Professional Documents

Culture Documents

Mind Map 4

Mind Map 4

Uploaded by

darylle roblesOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Mind Map 4

Mind Map 4

Uploaded by

darylle roblesCopyright:

Available Formats

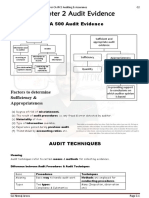

Independence

Audit Evidence Accepting Engagement Retention of Existing Clients

According to the firm’s quality control policies and Ability to serve the client properly Cients should be evaluated at least once a year

refers to the information obtained by the auditor in procedures, there must be a system for deciding

arriving at the conclusions on which the audit opinion is upon occurrence of major events such as:

whether to accept or reject an audit engagement 1. changes in management

based. Comprise source documents and accounting records Making this decision the firm should consider the

underlying the financial statements and corroborating following Not all audit engagements are to be

Integrity of the prospective 2. directors

information from other sources. This evidence will either client / management 3. ownership

accepted by the auditors.

prove or disprove the validity of management assertion. 4. nature of client’s business

5. other changes that may affect the scope of

Issuing a Report SA request permission examination.

In general, conditions which would have caused an

Completing the Audit RID accounting firm to reject a prospective client

may also result or lead to a decision of

Performing Substantive Test NO SA considered

Client’s gives permission refusal, perform terminating an audit engagement.

Considering Internal Control other procedures Clients should be evaluated At least once a year or

YES Successor Predecessor

Audit Planning Auditor Auditor

SA request RID from PA Major events occurred

Accepting an Engagement \SA) (PA)

Audit process – the sequence of different activities involved in an audit. NO

PA replies that no

Recurring Audits

Client’s gives permission to reply information would The auditor normally does not send new

YES

be provided CLIENT engagement letter every year. However, the

following factors may cause the auditor to

Engagement Letter PA replies to the requested Information

send a new engagement letter.

written contract between the auditor and the client

- Any indication that the client misunderstand the objective and scope

Contents ;

of the audit.

Additional Contents: - Any revised or special terms.

Objective and Scope – which is to express an opinion in the financial statement 1. Billing arrangements

2. Management written - A recent change of senior management, board of directors or

The management responsibility for the fair presentation of the financial statement representation management

3. Arrangements including - Legal requirements and other government agencies pronouncements

The scope of the audit the involvement of the

experts If the auditor opt not to send a new engagement letter, the auditor

The forms or any reports or other communication that the auditor expects to issue. 4. Acknowledgement from should remind the client of original agreement

management

The fact that because of the limitations of the audit, there is an unavoidable

risk that material misstatements may remain undiscovered. Occurrence

Importance

The responsibility of the client is to allow the auditor to have unrestricted o Avoid misunderstandings with – T&E that have been recorded have

access to whatever records, documentation and other information occurred and pertain to the entity

requested in connection with the audit. respect to the engagement Financial Statement Completeness

Document and confirm the auditor’s Assertion – all T&E that should have been recorded

have been recorded

Audit Procedure

acceptance of the appointment.

Accuracy

– amounts that other data relating to

Selection of the appropriate procedure to satisfy a particular

ertion Occurrence C o m plete n ess Sample: recorded T&E have been recorded

assertion is affected by a number of factors including the

auditor’s assessment of materiality and risk. Regardless, of Flow of the Audit ss Accuracy Salaries & appropriately

Cutoff

A

the procedures selected, there is only one basic criterion. C utoff Classification wages Cost – T&E have been recorded int eh correct

The procedure selected should enable the auditor to gather accounting period

sufficient and appropriate evidence about a particular T r a n s a cti o n L e v els Classification

assertion.

Audit ertion

- T&E have been recorded in the proper

Financial ss

accounts

Procedure

; R i g h ts & O b li g a ti o n s Completeness Sample:

A

Statement

Below are the audit procedures

used by the auditor to gather A c c o u nt B ala n c es

Inventory Existence

sufficient and appropriate evidence E xist e n c e V al u a ti o n a n d all o c a ti o n Balance – AL&E interest exists

Rights and obligations

I n s p e cti o n – the entity holds or controls the rights

involves examining of records, documents, or tangible assets P r e s e n t ati o n & Dis cl o s u r e to assets and liabilities are the

O b s e r v ati o n consists of looking at a process or procedure being performed by others Audit A c c u r a c y & V al u ati o n obligations of the entity.

