Professional Documents

Culture Documents

Praktikum Audit

Praktikum Audit

Uploaded by

Joseph LimbongCopyright:

Available Formats

You might also like

- Enterprise TechDocument4 pagesEnterprise TechNatalie Daguiam100% (2)

- ACCA AAA Sample AnswersDocument4 pagesACCA AAA Sample AnswersAzhar RahamathullaNo ratings yet

- The Basic Process in Recording TransactionsDocument13 pagesThe Basic Process in Recording TransactionsJoseph LimbongNo ratings yet

- SQM 16 & 2marks With AnsDocument21 pagesSQM 16 & 2marks With AnsKalyan SundaramNo ratings yet

- Exercise 001 Preparation of Financial StatementsDocument3 pagesExercise 001 Preparation of Financial StatementsGenevaMalabananAustriaIINo ratings yet

- Acctg1205 - Chapter 8Document48 pagesAcctg1205 - Chapter 8Elj Grace BaronNo ratings yet

- Comprehensive SOCF ProblemDocument1 pageComprehensive SOCF ProblemAbdullah alhamaadNo ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- Applied Auditing - ExercisesDocument2 pagesApplied Auditing - ExercisesJoshua Sto DomingoNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Empire Brandy FSDocument4 pagesEmpire Brandy FSStephanie DoceNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- Section A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesDocument7 pagesSection A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesgeofreyNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- TUGAS Topik Bab 5Document2 pagesTUGAS Topik Bab 5Imanuel ChrisNo ratings yet

- TOPIC 2 - AF09101- FINANCIAL STATEMENTSDocument24 pagesTOPIC 2 - AF09101- FINANCIAL STATEMENTSIsaack MgeniNo ratings yet

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoDocument31 pagesFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- End Term On 24.09.2019 FR MBA 2019-21 Term IDocument10 pagesEnd Term On 24.09.2019 FR MBA 2019-21 Term Ideliciousfood463No ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- 2023 - Session12 - 13 FSA2 - MBA - SentDocument32 pages2023 - Session12 - 13 FSA2 - MBA - SentAkshat MathurNo ratings yet

- B326 MTA Fall 2017-2018 MGLDocument7 pagesB326 MTA Fall 2017-2018 MGLmjlNo ratings yet

- BusFin PT 4Document2 pagesBusFin PT 4Nadjmeah AbdillahNo ratings yet

- 648235Document5 pages648235mohitgaba19No ratings yet

- FABM2-Chapter4 NDocument10 pagesFABM2-Chapter4 NArchie CampomanesNo ratings yet

- Statement of Cash Flows WordDocument6 pagesStatement of Cash Flows WordJmaseNo ratings yet

- Cash Flow QuestionsDocument6 pagesCash Flow QuestionsBhakti GhodkeNo ratings yet

- Fina 470 Project Two - Check PointDocument9 pagesFina 470 Project Two - Check PointMitchell ParrottNo ratings yet

- Exercise #1 (Red Claude Palacio)Document2 pagesExercise #1 (Red Claude Palacio)Red Cloudy PalacioNo ratings yet

- Notes For Ratios: Accounting Principles AssetsDocument14 pagesNotes For Ratios: Accounting Principles AssetsSudhanshu MathurNo ratings yet

- Answered The Following Information Was Provided BartlebyDocument5 pagesAnswered The Following Information Was Provided BartlebyMarkNo ratings yet

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnNo ratings yet

- Financial Accounting & AnalysisDocument7 pagesFinancial Accounting & AnalysisIshaNo ratings yet

- Assigment 4Document3 pagesAssigment 4Syakil AhmedNo ratings yet

- Trial Balance As On 31 March 2020 Particulars Debit Balance Credit BalanceDocument14 pagesTrial Balance As On 31 March 2020 Particulars Debit Balance Credit BalanceSantosh KumarNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Problem 1: Total Assets 937,500 Total Liab &she 937,500Document14 pagesProblem 1: Total Assets 937,500 Total Liab &she 937,500Kez MaxNo ratings yet

- Akuntansi Keuangan 1Document15 pagesAkuntansi Keuangan 1Vincenttio le CloudNo ratings yet

- FS Analysis, Cash Flow, Cap BdgtingDocument8 pagesFS Analysis, Cash Flow, Cap BdgtingArthur Richard SumaldeNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisJasffer DebolgadoNo ratings yet

