Professional Documents

Culture Documents

Creditcollection Chap1

Creditcollection Chap1

Uploaded by

Charity Iglesias0 ratings0% found this document useful (0 votes)

10 views7 pagesThis document discusses credit management and collection management. It notes that bad credit is often due to negligence in granting or enforcing credit, stemming from a lack of education, training, and experience. It emphasizes that collection is an art that requires developing skills in negotiation, handling difficult debtors, and working within legal guidelines. The document concludes by stressing the importance of evaluating credit and collection operations, and providing training to synergize sales, credit, and collection functions based on cultural understanding of debtors and creditors.

Original Description:

Original Title

creditcollection-chap1

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentThis document discusses credit management and collection management. It notes that bad credit is often due to negligence in granting or enforcing credit, stemming from a lack of education, training, and experience. It emphasizes that collection is an art that requires developing skills in negotiation, handling difficult debtors, and working within legal guidelines. The document concludes by stressing the importance of evaluating credit and collection operations, and providing training to synergize sales, credit, and collection functions based on cultural understanding of debtors and creditors.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

10 views7 pagesCreditcollection Chap1

Creditcollection Chap1

Uploaded by

Charity IglesiasThis document discusses credit management and collection management. It notes that bad credit is often due to negligence in granting or enforcing credit, stemming from a lack of education, training, and experience. It emphasizes that collection is an art that requires developing skills in negotiation, handling difficult debtors, and working within legal guidelines. The document concludes by stressing the importance of evaluating credit and collection operations, and providing training to synergize sales, credit, and collection functions based on cultural understanding of debtors and creditors.

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 7

Guaranteeing Credit by the absence or under education, training, and

experience of the people under whose shoulders rest

A good man is willing to guarantee his neighbor's

the management of the credit and collection

debts. Only someone who has lost all sense of

operation. They may be educated in their chosen

decency would refuse to do so. If someone does this

academic field but maybe want the demands and

favor for you, don't forget it; he has risked his good

expectations for a no-nonsense credit and collection

name for you. There are some ungrateful sinners who

performance. Compounding this situation is the

abandon those who stand behind them, and they

disregard by creditors of how the credit and

cause them loss of property. Guaranteeing loans has

collection function is looked at in relation to the sales

ruined many prosperous men and caused them

operation of a company. Generally, in cases of

unsettling storms of trouble. Influential people have

conflict between the sales and credit and collection

lost their homes over it and have had to go wandering

operations, the latter is most often than not sacrificed

in foreign countries.

for a sale. But wait when a credit is uncollected the

A sinner who hopes to make a profit by credit and collection operation is blamed for sales'

guaranteeing a loan is going to find himself involved witting or unwitting negligence, in not being able to

in lawsuits. So, help your neighbor as much as you collect its sale. There is a misplaced bias for sales

can, but protect yourself against the dangers over credit and collection operation.

involved. -Sirach 29: 14-20

It must be remembered that "a sale is never sale'

• Credit management - is the science of unless collected. There is also the lack of a

evaluating the creditworthiness of a person collegially developed capacity bias credit and

and its grant. collection policy. Experience will attest to the

• Collection management - is the art of practice of most creditors/lenders or sellers to just

collecting what has been granted in credit to come up with credit policies that are practically

persons and maintaining continued patronage based on the “character" of the person applying for

and goodwill in the process. credit. No one in this world was born without

integrity and character. Everyone has integrity and

Bad credit can never be eliminated but maybe character; it's the circumstances of an individual's

minimized. As long as people are managing it, they upbringing, education, work, culture, and discipline

are bound most often than not to commit negligence, in using, enforcing one's credit that spell the

either by commission or omission in its grant or difference between a good and bad debtor. Under a

enforcement. This is so because discipline is not capacity bias credit granting paradigm the emphasis

ironclad like science, particularly in its enforcement is on the cashflow of the credit applicant, buttressed

being an art. But how does one become artful in a by good character, capital and acceptable condition

collection? One need not be very educated, or risk. Last but not least, there must be a positive

intellectual, and learned. An ordinary educated exchange of value for the credit granted. The sales-

person in the arts, socio-economic discipline may marketing and credit and collection people must be

become artful; or, to our way of thinking a no- trained and immersed in this paradigm so that

nonsense credit and collection practitioner. This goes collection may be effective and efficient.

