Professional Documents

Culture Documents

Exemption 1

Exemption 1

Uploaded by

sweathacaCopyright:

Available Formats

You might also like

- AT&T BillDocument6 pagesAT&T Billblackson knightson100% (1)

- Burton SensorsDocument7 pagesBurton SensorsMOHIT SINGHNo ratings yet

- Dissertation Report Aadriti Mba (Finance)Document75 pagesDissertation Report Aadriti Mba (Finance)Aadriti Upadhyay100% (7)

- ITIDC PGCIL - Colo Commercial - 09 05 22 - v1.0Document2 pagesITIDC PGCIL - Colo Commercial - 09 05 22 - v1.0Cse 2k17No ratings yet

- Ferrovial / BAA - A Transforming Acquisition: 3rd July 2006Document38 pagesFerrovial / BAA - A Transforming Acquisition: 3rd July 2006Andrew YangNo ratings yet

- March 13, 2018 Utility Vs Axon Body-Worn & In-Car Camera PresentationDocument10 pagesMarch 13, 2018 Utility Vs Axon Body-Worn & In-Car Camera PresentationDillon CollierNo ratings yet

- Sbi Stock Statement Format in ExcelDocument33 pagesSbi Stock Statement Format in ExcelShadab Malik67% (3)

- SBI Sanction Letter 2019-20-1Document14 pagesSBI Sanction Letter 2019-20-1s2amirthaNo ratings yet

- GST BasicDocument47 pagesGST BasicRachna khuranaNo ratings yet

- Fees_Structure_2023-24_DSE_BTechDocument1 pageFees_Structure_2023-24_DSE_BTechalltimepass09No ratings yet

- Jai Jawan Salary Plus AccDocument4 pagesJai Jawan Salary Plus AccLakshmi NarasaiahNo ratings yet

- Idt Compiler 4.0 - Ca Final - by Ca Ravi AgarwalDocument650 pagesIdt Compiler 4.0 - Ca Final - by Ca Ravi Agarwalaella shivaniNo ratings yet

- 43rd GST Council MeetingDocument15 pages43rd GST Council MeetingShaik NoorshaNo ratings yet

- Cost Sheet - PVR ScreenDocument1 pageCost Sheet - PVR ScreensumitNo ratings yet

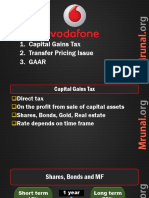

- Capital Gains Tax 2. Transfer Pricing Issue 3. GaarDocument62 pagesCapital Gains Tax 2. Transfer Pricing Issue 3. GaarNishant GauravNo ratings yet

- Goods and Services Tax (GST) : Simplified byDocument14 pagesGoods and Services Tax (GST) : Simplified bypushpendra singh sodhaNo ratings yet

- SubventionDocument1 pageSubventionAshwini SinghNo ratings yet

- Investment POI Guidance Notes (FY 23-24)Document33 pagesInvestment POI Guidance Notes (FY 23-24)Puneet GuptaNo ratings yet

- Aetna Open Choice Ppo: Plan DetailsDocument2 pagesAetna Open Choice Ppo: Plan DetailsSnake Diet RyanNo ratings yet

- SBI Contra FundDocument2 pagesSBI Contra FundScribbydooNo ratings yet

- Chp 7 - Composition scheme final (1)Document7 pagesChp 7 - Composition scheme final (1)sunraypower2010No ratings yet

- Import Local Charges - 6-06-24Document4 pagesImport Local Charges - 6-06-24Arvind ChaudharyNo ratings yet

- Report W-311325542Document39 pagesReport W-311325542Deepak TiwariNo ratings yet

- For The Billing Period 202005Document2 pagesFor The Billing Period 202005DASURECOWebTeamNo ratings yet

- Techno Commercial Proposal TCZPL 2022 245Document8 pagesTechno Commercial Proposal TCZPL 2022 245Brijal padhiyarNo ratings yet

- For The Billing Period May 2020Document1 pageFor The Billing Period May 2020DASURECOWebTeamNo ratings yet

- Schedule of Charges 2010Document2 pagesSchedule of Charges 2010Fcma0903No ratings yet

- Pushpam - ComplianceDocument6 pagesPushpam - ComplianceRamdas NagareNo ratings yet

- Service Charges W.E.F 18.11.2022Document58 pagesService Charges W.E.F 18.11.2022anandNo ratings yet

- All India Import Local Charges - 2023 - 05Document4 pagesAll India Import Local Charges - 2023 - 05Purushotam TapariyaNo ratings yet

- Urnkey - I 2023 65 01 11 04 110Document2 pagesUrnkey - I 2023 65 01 11 04 110munichaitanya.kNo ratings yet

- Jaipur Vidut Vitran Nigam LTD.: (A) Meter Reading & ConsumptionDocument1 pageJaipur Vidut Vitran Nigam LTD.: (A) Meter Reading & ConsumptionSangwan ParveshNo ratings yet

- Monetary Limit - Rates To Remember in GSTDocument15 pagesMonetary Limit - Rates To Remember in GSTtholsjk14No ratings yet

- Tax Invoice: Delhi International Cargo Terminal PVT LTDDocument1 pageTax Invoice: Delhi International Cargo Terminal PVT LTDyogesh nagarNo ratings yet

- Idt Compiler 2.0 CA Final New by CA Ravi AgarwalDocument402 pagesIdt Compiler 2.0 CA Final New by CA Ravi AgarwalAnisha PujNo ratings yet

- SBI Bluechip Fund - One PagerDocument1 pageSBI Bluechip Fund - One PagerjoycoolNo ratings yet

- Service-Charges 01.01.2022 WEBDocument58 pagesService-Charges 01.01.2022 WEBRenesh RNo ratings yet

- In Fa Ev Covid NoexpDocument8 pagesIn Fa Ev Covid NoexpThrishul Reddy KothapallyNo ratings yet

- CGT - Slides - Part 1Document26 pagesCGT - Slides - Part 1AceNo ratings yet

- Trial Balance: 1-Apr-2018 To 25-Feb-2019Document11 pagesTrial Balance: 1-Apr-2018 To 25-Feb-2019Venkatesh BoyinaNo ratings yet

- Vignesh CochinDocument1 pageVignesh CochinRajan KMRNo ratings yet

- BoB - MITC - A4 Booklet - Ver 5.0 - 25JAN23 NewDocument8 pagesBoB - MITC - A4 Booklet - Ver 5.0 - 25JAN23 NewThakur KdNo ratings yet

- Custom Duty in India, Centr...Document3 pagesCustom Duty in India, Centr...sandysharmaNo ratings yet

- Solar Rooftop - 3DECDocument8 pagesSolar Rooftop - 3DECWais AlemiNo ratings yet

- CA FINAL IDT QUESTION BANK FOR MAYNOV 2021 Atul AgarwalDocument463 pagesCA FINAL IDT QUESTION BANK FOR MAYNOV 2021 Atul AgarwalRonita DuttaNo ratings yet

- GST IntroductionDocument42 pagesGST IntroductionAnant singhNo ratings yet

- BurtonsDocument6 pagesBurtonsKritika GoelNo ratings yet

- SME & Calculator Final Edited (1) - 1Document3 pagesSME & Calculator Final Edited (1) - 1Amany CalvinNo ratings yet

- IDT Focus Area Sheet For May 23Document2 pagesIDT Focus Area Sheet For May 23DevaL TrivediNo ratings yet

- Btech MCA MBA Ist YrDocument1 pageBtech MCA MBA Ist YrPrashant KumarNo ratings yet

- BCC - BR - 115 - 401 ROI ConcessionDocument2 pagesBCC - BR - 115 - 401 ROI ConcessionYatin AshtekarNo ratings yet

- Service Charges: Sno HeadDocument57 pagesService Charges: Sno HeadRakshit Ranjan SinghNo ratings yet

- Super Shakti Savings AccountDocument2 pagesSuper Shakti Savings Accountrcosmic1980No ratings yet

- HDFC ERGO General Insurance Company Limited: Certificate No. 2045660330000201422100 Certificate of InsuranceDocument2 pagesHDFC ERGO General Insurance Company Limited: Certificate No. 2045660330000201422100 Certificate of InsurancePrateek MondolNo ratings yet

- Investor Presentation Q2 FY24Document24 pagesInvestor Presentation Q2 FY24Sushant AggarwalNo ratings yet

- BES172 P3 GST Goods Services TaxDocument97 pagesBES172 P3 GST Goods Services TaxVibhore Kumar SainiNo ratings yet

- Credit Scheme - Credit Lifeline For Covid-Hit Sectors Gets A 50,000 Crore Push - The Economic TimesDocument1 pageCredit Scheme - Credit Lifeline For Covid-Hit Sectors Gets A 50,000 Crore Push - The Economic TimescreateNo ratings yet

- Mahogany Bullet Payment Plan Dec 2018Document1 pageMahogany Bullet Payment Plan Dec 2018prajjal111No ratings yet