As

se Sample: Completeness

In q uir y consists of seeking information from knowledgeable persons inside

Evidence r ti

on

O c c u r r e n c e & R i g h ts & O bli g a ti o n s Related Party - All AL&E interests that’s should have

been recorded have been recorded.

or outside the entity. Disclosure

C l a s sifi c a ti o n & U n d e r st a bilit y Valuation and allocation

C o n fi r m ati o n verify assertions

C o m plete n ess – AL&E interest are included in the

consist of the response to an inquiry to corroborate information contained in

the accounting records. against criteria financial statements at appropriate

amounts and any resulting valuation or

C o m p u t ati o n consists of checking the arithmetical accuracy of source documents (GAAP, PFRS or IFRS), allocation adjustments are appropriately

and accounting records or performing independent calculations

Audit Audit Assertion recorded

A n al y ti c al p r o c e d u r e s consists of the analysis of significant ratios and trends including the

resulting investigation of fluctuations and relationships that are

inconsistent with other relevant information or deviate from predicted

Opinion Management Assertions and

Financial Statement Assertions Occurrence and rights and obligations

amounts. – disclosed events, transactions, and

implicit or explicit claims and

Who appoints the auditor of the component other matters have occurred and pertain

Audit of Components Whether a separate audit report is to be issued on the component

representations made by the

management

to the entity

Completeness

When the auditor or a parent entity is also – all disclosures that should have been

Legal requirements included in the financial statements

the auditor of its subsidiary, branch or have been included

division (component), the auditor should The extent of any work performed by the other auditor Classification and understandability

consider the following factors in making a – financial information is appropriately

decision of whether to send a separate Degree of ownership of parent presented and described, and disclosures

letter to the component are clearly expressed

Degree of independence of the component’s management. Accuracy and valuation

– financial and other information are

disclosed fairly and at appropriate

amounts

You might also like

- Overview of Audit ProcessDocument3 pagesOverview of Audit Process03LJNo ratings yet

- The PWC Audit - 011704 PresentationDocument34 pagesThe PWC Audit - 011704 PresentationSohail AusafNo ratings yet

- SA 200 300 SeriesDocument9 pagesSA 200 300 SeriesfgbrtbryhtyNo ratings yet

- ACAUD 3149 TOPIC 1 Overview of The Audit ProcessDocument2 pagesACAUD 3149 TOPIC 1 Overview of The Audit ProcessCazia Mei JoverNo ratings yet

- 8 Accepting An EngagementDocument2 pages8 Accepting An EngagementChan Chan GamoNo ratings yet

- Slide RMK Chapter 1 - Kelompok 5 - Maksi 43CDocument15 pagesSlide RMK Chapter 1 - Kelompok 5 - Maksi 43CJali FusNo ratings yet

- Group2 - A1 - Audit Process Accepting An Engagement HandoutDocument3 pagesGroup2 - A1 - Audit Process Accepting An Engagement HandoutKemerutNo ratings yet

- Aaca - m2 To 5Document13 pagesAaca - m2 To 5Patricia CruzNo ratings yet

- Preliminary Enga Gement ActivitiesDocument7 pagesPreliminary Enga Gement ActivitiesJuliana ChengNo ratings yet

- This Study Resource Was: Lecture NotesDocument8 pagesThis Study Resource Was: Lecture NotesAnthony Ariel Ramos DepanteNo ratings yet

- Chapter 4Document3 pagesChapter 4Gerrelle Cap-atanNo ratings yet

- Obtained by The Auditor in Arriving at The Conclusions On Which The Audit Opinion Is BaseDocument2 pagesObtained by The Auditor in Arriving at The Conclusions On Which The Audit Opinion Is BaseTech for lifeNo ratings yet

