Professional Documents

Culture Documents

Salary: Basic of Charge (Sec - 15)

Salary: Basic of Charge (Sec - 15)

Uploaded by

Rajesh NangaliaOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Salary: Basic of Charge (Sec - 15)

Salary: Basic of Charge (Sec - 15)

Uploaded by

Rajesh NangaliaCopyright:

Available Formats

RAJESH NANGALIA CLASSES 9903133927

SALARY

Basic of charge [Sec – 15]

(1) Due or receipt basis whichever is earlier

(2) Bonus → Receipt basis

(3) Any arrears of salary taxable in year in which allowed to pay in P.Y. by any

employer [Arrears → increase in salary form back date][ Relief u/s 89]

How to compute salary :

Particulars ` `

1. Basic salary

2. Advance salary (Sec-15)

3. Arrears of salary [Sec-15]

4. Bonus (Receipt basis)

5. Commission (Fixed,% of NP,% of turnover)

6. Allowances (W.N. 1)

Less : Exemptions ()

7. Retirement benefits (W.N. 2)

Less : Exemptions ()

8. Perquisite [17(2)] (W.N.3)

9. Gross Salary

Less : Deduction [Sec-16] (W.N.4) ()

Net Salary

W.N.1: Allowances

Allowance → amount given for expense (Monetary) on monthly basis as fixed

amount.

perq→ non-monetary- direct benefit or reimbursement of exps.

(1) Dearness allowance: It is the allowance given for mitigating gap due to inflation.

D.A. is fully taxable whether or not it is forming part of retirement benefit

(Forming part of employment)

Inter CA DT Revision Lectures 1

RAJESH NANGALIA CLASSES 9903133927

(2) Foreign Allowances :

Sec-10(7): Foreign Allowance is exempt if

Allowance or By GOI to Indian Citizen For rendering service o/s

Perq. o/s India India.

(3) House Rent Allowance [10(13A)]:

Lowest of the following is exempt

1) Actual HRA Received or

2) 50% salary (Metro cities) → [DKBC-Delhi, Kolkata, Bombay, Chennai] or

40% of salary (Other Cities) or

3) Rent paid (-) 10% of salary.

→ Points: No exemption if 115BAC followed.

: Salary = Basic + DA (% in terms of retirement Purpose) + commission [%

of T/o]

Here advanced salary not considered

→ Note: Exemption of HRA depends on

Salary Rent HRA Location

So, advisable to calc. monthly if there are any changes in any of the above factor.

Note : if no rent paid then No exemption.

(4) Special Allowances [Sec 10(14)(i) + Rule 2BB]:

Exemption = Allowance or Amount Spent w.e. Lower

C = Conveyance Allowance (Journey b/w office to client place)

U = Uniform Allowance (Purchase or maintenance)

T = Tour, Travel, Transfer Allowance (For Transfer of Place of Job.)

H = Helper Allowance (To meet official duly)

A = Academic Pursuit Allowance

D = Daily Allowance

Inter CA DT Revision Lectures 2

RAJESH NANGALIA CLASSES 9903133927

No exemption if 115BAC followed except CTD-Conveyance, travelling, daily

allowance.

(5) Allowances → exemption based on limit [10(14)(ii) + 2BB]

Sr. No Name of Allowance Purpose Exemption

1 Transport Allowance Journey b/w office to Blind/ Handicap →

home ` 3200 p.m

Other → Fully

Taxable

2 Children Education - ` 100 p.m per child

Allowance max. for 2 children

3 Hostel Expense - ` 300 p.m per child

Allowance max. for 2 children

4 Special Tribal/ - ` 200 p.m

Schedule area

Allowance

No exemption if 115BAC followed except transport allowance.