- Kelompok 6 - UTS AKMDocument18 pagesKelompok 6 - UTS AKM21-010 Desi MailaniNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Complete Financial ModelDocument47 pagesComplete Financial ModelArrush AhujaNo ratings yet

- Financial Accounting Cat 1 JonathanDocument14 pagesFinancial Accounting Cat 1 JonathanjonathanNo ratings yet

- 17769cash Flow Practice QuestionsDocument8 pages17769cash Flow Practice QuestionsirmaNo ratings yet

- Topic 2 - Af09101 - Financial StatementsDocument42 pagesTopic 2 - Af09101 - Financial Statementsarusha afroNo ratings yet

- Chapter 1 Case 1 Net Asset AcquisitionDocument4 pagesChapter 1 Case 1 Net Asset AcquisitionANGELI GRACE GALVANNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaNo ratings yet

- 5 Worksheet and Financial StatementsDocument10 pages5 Worksheet and Financial StatementsLee-Ann LimNo ratings yet

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponNo ratings yet

- Assets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Document4 pagesAssets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Harsh GuptaNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Chapter 4. Financial Ratio Analyses and Their Implications To Management Learning ObjectivesDocument29 pagesChapter 4. Financial Ratio Analyses and Their Implications To Management Learning ObjectivesChieMae Benson QuintoNo ratings yet

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- 2016-01-08 Exame enDocument6 pages2016-01-08 Exame enbarbaraNo ratings yet

- Cash Flow ExampleDocument2 pagesCash Flow ExampleAlhassan ShakirNo ratings yet

- Netapp, Inc Com in Dollar US in ThousandsDocument6 pagesNetapp, Inc Com in Dollar US in Thousandsluisa Fernanda PeñaNo ratings yet

- Financial Statements and Ratio AnalysisDocument26 pagesFinancial Statements and Ratio Analysismary jean giananNo ratings yet

- Corp. BankruptcyDocument7 pagesCorp. BankruptcyLorifel Antonette Laoreno TejeroNo ratings yet

- Reconciliation Statement MathDocument6 pagesReconciliation Statement MathRajibNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Praktikum Keuangan MenengahDocument5 pagesPraktikum Keuangan MenengahJoseph LimbongNo ratings yet

- The Accounting Equation and The Rules of Debit and CreditDocument9 pagesThe Accounting Equation and The Rules of Debit and CreditJoseph LimbongNo ratings yet

- Corporate Governance JournalDocument17 pagesCorporate Governance JournalJoseph LimbongNo ratings yet

- Prooblem 4-5 No. 2 Journal EntriesDocument12 pagesProoblem 4-5 No. 2 Journal EntriesJoseph LimbongNo ratings yet

- Concept of LaborDocument14 pagesConcept of LaborJoseph LimbongNo ratings yet

- 19 Internal ControlDocument17 pages19 Internal ControlJoseph LimbongNo ratings yet

- Regulations and ComplianceDocument5 pagesRegulations and ComplianceJayateerthMokashi100% (1)

- Auditors Company LawDocument13 pagesAuditors Company LawNuratul FakriahNo ratings yet

- Bid Document Volume II PKG 3 PDFDocument124 pagesBid Document Volume II PKG 3 PDFJ.S. RathoreNo ratings yet

- Performance Objective 1Document9 pagesPerformance Objective 1banglauserNo ratings yet

- Audit Works Template Issued by ICAI June 23Document331 pagesAudit Works Template Issued by ICAI June 23Mayank KapadiaNo ratings yet

- Fraud Corruption GistDocument27 pagesFraud Corruption GistAniket KumarNo ratings yet

- JM ArcDocument89 pagesJM ArcRAJASHEKAR REDDYNo ratings yet

- 5th Sem I Unit Auditing PPT 1.pdf334Document26 pages5th Sem I Unit Auditing PPT 1.pdf334Asad RNo ratings yet

- Chap 3 Co ActDocument47 pagesChap 3 Co ActrajuNo ratings yet

- Adieu To Cost Audit?".by A.R.Ramanathan.: Financial Audit of Financial RecordsDocument5 pagesAdieu To Cost Audit?".by A.R.Ramanathan.: Financial Audit of Financial RecordspRiNcE DuDhAtRaNo ratings yet

- AUDnotes 17Document139 pagesAUDnotes 17Revanth Narigiri75% (4)

- Chapter 5. Jishu Hozen ManualDocument71 pagesChapter 5. Jishu Hozen ManualVivek Kumar100% (4)