without saying that the person's personality fits into

dealing with persons/debtors of varied cultures, Collection is an art to be developed in a person,

habits, idiosyncrasies, practices, regarding its particularly the salespeople supported actively by the

extension and enforcement. credit and collection personnel. Collection out of

court is not limited to the routinary efforts of sending

Many a creditor or debtor when confronted with collectors, statements of account and collection

cashflow or illiquidity problem put the blame on letters or attorney's demand letter. It's much more

socio-economic-political factors never their own acts than that in the sense that there are many laws to

of negligence. Bad credit is traceable to negligence comply with or avoid in order to collect extra-

in credit and collection management brought about judicially or legally without complication.

Efforts have been exerted to provide the PRINCIPLES, CONCEPTS, USES,

fundamentals of the laws directly related to credit FUNCTIONS OF CREDIT

and collection transactions. Many collectors do not

CREDIT

know how to identify debtors and their defenses in

delaying and/or not paying their credit. More so, the • It's rooted in trust in an individual.

strategies and tactics to use in their collection efforts. • As to its use or function, it is the ability of a

The various forms of collection negotiation as well person to obtain goods or services under the

as handling angry debtors are wanting in collectors. promise of future payment.

These are the arts of the trade which one must be • Credit used generically may mean many

immersed in to be artful in the discipline. things to different people. It is a power,

If extra-legal collection efforts fail, of necessity legal ability, and capacity to repay one's financial

collection efforts ensues. There is much to be desired obligation. Debt on the other hand is the

and good room for improving the knowledge, skills outstanding unpaid balance of credit obtained

and art of the credit and collection man/woman on from another. Purchasing power must not be

how to able to collect, legally working closely with confused either with credit because

the attorney. There are rules provided in the law to purchasing power comes about only by one's

reduce the time of litigating a case in court which the tangible use or availment of credit and the

credit and collection person must know and actual payment of that debt adds or increases

understand so he may be able to work better with the one's purchasing power.

attorney on the case. • Credit may be a boon or bane depending on

the skills with which it is managed in credit

Most credit and collection operation of a company is transactions. All credit extension is as sound

not evaluated or audited whether or not it has attained as the promises under which it was granted.

the goals, objectives set by management unlike the The vulnerability of credit is generally

sale marketing operation which is scrutinized and caused by the imprudent use by an individual

given sanctions, penalties, and rewards in applicable or person of his/her credit and the weaknesses

cases. of the credit operation of a business

There are ways to evaluate, appraise and audit credit enterprise due to the unwitting or witting

and collection operation which are not use by negligence of commission or omission by the

companies vis-à-vis sales operation with the end in credit and collection rank and file due to lack

view of synergizing their relationship and operation. of education, training, and experience on the

discipline.

The culture, psychology, credit and collection • Credit per se must be viewed from its totality

practices, idiosyncrasies of debtors and creditors because credit in business cannot be

alike must be part and parcel of the education and considered apart from its use in the political

training of the sales-credit and collection persons if economy.

their operations hopes to attain their goals. • It's government that creates the climate for

Finally, for the education and development of credit favorable or unfavorable credit environment

consciousness and discipline in the no-nonsense use, due to its administrative and supervisory

enforcement of one's credit guides have been put in powers over the economic life of the country.

this book so that the reader may not only be • When the government flexes its powers over

creditworthy but progressive by their use, the economy thru the mechanisms of the legal

enforcement of their personal credit for the and liquidity reserves, interests ceiling rates,

attainment of their temporal growth, security, and public debts, rediscounting windows for

progress as well as the country in general. commerce and industries and fiscal deficits,

necessarily the credit available for commerce

and industry or its effect on business will be

substantial. The ways and methods of quantities between and among people and

government use of its managerial, fiscal nations.

power over the economy will either expand 3. Credit is a liquidity medium - Credit, to a

or contract economic activity. large extent, has a direct relationship with

money as a medium of exchange, because

CREDIT: TOOL FOR SOCIO-ECONOMIC

credit has the effect of increasing the total

DEVELOPMENT AND GROWTH

amount of money in circulation and liquidity

THE IMPORTANCE OF CREDIT TO in a country. More money, as long as it is in

BUSINES/COUNTRY correct proportion with the gross national

product and supported by sufficient foreign

The value of credit management to a business and to exchange reserves, increases the purchasing

the national economy lies in its vast power to help power of people.

ensure an uninterrupted flow of money and 4. Credit is a medium of capital formation -

resources. One cannot pay when one cannot save or Business today grows and continues to grow

collect enough to pay with. by relying on credit for the accumulation of

CREDIT AND COLLECTION FUNCTIONS: capital.