(6) Fully Taxable Allowances

→ City compensatory allowance (for high cost)

→ Entertainment allowance (Ded’ u/s 16)

→ Transport allowance (Other than disable)

→ Telephone allowance

→ Medical allowance

→ Tiffin allowance/Food allowance

→ Project allowance

→ Dearness allowance [D.A]

Inter CA DT Revision Lectures 3

RAJESH NANGALIA CLASSES 9903133927

W.N.-2 Retirement Benefit

(1) Gratuity [ Exempted u/s 10(10)](Voluntary payment for appreciation of service)

→ Exemption only after service received

Govt. Employee Other Employee

Fully Exempt

[10(10)(i)] Covered by Payment of Not Covered by

Gratuity Act, 1972 Gratuity Act, 1972

→ Least of following is → least of following is

Exempt [10(10)(ii)] Exempt[10(10)(iii)]

A. Actual Gratuity Received A. Actual Received

B. 15/26 x Last Salary B. 15/30xAvg. Salary of

x completed years of 10 Month x completed

Service years of Service

C. upto ` 20,00,000 C. upto ` 20,00,000

↓ ↓

1) Salary = Basic + 1) Salary = Basic +

DA(All) DA(forming part)+

2) If no. of month >6 Commission(%)

month 2) Any fraction of

→ full year year→Ignore

Covered by Act Not Covered by Act

24 yrs 5 months = 24 yrs 24 yrs 5 months = 24 yrs

24 yrs 6 months = 24 yrs 24 yrs 6 months = 24 yrs

24 yrs 7 months = 25 yrs 24 yrs 8 months = 24 yrs

Note :

(i) Gratuity Received during employment→ Fully Taxable

(ii) Gratuity exemption from any employer together cannot exceed ` 20L

Inter CA DT Revision Lectures 4

RAJESH NANGALIA CLASSES 9903133927

(2) Pension :

Pension [10(10A)]

Uncommuted Commuted (Lumpsum)

(Monthly Basis)

Taxable for any Govt. Employee Other Employee

Employee

Fully exempt

In receipt of Not in receipt of

Gratuity Gratuity

1/3 of full 1/2 of full

Pension is exempt pension is exempt

Full pension = Commuted pension X 100

% of commutation

(Note → after commuted pension, uncommuted will be reduced by that %)

(3) Leave Salary [10(10AA)]

During On retirement

employment

Govt. Employee Other Employee

Least is exempt:

(a) Actual A/m received

(b) Total salary of last 10 month

(i.e. avg salary * 10 months)

(c) Cash equivalent of leave (note-1)

(d) Max. upto ` 3,00,000

[Salary = Basic + DA (In part) + Commission (%)]

Inter CA DT Revision Lectures 5

RAJESH NANGALIA CLASSES 9903133927

Note-1 Cash equivalent:

o As per Income Tax Act leave can’t exceed 30 days for every completed year of

service.

o Steps for calc. of cash equivalent:

It is nothing but balance leaves as per I.Tax Act in terms of months.

1) Find out duration of service in yrs (ignore fraction)

2) Find out Gross Earned leave (but 1 yr = Max 30 days)

3) Reduce leave availed during e’ment

4) Balance is earned leave as per I.T ÷ 30 days. (Unavailed leave as per IT Act

in mnths)

5) Step-4 * Average salary of last 10 month.

(4) Provident fund :

Stat. Prov. Fund (SPF) Reco. PF (RPF) Unreco PF (URPF)

(10(11))

For Govt. e’yees (SPF other e’yees

Act, 1925) (EPF Act, 1952)

1- E’yer Exempt Exempt upto 12% Not taxable yearly

contri. of salary (cross ref.

sec-7)

2- Int. Exempt Exempt upto int rate Not taxable yearly

credited =9.5% p.a (sec-7)

to P.F

3- Ded’ Available Available Not Available

u/s 80C

e ’ y e e

contri

4- On Exempt Exempt in some case Taxable (Note-2)

Maturity (Note-1)

[10(12)]

→ Salary = Basic + DA (%) + commission (%)

Note:-1 RPF p’ment exempt only if e’yee has discharged continuous service of 5

years.

