Professional Documents

Culture Documents

Dabur 5

Dabur 5

Uploaded by

faheem.ashrafOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Dabur 5

Dabur 5

Uploaded by

faheem.ashrafCopyright:

Available Formats

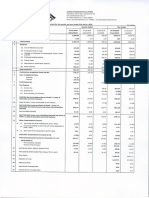

Dabur India Limited

Statement of unaudited consolidated financial results for the quarter ended 30 June 2023 ^-

fw

(? in crores)

;I.No 'articulars Quarter ended Preceding Corresponding Previous year

(30/06/2023) quarter ended quarter ended ended

(31/03/2023) (30/06/2022) (31/03/2023)

(Unaudited) | (Refer note 4) | (Unaudited) (Audited)

1 ncome

tevenue from operations 3,130.47 2,677.80 2,822.43 11,529.89

3ther income 109.78 120.72 100.55 445.39

otal income 3,240.25 2,798.52 2,922.98 11,975.28

2 :xpenses

Cost of materials consumed (including excise duty) 1,345.37 1,446.83 1,373.98 5,306.97

Purchases of stock in trade 233.90 149.74 253.01 1,052.49

Changes in inventories of finished goods, stock-in-trade and work-in- 92.45 (145.54) (98.88) (90.79)1

progress

Employee benefits expense 297.24 288.74 269.89 1,137.00

Finance costs 24.31 32.12 12.15 78.24

Depreciation and amortisation expense 96.64 102.00 67.60 310.96

Other expenses

Advertisement and publicity 204.34 151.63 157.20 640.27

Others 352.44 376.56 323.57 1,319.83

otalexpenses 2,646.69 2,402.08 2,358.52 9,754.97

3 'rofit before share of loss from joint venture, exceptional items and tax 593.56 396.44 564.46 2,220.31

hare of loss of joint venture (0.20) (0.19) (0.34) (1.63)1

4 Profit before exceptional items and tax 593.36 396.25 564.12 2,218.68

5 Exceptional items

6 Profit before tax 593.36 396.25 564.12 2,218.68

7 Tax expense

Current tax 133.59 75.90 120.84 481.63

Deferred tax 3.16 27.59 2.22 35.72

8 ] Net profit for the period/year (A) 456.61 292.76 441.06 1,701.33

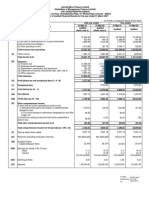

9 Other comprehensive income

a) Items that will not be reclassified to profit or loss (0.61) 4.22 1.04 (2.21)]

Income tax relating to items that will not be reclassified to profit or loss 0.21 (1.48) (0.36) 0.77

b) Items that will be reclasssified to profit or loss (13.63) (102.47] (101.82; (247.93)

Income tax relating to items that will be reclasssified to profit or loss (6.71) (2.22) 32.76 23.98

10 |Total other comprehensive income/floss) for the period/year (B) (20.74: (101.95 (68.38: (225.39)

11 [Total comprehensive income for the period/year (A+B) 435.87 190.81 372.68 1,475.94

Net profit attributable to;

Owners of the holding company 463.88 300.83 440.32 1,707.15

Non-controlling interest (7.27 (8.07: 0.74 (5.82)

Other comprehensive income attributable to:

Owners of the holding company (20.73 (104.69 (67.39: (225.49)

Non-controlling interest (0.01: 2.74 (0.99: 0.10

Total comprehensive income attributable to:

Owners of the holding company 443.15 196.14 372.93 1,481.66

Non-controlling interest (7.28: (5.33 (0.25 (5.72)

12 | Paid-up equity share capital (Face value of Bleach) 177.20 177.18 177.17 177.18

13 Other equity 8,796.08

14 | Earnings per share (Face value of?l each) (notannualised)

Basic (?) 2.62 1.70 2.49 9.64

Diluted (?) 2.61 1.69 2.48 9.61

^

^

You might also like

- PW Pitch Deck v1Document12 pagesPW Pitch Deck v1karthibenNo ratings yet

- First Pre-Board in Taxation Items 1 - 5: D. Within and WithoutDocument12 pagesFirst Pre-Board in Taxation Items 1 - 5: D. Within and WithoutAngel AtirazanNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document9 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)hemant goyalNo ratings yet