5. Credit complements the monetary system

1. Facilitates the movement of goods and - This is best exemplified by the Bangko

services through the channels of trade to the Sentral's credit instruments such as its

consumers. certificates of indebtedness (CBCIs), various

2. Sustains and promotes production. government securities and bonds and similar

3. Establishes rules for credit and collection instruments issued by the private sector.

transactions. 6. Credit is a tool for the redistribution of

4. Leads to efficient collection of accounts wealth - Credit makes it possible for

receivable. someone without financial resources to

5. Contribute as a profit center to the attainment acquire goods and services necessary to earn

of a company's desired profit targets, either or save to acquire wealth.

by itself or in cooperation with a company's 7. Credit helps in the creation of business -

sales and marketing units. Credit makes possible the organization of

6. Helps in teaching debtors good credit habits business firms by providing vital funds

and practices. necessary for the start-up of any

7. Can serve as a tool in attaining personal and business/economic enterprise.

business goals. 8. Credit motivates higher business

WHY IS CREDIT IMPORTANT TO THE standards and practices - Credit makes it

COUNTRY? possible for the consumer to acquire more

goods and avail of more services. Credit,

1. Credit is an agent of production - Credit therefore, contributes to improving business

makes possible the availability of funds for standards by providing manufacturers,

productive purposes. This is amply sellers, and lenders with the initiative to

demonstrated in the many socially oriented improve the quality of their products or

loans and credit programs of the national services in the hope of boosting sales.

government and the private sector. 9. Credit Increases Purchasing Power - The

2. Credit develops the salability of goods and additional liquidity provided by loan or credit

services - Economic development in the to debtors, correspondingly increases their

Philippines and in the other market-oriented purchasing ability.

economies of the world would stagnate 10. Credit makes it possible to attain growth

without credit. Because of credit, goods and and progress - More economic activities can

services will move faster and in greater

be made by using credit judiciously, 3. The savings potential of the population to

prudently. determine their disposable income and to

determine what sector of the population must

WHAT ARE THE NEGATIVE IMPACT OF

be extended or not liberal or restrictive credit.

CREDIT ON PEOPLE?

4. The public sector debt (deficit) which has a

1. Can be a wedge between people. direct bearing in the availability of macro-

2. May motivate for unwise and/or conspicuous credit; and, as stimulus for socio-economic

consumption. activity, as well as its effect on the cost of

3. May lead to speculation / over expansion. money.

4. Credit causes dependence on others. 5. The debt service of the country as it directly

5. Lack of credit is one bit reason for impacts on public sector ability to stimulate

stagnation/retrogression of people. the economy.

CATEGORIES OF CREDIT The banking sector's level of non-performing

loans and assets which greatly influence the

1. Consumer Credit. availability and cost of credit to the private

a. Retail credit sector.

b. Personal credit

2. Mercantile or commercial. 1. The nation's (and regional) buying and credit

3. Commercial, development, investment bank practices for the sales and credit

credit. professionals to be able to develop programs

4. Rural, thrift bank credit. of selling and marketing; and, credit and

5. Cooperative, credit union or savings and collection strategies.

loans and micro-credit. 2. Interest ceiling rates which determine the

6. Government credit. cost of money:

7. Foreign credit. 3. Consumer price index which indicates the

market environment for sellers and buyers in

MACRO-ECONOMIC FACTORS AFFECTING their interplay in the open market through

CREDIT AND COLLECTION OPERATION credit.

