Professional Documents

Culture Documents

0 ratings0% found this document useful (0 votes)

7 viewsManagerial Economics: Alternatives in Terms of The Objectives of The Organization

Managerial Economics: Alternatives in Terms of The Objectives of The Organization

Uploaded by

Gelli CalingasanThis document discusses managerial economics concepts related to costs, profits, and decision-making. It covers the differences between fixed and variable costs, as well as marginal costs, average costs, total revenue, and marginal profits. The key points are:

1) In the long run, all costs are variable and fixed costs equal zero. Managers must consider both benefits and costs when making decisions.

2) Effective managers collect and analyze relevant operating information to arrive at optimal decisions that maximize profits.

3) Profits are maximized when marginal revenue equals marginal cost, meaning additional revenue from one more unit of output equals the additional cost of producing that unit.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

You might also like

- UGRD-BAMM6204 Professional Salesmanship QuizDocument11 pagesUGRD-BAMM6204 Professional Salesmanship QuizJordan Nieva AndioNo ratings yet

- Notes Exam MGMT Control FinanceDocument76 pagesNotes Exam MGMT Control Financecamilla.louiseNo ratings yet

- Managerial Accounting Managerial AccountingDocument30 pagesManagerial Accounting Managerial Accountingpvsk17072005No ratings yet

- Manecon NotesDocument11 pagesManecon NotesMikasa AckermanNo ratings yet

- Chapter Cost Volume Profit and Break-Even AnalysisDocument20 pagesChapter Cost Volume Profit and Break-Even AnalysisINDIAN BEASTNo ratings yet

- Cost Accounting Nature of Costs/Cost Volume Profit Analysis IDocument25 pagesCost Accounting Nature of Costs/Cost Volume Profit Analysis IMackenzie Heart Obien0% (1)

- Assignment Nos.3 Optimal Decision Using Marginal AnalysisDocument4 pagesAssignment Nos.3 Optimal Decision Using Marginal AnalysisKeziaNo ratings yet

- MA - LO2 - Marginal CostingDocument36 pagesMA - LO2 - Marginal CostingLê MinhNo ratings yet

- Cost Terminology and Cost BehaviorsDocument2 pagesCost Terminology and Cost BehaviorsNicole Anne Santiago SibuloNo ratings yet

- 1.3 CVP AnalysisDocument2 pages1.3 CVP AnalysisLea GerodiazNo ratings yet

- Business O Level Notes - Chapter 16 PDFDocument4 pagesBusiness O Level Notes - Chapter 16 PDFHeba KhattabNo ratings yet

- Business O Level Notes - Chapter 16Document4 pagesBusiness O Level Notes - Chapter 16Heba KhattabNo ratings yet

- Using Costs in Decision Making: Pricing - Cost Can Determine If A Firm CanDocument10 pagesUsing Costs in Decision Making: Pricing - Cost Can Determine If A Firm Cansneha mallikaNo ratings yet

- Lec 06 - CVP AnalysisDocument64 pagesLec 06 - CVP AnalysisABDUL HASIB HASAN ZAYEDNo ratings yet

- Cost Volume Profit Upd(1)Document11 pagesCost Volume Profit Upd(1)wigfieldcalebNo ratings yet

- CH 5Document21 pagesCH 5hohrmpm2No ratings yet

- Finals+Topic+1 Notes CVP+and+Break-even+AnalysisDocument5 pagesFinals+Topic+1 Notes CVP+and+Break-even+AnalysisEA RL BrionesNo ratings yet

- Mapa ConceptualDocument2 pagesMapa ConceptualJuan David Romero CarrilloNo ratings yet

- Cost Behavior 2020 09 28 22 06 03 PDFDocument33 pagesCost Behavior 2020 09 28 22 06 03 PDFRiccardo SacchettiNo ratings yet

- Cost I Exit SummaryDocument92 pagesCost I Exit Summarykeyruebrahim44No ratings yet

- Marginal CostingDocument33 pagesMarginal CostingYaminiDevpuraSomaniNo ratings yet

- VariableandRelevant Costing Method - SCMDocument4 pagesVariableandRelevant Costing Method - SCMryokie dumpNo ratings yet

- ECON 2a PrelimsDocument8 pagesECON 2a PrelimskestenpeytNo ratings yet

- Managerial Economics ReviewerDocument9 pagesManagerial Economics ReviewerMerrie Rainelle Delos ReyesNo ratings yet

- Costing (Old)Document283 pagesCosting (Old)SubhamNo ratings yet

- Cost Acc Chapter 4Document5 pagesCost Acc Chapter 4ElleNo ratings yet

- 8 - Operating and Financial LeverageDocument15 pages8 - Operating and Financial LeverageClariz VelasquezNo ratings yet