1) Mr. X → serves A ltd for 5 yrs

Inter CA DT Revision Lectures 6

RAJESH NANGALIA CLASSES 9903133927

2) Mr. X → serves A ltd for 3 yrs

&

B ltd for 2 yrs the also exemption available if a/m is transferred to RPF (A ltd)

to RPF (B ltd)

3) Not able to complete 5 yrs because of unavoidable circumstances.

4) Means RPF maturity is exempt in all cases except <5 yrs due to avoidable

circumstances.

5) If balance of RPF transferred to NPS account then also exempt.

Note:-2 Taxability for lump sum under URPF

Amt. of e’yer Contri Int. on e’yer e’yee contri int on e’yees

contri contri.

Taxable under head exempt

Salary salary (it is inflow not IFOS

income)

Note: W.e.from P.Y.20-21, employer’s contribution to RPF, superannuation fund and NPS

together if exceeding 750000 in a year then excess is taxable and interest on such

excess is also taxable.(Means now max exemption=Total Exemption or 750000

w.e.lower)

Inter CA DT Revision Lectures 7

RAJESH NANGALIA CLASSES W. N. -3 Perquisites 9903133927

(1) Value of Rent free Unfurnished accommodation:

[House, Flat, Farm House, Hotel, Motel, Guest House]

(if provided to Judge of HC or SC not taxable)

Taxable Perquisites

[Rule 3(1)]

Govt. employee Non Govt. employee

Taxable = License fee as

Per govt. rules Accommodation Accommodation

owned by e’yer not owned by employer

Taxable = lower of

a) Actual Rent paid

Population >10L but >25L or

Of city ≤ 10L ≤ 25L b) 15% of salary

Salary = Basic + DA (forming

7.5% of salary 10% 15% part) + Bonus + Commission

Population from 2001 Census (all) + All Taxable Allowance

(2) Value of Rent-free furnished Accommodation:

When accommodation is not hotel

Step-1 : find out value as if unfurnished

Step-2 : Add value of furniture →Rule 3(7)

Furnitures owned Not owned

By e’yer

10% p.a of original Actual hire charges

cost (Ignore WDV)

Furniture includes Radio, TV, Fridge, AC.

General Notes : Value to be calculated for period of occupation of house.(Month

wise)

Inter CA DT Revision Lectures 8

RAJESH NANGALIA CLASSES 9903133927

(3) Value of accommodation Provided at concessional rent:

(I.e. Some amount is charged from e’yee)

Step-1: find value as per 1 & 2

Step-2: Deduct rent recovered from e’yee

[If amount positive → then Taxable]

(4) Value of perq. In respect of free domestic servants.

(Sweeper, Gardener, Watchman, Personal attendant, etc)

Rule 3(3)

taxable = Actual cost to employer

(–) Recovery from employee

(5) Valuation of perq. In respect of free institute [ Rule 3(5)]

Provided to employee provided to children or other

Household member

Not Taxable

Whether education trust owned By employer?

Yes No

Whether outside student Allowed? Actual fees paid by The employer

Yes (i.e. Open) No (i.e Close)

Taxable value= Fees Taxable value = fees

charged from Other charged by other institute

students in similar Locality

providing Similar facility.

Less: Amount reimbursed by e’yee to e’yer

Balance (If positive)-Taxable.

Inter CA DT Revision Lectures 9

RAJESH NANGALIA CLASSES 9903133927

Note : If educational inst. is owned by e’yer then whether open & close if

facility is provided to children then not taxable if upto ` 1000 p.m. per children.

(No limit on children)...So if exceeding 1000 p.m no exemption(Alternatively

we can also take value above 1000 p.m. only taxable)

(Not for other member & not in case not owned by e’yer)

Note: If tie-up with school then also deemed owned by employer

(6) Leave Travel concession [Section 10(5)]

Exemption of LTC can be availed twice in a block of 4 calendar years (from

1986 → Rules 2B) Current Block = 2018-2021 and 2022-2025

LTC exemption can be availed for Travel anywhere in India (Not O/s India)

Exemption for Travellers who is e’yee + Family.

o Family = Spouse, children (Dependent or Not), Parents, Brother, Sister

(Dependent).(Do not Include → Grand Parents, in Laws)

Children if Date of Birth

Before 1-10-98 On or after 1-10-98

Max 2 Children allowed

1st Child- Single 1st Child- Multiple

2ndChild – Multiple 2ndChild – Single

(Multiple Birth after single) (Single birth after multiple)

[to be consi →2] [to be consi →3]

For 1 child it is taxable.