- Auditing Full Version Sir Jaypee Tinipid Version1Document17 pagesAuditing Full Version Sir Jaypee Tinipid Version1Lovely Rose ArpiaNo ratings yet

- Lecture Notes: Auditing Theory AT.0104-Introduction To Audit of Financial StatementsDocument8 pagesLecture Notes: Auditing Theory AT.0104-Introduction To Audit of Financial StatementsMaeNo ratings yet

- Preliminary Engagement Activities LearningDocument8 pagesPreliminary Engagement Activities Learningpanda 1No ratings yet

- ACT 303 Auditing and Assurance Services in Australia AssignmentDocument13 pagesACT 303 Auditing and Assurance Services in Australia AssignmentSujan SilwalNo ratings yet

- Isa 210 Smart NotesDocument18 pagesIsa 210 Smart Notesmnouman0309No ratings yet

- Mahusay - Bsa211 - Module 3 Major OutputDocument3 pagesMahusay - Bsa211 - Module 3 Major OutputJeth MahusayNo ratings yet

- Assertions About Classes of Transactions and Events For The Period Under AuditDocument1 pageAssertions About Classes of Transactions and Events For The Period Under AuditLyka CastroNo ratings yet

- Overview of Audit Process and Pre-Engagement ActivitiesDocument5 pagesOverview of Audit Process and Pre-Engagement ActivitiesJoyce Ann CortezNo ratings yet

- Auditing - Introduction To Auditing NotesDocument2 pagesAuditing - Introduction To Auditing NotesCharlize Natalie ReodicaNo ratings yet

- Audit Review Compilation Agreed Upon Procedures: What Is An.Document3 pagesAudit Review Compilation Agreed Upon Procedures: What Is An.Mariane ValenzuelaNo ratings yet

- (REPORT) CHAPTER 9 - Risk Assessment Part 1Document12 pages(REPORT) CHAPTER 9 - Risk Assessment Part 1Jnn Cyc100% (1)

- Audit Process - Risk Assesment Kel 4Document33 pagesAudit Process - Risk Assesment Kel 4MylaNo ratings yet

- Chapter 4 - The Audit Process - Accepting An EngagementDocument2 pagesChapter 4 - The Audit Process - Accepting An EngagementMichelleNo ratings yet

- Observations Reminders Confirmation Process SpotlightDocument7 pagesObservations Reminders Confirmation Process SpotlightAbdelmadjid djibrineNo ratings yet

- Chapter 2 Audit EvidenceDocument13 pagesChapter 2 Audit EvidencelohitacademyNo ratings yet

- Chapter 7 - Accepting The Engagement and Planning The AuditDocument19 pagesChapter 7 - Accepting The Engagement and Planning The AuditDanar IriantoNo ratings yet

- AAA Pass 68% 05122022Document74 pagesAAA Pass 68% 05122022Financial ConsultingNo ratings yet

- 4 5850471109056532136Document38 pages4 5850471109056532136Yehualashet MulugetaNo ratings yet

- REVIEWER2 - Introduction To Audit of Historical Financial InformationDocument8 pagesREVIEWER2 - Introduction To Audit of Historical Financial InformationErine ContranoNo ratings yet

- Isa 210Document5 pagesIsa 210bilaladnan.120802No ratings yet

- Audi 21 (Reviewer)Document9 pagesAudi 21 (Reviewer)ninja ni ashley de sagunNo ratings yet

- Tax 2 and Ism ProjetDocument22 pagesTax 2 and Ism ProjetAngelica CastilloNo ratings yet

- Module 1 - Overview of The AuditingDocument13 pagesModule 1 - Overview of The AuditingJesievelle Villafuerte NapaoNo ratings yet

- Business Processes - Part 1Document15 pagesBusiness Processes - Part 1Malinda NayanajithNo ratings yet

- Chapter 6 - Stages of An Audit - AppointmentDocument5 pagesChapter 6 - Stages of An Audit - AppointmentTalamoon NishaNo ratings yet

- Fundamentals of Auditing and Assurance Services OverviewDocument8 pagesFundamentals of Auditing and Assurance Services OverviewSkye LeeNo ratings yet

