Professional Documents

Culture Documents

Pepper CLEAR Full Doc and Alt Doc (Page 6)

Pepper CLEAR Full Doc and Alt Doc (Page 6)

Uploaded by

Princess DomingoOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Pepper CLEAR Full Doc and Alt Doc (Page 6)

Pepper CLEAR Full Doc and Alt Doc (Page 6)

Uploaded by

Princess DomingoCopyright:

Available Formats

Pepper CLEAR

Near Prime Clear

Loan Purpose Purchase or refinance of owner occupied and/or investment properties

Maximum Loan $2,500,000 (inclusive of fees)

Paid/Unpaid Defaults up to $1,000 may be considered

Credit History

Up to 1 month non-mortgage arrears (within the last 3 months)#

Genuine Savings Not required

Debt consolidation for an unlimited number of debts including pay out of ATO debts. Only allowed

Debt Consolidation if the debt if not overdue. This is where the due date has not passed OR the customer entered into

a payment arrangement prior to the due date.

Acceptable Securities Residential securities in categories 1 - 41 with a maximum land size of 25 acres (10 hectares)

Fee Capitalisation All fees can be capitalised to maximum LVR available

Product Specifications

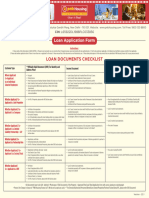

Full Doc

• Up to 95% for purchases

Maximum LVR

• Up to 90% for all other loan purposes

Cash Out Unlimited for acceptable purposes, including renovations and business use

Last 2 pay slips plus one of the following: OR Choose from any two of the following:

• Letter of employment • Most recent pay slip

Income Documentation (PAYG) • Notice of assessment • 3 months bank statements

• Latest PAYG Payment Summary • Employment check completed by Pepper

• 3 months bank statements or Mortgage Manager

• Last 1 year^ tax returns and last 1 year notice of assessments (tax returns < 6 months old) OR

• Last 1 year^ tax returns and last 1 year notice of assessments (tax returns > 6 months old) and one

of the following:

- Most recent BAS or last 3 months business banks statements OR

- Interim accounts from Accountant from end of last financial year to date

Income Documentation

(Self-Employed) • Last 1 year^ Financial Statements executed by a registered tax agent or Accountant* (Financial

Statements < 6 months old) OR

• Last 1 year^ Financial Statements executed by a registered tax agent or Accountant* (Financial

Statements > 6 months old) and one of the following:

- Most recent BAS or last 3 months business banks statements OR

- Interim accounts from Accountant from end of last financial year to date

Vacant Residential Land only in categories 1 and 2 with a maximum size of 2.5 acres (max 75% LVR

Acceptable Securities

and max loan size of $650,000)

184002_LHL-CRE-SMSF_Pepper Retail_Residential CRE and SMSF_Product Guide_201023_V2

Alt Doc

• Up to 90% for purchases

Maximum LVR

• Up to 80% for all other loan purposes

Cash Out Unlimited for acceptable purposes, including renovations and business use

• ABN registered for 24 months;

• GST registered for 12 months;

Income Documentation • Declaration of financial position plus one of the following:

(Self-Employed) - 6 months business bank statements

- 6 months BAS

- Pepper Money accountant’s letter

For all loan sizes and loan term, please refer to Product Comparison on page 9

Refer to page 14 for additional notes

*registered with CPA, CAA or NIA

^ If prior years’ financial results are also provided, we are obliged to consider this in our assessment .

# Refer to Repayment History Information on page 13

6 PEPPER MONEY HOME LOAN AND COMMERCIAL LENDING PRODUCT GUIDE

You might also like

- Business Plan For A Organic Cosmetic Company Love AppleDocument25 pagesBusiness Plan For A Organic Cosmetic Company Love Applejustin joy100% (2)

- MIS Final ProjectDocument51 pagesMIS Final ProjectShehrozAyazNo ratings yet

- All Bank Policy HL & LapDocument25 pagesAll Bank Policy HL & LapmadirajunaveenNo ratings yet

- Bank Branch Audit ManualDocument55 pagesBank Branch Audit ManualNeeraj Goyal100% (1)

- Engro Corporation: Analysis of Engro's BCG Matrix and Relaunch Strategies For Omung LassiDocument11 pagesEngro Corporation: Analysis of Engro's BCG Matrix and Relaunch Strategies For Omung LassiUnzila AtiqNo ratings yet

- ABM - Principles of Marketing CGDocument5 pagesABM - Principles of Marketing CGAlfredo del Mundo Jr.88% (8)

