Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

14 viewsCash Flow Statement

Cash Flow Statement

Uploaded by

Mohammad SahiliThe statement of cash flows reports cash inflows and outflows categorized into operating, investing, and financing activities. It reconciles net income to cash from operating activities since the income statement is on an accrual basis while the statement of cash flows focuses on actual cash amounts. The statement of cash flows provides important information to investors for evaluating a company's liquidity and ability to generate cash.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

You might also like

- NC-III Bookkeeping ReviewerDocument33 pagesNC-III Bookkeeping ReviewerNovelyn Gamboa94% (62)

- Break Free Taste PDFDocument11 pagesBreak Free Taste PDFJash Bulatao100% (1)

- 2007-2013 MERCANTILE Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Document173 pages2007-2013 MERCANTILE Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Jay-Arh97% (103)

- Orange County Case StudyDocument6 pagesOrange County Case StudyPiyush Dhar DwivediNo ratings yet

- 13 - Chapter 7 PDFDocument30 pages13 - Chapter 7 PDFLoveleena RodriguesNo ratings yet

- Unit II - Cash Flow StatementDocument11 pagesUnit II - Cash Flow Statementsubhash dalviNo ratings yet

- Unit II - Cash Flow StatementDocument11 pagesUnit II - Cash Flow Statementsubhash dalviNo ratings yet

- Cash Flow Statement: Dr.K.Baranidharan, SRI SAIRAM INSTITUTE OF TECHNOLOGY, CHENNAI 44Document17 pagesCash Flow Statement: Dr.K.Baranidharan, SRI SAIRAM INSTITUTE OF TECHNOLOGY, CHENNAI 44Dr.K.BaranidharanNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow StatementGokul KulNo ratings yet

- Financial Statement Analysis For Credit Decision Presented by Rabah ElmasriDocument5 pagesFinancial Statement Analysis For Credit Decision Presented by Rabah Elmasrinuwany2kNo ratings yet

- Cash Flow Statements: Deepti Gurvinder Jitender Niraj PalakDocument29 pagesCash Flow Statements: Deepti Gurvinder Jitender Niraj PalakPalak GoelNo ratings yet

- Ch-5 Cash Flow AnalysisDocument9 pagesCh-5 Cash Flow AnalysisQiqi GenshinNo ratings yet

- Nature of Cash & Cashflows Ma2Document12 pagesNature of Cash & Cashflows Ma2ali hansiNo ratings yet

- Theory On Fund FlowDocument7 pagesTheory On Fund FlowRajeev CuteboyNo ratings yet

- Statement of Cash FlowsDocument35 pagesStatement of Cash Flowsonthelinealways100% (4)

- Cash Flow Statments Lesson 16Document46 pagesCash Flow Statments Lesson 16Charos Aslonovna100% (1)

- The Cash Flow StatementsDocument13 pagesThe Cash Flow Statementsdeo omachNo ratings yet

- Funds Flow AnalysisDocument31 pagesFunds Flow Analysisadnan arshadNo ratings yet

- SCF - 3rd YrDocument27 pagesSCF - 3rd YrA.J. Chua100% (1)

- Cash Flow NotesDocument14 pagesCash Flow NotesProchetto Da100% (1)

- Managing The Venture's Financial ResourcesDocument28 pagesManaging The Venture's Financial ResourcesAnto DNo ratings yet

- Managerial Finance, Financial Accounting and Analysis For Engineering Managers PDFDocument5 pagesManagerial Finance, Financial Accounting and Analysis For Engineering Managers PDFAshuriko KazuNo ratings yet

- Accounting 3 Cash Flow Statement DiscussionDocument6 pagesAccounting 3 Cash Flow Statement DiscussionNoah HNo ratings yet

- Cashflow Project+SandhyaDocument71 pagesCashflow Project+Sandhyaabdulkhaderjeelani1480% (5)

- Terminalogies Used in Financial Statements and Insights From Annual ReportsDocument24 pagesTerminalogies Used in Financial Statements and Insights From Annual ReportsKaydawala Saifuddin 20100% (1)

- 01 - Financial Analysis Overview - Lecture MaterialDocument34 pages01 - Financial Analysis Overview - Lecture MaterialNaia SNo ratings yet