- Module 1 PPT Audit Process PDFDocument27 pagesModule 1 PPT Audit Process PDFJasmine LimNo ratings yet

- Definition and Objective of AuditDocument7 pagesDefinition and Objective of AuditZednem JhenggNo ratings yet

- (Notes) MET 2 Auditing and Other Assurance PrinciplesDocument6 pages(Notes) MET 2 Auditing and Other Assurance PrinciplesMa. Helena Angela SerranoNo ratings yet

- 74938bos60526-Cp5 UnlockedDocument38 pages74938bos60526-Cp5 Unlockedhrudaya boysNo ratings yet

- Module 5 - Audit Process, Accepting An EngagementDocument9 pagesModule 5 - Audit Process, Accepting An EngagementMAG MAGNo ratings yet

- Auditing AssignmentDocument7 pagesAuditing AssignmentYusef ShaqeelNo ratings yet

- Webinar 2: Performing The Audit in The Pandemic Environment: Summary of Key TakeawaysDocument6 pagesWebinar 2: Performing The Audit in The Pandemic Environment: Summary of Key TakeawaysSandro BonillaNo ratings yet

- Overview of The Audit Process and Pre Engagement Activities AsuncionDocument7 pagesOverview of The Audit Process and Pre Engagement Activities AsunciontjasonkiddNo ratings yet

- Audit of Overview: Auditing IsDocument26 pagesAudit of Overview: Auditing IsMaria BeatriceNo ratings yet

- DNV Certification: Customer CommunicationsDocument4 pagesDNV Certification: Customer Communicationsindika_kumara70No ratings yet

- External Audit - Definition - Objectives - Process - AccountinguideDocument5 pagesExternal Audit - Definition - Objectives - Process - AccountinguideBennice 8No ratings yet

- LS 3.90A - PSA 570. Going ConcernDocument4 pagesLS 3.90A - PSA 570. Going ConcernSkye LeeNo ratings yet

- Chapter 2 - Audit Strategy, Planning and ProgrammingDocument1 pageChapter 2 - Audit Strategy, Planning and Programmingthuzh007No ratings yet

- Chapter 9-AuditDocument45 pagesChapter 9-AuditMisshtaCNo ratings yet

- MidtermDocument10 pagesMidtermNicole ReintegradoNo ratings yet

- NSA 220 FinalDocument12 pagesNSA 220 FinalMohamedNo ratings yet

- AT.1807 Preliminary Engagement Activities 1 PDFDocument7 pagesAT.1807 Preliminary Engagement Activities 1 PDFPia DumigpiNo ratings yet

- Chapter 1 AuditingDocument29 pagesChapter 1 AuditingAisa TriNo ratings yet

- Over View OFF S AUD It PR Oces SDocument39 pagesOver View OFF S AUD It PR Oces SYamateNo ratings yet

- At 04 PSQC Psa 20 Psa 210Document3 pagesAt 04 PSQC Psa 20 Psa 210Princess Mary Joy LadagaNo ratings yet

- Information Systems Auditing: The IS Audit Follow-up ProcessFrom EverandInformation Systems Auditing: The IS Audit Follow-up ProcessRating: 2 out of 5 stars2/5 (1)

- Annual Update and Practice Issues for Preparation, Compilation, and Review EngagementsFrom EverandAnnual Update and Practice Issues for Preparation, Compilation, and Review EngagementsNo ratings yet

- Reading 23 NovDocument5 pagesReading 23 NovAdhwa QurrotuainiNo ratings yet

- Production of Germ Cell Spermatozoa From The Testis During Coitus Production of Male Sex Hormone Testosterone From The TestisDocument3 pagesProduction of Germ Cell Spermatozoa From The Testis During Coitus Production of Male Sex Hormone Testosterone From The Testisamelia niitaNo ratings yet

- Report On VSATDocument19 pagesReport On VSATchinu meshramNo ratings yet

- Read and Write Fill UpDocument6 pagesRead and Write Fill Uppoonam_goyal26No ratings yet