Monetary Limits :

Journey by Max exemption upto

Air Economy class fare

Railway AC 1st Class fare

Recognized public transport Executive class fare

Any other mode AC 1st class fare as if travel done

by railway

Inter CA DT Revision Lectures 10

RAJESH NANGALIA CLASSES 9903133927

Carry over concession :

Concession can be carried forward if assessee has not availed travel

concession during block to next block. But it should be claimed in 1st calendar

year of next block [only 1 carryover].

Exemption is only for fare not for other expense.

(7) Valuation of perq. For interest free loan or loan at concessional rate of interest. [To

e’yee or Family member](Rule 3(7)(i))

Perquisites= Interest @ market rate- Interest charged by employer

If repayment is monthly then calculate perq monthly.

Market rate= Find out rate of interest charged by SBI as on first day of P.Y. for

same purpose.

(8) Valuation of perq. In respect of use of movable asset [3(7)(vii)]

If computer/ Laptop/ Any other movable asset(except car)

telephone/mobile Given

Owned by e’yer Taken on Rent

Taxable = 10% p.a of original Taxable = Rent Paid

(–) Amt recovered (–) Amt recovered

Balance (if +ve) Balance (if +ve)

(9) Valuation of perq. For sale movable asset by e’yer to e’yee of nominal price [3(7)(viii)]

Electronic/ computers Motor car any other (furniture, Motorbike etc)

Actual Cost to e’yer Actual cost Actual cost

Less : 50% for each (–) 20% for each dep (–) 10% for each dep

Dep. Completed yr by completed yr by completed yr by

WDV WDV SLM

Less : Amt. recovered (–) Amt. recovered (–) Amt. recovered

Balance (if +ve) Balance (if +ve) Balance (if +ve)

Inter CA DT Revision Lectures 11

RAJESH NANGALIA CLASSES 9903133927

(in year → ignore fractions-only completed year to be taken)

(10) Valuation of medical facilities : [Proviso to 17(2)]

Exemption only for himself or family → [spouse, children (dep. Or not),

parents, brother, sister(Dep)] does not include Grand Parents inlaws.

So any exps paid by employer for a person who is not Family-Always

taxable

Medical facilities in India-For himself/family

Provided by Hospital Provided in Govt. Provided in hospital provided in

owned By e’yer Hospital approved by I. Private hospital

tax authority [For (family Dr,

Not Taxable Not Taxable deceases mentioned Nursing home.

In rule 3A(2)] etc)

Not Taxable Fully Taxable

Medical facilities O/s India-For himself/family

Treatments expense Staying expenses Travelling expenses

Exempt upto amount certified by RBI for if GTI > 2 lakh if GTI ≤ 2 Lakh

patient & 1 attendant Fully Taxable Fully Exempt

[GTI only excluding travelling exps.]

Note: if e’yer pays medical ins. Premium of e’yee or family then it is not perq. →

Clause (iii) of 1st proviso to section 17(2) .

But life ins prem paid by employer is fully taxable.

Inter CA DT Revision Lectures 12

RAJESH NANGALIA CLASSES 9903133927

(11) Valuation of perquisite in respect of Motor car [3(2)]

Car is owned by employee:

Situation Exps. Met by e’yee Exps. Met by e’yer

Office purpose Not Taxable No benefit = not Taxable

Private Purpose Not Taxable Cost to e’yer (Running

& maintainance+ Driver

Salary)

(–) Amt. recovered

Bal. (+ ve) → Taxable.

Partly office / Not Taxable Cost to e’yer

Partly Private (–) Used for office purpose

(W.N -1)

(–) Amt. recovered

Bal. (+ ve) → Taxable.