- Statement of Cash Flow: Lecture-8Document11 pagesStatement of Cash Flow: Lecture-8Nirjon BhowmicNo ratings yet

- Lecture 5 - Cash Flow StatementDocument60 pagesLecture 5 - Cash Flow StatementMutesa Chris100% (1)

- ACC501 - Lecture 22Document45 pagesACC501 - Lecture 22Shivati Singh Kahlon100% (1)

- What Is A Cash Flow StatementDocument4 pagesWhat Is A Cash Flow StatementDaniel GarciaNo ratings yet

- What Is 'Cash Flow'Document7 pagesWhat Is 'Cash Flow'Selvi VinoseKumarNo ratings yet

- Chapter 7 Statement of Cash FlowsDocument5 pagesChapter 7 Statement of Cash FlowskajsdkjqwelNo ratings yet

- Pas 7 - Statement of Cash FlowsDocument8 pagesPas 7 - Statement of Cash FlowsJohn Rafael Reyes PeloNo ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementJonathanKelly Bitonga BargasoNo ratings yet

- Fabm 2 and FinanceDocument5 pagesFabm 2 and FinanceLenard TaberdoNo ratings yet

- Cash Flow StatementDocument10 pagesCash Flow Statementhitesh26881No ratings yet

- LESSON 07 - The Financial Aspect For EntrepreneursDocument28 pagesLESSON 07 - The Financial Aspect For Entrepreneurssalubrekimberly92No ratings yet

- Operating Cash FlowDocument3 pagesOperating Cash FlowmonumannaNo ratings yet

- Operating Cash FlowDocument3 pagesOperating Cash FlowmonumannaNo ratings yet

- Cash FlowDocument12 pagesCash FlowDivesh BabariaNo ratings yet

- Accounting & FinanceDocument17 pagesAccounting & FinanceInbasaat PirzadaNo ratings yet

- FM AssignmentDocument8 pagesFM Assignmentmihir_s9No ratings yet

- Cash Flow Statement TheoryDocument30 pagesCash Flow Statement Theorymohammedakbar88100% (5)

- Mid Term TopicsDocument10 pagesMid Term TopicsТемирлан АльпиевNo ratings yet

- 1 Financial Statements Cash Flows and TaxesDocument13 pages1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiNo ratings yet

- Cash Flow StatementDocument13 pagesCash Flow StatementMuhammed IbrahimNo ratings yet

- Financial Statement Analysis For Cash Flow StatementDocument5 pagesFinancial Statement Analysis For Cash Flow StatementOld School Value100% (3)

- Cashflow AnalysisDocument4 pagesCashflow AnalysisIdd Mic-dadyNo ratings yet

- FA - IAS 7 Statement of Cash FlowsDocument69 pagesFA - IAS 7 Statement of Cash FlowsMomiAbbas0069No ratings yet

- Cash Flow StatementDocument21 pagesCash Flow StatementthejojoseNo ratings yet

- Chapter 12Document8 pagesChapter 12Hareem Zoya WarsiNo ratings yet

- Accounting ConceptsDocument95 pagesAccounting Conceptsgaurav gargNo ratings yet

- The Four Financial StatementsDocument3 pagesThe Four Financial Statementsmuhammadtaimoorkhan100% (3)

- Cash Flow Statement PDFDocument18 pagesCash Flow Statement PDFPrithikaNo ratings yet

- Introduction Cash FlowDocument10 pagesIntroduction Cash FlowAmrit TejaniNo ratings yet

- Cash Flow Analysis2018Document54 pagesCash Flow Analysis2018En. Joe100% (1)

- Cash Flow - Wikipedia, The Free EncyclopediaDocument4 pagesCash Flow - Wikipedia, The Free EncyclopediaSachinsuhaNo ratings yet

- FADM Cheat SheetDocument2 pagesFADM Cheat Sheetvarun022084No ratings yet

- Cashflow-Project-Sandhya Hema FullDocument71 pagesCashflow-Project-Sandhya Hema Fullkannan Venkat100% (1)

- Cashflow-Project-Sandhya Hema FullDocument71 pagesCashflow-Project-Sandhya Hema Fullkannan VenkatNo ratings yet

