Professional Documents

Culture Documents

Final SCN SOP Non Responsive

Final SCN SOP Non Responsive

Uploaded by

anil deswalCopyright:

Available Formats

You might also like

- DRAFT Stay of Demand by CA NITIN KANWARDocument13 pagesDRAFT Stay of Demand by CA NITIN KANWARAmandeep Vats92% (12)

- NISSEM Global BriefsDocument454 pagesNISSEM Global BriefsNISSEM SDG4100% (1)

- SC Judgment Not Applies To Section 148 Notice For AY 2013-14 To 2015-16 - Taxguru - inDocument10 pagesSC Judgment Not Applies To Section 148 Notice For AY 2013-14 To 2015-16 - Taxguru - inShaik MastanvaliNo ratings yet

- ILDP Prashant Bhimrao KapseDocument3 pagesILDP Prashant Bhimrao Kapseanil deswalNo ratings yet

- Cit (A)Document8 pagesCit (A)Raaja ThalapathyNo ratings yet

- CIT v. Vegetable Products Ltd.Document4 pagesCIT v. Vegetable Products Ltd.Karsin ManochaNo ratings yet

- Rajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsDocument10 pagesRajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsSubramanyam SettyNo ratings yet

- Income Tax 2 j2019Document50 pagesIncome Tax 2 j2019Avinash ShettyNo ratings yet

- WWW - Livelaw.In: Judgment Uday Umesh Lalit, JDocument8 pagesWWW - Livelaw.In: Judgment Uday Umesh Lalit, JRaghav MehtaNo ratings yet

- The Commissioner of Income Tax Vs MS. Vegetables Products Ltd. Supreme Court of IndiaDocument5 pagesThe Commissioner of Income Tax Vs MS. Vegetables Products Ltd. Supreme Court of IndiaN MehtaNo ratings yet

- Advanced Tax Laws Question Paper 2021-2022Document4 pagesAdvanced Tax Laws Question Paper 2021-2022sorien panditNo ratings yet

- 1985 SCMR 786 Best Judgement Assessment DefinedDocument9 pages1985 SCMR 786 Best Judgement Assessment DefinedAsif MalikNo ratings yet

- Fakirappa Savadatti Revision PetitionDocument3 pagesFakirappa Savadatti Revision Petitionaaryakkaushik916No ratings yet

- ItatDocument9 pagesItatshantibholaNo ratings yet

- JHC 491832Document11 pagesJHC 491832Kunal NawaleNo ratings yet

- 148d 50 LAC Cost ImposedDocument36 pages148d 50 LAC Cost ImposedNeena BatlaNo ratings yet

- 1997 (3) TMI 9 - SC - Allied Motors Private Limited Versus Commissioner of Income-TaxDocument7 pages1997 (3) TMI 9 - SC - Allied Motors Private Limited Versus Commissioner of Income-TaxAnanya UpadhyeNo ratings yet

- Income Tax J2019Document50 pagesIncome Tax J2019Avinash ShettyNo ratings yet

- Ilovepdf MergedDocument58 pagesIlovepdf MergedGaurav shuklaNo ratings yet

- TLP Supplement DT Dec, 2019 - Old SyllabusDocument94 pagesTLP Supplement DT Dec, 2019 - Old Syllabusjanardhan CA,CSNo ratings yet

- In The High Court of Judicature at BombayDocument23 pagesIn The High Court of Judicature at BombayAjmera HarshalNo ratings yet

- TLP Supplement DT June 2019 Old SyllabusDocument60 pagesTLP Supplement DT June 2019 Old Syllabusjanardhan CA,CSNo ratings yet

- Trueblue India LLP Versus Deputy Commissioner of Income Tax Circle 43-1 & Ors. - 2022 (8) Tmi 93 - Delhi High CourtDocument13 pagesTrueblue India LLP Versus Deputy Commissioner of Income Tax Circle 43-1 & Ors. - 2022 (8) Tmi 93 - Delhi High CourtSrichNo ratings yet

- 2023 - AST - 7000000058449183 - 76923457 - 2023 - AST - AKNPG5533F - Show Cause Notice For Proceedings Us 147 - 1060240562 (1) - 30012024Document8 pages2023 - AST - 7000000058449183 - 76923457 - 2023 - AST - AKNPG5533F - Show Cause Notice For Proceedings Us 147 - 1060240562 (1) - 30012024meghan googlyNo ratings yet

- Draft Reply To Notice 143 (2) (AY 2022-23)Document5 pagesDraft Reply To Notice 143 (2) (AY 2022-23)Vineet AgrawalNo ratings yet