- Tme Rules and Procedures 2Document8 pagesTme Rules and Procedures 2api-297429895No ratings yet

- Nissan LEAF Information Kit June 2020Document14 pagesNissan LEAF Information Kit June 2020rahmandata06No ratings yet

- Tds - NCLT Directs Tax Department To Return TDS To Bankrupt Precision Fasteners - The Economic TimesDocument1 pageTds - NCLT Directs Tax Department To Return TDS To Bankrupt Precision Fasteners - The Economic TimescreateNo ratings yet

- Internship Report On Digital PaymentDocument38 pagesInternship Report On Digital PaymentSaurav BoruahNo ratings yet

- Procedural Guidelines1Document69 pagesProcedural Guidelines1sburugulaNo ratings yet

- Moneylife 9 July 2015Document68 pagesMoneylife 9 July 2015dhavalmeetsNo ratings yet

- Branch OfficeDocument32 pagesBranch OfficeVedang GupteNo ratings yet

- Credit Policy BOMDocument6 pagesCredit Policy BOMgopalushaNo ratings yet

- Private Banks: Entry of New Banks in The Private SectorDocument6 pagesPrivate Banks: Entry of New Banks in The Private SectorRabinarayan MandalNo ratings yet

- Due Amount: We're ListeningDocument2 pagesDue Amount: We're ListeningmehulNo ratings yet

- Microfinance ReportDocument68 pagesMicrofinance ReportrohanNo ratings yet

- V1. Loan - Application - Form - LoU-18.09.2020Document8 pagesV1. Loan - Application - Form - LoU-18.09.2020Aqueel HusainNo ratings yet

- Report of The Steering Committee On Fintech - 1Document150 pagesReport of The Steering Committee On Fintech - 1Trilochan Sai ChNo ratings yet

- Assets Management Liabilities in Bank PDFDocument61 pagesAssets Management Liabilities in Bank PDFHoàng Trần HữuNo ratings yet

- Union Bank of India - Application - 230317 - 073648Document6 pagesUnion Bank of India - Application - 230317 - 073648CA N RajeshNo ratings yet

- CRED's Plan To Acquire Smallcase Falls ThroughDocument1 pageCRED's Plan To Acquire Smallcase Falls ThroughaxfNo ratings yet

- What Is The Monetary Policy?Document20 pagesWhat Is The Monetary Policy?thisisnitin86No ratings yet

- Monthly Digest January 2023 Eng 57Document35 pagesMonthly Digest January 2023 Eng 57Ayub ArshadNo ratings yet

- Win23 Pill1B Banking NPA BadloansDocument15 pagesWin23 Pill1B Banking NPA BadloansSumit PandaNo ratings yet

- Mint 31.08.2020 PDFDocument20 pagesMint 31.08.2020 PDFApurav GuptaNo ratings yet

- Law of BankingDocument18 pagesLaw of BankingBHARATH JAJUNo ratings yet

- UntitledDocument122 pagesUntitledAdi ShaktiNo ratings yet

- One Hundred Small Steps: An In-Depth Analysis OnDocument15 pagesOne Hundred Small Steps: An In-Depth Analysis OnSachinSebastianNo ratings yet

- RCS Circular 2006Document172 pagesRCS Circular 2006kalkibookNo ratings yet

- Reserve Bank of India (Assistant 2015)Document7 pagesReserve Bank of India (Assistant 2015)amank114No ratings yet

- Capital AC ConvertibilityDocument4 pagesCapital AC ConvertibilityRenukaNo ratings yet

- FACTORS DasDocument71 pagesFACTORS DasRjendra LamsalNo ratings yet

- Bank AuditDocument18 pagesBank AuditPranav HariharanNo ratings yet

- HRM Group Project - C - Group 8Document30 pagesHRM Group Project - C - Group 8Hensi ShethNo ratings yet

- Role of Fdi in Banking Sector Towards Stimulating Green BankingDocument12 pagesRole of Fdi in Banking Sector Towards Stimulating Green Bankingapi-33150260No ratings yet

- Current Affairs e Magazine For IBPS PO Mains Exampundit LockedDocument61 pagesCurrent Affairs e Magazine For IBPS PO Mains Exampundit LockedNagarjuna surepalliNo ratings yet

Exemption 1

Exemption 1

Uploaded by

sweathacaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Exemption 1

Exemption 1

Uploaded by

sweathacaCopyright:

Available Formats

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

EXEMPTIONS &

REVERSE CHARGE MECHANISM

EXEMPTION FROM GST ON GOODS & SERVICES

Exemption on Essential Goods Exemption on Essential Services

(Exemption from CGST + SGST as well as IGST) (Exemption from CGST + SGST as well as IGST)

Unbranded Atta / Maida / Eggs, Exemption from CGST +

Exemption ONLY from IGST

Besan, Live Fish, SGST as well as IGST

Unpacked Food Grains, Indian National Flag, A Number of Cases 8 Special Cases

Fresh Milk / Curd / Lassi, Plastic Bangles, etc. NN 12/2017 – CT (Rate) read NN 9/2017 – IT (Rate)

with NN 9/2017 – IT (Rate)

(Refer Next Pages) (Refer Next Pages)

Note: 8 Special Cases, where exemption is ONLY from IGST are the

cases where the supply is always Inter-State Supply and thus,

exemption from IGST only will be required.

Vishal Jain Page 5A.1 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(1) SERVICE BY WAY OF ACCESS TO ROAD / BRIDGES

Toll Charges Other Charges OR Toll Collection Charges

Collection Charges or Service Charges paid to any Toll Collecting

Access to a Road or a Bridge (including access to National Agency

Highway or State Highway) on payment of Toll Charges OR

Any Other Charges

Exempt Taxable

Vishal Jain Page 5A.2 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

Notes:

Clarification in respect of Exemption to Overloading Charges at Toll Plaza – CBIC Circular 164/20/2021 – CGST

Issue Clarification regarding applicability of GST on overloading charges at toll plaza.

Clarification Entry 23 of EN 12/2017-CT (Rate), exempts service by way of access to a road or a bridge on payment of toll charges.

Ministry of Road Transport & Highways allowed overloaded vehicles to ply on the national highways after payment of

fees with multiplying factor of 2/4/6/8/10 times the base rate of toll. Therefore, it essence overloading fees are effectively

higher toll charges.

As recommended by the GST Council, it is clarified that overloading charges at toll plazas would get the same treatment

as given to toll charges.

Example 1: Toll Charges OR Overloading Charges at Toll Plazas Example 2: Annuity OR Collection Charges

Particulars GST Particulars GST

Toll Charges collected by L&T for Toll Gate on National Annuity collected by L&T for Toll Gate on National

Highway / State Highway Highway / State Highway

Overloading Charges at Toll Plazas for Overloaded Collection charges paid by L&T for Toll Collection to ABC

Vehicles & Co. Collection Agency

Vishal Jain Page 5A.3 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(2) ELECTRICITY TRANSMISSION OR DISTRIBUTION

BY Government Authority or Transmission Licensee BY Shopping Mall

Transmission or Construction, Erection, (a) Application fee for releasing connection of

distribution of Commissioning or Installation electricity; Charges collected

Electricity by an of infrastructure for extending (b) Rental Charges against metering equipment; by a Developer for

Electricity electricity distribution (c) Testing fee for meters / transformers, capacitors; distribution of

Transmission or network upto the tube well of (d) Labour charges from customers for shifting of electricity within a

Distribution the farmer or agriculturalist meters or shifting of service lines; Shopping Mall

Utility for agricultural use (e) Charges for duplicate bill;

Exempt Exempt Taxable Taxable

Vishal Jain Page 5A.4 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

Notes:

Clarification regarding GST on Certain Services – CBIC Circular 34/08/2018 – CGST

Issue Whether the activities carried by DISCOMS (Distribution Companies) against recovery of charges from consumers under State

Electricity Act are exempt from GST?

Clarification Service by way of transmission or distribution of electricity by an electricity transmission or distribution utility is exempt

from GST under EN 12/2017-CT (Rate).

The other services such as,

(a) Application fee for releasing connection of electricity;

(b) Rental Charges against metering equipment;

(c) Testing fee for meters / transformers, capacitors etc.;

(d) Labour charges from customers for shifting of meters or shifting of service lines;

(e) Charges for duplicate bill;

provided by DISCOMS to consumer are taxable.

Example 1: Electricity Transmission / Distribution Charges Example 2: Service BY Governmental Authority/Transmission License

Particulars GST Particulars GST

BY Governmental Authority / Transmission License For Electricity Transmission / Distribution

BY Others (For example, Lulu Mall collecting Rental For Application Fees for EB Connection, Rental Charges

Amount say Rs.1,00,000 along with Electricity Charges say for Meter, Testing Fees for Meters, Charges for Shift of

Rs.10,000 as part of Composite Supply) Meter, Charges for Duplicate Bill, etc.