A good credit and collection professional needs a GOVERNMENT MECHANISMS TO

good understanding of the macro-economic factors ADMINISTER CREDIT:

that influence liberal or restrictive credit and

collection operation. The professional credit 1. Increasing or decreasing the legal/liquidity

professional must not have a parochial view in the reserve requirements of banks and other

exercise of his/her functions, responsibilities. The financial institutions.

professional credit and collection man and woman 2. Issuing government credit instruments such

must know, understand, and act within a much wider as; bonds, government securities, treasury

horizon and playing field, because his performance bills and the like.

is part and parcel of the bigger picture-the national 3. Selective credit controls such as;

economy. rediscounting facilities given to Board of

Investment registered industries and

Among the basic and very important socio-economic companies.

factors a credit and collection professional must 4. Legal and moral persuasion such as; the 5-

know and understand are: day banking week and uniform clearing

1. Population as it impacts on the sales, procedures for checks, debt instruments;

marketing and liquidity arena of commerce 5. Legal action or outright coercion by the

and industry. secretary of finance, BSP Monetary Board.

2. The gross national product reflects the

economic performance of the country.

WHAT KIND OF A CREDITMAN ARE YOU? appreciate the value of the figures as reflected in the

financial report.

The management of the credit and collection

function particularly in the Philippines is viewed as Take as example companies which have filed petition

a staff or non- productive overhead in relation with for suspension of payments preparatory to

the sales operation. Very few recognized its influence rehabilitation. Generally, most have positive

or contribution to the attainment of more good, networth at the time of filing their petition. There is

collected sales leading to profit maximization. If at a school of credit managers who practice the

all, acceptance of the role of the credit manager in quantitative extension of credit up to 10% of a credit

companies is accorded passive acceptance only for applicant's networth or 20% of the working capital.

its role in the corporate administrative levels.

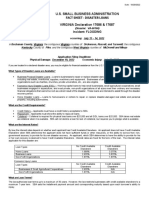

Example:

While managers in production, sales, finance, human

Comparative Consolidated Financial Statements

resources and similar positions aspire to be in the

upper echelons of management like vice presidency,

the credit and collection manager is looked at as a

mere staff manager not worth giving a higher degree

of confidence or higher responsibility in the

company.

For the credit and collection officer to be recognized

in his company he must endeavor more seriously to

improve himself/herself professionally, be provoked

and dare to accept challenges within the organization

to be recognized like his peers within the

organization.

In my more than 50 years in the credit and collection

service industry very few exceptional credit and A "Mathematician Creditman" may extend a 10% of

collection persons have attained higher the networth or 20% of the working capital or

responsibilities in their company. To those who were Php300,000.00 credit line to both companies. A more

able to rise in the hierarchy of their company they detailed analysis of the financial statements will

have dared to improve themselves via further show the difference in the companies' current ratios,

schooling, accepted challenges not only in their vis-à-vis the degree of pressure; the quality of the

credit and collection realm, but in other operating receivables and inventory, relating them to sales;

units of their organization. and, in the operating results.

Those who are left behind and are satisfied with their If the trend of operations for both companies

status quo are most often than not fall under the continues company A may not be rehabilitated

following categories of credit and collection whereas company B will be rehabilitated To extend

personality. the same credit line to both companies does not

recognize the companies financial strength and

• "MATHEMATICIAN" CREDITMAN weakness which is foolish of the credit manager.

One who is generally impressed by the financial The other school of "Mathematician Creditman"

reports submitted or obtained from the credit practices the extension or rejection of an order on

applicants. They fail to appreciate and recognize the whether the credit applicant has a 2:1 current ratio or

element of relativity or the fact that the figures in the better. This again is a quantitative method of credit

financial reports are historical, quantitative figures, extension that fails to recognize the influence on

which must be subjected to qualitative evaluation to payment performance exerted by the receivables

quality or inventory. If current assets are inflated by

delinquent, uncollected or slow paying receivables or paid to recall history or for that matter current

by overvalued, sluggish inventory, the 2.1 ratio performance. Instead his value generally lies in

losses its apparent significance. anticipating the future because every current credit

decision is future oriented. Credit granted now will

Both of these quantitative methods of credit

be paid in the future. While past and present is

extension will deny credit to customers in deficit,

important- it is just an aspect of the perspective

many of whom may be regular discounters of bills

needed to make a good value judgment as to how the

and who may be actual or potential quality customers

customer will perform in the future.

in the future.