W.N -1 : How much amt. used for office purpose :

Car engine ≤ 1600 c.c (1.6litre) = ` 1800 p.m.

> 1600 c.c (1.6 litre) = ` 2400 p.m.

+ Driver salary (if provided) = ` 900 p.m.

Car is owned by employer:

Situation Exps. Met by e’yee Exps. Met by e’yer

Office purpose Not Taxable Not Taxable

Private Purpose Cost to e’yer Cost to e’yer [10% Dep./Hire]

[10% of Dep. SLM/ Hire + Running main. exps

charges] + Driver Salary (if provided)

(–) Recovered from e’yee (–) Amt. recovered

Bal. (+ ve) → Taxable. Bal. (+ ve) → Taxable.

[here running cost→by e’yee]

Partly office / Value of Taxable Perqs. Value of Taxable Perqs.

Partly Private CC → ≤ 1600 cc → ` 600 p.m → ≤ 1600 cc → ` 1800 p.m

CC → > 1600 cc → ` 900 p.m → > 1600 cc → ` 2400 p.m

+ Driver salary → ` 900 p.m

(if provided)

Inter CA DT Revision Lectures 13

RAJESH NANGALIA CLASSES 9903133927

(12) Value of perquisite of gift, voucher, token [Rule 3(7)(iv)]

Gift made in cash or Gift in kind upto ` 5000 in

Convertible to money aggregate p.a.

(like gift cheque)

Exempt (beyond that

taxable) 2 views

If above 5000 Fully Only amt above 5000 is

taxable (Follow this) taxable

(13) Value of specified security or sweat equity share for purpose of sec-17(2)

Perq. Taxable Value = FMV on date of exercising option

(–) Cost (any) recovered from e’yee

Bal. if +ve Taxable.

Note-1 : At time of sale of such shares cost of acq. wiil be such FMV[sec-

49(2AA)]

(14) Valuation of perq. For any other purpose not specified elsewhere

Find out exp by employer

(–) exp. On use for official purpose

(–) Amt. recovered from e’yee

Bal. (+ ve) → Taxable

Inter CA DT Revision Lectures 14

RAJESH NANGALIA CLASSES 9903133927

W. N. 4 : Deduction (Sec 16)

1) Standard deduction [16(ia)]

Gross Amt. of salary or ` 50,000 w.e. less (For all salary together in the P.Y.)

2) Entertainment allowance: [16(ii)]

Step-1 First add to salary for all employee.

Step-2 Then deduction only for Govt. e’yee

1/5th (20%) of or amount received or ` 5,000 p.a.

Basic salary

w.e less

3) Professional Tax or Tax on employment [16(iii)]

→ Levied by state Govt. → Deduction only when paid by employee in P.Y.

If paid by If paid by employer on behalf

employee of employee

Step-1-First add to Salary (Perq)

Step-2-Take deduction if employer has actually paid

No deduction in section 16 if followed 115BAC

Inter CA DT Revision Lectures 15

You might also like

- Power BinsDocument1 pagePower Binsrickymarts100% (2)

- Tax Melville AnswersDocument58 pagesTax Melville AnswersAmrita Dhasmana25% (4)

- LV Pitch Deck - 200223Document14 pagesLV Pitch Deck - 200223Hiren ExtraNo ratings yet

- Pecos Company and Suaro CompanyDocument4 pagesPecos Company and Suaro CompanyCharlotte0% (1)

- Salaries NotesDocument48 pagesSalaries Notesbhatiasanjay89No ratings yet

- STMT 20210131Document2 pagesSTMT 20210131manonmani somasundaramNo ratings yet

- Chapter 16 HomeworkDocument9 pagesChapter 16 HomeworkRin ZhafiraaNo ratings yet

- 3 Income From Salary Part 2Document30 pages3 Income From Salary Part 2mxwnknm4ckNo ratings yet

- Chapter 3 - Income From SalariesDocument14 pagesChapter 3 - Income From SalariesADARSH MISHRANo ratings yet

