Professional Documents

Culture Documents

Child Max Ulip

Child Max Ulip

Uploaded by

jagdevwasson761Original Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Child Max Ulip

Child Max Ulip

Uploaded by

jagdevwasson761Copyright:

Available Formats

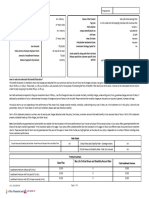

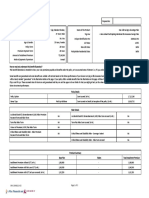

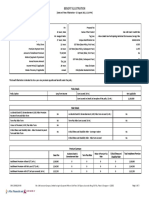

Proposal No:

Name of the Prospect/Policyholder: Mr. Sanjay Name of the Product: Max Life Online Savings Plan

Tag Line: A Unit Linked Non Participating Individual Life Insurance Plan

Age & Gender: 33 Years, Male

Policy Option: Variant 2

Name of the Life Assured: Mr. Sanjay Unique Identification No: 104L098V05

GST Rate: 18.00%

Age & Gender: 33 Years, Male Max Life State: Haryana

Policyholder Residential State: Haryana

Sum Assured: `8,40,000 Investment Strategy Opted for: NA

Policy Term & Premium Payment Term: 30 Years & 5 Years

Funds opted for along with their risk level

Amount of Installment Premium: `7,000 [Please specify the customer specific fund

Mode of payment of premium: Monthly option): NIFTY Smallcap Quality Index Fund (Risk Rating-Very High) :

100%

How to read and understand this benefit illustration?

This benefit illustration is intended to show what charges are deducted from your premiums and how the unit fund, net of charges and taxes, may grow over the years of the policy term if the fund earns a gross

return of 8% p.a. or 4% p.a. These rates, i.e., 8% p.a. and 4% p.a. are assumed only for the purpose of illustrating the flow of benefits if the returns are at this level. It should not be interpreted that the returns

under the plan are going to be either 8% p.a. or 4% p.a.

Net Yield mentioned corresponds to the gross investment return of 8% p.a., net of all charges but does not consider mortality, morbidity charges, underwriting extra, if any, guarantee charges and cost of riders, if

deducted by cancellation of units. It demonstrates the impact of charges exclusive of taxes on the net yield. Please note that the mortality charges per thousand sum assured in general, increases with age.

The actual returns can vary depending on the performance of the chosen fund, charges towards mortality, morbidity, underwriting extra, cost of riders, etc. The investment risk in this policy is borne by the

policyholder, hence, for more details on terms and conditions please read sales literature carefully.

Part A of this statement presents a summary view of year-by-year charges deducted under the policy, fund value, surrender value and the death benefit, at two assumed rates of return. Part B of this statement

presents a detailed break-up of the charges, and other values.

Note: Some benefits are guaranteed and some benefits are variable with returns based on the future performance of your insurer carrying on life insurance business. If your policy offers guaranteed benefits then

these will be clearly marked “guaranteed” in the illustration table on this page. If your policy offers variable benefits then the illustration on this page will show two different rates of assumed future investment

returns. These assumed rates of return are not guaranteed and they are not the upper or lower limits of what you might get back, as the value of your policy is dependent on a number of factors including actual

future investment performance.

Rider Details

Critical Illness and Disability-Secure Rider - Rider Premium Payment Term and Rider Term NA Critical Illness and Disability Rider - Coverage Variant NA

Critical Illness and Disability Rider - Rider Sum Assured NA

Premium Summary

Max Life Critical Illness and Disability-Secure Rider

Base Plan Total Installment Premium

Installment Premium without GST (in Rs.) 7,000 0 7,000

Installment Premium with first year GST (in Rs.) 7,000 0 7,000

Installment Premium with GST 2nd year onwards (in Rs.) 7,000 0 7,000

UIN: 104L098V05 Page 1 of 6

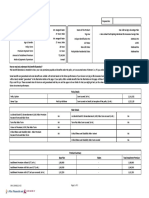

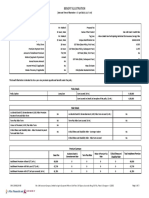

Part A

(Amount in Rupees.)

