Professional Documents

Culture Documents

Summary

Summary

Uploaded by

sachin saurabh0 ratings0% found this document useful (0 votes)

5 views2 pagesThe document calculates taxable income and tax payable for an individual. It shows that the individual has a gross total income of Rs. 113 and no deductions, resulting in a total taxable income of Rs. 113. However, the total tax payable is Rs. 0. The individual paid Rs. 6,082 in taxes deducted at the source from other income. This leads to a refund amount of Rs. 6,080 since the total tax liability is Rs. 0.

Original Description:

Original Title

summary

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThe document calculates taxable income and tax payable for an individual. It shows that the individual has a gross total income of Rs. 113 and no deductions, resulting in a total taxable income of Rs. 113. However, the total tax payable is Rs. 0. The individual paid Rs. 6,082 in taxes deducted at the source from other income. This leads to a refund amount of Rs. 6,080 since the total tax liability is Rs. 0.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

5 views2 pagesSummary

Summary

Uploaded by

sachin saurabhThe document calculates taxable income and tax payable for an individual. It shows that the individual has a gross total income of Rs. 113 and no deductions, resulting in a total taxable income of Rs. 113. However, the total tax payable is Rs. 0. The individual paid Rs. 6,082 in taxes deducted at the source from other income. This leads to a refund amount of Rs. 6,080 since the total tax liability is Rs. 0.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

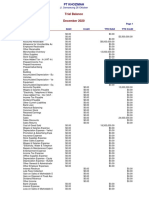

Calculation of Your Taxable Income

A. Gross Total Income „ 113

Hide Details

Income Chargeable under the head ’Salaries’ „ 0

Income Chargeable under the head ’House Property’ „ 0

Income Chargeable under the head ’Other Sources’ „ 113

Gross Total Income „ 113

B. Total Deductions „ 0

Hide Details

Total Deductions ( ) „ 0

C. Total Taxable Income (AB) „ 110

Calculation of Tax Payable

D. Total Tax, Fee and Interest „ 0

Hide Details

Tax Payable on Total Income „ 0

Rebate u/s 87A „ 0

Tax payable after rebate „ 0

Health and Education Cess at 4% „ 0

Total Tax & Cess „ 0

Relief u/s 89 „ 0

Balance Tax After Relief „ 0

Interest u/s 234A „ 0

Interest u/s 234B „ 0

Interest u/s 234C „ 0

Fees u/s 234F „ 0

Total Interest and Fee Payable „ 0

Total Tax, Fee and Interest „ 0

E. Total Tax Paid „ 6,082

Hide Details

Tax Deducted at Source (TDS1) on Salary Income „ 0

Tax Deducted at Source (TDS) from Income Other than Salary „ 6,082

Tax Deducted at Source (TDS) as furnished by Payer(s) „ 0

Tax Collected at Source (TCS) „0

Advance Tax „0

Self Assessment Tax „0

Total Tax Paid „ 6,082

Refund Amount „ 6,080

Hide Details

Total Tax Liability „ 0

Total Tax Paid „ 6,082

Total Amount Refund „ 6,080

You might also like

- New Tax Return Transcript 2222Document7 pagesNew Tax Return Transcript 2222James Franklin67% (3)

- SummaryDocument2 pagesSummarySanjeet DuhanNo ratings yet

- Hide DetailsDocument2 pagesHide Detailskanth_kNo ratings yet

- SummaryDocument3 pagesSummarydebasisghosh081No ratings yet

- SummaryDocument3 pagesSummaryKANCHAN BHANDARINo ratings yet

- SummaryDocument3 pagesSummarymanas sulokNo ratings yet

- CalculateDocument1 pageCalculateSneha dhakoliyaNo ratings yet

- SummaryDocument2 pagesSummaryRAJ KUMHARENo ratings yet

- SummaryDocument3 pagesSummaryDIPAK SINGHANo ratings yet

- Income Tax Computation: Less: Standard Deduction U/S 16Document10 pagesIncome Tax Computation: Less: Standard Deduction U/S 16sidrijegnoNo ratings yet

- SummaryDocument1 pageSummarySkill IndiaNo ratings yet

- SummaryDocument2 pagesSummarySachin KumarNo ratings yet

- SummaryDocument2 pagesSummaryAmit ParouhaNo ratings yet

- EstimateDocument1 pageEstimatesandeep sandyNo ratings yet

- TalbsbsndsksiiaDocument3 pagesTalbsbsndsksiiakailashkunwar1210No ratings yet

- SummaryDocument2 pagesSummarynilnikNo ratings yet

- SummaryDocument2 pagesSummaryuwxodjiuwuuiNo ratings yet

- EstimateDocument1 pageEstimateAtulPalNo ratings yet

- SummaryDocument3 pagesSummaryMayakuntla NeeladriNo ratings yet

- EstimateDocument1 pageEstimateSrinivasarao ObillaNo ratings yet

- PL and Balance Sheet Detailed FormatDocument5 pagesPL and Balance Sheet Detailed FormatPradeep G MenonNo ratings yet