- Ramco Cements Ar 2023 E7be360a72Document339 pagesRamco Cements Ar 2023 E7be360a72avinashpandey10102001No ratings yet

- Hermans K. Auditing Essentials. A Comprehensive Guide To Learn... 2023Document263 pagesHermans K. Auditing Essentials. A Comprehensive Guide To Learn... 2023Karoly SoosNo ratings yet

- Law Society of Zimbabwe by - Laws SI 314 of 1982Document16 pagesLaw Society of Zimbabwe by - Laws SI 314 of 1982Dickson Tk Chuma Jr.No ratings yet

- B3Document12 pagesB3issa adiemaNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The RestDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The RestOscar CopierNo ratings yet

- Workforce Environment and Audit Fees (2020)Document22 pagesWorkforce Environment and Audit Fees (2020)Nadhiit aNo ratings yet

- Midterm Examination Acctg. 204B Instruction: Multiple ChoiceDocument6 pagesMidterm Examination Acctg. 204B Instruction: Multiple ChoiceDonalyn BannagaoNo ratings yet

- Root Cause Analysis and Critical Thought: July 19, 2012Document24 pagesRoot Cause Analysis and Critical Thought: July 19, 2012KushNo ratings yet

- SGS Legal CFP Code of Practice enDocument8 pagesSGS Legal CFP Code of Practice enVicky LyuNo ratings yet

- SQA Plan TemplateDocument105 pagesSQA Plan TemplatejorscorpionNo ratings yet

- GM Scorecard Quick Reference Guide Jan 2023 1Document3 pagesGM Scorecard Quick Reference Guide Jan 2023 1Luis AldanaNo ratings yet

- Functional Testing - SAP (HR, HCM)Document4 pagesFunctional Testing - SAP (HR, HCM)gopualakrishnanNo ratings yet

- Adopting Generalized Audit Software - An Indonesian PerspectiveDocument28 pagesAdopting Generalized Audit Software - An Indonesian PerspectiveEmmelinaErnestineNo ratings yet

- NTB Annual Report 2015Document288 pagesNTB Annual Report 2015Sajith PrasangaNo ratings yet

- 2 5328212633575231443Document12 pages2 5328212633575231443Jack PayneNo ratings yet

Praktikum Audit

Praktikum Audit

Uploaded by

Joseph LimbongOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Praktikum Audit

Praktikum Audit

Uploaded by

Joseph LimbongCopyright:

Available Formats

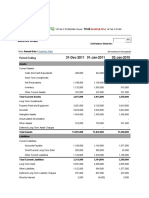

Debit Credit

Accumulated Depreciation 472,500

Accounts receivable (including $90,000 due after one year) 510,000

Accounts payable 247,500

Accrued expenses 157,500

Allowance for doubtful accounts 56,250

Amortization of bond discount and expenses 5,250

Building, machinery and equipment 3,262,500

Bank overdraft 187,500

Cash 225,000

Common stock, $100 par value

Authorized, 37,500 shares

Issued- 13,875 share 1,387,500

Subscribed - 375 shares 37,500

Construction in Progress 165,000

Cost of goods sold 3,225,000

10% Debenture, due Jan 1, 2007 750,000

Inventories

Finished goods 465,000

Goods in process 116,250

Raw materials 352,500

Dividend income 30,000

Investments in affiliated companies 262,500

Interest expense 176,250

Income tax payable 269,450

Land 345,000

Marketable securities 71,250

Mortgage payable (including current portion of $150,000) 750,000

Operating expenses 397,500

Preferred stock, 7% cumulative, non-participating,

authorized and issued, 7,5000 shares, $100 par value 750,000

Pre-operating expenses 90,000

Prepaid expenses 37,500

Provision for income tax 269,450

Reserve for contingencies 150,000

Retained earnings 114,750

Sales 4,425,000

Subscription receivable 15,000

Treasury stock (cost of 75 shares) 8,250

Unamortized bond discount and expenses 48,750

Excess of issue price over par value of common stock 262,500

10,047,950 10,047,950

TRUE

INDEPENDENT AUDITORS’ REPORT

Report No : 00001/3.0123/AU.1/01/0111-1/1/III/2016

The Shareholders, Board of Commissioners and Directors

Jujur Corp.

Opinion

We have audited the financial statements of Jujur Corp. (“the Company”), which comprise the statement

of financial position as at December 31, 2015, and the statement of profit or loss and notes to the

financial statements.