At 4% p.a. Gross Investment Return At 8% p.a. Gross Investment Return

Commission

Policy Annualized

payable to

Year Premium Mortality, Morbidity Fund at End Surrender Mortality, Fund at End Surrender

Other Charges* GST Death Benefit Other Charges* GST Death Benefit intermediary

Charges of Year Value Morbidity Charges of Year Value

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

1 84,000 2,212 448 479 82,607 76,759 12,60,000 2,212 455 480 84,325 78,378 12,60,000 -

2 84,000 2,242 1,291 636 1,67,471 1,63,506 12,60,000 2,242 1,333 643 1,74,287 1,70,323 12,60,000 -

3 84,000 2,306 2,157 803 2,54,611 2,51,637 12,60,000 2,306 2,270 824 2,70,222 2,67,248 12,60,000 -

4 84,000 2,358 3,046 973 3,44,105 3,42,123 12,60,000 2,358 3,269 1,013 3,72,545 3,70,563 12,60,000 -

5 84,000 2,417 3,959 1,148 4,36,012 4,36,012 12,60,000 2,417 4,335 1,215 4,81,680 4,81,680 12,60,000 -

6 - 2,532 4,434 1,254 4,45,073 4,45,073 12,60,000 2,532 5,002 1,356 5,10,985 5,10,985 12,60,000 -

7 - 2,716 4,525 1,303 4,54,166 4,54,166 12,60,000 2,716 5,306 1,444 5,42,037 5,42,037 12,60,000 -

8 - 2,941 4,616 1,360 4,63,241 4,63,241 12,60,000 2,941 5,628 1,542 5,74,902 5,74,902 12,60,000 -

9 - 3,206 4,707 1,424 4,72,251 4,72,251 12,60,000 3,206 5,969 1,651 6,09,654 6,09,654 12,60,000 -

10 - 3,492 4,797 1,492 4,81,168 4,81,168 12,60,000 3,492 6,329 1,768 6,46,394 6,46,394 12,60,000 -

11 - 3,839 4,886 1,571 4,89,916 4,89,916 12,60,000 3,839 6,709 1,899 6,85,181 6,85,181 12,60,000 -

12 - 4,227 4,973 1,656 4,98,442 4,98,442 12,60,000 4,227 7,111 2,041 7,26,102 7,26,102 12,60,000 -

13 - 4,697 5,057 1,756 5,06,643 5,06,643 12,60,000 4,697 7,534 2,202 7,69,202 7,69,202 12,60,000 -

14 - 5,228 5,137 1,866 5,14,434 5,14,434 12,60,000 5,228 7,980 2,377 8,14,552 8,14,552 12,60,000 -

15 - 5,820 5,213 1,986 5,21,733 5,21,733 12,60,000 5,820 8,448 2,568 8,62,228 8,62,228 12,60,000 -

16 - 6,515 5,283 2,124 5,28,403 5,28,403 12,60,000 6,515 8,940 2,782 9,12,262 9,12,262 12,60,000 -

17 - 7,270 5,346 2,271 5,34,352 5,34,352 12,60,000 7,270 9,457 3,011 9,64,738 9,64,738 12,60,000 -

18 - 8,087 5,401 2,428 5,39,488 5,39,488 12,60,000 8,087 9,998 3,255 10,19,746 10,19,746 12,60,000 -

19 - 8,965 5,448 2,594 5,43,715 5,43,715 12,60,000 8,965 10,565 3,516 10,77,380 10,77,380 12,60,000 -

20 - 9,884 5,485 2,767 5,46,959 5,46,959 12,60,000 9,884 11,160 3,788 11,37,767 11,37,767 12,60,000 -

21 - 10,685 5,513 2,916 5,49,333 5,49,333 12,60,000 10,685 11,784 4,044 12,01,237 12,01,237 12,60,000 -

22 - 11,309 5,533 3,032 5,51,026 5,51,026 12,60,000 11,309 12,441 4,275 12,68,214 12,68,214 12,60,000 -

23 - 11,888 5,547 3,138 5,52,073 5,52,073 12,60,000 11,888 13,135 4,504 13,38,988 13,38,988 12,60,000 -

24 - 12,394 5,554 3,231 5,52,543 5,52,543 12,60,000 12,394 13,869 4,727 14,13,905 14,13,905 12,60,000 -

25 - 12,851 5,556 3,313 5,52,478 5,52,478 12,60,000 12,851 14,647 4,950 14,93,303 14,93,303 12,60,000 -

26 - 13,245 5,553 3,384 5,51,940 5,51,940 12,60,000 13,245 15,471 5,169 15,77,559 15,77,559 12,60,000 -