- Versus: Efore R Rora Hairman AND Ajiv Isra Ember DministrativeDocument7 pagesVersus: Efore R Rora Hairman AND Ajiv Isra Ember DministrativeshailjaNo ratings yet

- Recei: Bureau of Internal Revenue Recg&Bs Mgt. DivisionDocument11 pagesRecei: Bureau of Internal Revenue Recg&Bs Mgt. DivisionMaria Izza Perez KatonNo ratings yet

- Can GST Scrutiny Be There After Audit 1705059483Document5 pagesCan GST Scrutiny Be There After Audit 1705059483RajatNo ratings yet

- Tolia AppealDocument7 pagesTolia Appealmau8684No ratings yet

- 2023 - AST - 7000000064463914 - 84984933 - 2023 - AST - FRPPK9574Q - Show Cause Notice - 1062611079 (1) - 14032024Document5 pages2023 - AST - 7000000064463914 - 84984933 - 2023 - AST - FRPPK9574Q - Show Cause Notice - 1062611079 (1) - 14032024atishrijiNo ratings yet

- TLP Supplement DT June 2020-OSDocument105 pagesTLP Supplement DT June 2020-OSZamr GNo ratings yet

- Hapag Lloyd India Pvt. LTD 1Document9 pagesHapag Lloyd India Pvt. LTD 1mani712fcaNo ratings yet

- 2023 - AST - 7000000066219100 - 87442168 - 2023 - AST - FRPPK9574Q - Order Us 147 - 1063432472 (1) - 27032024Document6 pages2023 - AST - 7000000066219100 - 87442168 - 2023 - AST - FRPPK9574Q - Order Us 147 - 1063432472 (1) - 27032024atishrijiNo ratings yet

- IT12. Assessments and RevisionsDocument12 pagesIT12. Assessments and Revisionsshree varanaNo ratings yet

- Assessment: Issues in Assessment & Reassessment Under I. T. ActDocument36 pagesAssessment: Issues in Assessment & Reassessment Under I. T. ActSUNILNo ratings yet

- 2024 05 16 2024 162 Taxmann Com 466 Gujarat 30 04 2024 Chatursinh Javanji Chavda Vs Assistant CoDocument4 pages2024 05 16 2024 162 Taxmann Com 466 Gujarat 30 04 2024 Chatursinh Javanji Chavda Vs Assistant CoCA Ujjwal GuptaNo ratings yet

- Cta 2D CV 10517 R 2023may18 AssDocument14 pagesCta 2D CV 10517 R 2023may18 AssgregmanilaNo ratings yet

- J 2018 SCC OnLine Bom 9088 2018 305 CTR 939 Durgeshkhanapurkar Desaidiwanjicom 20240626 143107 1 3Document3 pagesJ 2018 SCC OnLine Bom 9088 2018 305 CTR 939 Durgeshkhanapurkar Desaidiwanjicom 20240626 143107 1 3Niharika VyasNo ratings yet

- Order 122Document9 pagesOrder 122Zaid NaveedNo ratings yet

- Appeal SummaryDocument49 pagesAppeal Summarymaapitambraenterprises700No ratings yet

- Tax Laws and Practice Direct Tax June 2021Document98 pagesTax Laws and Practice Direct Tax June 2021niraliparekh27No ratings yet

- Sro 1262Document4 pagesSro 1262muhammadjavaid698No ratings yet

- Asst Order Priya Arya AY 2022-23Document8 pagesAsst Order Priya Arya AY 2022-23basecandlesNo ratings yet

- AKTPS1245A - Notice Us 142 (1) - 06032022Document3 pagesAKTPS1245A - Notice Us 142 (1) - 06032022Birdhi ChandNo ratings yet

- Per Rajpal Yadav, Judicial MemberDocument5 pagesPer Rajpal Yadav, Judicial MemberSrijan MishraNo ratings yet

- US Internal Revenue Service: 061701fDocument4 pagesUS Internal Revenue Service: 061701fIRSNo ratings yet

- Abci V Cir DigestDocument9 pagesAbci V Cir DigestSheilaNo ratings yet

- Tax Agrguments WordDocument16 pagesTax Agrguments WordkingNo ratings yet

- RefundsDocument32 pagesRefundsanubalanNo ratings yet

- (Rajasthan) / (2022) 447 ITR 698 (Rajasthan) (29-06-2022)Document6 pages(Rajasthan) / (2022) 447 ITR 698 (Rajasthan) (29-06-2022)rigiyanNo ratings yet

- Rajesh Kumar Sharma - Submission Before ITAT - Penalty - 201617Document6 pagesRajesh Kumar Sharma - Submission Before ITAT - Penalty - 201617sssadangiNo ratings yet