In our opinion, the accompanying financial statements present fairly, in all material respects, the financial

position of the Company as at December 31, 2015, and its financial performance for the year then ended,

in accordance with Indonesian Financial Accounting Standards.

Basis for Opinion

We conducted our audit in accordance with Standards on Auditing established by the Indonesian Institute

of Certified Public Accountants. Our responsibilities under those standards are further described in the

Auditor’s Responsibilities for the Audit of the Financial Statements paragraph of our report. We are

independent of the Company in accordance with the ethical requirements that are relevant to our audit of

the financial statements in Indonesia, and we have fulfilled our other ethical responsibilities in

accordance with these requirements. We believe that the audit evidence we have obtained is sufficient

and appropriate to provide a basis for our opinion.

Responsibilities of Management and Those Charged with Governance for the Financial Statements

Management is responsible for the preparation and fair presentation of the financial statements in

accordance with Indonesian Financial Accounting Standards, and for such internal control as

management determines is necessary to enable the preparation of financial statements that are free from

material misstatement, whether due to fraud or error.

In preparing the financial statements, management is responsible for assessing the Company’s ability to

continue as a going concern, disclosing, as applicable, matters related to going concern and using the

going concern basis of accounting unless management either intends to liquidate the Company or to cease

operations, or has no realistic alternative but to do so.

Those charged with governance are responsible for overseeing the Company’s financial reporting

process.

Auditor’s Responsibilities for the Audit of the Financial Statements

Our objectives are to obtain reasonable assurance about whether the financial statements as a whole are

free from material misstatement, whether due to fraud or error, and to issue an auditor’s report that

includes our opinion. Reasonable assurance is a high level of assurance, but is not a guarantee that an

audit conducted in accordance with Standards on Auditing will always detect a material misstatement

when it exists. Misstatements can arise from fraud or error and are considered material if, individually or

in the aggregate, they could reasonably be expected to influence the economic decisions of users taken on

the basis of these financial statements.

As part of an audit in accordance with Standards on Auditing, we exercise professional judgment and

maintain professional skepticism throughout the audit. We also:

•

Identify and assess the risks of material misstatement of the financial statements, whether due to

fraud or error, design and perform audit procedures responsive to those risks, and obtain audit

evidence that is sufficient and appropriate to provide a basis for our opinion. The risk of not

detecting a material misstatement resulting from fraud is higher than for one resulting from error, as

fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the override of

internal control.

•

Obtain an understanding of internal control relevant to the audit in order to design audit procedures

that are appropriate in the circumstances, but not for the purpose of expressing an opinion on the

effectiveness of the Company’s internal control.

• Evaluate the appropriateness of accounting policies used and the reasonableness of accounting

estimates and related disclosures made by management.

Conclude on the appropriateness of management’s use of the going concern basis of accounting and,

based on the audit evidence obtained, whether a material uncertainty exists related to events or

conditions that may cast significant doubt on the Company’s ability to continue as a going concern.

If we conclude that a material uncertainty exists, we are required to draw attention in our auditor’s

report to the related disclosures in the financial statements or, if such disclosures are inadequate, to

modify our opinion. Our conclusions are based on the audit evidence obtained up to the date of our

auditor’s report. However, future events or conditions may cause the Company to cease to continue

as a going concern.

•

Evaluate the overall presentation, structure and content of the financial statements, including the

disclosures, and whether the financial statements represent the underlying transactions and events in

a manner that achieves fair presentation

We communicate with those charged with governance regarding, among other matters, the planned scope

and timing of the audit and significant audit findings, including any significant deficiencies in internal

control that we identify during our audit.

SAYA AND ANDA CPA

Miolin Limbong, S. AK., CPA

License: AP 0001

March 31, 2016

JUJUR Corp.