- Cashflow-Project-Sandhya Hema FullDocument71 pagesCashflow-Project-Sandhya Hema Fullkannan VenkatNo ratings yet

- Preface Cash Flow Analysis Is The Study of The Cycle of Your Business' Cash Inflows and OutflowsDocument45 pagesPreface Cash Flow Analysis Is The Study of The Cycle of Your Business' Cash Inflows and Outflowskannan VenkatNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- PA00M4F9Document35 pagesPA00M4F9Mohammad SahiliNo ratings yet

- CSA report template (1)Document8 pagesCSA report template (1)Mohammad SahiliNo ratings yet

- pdf_20230221_211330_0000Document1 pagepdf_20230221_211330_0000Mohammad SahiliNo ratings yet

- Marketing project FinalDocument27 pagesMarketing project FinalMohammad SahiliNo ratings yet

- Assets, LiabilitiesDocument3 pagesAssets, LiabilitiesMohammad SahiliNo ratings yet

- Double Entry SystemDocument26 pagesDouble Entry SystemMohammad SahiliNo ratings yet

- CFP Mock Test Introduction To Financial PlanningDocument7 pagesCFP Mock Test Introduction To Financial PlanningDeep ShikhaNo ratings yet

- 024 Defining-Value-Vbhc enDocument94 pages024 Defining-Value-Vbhc enmert05No ratings yet

- Problems For Topic 3Document4 pagesProblems For Topic 3Quỳnh Anh TrầnNo ratings yet

- 6 Causes of Miscommunication - How To Use Plain Language EffectivelyDocument14 pages6 Causes of Miscommunication - How To Use Plain Language EffectivelyLouiegie B. MendozaNo ratings yet

- Chapter 19 Financial Statement Analysis AnswerDocument53 pagesChapter 19 Financial Statement Analysis AnswerHằngNo ratings yet

- Bhavik Gandhi ResumeDocument1 pageBhavik Gandhi ResumeBhavik GandhiNo ratings yet

- About Parag Parikh Flexi Cap Fund: (Please Visit Page 2)Document13 pagesAbout Parag Parikh Flexi Cap Fund: (Please Visit Page 2)sbk018No ratings yet

- Casestudy On Kingfisher AirlinesDocument5 pagesCasestudy On Kingfisher Airlinesbette_ruffles60% (10)

- Gold Monetization Scheme.Document26 pagesGold Monetization Scheme.keerthiNo ratings yet

- Introduction To Financial Statement AnalysisDocument2 pagesIntroduction To Financial Statement AnalysisTričiaStypayhørliksønNo ratings yet

- Trade Station Calculated IndicesDocument33 pagesTrade Station Calculated IndicesviccarterNo ratings yet

- Book 2Document2 pagesBook 2Khang TrầnNo ratings yet

- Deloitte Oil & Gas Mergers and Acquisitions ReportDocument52 pagesDeloitte Oil & Gas Mergers and Acquisitions ReportAnithaNo ratings yet

- Ice Cream ProjectDocument53 pagesIce Cream Projectblackrose_nhungNo ratings yet

- Basic Finance Module Materials List of Modules: No. Module Title CodeDocument49 pagesBasic Finance Module Materials List of Modules: No. Module Title CodeShaina LimNo ratings yet

- The Uniform System of AccountsDocument5 pagesThe Uniform System of AccountsThang Jason TranNo ratings yet

- Oil PricingDocument68 pagesOil Pricingyash saragiya100% (2)

- Total Financial RatiosDocument2 pagesTotal Financial RatioshoangsubaxdNo ratings yet

- Chart PattrenDocument5 pagesChart PattrenmouddenzaydNo ratings yet

- Ross12e Chapter06 TBDocument26 pagesRoss12e Chapter06 TBHải YếnNo ratings yet

- 2023 Financial MathsDocument5 pages2023 Financial MathscaitlynntangNo ratings yet

- MBB 15 - Environmental and Social Risk Management For MFIsDocument8 pagesMBB 15 - Environmental and Social Risk Management For MFIsAen071No ratings yet

- BCK Test Paper (40 Marks) Nov 2023 With AnswersDocument6 pagesBCK Test Paper (40 Marks) Nov 2023 With Answersbaidshruti123No ratings yet