- Summer Farm: By: Norman Maccaig Group: Camila Luna and Estrella LinDocument8 pagesSummer Farm: By: Norman Maccaig Group: Camila Luna and Estrella LinJamieDuncanNo ratings yet

- 3 - FDTD Simulation of The Optical Properties For Gold NanoparticlesDocument9 pages3 - FDTD Simulation of The Optical Properties For Gold NanoparticlesMarcio Antônio CostaNo ratings yet

- Pdvsa: Engineering Design ManualDocument2 pagesPdvsa: Engineering Design ManualElvina Sara Sucre BuenoNo ratings yet

- Campbell Systematic Reviews - 2011 - Morton - Youth Empowerment Programs For Improving Self Efficacy and Self Esteem ofDocument81 pagesCampbell Systematic Reviews - 2011 - Morton - Youth Empowerment Programs For Improving Self Efficacy and Self Esteem ofAndra ComanNo ratings yet

- Tyler Street News November 2010Document4 pagesTyler Street News November 2010tsumcNo ratings yet

- Starter Case 580M 1Document4 pagesStarter Case 580M 1JESUSNo ratings yet

- Practicallist11 1Document1 pagePracticallist11 1vikas_2No ratings yet

- D296 DetectorDocument4 pagesD296 Detectorventas2.fireproofcolNo ratings yet

- Jody Howard Director, Social Responsibility Caterpillar, IncDocument17 pagesJody Howard Director, Social Responsibility Caterpillar, IncJanak ValakiNo ratings yet

- Eugene Life DirectoryDocument84 pagesEugene Life DirectoryEugene Area Chamber of Commerce Communications100% (1)

- Sealwell-Pump Mechanical SealsDocument8 pagesSealwell-Pump Mechanical SealsVaibhav JainNo ratings yet

- Starkville Dispatch Eedition 11-4-18Document32 pagesStarkville Dispatch Eedition 11-4-18The DispatchNo ratings yet

- T7350 Installation InstructionsDocument12 pagesT7350 Installation InstructionsAmy ThompsonNo ratings yet

- When Things Go Wrong, Reach For Devcon: Maintenance RepairDocument20 pagesWhen Things Go Wrong, Reach For Devcon: Maintenance RepairJuanNo ratings yet

- Part B Unit 3 DBMSDocument4 pagesPart B Unit 3 DBMSkaran.1888kNo ratings yet

- Microelectronic Circuit Design Fourth Edition Solutions To ExercisesDocument8 pagesMicroelectronic Circuit Design Fourth Edition Solutions To Exercisesreky_georgeNo ratings yet

- Comandos de ScilabDocument11 pagesComandos de ScilabAlejandro Galindo Vega0% (1)

- 329672001-Jacobs Engineering Group IncDocument5 pages329672001-Jacobs Engineering Group IncJaram Johnson67% (3)

- Historiography On The Origins of The Cold WarDocument4 pagesHistoriography On The Origins of The Cold Warapi-297872327100% (2)

- CAPtain Online ExplainedDocument13 pagesCAPtain Online ExplainedRebekaNo ratings yet

- 2046 - Decorative Synthetic Bonded Laminated SheetsDocument53 pages2046 - Decorative Synthetic Bonded Laminated SheetsKaushik SenguptaNo ratings yet

- CICSDB2 Guide NotesDocument4 pagesCICSDB2 Guide Notesshobhit10aprilNo ratings yet

- Phyu Phyu Lwin CVDocument5 pagesPhyu Phyu Lwin CVphuy phyu100% (1)

- BGP Route Reflector ConfederationDocument9 pagesBGP Route Reflector ConfederationAll PurposeNo ratings yet

- Bad For Democracy How The Presidency Undermines The Power of The PeopleDocument272 pagesBad For Democracy How The Presidency Undermines The Power of The PeoplePaulNo ratings yet

- Coping Strategies, Optimism, and Life SatisfactionDocument12 pagesCoping Strategies, Optimism, and Life SatisfactionNurulAtiqahAbRajiNo ratings yet