• "SENTINEL" CREDITMAN

Credit extension decision anchored on mathematical

calculation demean or does not speak well of a credit Many a credit manager unwittingly practices this

manager. Anyone who has mathematical skills may mode of managing their department operation

replace the credit manager. generally due to lack of education, training or

experience and challenges met in the demanding role

Mathematical approach to credit extension in the

of their position. The credit department is an ally of

long run doesn't bring out the best in the credit

the sales department in boosting, cultivating more

manager.

good or even fairly marginal accounts resulting to

• "GAYA-GAYA PUTO MAYA" more profitable sales volume. Manager of companies

(FOLLOWER) CREDITMAN do not wittingly select and fit their choice of credit

manager into the demands, expectations of the sales

This credit manager will extend credit to a customer force to have an ally, so much so that it results to

up to 25% -50% of the amount extended by the unnecessary conflict and friction between these two

recognized leaders of the credit manager's industry departments.

(business).

• "NECESSARY EVIL" CREDITMAN

The rationale for this kind of credit extension is the

perception that the industry leader's credit and This kind of a credit manager will invariably pose no

collection operation have outstanding credit and objection in having some losses in the management

collection operation. This way of credit extension by of his receivables, conscious of the fact that not all

the "Gaya-Gaya Puto Maya" credit manager most credit transactions can be collected. So he provides

often than not do not consider profit margin, capacity for a bigger than generally acceptable level for

to absorb loss, whether the amount involved is too allowance for uncollected receivables.

much for his company, whether there is security or

Every credit manager must aspire for perfection as a

collateral given and similar factors secured by the

goal even if it may not be attainable. Perfection may

leader or model in the industry.

mean acceptable bad debt loss; and of equal

Anchoring one's credit extension decision based on importance no loss of profitable sales due to

what big competitors extend is a haphazard "oido" incompetence, unartful credit and collection actions.

kind of credit decision and implied admission that the

A NONSENSE CREDIT AND COLLECTION

credit manager does not know any better, because

MANAGEMENT OPERATION

you may have been a wrong choice for credit

manager for your company. Credit and collection management encompasses the

whole range of activities and responsibilities from

• "HISTORIAN" CREDITMAN

the planning, development and formulation of a

This credit manager generally based his credit capacity bias credit and collection policies and

extension decision on the past performance of the procedures. Proper and expeditious recording of

customer without giving serious consideration about credit transactions until the completion of the

the exigencies of socio-political, economic factors collection processes either out of court and/or thru

locally or internationally. Credit managers are not

the courts and the critical evaluation, analysis of the Synergistic cooperation is the raison-d-itre" of

results of its operation. business for all operating units to cooperate

positively with each other to attain overall business

It's the expectation and goal of management of any

objectives. The sales and credit, collection operations

business organization to be generally in liquid and

must endeavor to develop a positive symbiosis

profitable condition.

because their success or failure directly affects their

To attain these objectives management must set stakes in the business organization.

conditions for:

1. Maximization of sales via credit.

2. Rationalize or control the amount of assets

invested in receivables.

3. Control costs of credit and collection

operation.

4. Develop credit consciousness, discipline

among its people and customers.

The accounts receivable may be rationalized or

controlled by the mechanisms of:

1. Credit limits, terms, or periods.

2. Adjustment in the volume of credit sales due

to socio-economic factors in the economy.

3. Competitive and strategic considerations.

The costs and expenses of credit and collection

operation maybe controlled via the following:

1. The correct number of personnel as well as

the salaries, wages of the rank and file in the

credit and collection operation.

2. Costs of funds tied up in receivables.

3. Bad debt losses.

4. Costs of credit information.

5. Depreciation expense.

6. Charges and fees of outside assistance in the

credit and collection efforts particularly for

distressed or bad accounts receivable

collection.

Controlling costs and expenses for the credit

operation must not be on a 'false economy" mode

where needed and necessary expenses such as for;

no-nonsense educational training programs for the

rank and file is avoided to the detriment of a no-

nonsense collection efforts. A low percentage of bad

debt is not a convincing proof of good credit

management. Losses may be made low by sacrificing

good sales which may give profit over and above the

anticipated loss therefrom. Have a reasonable bad

debt loss, proportionate to a maximum sales volume.

