Professional Documents

Culture Documents

Understanding Your Payslip

Understanding Your Payslip

Uploaded by

mariamaquengo36Original Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Understanding Your Payslip

Understanding Your Payslip

Uploaded by

mariamaquengo36Copyright:

Available Formats

Understanding Your Payslip

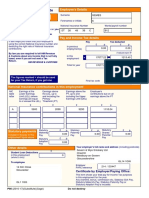

Employee & PAYE

Information

Assignment Number – This Inc. Date - Date of your next pay Tax Office Name - Tax Office that

should be quoted in all step/increment or when you is responsible for your employer’s

correspondence and will be reached the maximum point of Tax Account

suffixed with -1, -2 etc if you have your payscale Tax Office Ref - This is required if

more than one post Standard Hours – Contracted you need to speak to HMRC

Payscale Description - Payscale hours Tax Code – Code as allocated by

which you are paid on PT Sal/Wage - Salary paid, this HMRC

Sal/Wage - Full Time salary for shows as a reduced amount if NI Number - National Insurance

grade you are part time Number

Pay & Allowances Deductions

Description – Details all payments made in the pay period This shows all the statutory

Wkd/Earned – Total hours worked and voluntary deductions that

Paid/Due - Number of hours payment is calculated on will be made from your pay

Rate – Amount the allowance is calculated on, e.g., hourly rate

Amount - Payment that will be made

Year To Date Balances This Period Summary Common abbreviations used

This section shows the total amounts you have received and had This shows the total amounts OSP Occupational Sick Pay

ARRS Arrears payment

deducted in the current tax year to the end of the period you are being you have received and had R Refund

EN Enhancement payment (e.g., unsocial)

paid for. deducted in the current pay ShPL Shared Parental Leave

OT Overtime payment (e.g., Saturday)

PAYE details will be included in your P60 at the end of the tax year. period. SMP Statutory Maternity Pay

NNI Payment not subject to NI contributions

Pension details will added to your NHS Pension record. It includes details of the date SSP Statutory Sick Pay

NP Non-Pensionable

SD Ref Number is your Employee reference number for your NHS you will be paid, how you will PAYE Pay as you earn

OMP Occupational Maternity Pay

Pension and should be quoted in any correspondence you have with be paid e.g. BACS and how

NHS Pensions. much will paid (Net Pay).

You might also like

- Sample Bank Statement PDFDocument4 pagesSample Bank Statement PDFSinchai Jones57% (7)

- Statement 1Document15 pagesStatement 1Adri antoNo ratings yet

- Pas 12 Income TaxesDocument4 pagesPas 12 Income TaxesFabrienne Kate Eugenio Liberato100% (1)

- Pay Slip TemplateDocument3 pagesPay Slip TemplateSujee HnbaNo ratings yet

- Induction V23 PDFDocument20 pagesInduction V23 PDFNagendra KumarNo ratings yet

- Understanding Your NHS Payslip 2022-2023Document20 pagesUnderstanding Your NHS Payslip 2022-2023UmasankarNo ratings yet

- Payslip GuideDocument2 pagesPayslip GuidesarahvirzidesignsNo ratings yet

- Guidance - BD Nextra Employee Calc To EASY Payslip ExplanationDocument6 pagesGuidance - BD Nextra Employee Calc To EASY Payslip ExplanationaicacsaicacsNo ratings yet

- Swissport - Payslip GuideDocument4 pagesSwissport - Payslip Guideazaan2005No ratings yet

- How To Access and Understand Your PayslipDocument9 pagesHow To Access and Understand Your PayslipbucalaeteclaudialoredanaNo ratings yet

- Su505i 2012enDocument3 pagesSu505i 2012entulkd91No ratings yet

- x6cWiJTtNswqquGU1iymdf2w NGURPv8eI9mmdBTx1gxAUB1ddV7CtLbXVshNVSJhOKZAZ0l7-k-maA2DqNc66ObsoxWTOzDJ5CL OapJjqfDocument1 pagex6cWiJTtNswqquGU1iymdf2w NGURPv8eI9mmdBTx1gxAUB1ddV7CtLbXVshNVSJhOKZAZ0l7-k-maA2DqNc66ObsoxWTOzDJ5CL OapJjqfAdemuyiwa OlaniyiNo ratings yet

- How To Read Your Payslip - MonthlyPaid - 2022Document2 pagesHow To Read Your Payslip - MonthlyPaid - 2022VladyslavNo ratings yet

- HR Block Income Tax Return Checklist Individuals 0620 FADocument1 pageHR Block Income Tax Return Checklist Individuals 0620 FAdeNo ratings yet

- HR Block Income Tax Return Checklist Individuals 0620 FADocument1 pageHR Block Income Tax Return Checklist Individuals 0620 FAAlNo ratings yet

- Payroll ChecklistDocument1 pagePayroll ChecklistDummy accountNo ratings yet

- Credit Assessment of Housing Loans in Australia: Data Compiled by Dr. D. Sreenivasa CharyDocument45 pagesCredit Assessment of Housing Loans in Australia: Data Compiled by Dr. D. Sreenivasa Charysaumya tiwariNo ratings yet