- HC Commissioner - of - Income - Tax - Vs - Hindustan - Bulk - Carris021238COM34602Document19 pagesHC Commissioner - of - Income - Tax - Vs - Hindustan - Bulk - Carris021238COM34602Neelesh ShuklaNo ratings yet

- Laxmi Mangal Products vs Samridhi Industries - Section 138 ComplaintDocument6 pagesLaxmi Mangal Products vs Samridhi Industries - Section 138 ComplaintVaibhav MishraNo ratings yet

- Appeal - Service TaxDocument22 pagesAppeal - Service TaxektaNo ratings yet

- Form No. 35 (See Rule 45)Document3 pagesForm No. 35 (See Rule 45)Savoir PenNo ratings yet

- Priyanka Rajbhar Date 26 02 2024Document6 pagesPriyanka Rajbhar Date 26 02 2024Anshul GuptaNo ratings yet

- Laxmi Mangal Products vs Samridhi Industries - Section 138 ComplaintDocument6 pagesLaxmi Mangal Products vs Samridhi Industries - Section 138 ComplaintVaibhav MishraNo ratings yet

- Taxing Statute InterpretationDocument33 pagesTaxing Statute Interpretationsomya jainNo ratings yet

- Annexure-B 108 Taxmann Com 491 Bombay 266 Taxman 29 Bombay 16 07 2019Document16 pagesAnnexure-B 108 Taxmann Com 491 Bombay 266 Taxman 29 Bombay 16 07 2019Shaik MastanvaliNo ratings yet

- Assessment Proceedings Under IT Act 1961Document31 pagesAssessment Proceedings Under IT Act 1961amanfreefire555No ratings yet

- Ack Asbpd7906m 2022-23 966623240240722Document1 pageAck Asbpd7906m 2022-23 966623240240722anil deswalNo ratings yet

- Screenshot 2023-02-11 at 6.00.56 AMDocument14 pagesScreenshot 2023-02-11 at 6.00.56 AManil deswalNo ratings yet

- My CardsDocument1 pageMy Cardsanil deswalNo ratings yet

- Notice Us 133 (6) - 1058288414 (1) - 29112023Document2 pagesNotice Us 133 (6) - 1058288414 (1) - 29112023anil deswalNo ratings yet

- Pinku Baroda Regional Office Allahabad - Google SearchDocument1 pagePinku Baroda Regional Office Allahabad - Google Searchanil deswalNo ratings yet

- Ito Ward Buxar - Google SearchDocument1 pageIto Ward Buxar - Google Searchanil deswalNo ratings yet

- CHAP 5.pmdDocument6 pagesCHAP 5.pmdanil deswalNo ratings yet

- ILDP Prashant Bhimrao KapseDocument3 pagesILDP Prashant Bhimrao Kapseanil deswalNo ratings yet

- Nuclear Physics PrimerDocument10 pagesNuclear Physics PrimerAnthony AffulNo ratings yet

- CO4CRT12 - Quantitative Techniques For Business - II (T)Document4 pagesCO4CRT12 - Quantitative Techniques For Business - II (T)Ann Maria GeorgeNo ratings yet

- Exercise 5.4 Analyzing EnthymemesDocument2 pagesExercise 5.4 Analyzing EnthymemesMadisyn Grace HurleyNo ratings yet

- Africa-chadicMusey English French DictionaryDocument168 pagesAfrica-chadicMusey English French DictionaryJordiAlberca100% (2)

- Sneaky Hypnosis PhrasesDocument4 pagesSneaky Hypnosis PhrasesRaiyanq67% (3)

- Bosch SpreadsDocument47 pagesBosch SpreadshtalibNo ratings yet

- Accomplishment Report BrigadaDocument2 pagesAccomplishment Report BrigadaVincent rexie AsuncionNo ratings yet

- Unilog - Taxonomy and Content Process v3Document26 pagesUnilog - Taxonomy and Content Process v3basuchitNo ratings yet

- Constellation Program BrochureDocument2 pagesConstellation Program BrochureBob Andrepont100% (1)

- Deathday ScriptDocument5 pagesDeathday Scriptpdabbsy185No ratings yet

- Deploy Qlik Sense Enterprise On KubernetesDocument45 pagesDeploy Qlik Sense Enterprise On Kubernetesstubadub99No ratings yet

- LayoffDocument2 pagesLayoffPooja PandaNo ratings yet

- Civil Engineer ListDocument9 pagesCivil Engineer ListMohammad AtiqueNo ratings yet