- Standalone Results - June 2017 - 0Document3 pagesStandalone Results - June 2017 - 0Varun SidanaNo ratings yet

- Aditya Birla Capital Limited Statement of Consolidated Unaudited Results For The Quarter Ended 30Th June 2019Document6 pagesAditya Birla Capital Limited Statement of Consolidated Unaudited Results For The Quarter Ended 30Th June 2019Bhavesh PatelNo ratings yet

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document8 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006pradeepNo ratings yet

- GHCL Limited (CIN: L24100GJ1983PLC006513)Document10 pagesGHCL Limited (CIN: L24100GJ1983PLC006513)soumyasibaniNo ratings yet

- Q1-Results Bal 2019-20Document5 pagesQ1-Results Bal 2019-20Krish PatelNo ratings yet

- Unaudited Consolidated Financial Results 30 06 2022 5fbd98142dDocument5 pagesUnaudited Consolidated Financial Results 30 06 2022 5fbd98142dheerkummar2006No ratings yet

- Digitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Document5 pagesDigitally Signed by Debolina Karmakar Date: 2023.08.10 12:39:40 +05'30'Mahesh hamneNo ratings yet

- Standalone Result Mar23Document9 pagesStandalone Result Mar23Amit KumarNo ratings yet

- MRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Document10 pagesMRF Limited: Regd - Office: 114, Greams Road, Chennai - 600 006Sourya MitraNo ratings yet

- Standalone Results - Mar'23 - 0Document5 pagesStandalone Results - Mar'23 - 0Honey SinghalNo ratings yet

- R D Offlc Mbic Oad, Va o A 3 003: of MaDocument10 pagesR D Offlc Mbic Oad, Va o A 3 003: of MaRavi AgarwalNo ratings yet

- Q4 Results of Bal 2022-23Document11 pagesQ4 Results of Bal 2022-23dewerNo ratings yet

- ITC Financial Result Q1 FY2024 SfsDocument3 pagesITC Financial Result Q1 FY2024 SfsAlricNo ratings yet

- Spandana Sporthy Balance SheetDocument1 pageSpandana Sporthy Balance SheetMs VasNo ratings yet

- Consol Result Mar23Document16 pagesConsol Result Mar23Amit KumarNo ratings yet

- Profit and LossDocument1 pageProfit and LossYagika Jagnani100% (1)

- BSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerDocument9 pagesBSE Limited National Stock Exchange of India Limited: Company Secretary and Compliance OfficerABHIRAJ PARMARNo ratings yet

- Financial Result Update Aug 02 02082023123958Document7 pagesFinancial Result Update Aug 02 02082023123958Surajit DasNo ratings yet

- Standalone Result Sep, 17Document4 pagesStandalone Result Sep, 17Varun SidanaNo ratings yet

- InfoEdge Annual Report 2023 1Document1 pageInfoEdge Annual Report 2023 1Aditya RoyNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- June 2022Document2 pagesJune 2022akshay kausaleNo ratings yet

- HawkinsDocument1 pageHawkinsNatarajNo ratings yet

- Audited Consolidated Financial Results 31 03 2023 5e87d66fb7Document9 pagesAudited Consolidated Financial Results 31 03 2023 5e87d66fb7LaraNo ratings yet

- Consolidated Q4Document6 pagesConsolidated Q4Qazi MudasirNo ratings yet

- q209 - Airtel Published FinancialsDocument7 pagesq209 - Airtel Published Financialsmixedbag100% (2)

- (In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanDocument9 pages(In Lakhs, Except Per Equity Share Data) : Digitally Signed Bysvraja VaidyanathanAnamika NandiNo ratings yet

- Q3 Results Bal - 2022-23Document5 pagesQ3 Results Bal - 2022-23dewerNo ratings yet

- 4.varroc Consolidated Result Sheet June 2021 SignedDocument3 pages4.varroc Consolidated Result Sheet June 2021 SignedA kumarNo ratings yet

- Statement of Profit and Loss: For The Year Ended 31st March, 2021Document2 pagesStatement of Profit and Loss: For The Year Ended 31st March, 2021Only For StudyNo ratings yet

- T Hi Liv S: - Ouc NG e OverDocument9 pagesT Hi Liv S: - Ouc NG e OverRavi AgarwalNo ratings yet