- Business Loan PolicyDocument7 pagesBusiness Loan Policyniteshparewa372No ratings yet

- Policy Update - Verified Income May'21Document3 pagesPolicy Update - Verified Income May'21debprosaddalalNo ratings yet

- HDFC Ltd. Home Loan FeaturesDocument8 pagesHDFC Ltd. Home Loan FeaturesVishv SharmaNo ratings yet

- Small Biz LoanDocument4 pagesSmall Biz LoanJulian AlbaNo ratings yet

- PNB Home Loan CircularDocument1 pagePNB Home Loan CircularNavdeep BainsNo ratings yet

- BDO Biñan BranchDocument4 pagesBDO Biñan BranchRosel Aubrey RemigioNo ratings yet

- Gbs Consultancy Firm: Negotiated RateDocument4 pagesGbs Consultancy Firm: Negotiated Ratealfx216No ratings yet

- Analyzing Credit ReportDocument5 pagesAnalyzing Credit Reportsambamurthy sunkaraNo ratings yet

- PAG IBIG Housing LoanDocument38 pagesPAG IBIG Housing LoanKrisha Jean ManzanoNo ratings yet

- Step 1: Check Your Qualifications: Bdo BankDocument4 pagesStep 1: Check Your Qualifications: Bdo BankCristy JavinarNo ratings yet

- DSA Business Loans PolicyDocument28 pagesDSA Business Loans PolicyS GothamNo ratings yet

- LoanDocument8 pagesLoanVedika DixitNo ratings yet

- Retail Assets Product NewDocument47 pagesRetail Assets Product NewRajkot academyNo ratings yet

- Return ChapterDocument8 pagesReturn ChapterShubham KuberkarNo ratings yet

- Clients Interview DiscussionDocument6 pagesClients Interview DiscussionchristophervaldeavillaNo ratings yet

- Credit Policy Pre Promotion 08.01.2022Document42 pagesCredit Policy Pre Promotion 08.01.2022tvmanhastvNo ratings yet

- Credit Monitoring Policy For 2020 ExamDocument8 pagesCredit Monitoring Policy For 2020 ExamSrikanth TanguturuNo ratings yet

- Tractor LoansProductDocument10 pagesTractor LoansProductkakali mondalNo ratings yet

- PNB Doctor - S DelightDocument18 pagesPNB Doctor - S DelightNishesh KumarNo ratings yet

- Loan Application FormDocument6 pagesLoan Application FormnavabharathsrinivasanNo ratings yet

- Mera Pakistan, Mera Ghar: (NAPHDA Projects) (Non-NAPHDA) (Non-NAPHDA)Document2 pagesMera Pakistan, Mera Ghar: (NAPHDA Projects) (Non-NAPHDA) (Non-NAPHDA)Hur Hussain SyedNo ratings yet

- hf5 MatrixDocument5 pageshf5 Matrixapi-322381844No ratings yet

- HBL Islamic Homefinance: Key FeaturesDocument6 pagesHBL Islamic Homefinance: Key FeaturesaftabNo ratings yet

- Business For Self Mortgage Insurance ProgramDocument2 pagesBusiness For Self Mortgage Insurance ProgramArlyne Tiam-CoronelNo ratings yet

- Local Authority Home Loan - Application Form - June 2023Document22 pagesLocal Authority Home Loan - Application Form - June 2023ollie.brady780No ratings yet

- Commercial Banking-Hdfc Housing FinanceDocument24 pagesCommercial Banking-Hdfc Housing FinancePankul KohliNo ratings yet

- Chapter 01 - AnswerDocument3 pagesChapter 01 - Answermenche galuraNo ratings yet

- Buying A Resale Flat Plan For Leeying and Xinghong PDFDocument8 pagesBuying A Resale Flat Plan For Leeying and Xinghong PDFLim Xing HongNo ratings yet

- Due Diligence Checklist - Small Business - SME - M&a - Caprica OnlineDocument3 pagesDue Diligence Checklist - Small Business - SME - M&a - Caprica OnlineHungreo411No ratings yet

- Interest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansDocument19 pagesInterest Concession of Available On The Above Card Rates Upto 31.10.2011 For All Types of New Home LoansapsagarNo ratings yet

- Income Recognition and Asset Classification (IRAC) : Paper: Management of Financial InstitutionDocument15 pagesIncome Recognition and Asset Classification (IRAC) : Paper: Management of Financial InstitutionBabul YumkhamNo ratings yet