- ReportDocument1 pageReportKristine ClementeNo ratings yet

- N01887estax2007 09Document2 pagesN01887estax2007 09api-3747051100% (1)

- Tax Computation ReportDocument12 pagesTax Computation ReportRajesh MNo ratings yet

- SummaryDocument2 pagesSummaryASWIN.M.MNo ratings yet

- Pas 12Document27 pagesPas 12Princess Jullyn ClaudioNo ratings yet

- How To Consider Excess Cash in Firm ValuationDocument7 pagesHow To Consider Excess Cash in Firm ValuationKizzy Figaro-RamdhanieNo ratings yet

- EMPH2800 TAXSHEET March 2021Document1 pageEMPH2800 TAXSHEET March 2021the anonymousNo ratings yet

- HCL Technologies Ltd.Document76 pagesHCL Technologies Ltd.Hemendra GuptaNo ratings yet

- Tax Return: Wealth and Income Tax 2021Document6 pagesTax Return: Wealth and Income Tax 2021evelinaburagaite2001No ratings yet

- Sales Break-Even CalculationDocument5 pagesSales Break-Even CalculationTaranum RandhawaNo ratings yet

- Yadnya-Income Tax Regime CalculatorDocument16 pagesYadnya-Income Tax Regime CalculatorRaghavendra DeshpandeNo ratings yet

- Balance Sheet As of December 2020: Jl. Semawung 26 OktoberDocument1 pageBalance Sheet As of December 2020: Jl. Semawung 26 Oktoberkhozimah nurNo ratings yet

- 2018-Income-Statement Copy-2Document9 pages2018-Income-Statement Copy-2api-464285260No ratings yet

- Salary Slip For The Month of NOVEMBER-2023Document1 pageSalary Slip For The Month of NOVEMBER-2023MUBEEN ZAFARNo ratings yet

- Salaried Tax Calculator Ay 23-24Document2 pagesSalaried Tax Calculator Ay 23-24Proddut BasakNo ratings yet

- Tax Exercises May 2017 JointDocument31 pagesTax Exercises May 2017 JointLorenaNo ratings yet

- Joint Exercises May 2017 JointDocument31 pagesJoint Exercises May 2017 JointLorenaNo ratings yet

- Tax Exercises May 2017 JointDocument31 pagesTax Exercises May 2017 JointLorenaNo ratings yet

- Joint Exercises May 2017 JointDocument31 pagesJoint Exercises May 2017 JointLorenaNo ratings yet

- Mahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahDocument4 pagesMahnia Wala Chak No 190 JB Post Office Khas Tehsil Chiniot Distt Muhammad Saleem Raza ShahMUHAMMAD SALEEM RAZANo ratings yet

- EstimateDocument1 pageEstimateama kumarNo ratings yet

- 0 GPIND TMCGOFFOCT2022 V2 Gpinit01Document2 pages0 GPIND TMCGOFFOCT2022 V2 Gpinit01lakb5304No ratings yet

- Income Statement QuaterlyDocument9 pagesIncome Statement Quaterlyndiarra6689No ratings yet

- Trial Balance December 2020: 10/26/2020 3:04:30 PM Account Debit Credit YTD Debit YTD CreditDocument2 pagesTrial Balance December 2020: 10/26/2020 3:04:30 PM Account Debit Credit YTD Debit YTD Creditkhozimah nurNo ratings yet

- DownloadDocument1 pageDownloadJitaram SamalNo ratings yet

- Computation ITRDocument1 pageComputation ITRsuneetbansalNo ratings yet

- Provisional Taxsheet Mar 2020Document1 pageProvisional Taxsheet Mar 2020vivianNo ratings yet

- MediaAgility 2019 Form16Document1 pageMediaAgility 2019 Form16SiddharthNo ratings yet

- TaxComputation SYEDL PUN0157 2023 2024Document2 pagesTaxComputation SYEDL PUN0157 2023 2024nitin patilNo ratings yet

- Budget Tracker: Personal Income Statement WorksheetDocument2 pagesBudget Tracker: Personal Income Statement Worksheetapi-353423707No ratings yet

- NewOldRegime - 2024-2025 - SALUNKEDocument1 pageNewOldRegime - 2024-2025 - SALUNKEYogesh KaleNo ratings yet

- Vat & Tax CalculatorDocument6 pagesVat & Tax CalculatorRoyNo ratings yet

- Budget Totals Estimated Actual Difference: Personnel ExpensesDocument1 pageBudget Totals Estimated Actual Difference: Personnel ExpensesMarco Thaddeus AlabaNo ratings yet

- Income Statement - QuarterlyDocument3 pagesIncome Statement - QuarterlyNu SNo ratings yet

- Comp Anubhav Garg 21 - 22Document1 pageComp Anubhav Garg 21 - 22prateek gangwaniNo ratings yet