- Ermias TesfayeDocument111 pagesErmias TesfayeYayew MaruNo ratings yet

- Micro Focus Cobol Survey Itl 2015 Report PTDocument22 pagesMicro Focus Cobol Survey Itl 2015 Report PTprojrev2No ratings yet

- 0 Modul Kelas Regular by IsbatDocument52 pages0 Modul Kelas Regular by IsbatTikaa RachmawatiNo ratings yet

- 1P ThornhillDocument1 page1P ThornhillvincentNo ratings yet

- Siemens-BT300 VFDDocument6 pagesSiemens-BT300 VFDdiansulaemanNo ratings yet

- Introduction To Cisco Router ConfigurationDocument545 pagesIntroduction To Cisco Router ConfigurationDave WilliamsNo ratings yet

- Chocolate Cake RecipeTin EatsDocument2 pagesChocolate Cake RecipeTin Eatsantoniapatsalou1No ratings yet

- Persuasive Essay: English Proficiency For The Empowered ProfessionalsDocument2 pagesPersuasive Essay: English Proficiency For The Empowered ProfessionalsKyle Sanchez (Kylie)No ratings yet

- Activity Question To Ponder OnDocument3 pagesActivity Question To Ponder OnMatthew Frank Melendez QuerolNo ratings yet

- Model Dinamik Pengelolaan TK Di Kep SeribuDocument212 pagesModel Dinamik Pengelolaan TK Di Kep SeribuMeylan HusinNo ratings yet

- Material Safety Data Sheet: 1. Product and Company IdentificationDocument11 pagesMaterial Safety Data Sheet: 1. Product and Company IdentificationRenalyn TorioNo ratings yet

- The Effect If Strategic Planning On Small Business Success (1) - 1Document10 pagesThe Effect If Strategic Planning On Small Business Success (1) - 1farduusmaxamedyuusufNo ratings yet

- Led LightssDocument23 pagesLed LightssBhavin GhoniyaNo ratings yet

- The Art & Science of Coaching 2022Document23 pagesThe Art & Science of Coaching 2022ak cfNo ratings yet

- I (-02t,-1m - : - .8m-R-18m-M - 8A) :-+$-3 # - 1&) +-0bo# K! !!!: Milarapa's Guru Yoga and Tsok Offering !Document34 pagesI (-02t,-1m - : - .8m-R-18m-M - 8A) :-+$-3 # - 1&) +-0bo# K! !!!: Milarapa's Guru Yoga and Tsok Offering !Kaleb Singh100% (1)

- Sustainability 13 10705 v2 PDFDocument18 pagesSustainability 13 10705 v2 PDFVũ Ngọc Minh ThuNo ratings yet

Final SCN SOP Non Responsive

Final SCN SOP Non Responsive

Uploaded by

anil deswalOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Final SCN SOP Non Responsive

Final SCN SOP Non Responsive

Uploaded by

anil deswalCopyright:

Available Formats

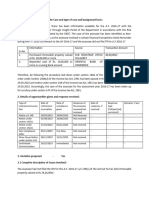

1.

Details of opportunities given:

Type of Date of Date of Response of Date of Response Remarks, if any

notice/communica notice/com compliance the assessee response, if type

tion munication given received/not received (Full/part/adj

received ournment)

Notice u/s 148 29/03/2023 29/04/2023 Not Received - - -

Notice under 02/08/2023 16/08/2023 Not received - - -

section 142(1)

Notice under 27/10/2023 02/11/2023 Not received - - -

section 142(1)

Non-compliance 03/11/2023 Five Days Not received - - -

letter

Show Cause Notice 09/11/2023 15/11/2023 Not received - - -

under section 144

Centralized 26/10/2023 Immediately Not received - - -

Communication

2. Variation proposed - Yes

2.1 Complete description of issues involved:-

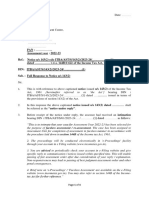

Notice under section 148 of the Income-tax Act, 1961 has been issued to you on 29/03/2023 for the

assessment year 2016-17, whereby you were required to file the return of income for the assessment

year 2016-17 within 30 days. The case has been opened on the basis of following information available

with the Income Tax Department:

“You had sold immovable property for an aggregate consideration of Rs. 76,26,000/- and no

return of income has been filed by you for the assessment year 2016-17”

2.2 Synopsis of all submission of the assessee relating to the issue and indicating the dates of

submission

Details of the opportunities afforded to you to file return for the assessment year 2016-17 and

thereafter for filing the reply with regard to the transactions of sale of property entered into by you has

been given above but you have remained non-responsive; as no return under section 148 of the Income-

tax Act, 1961 has been filed and no reply to the questionnaire issued has been filed. As such, during the

course of assessment proceedings, you did not file any response to the notice as well as

communications issued both electronically and manually. Thus the assessment in this case for the

assessment year 2016-17 is proposed to be completed on the basis of information available on record

on the following lines.