- LoansDocument17 pagesLoansPia Samantha DasecoNo ratings yet

- Theoretical Framework of Home LoanDocument8 pagesTheoretical Framework of Home LoanTulika GuhaNo ratings yet

- Home Improvement Loan-618: NF-546 NF - 964 NF-990 NF-967 NF-482 NF-803Document3 pagesHome Improvement Loan-618: NF-546 NF - 964 NF-990 NF-967 NF-482 NF-803Santosh KumarNo ratings yet

- Trust Questionnaire 2017Document5 pagesTrust Questionnaire 2017Hajra MakhdoomNo ratings yet

- SBI Loan Transfer - TAKE OVERDocument1 pageSBI Loan Transfer - TAKE OVERRathinder RathiNo ratings yet

- Ease of Paying Taxes ActDocument4 pagesEase of Paying Taxes ActwhitekaisuNo ratings yet

- Landbank AccountsDocument17 pagesLandbank AccountscammiecazzieNo ratings yet

- Acq Applicantchecklist 1Document3 pagesAcq Applicantchecklist 1api-335214311No ratings yet

- Banking Department: Mumbai Regional OfficeDocument25 pagesBanking Department: Mumbai Regional OfficeAditya KulkarniNo ratings yet

- IDBI Bank Home LoanDocument11 pagesIDBI Bank Home Loansahil7827No ratings yet

- Product Feature: S$500,000 5 Years 10.88% P.ADocument1 pageProduct Feature: S$500,000 5 Years 10.88% P.ACANo ratings yet

- Excerpt of Launch Booklets PDFDocument83 pagesExcerpt of Launch Booklets PDFHimanshu MittalNo ratings yet

- Housing FinanceDocument38 pagesHousing FinanceÀîßhâ SêhrNo ratings yet

- Patna Retail Assets CentreDocument31 pagesPatna Retail Assets CentreSatyajit BanerjeeNo ratings yet

- PFL LAP - Product Construct - ExtDocument14 pagesPFL LAP - Product Construct - Extvikash pandeyNo ratings yet

- NPA MGMTDocument60 pagesNPA MGMTRajib Ranjan SamalNo ratings yet

- Retail Loan Proposal and DocumentationDocument50 pagesRetail Loan Proposal and DocumentationDutch Bangla Bank Rosul NagorNo ratings yet

- Yocket Loan Assistance Documents RequiredDocument1 pageYocket Loan Assistance Documents RequiredMaulik SolankiNo ratings yet

- Annual Statement 24-DEC-18 AC 53237052Document4 pagesAnnual Statement 24-DEC-18 AC 53237052Rares Cornel DragomirNo ratings yet

- Document Transmittal & Checklist Form: Forms Date&Received By: Locally Employed Date&Received byDocument1 pageDocument Transmittal & Checklist Form: Forms Date&Received By: Locally Employed Date&Received byRonnel S. DabuNo ratings yet

- US Internal Revenue Service: I8027 - 1994Document4 pagesUS Internal Revenue Service: I8027 - 1994IRSNo ratings yet

- Business Loan: Normal Current AccountDocument16 pagesBusiness Loan: Normal Current AccountUthaiah CmNo ratings yet

- Saibaan Comprehensive PresentationDocument61 pagesSaibaan Comprehensive PresentationTalha SiddiquiNo ratings yet

- BranchNotice Non HomeNoSalaryDocument1 pageBranchNotice Non HomeNoSalaryAbhay KumarNo ratings yet

- Home Loan Application Form - WEBDocument8 pagesHome Loan Application Form - WEBanandNo ratings yet

- Your Amazing Itty Bitty® Book of QuickBooks® TerminologyFrom EverandYour Amazing Itty Bitty® Book of QuickBooks® TerminologyNo ratings yet

- Financial Accounting and Reporting Study Guide NotesFrom EverandFinancial Accounting and Reporting Study Guide NotesRating: 1 out of 5 stars1/5 (1)

- 10 G.R. No. 191525 - INTERNATIONAL ACADEMY..Document11 pages10 G.R. No. 191525 - INTERNATIONAL ACADEMY..Princess DomingoNo ratings yet

- 25 Salido Vs Aramaywan MetalsDocument12 pages25 Salido Vs Aramaywan MetalsPrincess DomingoNo ratings yet

- Cta Eb CV 02489 D 2022sep14 AssDocument23 pagesCta Eb CV 02489 D 2022sep14 AssPrincess DomingoNo ratings yet