STATEMENT OF FINANCIAL POSITION (BALANCE SHEETS)

DECEMBER 31, 2015

(Expressed in Dollar, uness otherwise stated)

-

Notes December 31, 2015

ASSETS

CURRENT ASSETS

Cash and cash equivalents 225,000

Marketable Securities 198,750

Accounts Receivable 420,000

Less: Allowance for doubtful accounts (56,250)

Subscription receivable 15,000

Prepaid Expenses 37,500

Inventories 1 933,750

TOTAL CURRENT ASSETS 1,773,750

NON - CURRENT ASSETS

Fixed Assets - net 2 3,300,000

Notes Receivable 90,000

Fictitious Assets 3 90,000

Investments in Affiliated Companies 262,500

TOTAL NON - CURRENT ASSETS 3,742,500

TOTAL ASSETS 5,516,250

LIABILITIES AND EQUITY

CURRENT LIABILITIES

Accounts Payable 247,500

Bank Overdraft 187,500

Accrued Expenses 157,500

Currents maturities of :

Mortgage Payable 150,000

TOTAL CURRENT LIABILITIES 742,500

NON - CURRENT LIABILITIES

Mortgage Payable 600,000

Income Tax Payable 269,450

Debenture 750,000

Less: Unamortized Bond Discount (48,750)

Reserves for Contingency 150,000

TOTAL NON - CURRENT LIABILITIES 1,720,700

TOTAL LIABILITIES 2,463,200

EQUITY

Common stock, $100 par value

Authorized, 37,500 shares

Issued- 13,875 share 1,387,500

Subscribed - 375 shares 37,500

Preferred stock, 7% cumulative,

non-participating, authorized and

issued, 7,5000 shares, $100 par value 750,000

Additional Paid-in Capital 262,500

Treasury Stock (8,250)

Retained Earnings 623,800

TOTAL EQUITY 3,053,050

TOTAL LIABILITIES AND EQUITY 5,516,250

See accompanying Notes to Financial Statements

which are an integral part of the Financial Statements taken as a whole.

JUJUR Corp.

STATEMENT OF PROFIT AND LOSS (INCOME STATEMENT)

For the Year Ended December 31, 2015

(Expressed in Dollar, uness otherwise stated)

Notes December 31, 2015

Sales 4,425,000

Cost of Goods Sold (3,225,000)

GROSS PROFIT 1,200,000

Operating Expenses (397,500)

Other Income (Expenses) - net 4 (24,000)

INCOME (LOSS) BEFORE INCOME TAX 778,500

Provision for income tax (269,450)

NET INCOME (LOSS) CURRENT YEAR 509,050

See accompanying Notes to Financial Statements

which are an integral part of the Financial Statements taken as a whole.

JUJUR Corp.

NOTES TO FINANCIAL STATEMENTS

As of and For the Year Ended December 31, 2015

(Expressed in Dollar, uness otherwise stated)

1 Inventories

This account consist of:

Finished goods 465,000

Goods in process 116,250

Raw materials 352,500

Total 933,750

2 Fixed Assets

This account consist of:

Land 345,000

Building, machinery and equipment 3,262,500

Construction in Progress 165,000

Acquisition Cost 3,772,500

Less: Accumulated Depreciation (472,500)

Total 3,300,000

3 Ficituous Assets

This account consist of:

Pre-operating expenses 90,000

Total 90,000

Pre-operating expenses, also known as preliminary expenses, are costs

incurred before the start of business operations. According To IFRS For

SMEs, Pre-Operating Expenses Should Only Be Capitalized If The Following

Conditions Are Met:

1. It is probable that the business will be successfully started and that the

expenses will be recouped through future operations.

2. The expenses are directly attributable to the start of the business.

3. The expenses are directly related to the start of the business and would not

have been incurred if the business had not been started.

4 Other Income (Expense)

This account consist of:

Other Income

Unrealized Holding Gain 127,500

Dividend Income 30,000

Total 157,500

Other Expenses

Interest Expense 176,250

Bond Interest Expense 5,250

Total 181,500

Other Income (Expense) (24,000)

Under GAAP, Marketable Securities must be adjusted at each balance sheet

date so that the value shown on the balance sheet is the market value. The

increase of market price of marketable securities are adjusted at year end and

the difference is credited to Unrealized Gain on Marketable Securities

(Unrealized holding gain)

5 Events after the Reporting Period

On January 10, 2016, the board of directors approved that cash in the amount

of $150,000 be restricted to meet the down payment of the possible

acquisition of the land adjoining the plant site to be purchased for future

plant expansion. Based on the current market price, the amount of land is

$375,000.