Vishal Jain Page 5A.5 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(3) RESERVE BANK OF INDIA SERVICES

BY Reserve Bank of India TO Reserve Bank of India

Services BY person outside India TO RBI Services BY person in India TO RBI

Any Services BY RBI

(Import of Service) (Domestic Service)

Taxable

Service BY Members of

Service BY

Overseeing Committee

Any Services Any Other

constituted by Reserve Bank of

Person

India

Taxable Taxable Taxable

(Reverse (Reverse (Forward

Charge) Charge) Charge)

Example 1: Services BY Supplier in USA TO RBI Example 2: Services BY Supplier in India TO RBI

Particulars GST Particulars GST

Services by Members of Overseeing Committee (RCM)

Any Services (Import of Services) (RCM)

Services by Any Other Person (FCM)

Vishal Jain Page 5A.6 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(4) BANKING & FINANCIAL SERVICES

(I) PRIMARY BANKING & FINANCIAL SERVICES BY BANKING COMPANIES & OTHER COMPANIES

Extending Loans, Advances and Deposits Money Changing Services

Services by way of extending Deposits, Loans or Advances in so Services by way of inter se Sale or Purchase of Foreign Currency

far as the Consideration is represented by way of Interest or amongst Banks or Authorised Dealers of Foreign Exchange or

Discount amongst Banks and such Dealers

Interest in Credit Card Bank 1 & Bank 2

Bank & Consumer

Interest or Discount Services, Processing Fees, AD 1 & AD 2

Authorized Dealer & Consumer

Documentation Charges, etc. Bank & Authorized Dealer

Exempt Taxable Exempt Taxable

Vishal Jain Page 5A.7 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(II) OTHER BANKING & FINANCIAL SERVICES BY BANKING COMPANIES

Services BY an Acquiring Bank TO any

person in relation to settlement of an Services provided BY a Banking Company

amount upto Rs.2,000 in a single TO Basic Saving Bank Deposit (BSBD)

Any Other Case

transaction transacted through credit card, Account Holders under Pradhan Mantri Jan

debit card, charge card or other payment Dhan Yojana (PMJDY)

card

Exempt Exempt Taxable

Example 1: Banking Services Example 2: Money Changing Services

Particulars GST Particulars GST

Interest on Loans / Deposits, etc. Money Changing between 2 Banks / 2 Authorised Dealers

Interest on Credit Card Services Money Changing between Bank and Authorised Dealer

Processing Fees, Documentation Charges, etc. Money Changing between Bank / AD and Other Persons

Example 3: Bank Charges for Payment through Card Example 4: Bank Charges for Payment through Card

Particulars GST Particulars GST

Bank Charges – Rs.50 for Wallet Purchase for Rs.1,800 Bank Charges – Rs.50 for Wallet Purchase for Rs.3,800

(including GST) by making payment through Credit Card (including GST) by making payment through Credit Card

Vishal Jain Page 5A.8 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(III) OTHER BANKING & FINANCIAL SERVICES TO BANKING COMPANIES

Services BY

Business

Services Services

Facilitator / Services BY Business

BY Recovery Agent (RA) BY Direct Selling Agent

Business Facilitator / Business

TO Banking Company or a (DSA)

Correspondent Correspondent TO a

Financial Institution or a TO Banking Company or a Any Other Services

TO a Banking Banking Company with

Non-Banking Financial Non-Banking Financial

Company with respect to its accounts in a

Company located in Company located in

respect to its Urban Area

Taxable Territory Taxable Territory

accounts in a

Rural Area

Exempt Taxable Taxable Taxable Taxable

BY Indl. BY Non-

BY BF BY BC BY RA BY RA

DSA Indl. DSA

TO Banks TO Bank TO Banks TO Others

TO Banks TO Banks

Reverse Forward Reverse Forward Reverse Forward

Charge Charge Charge Charge Charge Charge

Example 1: Services by Recovery Agent (RA) Example 2: Services by Direct Selling Agent (DSA)

Particulars GST Particulars GST

Services by RA to Banking Sector (RCM) Services by DSA (Mr. A) to Bank (RCM)

Services by RA to Other Company (FCM) Services by DSA (A Ltd. / ABC & Co.) to Bank (FCM)

Vishal Jain Page 5A.9 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(IV) OTHER FINANCIAL SERVICES

Services Services BY an Services

supplied BY Intermediary of provided BY

CG, SG or UT Financial Services ** any person as

TO their located in a multi an Services provided BY

Undertakings or services SEZ with Intermediary any person as an

PSUs by way of International TO Business Intermediary TO

Services BY RBI guaranteeing the Financial Services Facilitator / Business Facilitator /

loans taken by Centre (IFSC) Business Business Any Other Service

Services BY SEBI such status TO a Corresponde Correspondent with

undertakings or customer located nt with respect to ONLY

PSUs from the outside India for respect to Banking Company in

Banking international ONLY Urban Area

Companies and financial services in Banking

Financial currencies other Company in

Institutions than INR. Rural Area

Exempt Exempt Exempt Exempt Taxable Taxable

BY Agent BY Agent SLS BY

of BC of BF Lender TO Others

TO BC TO BF Borrower

RCM FCM RCM FCM

** Note: Intermediary of Financial Services in IFSC is a person,

(a) who is permitted or recognised as such by the Government of India or any Regulator appointed for regulation of IFSC; OR

(b) who is treated as a person resident outside India under the FEMA (International Financial Services Centre) Regulations 2015; OR

(c) who is registered under the IRDA (International Financial Service Centre) Guidelines, 2015 as IFSC Insurance Office; OR

(d) who is permitted as such by SEBI under the SEBI (International Financial Services Centres) Guidelines, 2015

Vishal Jain Page 5A.10 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

Clarification regarding Value for computing GST on services of Business Facilitator (BF) or Business Correspondent (BC) to Banking

Company – CBIC Circular 86/05/2019 – CGST

Issue What is the value to be adopted for the purpose of computing GST on services provided by BF / BC to a banking company?

Clarification As per RBI’s Circular and subsequent instructions on the issue (referred to as ‘guidelines’ hereinafter), banks may pay

reasonable commission / fee to the BC, the rate and quantum of which may be reviewed periodically.

The agreement of banks with the BC specifically prohibits them from directly charging any fee to the customers for

services rendered by them on behalf of the bank.

On the other hand, banks (and not BCs) are permitted to collect reasonable service charges from the customers for such

service in a transparent manner. The arrangements of banks with the BCs specify the requirement that the transactions are

accounted for and reflected in the bank's books by end of the day or the next working day, and all agreements/contracts

with the customer shall clearly specify that bank is responsible to customer for acts of omission and commission of BF/BC.

Hence, banking company is the service provider in the BF model or the BC model operated by a banking company as per

RBI guidelines. The banking company is liable to pay GST on the entire value of service charge or fee charged to customers

whether or not received via BF or BC.

Clarification regarding Taxability of Supply of Securities under Securities Lending Scheme, 1997 – CBIC Circular 119/38/2019 – CGST

Background SEBI facilitates lending and borrowing of securities. The lender temporarily lends the securities held by him to a borrower

and charges lending fee for the same from the borrower. The borrower of securities can further sell or buy these securities

and is required to return the lended securities after stipulated period of time. The transaction takes place through an

electronic screen-based order matching mechanism provided by the recognized stock exchange in India, which charges a

fee for the same. There is anonymity between the lender and borrower since there is no direct agreement between them.

Levy of GST Securities are NOT covered in the definition of goods under Section 2(52) and services under Section 2(102) of the CGST

Act. Thus, transaction in securities which involves disposal of securities is NOT a supply in GST and hence not taxable.

The activity of lending of securities is NOT a transaction in securities as it does not involve disposal of securities. The

lending fee charged from borrowers of securities has the character of consideration and this activity is taxable in GST. The

activities of intermediaries facilitating lending and borrowing of securities for commission/fee are also taxable separately.

Nature of The borrower of securities shall be liable to discharge GST under Reverse Charge Mechanism (RCM).

Supply & The nature of GST to be paid shall be IGST under RCM.