- Evaluation of Health ProgrammeDocument3 pagesEvaluation of Health ProgrammeRahul Singh TiwariNo ratings yet

- Cost Accounting Can Be Viewed As TheDocument5 pagesCost Accounting Can Be Viewed As TheShannonNo ratings yet

- W3 AC:VC ShortDocument20 pagesW3 AC:VC ShortEugene TeoNo ratings yet

- Logisticmanagement 09Document12 pagesLogisticmanagement 09Budy AriyantoNo ratings yet

- Be601 Lecture7 (Module6 CVP) 03nov21 ClassDocument36 pagesBe601 Lecture7 (Module6 CVP) 03nov21 ClassMohammad Musa AbidNo ratings yet

- Chapter 3Document55 pagesChapter 3mohammedNo ratings yet

- 4 Chapter20Document40 pages4 Chapter20154 ahmed ehabNo ratings yet

- Marginal and Absorption Costing: Prepared By: Talha Majeed Khan (M.Phil), Lecturer UCP, Faculty of Management StudiesDocument8 pagesMarginal and Absorption Costing: Prepared By: Talha Majeed Khan (M.Phil), Lecturer UCP, Faculty of Management StudieszubairNo ratings yet

- Caie A2 Level Economics 9708 Theory v1Document23 pagesCaie A2 Level Economics 9708 Theory v1ammarahmed8855No ratings yet

- Relationship Between Revenues and Costs: Concept FormulaDocument2 pagesRelationship Between Revenues and Costs: Concept FormulaDionysis PonirosNo ratings yet

- Module 4 MACDocument4 pagesModule 4 MACBroniNo ratings yet

- Chapter 9 Marginal Costing and Absorption CostingDocument7 pagesChapter 9 Marginal Costing and Absorption CostingLinyVatNo ratings yet

- Operating and Financial LeverageDocument20 pagesOperating and Financial LeverageEmilio Joshua PaduaNo ratings yet

- Brewer6ce - PPT - Ch06 (64) - Read-OnlyDocument46 pagesBrewer6ce - PPT - Ch06 (64) - Read-Onlyjane chiangNo ratings yet

- STCM 03AbsorptionandVariableCostingDocument5 pagesSTCM 03AbsorptionandVariableCostingdin matanguihanNo ratings yet

- Acc 179 Report FinalDocument44 pagesAcc 179 Report Finalpatriciaann881115No ratings yet

- Marginal and Incremental AnalysesDocument2 pagesMarginal and Incremental AnalysesAaryan BansalNo ratings yet

- Fourth QuarterDocument13 pagesFourth QuarterBianca CapadociaNo ratings yet

- Preparing The Financial Section of A Business Plan: by Michele BertoniDocument31 pagesPreparing The Financial Section of A Business Plan: by Michele BertoniDavid MirandaNo ratings yet

- 02-Cost-Terms-Concepts-and-Behavior - Managerial AccountingDocument58 pages02-Cost-Terms-Concepts-and-Behavior - Managerial Accountingsabrina jane falconNo ratings yet

- Short Term Decision Making (OK Na!)Document12 pagesShort Term Decision Making (OK Na!)daemonspadechocoy100% (1)

- Variable and Absorption CostingDocument2 pagesVariable and Absorption CostingLaura OliviaNo ratings yet

- Cost BehaviorDocument10 pagesCost BehaviorSteven Sanderson100% (5)

- Condensed Format 1Document10 pagesCondensed Format 1Mariz RapadaNo ratings yet

- Lecture-5-Cost-08-10-2021 PDFDocument65 pagesLecture-5-Cost-08-10-2021 PDFARJUN SRIVASTAVANo ratings yet

- Chapter 15 Cost EstimatingDocument12 pagesChapter 15 Cost EstimatingBoys netflixNo ratings yet

- END3972 Week2 v2Document27 pagesEND3972 Week2 v2Enes TürksalNo ratings yet

- Module-2 2Document4 pagesModule-2 2Danna VargasNo ratings yet

- Marginal CostingDocument42 pagesMarginal CostingAbdifatah SaidNo ratings yet

- Unit 1 Section 5Document4 pagesUnit 1 Section 5Babamu Kalmoni JaatoNo ratings yet

- Building Cost Management: Case Study Using Costing Methods: International Journal of Advances in Management and EconomicsDocument5 pagesBuilding Cost Management: Case Study Using Costing Methods: International Journal of Advances in Management and EconomicsHime Silhouette GabrielNo ratings yet