27 - 13,561 5,545 3,439 5,51,008 5,51,008 12,60,000 13,561 16,347 5,384 16,67,096 16,67,096 12,60,000 -

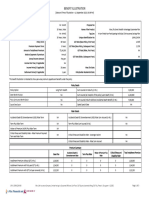

UIN: 104L098V05 Page 2 of 6

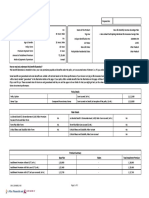

1 2 3 4 5 6 7 8 9 10 11 12 13 14 15

28 - 14,219 5,532 3,555 5,49,263 5,49,263 12,60,000 14,219 17,275 5,669 17,61,853 17,61,853 12,60,000 -

29 - 15,359 5,506 3,756 5,46,104 5,46,104 12,60,000 15,359 18,255 6,051 18,61,589 18,61,589 12,60,000 -

30 - 16,687 5,465 3,987 5,41,266 5,41,266 12,60,000 16,687 19,286 6,475 19,66,411 19,66,411 12,60,000 -

*See Part B for details

IN THIS POLICY, THE INVESTMENT RISK IS BORNE BY THE POLICYHOLDER AND THE ABOVE INTEREST RATES ARE ONLY FOR ILLUSTRATIVE PURPOSE.

I ALSO UNDERSTAND THAT WHILST 100% OF MY FIRST YEAR PREMIUM WILL BE INVESTED IN UNIT LINKED INVESTMENT FUNDS THERE ARE CHARGES DURING THE FIRST POLICY

YEAR AS GIVEN IN THE BENEFIT ILLUSTRATION.

I, ……………………………………………. (name), have explained the premiums, charges and I, Sanjay (name), having received the information with respect to the above, have understood

benefits under the policy fully to the prospect / policyholder. the above statement before entering into the contract.

Place:

Date: 12/26/23 Signature / OTP Confirmation Date / Thumb Impression / Date:12/26/23 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104L098V05 Page 3 of 6

