Professional Documents

Culture Documents

Option Pricing Model March 2021

Option Pricing Model March 2021

Uploaded by

MohamedCopyright:

Available Formats

You might also like

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- All Trades Profit Trades Losing TradesDocument5 pagesAll Trades Profit Trades Losing TradesLeandro GuimaraesNo ratings yet

- Imf Database 2016 061716Document552 pagesImf Database 2016 061716lukeniaNo ratings yet

- Flowsniper Daily ReportDocument1 pageFlowsniper Daily ReportMatt EbrahimiNo ratings yet

- Cds ValuationDocument7 pagesCds Valuationdoc_oz3298No ratings yet

- Capture D'écran, Le 2022-05-14 À 11.14.19Document1 pageCapture D'écran, Le 2022-05-14 À 11.14.19x maybeassylaNo ratings yet

- LNDRY $0.09955186, LNDRY Chart, Live ForecastDocument1 pageLNDRY $0.09955186, LNDRY Chart, Live ForecastsendiscimaNo ratings yet

- Implied Volatility Formula Excel TemplateDocument7 pagesImplied Volatility Formula Excel Templateheisenburg0510No ratings yet

- Derivatives Trade Details of FWD PointsDocument11 pagesDerivatives Trade Details of FWD PointsMyagmarsuren SanaakhorolNo ratings yet

- HSBCDocument7 pagesHSBCaqswdeNo ratings yet

- United Commercial Bank PLC: Ta D (FX D)Document1 pageUnited Commercial Bank PLC: Ta D (FX D)Mirza AsadNo ratings yet

- Rate 2023 01 11 1673416889Document1 pageRate 2023 01 11 1673416889বৃত্তের বাইরেNo ratings yet

- Scanner 29 Sept. 2023 À 15.17Document6 pagesScanner 29 Sept. 2023 À 15.17Marie-Claude St-OngeNo ratings yet

- P:13 Real Options in Capital Budgeting Options To ExpandDocument3 pagesP:13 Real Options in Capital Budgeting Options To ExpandL1588AshishNo ratings yet

- Exchange RateDocument1 pageExchange RateAli Hossen VoltaNo ratings yet

- FX Rate Sheet 03 11 2022Document1 pageFX Rate Sheet 03 11 2022Saphena DentalNo ratings yet

- Swing Trading Risk Management SheetDocument4 pagesSwing Trading Risk Management SheetAmandeepSinghNottaNo ratings yet

- 20 04 24Document21 pages20 04 24abdul.fattaahbakhsh29No ratings yet

- TM1!02!14 2022 Sales Comparison Irvin Blais 2122022 3Document29 pagesTM1!02!14 2022 Sales Comparison Irvin Blais 2122022 3fredericbrossoitNo ratings yet

- Cdears ETFDocument10 pagesCdears ETFMisha MishaNo ratings yet

- 1thang4 3Document3 pages1thang4 32j4gv7drscNo ratings yet

- Daily Exchange Rate Sheet 18-02-2024 - 1708228292Document1 pageDaily Exchange Rate Sheet 18-02-2024 - 1708228292Abid HossainNo ratings yet

- Accounting FinalDocument12 pagesAccounting FinalChithra NellametlaNo ratings yet

- Exchange Rate 23 October 2022Document2 pagesExchange Rate 23 October 2022JsjsNo ratings yet

- OMSEC Morning Note 15 09 2022Document6 pagesOMSEC Morning Note 15 09 2022Ropafadzo KwarambaNo ratings yet

- Rate Sheet 12032023Document1 pageRate Sheet 12032023Fernando TorresNo ratings yet

- Bill Buying Rates Per Unit of Currency: Treasury & Capital Markets GroupDocument1 pageBill Buying Rates Per Unit of Currency: Treasury & Capital Markets GroupFaizanNo ratings yet

- FX Rate Sheet 08.02.2024Document1 pageFX Rate Sheet 08.02.2024tanvirNo ratings yet

- DKKNWSZK LLDocument1 pageDKKNWSZK LLvanedys1No ratings yet

- Export Price CalculationDocument5 pagesExport Price Calculationphuc hauNo ratings yet

- Round: 4 Dec. 31, 2024: Selected Financial StatisticsDocument15 pagesRound: 4 Dec. 31, 2024: Selected Financial StatisticsCRNo ratings yet

- Artikel 24J BerekeningeDocument4 pagesArtikel 24J Berekeningesenari3164No ratings yet