- Most Common Frameworks - ProfitabilityDocument13 pagesMost Common Frameworks - Profitabilitynaresh veesam1No ratings yet

- Brewer6ce PPT Ch02Document70 pagesBrewer6ce PPT Ch02kajol.leoNo ratings yet

- The Political Economy of Participatory EconomicsFrom EverandThe Political Economy of Participatory EconomicsRating: 4 out of 5 stars4/5 (5)

- Compilation of Assignments: Structural Theory IDocument2 pagesCompilation of Assignments: Structural Theory ITejay TolibasNo ratings yet

- Ms Iso 16120 42008 Non Alloy SteelDocument13 pagesMs Iso 16120 42008 Non Alloy SteelINSTECH Consulting100% (1)

- Mele - Free Will and NeuroscienceDocument17 pagesMele - Free Will and NeuroscienceKbkjas JvkndNo ratings yet

- Albersheims EquationDocument6 pagesAlbersheims EquationAhmedShahNo ratings yet

- 銘板貼紙新Document8 pages銘板貼紙新Nguyễn Hoàng SơnNo ratings yet

- General Physics I Module 3-4Document16 pagesGeneral Physics I Module 3-4Walter MataNo ratings yet

- F520Document2 pagesF520Marcos AldrovandiNo ratings yet

- Acoustic PhoneticsDocument19 pagesAcoustic PhoneticsRihane El Alaoui100% (1)

- Wheel ChairDocument23 pagesWheel ChairShivam YadavNo ratings yet

- HMBD 50B Drain ManualDocument14 pagesHMBD 50B Drain Manualindra bayujagadNo ratings yet

- Atlas 3CR12 DatasheetDocument3 pagesAtlas 3CR12 DatasheettridatylNo ratings yet

- Cl400e VDocument2 pagesCl400e VCá ThuNo ratings yet

- SECOND Periodic Test in AP 4 With TOS SY 2022 2023Document6 pagesSECOND Periodic Test in AP 4 With TOS SY 2022 2023MICHAEL VERINANo ratings yet

- Ethernet Transport Over PDH Networks With Virtual Concatenation TutorialDocument15 pagesEthernet Transport Over PDH Networks With Virtual Concatenation TutorialAnovar_ebooksNo ratings yet

- Physics Category 1 9th - 10th Grades SAMPLE TESTDocument4 pagesPhysics Category 1 9th - 10th Grades SAMPLE TESTAchavee SukratNo ratings yet

- Unit-3 NotesDocument17 pagesUnit-3 Notesj79494793No ratings yet

- Chafi2009Document7 pagesChafi2009radhakrishnanNo ratings yet

- PDF Psychotherapy Relationships That Work Volume 1 Evidence Based Therapist Contributions John C Norcross Ebook Full ChapterDocument47 pagesPDF Psychotherapy Relationships That Work Volume 1 Evidence Based Therapist Contributions John C Norcross Ebook Full Chapterdavid.muterspaw637100% (2)

- Ansys Fluent Brings CFD Performance With Intel Processors and FabricsDocument8 pagesAnsys Fluent Brings CFD Performance With Intel Processors and FabricsSaid FerdjallahNo ratings yet

- Economics:Presentation On Law of Equi Marginal Utility...Document11 pagesEconomics:Presentation On Law of Equi Marginal Utility...vinay rakshithNo ratings yet

- Leed NDDocument2 pagesLeed NDElnaz YousefzadehNo ratings yet

- Purdue Engineering 2010 PDFDocument98 pagesPurdue Engineering 2010 PDFGanesh BabuNo ratings yet

- ART300Document45 pagesART300Gerlyn OrdonioNo ratings yet

- Civil AutoCAD - CVDocument3 pagesCivil AutoCAD - CVNaseef PnNo ratings yet

- Erection Steel Structure ProcedureDocument15 pagesErection Steel Structure ProcedureOussama Sissaoui100% (2)

- Reciprocating Compressor Power Calculation Part 2Document6 pagesReciprocating Compressor Power Calculation Part 2Rifka Aisyah0% (1)

- Xii Economics 2022 Revision Model QuestionDocument7 pagesXii Economics 2022 Revision Model QuestionRahul RockNo ratings yet

- Z370 AORUS Gaming 3: User's ManualDocument48 pagesZ370 AORUS Gaming 3: User's ManualAtrocitus RedNo ratings yet

- CO 126 F FRESDENLEN 410358301910485666 Candy 126 F Optima Wash SystemDocument41 pagesCO 126 F FRESDENLEN 410358301910485666 Candy 126 F Optima Wash SystemSweetOfSerbiaNo ratings yet

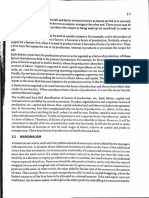

Managerial Economics: Alternatives in Terms of The Objectives of The Organization

Managerial Economics: Alternatives in Terms of The Objectives of The Organization

Uploaded by

Gelli Calingasan0 ratings0% found this document useful (0 votes)

7 views1 pageThis document discusses managerial economics concepts related to costs, profits, and decision-making. It covers the differences between fixed and variable costs, as well as marginal costs, average costs, total revenue, and marginal profits. The key points are:

1) In the long run, all costs are variable and fixed costs equal zero. Managers must consider both benefits and costs when making decisions.