- Personal Finance BulletinDocument7 pagesPersonal Finance Bulletinfarazalam08No ratings yet

- Celebrity EndorsementDocument13 pagesCelebrity EndorsementMuhammad ZeshanNo ratings yet

- Case Study - Newland TechnologiesDocument10 pagesCase Study - Newland TechnologiesKartik Tewari50% (2)

- Financial MarketDocument14 pagesFinancial MarketDavid DavidNo ratings yet

Cash Flow Statement

Cash Flow Statement

Uploaded by

Mohammad Sahili0 ratings0% found this document useful (0 votes)

14 views5 pagesThe statement of cash flows reports cash inflows and outflows categorized into operating, investing, and financing activities. It reconciles net income to cash from operating activities since the income statement is on an accrual basis while the statement of cash flows focuses on actual cash amounts. The statement of cash flows provides important information to investors for evaluating a company's liquidity and ability to generate cash.

Original Description:

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe statement of cash flows reports cash inflows and outflows categorized into operating, investing, and financing activities. It reconciles net income to cash from operating activities since the income statement is on an accrual basis while the statement of cash flows focuses on actual cash amounts. The statement of cash flows provides important information to investors for evaluating a company's liquidity and ability to generate cash.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

14 views5 pagesCash Flow Statement

Cash Flow Statement

Uploaded by

Mohammad SahiliThe statement of cash flows reports cash inflows and outflows categorized into operating, investing, and financing activities. It reconciles net income to cash from operating activities since the income statement is on an accrual basis while the statement of cash flows focuses on actual cash amounts. The statement of cash flows provides important information to investors for evaluating a company's liquidity and ability to generate cash.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 5

The statement of cash flows ( )بيان التدفقات النقديةreports

the cash generated and used during the time interval

specified in its heading.

used in the following categories:

◦ Operating activities – converts the items reported

on the income statement from the accrual basis of

accounting to cash.

◦ Investing activities – reports the purchase and

sale of long-term investments and property, plant and

equipment.

◦ Financing activities – reports the issuance and

repurchase of the company's own bonds and stock and the

payment of dividends.

◦ Supplemental information – reports the

exchange of significant items that did not involve cash and

reports the amount of income taxes paid and interest paid.

Because the income statement is prepared

under the accrual basis of accounting, the

revenues reported may not have been

collected. Similarly, the expenses reported on

the income statement might not have been

paid.

◦ You could review the balance sheet changes to

determine the facts, but the cash flow statement

already has integrated all that information.

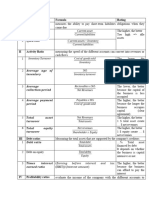

The cash from operating activities is compared to the

company's net income.

◦ If the cash from operating activities is consistently greater than

the net income, the company's net income or earnings are said to

be of a "high quality".

◦ If the cash from operating activities is less than net income, a red

flag is raised as to why the reported net income is not turning into

cash.

Some investors believe that "cash is king". The cash flow

statement identifies the cash that is flowing in and out of

the company.

◦ If a company is consistently generating more cash than it is using,

the company will be able to increase its dividend, buy back some

of its stock, reduce debt, or acquire another company. All of these

are perceived to be good for stockholder value.

Some financial models are based upon cash flow.

When you use cash to buy a book, you now own the book (you've

increased your "assets") but you also have less money (you've

decreased your cash).

When an asset (other than cash) increases, the Cash

account decreases.

When an asset (other than cash) decreases, the Cash

account increases.

When a liability increases, the Cash account increases.

When a liability decreases, the Cash account decreases.

When owner's equity increases, the Cash account increases.

When owner's equity decreases, the Cash account decreases.

Here’s a Tip

For a change in assets (other than cash)—the change in the Cash

account is in the opposite direction.