You might also like

- Enterprise TechDocument4 pagesEnterprise TechNatalie Daguiam100% (2)

- ACCA AAA Sample AnswersDocument4 pagesACCA AAA Sample AnswersAzhar RahamathullaNo ratings yet

- The Basic Process in Recording TransactionsDocument13 pagesThe Basic Process in Recording TransactionsJoseph LimbongNo ratings yet

- SQM 16 & 2marks With AnsDocument21 pagesSQM 16 & 2marks With AnsKalyan SundaramNo ratings yet

- Exercise 001 Preparation of Financial StatementsDocument3 pagesExercise 001 Preparation of Financial StatementsGenevaMalabananAustriaIINo ratings yet

- Acctg1205 - Chapter 8Document48 pagesAcctg1205 - Chapter 8Elj Grace BaronNo ratings yet

- Comprehensive SOCF ProblemDocument1 pageComprehensive SOCF ProblemAbdullah alhamaadNo ratings yet

- Corporate Liquidation DFCAMCLPDocument13 pagesCorporate Liquidation DFCAMCLPJessaNo ratings yet

- Applied Auditing - ExercisesDocument2 pagesApplied Auditing - ExercisesJoshua Sto DomingoNo ratings yet

- FFS - Numericals 2Document3 pagesFFS - Numericals 2Funny ManNo ratings yet

- Empire Brandy FSDocument4 pagesEmpire Brandy FSStephanie DoceNo ratings yet

- Pakistan Institute of Public Finance Accountants: Financial AccountingDocument27 pagesPakistan Institute of Public Finance Accountants: Financial AccountingMuhammad QamarNo ratings yet

- Section A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesDocument7 pagesSection A Q1) A) : Particulars Amount Total Revenue 190,000,000 ExpensesgeofreyNo ratings yet

- Module 2 - Financial StatementsDocument6 pagesModule 2 - Financial Statementskemifawole13No ratings yet

- TUGAS Topik Bab 5Document2 pagesTUGAS Topik Bab 5Imanuel ChrisNo ratings yet

- TOPIC 2 - AF09101- FINANCIAL STATEMENTSDocument24 pagesTOPIC 2 - AF09101- FINANCIAL STATEMENTSIsaack MgeniNo ratings yet

- Financial Reporting Tutorial QSN Solutions 2021 JC JaftoDocument31 pagesFinancial Reporting Tutorial QSN Solutions 2021 JC JaftoInnocent GwangwaraNo ratings yet

- Bac 203 Cat 2Document3 pagesBac 203 Cat 2Brian MutuaNo ratings yet

- End Term On 24.09.2019 FR MBA 2019-21 Term IDocument10 pagesEnd Term On 24.09.2019 FR MBA 2019-21 Term Ideliciousfood463No ratings yet

- Closing EntriesDocument10 pagesClosing EntriesFranco DexterNo ratings yet

- 2023 - Session12 - 13 FSA2 - MBA - SentDocument32 pages2023 - Session12 - 13 FSA2 - MBA - SentAkshat MathurNo ratings yet

- B326 MTA Fall 2017-2018 MGLDocument7 pagesB326 MTA Fall 2017-2018 MGLmjlNo ratings yet

- BusFin PT 4Document2 pagesBusFin PT 4Nadjmeah AbdillahNo ratings yet

- 648235Document5 pages648235mohitgaba19No ratings yet

- FABM2-Chapter4 NDocument10 pagesFABM2-Chapter4 NArchie CampomanesNo ratings yet

- Statement of Cash Flows WordDocument6 pagesStatement of Cash Flows WordJmaseNo ratings yet

- Cash Flow QuestionsDocument6 pagesCash Flow QuestionsBhakti GhodkeNo ratings yet

- Fina 470 Project Two - Check PointDocument9 pagesFina 470 Project Two - Check PointMitchell ParrottNo ratings yet

- Exercise #1 (Red Claude Palacio)Document2 pagesExercise #1 (Red Claude Palacio)Red Cloudy PalacioNo ratings yet

- Notes For Ratios: Accounting Principles AssetsDocument14 pagesNotes For Ratios: Accounting Principles AssetsSudhanshu MathurNo ratings yet

- Answered The Following Information Was Provided BartlebyDocument5 pagesAnswered The Following Information Was Provided BartlebyMarkNo ratings yet

- Cash Flow Statement Cash AnalysisDocument21 pagesCash Flow Statement Cash Analysisshrestha.aryxnNo ratings yet

- Financial Accounting & AnalysisDocument7 pagesFinancial Accounting & AnalysisIshaNo ratings yet

- Assigment 4Document3 pagesAssigment 4Syakil AhmedNo ratings yet

- Trial Balance As On 31 March 2020 Particulars Debit Balance Credit BalanceDocument14 pagesTrial Balance As On 31 March 2020 Particulars Debit Balance Credit BalanceSantosh KumarNo ratings yet