Person liable

to pay GST

Vishal Jain Page 5A.11 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(5) INSURANCE SERVICES

(I) SERVICES BY INSURANCE COMPANIES

Specified General Insurance Services Specified Life Insurance Services Other Insurance Services

Services of General Insurance Business Services of Life Insurance Business (including re-insurance) Any Other Life Insurance

(including re-insurance) under following under following schemes: Services BY Life Insurance

schemes: (a) Janashree Bima Yojana Company

(a) Hut Insurance Scheme (b) Aam Aadmi Bima Yojana OR

(b) Cattle Insurance under Swarnajaynti Gram

(c) Life Micro-Insurance product having maximum amount of Any Other General Insurance

Swarozgar Yojna

cover of Rs.2,00,000 Services BY General Insurance

(c) Scheme for Insurance of Tribals

(d) Janata Personal Accident Policy and (d) Varishtha Pension Bima Yojana Company

Gramin Accident Policy (e) Pradhan Mantri Jeevan Jyoti Bima Yojna

(e) Group Personal Accident Policy for Self- (f) Pradhan Mantri Jan Dhan Yojna

Employed Women (g) Pradhan Mantri Vaya Vandan Yojna

(f) Agricultural Pumpset and Failed Well

Insurance Services by way of Collection of Contribution under Atal Pension

(g) Premia collected on Export Credit Yojna OR under any Pension Scheme of the State Government

Insurance

Services of Life Insurance Business provided by way of annuity

(h) Restructured Weather Based Crop

under the National Pension System Services

Insurance Scheme (RWCIS)

(i) Jan Arogya Bima Policy Services of Life Insurance Business BY the Army, Naval and Air provided TO

(j) Pradhan Mantri Fasal BimaYojana (PMFBY) Force Group Insurance Funds TO their members under the Group Government

(k) Pilot Scheme on Seed Crop Insurance

Insurance Schemes of the Central Government under Any

(l) Central Sector Scheme on Cattle Insurance Insurance

(m) Universal Health Insurance Scheme Services of Life Insurance Business BY the Naval Group Insurance Any Other

Scheme

(n) Rashtriya Swasthya Bima Yojana Fund TO the personnel of Coast Guard under the Group Case

(including re-

(o) Coconut Palm Insurance Scheme Insurance Schemes of the Central Government insurance) for

(p) Pradhan Mantri Suraksha Bima Yojna

Services of Life Insurance Business BY the Central Armed Police which Total

(q) Niramaya’ Health Insurance Scheme

(r) Bangla Shasya Bima Forces (under Ministry of Home Affairs) Group Insurance Funds Premium is paid

TO their members under the Group Insurance Schemes of CAPF by Government

Exempt Exempt Exempt Taxable

Vishal Jain Page 5A.12 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(II) SERVICES TO INSURANCE COMPANIES

Services BY Business Facilitator / Business Correspondent TO a

Any Other Services

Insurance Company with respect to its accounts in a Rural Area

Exempt Taxable

Services

Services

BY Insurance Agent (having

BY Any Other Person (such as

License under Section 42 of

Actuary, Surveyor, etc.)

Insurance Act)

TO Insurance Company

TO Insurance Company

Reverse Charge Forward Charge

Special Note: Services provided BY any person as an Intermediary TO Business Facilitator / Business Correspondent with respect to Insurance

Company in Rural Area or in Urban Area is Taxable.

If the services are provided BY Agent of Business Correspondent TO Business Correspondent, it is taxable under RCM.

If the services are provided BY Agent of Business Facilitator TO Business Facilitator, it is taxable under FCM.

Note: “Business Facilitator or Business Correspondent” means an intermediary appointed under the Business Facilitator Model or the Business

Correspondent Model by a Banking Company or an Insurance Company under the guidelines issued by the Reserve Bank of India;

Agent --------------------> Business Facilitator --------------------> Bank Agent -----------------> Business Facilitator -----------------> Insurance

FCM RCM FCM FCM

`

Agent -------------------> Business Correspondent -------------------> Bank Agent ----------------> Business Correspondent ----------------> Insurance

RCM FCM RCM FCM

Vishal Jain Page 5A.13 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

Example 1: Banking Company in Rural Area Example 2: Insurance Company in Rural Area

Particulars GST Particulars GST

Service by BF to such Banking Co. in Rural Area Service by BF to such Insurance Co. in Rural Area

Service by BC to such Banking Co. in Rural Area Service by BC to such Insurance Co. in Rural Area

Service by Intermediary to such above BF Service by Intermediary to such above BF (FCM)

Service by Intermediary to such above BC Service by Intermediary to such above BC (RCM)

Example 3: Banking Company in Urban Area Example 4: Insurance Company in Urban Area

Particulars GST Particulars GST

Service by BF to such Banking Co. in Urban Area (RCM) Service by BF to such Insurance Co. in Urban Area (FCM)

Service by BC to such Banking Co. in Urban Area (FCM) Service by BC to such Insurance Co. in Urban Area (FCM)

Service by Intermediary to such above BF (FCM) Service by Intermediary to such above BF (FCM)

Service by Intermediary to such above BC (RCM) Service by Intermediary to such above BC (RCM)

Example 5: Non-Exempted Insurance Scheme BY Insurance Company Example 6: Services TO Insurance Company

Particulars GST Particulars GST

Total Premium paid by Govt. Services by Insurance Agent to Insurance Co. (RCM)

Total Premium paid by other than Govt. Services by Actuary, Surveyor, etc to Insurance Co. (FCM)

Vishal Jain Page 5A.14 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(6) ENTERTAINMENT SERVICES

Admission to a

Museum, National Park, Services by way of right to admission to-

Wildlife Sanctuary, Tiger (a) Circus, Dance, or Theatrical Performance

Reserve or Zoo including Drama or Ballet

Services by an Artist by way of a performance in

(b) Award Function, Concert, Pageant, Musical

Folk or Classical Art Forms Admission to a Protected Performance

(NOT Western Art Forms) of Monument so declared (c) Sporting Event other than a Recognised

Music / Dance / Theatre under Ancient Monuments Sporting Event;

and Archaeological Sites (d) Recognised Sporting Event,

and Remains Act, 1958 OR (e) Planetarium

any of the State Acts

Consideration is more Consideration is less than Exempt

than to Rs.1.50 lakhs or equal to Rs.1.50 lakhs (irrespective of Entry Fees)

OR AND Consideration is less than Consideration is more

Artist is Acting as Brand Artist is NOT Acting as or equal to Rs.500 than Rs.500

Ambassador Brand Ambassador

Taxable Exempt Exempt Taxable

Example 1: Thala Ajith performing Bharatnatiyam Dance Example 2: Prabhu Deva performing Western Dance

Particulars GST Particulars GST

Artist Fees is Rs.1 lakh promoting “Pothys” Brand Artist Fees is Rs.1 lakh promoting “Pothys” Brand

Artist Fees is Rs.3 lakhs performing at “PSG College” Artist Fees is Rs.3 lakhs performing at “PSG College”

Artist Fees is Rs.1 lakh performing at “ICAI” Artist Fees is Rs.1 lakh performing at “ICAI”

Example 3: Entry to Museum, Zoo, Protected Monument, etc. Example 4: Entry to Circus, Dance, Sporting Event, Planetarium, etc.

Particulars GST Particulars GST

Entry Fees is Rs.1,000 Entry Fees is Rs.1,000

Entry Fees is Rs.500 Entry Fees is Rs.500

Vishal Jain Page 5A.15 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(7) SPORTS SERVICES

(I) PRIMARY SPORTS SERVICES

Sponsorship of Events organized BY Notified Sporting Body Services provided TO Recognized Sporting Body

Services by way of sponsorship of sporting events organised,- BY Another BY an individual for participation in a

(a) by a National Sports Federation, or its Affiliated Federations, Recognized sporting event organized by a Recognized

where the Participating Teams or Individuals represent any Sporting Body Sporting Body acting as

District, State, Zone or Country;

(b) by Association of Indian Universities, Inter-University Sports Exempt Selectors,

Player, Referee,

Board, School Games Federation of India, All India Sports Commentators,

Umpire, Coach or

Council for the Deaf, Paralympic Committee of India or Curators or

Team Manager

Special Olympics Bharat; Technical Experts

(c) by Central Civil Services Cultural and Sports Board;

(d) as part of National Games, by Indian Olympic Association; or Exempt Taxable

(e) under Panchayat Yuva Kreeda Aur Khel Abhiyaan (PYKKA)

Scheme;

Exempt

Example 1: Recognized Sporting Body to Recognized Sporting Body Example 2: Player to Recognized Sporting Body & to Others

Particulars GST Particulars GST

Services provided by BCCI to ECB Services provided by Virak Kohli to BCCI (Match Fees)

Services provided by BCCI to TNCB Services provided by Virak Kohli to Sun Silk (Brand Fees)

Example 3: Player, Referee, Umpire, Coach or Team Manager to RSB Example 4: Others to RSB

Particulars GST Particulars GST

Services provided by Ravi Shastri (Coach) to BCCI Services provided by Curator to BCCI

Services provided by Billy Bowden (Umpire) to BCCI Services provided by Physiotherapist to BCCI (Health Care)

Vishal Jain Page 5A.16 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(II) OTHER SPORTS SERVICES