You might also like

- NC-III Bookkeeping ReviewerDocument33 pagesNC-III Bookkeeping ReviewerNovelyn Gamboa94% (62)

- Break Free Taste PDFDocument11 pagesBreak Free Taste PDFJash Bulatao100% (1)

- 2007-2013 MERCANTILE Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Document173 pages2007-2013 MERCANTILE Law Philippine Bar Examination Questions and Suggested Answers (JayArhSals)Jay-Arh97% (103)

- Orange County Case StudyDocument6 pagesOrange County Case StudyPiyush Dhar DwivediNo ratings yet

- 13 - Chapter 7 PDFDocument30 pages13 - Chapter 7 PDFLoveleena RodriguesNo ratings yet

- Unit II - Cash Flow StatementDocument11 pagesUnit II - Cash Flow Statementsubhash dalviNo ratings yet

- Unit II - Cash Flow StatementDocument11 pagesUnit II - Cash Flow Statementsubhash dalviNo ratings yet

- Cash Flow Statement: Dr.K.Baranidharan, SRI SAIRAM INSTITUTE OF TECHNOLOGY, CHENNAI 44Document17 pagesCash Flow Statement: Dr.K.Baranidharan, SRI SAIRAM INSTITUTE OF TECHNOLOGY, CHENNAI 44Dr.K.BaranidharanNo ratings yet

- Cash Flow StatementDocument19 pagesCash Flow StatementGokul KulNo ratings yet

- Financial Statement Analysis For Credit Decision Presented by Rabah ElmasriDocument5 pagesFinancial Statement Analysis For Credit Decision Presented by Rabah Elmasrinuwany2kNo ratings yet

- Cash Flow Statements: Deepti Gurvinder Jitender Niraj PalakDocument29 pagesCash Flow Statements: Deepti Gurvinder Jitender Niraj PalakPalak GoelNo ratings yet

- Ch-5 Cash Flow AnalysisDocument9 pagesCh-5 Cash Flow AnalysisQiqi GenshinNo ratings yet

- Nature of Cash & Cashflows Ma2Document12 pagesNature of Cash & Cashflows Ma2ali hansiNo ratings yet

- Theory On Fund FlowDocument7 pagesTheory On Fund FlowRajeev CuteboyNo ratings yet

- Statement of Cash FlowsDocument35 pagesStatement of Cash Flowsonthelinealways100% (4)

- Cash Flow Statments Lesson 16Document46 pagesCash Flow Statments Lesson 16Charos Aslonovna100% (1)

- The Cash Flow StatementsDocument13 pagesThe Cash Flow Statementsdeo omachNo ratings yet

- Funds Flow AnalysisDocument31 pagesFunds Flow Analysisadnan arshadNo ratings yet

- SCF - 3rd YrDocument27 pagesSCF - 3rd YrA.J. Chua100% (1)

- Cash Flow NotesDocument14 pagesCash Flow NotesProchetto Da100% (1)

- Managing The Venture's Financial ResourcesDocument28 pagesManaging The Venture's Financial ResourcesAnto DNo ratings yet

- Managerial Finance, Financial Accounting and Analysis For Engineering Managers PDFDocument5 pagesManagerial Finance, Financial Accounting and Analysis For Engineering Managers PDFAshuriko KazuNo ratings yet

- Accounting 3 Cash Flow Statement DiscussionDocument6 pagesAccounting 3 Cash Flow Statement DiscussionNoah HNo ratings yet

- Cashflow Project+SandhyaDocument71 pagesCashflow Project+Sandhyaabdulkhaderjeelani1480% (5)

- Terminalogies Used in Financial Statements and Insights From Annual ReportsDocument24 pagesTerminalogies Used in Financial Statements and Insights From Annual ReportsKaydawala Saifuddin 20100% (1)

- 01 - Financial Analysis Overview - Lecture MaterialDocument34 pages01 - Financial Analysis Overview - Lecture MaterialNaia SNo ratings yet

- Statement of Cash Flow: Lecture-8Document11 pagesStatement of Cash Flow: Lecture-8Nirjon BhowmicNo ratings yet

- Lecture 5 - Cash Flow StatementDocument60 pagesLecture 5 - Cash Flow StatementMutesa Chris100% (1)

- ACC501 - Lecture 22Document45 pagesACC501 - Lecture 22Shivati Singh Kahlon100% (1)

- What Is A Cash Flow StatementDocument4 pagesWhat Is A Cash Flow StatementDaniel GarciaNo ratings yet

- What Is 'Cash Flow'Document7 pagesWhat Is 'Cash Flow'Selvi VinoseKumarNo ratings yet

- Chapter 7 Statement of Cash FlowsDocument5 pagesChapter 7 Statement of Cash FlowskajsdkjqwelNo ratings yet