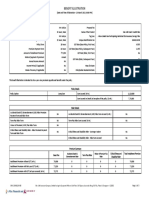

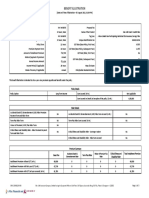

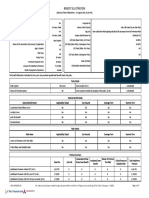

Part B

Gross Yield 8% p.a. Net Yield 6.92% Amount in Rupees

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges Charge

1 84,000 - 84,000 2,212 480 - - - - 84,409 455 84,325 78,378 12,60,000

2 84,000 - 84,000 2,242 643 - - - - 1,74,460 1,333 1,74,287 1,70,323 12,60,000

3 84,000 - 84,000 2,306 824 - - - - 2,70,489 2,270 2,70,222 2,67,248 12,60,000

4 84,000 - 84,000 2,358 1,013 - - - - 3,72,914 3,269 3,72,545 3,70,563 12,60,000

5 84,000 - 84,000 2,417 1,215 - - - - 4,82,157 4,335 4,81,680 4,81,680 12,60,000

6 - - - 2,532 1,356 - - - - 5,11,490 5,002 5,10,985 5,10,985 12,60,000

7 - - - 2,716 1,444 - - - - 5,42,573 5,306 5,42,037 5,42,037 12,60,000

8 - - - 2,941 1,542 - - - - 5,75,471 5,628 5,74,902 5,74,902 12,60,000

9 - - - 3,206 1,651 - - - - 6,10,257 5,969 6,09,654 6,09,654 12,60,000

10 - - - 3,492 1,768 - - - - 6,47,033 6,329 6,46,394 6,46,394 12,60,000

11 - - - 3,839 1,899 - - - - 6,85,858 6,709 6,85,181 6,85,181 12,60,000

12 - - - 4,227 2,041 - - - - 7,26,820 7,111 7,26,102 7,26,102 12,60,000

13 - - - 4,697 2,202 - - - - 7,69,962 7,534 7,69,202 7,69,202 12,60,000

14 - - - 5,228 2,377 - - - - 8,15,357 7,980 8,14,552 8,14,552 12,60,000

15 - - - 5,820 2,568 - - - - 8,63,080 8,448 8,62,228 8,62,228 12,60,000

16 - - - 6,515 2,782 - - - - 9,13,164 8,940 9,12,262 9,12,262 12,60,000

17 - - - 7,270 3,011 - - - - 9,65,692 9,457 9,64,738 9,64,738 12,60,000

18 - - - 8,087 3,255 - - - - 10,20,754 9,998 10,19,746 10,19,746 12,60,000

19 - - - 8,965 3,516 - - - - 10,78,445 10,565 10,77,380 10,77,380 12,60,000

20 - - - 9,884 3,788 - - - - 11,38,892 11,160 11,37,767 11,37,767 12,60,000

21 - - - 10,685 4,044 - - - - 12,02,425 11,784 12,01,237 12,01,237 12,60,000

22 - - - 11,309 4,275 - - - - 12,69,468 12,441 12,68,214 12,68,214 12,60,000

23 - - - 11,888 4,504 - - - - 13,40,312 13,135 13,38,988 13,38,988 12,60,000

24 - - - 12,394 4,727 - - - - 14,15,304 13,869 14,13,905 14,13,905 12,60,000

25 - - - 12,851 4,950 - - - - 14,94,780 14,647 14,93,303 14,93,303 12,60,000

26 - - - 13,245 5,169 - - - - 15,79,119 15,471 15,77,559 15,77,559 12,60,000

27 - - - 13,561 5,384 - - - - 16,68,745 16,347 16,67,096 16,67,096 12,60,000

28 - - - 14,219 5,669 - - - - 17,63,595 17,275 17,61,853 17,61,853 12,60,000

29 - - - 15,359 6,051 - - - - 18,63,430 18,255 18,61,589 18,61,589 12,60,000

UIN: 104L098V05 Page 4 of 6

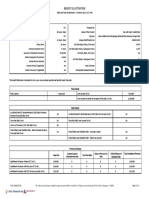

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges Charge

30 - - - 16,687 6,475 - - - - 19,68,355 19,286 19,66,411 19,66,411 12,60,000

Gross Yield 4% p.a. Amount in Rupees

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges Charge

1 84,000 - 84,000 2,212 479 - - - - 82,689 448 82,607 76,759 12,60,000

2 84,000 - 84,000 2,242 636 - - - - 1,67,636 1,291 1,67,471 1,63,506 12,60,000

3 84,000 - 84,000 2,306 803 - - - - 2,54,862 2,157 2,54,611 2,51,637 12,60,000

4 84,000 - 84,000 2,358 973 - - - - 3,44,446 3,046 3,44,105 3,42,123 12,60,000

5 84,000 - 84,000 2,417 1,148 - - - - 4,36,443 3,959 4,36,012 4,36,012 12,60,000

6 - - - 2,532 1,254 - - - - 4,45,513 4,434 4,45,073 4,45,073 12,60,000

7 - - - 2,716 1,303 - - - - 4,54,615 4,525 4,54,166 4,54,166 12,60,000

8 - - - 2,941 1,360 - - - - 4,63,699 4,616 4,63,241 4,63,241 12,60,000

9 - - - 3,206 1,424 - - - - 4,72,718 4,707 4,72,251 4,72,251 12,60,000

10 - - - 3,492 1,492 - - - - 4,81,643 4,797 4,81,168 4,81,168 12,60,000

11 - - - 3,839 1,571 - - - - 4,90,400 4,886 4,89,916 4,89,916 12,60,000

12 - - - 4,227 1,656 - - - - 4,98,935 4,973 4,98,442 4,98,442 12,60,000

13 - - - 4,697 1,756 - - - - 5,07,144 5,057 5,06,643 5,06,643 12,60,000

14 - - - 5,228 1,866 - - - - 5,14,943 5,137 5,14,434 5,14,434 12,60,000

15 - - - 5,820 1,986 - - - - 5,22,249 5,213 5,21,733 5,21,733 12,60,000

16 - - - 6,515 2,124 - - - - 5,28,925 5,283 5,28,403 5,28,403 12,60,000

17 - - - 7,270 2,271 - - - - 5,34,881 5,346 5,34,352 5,34,352 12,60,000

18 - - - 8,087 2,428 - - - - 5,40,022 5,401 5,39,488 5,39,488 12,60,000

19 - - - 8,965 2,594 - - - - 5,44,253 5,448 5,43,715 5,43,715 12,60,000

UIN: 104L098V05 Page 5 of 6

Premium Annualized Premium - Policy

Policy Annualized Mortality Guarantee Other Additions to the Fund before Fund at End of Surrender Death