Sports Services BY Unincorporate Club / BY Section 12AA or

Others Sports Related Services

Section 12AB Entity

Service BY an Unincorporated

Services by way of right to admission

Body / Registered Non-Profit

to

Entity, engaged in promotion Services by way of training

(a) any Sporting Event other than a Any Other Services

of Sports, TO its own members or coaching in Sports

Recognised Sporting Event;

against consideration in the

(b) Recognised Sporting Event,

form of Membership Fee

Mem. Fees Mem. Fees > BY Chari. Consideration is Consideration Taxable

BY Other

upto Rs.1,000 Rs.1,000 / Yr. Entities u/s less than or is more than

Entity

/ Yr. / Mem. / Mem. 12AA / 12AB equal to Rs.500 Rs.500

Exempt Taxable Exempt Taxable Exempt Taxable

Example 1: Services by Unincorporated Body to its Members for Example 2: Services by way of Admission to Sporting Event

Promotion of Sports (Recognized Event or Unrecognized Event)

Particulars GST Particulars GST

Membership Fees is Rs.5,000 / Year / Member Entry Fees is Rs.1,000

Membership Fees is Rs.1,000 / Year / Member Entry Fees is Rs.500

Example 3: Lalit Kalashetra Academy providing training in Painting Example 4: Dravid Academy providing training in playing Cricket

Particulars GST Particulars GST

Lalit Kalashetra Academy is a Proprietorship Concern Dravid Academy is registered u/s 12AA/12AB

Lalit Kalashetra Academy is a Partnership Firm Dravid Academy is not registered u/s 12AA/12AB

Vishal Jain Page 5A.17 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(III) OTHER SPORTS SERVICES RELATED TO FOOTBALL EVENTS IN INDIA

FIFA U-17 Women’s World Cup 2020 in India Asian Football Confederation Women’s Asia Cup 2022 in India

Services provided BY and TO Services provided BY and TO Asian

Fédération Internationale de Football Football Confederation (AFC) and

Association (FIFA) and its subsidiaries its subsidiaries directly or indirectly

directly or indirectly related to any of Services by way of related to any of the events under

the events under FIFA U-17 Women's right to admission AFC Women's Asia Cup 2022 to be Services by way of right

World Cup 2020 to be hosted in India to the events hosted in India. to admission to the

whenever rescheduled. organised under events organised under

Provided that Director (Sports), FIFA U-17 Women's Provided that Director (Sports), AFC Women's Asia Cup

Ministry of Youth Affairs and Sports World Cup 2020, Ministry of Youth Affairs and 2022.

certifies that services are directly or whenever reschedule. Sports certifies that services are

indirectly related to any of the events directly or indirectly related to any

under FIFA U-17 Women's World Cup of the events under AFC Women's

2020. Asia Cup 2022.

Exempt Exempt Exempt Exempt

Vishal Jain Page 5A.18 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(8) SPONSORSHIP SERVICES

Sponsorship of Events organized BY Notified Sporting Body Any Other Sponsorship Services

Services by way of Sponsorship of sporting events organised,

(a) by a National Sports Federation, or its Affiliated Federations,

where the Participating Teams or Individuals represent any

District, State, Zone or Country;

(b) by Association of Indian Universities, Inter-University Sports

Board, School Games Federation of India, All India Sports

Any Other Case of Sponsorship Service

Council for the Deaf, Paralympic Committee of India or

Special Olympics Bharat;

(c) by Central Civil Services Cultural and Sports Board;

(d) as part of National Games, by Indian Olympic Association; or

(e) under Panchayat Yuva Kreeda Aur Khel Abhiyaan (PYKKA)

Scheme;

Exempt Taxable

BY Any Person BY Any Person

TO Body Corporate / TO other than Body Corporate

Partnership Firm / LLP / Partnership Firm / LLP

Reverse Charge Forward Charge

Example 1: Sponsorship Services for Sporting Event Example 2: Sponsorship Services for Any Event (including Sports)

Particulars GST Particulars GST

Event organised by Notified Sporting Body Rajinikant sponsored an event orgainsed by ITC Co. (FCM)

Event organised by Other Sporting Body Rajinikant Ltd. provided sponsorship sr. to ITC Ltd. (RCM)

Vishal Jain Page 5A.19 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(9) TEMPORARY TRANSFER OF INTELLECTUAL PROPERTY RIGHT

Temporary Transfer of

Temporary Transfer of Copyright

Patents, Trademarks, etc.

Temporary Transfer of

IPR other than Copyright

Temporary Transfer of Copyright

such as Patents,

Trademarks, etc.

Taxable Taxable

Relating to Original Literary

Works

Relating to Original

BY Author

Dramatic, Musical or

TO Publisher located in Relating to Original

Artistic Works Relating to other

Taxable Territory Literary Works

BY Music Composer, than Original

[(i) Author takes Reg. + Files BY Author

Photographer, Artist or Dramatic, Musical

Declaration in Ann. I before TO Publisher located

the like or Artistic Works

commencement of FY (not in Taxable Territory

TO Music Company, BY Any Person

withdraw such option for 1

Producer or the like TO Any Person

Year) [Other Cases]

located in Taxable

(ii) Author files Declaration

Territory

in Ann. II on invoice issued

by him in GST INV-1]

Forward Charge Reverse Charge Reverse Charge Forward Charge

Vishal Jain Page 5A.20 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

Example 1: Temporary Transfer of Patent, Trademark, etc. Example 2: Temporary Transfer of Copyright

Particulars GST Particulars GST

Temporary Transfer of Patent, Trademark, etc. Temporary Transfer of Copyright

(FCM) (Refer Below)

Example 3: Temporary Transfer of Copyright – Author Example 4: Temporary Transfer of Copyright – Author

Particulars GST Particulars GST

Temporary Transfer of Copyright by Author to Temporary Transfer of Copyright by Author to

Publisher (opting for FCM and satisfying Publisher (NOT opting for FCM)

(FCM) (RCM)

conditions for the same)

Example 5: Temporary Transfer of Copyright – Others Example 6: Temporary Transfer of Copyright – Others

Particulars GST Particulars GST

Temporary Transfer of Copyright by AR Rehman Temporary Transfer of Copyright by Sony Music

to Sony Music (RCM) to Jio Sawan Music (FCM)

Vishal Jain Page 5A.21 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(10) RIGHT TO USE RADIO-FREQUENCY SPECTRUM

Prior to 01st April 2016 After 01st April 2016

Services BY Government or Local Authority by way of allowing a Licence Fee or Spectrum User Charges for using Radiofrequency

Business Entity to operate as a Telecom Service Provider or use Spectrum after 1st April 2016

Radiofrequency Spectrum during the period before 1st April 2016

on payment of Licence Fee or Spectrum User Charges, as the case Taxable

may be;

BY Government / Local

BY one Business Entity

Exempt Authority

TO another Business Entity

TO Business Entity

Reverse Charge Forward Charge

Example 1: Spectrum Fees for upto FY 2015-16 Example 2: Spectrum Fees from FY 2016-17 onwards

Particulars GST Particulars GST

Spectrum Fees for FY 2015-16 Spectrum Fees for FY 2018-19

Example 3: Spectrum Fees by Government to Business Entity Example 4: Spectrum Fees by Business Entity to Business Entity

Particulars GST Particulars GST

Spectrum Fees charged by Government from JIO (RCM) Spectrum Fees charged by JIO from Airtel (FCM)

Vishal Jain Page 5A.22 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(11) INCUBATOR & INCUBATEE SERVICES

Services provided BY Incubator (TBI / STEP / BI) Services provided BY Incubatee

Services provided BY Services provided BY

(a) Technology Business Incubator (TBI) / an Incubatee (i.e. Entrepreneur located within

Science and Technology Entrepreneurship Service the premises TBI / STEP and Agreement with

Park (STEP) recognized by the National provided BY TBI / STEP to develop and produce hi-tech and

Science and Technology Entrepreneurship Any Other innovative products) up to a Total Turnover of Service

Development Board (NSTEDB), Incubator Rs.50 lakhs in a Financial Year subject to the provided BY

Department of Science and Technology, (for example following conditions, namely:- Incubatee in

Government of India Private (a) Total Turnover had not exceeded Rs.50 Any Other

OR Incubator lakhs during the Preceding Financial Year; Case

(b) Bio-Incubators (BI) recognized by the such as AND

Biotechnology Industry Research TATA) (b) 3 years has not been elapsed from the date

Assistance Council, under Department of of entering into an Agreement as an

Biotechnology, Government of India Incubatee

Exempt Taxable Exempt Taxable

Example: A start-up company within the premises of TBI / STEP gives the following information:

No. of Years Previous Yr. Turnover Current Yr. Turnover Eligible for EN Exempt Portion & Taxable Portion

1 0 Rs.60 lakhs No GST on Rs.50 lakhs and Pay GST on Rs.10 lakhs

2 Rs.60 lakhs Rs.70 lakhs Pay GST on Rs.70 lakhs

3 Rs.70 lakhs Rs.30 lakhs Pay GST on Rs.30 lakhs

4 Rs.30 lakhs Rs.10 lakhs Pay GST on Rs.10 lakhs (Refer Note)

Note: The start-up company in the 4 year of agreement can apply for cancellation of registration under Section 29 as it is no longer liable for

th

registration (Aggregate Turnover is less than Rs.20 lakhs) and thereby stop paying GST.