- Pas 7 - Statement of Cash FlowsDocument8 pagesPas 7 - Statement of Cash FlowsJohn Rafael Reyes PeloNo ratings yet

- Cash Flow StatementDocument11 pagesCash Flow StatementJonathanKelly Bitonga BargasoNo ratings yet

- Fabm 2 and FinanceDocument5 pagesFabm 2 and FinanceLenard TaberdoNo ratings yet

- Cash Flow StatementDocument10 pagesCash Flow Statementhitesh26881No ratings yet

- LESSON 07 - The Financial Aspect For EntrepreneursDocument28 pagesLESSON 07 - The Financial Aspect For Entrepreneurssalubrekimberly92No ratings yet

- Operating Cash FlowDocument3 pagesOperating Cash FlowmonumannaNo ratings yet

- Operating Cash FlowDocument3 pagesOperating Cash FlowmonumannaNo ratings yet

- Cash FlowDocument12 pagesCash FlowDivesh BabariaNo ratings yet

- Accounting & FinanceDocument17 pagesAccounting & FinanceInbasaat PirzadaNo ratings yet

- FM AssignmentDocument8 pagesFM Assignmentmihir_s9No ratings yet

- Cash Flow Statement TheoryDocument30 pagesCash Flow Statement Theorymohammedakbar88100% (5)

- Mid Term TopicsDocument10 pagesMid Term TopicsТемирлан АльпиевNo ratings yet

- 1 Financial Statements Cash Flows and TaxesDocument13 pages1 Financial Statements Cash Flows and TaxesAyanleke Julius OluwaseunfunmiNo ratings yet

- Cash Flow StatementDocument13 pagesCash Flow StatementMuhammed IbrahimNo ratings yet

- Financial Statement Analysis For Cash Flow StatementDocument5 pagesFinancial Statement Analysis For Cash Flow StatementOld School Value100% (3)

- Cashflow AnalysisDocument4 pagesCashflow AnalysisIdd Mic-dadyNo ratings yet

- FA - IAS 7 Statement of Cash FlowsDocument69 pagesFA - IAS 7 Statement of Cash FlowsMomiAbbas0069No ratings yet

- Cash Flow StatementDocument21 pagesCash Flow StatementthejojoseNo ratings yet

- Chapter 12Document8 pagesChapter 12Hareem Zoya WarsiNo ratings yet

- Accounting ConceptsDocument95 pagesAccounting Conceptsgaurav gargNo ratings yet

- The Four Financial StatementsDocument3 pagesThe Four Financial Statementsmuhammadtaimoorkhan100% (3)

- Cash Flow Statement PDFDocument18 pagesCash Flow Statement PDFPrithikaNo ratings yet

- Introduction Cash FlowDocument10 pagesIntroduction Cash FlowAmrit TejaniNo ratings yet

- Cash Flow Analysis2018Document54 pagesCash Flow Analysis2018En. Joe100% (1)

- Cash Flow - Wikipedia, The Free EncyclopediaDocument4 pagesCash Flow - Wikipedia, The Free EncyclopediaSachinsuhaNo ratings yet

- FADM Cheat SheetDocument2 pagesFADM Cheat Sheetvarun022084No ratings yet

- Cashflow-Project-Sandhya Hema FullDocument71 pagesCashflow-Project-Sandhya Hema Fullkannan Venkat100% (1)

- Cashflow-Project-Sandhya Hema FullDocument71 pagesCashflow-Project-Sandhya Hema Fullkannan VenkatNo ratings yet

- Cashflow-Project-Sandhya Hema FullDocument71 pagesCashflow-Project-Sandhya Hema Fullkannan VenkatNo ratings yet

- Preface Cash Flow Analysis Is The Study of The Cycle of Your Business' Cash Inflows and OutflowsDocument45 pagesPreface Cash Flow Analysis Is The Study of The Cycle of Your Business' Cash Inflows and Outflowskannan VenkatNo ratings yet

- Financial Accounting - Want to Become Financial Accountant in 30 Days?From EverandFinancial Accounting - Want to Become Financial Accountant in 30 Days?Rating: 3.5 out of 5 stars3.5/5 (2)