- FINAL EXAM - Part 2Document4 pagesFINAL EXAM - Part 2Elton ArcenasNo ratings yet

- Problem 1: Total Assets 937,500 Total Liab &she 937,500Document14 pagesProblem 1: Total Assets 937,500 Total Liab &she 937,500Kez MaxNo ratings yet

- Akuntansi Keuangan 1Document15 pagesAkuntansi Keuangan 1Vincenttio le CloudNo ratings yet

- FS Analysis, Cash Flow, Cap BdgtingDocument8 pagesFS Analysis, Cash Flow, Cap BdgtingArthur Richard SumaldeNo ratings yet

- Financial Statement AnalysisDocument3 pagesFinancial Statement AnalysisJasffer DebolgadoNo ratings yet

- Kelompok 6 - UTS AKMDocument18 pagesKelompok 6 - UTS AKM21-010 Desi MailaniNo ratings yet

- 8447809Document11 pages8447809blackghostNo ratings yet

- Complete Financial ModelDocument47 pagesComplete Financial ModelArrush AhujaNo ratings yet

- Financial Accounting Cat 1 JonathanDocument14 pagesFinancial Accounting Cat 1 JonathanjonathanNo ratings yet

- 17769cash Flow Practice QuestionsDocument8 pages17769cash Flow Practice QuestionsirmaNo ratings yet

- Topic 2 - Af09101 - Financial StatementsDocument42 pagesTopic 2 - Af09101 - Financial Statementsarusha afroNo ratings yet

- Chapter 1 Case 1 Net Asset AcquisitionDocument4 pagesChapter 1 Case 1 Net Asset AcquisitionANGELI GRACE GALVANNo ratings yet

- Additional InformationDocument6 pagesAdditional InformationBabylyn NavarroNo ratings yet

- Kellogg Company Balance SheetDocument5 pagesKellogg Company Balance SheetGoutham BindigaNo ratings yet

- 5 Worksheet and Financial StatementsDocument10 pages5 Worksheet and Financial StatementsLee-Ann LimNo ratings yet

- Ce Quiz II (A+b+c)Document3 pagesCe Quiz II (A+b+c)Mohaiminur ArponNo ratings yet

- Assets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Document4 pagesAssets 2005 2004: Ques2. Prepare A Cash Flow Statement As Per As-3Harsh GuptaNo ratings yet

- Decision Case 12-4Document2 pagesDecision Case 12-4cbarajNo ratings yet

- Chapter 4. Financial Ratio Analyses and Their Implications To Management Learning ObjectivesDocument29 pagesChapter 4. Financial Ratio Analyses and Their Implications To Management Learning ObjectivesChieMae Benson QuintoNo ratings yet

- Final Proj Sy2022-23 Agrigulay Corp.Document4 pagesFinal Proj Sy2022-23 Agrigulay Corp.Jan Elaine CalderonNo ratings yet

- 2016-01-08 Exame enDocument6 pages2016-01-08 Exame enbarbaraNo ratings yet

- Cash Flow ExampleDocument2 pagesCash Flow ExampleAlhassan ShakirNo ratings yet

- Netapp, Inc Com in Dollar US in ThousandsDocument6 pagesNetapp, Inc Com in Dollar US in Thousandsluisa Fernanda PeñaNo ratings yet

- Financial Statements and Ratio AnalysisDocument26 pagesFinancial Statements and Ratio Analysismary jean giananNo ratings yet

- Corp. BankruptcyDocument7 pagesCorp. BankruptcyLorifel Antonette Laoreno TejeroNo ratings yet

- Reconciliation Statement MathDocument6 pagesReconciliation Statement MathRajibNo ratings yet

- Cash Flow AnalysisDocument4 pagesCash Flow AnalysisMargin Pason RanjoNo ratings yet

- Wiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsFrom EverandWiley Practitioner's Guide to GAAS 2006: Covering all SASs, SSAEs, SSARSs, and InterpretationsRating: 2 out of 5 stars2/5 (2)

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Praktikum Keuangan MenengahDocument5 pagesPraktikum Keuangan MenengahJoseph LimbongNo ratings yet

- The Accounting Equation and The Rules of Debit and CreditDocument9 pagesThe Accounting Equation and The Rules of Debit and CreditJoseph LimbongNo ratings yet

- Corporate Governance JournalDocument17 pagesCorporate Governance JournalJoseph LimbongNo ratings yet