- Quarter AnnualDocument8 pagesQuarter AnnualNeetu JainNo ratings yet

- Book 2Document18 pagesBook 2Aishwarya DaymaNo ratings yet

- Unaudited Standalone Financial Results 30 06 2022 7dcaac46eaDocument4 pagesUnaudited Standalone Financial Results 30 06 2022 7dcaac46eamobgamer677No ratings yet

- June 2021Document3 pagesJune 2021akshay kausaleNo ratings yet

- Hero DetailsDocument11 pagesHero DetailsLaksh SinghalNo ratings yet

- Mahindra & Mahindra Limited: Rs. in CroresDocument4 pagesMahindra & Mahindra Limited: Rs. in CroresGeorge Chalissery RajuNo ratings yet

- Web Standalone Sep23Document7 pagesWeb Standalone Sep23coolstiffler08No ratings yet

- Sebi Release EditDocument2 pagesSebi Release Editkarthikpranesh7No ratings yet

- Bajaj Auto Limited: Page 1 of 7Document7 pagesBajaj Auto Limited: Page 1 of 7DPH ResearchNo ratings yet

- Q1 20 - DhunseriDocument4 pagesQ1 20 - Dhunserica.anup.kNo ratings yet

- Touc NG Lives Over: YearsDocument15 pagesTouc NG Lives Over: YearsRavi AgarwalNo ratings yet

- Apollo Tyres Ltd.Document3 pagesApollo Tyres Ltd.Nishant HardiyaNo ratings yet

- Scrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Document3 pagesScrip Code: MSUMI Scrip Code: 543498 Ref.: Un-Audited Financial Results For The Quarter Ended June 30, 2022Amruta TarmaleNo ratings yet

- Investor Download DataDocument9 pagesInvestor Download Dataindradanush2608No ratings yet

- Financial Results Consolidated Q2 FY 2023 2024Document10 pagesFinancial Results Consolidated Q2 FY 2023 2024surendran naiduNo ratings yet

- Tata MotorsDocument41 pagesTata MotorsShubham SharmaNo ratings yet

- Indiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Document6 pagesIndiabulls Housing Finance Limited (CIN: L65922DL2005PLC136029)Kumar RajputNo ratings yet

- Audited Annual Financial Results-Standalone & Consolidated-31.03.2020-WebsiteDocument11 pagesAudited Annual Financial Results-Standalone & Consolidated-31.03.2020-WebsiteRaj LallNo ratings yet

- Audited Financial Results For The Quarter and Year Ended 31st March, 2021Document21 pagesAudited Financial Results For The Quarter and Year Ended 31st March, 2021Vilas ShahNo ratings yet

- Tata Motors Group Q4 Annual Financial Results FY19 20Document10 pagesTata Motors Group Q4 Annual Financial Results FY19 20Anil Kumar AkNo ratings yet

- ACAPL - Outcome of BM - Finnancials - Asset Cover CertificateDocument23 pagesACAPL - Outcome of BM - Finnancials - Asset Cover CertificateShashi Bhushan PrinceNo ratings yet

- JM Financial: L Indi N L 1 LDocument9 pagesJM Financial: L Indi N L 1 LPiyush LuthraNo ratings yet

- Indigo Income STMT 1Document1 pageIndigo Income STMT 1deepzNo ratings yet

- MM Q3 F22 Financial Results PackDocument12 pagesMM Q3 F22 Financial Results PackBharathNo ratings yet

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Document4 pagesStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderNo ratings yet

- Data To Use - Detail InformationDocument44 pagesData To Use - Detail InformationAninda DuttaNo ratings yet

- Ratios AssignmentDocument5 pagesRatios AssignmentDaksh NagpalNo ratings yet

- SodapdfDocument49 pagesSodapdffaheem.ashrafNo ratings yet

- ECARDPDFDocument1 pageECARDPDFfaheem.ashrafNo ratings yet

- Sliced PDF CompressedDocument49 pagesSliced PDF Compressedfaheem.ashrafNo ratings yet

- Table 3010101Document1 pageTable 3010101faheem.ashrafNo ratings yet

- Corporate Hons. IIDocument14 pagesCorporate Hons. IIAnonymous KRQaT2PnYqNo ratings yet

- Mid-Term Exam - TAXN 2200 - MRjacinto2021 QuestionnaireDocument12 pagesMid-Term Exam - TAXN 2200 - MRjacinto2021 QuestionnaireDanica RamosNo ratings yet