- PA00M4F9Document35 pagesPA00M4F9Mohammad SahiliNo ratings yet

- CSA report template (1)Document8 pagesCSA report template (1)Mohammad SahiliNo ratings yet

- pdf_20230221_211330_0000Document1 pagepdf_20230221_211330_0000Mohammad SahiliNo ratings yet

- Marketing project FinalDocument27 pagesMarketing project FinalMohammad SahiliNo ratings yet

- Assets, LiabilitiesDocument3 pagesAssets, LiabilitiesMohammad SahiliNo ratings yet

- Double Entry SystemDocument26 pagesDouble Entry SystemMohammad SahiliNo ratings yet

- CFP Mock Test Introduction To Financial PlanningDocument7 pagesCFP Mock Test Introduction To Financial PlanningDeep ShikhaNo ratings yet

- 024 Defining-Value-Vbhc enDocument94 pages024 Defining-Value-Vbhc enmert05No ratings yet

- Problems For Topic 3Document4 pagesProblems For Topic 3Quỳnh Anh TrầnNo ratings yet

- 6 Causes of Miscommunication - How To Use Plain Language EffectivelyDocument14 pages6 Causes of Miscommunication - How To Use Plain Language EffectivelyLouiegie B. MendozaNo ratings yet

- Chapter 19 Financial Statement Analysis AnswerDocument53 pagesChapter 19 Financial Statement Analysis AnswerHằngNo ratings yet

- Bhavik Gandhi ResumeDocument1 pageBhavik Gandhi ResumeBhavik GandhiNo ratings yet

- About Parag Parikh Flexi Cap Fund: (Please Visit Page 2)Document13 pagesAbout Parag Parikh Flexi Cap Fund: (Please Visit Page 2)sbk018No ratings yet

- Casestudy On Kingfisher AirlinesDocument5 pagesCasestudy On Kingfisher Airlinesbette_ruffles60% (10)

- Gold Monetization Scheme.Document26 pagesGold Monetization Scheme.keerthiNo ratings yet

- Introduction To Financial Statement AnalysisDocument2 pagesIntroduction To Financial Statement AnalysisTričiaStypayhørliksønNo ratings yet

- Trade Station Calculated IndicesDocument33 pagesTrade Station Calculated IndicesviccarterNo ratings yet

- Book 2Document2 pagesBook 2Khang TrầnNo ratings yet

- Deloitte Oil & Gas Mergers and Acquisitions ReportDocument52 pagesDeloitte Oil & Gas Mergers and Acquisitions ReportAnithaNo ratings yet

- Ice Cream ProjectDocument53 pagesIce Cream Projectblackrose_nhungNo ratings yet

- Basic Finance Module Materials List of Modules: No. Module Title CodeDocument49 pagesBasic Finance Module Materials List of Modules: No. Module Title CodeShaina LimNo ratings yet

- The Uniform System of AccountsDocument5 pagesThe Uniform System of AccountsThang Jason TranNo ratings yet

- Oil PricingDocument68 pagesOil Pricingyash saragiya100% (2)

- Total Financial RatiosDocument2 pagesTotal Financial RatioshoangsubaxdNo ratings yet

- Chart PattrenDocument5 pagesChart PattrenmouddenzaydNo ratings yet

- Ross12e Chapter06 TBDocument26 pagesRoss12e Chapter06 TBHải YếnNo ratings yet

- 2023 Financial MathsDocument5 pages2023 Financial MathscaitlynntangNo ratings yet

- MBB 15 - Environmental and Social Risk Management For MFIsDocument8 pagesMBB 15 - Environmental and Social Risk Management For MFIsAen071No ratings yet

- BCK Test Paper (40 Marks) Nov 2023 With AnswersDocument6 pagesBCK Test Paper (40 Marks) Nov 2023 With Answersbaidshruti123No ratings yet

- Personal Finance BulletinDocument7 pagesPersonal Finance Bulletinfarazalam08No ratings yet

- Celebrity EndorsementDocument13 pagesCelebrity EndorsementMuhammad ZeshanNo ratings yet

- Case Study - Newland TechnologiesDocument10 pagesCase Study - Newland TechnologiesKartik Tewari50% (2)

- Financial MarketDocument14 pagesFinancial MarketDavid DavidNo ratings yet