- JSE Bond Tradesheet February 7 2020Document1 pageJSE Bond Tradesheet February 7 2020Giggz 2020No ratings yet

- Courier C136952 R1 TEK0 CA2Document14 pagesCourier C136952 R1 TEK0 CA2shivam kumarNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateZabed HossainNo ratings yet

- FexRate 13 December 2021Document1 pageFexRate 13 December 2021Abir MohammadNo ratings yet

- CONSUMO ELC-1444-001 1 August 28 AugustDocument2 pagesCONSUMO ELC-1444-001 1 August 28 AugustLuis Herrera ValbuenaNo ratings yet

- Case1 SecC GroupJDocument7 pagesCase1 SecC GroupJNimish JoshiNo ratings yet

- Report On ZomatoDocument10 pagesReport On ZomatoNikhil ParidaNo ratings yet

- Fin Acc MBADocument7 pagesFin Acc MBAdavit kavtaradzeNo ratings yet

- Hilton Case 1Document10 pagesHilton Case 1Kunal SharmaNo ratings yet

- 15 December 2010 - Wednesday: Liquidity IndicatorsDocument8 pages15 December 2010 - Wednesday: Liquidity Indicatorskhaitan_malviyaNo ratings yet

- Curva de Bonos PBA en USD Por ParidadDocument54 pagesCurva de Bonos PBA en USD Por ParidadIsaías CorvalanNo ratings yet

- OMSEC Morning Note 07 09 2022Document6 pagesOMSEC Morning Note 07 09 2022Ropafadzo KwarambaNo ratings yet

- OMSEC Morning Note 16 09 2022Document6 pagesOMSEC Morning Note 16 09 2022Ropafadzo KwarambaNo ratings yet

- Initial investment Time horizon (years) Return µ σ Stock marketDocument17 pagesInitial investment Time horizon (years) Return µ σ Stock marketvaskoreNo ratings yet

- CONSUMO ELC-1444-001 1 August 27 AugustDocument2 pagesCONSUMO ELC-1444-001 1 August 27 AugustLuis Herrera ValbuenaNo ratings yet

- Exchange Rate 22 December 2022Document2 pagesExchange Rate 22 December 2022JsjsNo ratings yet

- Strategy Tester EA HOUR JOE FEBRUARI 2022Document7 pagesStrategy Tester EA HOUR JOE FEBRUARI 2022Nor NofalNo ratings yet

- Financial Management Pratice Q Batch 2022-24Document5 pagesFinancial Management Pratice Q Batch 2022-24Neeraj GourNo ratings yet

- Exchange Rate 08 September 2022Document2 pagesExchange Rate 08 September 2022Md. Shahriar Mahmud RakibNo ratings yet

- HFPLPKDocument3 pagesHFPLPKKami creativeNo ratings yet

- Balance Sheet of Blue Dart ExpressDocument6 pagesBalance Sheet of Blue Dart ExpressTakauv-thiyagi ThiyaguNo ratings yet

- Proforma 01Document1 pageProforma 01Daniel ChrisNo ratings yet

- Deffered AccountDocument24 pagesDeffered AccountyohannesinagaaNo ratings yet

- Strategy Tester Voltrap DiamondDocument1 pageStrategy Tester Voltrap DiamondThobib OtaiNo ratings yet

- Round: 4 Dec. 31, 2023: Selected Financial StatisticsDocument15 pagesRound: 4 Dec. 31, 2023: Selected Financial StatisticsUjjawal MittalNo ratings yet

- Perhitungan LODDocument4 pagesPerhitungan LODFranciskus Febry AnggoroNo ratings yet

- Exchange Rate 30 January 2023Document1 pageExchange Rate 30 January 2023Intisar reza AbirNo ratings yet

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet

Option Pricing Model March 2021

Option Pricing Model March 2021

Uploaded by

MohamedOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Option Pricing Model March 2021

Option Pricing Model March 2021

Uploaded by

MohamedCopyright:

Available Formats

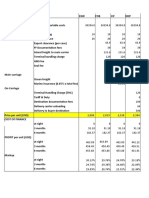

Currency options pricing - Black and Scholes

Spot date 10-Jun-21

Forward date 10-Sep-21

Spot 14.5 DAY BASE

Terms Int Rate 6.00% ZAR 365

Base Int rate 1.00% USD 360

Forward rate 14.6818

Forward points 1818

At the money strike 14.6818

Days to expiry 92

Expiry of Option 10-Sep-21

Strike 14.6818

Volatility 10.00%

d1 0.0251

d2 -0.0251

Call 0.2940

Put 0.2940

PCT Call 2.00%

PCT Put 2.00%

Option value $1,000,000.00

Call Premium $20,025.74

Put Premium $20,027.94

call point value 2,904

put point value 2,904

Break even call 14.9722

Break even put 14.3914

Delta Call 0.50999587747

Deltta Put 0.49000412253

Gamma 0.54140291886

Vega 0.02941522984

Yearfrac 0.25205479452

You might also like

- Simple LBODocument16 pagesSimple LBOsingh0001No ratings yet

- All Trades Profit Trades Losing TradesDocument5 pagesAll Trades Profit Trades Losing TradesLeandro GuimaraesNo ratings yet

- Imf Database 2016 061716Document552 pagesImf Database 2016 061716lukeniaNo ratings yet

- Flowsniper Daily ReportDocument1 pageFlowsniper Daily ReportMatt EbrahimiNo ratings yet

- Cds ValuationDocument7 pagesCds Valuationdoc_oz3298No ratings yet

- Capture D'écran, Le 2022-05-14 À 11.14.19Document1 pageCapture D'écran, Le 2022-05-14 À 11.14.19x maybeassylaNo ratings yet

- LNDRY $0.09955186, LNDRY Chart, Live ForecastDocument1 pageLNDRY $0.09955186, LNDRY Chart, Live ForecastsendiscimaNo ratings yet

- Implied Volatility Formula Excel TemplateDocument7 pagesImplied Volatility Formula Excel Templateheisenburg0510No ratings yet

- Derivatives Trade Details of FWD PointsDocument11 pagesDerivatives Trade Details of FWD PointsMyagmarsuren SanaakhorolNo ratings yet

- HSBCDocument7 pagesHSBCaqswdeNo ratings yet

- United Commercial Bank PLC: Ta D (FX D)Document1 pageUnited Commercial Bank PLC: Ta D (FX D)Mirza AsadNo ratings yet

- Rate 2023 01 11 1673416889Document1 pageRate 2023 01 11 1673416889বৃত্তের বাইরেNo ratings yet

- Scanner 29 Sept. 2023 À 15.17Document6 pagesScanner 29 Sept. 2023 À 15.17Marie-Claude St-OngeNo ratings yet

- P:13 Real Options in Capital Budgeting Options To ExpandDocument3 pagesP:13 Real Options in Capital Budgeting Options To ExpandL1588AshishNo ratings yet

- Exchange RateDocument1 pageExchange RateAli Hossen VoltaNo ratings yet

- FX Rate Sheet 03 11 2022Document1 pageFX Rate Sheet 03 11 2022Saphena DentalNo ratings yet

- Swing Trading Risk Management SheetDocument4 pagesSwing Trading Risk Management SheetAmandeepSinghNottaNo ratings yet

- 20 04 24Document21 pages20 04 24abdul.fattaahbakhsh29No ratings yet

- TM1!02!14 2022 Sales Comparison Irvin Blais 2122022 3Document29 pagesTM1!02!14 2022 Sales Comparison Irvin Blais 2122022 3fredericbrossoitNo ratings yet

- Cdears ETFDocument10 pagesCdears ETFMisha MishaNo ratings yet

- 1thang4 3Document3 pages1thang4 32j4gv7drscNo ratings yet

- Daily Exchange Rate Sheet 18-02-2024 - 1708228292Document1 pageDaily Exchange Rate Sheet 18-02-2024 - 1708228292Abid HossainNo ratings yet

- Accounting FinalDocument12 pagesAccounting FinalChithra NellametlaNo ratings yet

- Exchange Rate 23 October 2022Document2 pagesExchange Rate 23 October 2022JsjsNo ratings yet

- OMSEC Morning Note 15 09 2022Document6 pagesOMSEC Morning Note 15 09 2022Ropafadzo KwarambaNo ratings yet

- Rate Sheet 12032023Document1 pageRate Sheet 12032023Fernando TorresNo ratings yet

- Bill Buying Rates Per Unit of Currency: Treasury & Capital Markets GroupDocument1 pageBill Buying Rates Per Unit of Currency: Treasury & Capital Markets GroupFaizanNo ratings yet

- FX Rate Sheet 08.02.2024Document1 pageFX Rate Sheet 08.02.2024tanvirNo ratings yet