2.3 Summary of information/evidence collected which proposed to be used against it:-

You had sold immovable property for an aggregate consideration of Rs. 76,26,000/-. The

transactions of transfer of immovable property have been executed in the office of the Sub Registrar No.

2, Nagpur City. Vide notice under section 142(1) of the Income-tax Act, 1961 dated 02-08-2023, you

were asked to file the copies of the sale-deed executed by you in favour of purchaser and also to file the

parent deed (the deed executed in your favour in respect of the properties which have been sold)

alongwith the computation of capital gains. However, no reply has been received from you.

As no details regarding cost of acquisition and date of acquisition of the above said properties

has been provided by you which have been transferred for a consideration of Rs. 76,26,000/- during the

period 01/04/2015 to 31/03/2016. Therefore, it is assumed that the property transferred by you is short

term capital asset within the meaning of section 2(42A) of the Income-tax Act, 1961 and is chargeable to

tax under the head capital gain under section 45 of the Income-tax Act, 1961 which is to be computed

under section 48 of the Income-tax Act, 1961. Cost of acquisition is also taken as nil in the absence of

any reply from you. Accordingly the short term capital gain is computed at Rs. 76,26,000/- which is

computed as under:

1 Sale consideration received Rs. 76,26,000/-

2 Cost of acquisition Rs. Nil

3 Short Term Capital Gain Rs. 76,26,000/-

2.4 Variation proposed on the basis of inference drawn:-

Amount of Rs. 76,26,000/- is proposed to be treated as your income from capital gains under

the head short term capital gain and to be taxed accordingly as per provisions of the Income-tax Act,

1961 along with initiation of penalty under section 271(1)(c) of the Income-tax Act, 1961 for

concealment of particulars of income. Your total income is proposed to be assessed at Rs. 76,26,000/-.

Interest shall also be charged under section 234A and 234B of the Income-tax Act, 1961 along

with initiation of penalty under section 271(1)(c), 271(1)(b) and 271F of the Income-tax Act, 1961.

You might also like

- DRAFT Stay of Demand by CA NITIN KANWARDocument13 pagesDRAFT Stay of Demand by CA NITIN KANWARAmandeep Vats92% (12)

- NISSEM Global BriefsDocument454 pagesNISSEM Global BriefsNISSEM SDG4100% (1)

- SC Judgment Not Applies To Section 148 Notice For AY 2013-14 To 2015-16 - Taxguru - inDocument10 pagesSC Judgment Not Applies To Section 148 Notice For AY 2013-14 To 2015-16 - Taxguru - inShaik MastanvaliNo ratings yet

- ILDP Prashant Bhimrao KapseDocument3 pagesILDP Prashant Bhimrao Kapseanil deswalNo ratings yet

- Cit (A)Document8 pagesCit (A)Raaja ThalapathyNo ratings yet

- CIT v. Vegetable Products Ltd.Document4 pagesCIT v. Vegetable Products Ltd.Karsin ManochaNo ratings yet

- Rajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsDocument10 pagesRajasthan HC Rampal Samdani - 148 - Change of Opinion - After 4 YearsSubramanyam SettyNo ratings yet

- Income Tax 2 j2019Document50 pagesIncome Tax 2 j2019Avinash ShettyNo ratings yet

- WWW - Livelaw.In: Judgment Uday Umesh Lalit, JDocument8 pagesWWW - Livelaw.In: Judgment Uday Umesh Lalit, JRaghav MehtaNo ratings yet

- The Commissioner of Income Tax Vs MS. Vegetables Products Ltd. Supreme Court of IndiaDocument5 pagesThe Commissioner of Income Tax Vs MS. Vegetables Products Ltd. Supreme Court of IndiaN MehtaNo ratings yet

- Advanced Tax Laws Question Paper 2021-2022Document4 pagesAdvanced Tax Laws Question Paper 2021-2022sorien panditNo ratings yet

- 1985 SCMR 786 Best Judgement Assessment DefinedDocument9 pages1985 SCMR 786 Best Judgement Assessment DefinedAsif MalikNo ratings yet

- Fakirappa Savadatti Revision PetitionDocument3 pagesFakirappa Savadatti Revision Petitionaaryakkaushik916No ratings yet

- ItatDocument9 pagesItatshantibholaNo ratings yet

- JHC 491832Document11 pagesJHC 491832Kunal NawaleNo ratings yet

- 148d 50 LAC Cost ImposedDocument36 pages148d 50 LAC Cost ImposedNeena BatlaNo ratings yet