- Direct Taxes Module 2 Class NotesDocument13 pagesDirect Taxes Module 2 Class NotesSwetha AshokNo ratings yet

- 182 Day in PY (2022-2023) : and 365 Days in 4 PPY (2018 - 2022)Document13 pages182 Day in PY (2022-2023) : and 365 Days in 4 PPY (2018 - 2022)nadiyakadri246No ratings yet

- Direct Tax Summary Notes For IPCC JKQK1AK0Document24 pagesDirect Tax Summary Notes For IPCC JKQK1AK0Vivek ShimogaNo ratings yet

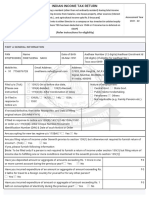

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 523799420050920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 523799420050920 Assessment Year: 2020-21Sushant MishraNo ratings yet

- Form PDF 129564520091221Document6 pagesForm PDF 129564520091221shivam kumarNo ratings yet

- Income From SalaryDocument60 pagesIncome From SalaryroopamNo ratings yet

- Salary HP Liability in Special CasesDocument30 pagesSalary HP Liability in Special CasesParth ThakkarNo ratings yet

- Salary HP Liability in Special CasesDocument33 pagesSalary HP Liability in Special CasesMr FunambulistNo ratings yet

- Salary HP Liability in Special CasesDocument33 pagesSalary HP Liability in Special CasesPriyanshu tripathiNo ratings yet

- Incone From Salary Ppts - pdf348Document48 pagesIncone From Salary Ppts - pdf348saloniagarwalagarwal3No ratings yet

- 2.2 Module 2 Part 2Document12 pages2.2 Module 2 Part 2Arpita ArtaniNo ratings yet

- 2.2-Module 2-Part 2 PDFDocument12 pages2.2-Module 2-Part 2 PDFArpita ArtaniNo ratings yet

- Form PDF 927814290281220Document8 pagesForm PDF 927814290281220Project EngineerNo ratings yet

- Unit-2 Calculation of Income Under The Head SalaryDocument26 pagesUnit-2 Calculation of Income Under The Head Salaryguddujan00015No ratings yet

- Lec 3 SalaryDocument28 pagesLec 3 SalaryManasi PatilNo ratings yet

- Indian Income Tax Return: Part A General InformationDocument8 pagesIndian Income Tax Return: Part A General Informationsushilprajapati10_77No ratings yet

- Retirement BenefitsDocument17 pagesRetirement BenefitsadityaNo ratings yet

- Income From SalaryDocument35 pagesIncome From SalaryNistha RayNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)CA Madhu Sudhan ReddyNo ratings yet

- Q1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDocument40 pagesQ1 (A) Discuss Provisions Relating To Taxability of Salary According To Charging Section 15 of The Income Tax ActDhiraj YAdavNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: Assessment Year: 2020-21MaheshNo ratings yet

- Form PDF 375787380280821Document6 pagesForm PDF 375787380280821nthakur1410No ratings yet

- Head Salary PDFDocument48 pagesHead Salary PDFRvi MahayNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document9 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Daniel DasNo ratings yet

- Final Itr PDFDocument8 pagesFinal Itr PDFharish1000No ratings yet

- Module - 2 Incomes From Salary and Income From House PropertyDocument7 pagesModule - 2 Incomes From Salary and Income From House PropertyNikitha AlpetNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 992002830030121 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 992002830030121 Assessment Year: 2020-21Shweta ShirsatNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document7 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pavani MsrNo ratings yet

- Particulars Exemption Amount Taxable: Taxable Receipts Under SalaryDocument5 pagesParticulars Exemption Amount Taxable: Taxable Receipts Under Salaryvijay.patNo ratings yet

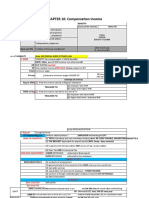

- CHAPTER 10: Compensation Income: 1. MWE Exempt! 250K RULE!Document78 pagesCHAPTER 10: Compensation Income: 1. MWE Exempt! 250K RULE!Anabel Lajara AngelesNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 433739630310720 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 433739630310720 Assessment Year: 2020-21Satyajeet SahooNo ratings yet

