Professional Documents

Culture Documents

Basics & House Property - Paper

Basics & House Property - Paper

Uploaded by

vishwajeetpatil0542Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Basics & House Property - Paper

Basics & House Property - Paper

Uploaded by

vishwajeetpatil0542Copyright:

Available Formats

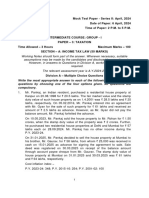

Topic wise Test Papers of CA Inter - Direct Tax – MAY-24 Exams

Topic: Basics, Agriculture Income & House Property

Total Marks: 47 Marks

Time Allowed: 90 minute

Questions:

Part-A Multiple Choice Questions

[Total 10 Marks]

1. Mr. Ashutosh, aged 65 years and a resident in India, has a total income of ` 3,20,00,000, comprising

long term capital gain taxable under section 112 of ` 57,00,000, long term capital gain taxable under

section 112A of ` 65,00,000 and other income of ` 1,98,00,000. What would be his tax liability for

A.Y. 2024-25. Assume that Mr. Ashutosh has not opted for the provisions of section 115BAC.

(a) ` 90,05,880

(b) ` 97,25,690

(c) ` 97,34,400

(d) ` 97,22,440

2. What is the amount of marginal relief available to Sadvichar Ltd., a domestic company, on the total

income of `10,03,50,000 for P.Y. 2023-24 (comprising only of business income) whose turnover in

P.Y. 2021-22 is ` 450 crore, paying tax as per regular provisions of Income-tax Act? Assume that the

company does not exercise option under section 115BAA.

(a) ` 9,98,000

(b) ` 12,67,600

(c) ` 3,50,000

(d) ` 13,32,304

3. For A.Y.2024-25, Mr. Hari, a resident Indian, earns income of ` 10 lakhs from sale of rubber

manufactured from latex obtained from rubber plants grown by him in India and ` 15 lakhs from sale

of rubber manufactured from latex obtained from rubber plants grown by him in Malaysia. What would

be his business income chargeable to tax in India, assuming he has no other business?

(a) ` 3,50,000

(b) ` 4,00,000

(c) ` 8,75,000

(d) ` 18,50,000

4. Ms. Sowmya has three farm buildings situated in the immediate vicinity of a rural agricultural land. In

the P.Y.2023-24, she earned ` 3 lakh from letting out her farm building 1 for storage of food grains, `

10 lakh from letting out her farm building 2 for storage of dairy products and ` 15 lakh from letting out

her farm building 3 for residential purposes of Mr. Sumanth, whose food grain produce is stored in

farm building 1. What is the amount of agricultural income exempt from income-tax?

(a) Nil

(b) ` 3,00,000

(c) ` 13,00,000

(d) ` 18,00,000

CA Bhanwar Borana BB VIRTUALS

2 Test Papers of CA Inter - Direct Tax - MAY/NOV-24 Exams — Questions

5. Mr. Virat has a house property in Chennai which he let out to Mr. Sumit. For acquisition of this house,

Mr. Virat has taken a loan of ` 30,00,000 @10% p.a. on 1-4-2017. He has further taken a loan of ` 5

lakhs @12% p.a. on 1.7.2023 towards repairs of the house. He has not repaid any amount of loan so

far. The amount of interest deduction u/s 24(b) to Mr. Virat for A.Y. 2024-25 if he opted for the

provisions of section 115BAC is –

(a) ` 2,00,000 (b) ` 2,30,000 (c) ` 3,45,000 (d) ` 3,60,000

CA Bhanwar Borana BB VIRTUALS

Test Papers of CA Inter - Direct Tax - MAY/NOV-23 Exams — Questions 3

Part-B Descriptive Questions

Question: 1

Mr. Roy owns a house in Kolkata. During the previous year 2023-24, 3/4th portion of the house was self-

occupied and 1/4th portion was let out for residential purposes at a rent of ` 12,000 p.m. The tenant vacated the

property on 28th February, 2024. The property was vacant during March, 2024. Rent for the months of January

2024 and February 2024 could not be realised in spite of the owner’s efforts. All the conditions prescribed

under Rule 4 are satisfied.

Municipal value of the property is ` 4,50,000 p.a., fair rent is ` 4,70,000 p.a. and standard rent is ` 5,00,000.