Vishal Jain Page 5A.23 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(12) UNINCOPORATED BODY OR NON-PROFIT ENTITY

Service BY an Unincorporated Body / Service BY an Unincorporated Body /

Registered Non-Profit Entity TO its own Registered Non-Profit Entity, engaged in

members by way of reimbursement of (a) activities relating to the welfare of

charges or share of contribution: Industrial or Agricultural Labour or

(a) as a Trade Union (No limit of amount Farmers;

for exemption) (b) promotion of

(b) for the provision of carrying out any Trade, Commerce, Industry,

activity which is exempt from levy of Agriculture,

Any Other Case

GST (No limit of amount for Art, Science, Literature, Culture,

exemption) Sports, Education,

(c) up to an amount of Rs.7,500 / Month / Social Welfare, Charitable Activities

Member for sourcing of Goods / and Protection of Environment,

Services from a Third Person for the TO its own members against

Common Use of its Members in a consideration in the form of Membership

Housing Society / Residential Fee upto an amount of Rs.1,000 / Year /

Complex Member

Exempt Exempt Taxable

Example 1: Charges collected by Trade Union from its Members Example 2: Charges collected by RWA from its Members

Particulars GST Particulars GST

Case 1: Charges – Rs.6,000 / Month / Member Case 1: Charges – Rs.6,000 / Month / Member

Case 2: Charges – Rs.10,000 / Month / Member Case 2: Charges – Rs.10,000 / Month / Member

Example 3: Membership Fees collected by Unincorporated Body for Welfare of Agricultural Farmers from its Members

Particulars GST Particulars GST

Case 1: Membership Fees – Rs.1,000 / Year / Member Case 2: Membership Fees – Rs.2,000 / Year / Member

Vishal Jain Page 5A.24 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

Clarifications related to GST on Monthly Subscription / Contribution charged by RWA from its Members – CBIC Circular 109/28/2019 –

CGST

Issue 1 Are the maintenance charges paid by residents to the Resident Welfare Association (RWA) in a housing society exempt from

GST and if yes, is there an upper limit on the amount of such charges for the exemption to be available?

Clarification Supply of service by RWA (unincorporated body or a non- profit entity registered under any law) to its own members by

way of reimbursement of charges or share of contribution upto an amount of Rs.7,500 per month per member for providing

services and goods for the common use of its members in a housing society or a residential complex are exempt from GST.

Issue 2 A RWA has aggregate turnover of Rs.20 lakh or less in a financial year. Is it required to take registration and pay GST on

maintenance charges if the amount of such charges is more than Rs.7,500 per month per member?

Clarification If aggregate turnover of an RWA does not exceed Rs.20 lakhs in a financial year, it shall not be required to take

registration and pay GST EVEN if the amount of maintenance charges exceeds Rs.7,500 per month per member.

Aggregate Turnover of RWA Maintenance Charges by RWA Exempt

More than Rs.20 lakhs More than Rs7,500 No

More than Rs.20 lakhs Upto Rs.7,500 Yes

Upto Rs.20 lakhs Upto Rs.7,500 Yes

Upto Rs.20 lakhs More than Rs7,500 Yes

Issue 3 Is the RWA entitled to take ITC of GST paid on input and services used by it for making supplies to its members and use such

ITC for discharge of GST liability on such supplies where the amount charged for such supplies is more than Rs.7,500 per

month per member?

Clarification RWAs are entitled to take ITC of GST paid by them on Capital Goods (generators, water pumps, lawn furniture etc.),

Inputs (taps, pipes, other sanitary / hardware fillings etc.) and Input Services (repair and maintenance services, etc.).

Issue 4 Where a person owns 2 or more flats in the housing society or residential complex, whether the ceiling of Rs.7,500 per month

per member on the maintenance for the exemption to be available shall be applied per residential apartment or per person?

Clarification As per general business sense, a person who owns 2 or more residential apartments in a housing society or a residential

complex shall normally be a member of the RWA for each residential apartment owned by him separately. The ceiling of

Vishal Jain Page 5A.25 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

Rs.7,500 per month per member shall be applied separately for each residential apartment owned by him.

For example, if a person owns 2 residential apartments in a residential complex and pays Rs.15,000 per month as

maintenance charges towards maintenance of both apartments to the RWA, the exemption from GST (Rs.7,500 per month

in respect of each residential apartment) shall be available to each apartment.

Issue 5 How should the RWA calculate GST payable where the maintenance charges exceed Rs.7,500 per month per member? Is the

GST payable only on the amount exceeding Rs.7,500 or on the entire amount of maintenance charges?

Clarification The exemption from GST on maintenance charges charged by a RWA from residents is available ONLY if such charges are

upto Rs.7,500 per month per member. In case the charges exceed Rs.7,500 per month per member, the entire amount is

taxable.

For example, if the maintenance charges are Rs.9,000 per month per member, GST @ 18% shall be payable on the entire

amount of Rs.9,000 and NOT on Rs.1,500 (Rs.9,000 - Rs.7,500).

Example 1: GST by RWA – Various Scenarios

Aggregate Turnover of RWA Maintenance Charges by RWA GST

1. Upto Rs.20 lakhs (Assuming NOT Registered) Upto Rs.7,500

2. Upto Rs.20 lakhs (Assuming NOT Registered) More than Rs7,500

3. More than Rs.20 lakhs Upto Rs.7,500

4. More than Rs.20 lakhs More than Rs7,500

5. More than Rs.20 lakhs Upto Rs.7,500 from Few Members & More than Rs7,500 from Few Members

Example 2: Charges by RWA from Single Member having 2 Flats Example 3: Charges by RWA from Single Member having 2 Flats

Particulars GST Particulars GST

Case 1: Charges for Flat 1 – Rs.6,000 / Month / Member Case 1: Charges for Flat 1 – Rs.7,500 / Month / Member

Case 2: Charges for Flat 2 – Rs.7,500 / Month / Member Case 2: Charges for Flat 2 – Rs.10,000 / Month / Member *

* Note: GST is payable on ENTIRE Rs.10,000 and NOT on Rs.2,500

Vishal Jain Page 5A.26 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(13) FOREIGN DIPLOMATIC MISSION SERVICES

BY Foreign Diplomatic Mission TO Foreign Diplomatic Mission

Import of Services BY FDM,

Consular Post OR Diplomatic Domestic Services BY

Any Services BY FDM in India Agents OR Career Consular Supplier in India TO FDM in

Officers posted therein subject India

to specified conditions

Exempt Exempt * Taxable **

* Note: Specified Conditions for exemption are as follows:

(a) Exemption is available based on Certificate is issued by the Protocol Division of the Ministry of External Affairs, based on the principle of

reciprocity and exemption is available till the Certificate is withdrawn.

(b) Exemption is available if service is imported for official purpose of the said FDM or CP; OR for personal use of the said Diplomatic Agent

or Career Consular Officer or members of his or her family.

** Note: FDM having UIN Registration can apply for Refund of GST on such Inward Supplies under Section 55 of CGST Act, 2017.

Vishal Jain Page 5A.27 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(14) IMPORT OF SERVICES & EXPORT AKIN SERVICES

(I) IMPORT OF SERVICES

Services BY a provider of service located in a Non-

Taxable Territory

(a) TO Government / Local Authority /

Import of services BY

Governmental Authority / Individual in relation Royalty and License Fee

United Nations OR

to any purpose other than Commerce / Industry / to the extent it is included

Specified International

any other Business / Profession (This exemption in Transaction Value in Any Other Service

Organisation

is not applicable to Online Information & Customs under Rule other than

for Official Use

Database Access & Retrieval Services i.e. OIDAR 10(1)(c) of Customs OIDARS BY

Services) Valuation (Determination Supplier in Non-

Import of services BY

(b) TO an entity registered under Section 12AA / of value of imported Taxable Territory

Foreign Diplomatic

Section 12AB of IT Act, 1961 for the purposes of Goods) Rules, 2007 and

Mission OR Consular

providing Charitable Activities (This exemption (This is due to the fact Freight Service BY

Post in India, OR

is not applicable to OIDAR Services) that as IGST within Foreign Shipping

Diplomatic Agents OR

(c) TO Educational Institution (Category B) by way Custom Duty would have Line

Career Consular Officers

of supply of online journals or periodicals been already paid on the

posted therein subject to

(d) TO a person located in a Non-Taxable Territory same)

specified conditions

(This exemption is not applicable to services of

transportation of goods by vessel in case of

import of goods)

Exempt Exempt Exempt Taxable

(EXEMPTION IS ONLY FROM IGST) (Reverse Charge)

Note: Specified International Organization means International Organization declared by Central Government in pursuance of Section 3 of

United Nations (Privileges and Immunities) Act, 1947, to which the provisions of the Schedule to the said Act apply.