- Form PDF 343591640231221Document6 pagesForm PDF 343591640231221kep24sachinNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Pandian KNo ratings yet

- 2 Income From Salary Part 1Document46 pages2 Income From Salary Part 1mxwnknm4ckNo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 592798150280920 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 592798150280920 Assessment Year: 2020-21manishNo ratings yet

- Return Form - 692429350311221Document6 pagesReturn Form - 692429350311221Santhosh KumarNo ratings yet

- Form PDF 253535800070821Document8 pagesForm PDF 253535800070821kotasrihariNo ratings yet

- Print This PageDocument1 pagePrint This PageTenali ChandanaNo ratings yet

- TAX667 CT SS NOV 2023 - AmmendedDocument4 pagesTAX667 CT SS NOV 2023 - Ammendedxfs5k9m8stNo ratings yet

- Income Tax: Ca - Cma - Cs Inter / EPDocument55 pagesIncome Tax: Ca - Cma - Cs Inter / EPINDIRA GHOSHNo ratings yet

- Sunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Document14 pagesSunday, April 5, 2009: Income Under The Head Salary (Section 15 - 17)Prashant singhNo ratings yet

- Salary Head Notes For ZIDDDocument55 pagesSalary Head Notes For ZIDDarham.choraria04No ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 754167410271120 Assessment Year: 2020-21Document8 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 754167410271120 Assessment Year: 2020-21Manish MishraNo ratings yet

- Form PDF 927448140281220Document7 pagesForm PDF 927448140281220Arvind KumarNo ratings yet

- Form PDF 927448140281220Document7 pagesForm PDF 927448140281220Arvind KumarNo ratings yet

- Whichever Is Lower: A) DeductionsDocument3 pagesWhichever Is Lower: A) Deductions8151 KATALE PRIYANKANo ratings yet

- Itr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Document7 pagesItr-1 Sahaj Indian Income Tax Return: Acknowledgement Number: 409150350210720 Assessment Year: 2020-21Vasanth Kumar AllaNo ratings yet

- 30 SalaryDocument13 pages30 SalaryBahi Rathan RNo ratings yet

- Form PDF 525484870281221Document6 pagesForm PDF 525484870281221potod29484No ratings yet

- Form PDF 767967830311221Document6 pagesForm PDF 767967830311221ClaptrapjackNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document6 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)singam jasNo ratings yet

- Chapter 4a PDFDocument14 pagesChapter 4a PDFBrinda RNo ratings yet

- Income TaxDocument79 pagesIncome TaxRaj HanumanteNo ratings yet

- Form PDF 712550240101120Document7 pagesForm PDF 712550240101120Animesh JainNo ratings yet

- Indian Income Tax Return: (Refer Instructions For Eligibility)Document10 pagesIndian Income Tax Return: (Refer Instructions For Eligibility)Kiruthika nagarajanNo ratings yet

- Indian Income Tax Return: Part A General InformationDocument8 pagesIndian Income Tax Return: Part A General InformationDevbrat BoseNo ratings yet

- Agricultural IncomeDocument8 pagesAgricultural IncomeRajesh NangaliaNo ratings yet

- Rajesh Nangalia Classes 9903133927Document12 pagesRajesh Nangalia Classes 9903133927Rajesh NangaliaNo ratings yet

- Valuation of Goodwill XII ScannerDocument5 pagesValuation of Goodwill XII ScannerRajesh NangaliaNo ratings yet

- Cost of CapitalDocument18 pagesCost of CapitalRajesh NangaliaNo ratings yet

- ConsignmentDocument15 pagesConsignmentRajesh Nangalia100% (1)

- Internal ReconstructionDocument26 pagesInternal ReconstructionRajesh NangaliaNo ratings yet