He paid municipal taxes @10% of municipal value during the year. A loan of ` 30,00,000 was taken by him

during the year 2014 for acquiring the property. Interest on loan paid during the previous year 2023-24 was `

1,51,000. Compute Roy’s income from house property for the A.Y. 2024-25. [7 Marks]

Question: 2

Compute the tax liability of Mr. B (aged 51), having total income of ` 1,01,00,000 for the Assessment Year

2024-25. Assume that his total income comprises of salary income, Income from house property and interest

on fixed deposit and in both the regime his total income is same.

(i) Mr. B opted default taxation regime u/s 115BAC.

(ii) Mr. B opt out from default taxation regime and followed normal provisions. [7 Marks]

Question: 3

Mr. Raghav aged 26 years and a resident in India, has a total income of ` 6,50,000, comprising his salary

income and interest on bank fixed deposit. Compute his tax liability for A.Y.2024-25 under default tax regime

under section 115BAC. [3 Marks]

Question: 4

Mr. X, a resident (age 40 Years), has provided the following particulars of his income for the P.Y.2023-24. i.e.

(i) Income from salary (computed) - ` 4,00,000

(ii) Income from house property (computed) - ` 3,80,000

(iii) Agricultural income from a land in Assam - ` 4,50,000

(iv) Expenses incurred for earning agricultural income - ` 1,60,000

Compute his tax liability for A.Y. 2024-25. [8 Marks]

Question: 5

Mr. Raja, a resident Indian, earns income of ` 10 lakhs from sale of coffee grown and cured in India during the

A.Y. 2024-25. His friend, Mr. Shyam, a resident Indian, earns income of ` 20 lakhs from sale of coffee grown,

cured, roasted and grounded by him in India during the A.Y.2024-25. What would be the business income

chargeable to tax in India of Mr. Raja and Mr. Shyam? [4 Marks]

Question: 6

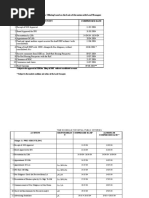

Mr. Akash owns a residential house property whose Municipal Value, Fair Rent and Standard Rent are `

1,60,000, ` 1,70,000 and ` 1,90,000, respectively. The house has two independent units. Unit I (25% of floor

area) is utilized for the purpose of his profession and Unit II (75% of floor area) is let out for residential purposes

at a monthly rent of ` 8,500. Municipal taxes @8% of the Municipal Value were paid during the year by Mr.

Akash. He made the following payments in respect of the house property during the previous year 2023-24:

CA Bhanwar Borana BB VIRTUALS

4 Test Papers of CA Inter - Direct Tax - MAY/NOV-24 Exams — Questions

Light and Water charges ` 2,000, Repairs ` 1,45,000, Interest on loan taken for the repair of property ` 36,000.

Mr. Akash has taken a loan of ` 5,00,000 in July, 2017 for the construction of the above house property.

Construction was completed on 30th June, 2020. He paid interest on loan @12% per annum and every month

such interest was paid. No repayment of loan has been made so far.

Income of Mr. Akash from his profession amounted to ` 8,00,000 during the year (without debiting house rent

and other incidental expenditure including admissible depreciation of ` 8,000 on the portion of house used for

profession).

Determine the Gross total income of Mr. Akash for the A.Y. 2024-25 ignoring the provisions of section

115BAC. [8 Marks]

CA Bhanwar Borana BB VIRTUALS

You might also like

- Final Project Report On Tax Planning PDFDocument69 pagesFinal Project Report On Tax Planning PDFKomal Nanware75% (63)

- Managing ExpectationsDocument16 pagesManaging ExpectationsAnthony Saliba50% (6)

- Dicionário Jurídico Ingles Portugues Pinheiro Neto - Law DictionaryDocument169 pagesDicionário Jurídico Ingles Portugues Pinheiro Neto - Law DictionaryRenata Miranda89% (18)

- Computerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionFrom EverandComputerised Accounting Practice Set Using MYOB AccountRight - Advanced Level: Australian EditionNo ratings yet

- TEST - 1 NOV 23 Batch Basics & HPDocument4 pagesTEST - 1 NOV 23 Batch Basics & HPyashsatardekar2206No ratings yet