- Computation 21-22Document1 pageComputation 21-22prateek gangwaniNo ratings yet

- Cordero AngeloDocument1 pageCordero AngelohandugangeloyNo ratings yet

- J.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineFrom EverandJ.K. Lasser's Small Business Taxes 2021: Your Complete Guide to a Better Bottom LineNo ratings yet

- Anvt SVDocument1 pageAnvt SVsachin saurabhNo ratings yet

- The Cricketing World Held Its Collective Breath As Two GiantDocument7 pagesThe Cricketing World Held Its Collective Breath As Two Giantsachin saurabhNo ratings yet

- Test 6Document44 pagesTest 6sachin saurabhNo ratings yet

- Attachment Historical Background Lyst1937Document53 pagesAttachment Historical Background Lyst1937sachin saurabhNo ratings yet

- Provided by Sherazi (Accounts) : Final AccountDocument3 pagesProvided by Sherazi (Accounts) : Final AccountShahid AbbasNo ratings yet

- Mercado Libre Press Release 2Q21Document12 pagesMercado Libre Press Release 2Q21BAE NegociosNo ratings yet

- Final AFS 2021 MBA 6th MorDocument3 pagesFinal AFS 2021 MBA 6th MorSyed Mursaleen ShahNo ratings yet

- Sustainability 13 03746 v2Document15 pagesSustainability 13 03746 v2thyb2015571No ratings yet

- Consolidated Balance Sheet Equity and Liabilities Shareholders' FundsDocument17 pagesConsolidated Balance Sheet Equity and Liabilities Shareholders' FundsGaurav SharmaNo ratings yet

- Timothy - Chap 8Document43 pagesTimothy - Chap 8Chaeyeon Jung100% (1)

- Gross Income: Valencia CH 6 Answer KeyDocument46 pagesGross Income: Valencia CH 6 Answer KeyShane TorrieNo ratings yet

- Investors DiagramDocument4 pagesInvestors DiagramSasindu GimhanNo ratings yet

- The Purpose Is Profit Mclaughlin en 26797Document5 pagesThe Purpose Is Profit Mclaughlin en 26797Tej ShahNo ratings yet

- Tutorial Questions - Accounting Non-Profit OrganizationDocument3 pagesTutorial Questions - Accounting Non-Profit OrganizationMoriatyNo ratings yet

- Entrepreneurship ExamDocument6 pagesEntrepreneurship ExamMark Gil GuillermoNo ratings yet

- Bocw Rules RajasthanDocument184 pagesBocw Rules RajasthanEzhil Vendhan PalanisamyNo ratings yet

- Fedex Term PaperDocument7 pagesFedex Term Papere9xsjk8h100% (1)

- Estimating and Costing MaterialDocument42 pagesEstimating and Costing MaterialQuestion paperNo ratings yet

- R17 Understanding Income Statements IFT NotesDocument21 pagesR17 Understanding Income Statements IFT Notessubhashini sureshNo ratings yet

- Leverage: Capital StructureDocument74 pagesLeverage: Capital Structurekomalgupta89No ratings yet

- Exercises - Financial Statement AnalysisDocument48 pagesExercises - Financial Statement AnalysisBel NochuNo ratings yet

- Advanced Financial Accounting (Acfn3151)Document2 pagesAdvanced Financial Accounting (Acfn3151)alemayehu100% (4)

- FM - Chapter 3 - QuizDocument8 pagesFM - Chapter 3 - QuizHausland Const. Corp.No ratings yet

- TemenosDocument13 pagesTemenosthejerry11No ratings yet

- Accounts Book - BBA 1st SemDocument96 pagesAccounts Book - BBA 1st SemClay JensenNo ratings yet

- Local Fiscal AdministrationDocument15 pagesLocal Fiscal AdministrationRoy Basanez100% (2)

- The Case of 125346Document2 pagesThe Case of 125346markuslagan06No ratings yet

- Florida Palms Country Club Adjusts Its Accounts Monthly Club MembersDocument1 pageFlorida Palms Country Club Adjusts Its Accounts Monthly Club Memberstrilocksp SinghNo ratings yet

- CONSTITUTION OF SIMA Community Based Organization DefinitionDocument9 pagesCONSTITUTION OF SIMA Community Based Organization Definitionrapho2014100% (1)

- Captive Outsourcing Model DraftDocument14 pagesCaptive Outsourcing Model DraftArchitNo ratings yet

- HOSPITALITY FINANCIAL ACCOUNTING Notes 1Document17 pagesHOSPITALITY FINANCIAL ACCOUNTING Notes 1conyango1853No ratings yet

- Home & Hill Affairs Department Pay Slip Government of West BengalDocument1 pageHome & Hill Affairs Department Pay Slip Government of West BengalP GhosalNo ratings yet

- (Week 2) Preliminary Analytical ProcedureDocument56 pages(Week 2) Preliminary Analytical ProcedureJonathan EdricNo ratings yet

- FT12 - Day 6 - SSV - GKR - 06062021Document81 pagesFT12 - Day 6 - SSV - GKR - 06062021AnshulNo ratings yet