Allocation Premium Allocation GST Admin. FMC

Year Premium (AP) Charge Charge Charges* fund* FMC the Year Value Benefit

Charge (PAC) Charges Charge

20 - - - 9,884 2,767 - - - - 5,47,500 5,485 5,46,959 5,46,959 12,60,000

21 - - - 10,685 2,916 - - - - 5,49,876 5,513 5,49,333 5,49,333 12,60,000

22 - - - 11,309 3,032 - - - - 5,51,571 5,533 5,51,026 5,51,026 12,60,000

23 - - - 11,888 3,138 - - - - 5,52,618 5,547 5,52,073 5,52,073 12,60,000

24 - - - 12,394 3,231 - - - - 5,53,089 5,554 5,52,543 5,52,543 12,60,000

25 - - - 12,851 3,313 - - - - 5,53,025 5,556 5,52,478 5,52,478 12,60,000

26 - - - 13,245 3,384 - - - - 5,52,486 5,553 5,51,940 5,51,940 12,60,000

27 - - - 13,561 3,439 - - - - 5,51,553 5,545 5,51,008 5,51,008 12,60,000

28 - - - 14,219 3,555 - - - - 5,49,806 5,532 5,49,263 5,49,263 12,60,000

29 - - - 15,359 3,756 - - - - 5,46,644 5,506 5,46,104 5,46,104 12,60,000

30 - - - 16,687 3,987 - - - - 5,41,801 5,465 5,41,266 5,41,266 12,60,000

*There are no charges included in other charges. There are no additions included on Additions to the fund.

Notes: 1. Refer the sales literature for explanation of terms used in this illustration.

2. Fund management charge is based on the specific fund option(s) chosen.

3. In case rider charges are collected explicitly through collection of rider premium, and not by way of cancellation of units, then, such charges are not considered in this illustration. In other cases, rider charges are included in

other charges.

I, ……………………………………………. (name), have explained the premiums, charges and I, Sanjay (name), having received the information with respect to the above, have understood

benefits under the policy fully to the prospect / policyholder. the above statement before entering into the contract.

Place:

Date: 12/26/23 Signature / OTP Confirmation Date / Thumb Impression / Date:12/26/23 Signature / OTP Confirmation Date / Thumb Impression /

Electronic Signature of Agent/ Intermediary / Official Electronic Signature of Prospect/ Policyholder

This system generated benefit illustration shall be treated as signed by me.

UIN: 104L098V05 Page 6 of 6

You might also like

- Rich by Retirement - Invest Smart Retire Wealthy - 2021 EditionDocument119 pagesRich by Retirement - Invest Smart Retire Wealthy - 2021 EditionIvan Chua100% (1)

- Sapient Offer Letter Gurgoan PDFDocument15 pagesSapient Offer Letter Gurgoan PDFdimpy50% (2)

- Role of Integreted Marketing Communication in Life Insurence New PDFDocument99 pagesRole of Integreted Marketing Communication in Life Insurence New PDFSora Ghosh0% (1)

- Bajaj Capital 1Document32 pagesBajaj Capital 1Shahnawaz HussainNo ratings yet

- Max Life BIDocument8 pagesMax Life BIcambrittvNo ratings yet

- Bi 4299eekbDocument4 pagesBi 4299eekbchigiliseenaNo ratings yet

- Bi 4258jcbuDocument5 pagesBi 4258jcburayees khanNo ratings yet

- UIN: 104L115V01 Page 1 of 6Document6 pagesUIN: 104L115V01 Page 1 of 6Gobinda SinhaNo ratings yet

- Bi 9351xmteDocument7 pagesBi 9351xmtetoptrendingtoday30No ratings yet

- Max Life UlipDocument4 pagesMax Life Ulipjagdevwasson761No ratings yet

- Bi 0655kgueDocument9 pagesBi 0655kguevanselimNo ratings yet

- UIN: 104L082V04 Page 1 of 4Document4 pagesUIN: 104L082V04 Page 1 of 4Indhug SharathNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 2vipinpvNo ratings yet

- Mangesh Katar SapDocument3 pagesMangesh Katar SapPARIKSHIT GHODKENo ratings yet

- Mangesh Katar MiapDocument3 pagesMangesh Katar MiapPARIKSHIT GHODKENo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vivek0955158No ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Aman SaxenaNo ratings yet