You might also like

- Collection Policies and Procedures PrintedDocument10 pagesCollection Policies and Procedures PrintedCarl Joseph Ninobla JosueNo ratings yet

- Debtor'S Culture, Psychology, Practices and Idiosyncracies Filipino Traditional Practices Related With Credit and CollectionDocument6 pagesDebtor'S Culture, Psychology, Practices and Idiosyncracies Filipino Traditional Practices Related With Credit and CollectionRoseanne Binayao Lontian100% (2)

- 6 Cs of CreditDocument6 pages6 Cs of CreditNaseem Abbas100% (2)

- Cred&coll Reviewer MidtermsDocument24 pagesCred&coll Reviewer MidtermsElla Marie LopezNo ratings yet

- Chap 1 C and CDocument29 pagesChap 1 C and CKyle JovenNo ratings yet

- Credit and Collection Prelim ReviewerDocument32 pagesCredit and Collection Prelim ReviewerRhenzo ManayanNo ratings yet

- Lecture Note 4 - Basics of Bank Lending PDFDocument11 pagesLecture Note 4 - Basics of Bank Lending PDFphillip chirongweNo ratings yet

- Banking Chapter 7Document24 pagesBanking Chapter 7John Kenneth CaminoNo ratings yet

- Collection ProceduresDocument8 pagesCollection Proceduresfilfam4545No ratings yet

- 1111Document10 pages1111coleenNo ratings yet

- Introduction To Credit ManagementDocument48 pagesIntroduction To Credit ManagementHakdog KaNo ratings yet

- Good LendingDocument35 pagesGood LendingSirsanath Banerjee100% (7)

- 3 The Nature of DefaultDocument10 pages3 The Nature of DefaultDesara_GJoka123No ratings yet

- Chapter 2 Soft Copy Introduction To Credit ManagementDocument11 pagesChapter 2 Soft Copy Introduction To Credit ManagementHakdog KaNo ratings yet

- Unit-1Financial Credit Risk AnalyticsDocument40 pagesUnit-1Financial Credit Risk AnalyticsAkshitNo ratings yet

- Ten Commandments of Commercial LendingDocument4 pagesTen Commandments of Commercial LendingcapitalfinNo ratings yet

- Unit-1Financial Credit Risk AnalyticsDocument40 pagesUnit-1Financial Credit Risk Analyticsblack canvasNo ratings yet

- AJDFI - Principles of Credit - PPP - 16nov2012Document51 pagesAJDFI - Principles of Credit - PPP - 16nov2012Fretchie SenielNo ratings yet

- Topic I Introduction To CreditDocument4 pagesTopic I Introduction To CreditLemon OwNo ratings yet

- Module 3: Chapter 7 Credit EvaluationDocument30 pagesModule 3: Chapter 7 Credit EvaluationHarlene Bulaong0% (1)

- CMCP Module 2 Chapter 4Document4 pagesCMCP Module 2 Chapter 4Kaila MaeNo ratings yet

- Chapter OneDocument119 pagesChapter Onegary galangNo ratings yet

- Credit ManagementDocument4 pagesCredit ManagementYuuna HoshinoNo ratings yet

- Credit and Collection Org. ChartDocument2 pagesCredit and Collection Org. ChartKimberly VenturaNo ratings yet

- Fima30063-Lect1-Overview of CreditDocument24 pagesFima30063-Lect1-Overview of CreditNicole Lanorio100% (1)

- Chapters 2 To 5 Complete PDFDocument87 pagesChapters 2 To 5 Complete PDFElizabeth N. BernalesNo ratings yet

- Chapter 1. The Nature of CreditDocument14 pagesChapter 1. The Nature of CreditcalliemozartNo ratings yet

- 9 Central Avenue, New Era, Quezon City, 1107, PhilippinesDocument9 pages9 Central Avenue, New Era, Quezon City, 1107, PhilippinesRed YuNo ratings yet

- FM16 Credit and Collection Semi-FinalDocument22 pagesFM16 Credit and Collection Semi-FinalMark Anthony Jr. Yanson100% (2)

- Ortega, Wendy B. Prof. Malanum Bsba FTM 3-4: What Is Credit Management?Document7 pagesOrtega, Wendy B. Prof. Malanum Bsba FTM 3-4: What Is Credit Management?Mhabel MaglasangNo ratings yet