2) Effective managers collect and analyze relevant operating information to arrive at optimal decisions that maximize profits.

3) Profits are maximized when marginal revenue equals marginal cost, meaning additional revenue from one more unit of output equals the additional cost of producing that unit.

Original Description:

Original Title

Document (4) (4)

Copyright

© © All Rights Reserved

Available Formats

DOCX, PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses managerial economics concepts related to costs, profits, and decision-making. It covers the differences between fixed and variable costs, as well as marginal costs, average costs, total revenue, and marginal profits. The key points are:

1) In the long run, all costs are variable and fixed costs equal zero. Managers must consider both benefits and costs when making decisions.

2) Effective managers collect and analyze relevant operating information to arrive at optimal decisions that maximize profits.

3) Profits are maximized when marginal revenue equals marginal cost, meaning additional revenue from one more unit of output equals the additional cost of producing that unit.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

0 ratings0% found this document useful (0 votes)

7 views1 pageManagerial Economics: Alternatives in Terms of The Objectives of The Organization

Managerial Economics: Alternatives in Terms of The Objectives of The Organization

Uploaded by

Gelli CalingasanThis document discusses managerial economics concepts related to costs, profits, and decision-making. It covers the differences between fixed and variable costs, as well as marginal costs, average costs, total revenue, and marginal profits. The key points are:

1) In the long run, all costs are variable and fixed costs equal zero. Managers must consider both benefits and costs when making decisions.

2) Effective managers collect and analyze relevant operating information to arrive at optimal decisions that maximize profits.

3) Profits are maximized when marginal revenue equals marginal cost, meaning additional revenue from one more unit of output equals the additional cost of producing that unit.

Copyright:

© All Rights Reserved

Available Formats

Download as DOCX, PDF, TXT or read online from Scribd

Download as docx, pdf, or txt

You are on page 1of 1

THE ETHICS OF GREED VERSUS SELF-

MANAGERIAL ECONOMICS INTEREST

Because all costs are variable in the long run, long-run 05 INCENTIVES

Managers make tough choices that involve benefits and Capitalismpeople is based on voluntary exchange

fixed costs always equal zero. Rewarding according to the value created

costs. between self-interested parties.

Long Run – period of complete flexibility with respect to for the organization.

Spreadsheets were a pivotal innovation because they put Market-based exchange is voluntary; both

input use.

the tools for insightful demand, cost, and profit analysis at TOTAL PROFIT

parties must perceive benefits, or profit, for

Total Costs – fixed and variable expenses.

the finger tips of decision makers. market transactions to take place. If only one

Fixed Costs – expenses that do not vary with output. It is simply the difference between total revenue

Effective managers must collect, organize, and process party were to benefit from a given transaction,

Variable Costs – expenses that fluctuate with output. and total cost. Π = TR – TC

relevant operating information. However, efficient there would be no incentive for the other party to

information

MARGINAL ANDprocessing

AVERAGE COST requires more than electronic cooperate and no voluntary exchange would

MARGINAL PROFIT

computing capability; it requires a fundamental take place.

Marginal

understanding Costof– basic change in total relations.

economic cost associated with a 1- ItAisself-interested

the change in total profit due to aalso

1-unit change

capitalist must have in

unit change in output.

“Effective managerial decision making is the process of inmind

output.

the interest of others. In contrast, a truly

MC=∂TC/∂Q

arriving at the best solution to a problem.’’

“Marginal cost

OPTIMAL DECISIONis the change

– Choice in total cost caused

alternative by a I-unit

that produces a “Marginalselfish individual

profit is the change is only concerned

in total with himself

profit caused by a 1-

change

result mostin the number with

consistent of units producedobjectives.

managerial (Q).” unit change in the number of units sold.” Mπ = ∂π / ∂Q of

or herself, without regard for the well-being

others.