- Benefit Illu1212Document3 pagesBenefit Illu1212parikshitNo ratings yet

- UIN: 104L098V03 Page 1 of 4Document4 pagesUIN: 104L098V03 Page 1 of 4sajeet sahNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3NagarjunaNo ratings yet

- Max MiapDocument3 pagesMax MiapKrishna GoyalNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3VISHAL CHAUDHARYNo ratings yet

- Monthly Income Advantage PlanDocument3 pagesMonthly Income Advantage PlanGurkirt SinghNo ratings yet

- Benefit Illustration: UIN: 104N120V02 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V02 Page 1 of 4Karthik GopalanNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 2vivek0955158No ratings yet

- Benefit Illustration: UIN: 104N120V01 Page 1 of 4Document4 pagesBenefit Illustration: UIN: 104N120V01 Page 1 of 4Gobinda SinhaNo ratings yet

- Bi 5774vgsaDocument3 pagesBi 5774vgsaMahesh GediyaNo ratings yet

- TNTNDocument4 pagesTNTNsamvil2007No ratings yet

- Wa0000.Document3 pagesWa0000.NishanthNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionAlok .kNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3parikshitNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageSamyNo ratings yet

- Benefit Illustration: UIN: 104N116V04 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V04 Page 1 of 3Bimal DeyNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 2Gurkirt SinghNo ratings yet

- Illustration - 2022-07-30T133834.945Document3 pagesIllustration - 2022-07-30T133834.945Soumen BeraNo ratings yet

- Illustration - 2022-02-16T110618.998Document3 pagesIllustration - 2022-02-16T110618.998mosarafNo ratings yet

- Mangesh Katar SWPDocument3 pagesMangesh Katar SWPPARIKSHIT GHODKENo ratings yet

- IllustrationDocument3 pagesIllustrationSoumen BeraNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageLaviNo ratings yet

- Benefit IllustrationDocument4 pagesBenefit IllustrationAbhilash KumarNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 2Document2 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 2Yashwant ojhaNo ratings yet

- Benefit Illustration: UIN: 104N116V11 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V11 Page 1 of 3Abhimanyu Singh BhatiNo ratings yet

- Benefit Illustration of ICICI Pru Lakshya Prepared For: Mr. A BDocument3 pagesBenefit Illustration of ICICI Pru Lakshya Prepared For: Mr. A BMayur NagdiveNo ratings yet

- Benefit Illustration For ICICI Pru Saving SurakshaDocument3 pagesBenefit Illustration For ICICI Pru Saving SurakshaVikas DubeyNo ratings yet

- Benefit Illustration: UIN: 104N116V08 Page 1 of 3Document5 pagesBenefit Illustration: UIN: 104N116V08 Page 1 of 3Revathy SanthanakrishnanNo ratings yet

- Benefit Illustration: UIN: 104N116V03 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V03 Page 1 of 3GurjitNo ratings yet

- IllustrationDocument3 pagesIllustrationRahul KumwatNo ratings yet

- Illustration Qbxt9qkqiyoe8Document3 pagesIllustration Qbxt9qkqiyoe8mr copy xeroxNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3vishal pNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par Advantageraja reddyNo ratings yet

- Benefit Illustration: UIN: 104N116V06 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N116V06 Page 1 of 3Vikram KsNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionamarjeet456No ratings yet

- Bi 7313vviwDocument3 pagesBi 7313vviwMahesh GediyaNo ratings yet

- Benefit Illustration For HDFC Life Sampoorn Samridhi PlusDocument2 pagesBenefit Illustration For HDFC Life Sampoorn Samridhi PlusVamsi Krishna BNo ratings yet

- UIN: 104N113V02 Page 1 of 4Document4 pagesUIN: 104N113V02 Page 1 of 4NagarjunaNo ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001487090721Document5 pagesE SymbiosysFiles Generated OutputSIPDF 10200001487090721Sankalp SrivastavaNo ratings yet

- Benefit Illustration For HDFC Life Sanchay Par AdvantageDocument3 pagesBenefit Illustration For HDFC Life Sanchay Par AdvantageBLOODY ASHHERNo ratings yet

- Benefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date OptionDocument3 pagesBenefit Illustration: Death Benefit Multiple Policy Continuance Benefit Option Special Date Optionvipin jainNo ratings yet