- Test Paper 1 CA INTER MAYNOV 2024 Basics & House PropertyDocument4 pagesTest Paper 1 CA INTER MAYNOV 2024 Basics & House Propertymshivam617No ratings yet

- Tax Mock Test PaperDocument17 pagesTax Mock Test Papermanyagoyall20No ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperVenkataRajuNo ratings yet

- Basics & House Property - PaperDocument5 pagesBasics & House Property - PaperLaavanya JainNo ratings yet

- CA INTER CompilerDocument12 pagesCA INTER CompilernehajnvniwarsiNo ratings yet

- MTP 10 17 Questions 1694188914Document11 pagesMTP 10 17 Questions 1694188914luvkumar3532No ratings yet

- MTP 19 50 Questions 1712317445Document13 pagesMTP 19 50 Questions 1712317445Nitin KumarNo ratings yet

- UntitledDocument11 pagesUntitleddeepika devsaniNo ratings yet

- Question Test Paper 2 - NOV 2023Document2 pagesQuestion Test Paper 2 - NOV 2023ABCXYZNo ratings yet

- Tax - MTP2 - QP - M24 @CAInterLegendsDocument17 pagesTax - MTP2 - QP - M24 @CAInterLegendsPrince ManglaNo ratings yet

- Final DT MCQ BookletDocument95 pagesFinal DT MCQ BookletSavya Sachi100% (1)

- Paper 4: Taxation Section A: Income Tax Law: Questions and AnswersDocument24 pagesPaper 4: Taxation Section A: Income Tax Law: Questions and AnswersShivani KumariNo ratings yet

- Tax (Old) Q Mtp1 Ipc Oct21Document10 pagesTax (Old) Q Mtp1 Ipc Oct21Karan Singh RanaNo ratings yet

- MTP 2 TaxDocument10 pagesMTP 2 TaxPrathmesh JambhulkarNo ratings yet

- CA Inter Tax Q MTP 2 May 2024 Castudynotes ComDocument13 pagesCA Inter Tax Q MTP 2 May 2024 Castudynotes ComineffableadityisticNo ratings yet

- Test Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)Document11 pagesTest Series: March, 2021 Mock Test Paper 1 Intermediate (New) Course Paper - 4: Taxation Time Allowed - 3 Hours Maximum Marks - 100 Section - A: Income Tax Law (60 Marks)M100% (1)

- Capital Gain & IFOS - PaperDocument3 pagesCapital Gain & IFOS - Papermshivam617No ratings yet

- House Property - Paper MAY NOV 24Document5 pagesHouse Property - Paper MAY NOV 24gkumar10121979No ratings yet

- Part - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceDocument12 pagesPart - I (MCQS) All Mcqs Are Compulsory: Permission Is Punishable OffenceShashwat SharmaNo ratings yet

- Tax Nov 22 RTPDocument28 pagesTax Nov 22 RTPShailjaNo ratings yet

- 1643296847cma Inter DT MCQ Jd22Document216 pages1643296847cma Inter DT MCQ Jd22Vibha Gupta100% (1)

- Residential Status, Exempt Income & AMT - PaperDocument6 pagesResidential Status, Exempt Income & AMT - PaperBharatbhusan RoutNo ratings yet

- Tax Old Q Mtp1 Ipc Oct21Document10 pagesTax Old Q Mtp1 Ipc Oct21abhishankar2904No ratings yet

- CA Inter Taxation Q MTP 2 May 23Document11 pagesCA Inter Taxation Q MTP 2 May 23sureshstipl sureshNo ratings yet

- Mock Test - 2-2Document10 pagesMock Test - 2-2Deepsikha maitiNo ratings yet

- MTP 12 17 Questions 1696512917Document11 pagesMTP 12 17 Questions 1696512917harshallahotNo ratings yet

- CS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaDocument269 pagesCS Executive OLD SYLLABUS MCQs JUNE 2024 by CA Vivek GabaParitoshNo ratings yet

- TaxationDocument24 pagesTaxation1088Anushka SharmaNo ratings yet

- May 2024 Full Length DT Test 2Document6 pagesMay 2024 Full Length DT Test 2Jyoti ManwaniNo ratings yet

- 78728bos63016 p3Document34 pages78728bos63016 p3dileepkarumuri93No ratings yet

- Series I - QuestionsDocument11 pagesSeries I - QuestionsAlok MishraNo ratings yet