- SBDC Counselor Certification Manual MODULE 9 - Sources & Requirements For FinancingDocument24 pagesSBDC Counselor Certification Manual MODULE 9 - Sources & Requirements For FinancingHeidiNo ratings yet

- Credit Risk Management in BanksDocument19 pagesCredit Risk Management in BanksMahmudur RahmanNo ratings yet

- Nature of CreditDocument6 pagesNature of CreditMikk Mae GaldonesNo ratings yet

- DUMAOG FM 328 Module 2Document2 pagesDUMAOG FM 328 Module 2Grace DumaogNo ratings yet

- Personal Finance 9th Edition pdf-181-185Document5 pagesPersonal Finance 9th Edition pdf-181-185Jan Allyson BiagNo ratings yet

- Finance 313Document8 pagesFinance 313Charina Jane CatallaNo ratings yet

- 2.1.Credit Appraisal Techniques_Dr. K. Bhavana RajDocument12 pages2.1.Credit Appraisal Techniques_Dr. K. Bhavana Raj2203037No ratings yet

- CRM Unit 1 (Autosaved) (Autosaved)Document54 pagesCRM Unit 1 (Autosaved) (Autosaved)Sanjeela JoshiNo ratings yet

- Credit DepartmentDocument6 pagesCredit DepartmentArnold BelangoyNo ratings yet

- QuizDocument2 pagesQuizCris TineNo ratings yet

- What Qualifies You For Credit?: The Six "C'S" of CreditDocument5 pagesWhat Qualifies You For Credit?: The Six "C'S" of CreditShpresa PejaNo ratings yet

- FM 05 Unit IDocument9 pagesFM 05 Unit IMO. SHAHVANNo ratings yet

- Personal FinanceDocument10 pagesPersonal FinanceBianca MalinabNo ratings yet

- Final Microfinance Lending and Risk ManagementDocument241 pagesFinal Microfinance Lending and Risk ManagementSabelo100% (2)

- Final Microfinance Lending and Risk ManagementDocument241 pagesFinal Microfinance Lending and Risk ManagementSabelo100% (2)

- Credit SystemDocument57 pagesCredit SystemHakdog CheeseNo ratings yet

- Introduction To Credit Management: Group 2 BSBA FM 3-10SDocument30 pagesIntroduction To Credit Management: Group 2 BSBA FM 3-10SThamuz Lunox100% (2)

- Cred&coll Reviewer MidtermsDocument24 pagesCred&coll Reviewer MidtermsElla Marie LopezNo ratings yet

- FNM105Document65 pagesFNM105ann shaneNo ratings yet

- 30 Senior Loan Officer Interview Questions and AnswersDocument17 pages30 Senior Loan Officer Interview Questions and Answersselamalex737No ratings yet

- Creditcollection Chap2Document20 pagesCreditcollection Chap2Charity IglesiasNo ratings yet

- ReflectionDocument1 pageReflectionArchie BaluyoNo ratings yet

- Six C's of creditDocument4 pagesSix C's of creditGizachew NadewNo ratings yet

- Topic 3 - CREDIT MANAGEMENTDocument43 pagesTopic 3 - CREDIT MANAGEMENTeogollaNo ratings yet

- Unit 1Document28 pagesUnit 1saurabh thakurNo ratings yet

- PG - M7 - Nesma - v2 - 31 09Document22 pagesPG - M7 - Nesma - v2 - 31 09mirna tayehNo ratings yet

- Act in FinanceDocument6 pagesAct in FinanceMark Oliver HilarioNo ratings yet

- Baluyo, Archie-ReflectionDocument1 pageBaluyo, Archie-ReflectionArchie BaluyoNo ratings yet

- Reviewer StratmanDocument12 pagesReviewer StratmanCharity IglesiasNo ratings yet

- HRM Topic 3 4Document6 pagesHRM Topic 3 4Charity IglesiasNo ratings yet

- Finman 3 MTRDocument16 pagesFinman 3 MTRCharity IglesiasNo ratings yet

- Life and Works of RizalDocument6 pagesLife and Works of RizalCharity IglesiasNo ratings yet