Vishal Jain Page 5A.28 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

Example 1: Import of Normal Services (say Architect Sr.) from USA Example 2: Import of Normal Services (say Architect Sr.) from USA

Particulars GST Particulars GST

Import by A & Co., a CA Firm (Business Entity) (RCM) Import by Mr. B., a Student (Non-Business Entity)

Example 3: OIDARS from India Example 4: OIDARS from USA

Particulars GST Particulars GST

Case 1: Receipt of OIDARS by A & Co., a CA Firm Case 1: Import of OIDARS by A & Co., a CA Firm

(FCM) (RCM)

(Business Entity) (Business Entity)

Case 2: Receipt of OIDARS by Mr. B., a Student Case 2: Import of OIDARS by Mr. B., a Student

(FCM) (FCM)

(Non-Business Entity) (Non-Business Entity)

Example 5: Import of Freight Services by Importer at the time of Import of Goods in Foreign Shipping Line of USA

Import of goods is by Mr. A for Personal Use Import Duty Import of goods is by B Ltd. for Business Use Import Duty

(Baggage) and GST (Commercial Cargo) and GST

Import Duty (BCD + SWS + IGST) on CIF Value of Import Duty (BCD + SWS + IGST) on CIF Value of

Goods (Baggage) after General Free Allowance (Importer) Goods (Commercial Cargo) (Importer)

GST (IGST) on Freight Charges on Freight Value by GST (IGST) on Freight Charges on Freight Value by

Foreign Shipping Line Foreign Shipping Line (Refer Author’s Note) (RCM)

Author’s Note: Supreme Court in the case of MOHIT MINERALS PVT. LTD. & ORS. VS. UNION OF INDIA & ORS. has held that no tax is

leviable on the ocean freight for services provided by a person located in non-taxable territory by way of transportation of goods by a vessel

from a place outside India up to the customs station of clearance in India.

Example 6: Import of Freight Services by Importer at the time of Import of Goods in Indian Shipping Line of USA

Import of goods is by Mr. A for Personal Use Import Duty Import of goods is by B Ltd. for Business Use Import Duty

(Baggage) and GST (Commercial Cargo) and GST

Import Duty (BCD + SWS + IGST) on CIF Value of Import Duty (BCD + SWS + IGST) on CIF Value of

Goods (Baggage) after General Free Allowance (Importer) Goods (Commercial Cargo) (Importer)

GST (IGST or CGST + SGST) on Freight Charges on GST (IGST or CGST + SGST) on Freight Charges on

Freight Value by Indian Shipping Line (FCM) Freight Value by Indian Shipping Line (FCM)

Vishal Jain Page 5A.29 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(II) EXPORT AKIN SERVICES

Services provided BY a Tour Operator TO a Foreign Tourist in

Supply of services having place of supply in Nepal or Bhutan

relation to a Tour conducted Wholly Outside India

Payment in Foreign Currency Payment in INR Payment in Foreign Currency Payment in INR

Export Exempt Export Export

(ZERO RATED AS PER IGST (EXEMPTION IS ONLY FROM (ZERO RATED AS PER IGST (ZERO RATED AS PER IGST

ACT, 2017) IGST) ACT, 2017) ACT, 2017)

Supply of services having place of supply is outside India

[in accordance with Section 13 of IGST Act] Services provided by an Intermediary

BY Supplier in India TO Recipient outside India

Supplier and Recipient are NOT Supplier and Recipient are Both Location of Supplier of

Either Location of Supplier of

establishments of Distinct establishments of Distinct Goods AND Location of

Goods OR Location of Recipient

Persons [Explanation 1 in Persons [Explanation 1 in Recipient of Goods are in Non-

of Goods is in Taxable Territory

Section 8 of the IGST Act] Section 8 of the IGST Act] Taxable Territory

Export Exempt Taxable Exempt **

(ZERO RATED AS PER IGST (EXEMPTION IS ONLY FROM (EXEMPTION IS ONLY FROM

ACT, 2017) IGST) IGST)

** Note: Following documents shall be maintained for a minimum duration of 5 years:

(i) Copy of Bill of Lading

(ii) Copy of executed contract between Supplier / Seller and Receiver / Buyer of goods

(iii) Copy of Commission Debit Note raised by an Intermediary Service Provider in Taxable Territory from Service Recipient located in Non-Taxable Territory

(iv) Copy of Certificate of Origin issued by Service Recipient located in Non-Taxable Territory

(v) Declaration Letter from an Intermediary Service Provider in Taxable Territory on company letter head confirming that Commission Debit Note raised

relates to contract when both supplier and receiver of goods are outside the taxable territory.

Vishal Jain Page 5A.30 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

Example 1: Heena Tours supplies tour services to Mr. Modi (Indian) Example 2: Heena Tours supplies tour services to Mr. Trump (USA)

Particulars GST Particulars GST

Tour is in India Tour is in India

Tour is in China Tour is in China

Tour is in India and China Tour is in India and China

Example 3: Heena Tours supplies tour services to Mr. Trump (USA) Example 4: Supply of Any Services having Place of Supply in Nepal /

for trip in China Bhutan

Particulars GST Particulars GST

Amount is received in Foreign Currency Amount is received in Foreign Currency

(Export) (Export)

Amount is received in Indian Currency Amount is received in Indian Currency

(Exempt) (Export)

Note: If a supply is exempt, corresponding ITC cannot be availed. Note: If a supply is exempt, corresponding ITC cannot be availed.

However, if a supply is export, corresponding ITC can be availed. However, if a supply is export, corresponding ITC can be availed.

Example 5: Supply of service from supplier in USA to recipient in Example 6: Supply of service from supplier in India to recipient in

India having Place of Supply in India USA having Place of Supply in USA

Particulars GST Particulars GST

Supply of services between Distinct Persons (HO Supply of services between Distinct Persons (HO

– BO) (Import*) – BO) (Exempt)

Supply of services between Independent Persons Supply of services between Independent Persons

(Unrelated Persons) (Import*) (Unrelated Persons) (Export**)

*Note: In case of Import of Services, Recipient has to pay GST under **Note: If case of Export of Services, Supplier has to receive Foreign

RCM. Currency or Indian Rupees, wherever permitted by RBI.

Example 7: Service provided by Intermediary Example 8: Service provided by Intermediary

Particulars GST Particulars GST

Either Location of Supplier of GOODS or Both Location of Supplier of GOODS and

Location of Recipient of GOODS is in Taxable Location of Recipient of GOODS is in Taxable

Territory Territory

Vishal Jain Page 5A.31 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(15) ONLINE INFORMATION AND DATABASE ACCESS AND RETRIEVAL SERVICES

BY Supplier in BY Supplier in

Taxable Territory Non-Taxable Territory

Supply of OIDARS

BY Supplier in Non-Taxable Territory

Supply of OIDARS TO Non-Business Entity / TO Non-Taxable Online

Supply of OIDARS

BY Supplier in Recipient

BY Supplier in Non-Taxable Territory

Taxable Territory (i.e. Individual or Government or Local Authority /

TO Business Entity

TO Any Person Governmental Authority or Government Entity not

engaged in Business / Profession / Industry /

Commerce)

Taxable Taxable Taxable

(Forward Charge) (Forward Charge) (Reverse Charge)

(Supplier of OIDARS in Non-Taxable Territory (Recipient i.e. Business Entity in Taxable Territory

has to pay GST) has to pay GST)

Example 1: Supplier of OIDARS in India (say Slide Bazaar) Example 2: Supplier of OIDARS in USA (say Slide Share)

Particulars GST Particulars GST

OIDARS to A & Co., a CA Firm (Business Entity) (FCM) OIDARS to A & Co., a CA Firm (Business Entity) (RCM)

OIDARS to Mr. B., a Student (Non-Business Entity) (FCM) OIDARS to Mr. B., a Student (Non-Business Entity) (FCM)

Vishal Jain Page 5A.32 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(16) SECURITY SERVICES

SERVICES BY WAY OF SUPPLY OF SECURITY PERSONNEL

BY Body Corporate BY other than Body Corporate

Security Services

Security Services Security Services Security Services

Security Services BY other than

BY other than Body BY other than Body BY other than Body

BY Body Body Corporate

Corporate Corporate Corporate

Corporate TO Registered

TO Unregistered TO Registered Person TO Registered Person

TO Any Person Person

Person (Composition Scheme) (ONLY for TDS u/s 51)

(Regular Schme)

Taxable Taxable Taxable Taxable Taxable

(FCM) (FCM) (FCM) (FCM) (RCM)

Example 1: Supply of Security Services by Star Security (P) Ltd. Example 2: Supply of Security Services by Little Star Security Co.