- DT MCQs & Case Scenarios Booklet Solutions Yash KhandelwalDocument89 pagesDT MCQs & Case Scenarios Booklet Solutions Yash Khandelwalhtassociates12No ratings yet

- May 23 Tax RTPDocument24 pagesMay 23 Tax RTPShailjaNo ratings yet

- Question BankDocument146 pagesQuestion BankSanskriti JainNo ratings yet

- DT 2 New Question PaperDocument11 pagesDT 2 New Question Paperneha manglaniNo ratings yet

- Direct Tax Laws Detail Test 1 May 2024 Test Paper 1702105507Document9 pagesDirect Tax Laws Detail Test 1 May 2024 Test Paper 1702105507shauryagupta20013007No ratings yet

- DT Test 1Document3 pagesDT Test 1D. NEERAJ kumarNo ratings yet

- CA Inter Tax RTP May 2023Document24 pagesCA Inter Tax RTP May 2023olivegreen52No ratings yet

- INCOME TAX TEST 2 100 MARKS With Answer by CA VIVEK GABADocument16 pagesINCOME TAX TEST 2 100 MARKS With Answer by CA VIVEK GABAAmiya Upadhyay100% (1)

- CA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSDocument8 pagesCA FINAL Class Test Paper MAY/NOV-22 Exams Topics: Basics, Capital Gain & IFOSMayank GoyalNo ratings yet

- DT BB TestDocument5 pagesDT BB TestMayank GoyalNo ratings yet

- MTP 17 50 Questions 1709941063Document15 pagesMTP 17 50 Questions 1709941063Naveen R HegadeNo ratings yet

- MCQ House PropertyDocument12 pagesMCQ House PropertyKunal KapoorNo ratings yet

- 1686044906DTS-2 Taxation CA InteranswerDocument11 pages1686044906DTS-2 Taxation CA InteranswerViraj SharmaNo ratings yet

- HP MCQDocument7 pagesHP MCQ887 shivam guptaNo ratings yet

- Sem - IV Taxation - I Sample Paper-1Document5 pagesSem - IV Taxation - I Sample Paper-1yadavkari497No ratings yet

- Final DT 30 QPDocument6 pagesFinal DT 30 QPshivam chaturvediNo ratings yet

- CA Inter Taxation Q MTP 1 May 2024 Castudynotes ComDocument15 pagesCA Inter Taxation Q MTP 1 May 2024 Castudynotes Comraghavkanoongo3No ratings yet

- Taxation MTP 1 QuestionsDocument9 pagesTaxation MTP 1 QuestionsVishal Kumar 5504No ratings yet

- CA Inter N22 - Tax Model QPDocument14 pagesCA Inter N22 - Tax Model QPNAVEEN SURYA MNo ratings yet

- Sem 3rd INTERNAl - Income Tax Law & PracticeDocument2 pagesSem 3rd INTERNAl - Income Tax Law & PracticeAdarsh SinghNo ratings yet

- Tax Laws: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate To TheDocument8 pagesTax Laws: NOTE: All References To Sections Mentioned in Part-A of The Question Paper Relate To ThePriya MalhotraNo ratings yet

- Test Series - Set 5 - Ay 20-21Document16 pagesTest Series - Set 5 - Ay 20-21Urusi TeklaNo ratings yet

- MTP Taxation Question Paper 2Document12 pagesMTP Taxation Question Paper 2CursedAfNo ratings yet

- Direct Tax-IDocument21 pagesDirect Tax-Ivivek rajakNo ratings yet

- tax qpDocument6 pagestax qpAashish kumarNo ratings yet

- Salary - PaperDocument5 pagesSalary - PaperVenkataRajuNo ratings yet

- Tax AnswersDocument168 pagesTax AnswersukqrnnnjhfwsxqoykuNo ratings yet

- Costing 4Document67 pagesCosting 4vishwajeetpatil0542No ratings yet

- CamScanner 09-14-2022 18.45Document1 pageCamScanner 09-14-2022 18.45vishwajeetpatil0542No ratings yet

- Zydus Wellness: About CompanyDocument3 pagesZydus Wellness: About Companyvishwajeetpatil0542No ratings yet