- P60 Single Sheet 2022 To 2023Document1 pageP60 Single Sheet 2022 To 2023Manuel Brites FerreiraNo ratings yet

- SSSForm Member Loan Payment ReturnDocument1 pageSSSForm Member Loan Payment ReturnDream CunananNo ratings yet

- Downloads My Downloads 673Document1 pageDownloads My Downloads 673Katalin GemesNo ratings yet

- SSSForm - Member - Loan - Payment - Return 082020Document1 pageSSSForm - Member - Loan - Payment - Return 082020CaNo ratings yet

- ML 1Document1 pageML 1Ryan BonifacioNo ratings yet

- SSSForm - Member - Loan - Payment - Return CHARM 022023Document1 pageSSSForm - Member - Loan - Payment - Return CHARM 022023toncyespyjrNo ratings yet

- Ebook Compensation PayrollDocument9 pagesEbook Compensation PayrollKhyati BhardwajNo ratings yet

- FNF GuidelinesDocument1 pageFNF Guidelinesv.kisanNo ratings yet

- Full Service Payroll Set Up Checklist 2018Document1 pageFull Service Payroll Set Up Checklist 2018Anne EtrerozNo ratings yet

- Employee T4 Tax Slip Guide 2021 1Document1 pageEmployee T4 Tax Slip Guide 2021 1amanbajwa385No ratings yet

- Understanding Your Payslip Version 2016Document5 pagesUnderstanding Your Payslip Version 2016Ravi jiNo ratings yet

- CAN PayslipGuide enDocument5 pagesCAN PayslipGuide enreachtobloggerNo ratings yet

- QGov Your Payslip ExplainedDocument2 pagesQGov Your Payslip ExplainedbradrimmNo ratings yet

- Establishing and Maintaining Payroll System NewDocument12 pagesEstablishing and Maintaining Payroll System NewDagnachew WeldegebrielNo ratings yet

- Process Flow To Submit Tax Regime4102023Document12 pagesProcess Flow To Submit Tax Regime4102023Gokul KrishNo ratings yet

- P60single 2Document1 pageP60single 2Claira JervisNo ratings yet

- INCTAX Chapter 8 Lecture NotesDocument4 pagesINCTAX Chapter 8 Lecture NotesJoshua LisingNo ratings yet

- Your Complete Guide To Canadian Payroll (2022)Document35 pagesYour Complete Guide To Canadian Payroll (2022)petitmar1No ratings yet

- P60 For Year 2021/22Document1 pageP60 For Year 2021/22gd9pnygr27No ratings yet

- Accounting StudyDocument17 pagesAccounting StudyNhi TrầnNo ratings yet

- 4.03 Key Terms For Preparing PayrollDocument21 pages4.03 Key Terms For Preparing Payrollapi-262218593No ratings yet

- Remittance VoucherDocument2 pagesRemittance VoucherЕвгений БулгаковNo ratings yet

- Salary and Vacation Accrual Example Fiscal Year 2004: Executive SummaryDocument24 pagesSalary and Vacation Accrual Example Fiscal Year 2004: Executive Summarysaif22sNo ratings yet

- Franco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)Document1 pageFranco & Ciccio Limited - P60 End of Year Summary For Year 2022-23 For Abdul Mannan Bhuiyan (83) (ST 48 74 73 B)abdul mannan bhuiyanNo ratings yet

- PAS 12 INCOME TAXES Cont With ProbsDocument8 pagesPAS 12 INCOME TAXES Cont With ProbsFabrienne Kate Eugenio Liberato100% (1)

- p1779 PDFDocument2 pagesp1779 PDFkNo ratings yet

- MinterEllison Pro Bono COVID-19 Small Business Support Guide 1 May 2020Document5 pagesMinterEllison Pro Bono COVID-19 Small Business Support Guide 1 May 2020Michael LoNo ratings yet

- Entrep MODULE 7Document4 pagesEntrep MODULE 7stephen allan ambalaNo ratings yet

- BUS39409 N 10060514Document12 pagesBUS39409 N 10060514edible.plants.loverNo ratings yet

- IAS 12 Income Taxes STDocument12 pagesIAS 12 Income Taxes STNazmi PllanaNo ratings yet

- HeaderDocument5 pagesHeaderSudarsan Reddy Eragam ReddyNo ratings yet

- Change in Salary Structure Minimum Wages 30-08-2023Document2 pagesChange in Salary Structure Minimum Wages 30-08-2023Saquib ShaikhNo ratings yet

- Private and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASDocument1 pagePrivate and Confidential Mrs. Mihaela Misca 41 Prosser Street Wolverhampton West Midlands WV10 9ASMihaela MiscaNo ratings yet

- Earn Codes DescrDocument296 pagesEarn Codes DescrJaymee Andomang Os-agNo ratings yet

- RPT AFC2 ND PayrollDocument4 pagesRPT AFC2 ND Payrollpisey povNo ratings yet

- Income Taxes Lang HehezDocument8 pagesIncome Taxes Lang HehezDiana Rose BassigNo ratings yet