Particulars GST Particulars GST

Security Services TO Unregistered Person (FCM) Security Services TO Unregistered Person (FCM)

Security Services TO Registered Composition Security Services TO Registered Composition

(FCM) (FCM)

Taxable Person Taxable Person

Security Services TO Govt. Department (Registered Security Services TO Govt. Department (Registered

(FCM) (FCM)

only for TDS under Section 51) only for TDS under Section 51)

Security Services TO Govt. Department (Registered Security Services TO Govt. Department (Registered

(FCM) (RCM)

for TDS under Section 51 and for Payment of GST) for TDS under Section 51 and for Payment of GST)

Security Services TO Registered Regular Taxable Security Services TO Registered Regular Taxable

(FCM) (RCM)

Person Person

Vishal Jain Page 5A.33 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(17) CONSTRUCTION SERVICES

(I) CONSTRUCTION OF RESIDENTIAL PROPERTY

Construction of Single Residential Unit Construction of Residential Complex

Services by way of Pure Labour Contracts Services by way of Pure Labour Contracts

Services by way of Pure Labour Contracts of Residential Complex covered under of Residential Complex NOT covered

of Single Residential Unit Housing for All (Urban) Mission or under Housing for All (Urban) Mission or

Pradhan Mantri Awas Yojana Pradhan Mantri Awas Yojana

Primary Secondary Primary Secondary Primary Secondary

Construction Work Construction Work Construction Work Construction Work Construction Work Construction Work

Exempt Taxable Exempt Exempt Taxable Taxable

Example 1: Construction of Houses in Residential Complex under Example 2: Construction of Houses in Residential Complex NOT

Pradhan Mantri Awas Yojana (Special Case) under Pradhan Mantri Awas Yojana (General Case)

Particulars GST Particulars GST

Original Construction Original Construction

Repairs, Maintenance, Renovation, etc. Repairs, Maintenance, Renovation, etc.

Example 3: Construction of Single Residential Unit (NOT part of Residential Complex)

Particulars GST

Original Construction

Repairs, Maintenance, Renovation, etc.

Vishal Jain Page 5A.34 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

Services BY Landlord TO Promoter in relation to Construction of Residential Apartments by Promoter

Service (BY Any Person, generally being Landlord, TO Promoter)

Services (BY Any Person, generally being Landlord, TO Promoter)

by way of granting of long term lease of 30 years or more on

by way of Transfer of Development Rights (TDR) OR Floor Space

payment of Upfront amount (called as premium, salami, cost, price,

Index (FSI), including additional FSI, for construction of residential

development charges or by any other name) for construction of

apartments by a promoter in a project, intended for sale to a buyer,

residential apartments by a promoter in a project, intended for sale

wholly or partly

to a buyer, wholly or partly

Constructed Flats are sold before Entire Consideration is received Constructed Flats are sold before Entire Consideration is received

issuance of Completion after issuance of Completion issuance of Completion after issuance of Completion

Certificate / First Occupancy and Certificate / First Occupancy and Certificate / First Occupancy and Certificate / First Occupancy and

Tax is paid on such Constructed Tax is NOT paid on such Tax is paid on such Constructed Tax is NOT paid on such

Flats Constructed Flats Flats Constructed Flats

Exempt Taxable Exempt Taxable

(RCM) (RCM)

Note: Exemption of TDR, FSI and Long Term Lease (Upfront Amount) shall be withdrawn in case of flats sold after issue of completion

certificate, but such withdrawal shall be limited to 1% of value in case of affordable houses and 5% of value in case of other than affordable

houses. This will achieve a fair degree of taxation parity between under construction and ready to move property.

Vishal Jain Page 5A.35 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(II) CONSTRUCTION OF COMMERCIAL PROPERTY

Construction in Specified Case Construction in Other Cases

Services supplied BY Electricity Distribution Utilities by way of

Construction, Erection, Commissioning, or Installation of

Any Other Case

infrastructure for extending electricity distribution network upto

the tube well of the farmer or agriculturalist for agricultural use.

Taxable

Primary Construction Work Secondary Construction Work

Exempt Taxable

Notes:

(a) Primary Construction Work is a simple term used instead of Construction, Erection, Commissioning, or Installation of Original Works

(b) Secondary Construction Work is a simple term used instead of Completion, Fitting Out, Repair, Maintenance, Renovation, or Alteration of

a Civil Structure or any other Original Works

(c) “Original Works” means all new constructions and incudes

(i) all types of additions and alterations to abandoned or damaged structures on land that are required to make them workable;

(ii) erection, commissioning or installation of plant, machinery or equipment or structures, whether pre-fabricated or otherwise

(d) “Single Residential Unit” means a self-contained residential unit which is designed for use, wholly or principally, for residential purposes

for one family (i.e. Unit used for residential purposes for one family irrespective of number of floors and not part of Residential Complex)

(e) “Residential Complex” means more than 1 Single Residential Unit.

Vishal Jain Page 5A.36 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(18) RENTING / LEASING / HIRING SERVICES

(I) RENTING / LEASING OF IMMOVABLE PROPERTY

Renting of Residential Property

Services by way of Renting of Residential Dwelling for use as Residence EXCEPT where the residential dwelling is

rented TO a Registered Person

Explanation: For the purpose of exemption under this entry, this entry shall cover services by way of renting of

residential dwelling to a registered person where, Exempt

(i) the registered person is proprietor of a proprietorship concern and rents the residential dwelling in his personal

capacity for use as his own residence; and

(ii) such renting is on his own account and not that of the proprietorship concern

Services by way of Renting of Residential Dwelling (for use as residence or otherwise) TO a Registered Person Taxable

(RCM)

Renting of Commercial Property

Renting of Vacant Land with or without structure incidental to its use for Agriculture Produce Exempt

Services BY Central Government by way of grant of License / Lease to explore or mine Petroleum Crude / Natural Gas

or both where the consideration paid to the Central Government in the form of Central Government’s share of profit Exempt

petroleum as defined in the contract entered into by the Central Government in this behalf

Services by way of Assignment of Right to Use Natural Resources TO an Individual Farmer for the purposes of

Exempt

Agriculture

Long Term Lease (30 years or more) of Industrial Plots or Plots for Development of Infrastructure for Financial

Business BY State Government Industrial Development Corporations or BY any other entity having 20% or more

ownership of Central Government, State Government, Union territory TO Industrial Units or TO the Developers in Exempt

any Industrial or Financial Business Area on the one-time upfront amount (called as premium, salami, cost, price,

development charges, etc.)

Vishal Jain Page 5A.37 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

Explanation: For the purpose of this exemption, the Central Government, State Government or Union Territory shall

have 20% or more ownership in the entity directly or through an entity which is wholly owned by the Central

Government, State Government or Union Territory.

Conditions:

(i) The leased plots shall be used for the purpose for which they are allotted, that is, for industrial or financial activity

in an industrial or financial business area:

(ii) State Government concerned shall monitor and enforce the above condition as per the order issued by the State

Government in this regard:

(iii) In case of any violation or subsequent change of land use, due to any reason whatsoever, the original lessor,

original lessee as well as any subsequent lessee or buyer or owner shall be jointly and severally liable to pay such

amount of GST, as would have been payable on the upfront amount charged for the long term lease of the plots

but for the exemption contained herein, along with the applicable interest and penalty:

(iv) The lease agreement entered into by the original lessor with the original lessee or subsequent lessee, or sub-lessee,

as well as any subsequent lease or sale agreements, for lease or sale of such plots to subsequent lessees or buyers or

owners shall incorporate in the terms and conditions, the fact that the GST was exempted on the long term lease of

the plots by the original lessor to the original lessee subject to above condition and that the parties to the said

agreements undertake to comply with the same.

Clarification on Long Term Lease on One-Time Upfront Amount – CBIC Circular 101/20/2019 – CGST

Clarification GST exemption on the upfront amount is admissible irrespective of whether such upfront amount is

payable or paid in one or more instalments, provided the amount is determined upfront.

Renting of precincts of a religious place meant for general public, owned or managed by an entity registered as a

charitable or religious trust under Section 12AA / Section 12AB or Section 10(23C)(v) or Section 10(23BBA) of IT Act,

1961, where

(a) Charges are less than Rs.1,000 per day for Renting of Rooms Exempt

(b) Charges are less than Rs.10,000 per day for Renting of Premises, Community Halls, Kalyanmandapam or open

area, and the like

(c) Charges are less than Rs.10,000 per month for Renting of Shops or other spaces for business or commerce

Any other case Taxable

Vishal Jain Page 5A.38 Praveen Jain

360° Coverage! Train Your Brain!!!

Chapter 5A “Vidhya Peeth” Exemptions & RCM

Conceptual Learning! Study! Revise!! Krack!!!

(II) RENTING / HIRING OF MOVABLE PROPERTY

Service by way of giving on hire of a Motor Vehicle

meant to carry more than 12 passengers TO a State

Transport Undertaking

Services by way of giving on hire of an Electrically

Operated Vehicle meant to carry more than 12 passengers

TO a Local Authority

Renting or Leasing of

Agro Machinery

Service by way of giving on hire of a Means of Any Other Service

in relation to

Transportation of Goods TO a Goods Transport Agency

Agricultural Produce