Average

A challenge Costthat – total mustcostbedivided

met in by the

the decision-making

number of units

Self-interested

MARGINAL PROFIT behavior leads to profits and

produced.

process is characterizing the desirability of decision success under capitalism; selfish behavior

AC = TC/Q in terms of the objectives of the organization.

alternatives Marginal does

profit not.

can be thought of as the difference between

Managerial the

Whenever marginalalso

economics is less

provides than tools the foraverage, the

analyzing marginal revenue and marginal

Precise information aboutcost. Mπ = of

the effect MRa– MC

change

average will fall. Whenever the marginal

and evaluating decision alternatives. Economic concepts is greater than the

in output on total

PROFIT MAXIMIZATION RULE revenue is given by the

average, the average

and methodology are will

used rise.to Ifselect

the marginal

the optimal is equal to the

course of marginal relation between revenue and output.

average, the average is at either

action in light of available options and objectives.a minimum or a maximum.

Profit is maximized

Total, average,when and Mπ =marginal

MR-MC =relations

0 or MR=MC, are

If

MC = AC,ofand

Principles average cost

economic analysisfalls withformanthe expansion

basis for in

assumingvery profit declines

useful with further expansion

in optimization in number

analysis. Whereas

output, then AC is at a maximum.

describing demand, cost, and profit relations. Most If MC = AC, and average

of unit sold.

the definitions of totals and averages are well

cost rises the

important, withtheoryan expansion

and process in output, then AC isgives

of optimization at a

known, the meaning of marginal relations needs

minimum.

practical insight concerning the value maximization theory MARGINAL VERSUS INCREMENTAL CONCEPT

some explanation.

of the firm. Optimization techniques are helpful because A marginal

AVERAGE COST MINIMIZATION

they offer a realistic means for dealing with the MARGINAL CONCEPTrelation measuresis thethe change in the

effect associated

dependent

with unitary changesvariable

in output.caused by a 1-unit change in

– ancomplexities

activity level of goal-oriented

that generates the managerial

lowest average activities.cost. an independent variable.

In managerial economics, the primary objective of The marginal

Marginal revenueconcept

(MR)isis although

the change correct

in totalfor

MC=AC

management is assumed to be maximization of the analyzing

revenue unitary

associatedchanges

with ina output,

1-unit ischange

too narrow

in

The

value relationship

of the firm. between

This marginal cost and average

value maximization objectivecostis tooutput:

provide a general methodology for evaluating all

can be studied

expressed in Equation to determine the change in average cost

alternative

MR = ∂TR/∂Q courses of action.

that will occur EQUATION

MAXIMIZING with a 1-unitischange a complex in thetasknumber of units

that involves “Marginal revenue is the change in total revenue

produced.

consideration of future revenues, costs, and discount rates. INCREMENTAL CONCEPT

caused by a 1-unit change in the number of

With

TOTAL average

REVENUES cost are minimization,

directly determined the lowest by thepossible

quantity

average Itunits

is thesold (Q).”

generalization of the marginal concept. It

sold and cost is achieved.

the prices obtained

involves examining the impact of alternative

Factors that affect

MARKET-BASED MANAGEMENTprices and the quantity sold include DO FIRMS REALLY OPTIMIZE?

managerial decisions of courses of action on

the choice of products made available for sale, marketing

strategies,

Charles pricing and distribution policies, competition, and

Koch revenues,

Economic costs, and profit.

theory is useful for one simple

the general state of the economy reason—it works.

INCREMENTAL CHANGE

Market-Based

COST ANALYSIS Management includes (MBM) a detailed examination of the Cost Functions – relations between cost and

Itoutput.

is the change resulting from a given managerial

It is a business philosophy input

prices and availability of various that factors,

fosters alternative

principled, Short-run Cost Functions – cost relations

decision.

production schedules, production

entrepreneurial behavior among its employees. methods, and so on

when fixed costs are present; used for day-to-

‘’Effective

“seeks to adaptproduction and pricing

the principles of adecisions

free society dependand upon

market a

INCREMENTAL PROFIT

day operating decisions.

careful

economy understanding

to of

improve revenue relations.’’

management practice in

Spreadsheet Long-run Cost Functions – cost relation when

organizations.”– table of electronically stored data. It is the profit gain or loss associated with a given

all costs are variable; used for long-term

Equation – analytical expression of functional relationships managerial decision.

FIVE DIMENSIONS

Total Revenue –OF is aMBM

function of output. planning.

The easiest way to examine basic economic concepts is to Short Run Operating – period during which the

01 VISION

consider the functional relations incorporated in the basic availability of at least one input is fixed.

Determining

valuation model. whenConsider

and howthe the relation

organization between can output,

create theQ.

greatest long-term value based upon competitive COST RELATION

and total revenue, TR.

advantages.