- 1997 (3) TMI 9 - SC - Allied Motors Private Limited Versus Commissioner of Income-TaxDocument7 pages1997 (3) TMI 9 - SC - Allied Motors Private Limited Versus Commissioner of Income-TaxAnanya UpadhyeNo ratings yet

- Income Tax J2019Document50 pagesIncome Tax J2019Avinash ShettyNo ratings yet

- Ilovepdf MergedDocument58 pagesIlovepdf MergedGaurav shuklaNo ratings yet

- TLP Supplement DT Dec, 2019 - Old SyllabusDocument94 pagesTLP Supplement DT Dec, 2019 - Old Syllabusjanardhan CA,CSNo ratings yet

- In The High Court of Judicature at BombayDocument23 pagesIn The High Court of Judicature at BombayAjmera HarshalNo ratings yet

- TLP Supplement DT June 2019 Old SyllabusDocument60 pagesTLP Supplement DT June 2019 Old Syllabusjanardhan CA,CSNo ratings yet

- Trueblue India LLP Versus Deputy Commissioner of Income Tax Circle 43-1 & Ors. - 2022 (8) Tmi 93 - Delhi High CourtDocument13 pagesTrueblue India LLP Versus Deputy Commissioner of Income Tax Circle 43-1 & Ors. - 2022 (8) Tmi 93 - Delhi High CourtSrichNo ratings yet

- 2023 - AST - 7000000058449183 - 76923457 - 2023 - AST - AKNPG5533F - Show Cause Notice For Proceedings Us 147 - 1060240562 (1) - 30012024Document8 pages2023 - AST - 7000000058449183 - 76923457 - 2023 - AST - AKNPG5533F - Show Cause Notice For Proceedings Us 147 - 1060240562 (1) - 30012024meghan googlyNo ratings yet

- Draft Reply To Notice 143 (2) (AY 2022-23)Document5 pagesDraft Reply To Notice 143 (2) (AY 2022-23)Vineet AgrawalNo ratings yet

- Versus: Efore R Rora Hairman AND Ajiv Isra Ember DministrativeDocument7 pagesVersus: Efore R Rora Hairman AND Ajiv Isra Ember DministrativeshailjaNo ratings yet

- Recei: Bureau of Internal Revenue Recg&Bs Mgt. DivisionDocument11 pagesRecei: Bureau of Internal Revenue Recg&Bs Mgt. DivisionMaria Izza Perez KatonNo ratings yet

- Can GST Scrutiny Be There After Audit 1705059483Document5 pagesCan GST Scrutiny Be There After Audit 1705059483RajatNo ratings yet

- Tolia AppealDocument7 pagesTolia Appealmau8684No ratings yet

- 2023 - AST - 7000000064463914 - 84984933 - 2023 - AST - FRPPK9574Q - Show Cause Notice - 1062611079 (1) - 14032024Document5 pages2023 - AST - 7000000064463914 - 84984933 - 2023 - AST - FRPPK9574Q - Show Cause Notice - 1062611079 (1) - 14032024atishrijiNo ratings yet

- TLP Supplement DT June 2020-OSDocument105 pagesTLP Supplement DT June 2020-OSZamr GNo ratings yet

- Hapag Lloyd India Pvt. LTD 1Document9 pagesHapag Lloyd India Pvt. LTD 1mani712fcaNo ratings yet

- 2023 - AST - 7000000066219100 - 87442168 - 2023 - AST - FRPPK9574Q - Order Us 147 - 1063432472 (1) - 27032024Document6 pages2023 - AST - 7000000066219100 - 87442168 - 2023 - AST - FRPPK9574Q - Order Us 147 - 1063432472 (1) - 27032024atishrijiNo ratings yet

- IT12. Assessments and RevisionsDocument12 pagesIT12. Assessments and Revisionsshree varanaNo ratings yet

- Assessment: Issues in Assessment & Reassessment Under I. T. ActDocument36 pagesAssessment: Issues in Assessment & Reassessment Under I. T. ActSUNILNo ratings yet

- 2024 05 16 2024 162 Taxmann Com 466 Gujarat 30 04 2024 Chatursinh Javanji Chavda Vs Assistant CoDocument4 pages2024 05 16 2024 162 Taxmann Com 466 Gujarat 30 04 2024 Chatursinh Javanji Chavda Vs Assistant CoCA Ujjwal GuptaNo ratings yet

- Cta 2D CV 10517 R 2023may18 AssDocument14 pagesCta 2D CV 10517 R 2023may18 AssgregmanilaNo ratings yet