- IllustrationDocument3 pagesIllustrationmanibharathi199No ratings yet

- E SymbiosysFiles Generated OutputSIPDF 10200001722290821Document5 pagesE SymbiosysFiles Generated OutputSIPDF 10200001722290821Sankalp SrivastavaNo ratings yet

- Benefit Illustration: UIN: 104N118V02 Page 1 of 3Document3 pagesBenefit Illustration: UIN: 104N118V02 Page 1 of 3Bhim Worf ShankarNo ratings yet

- UIN: 104N091V06 Page 1 of 3Document3 pagesUIN: 104N091V06 Page 1 of 3Santosh DavaneNo ratings yet

- Life Time BenifitDocument3 pagesLife Time BenifitRajaNo ratings yet

- Tata AIG Life Insurance Company LTDDocument98 pagesTata AIG Life Insurance Company LTDbitturaja0% (1)

- SwissRe Understanding ReinsuranceDocument23 pagesSwissRe Understanding ReinsuranceHaldi Zusrijan PanjaitanNo ratings yet

- LifeTime Super PensionDocument8 pagesLifeTime Super Pensionquest_rakeshNo ratings yet

- Mitul Bhola Research Proposal 2019Document13 pagesMitul Bhola Research Proposal 2019Yajas BholaNo ratings yet

- Insurance and Pension Fund OperationsDocument37 pagesInsurance and Pension Fund OperationsShantanu ChoudhuryNo ratings yet

- Efficiency In... LIC Full Thesis (Nepal)Document80 pagesEfficiency In... LIC Full Thesis (Nepal)Dhrumil DeliwalaNo ratings yet

- PRETEST in BUSINESS FINANCE - 100 ITEMS 2ND SEMDocument4 pagesPRETEST in BUSINESS FINANCE - 100 ITEMS 2ND SEMBernardita Sison-CruzNo ratings yet

- GGCADocument2 pagesGGCAPrakash BaldaniyaNo ratings yet

- Ashutosh Kankane Final SipDocument10 pagesAshutosh Kankane Final Sipashutosh kankaneNo ratings yet

- SB 5 As Passed by The SenateDocument294 pagesSB 5 As Passed by The SenateED. DICKAUNo ratings yet

- Emergency Powers Act: Chapter 1 - Purpose of The ActDocument14 pagesEmergency Powers Act: Chapter 1 - Purpose of The Actcyber_leeNo ratings yet

- Ic38-IRDA Magic 99-Question & AnswersDocument4 pagesIc38-IRDA Magic 99-Question & Answerssandy vajjaNo ratings yet

- Personal Financial Planning Questionnaire / Data Gathering Sheet in ExcelDocument24 pagesPersonal Financial Planning Questionnaire / Data Gathering Sheet in ExcelSatish MistryNo ratings yet

- Customer Perception Towards Investment in Mutual FundDocument49 pagesCustomer Perception Towards Investment in Mutual FundPaankaj NetamNo ratings yet

- Bajaj CapitalDocument15 pagesBajaj Capitalharshita khadayteNo ratings yet

- Traditional Licensing Review Mock Exam - v2023.05.08Document18 pagesTraditional Licensing Review Mock Exam - v2023.05.08valdezkristineanneNo ratings yet

- Income Tax Planning With Respect of Individual Assessee Project FileDocument75 pagesIncome Tax Planning With Respect of Individual Assessee Project FileHell HellNo ratings yet

- Income Exempt From TaxDocument20 pagesIncome Exempt From TaxSaad AliNo ratings yet

- Great Pacific Life Insurance vs. CADocument1 pageGreat Pacific Life Insurance vs. CALaika CorralNo ratings yet

- Atty Balmes InsuranceDocument39 pagesAtty Balmes InsuranceKiko OralloNo ratings yet

- Rebate Under Section 80 of Income Tax ActDocument21 pagesRebate Under Section 80 of Income Tax Actsakshi tiwariNo ratings yet

- Bajaj AllianzDocument67 pagesBajaj AllianzrenuNo ratings yet

- Research ReportDocument92 pagesResearch ReportSuraj DubeyNo ratings yet

- Sample Life Exam QuestionsDocument10 pagesSample Life Exam Questionsrita tamohNo ratings yet

- Wealth Management Module PDFDocument109 pagesWealth Management Module PDFAnujBhanot100% (1)

- Insurance Week 1 and 2 DigestDocument4 pagesInsurance Week 1 and 2 DigestGeline Enriquez100% (1)