The value of the dependent variable (total revenue) is Total costs are comprised of fixed and variable

02 VIRTUE AND TALENTS

determined by the independent variable (output). expenses.

Helping ensure that

• Equation people

(2.2), TR with the right

= f(Q), doesvalues, skills, and

not indicate the

capabilities are hired, retained, and developed. In equation form, total cost can be expressed as

specific relation between output and total revenue;

03 KNOWLEDGE PROCESSES

it merely states that some relation exists.

Creating, sharing, andTR applying relevant aknowledge to TC = FC+VC.

• Equation (2.3), = PQ, provides more precise

discoverexpression

how employees and practices

of this functional relation: can become more Fixed costs do not vary with output. These costs

profitable.

• When a linear demand curve is written as P = include interest expenses, rent on leased plant and

04 DECISION RIGHTS equipment, depreciation charges associated with the

Ensuring the right people are in the right roles with the right

authority to make decisions and holding them accountable.

You might also like

- UGRD-BAMM6204 Professional Salesmanship QuizDocument11 pagesUGRD-BAMM6204 Professional Salesmanship QuizJordan Nieva AndioNo ratings yet

- Notes Exam MGMT Control FinanceDocument76 pagesNotes Exam MGMT Control Financecamilla.louiseNo ratings yet

- Managerial Accounting Managerial AccountingDocument30 pagesManagerial Accounting Managerial Accountingpvsk17072005No ratings yet

- Manecon NotesDocument11 pagesManecon NotesMikasa AckermanNo ratings yet

- Chapter Cost Volume Profit and Break-Even AnalysisDocument20 pagesChapter Cost Volume Profit and Break-Even AnalysisINDIAN BEASTNo ratings yet

- Cost Accounting Nature of Costs/Cost Volume Profit Analysis IDocument25 pagesCost Accounting Nature of Costs/Cost Volume Profit Analysis IMackenzie Heart Obien0% (1)

- Assignment Nos.3 Optimal Decision Using Marginal AnalysisDocument4 pagesAssignment Nos.3 Optimal Decision Using Marginal AnalysisKeziaNo ratings yet

- MA - LO2 - Marginal CostingDocument36 pagesMA - LO2 - Marginal CostingLê MinhNo ratings yet

- Cost Terminology and Cost BehaviorsDocument2 pagesCost Terminology and Cost BehaviorsNicole Anne Santiago SibuloNo ratings yet

- 1.3 CVP AnalysisDocument2 pages1.3 CVP AnalysisLea GerodiazNo ratings yet

- Business O Level Notes - Chapter 16 PDFDocument4 pagesBusiness O Level Notes - Chapter 16 PDFHeba KhattabNo ratings yet

- Business O Level Notes - Chapter 16Document4 pagesBusiness O Level Notes - Chapter 16Heba KhattabNo ratings yet

- Using Costs in Decision Making: Pricing - Cost Can Determine If A Firm CanDocument10 pagesUsing Costs in Decision Making: Pricing - Cost Can Determine If A Firm Cansneha mallikaNo ratings yet

- Lec 06 - CVP AnalysisDocument64 pagesLec 06 - CVP AnalysisABDUL HASIB HASAN ZAYEDNo ratings yet

- Cost Volume Profit Upd(1)Document11 pagesCost Volume Profit Upd(1)wigfieldcalebNo ratings yet

- CH 5Document21 pagesCH 5hohrmpm2No ratings yet

- Finals+Topic+1 Notes CVP+and+Break-even+AnalysisDocument5 pagesFinals+Topic+1 Notes CVP+and+Break-even+AnalysisEA RL BrionesNo ratings yet

- Mapa ConceptualDocument2 pagesMapa ConceptualJuan David Romero CarrilloNo ratings yet

- Cost Behavior 2020 09 28 22 06 03 PDFDocument33 pagesCost Behavior 2020 09 28 22 06 03 PDFRiccardo SacchettiNo ratings yet

- Cost I Exit SummaryDocument92 pagesCost I Exit Summarykeyruebrahim44No ratings yet

- Marginal CostingDocument33 pagesMarginal CostingYaminiDevpuraSomaniNo ratings yet

- VariableandRelevant Costing Method - SCMDocument4 pagesVariableandRelevant Costing Method - SCMryokie dumpNo ratings yet

- ECON 2a PrelimsDocument8 pagesECON 2a PrelimskestenpeytNo ratings yet

- Managerial Economics ReviewerDocument9 pagesManagerial Economics ReviewerMerrie Rainelle Delos ReyesNo ratings yet