- J 2018 SCC OnLine Bom 9088 2018 305 CTR 939 Durgeshkhanapurkar Desaidiwanjicom 20240626 143107 1 3Document3 pagesJ 2018 SCC OnLine Bom 9088 2018 305 CTR 939 Durgeshkhanapurkar Desaidiwanjicom 20240626 143107 1 3Niharika VyasNo ratings yet

- Order 122Document9 pagesOrder 122Zaid NaveedNo ratings yet

- Appeal SummaryDocument49 pagesAppeal Summarymaapitambraenterprises700No ratings yet

- Tax Laws and Practice Direct Tax June 2021Document98 pagesTax Laws and Practice Direct Tax June 2021niraliparekh27No ratings yet

- Sro 1262Document4 pagesSro 1262muhammadjavaid698No ratings yet

- Asst Order Priya Arya AY 2022-23Document8 pagesAsst Order Priya Arya AY 2022-23basecandlesNo ratings yet

- AKTPS1245A - Notice Us 142 (1) - 06032022Document3 pagesAKTPS1245A - Notice Us 142 (1) - 06032022Birdhi ChandNo ratings yet

- Per Rajpal Yadav, Judicial MemberDocument5 pagesPer Rajpal Yadav, Judicial MemberSrijan MishraNo ratings yet

- US Internal Revenue Service: 061701fDocument4 pagesUS Internal Revenue Service: 061701fIRSNo ratings yet

- Abci V Cir DigestDocument9 pagesAbci V Cir DigestSheilaNo ratings yet

- Tax Agrguments WordDocument16 pagesTax Agrguments WordkingNo ratings yet

- RefundsDocument32 pagesRefundsanubalanNo ratings yet

- (Rajasthan) / (2022) 447 ITR 698 (Rajasthan) (29-06-2022)Document6 pages(Rajasthan) / (2022) 447 ITR 698 (Rajasthan) (29-06-2022)rigiyanNo ratings yet

- Rajesh Kumar Sharma - Submission Before ITAT - Penalty - 201617Document6 pagesRajesh Kumar Sharma - Submission Before ITAT - Penalty - 201617sssadangiNo ratings yet

- HC Commissioner - of - Income - Tax - Vs - Hindustan - Bulk - Carris021238COM34602Document19 pagesHC Commissioner - of - Income - Tax - Vs - Hindustan - Bulk - Carris021238COM34602Neelesh ShuklaNo ratings yet

- Laxmi Mangal Products vs Samridhi Industries - Section 138 ComplaintDocument6 pagesLaxmi Mangal Products vs Samridhi Industries - Section 138 ComplaintVaibhav MishraNo ratings yet

- Appeal - Service TaxDocument22 pagesAppeal - Service TaxektaNo ratings yet

- Form No. 35 (See Rule 45)Document3 pagesForm No. 35 (See Rule 45)Savoir PenNo ratings yet

- Priyanka Rajbhar Date 26 02 2024Document6 pagesPriyanka Rajbhar Date 26 02 2024Anshul GuptaNo ratings yet

- Laxmi Mangal Products vs Samridhi Industries - Section 138 ComplaintDocument6 pagesLaxmi Mangal Products vs Samridhi Industries - Section 138 ComplaintVaibhav MishraNo ratings yet

- Taxing Statute InterpretationDocument33 pagesTaxing Statute Interpretationsomya jainNo ratings yet

- Annexure-B 108 Taxmann Com 491 Bombay 266 Taxman 29 Bombay 16 07 2019Document16 pagesAnnexure-B 108 Taxmann Com 491 Bombay 266 Taxman 29 Bombay 16 07 2019Shaik MastanvaliNo ratings yet

- Assessment Proceedings Under IT Act 1961Document31 pagesAssessment Proceedings Under IT Act 1961amanfreefire555No ratings yet

- Ack Asbpd7906m 2022-23 966623240240722Document1 pageAck Asbpd7906m 2022-23 966623240240722anil deswalNo ratings yet

- Screenshot 2023-02-11 at 6.00.56 AMDocument14 pagesScreenshot 2023-02-11 at 6.00.56 AManil deswalNo ratings yet

- My CardsDocument1 pageMy Cardsanil deswalNo ratings yet

- Notice Us 133 (6) - 1058288414 (1) - 29112023Document2 pagesNotice Us 133 (6) - 1058288414 (1) - 29112023anil deswalNo ratings yet

- Pinku Baroda Regional Office Allahabad - Google SearchDocument1 pagePinku Baroda Regional Office Allahabad - Google Searchanil deswalNo ratings yet

- Ito Ward Buxar - Google SearchDocument1 pageIto Ward Buxar - Google Searchanil deswalNo ratings yet

