District JUdge-1 - 37-2015Document32 pagesLatur District JUdge-1 - 37-2015mahendra KambleNo ratings yet

- Impact of Electronic Banking On Customer SatisfactionDocument5 pagesImpact of Electronic Banking On Customer SatisfactionEditor IJTSRDNo ratings yet

- IRS Processing Codes and Information Document6209 RedactedDocument504 pagesIRS Processing Codes and Information Document6209 Redactedsabiont100% (3)