- Final Accounts of Companies NotesDocument23 pagesFinal Accounts of Companies NotesRajesh NangaliaNo ratings yet

- Ratio Analysis XII Class NotesDocument36 pagesRatio Analysis XII Class NotesRajesh NangaliaNo ratings yet

- Department AccountingDocument12 pagesDepartment AccountingRajesh NangaliaNo ratings yet

- History of Index NumberDocument1 pageHistory of Index NumbersyukrizzNo ratings yet

- FRM 2011 GARP Practice Exam Level1 PDFDocument76 pagesFRM 2011 GARP Practice Exam Level1 PDFVitor SalgadoNo ratings yet

- Godley (1992) - Maastricht and All ThatDocument5 pagesGodley (1992) - Maastricht and All ThatmarceloscarvalhoNo ratings yet

- 1 Financial Statements AnalysisDocument6 pages1 Financial Statements AnalysisJamaica DavidNo ratings yet

- Financial Management: Manish SirDocument94 pagesFinancial Management: Manish SirHarmanjeet SinghNo ratings yet

- Accounting For Agency, Home Office and Branch - Special ProblemsDocument5 pagesAccounting For Agency, Home Office and Branch - Special ProblemsJen AcodeNo ratings yet

- Jan 31, 2022Document2 pagesJan 31, 2022kramergeorgec397No ratings yet

- The Performance of Micro Finance Institutions in Ethiopia: A Case of Six Microfinance InstitutionsDocument63 pagesThe Performance of Micro Finance Institutions in Ethiopia: A Case of Six Microfinance InstitutionselawelizaNo ratings yet

- APC 403 PFRS For SMEsDocument10 pagesAPC 403 PFRS For SMEsHazel Seguerra BicadaNo ratings yet

- Indian Income Tax Return Acknowledgement 2021-22: Assessment YearDocument1 pageIndian Income Tax Return Acknowledgement 2021-22: Assessment YearSwapna BahaddurNo ratings yet

- Bre X InfoDocument12 pagesBre X InfoSOLOMONlastNo ratings yet

- Section 186 of The Companies Act, 2013Document13 pagesSection 186 of The Companies Act, 2013Anshu Kumar023No ratings yet

- How To Use EA Scouts Gold V9.5.5Document7 pagesHow To Use EA Scouts Gold V9.5.5Sulistriono TyoNo ratings yet

- Quiz 2Document5 pagesQuiz 2asaad5299No ratings yet

- Test 1 C3Document8 pagesTest 1 C3SaviusNo ratings yet

- AC7052ES Assignment BriefDocument13 pagesAC7052ES Assignment BriefdemionNo ratings yet

- The Impact of Reward & Recognition On Employee MoDocument98 pagesThe Impact of Reward & Recognition On Employee MokomalNo ratings yet

- Financial Accounting - Tugas 4 - 23 Oktober 2019Document3 pagesFinancial Accounting - Tugas 4 - 23 Oktober 2019AlfiyanNo ratings yet

- Chapter 10 - Test BankDocument53 pagesChapter 10 - Test Bankjuan100% (3)

- Day 1 ECCA TrainingDocument78 pagesDay 1 ECCA Trainingadinsmaradhana100% (1)

- Fin702 Ud 2023Document12 pagesFin702 Ud 2023Emjes GianoNo ratings yet

- Sunshine ContractDocument13 pagesSunshine Contractnick wilkinsonNo ratings yet

- @canotes Ipcc GST Question Bank PDFDocument208 pages@canotes Ipcc GST Question Bank PDFHindutav aryaNo ratings yet

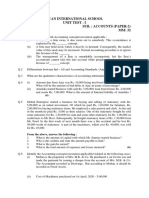

- Ryan International School Unit Test - I Class-Xi Sub.: Accounts (Paper-2) Time: 1 Hrs. MM: 32Document2 pagesRyan International School Unit Test - I Class-Xi Sub.: Accounts (Paper-2) Time: 1 Hrs. MM: 32RGN 11E 20 KHUSHI NAGARNo ratings yet