- CHAP 5.pmdDocument6 pagesCHAP 5.pmdanil deswalNo ratings yet

- ILDP Prashant Bhimrao KapseDocument3 pagesILDP Prashant Bhimrao Kapseanil deswalNo ratings yet

- Nuclear Physics PrimerDocument10 pagesNuclear Physics PrimerAnthony AffulNo ratings yet

- CO4CRT12 - Quantitative Techniques For Business - II (T)Document4 pagesCO4CRT12 - Quantitative Techniques For Business - II (T)Ann Maria GeorgeNo ratings yet

- Exercise 5.4 Analyzing EnthymemesDocument2 pagesExercise 5.4 Analyzing EnthymemesMadisyn Grace HurleyNo ratings yet

- Africa-chadicMusey English French DictionaryDocument168 pagesAfrica-chadicMusey English French DictionaryJordiAlberca100% (2)

- Sneaky Hypnosis PhrasesDocument4 pagesSneaky Hypnosis PhrasesRaiyanq67% (3)

- Bosch SpreadsDocument47 pagesBosch SpreadshtalibNo ratings yet

- Accomplishment Report BrigadaDocument2 pagesAccomplishment Report BrigadaVincent rexie AsuncionNo ratings yet

- Unilog - Taxonomy and Content Process v3Document26 pagesUnilog - Taxonomy and Content Process v3basuchitNo ratings yet

- Constellation Program BrochureDocument2 pagesConstellation Program BrochureBob Andrepont100% (1)

- Deathday ScriptDocument5 pagesDeathday Scriptpdabbsy185No ratings yet

- Deploy Qlik Sense Enterprise On KubernetesDocument45 pagesDeploy Qlik Sense Enterprise On Kubernetesstubadub99No ratings yet

- LayoffDocument2 pagesLayoffPooja PandaNo ratings yet

- Civil Engineer ListDocument9 pagesCivil Engineer ListMohammad AtiqueNo ratings yet

- Ermias TesfayeDocument111 pagesErmias TesfayeYayew MaruNo ratings yet

- Micro Focus Cobol Survey Itl 2015 Report PTDocument22 pagesMicro Focus Cobol Survey Itl 2015 Report PTprojrev2No ratings yet

- 0 Modul Kelas Regular by IsbatDocument52 pages0 Modul Kelas Regular by IsbatTikaa RachmawatiNo ratings yet

- 1P ThornhillDocument1 page1P ThornhillvincentNo ratings yet

- Siemens-BT300 VFDDocument6 pagesSiemens-BT300 VFDdiansulaemanNo ratings yet

- Introduction To Cisco Router ConfigurationDocument545 pagesIntroduction To Cisco Router ConfigurationDave WilliamsNo ratings yet

- Chocolate Cake RecipeTin EatsDocument2 pagesChocolate Cake RecipeTin Eatsantoniapatsalou1No ratings yet

- Persuasive Essay: English Proficiency For The Empowered ProfessionalsDocument2 pagesPersuasive Essay: English Proficiency For The Empowered ProfessionalsKyle Sanchez (Kylie)No ratings yet

- Activity Question To Ponder OnDocument3 pagesActivity Question To Ponder OnMatthew Frank Melendez QuerolNo ratings yet

- Model Dinamik Pengelolaan TK Di Kep SeribuDocument212 pagesModel Dinamik Pengelolaan TK Di Kep SeribuMeylan HusinNo ratings yet

- Material Safety Data Sheet: 1. Product and Company IdentificationDocument11 pagesMaterial Safety Data Sheet: 1. Product and Company IdentificationRenalyn TorioNo ratings yet

- The Effect If Strategic Planning On Small Business Success (1) - 1Document10 pagesThe Effect If Strategic Planning On Small Business Success (1) - 1farduusmaxamedyuusufNo ratings yet

- Led LightssDocument23 pagesLed LightssBhavin GhoniyaNo ratings yet

- The Art & Science of Coaching 2022Document23 pagesThe Art & Science of Coaching 2022ak cfNo ratings yet

- I (-02t,-1m - : - .8m-R-18m-M - 8A) :-+$-3 # - 1&) +-0bo# K! !!!: Milarapa's Guru Yoga and Tsok Offering !Document34 pagesI (-02t,-1m - : - .8m-R-18m-M - 8A) :-+$-3 # - 1&) +-0bo# K! !!!: Milarapa's Guru Yoga and Tsok Offering !Kaleb Singh100% (1)

- Sustainability 13 10705 v2 PDFDocument18 pagesSustainability 13 10705 v2 PDFVũ Ngọc Minh ThuNo ratings yet