- Cta Eb CV 02057 M 2021feb03 AssDocument6 pagesCta Eb CV 02057 M 2021feb03 AssPrincess DomingoNo ratings yet

- Oceanagold (Philippines) v. CIR, G.R. No. 234614, June 14, 2023Document13 pagesOceanagold (Philippines) v. CIR, G.R. No. 234614, June 14, 2023Princess DomingoNo ratings yet

- McDonald's Philippines Realty Corporation v. CIRDocument2 pagesMcDonald's Philippines Realty Corporation v. CIRPrincess DomingoNo ratings yet

- Mortgage SaverDocument1 pageMortgage SaverPrincess DomingoNo ratings yet

- Cryptocurrency BasicsDocument28 pagesCryptocurrency BasicsAziz hospitalNo ratings yet

- TMAE308 (2.2:2021) CLC.1 - Group 17Document38 pagesTMAE308 (2.2:2021) CLC.1 - Group 17ThaoMy LeNo ratings yet

- Luxembourg Investment Funds Guide - UCITS, SIF, UCIDocument8 pagesLuxembourg Investment Funds Guide - UCITS, SIF, UCIoliviersciales100% (2)

- Fundamentals of Hospitality and Tourism ManagementDocument210 pagesFundamentals of Hospitality and Tourism ManagementSumit Pratap85% (13)

- CCG 2011Document152 pagesCCG 2011wskabdNo ratings yet

- Group 3 RM AssignmentDocument14 pagesGroup 3 RM AssignmentANUSREE AnilkumarNo ratings yet

- Information Technology For Management Digital 10Th Full ChapterDocument41 pagesInformation Technology For Management Digital 10Th Full Chapterarnold.kluge705100% (26)

- The Development of Islamic Finance in Malaysia: January 2016Document21 pagesThe Development of Islamic Finance in Malaysia: January 2016fatinah izzatiNo ratings yet

- Prem Amul PaneerDocument57 pagesPrem Amul PaneerShailesh KumarNo ratings yet

- 2016.05.03+Revenue+Trifecta 30+Profit+Multipliers+ChecklistDocument22 pages2016.05.03+Revenue+Trifecta 30+Profit+Multipliers+ChecklistHayiath QureshiNo ratings yet

- Current Account Statement: United Bank LimitedDocument1 pageCurrent Account Statement: United Bank LimitedkarinaNo ratings yet

- Indr 2020Document146 pagesIndr 2020G6 LGNo ratings yet

- What Is Knowledge in BusinessDocument2 pagesWhat Is Knowledge in BusinessFarzana AksarNo ratings yet

- Employee Performance Appraisal Form: Noorain Abbasi Operations Manager Retail Operations 203313Document3 pagesEmployee Performance Appraisal Form: Noorain Abbasi Operations Manager Retail Operations 203313Arya AkbaniNo ratings yet

- KGIC For Consolidation - Deck Kompas GramediaDocument31 pagesKGIC For Consolidation - Deck Kompas GramediarrifmilleniaNo ratings yet

- Accounting 1Document11 pagesAccounting 1Gniese Stephanie Gallema AlsayNo ratings yet

- Tutorial 3 - Law 580Document5 pagesTutorial 3 - Law 580sofiaNo ratings yet

- Cover LetterDocument2 pagesCover LetterBilal AslamNo ratings yet

- Brazil Accounting Tax Processes v1 PDFDocument163 pagesBrazil Accounting Tax Processes v1 PDFGustavo GonçalvesNo ratings yet

- Staff StructureDocument3 pagesStaff StructuresaleenaNo ratings yet

- Alternate Coverage ofDocument70 pagesAlternate Coverage ofnist_nitesh100% (1)

- MKDA Assignment 1 Brief April 2023Document7 pagesMKDA Assignment 1 Brief April 2023Sakin KhanNo ratings yet

- Simco Finance ProjectDocument83 pagesSimco Finance ProjectSaja Nizam SanaNo ratings yet

- Case 08 16e, Oct 20th, 2023Document4 pagesCase 08 16e, Oct 20th, 2023Itzel OvalleNo ratings yet

- Healthcare Operations Management.: Sabu V U. DMS, (Hma), MbaDocument20 pagesHealthcare Operations Management.: Sabu V U. DMS, (Hma), Mbamy Vinay100% (1)

- Human Resource Management: BITS PilaniDocument25 pagesHuman Resource Management: BITS PilaniKrishna PrasathNo ratings yet