- Prooblem 4-5 No. 2 Journal EntriesDocument12 pagesProoblem 4-5 No. 2 Journal EntriesJoseph LimbongNo ratings yet

- Concept of LaborDocument14 pagesConcept of LaborJoseph LimbongNo ratings yet

- 19 Internal ControlDocument17 pages19 Internal ControlJoseph LimbongNo ratings yet

- Regulations and ComplianceDocument5 pagesRegulations and ComplianceJayateerthMokashi100% (1)

- Auditors Company LawDocument13 pagesAuditors Company LawNuratul FakriahNo ratings yet

- Bid Document Volume II PKG 3 PDFDocument124 pagesBid Document Volume II PKG 3 PDFJ.S. RathoreNo ratings yet

- Performance Objective 1Document9 pagesPerformance Objective 1banglauserNo ratings yet

- Audit Works Template Issued by ICAI June 23Document331 pagesAudit Works Template Issued by ICAI June 23Mayank KapadiaNo ratings yet

- Fraud Corruption GistDocument27 pagesFraud Corruption GistAniket KumarNo ratings yet

- JM ArcDocument89 pagesJM ArcRAJASHEKAR REDDYNo ratings yet

- 5th Sem I Unit Auditing PPT 1.pdf334Document26 pages5th Sem I Unit Auditing PPT 1.pdf334Asad RNo ratings yet

- Chap 3 Co ActDocument47 pagesChap 3 Co ActrajuNo ratings yet

- Adieu To Cost Audit?".by A.R.Ramanathan.: Financial Audit of Financial RecordsDocument5 pagesAdieu To Cost Audit?".by A.R.Ramanathan.: Financial Audit of Financial RecordspRiNcE DuDhAtRaNo ratings yet

- AUDnotes 17Document139 pagesAUDnotes 17Revanth Narigiri75% (4)

- Chapter 5. Jishu Hozen ManualDocument71 pagesChapter 5. Jishu Hozen ManualVivek Kumar100% (4)

- Ramco Cements Ar 2023 E7be360a72Document339 pagesRamco Cements Ar 2023 E7be360a72avinashpandey10102001No ratings yet

- Hermans K. Auditing Essentials. A Comprehensive Guide To Learn... 2023Document263 pagesHermans K. Auditing Essentials. A Comprehensive Guide To Learn... 2023Karoly SoosNo ratings yet

- Law Society of Zimbabwe by - Laws SI 314 of 1982Document16 pagesLaw Society of Zimbabwe by - Laws SI 314 of 1982Dickson Tk Chuma Jr.No ratings yet

- B3Document12 pagesB3issa adiemaNo ratings yet

- Question No. 1 Is Compulsory. Attempt Any Five Questions From The RestDocument7 pagesQuestion No. 1 Is Compulsory. Attempt Any Five Questions From The RestOscar CopierNo ratings yet

- Workforce Environment and Audit Fees (2020)Document22 pagesWorkforce Environment and Audit Fees (2020)Nadhiit aNo ratings yet

- Midterm Examination Acctg. 204B Instruction: Multiple ChoiceDocument6 pagesMidterm Examination Acctg. 204B Instruction: Multiple ChoiceDonalyn BannagaoNo ratings yet

- Root Cause Analysis and Critical Thought: July 19, 2012Document24 pagesRoot Cause Analysis and Critical Thought: July 19, 2012KushNo ratings yet

- SGS Legal CFP Code of Practice enDocument8 pagesSGS Legal CFP Code of Practice enVicky LyuNo ratings yet

- SQA Plan TemplateDocument105 pagesSQA Plan TemplatejorscorpionNo ratings yet

- GM Scorecard Quick Reference Guide Jan 2023 1Document3 pagesGM Scorecard Quick Reference Guide Jan 2023 1Luis AldanaNo ratings yet

- Functional Testing - SAP (HR, HCM)Document4 pagesFunctional Testing - SAP (HR, HCM)gopualakrishnanNo ratings yet

- Adopting Generalized Audit Software - An Indonesian PerspectiveDocument28 pagesAdopting Generalized Audit Software - An Indonesian PerspectiveEmmelinaErnestineNo ratings yet

- NTB Annual Report 2015Document288 pagesNTB Annual Report 2015Sajith PrasangaNo ratings yet

- 2 5328212633575231443Document12 pages2 5328212633575231443Jack PayneNo ratings yet