- Module 1 and 2 CFMADocument74 pagesModule 1 and 2 CFMAk 3117No ratings yet

- Drafting Pleading & Conveyance RPDocument25 pagesDrafting Pleading & Conveyance RPRoshan ShakNo ratings yet

- U.S. Small Business Administration Fact Sheet - Disaster LoansDocument2 pagesU.S. Small Business Administration Fact Sheet - Disaster LoansNews 5 WCYBNo ratings yet

- Credit Card ApplicationsDocument36 pagesCredit Card Applicationsapi-333146577No ratings yet

- Pari Passu ChargeDocument18 pagesPari Passu ChargeMushfiq AhmedNo ratings yet

- Deposits and Financing of Islamic BanksDocument12 pagesDeposits and Financing of Islamic BanksAzah Atikah Anwar BatchaNo ratings yet

- Credit and Collection.Document27 pagesCredit and Collection.Music as MagicNo ratings yet

- Central Bank Digital CurrencyDocument57 pagesCentral Bank Digital CurrencyForkLogNo ratings yet

- Chapter 5 - Simple InterestDocument34 pagesChapter 5 - Simple InterestKian GaboroNo ratings yet

- Risk Management in Vehicle FinanceDocument19 pagesRisk Management in Vehicle FinanceAbhishek BoseNo ratings yet

- Full & Final Report PKS WCMDocument55 pagesFull & Final Report PKS WCMAkash SinghNo ratings yet

- Case 5 - Exercise 2 Abernethy and Chapman Internal Control EvaluationDocument3 pagesCase 5 - Exercise 2 Abernethy and Chapman Internal Control Evaluationjaneeta mathewNo ratings yet

- 信用风险管理论文Document9 pages信用风险管理论文h68azak7No ratings yet

- Presented By:: Madhuri Koul Narayan Ambulgekar Vrushali Hadawale Anupam Sinha Prajakta KambleDocument14 pagesPresented By:: Madhuri Koul Narayan Ambulgekar Vrushali Hadawale Anupam Sinha Prajakta Kamblepratheesh_tulsiNo ratings yet

- 9706 Accounts Nov 08 p2Document16 pages9706 Accounts Nov 08 p2hiraashrafNo ratings yet

- Deconstructing InvITs REITs NEW 11 Oct PDFDocument158 pagesDeconstructing InvITs REITs NEW 11 Oct PDFparag_1089No ratings yet

- Agricultural Finance SpecialDocument7 pagesAgricultural Finance SpecialSarim ShahidNo ratings yet

- The Wiggle Factor Report 2022Document29 pagesThe Wiggle Factor Report 2022Temujin TalkenovNo ratings yet

- Bank of BarodaDocument41 pagesBank of BarodamilinddhandeNo ratings yet

- Summer Training Project ReportDocument63 pagesSummer Training Project ReportrathodmauleshNo ratings yet

- Treasury NotesDocument6 pagesTreasury NotesRobinson MojicaNo ratings yet

- Accounting AssignmentDocument15 pagesAccounting AssignmentYusef ShaqeelNo ratings yet

- Previous Year QuestionsDocument10 pagesPrevious Year QuestionsSoumiya MuthurajaNo ratings yet

- Guttman Fraudlent Disclosure To US, March 28, 2013 (Obtained by DiMarco)Document33 pagesGuttman Fraudlent Disclosure To US, March 28, 2013 (Obtained by DiMarco)larry-612445No ratings yet

- Assignment #4 (Sep2019) - GDB3023-SolutionDocument3 pagesAssignment #4 (Sep2019) - GDB3023-SolutionDanish Zabidi100% (1)

- Hari ShankerDocument4 pagesHari Shankershankerh931No ratings yet

- The Era of Buy Now Pay LaterDocument11 pagesThe Era of Buy Now Pay LaterAstha ShuklaNo ratings yet

- Cash Receivable and Inventory ManagementDocument23 pagesCash Receivable and Inventory ManagementRonald Tres ReyesNo ratings yet

- Fixed-Rate Mortgage, Monthly PaymentsDocument41 pagesFixed-Rate Mortgage, Monthly Paymentslinda zyongweNo ratings yet

- Bfs - Unit II Short NotesDocument12 pagesBfs - Unit II Short NotesvelmuruganbNo ratings yet