- DKKNWSZK LLDocument1 pageDKKNWSZK LLvanedys1No ratings yet

- Export Price CalculationDocument5 pagesExport Price Calculationphuc hauNo ratings yet

- Round: 4 Dec. 31, 2024: Selected Financial StatisticsDocument15 pagesRound: 4 Dec. 31, 2024: Selected Financial StatisticsCRNo ratings yet

- Artikel 24J BerekeningeDocument4 pagesArtikel 24J Berekeningesenari3164No ratings yet

- JSE Bond Tradesheet February 7 2020Document1 pageJSE Bond Tradesheet February 7 2020Giggz 2020No ratings yet

- Courier C136952 R1 TEK0 CA2Document14 pagesCourier C136952 R1 TEK0 CA2shivam kumarNo ratings yet

- Eastern Bank LTD: Effective Date: Exchange RateDocument2 pagesEastern Bank LTD: Effective Date: Exchange RateZabed HossainNo ratings yet

- FexRate 13 December 2021Document1 pageFexRate 13 December 2021Abir MohammadNo ratings yet

- CONSUMO ELC-1444-001 1 August 28 AugustDocument2 pagesCONSUMO ELC-1444-001 1 August 28 AugustLuis Herrera ValbuenaNo ratings yet

- Case1 SecC GroupJDocument7 pagesCase1 SecC GroupJNimish JoshiNo ratings yet

- Report On ZomatoDocument10 pagesReport On ZomatoNikhil ParidaNo ratings yet

- Fin Acc MBADocument7 pagesFin Acc MBAdavit kavtaradzeNo ratings yet

- Hilton Case 1Document10 pagesHilton Case 1Kunal SharmaNo ratings yet

- 15 December 2010 - Wednesday: Liquidity IndicatorsDocument8 pages15 December 2010 - Wednesday: Liquidity Indicatorskhaitan_malviyaNo ratings yet

- Curva de Bonos PBA en USD Por ParidadDocument54 pagesCurva de Bonos PBA en USD Por ParidadIsaías CorvalanNo ratings yet

- OMSEC Morning Note 07 09 2022Document6 pagesOMSEC Morning Note 07 09 2022Ropafadzo KwarambaNo ratings yet

- OMSEC Morning Note 16 09 2022Document6 pagesOMSEC Morning Note 16 09 2022Ropafadzo KwarambaNo ratings yet

- Initial investment Time horizon (years) Return µ σ Stock marketDocument17 pagesInitial investment Time horizon (years) Return µ σ Stock marketvaskoreNo ratings yet

- CONSUMO ELC-1444-001 1 August 27 AugustDocument2 pagesCONSUMO ELC-1444-001 1 August 27 AugustLuis Herrera ValbuenaNo ratings yet

- Exchange Rate 22 December 2022Document2 pagesExchange Rate 22 December 2022JsjsNo ratings yet

- Strategy Tester EA HOUR JOE FEBRUARI 2022Document7 pagesStrategy Tester EA HOUR JOE FEBRUARI 2022Nor NofalNo ratings yet

- Financial Management Pratice Q Batch 2022-24Document5 pagesFinancial Management Pratice Q Batch 2022-24Neeraj GourNo ratings yet

- Exchange Rate 08 September 2022Document2 pagesExchange Rate 08 September 2022Md. Shahriar Mahmud RakibNo ratings yet

- HFPLPKDocument3 pagesHFPLPKKami creativeNo ratings yet

- Balance Sheet of Blue Dart ExpressDocument6 pagesBalance Sheet of Blue Dart ExpressTakauv-thiyagi ThiyaguNo ratings yet

- Proforma 01Document1 pageProforma 01Daniel ChrisNo ratings yet

- Deffered AccountDocument24 pagesDeffered AccountyohannesinagaaNo ratings yet

- Strategy Tester Voltrap DiamondDocument1 pageStrategy Tester Voltrap DiamondThobib OtaiNo ratings yet

- Round: 4 Dec. 31, 2023: Selected Financial StatisticsDocument15 pagesRound: 4 Dec. 31, 2023: Selected Financial StatisticsUjjawal MittalNo ratings yet

- Perhitungan LODDocument4 pagesPerhitungan LODFranciskus Febry AnggoroNo ratings yet

- Exchange Rate 30 January 2023Document1 pageExchange Rate 30 January 2023Intisar reza AbirNo ratings yet

- Understanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyFrom EverandUnderstanding the Mathematics of Personal Finance: An Introduction to Financial LiteracyNo ratings yet