- Costing (Old)Document283 pagesCosting (Old)SubhamNo ratings yet

- Cost Acc Chapter 4Document5 pagesCost Acc Chapter 4ElleNo ratings yet

- 8 - Operating and Financial LeverageDocument15 pages8 - Operating and Financial LeverageClariz VelasquezNo ratings yet

- Evaluation of Health ProgrammeDocument3 pagesEvaluation of Health ProgrammeRahul Singh TiwariNo ratings yet

- Cost Accounting Can Be Viewed As TheDocument5 pagesCost Accounting Can Be Viewed As TheShannonNo ratings yet

- W3 AC:VC ShortDocument20 pagesW3 AC:VC ShortEugene TeoNo ratings yet

- Logisticmanagement 09Document12 pagesLogisticmanagement 09Budy AriyantoNo ratings yet

- Be601 Lecture7 (Module6 CVP) 03nov21 ClassDocument36 pagesBe601 Lecture7 (Module6 CVP) 03nov21 ClassMohammad Musa AbidNo ratings yet

- Chapter 3Document55 pagesChapter 3mohammedNo ratings yet

- 4 Chapter20Document40 pages4 Chapter20154 ahmed ehabNo ratings yet

- Marginal and Absorption Costing: Prepared By: Talha Majeed Khan (M.Phil), Lecturer UCP, Faculty of Management StudiesDocument8 pagesMarginal and Absorption Costing: Prepared By: Talha Majeed Khan (M.Phil), Lecturer UCP, Faculty of Management StudieszubairNo ratings yet

- Caie A2 Level Economics 9708 Theory v1Document23 pagesCaie A2 Level Economics 9708 Theory v1ammarahmed8855No ratings yet

- Relationship Between Revenues and Costs: Concept FormulaDocument2 pagesRelationship Between Revenues and Costs: Concept FormulaDionysis PonirosNo ratings yet

- Module 4 MACDocument4 pagesModule 4 MACBroniNo ratings yet

- Chapter 9 Marginal Costing and Absorption CostingDocument7 pagesChapter 9 Marginal Costing and Absorption CostingLinyVatNo ratings yet

- Operating and Financial LeverageDocument20 pagesOperating and Financial LeverageEmilio Joshua PaduaNo ratings yet

- Brewer6ce - PPT - Ch06 (64) - Read-OnlyDocument46 pagesBrewer6ce - PPT - Ch06 (64) - Read-Onlyjane chiangNo ratings yet

- STCM 03AbsorptionandVariableCostingDocument5 pagesSTCM 03AbsorptionandVariableCostingdin matanguihanNo ratings yet

- Acc 179 Report FinalDocument44 pagesAcc 179 Report Finalpatriciaann881115No ratings yet

- Marginal and Incremental AnalysesDocument2 pagesMarginal and Incremental AnalysesAaryan BansalNo ratings yet

- Fourth QuarterDocument13 pagesFourth QuarterBianca CapadociaNo ratings yet

- Preparing The Financial Section of A Business Plan: by Michele BertoniDocument31 pagesPreparing The Financial Section of A Business Plan: by Michele BertoniDavid MirandaNo ratings yet

- 02-Cost-Terms-Concepts-and-Behavior - Managerial AccountingDocument58 pages02-Cost-Terms-Concepts-and-Behavior - Managerial Accountingsabrina jane falconNo ratings yet

- Short Term Decision Making (OK Na!)Document12 pagesShort Term Decision Making (OK Na!)daemonspadechocoy100% (1)

- Variable and Absorption CostingDocument2 pagesVariable and Absorption CostingLaura OliviaNo ratings yet

- Cost BehaviorDocument10 pagesCost BehaviorSteven Sanderson100% (5)

- Condensed Format 1Document10 pagesCondensed Format 1Mariz RapadaNo ratings yet

- Lecture-5-Cost-08-10-2021 PDFDocument65 pagesLecture-5-Cost-08-10-2021 PDFARJUN SRIVASTAVANo ratings yet

- Chapter 15 Cost EstimatingDocument12 pagesChapter 15 Cost EstimatingBoys netflixNo ratings yet

- END3972 Week2 v2Document27 pagesEND3972 Week2 v2Enes TürksalNo ratings yet

- Module-2 2Document4 pagesModule-2 2Danna VargasNo ratings yet

- Marginal CostingDocument42 pagesMarginal CostingAbdifatah SaidNo ratings yet

- Unit 1 Section 5Document4 pagesUnit 1 Section 5Babamu Kalmoni JaatoNo ratings yet

- Building Cost Management: Case Study Using Costing Methods: International Journal of Advances in Management and EconomicsDocument5 pagesBuilding Cost Management: Case Study Using Costing Methods: International Journal of Advances in Management and EconomicsHime Silhouette GabrielNo ratings yet