- IcaiDocument2 pagesIcaivishwajeetpatil0542No ratings yet

- ICICI Bank LTD: About CompanyDocument4 pagesICICI Bank LTD: About Companyvishwajeetpatil0542No ratings yet

- Basics & House Property - SolutionDocument6 pagesBasics & House Property - Solutionvishwajeetpatil0542No ratings yet

- Risk Assessments For FormworkDocument1 pageRisk Assessments For FormworkQays YousefNo ratings yet

- 5143 - IMS - 00 - A - Quality ManualDocument35 pages5143 - IMS - 00 - A - Quality ManualNizar BoubakerNo ratings yet

- A2Z E-Commerce Website BRD: Bolt SolutionDocument54 pagesA2Z E-Commerce Website BRD: Bolt Solutionaspany loisNo ratings yet

- Sofa Case Study 7 - Steps and ExplanationsDocument2 pagesSofa Case Study 7 - Steps and ExplanationsCONV mitchNo ratings yet

- CJR Bahasa InggrisDocument16 pagesCJR Bahasa InggrisAnggi EmaliaNo ratings yet

- Daniel Oscar Baskoro - Embracing Digital Transformation in The Mining IndustryDocument25 pagesDaniel Oscar Baskoro - Embracing Digital Transformation in The Mining IndustrySabarNo ratings yet

- The CHIBI AdventureDocument19 pagesThe CHIBI AdventureEmre UgurNo ratings yet

- FBR Income Tax Detail of NSBDocument9 pagesFBR Income Tax Detail of NSBhamza naeemNo ratings yet

- Final Contemprory ManagementDocument8 pagesFinal Contemprory ManagementA.Rahman SalahNo ratings yet

- Welding JraDocument3 pagesWelding Jraaone mothupiNo ratings yet

- ITSM Scenarios Use Cases 1706233225Document12 pagesITSM Scenarios Use Cases 1706233225dsg1607No ratings yet

- ĐỀ THI NLKT ĐỀ 8Document3 pagesĐỀ THI NLKT ĐỀ 8Khánh LêNo ratings yet

- K and Ns Health and Happiness For PakistDocument6 pagesK and Ns Health and Happiness For PakistMuneeb AhmadNo ratings yet

- Cambridge IGCSE® Enterprise Coursebook (Houghton, Medi, Bryant, Matthew, Jain, Veenu) (Z-Library)Document159 pagesCambridge IGCSE® Enterprise Coursebook (Houghton, Medi, Bryant, Matthew, Jain, Veenu) (Z-Library)helenlxzNo ratings yet

- Backlonk Sites ListsDocument7 pagesBacklonk Sites Listsmohit kumarNo ratings yet

- Project Report On Lakme PDFDocument66 pagesProject Report On Lakme PDFMithun Konjath30% (10)

- Introduction To Accounting: Certificate in Accounting and Finance Stage ExaminationDocument5 pagesIntroduction To Accounting: Certificate in Accounting and Finance Stage ExaminationSYED ANEES ALINo ratings yet

- Chapter 2 THE EXTERNAL ASSESSMENTDocument11 pagesChapter 2 THE EXTERNAL ASSESSMENTPeter John SabasNo ratings yet

- Auditor Independence: Independence of Mind and AppearanceDocument3 pagesAuditor Independence: Independence of Mind and AppearancemanderiaNo ratings yet

- Total Quality ManagementDocument13 pagesTotal Quality ManagementVikas JainNo ratings yet

- SW - Homework 3 - Analyzing AbstractsDocument2 pagesSW - Homework 3 - Analyzing AbstractsMinh Anh NguyễnNo ratings yet

- Auditing TheoryDocument2 pagesAuditing TheoryMervidelleNo ratings yet

- Glossary 3Document8 pagesGlossary 3kalpana andraNo ratings yet

- Contract of Sale - Cooperative Apartment 2001Document6 pagesContract of Sale - Cooperative Apartment 2001Annie Young-KohbergerNo ratings yet

- Caso Logistica Ingles CompletoDocument15 pagesCaso Logistica Ingles CompletoFarley ZamudioNo ratings yet

- IPO ChecklistDocument8 pagesIPO Checklistpbush998873No ratings yet

- OutlineDocument9 pagesOutline姚嘉杭No ratings yet