- Accruals and DeferralsDocument2 pagesAccruals and DeferralsravisankarNo ratings yet

- Ep60 2016-17 PDFDocument1 pageEp60 2016-17 PDFAnonymous ZoN0SOKzVNo ratings yet

- EMBA - Lecture 7Document9 pagesEMBA - Lecture 7Shariq EjazNo ratings yet

- 13 - Provident FundDocument6 pages13 - Provident FundNishu GargNo ratings yet

- Tax1 TransDocument52 pagesTax1 Transethel hyugaNo ratings yet

- Ind As 12: Income Taxes: Definitions Concept Insight ExamplesDocument2 pagesInd As 12: Income Taxes: Definitions Concept Insight ExamplesDeepak singhNo ratings yet

- Measurement of Income 2Document26 pagesMeasurement of Income 2Abinash MishraNo ratings yet

- Bookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthFrom EverandBookkeeping 101 For Business Professionals | Increase Your Accounting Skills And Create More Financial Stability And WealthNo ratings yet

- Arcade Interior Mall LLP: Performa Invoice / QuotationDocument4 pagesArcade Interior Mall LLP: Performa Invoice / QuotationSourabh JaatNo ratings yet

- 102-101728601 185413078 98180XXXXX 8 2023Document7 pages102-101728601 185413078 98180XXXXX 8 2023bps777No ratings yet

- Proforma - Silgan - Ftir-AtrDocument1 pageProforma - Silgan - Ftir-AtrmigueldemacrolabNo ratings yet

- Scbank Makemytrip TNCDocument2 pagesScbank Makemytrip TNCu4rishiNo ratings yet

- Tax Invoice: Invoice Number: C16697T230055286Document1 pageTax Invoice: Invoice Number: C16697T230055286Sunny KhanNo ratings yet

- This Study Resource Was: Midterm Quiz 1 - Business Registration and VAT ExemptDocument6 pagesThis Study Resource Was: Midterm Quiz 1 - Business Registration and VAT ExemptJosephine CastilloNo ratings yet

- Form16 Part ADocument2 pagesForm16 Part ATrinadh CheemaladinneNo ratings yet

- Howcan I Buy A Gift Card in Hong Kong - Google SearchDocument1 pageHowcan I Buy A Gift Card in Hong Kong - Google SearchPayment Cash outNo ratings yet

- View Payslip: Personal Information Job InformationDocument1 pageView Payslip: Personal Information Job InformationJeffreyNo ratings yet

- US Internal Revenue Service: rr-99-40Document10 pagesUS Internal Revenue Service: rr-99-40IRSNo ratings yet

- Santos-Vs-Servier-PhilippinesDocument2 pagesSantos-Vs-Servier-PhilippinesAnonymous V0JQmPJc33% (6)

- Goods & Services Act FinalDocument78 pagesGoods & Services Act FinalParvesh AghiNo ratings yet

- CIR V Lingayen Gulf DigestDocument3 pagesCIR V Lingayen Gulf DigestDonn LinNo ratings yet

- Multan Electric Power Company: Say No To CorruptionDocument1 pageMultan Electric Power Company: Say No To CorruptionHaroon JaswalNo ratings yet

- Research Project Credit CardsDocument9 pagesResearch Project Credit CardsVikas Bansal0% (1)

- Not Ready For DispatchDocument1 pageNot Ready For DispatchRAHUL MAHAJANNo ratings yet

- 6th SemesterDocument1 page6th SemesterVijay SBNo ratings yet

- TAS RoadmapDocument1 pageTAS RoadmapKelly Phillips ErbNo ratings yet

- Chapter 4-Liabilities of PartiesDocument15 pagesChapter 4-Liabilities of PartiesSteffany RoqueNo ratings yet

- List of Bir FormsDocument49 pagesList of Bir Formsblessaraynes50% (4)

- Eb OdishaDocument1 pageEb OdishaD-Sign Infotech SevicesNo ratings yet

- EOLA's Equity Distribution - v4Document18 pagesEOLA's Equity Distribution - v4AR-Lion ResearchingNo ratings yet

- 07 - Visayan Cebu Terminal V CIRDocument2 pages07 - Visayan Cebu Terminal V CIRKristine De LeonNo ratings yet

- Unclaimed Dividend 2013 14Document34 pagesUnclaimed Dividend 2013 14adga rwerweNo ratings yet

- Cir Vs CA and ComarsecoDocument2 pagesCir Vs CA and ComarsecoEllen Glae DaquipilNo ratings yet

- R12 Oracle Learning Management Student GuideDocument77 pagesR12 Oracle Learning Management Student Guidebeem100% (1)

- Bitumen Price List Wef - 16.08.2019Document3 pagesBitumen Price List Wef - 16.08.2019P. Balaji Chakravarthy0% (2)

- Quarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeDocument2 pagesQuarter Receipt Numbers of Original Statements of Amount of Tax Deducted Amount of Tax Deducted/remitted TDS Under Sub-Section (3) of Section 200 in Respect of The Employee in Respect of The EmployeeSanjoy SamantaNo ratings yet