- Accumulated Depreciation of BuildingDocument12 pagesAccumulated Depreciation of BuildingLukastheofilus oNo ratings yet

- Taxation Law 2017 Law of Taxation PDFDocument39 pagesTaxation Law 2017 Law of Taxation PDFRanjan BaradurNo ratings yet

- Goodwill Valuation With ExamplesDocument6 pagesGoodwill Valuation With ExamplesVipin Mandyam KadubiNo ratings yet

- Group Members Name:: Iqra Hashim Jahnzaib Ali Bhatti Ammar Malik Mayra Sundas Amina MushtaqDocument62 pagesGroup Members Name:: Iqra Hashim Jahnzaib Ali Bhatti Ammar Malik Mayra Sundas Amina MushtaqIQRA HASHIMNo ratings yet

- JSW Steel - AR 2020 FinalDocument368 pagesJSW Steel - AR 2020 FinalRitika Chavhan0% (1)

- Icahn - Earnings Presentation (9.30.20) VfinalDocument21 pagesIcahn - Earnings Presentation (9.30.20) VfinalMiguel RamosNo ratings yet

- Ch-9 Advance Tax, TDS, TCSDocument122 pagesCh-9 Advance Tax, TDS, TCSrinkal jethiNo ratings yet

- SodaPDF-converted-PAYSLIP - Umashankar VDocument1 pageSodaPDF-converted-PAYSLIP - Umashankar VCyriac JoseNo ratings yet

- Sanjay Saraf SFM Volume 1 ForexDocument153 pagesSanjay Saraf SFM Volume 1 ForexShubham Agrawal100% (1)

- Annex F-Modified UACS Sub-Object Codes PDFDocument2 pagesAnnex F-Modified UACS Sub-Object Codes PDFBarbara Beatriz CarinoNo ratings yet

- Equity Research: India UpdateDocument10 pagesEquity Research: India UpdateRavichandra BNo ratings yet

- Msci 607: Applied Economics For ManagementDocument5 pagesMsci 607: Applied Economics For ManagementRonak PatelNo ratings yet

- India Payslip August 2022Document1 pageIndia Payslip August 2022rahul reddyNo ratings yet

- 06 AnsDocument4 pages06 AnsAnonymous 8ooQmMoNs1No ratings yet

- Digest RR 7-2001 PDFDocument1 pageDigest RR 7-2001 PDFMae TrabajoNo ratings yet

- Accp303 Prefinals Nov 15 2021 KeyDocument9 pagesAccp303 Prefinals Nov 15 2021 KeyAngelica RubiosNo ratings yet

- Instructions For A Cash Flows Statement Direct MethodDocument5 pagesInstructions For A Cash Flows Statement Direct MethodMary100% (8)

- Consolidated Balance Sheet: As at 31st March, 2016Document15 pagesConsolidated Balance Sheet: As at 31st March, 2016Saswata ChoudhuryNo ratings yet

- Attachmentsresources90316 101442 Advance Accounting Nov. 2008 PDFDocument25 pagesAttachmentsresources90316 101442 Advance Accounting Nov. 2008 PDFDipen AdhikariNo ratings yet

- What Is Product CostingDocument12 pagesWhat Is Product CostingAtulWalvekarNo ratings yet

- Gambit Corporation Purchased A New Plant Asset On April 1Document1 pageGambit Corporation Purchased A New Plant Asset On April 1Freelance WorkerNo ratings yet

- Quarter 1 Summative EntrepDocument2 pagesQuarter 1 Summative EntrepLignerrac Anipal UtadNo ratings yet

- Statements of Financial Position From The Airbus (Consolidated Balance Sheet) Assets Non-Current AssetsDocument8 pagesStatements of Financial Position From The Airbus (Consolidated Balance Sheet) Assets Non-Current AssetsSuhaas varmaNo ratings yet

- Accounts Paper 1 June 2001Document11 pagesAccounts Paper 1 June 2001BRANDON TINASHENo ratings yet

- G.R. No. 187521Document2 pagesG.R. No. 187521Magr EscaNo ratings yet

- CVP Cost For IEDocument1 pageCVP Cost For IEValerie Aubrey Luna BeatrizNo ratings yet