- Most Common Frameworks - ProfitabilityDocument13 pagesMost Common Frameworks - Profitabilitynaresh veesam1No ratings yet

- Brewer6ce PPT Ch02Document70 pagesBrewer6ce PPT Ch02kajol.leoNo ratings yet

- The Political Economy of Participatory EconomicsFrom EverandThe Political Economy of Participatory EconomicsRating: 4 out of 5 stars4/5 (5)

- Compilation of Assignments: Structural Theory IDocument2 pagesCompilation of Assignments: Structural Theory ITejay TolibasNo ratings yet

- Ms Iso 16120 42008 Non Alloy SteelDocument13 pagesMs Iso 16120 42008 Non Alloy SteelINSTECH Consulting100% (1)

- Mele - Free Will and NeuroscienceDocument17 pagesMele - Free Will and NeuroscienceKbkjas JvkndNo ratings yet

- Albersheims EquationDocument6 pagesAlbersheims EquationAhmedShahNo ratings yet

- 銘板貼紙新Document8 pages銘板貼紙新Nguyễn Hoàng SơnNo ratings yet

- General Physics I Module 3-4Document16 pagesGeneral Physics I Module 3-4Walter MataNo ratings yet

- F520Document2 pagesF520Marcos AldrovandiNo ratings yet

- Acoustic PhoneticsDocument19 pagesAcoustic PhoneticsRihane El Alaoui100% (1)

- Wheel ChairDocument23 pagesWheel ChairShivam YadavNo ratings yet

- HMBD 50B Drain ManualDocument14 pagesHMBD 50B Drain Manualindra bayujagadNo ratings yet

- Atlas 3CR12 DatasheetDocument3 pagesAtlas 3CR12 DatasheettridatylNo ratings yet

- Cl400e VDocument2 pagesCl400e VCá ThuNo ratings yet

- SECOND Periodic Test in AP 4 With TOS SY 2022 2023Document6 pagesSECOND Periodic Test in AP 4 With TOS SY 2022 2023MICHAEL VERINANo ratings yet

- Ethernet Transport Over PDH Networks With Virtual Concatenation TutorialDocument15 pagesEthernet Transport Over PDH Networks With Virtual Concatenation TutorialAnovar_ebooksNo ratings yet

- Physics Category 1 9th - 10th Grades SAMPLE TESTDocument4 pagesPhysics Category 1 9th - 10th Grades SAMPLE TESTAchavee SukratNo ratings yet

- Unit-3 NotesDocument17 pagesUnit-3 Notesj79494793No ratings yet

- Chafi2009Document7 pagesChafi2009radhakrishnanNo ratings yet

- PDF Psychotherapy Relationships That Work Volume 1 Evidence Based Therapist Contributions John C Norcross Ebook Full ChapterDocument47 pagesPDF Psychotherapy Relationships That Work Volume 1 Evidence Based Therapist Contributions John C Norcross Ebook Full Chapterdavid.muterspaw637100% (2)

- Ansys Fluent Brings CFD Performance With Intel Processors and FabricsDocument8 pagesAnsys Fluent Brings CFD Performance With Intel Processors and FabricsSaid FerdjallahNo ratings yet

- Economics:Presentation On Law of Equi Marginal Utility...Document11 pagesEconomics:Presentation On Law of Equi Marginal Utility...vinay rakshithNo ratings yet

- Leed NDDocument2 pagesLeed NDElnaz YousefzadehNo ratings yet

- Purdue Engineering 2010 PDFDocument98 pagesPurdue Engineering 2010 PDFGanesh BabuNo ratings yet

- ART300Document45 pagesART300Gerlyn OrdonioNo ratings yet

- Civil AutoCAD - CVDocument3 pagesCivil AutoCAD - CVNaseef PnNo ratings yet

- Erection Steel Structure ProcedureDocument15 pagesErection Steel Structure ProcedureOussama Sissaoui100% (2)

- Reciprocating Compressor Power Calculation Part 2Document6 pagesReciprocating Compressor Power Calculation Part 2Rifka Aisyah0% (1)

- Xii Economics 2022 Revision Model QuestionDocument7 pagesXii Economics 2022 Revision Model QuestionRahul RockNo ratings yet

- Z370 AORUS Gaming 3: User's ManualDocument48 pagesZ370 AORUS Gaming 3: User's ManualAtrocitus RedNo ratings yet

- CO 126 F FRESDENLEN 410358301910485666 Candy 126 F Optima Wash SystemDocument41 pagesCO 126 F FRESDENLEN 410358301910485666 Candy 126 F Optima Wash SystemSweetOfSerbiaNo ratings yet