Professional Documents

Culture Documents

Vijendra Kumar Dubey - Assignement-2

Vijendra Kumar Dubey - Assignement-2

Uploaded by

Vijendra Kumar DubeyOriginal Description:

Original Title

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Vijendra Kumar Dubey - Assignement-2

Vijendra Kumar Dubey - Assignement-2

Uploaded by

Vijendra Kumar DubeyCopyright:

Available Formats

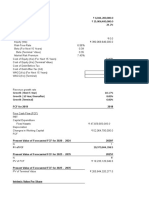

VIJENDRA KUMAR DUBEY PGDM(E)-9th Batch FRA Assignment No-02

RELIANCE POWER

PARTICULARS (IN CRORES)

FY

TOTAL REVENUES (TOPLINE) PAT (BOTTOMLINE) OPEX CAPEX WORKING CAPITAL(WC)

2022-23 ₹ 1,187.03 ₹ 654.71 ₹ 328.00 ₹ 0.00 ₹ 860.00

2021-22 ₹ 184.06 -₹ 277.32 ₹ 32.67 ₹ 0.00 ₹ 90.00

2020-21 ₹ 522.12 ₹ 55.34 ₹ 26.35 ₹ 0.00 ₹ 210.00

2019-20 ₹ 144.86 -₹ 388.84 ₹ 30.56 ₹ 0.00 ₹ 560.00

2018-19 -₹ 64.27 -₹ 601.66 ₹ 55.85 ₹ 0.00 -₹ 220.00

69.19 243.96 42.49 ₹ 0.00 11.32

CAGR(In %)

NOTE:These all data are taken from annual reports of RELIANCE POWER through their official website

Trend Analysis

RELIANCE POWER's topline has RELIANCE POWER's bottomline is RELIANCE POWER's OPEX has grown at RELIANCE POWER's is not investing in RELIANCE POWER's working capital

grown at a CAGR of 69.19% from 2020 not very consistent. However from 2021 a CAGR of 42.49% over the past five years. new projects or refurbishments presently. has grown at a CAGR of 11.32% over

to 2023. This is strong growth, and it to 2023 company has seen grown at a This is very high growth, and it is likely due This may be due to excessive loan burden the past four years. This is relatively low

indicates that the company is doing well CAGR of 243.96%. This is strong to the company's increasing investment in and unstable growth, and it indicates that the

in its core business. growth, and it indicates that the research and development. company is managing its working capital

company is controlling its costs effectively.

effectively now.

You might also like

- Darwin FactsDocument3 pagesDarwin Factsapi-334125776No ratings yet

- Adams Solver GuideDocument111 pagesAdams Solver GuideAvk SanjeevanNo ratings yet

- ISO 6330 2021 (E) - Character PDF DocumentDocument7 pagesISO 6330 2021 (E) - Character PDF DocumentNaveedNo ratings yet

- Thời gian làm bài: 60 phút không kể thời gian phát đềDocument11 pagesThời gian làm bài: 60 phút không kể thời gian phát đềLan Anh TạNo ratings yet

- Paytm Q4 FY 2023 Revised Earnings Release INRDocument20 pagesPaytm Q4 FY 2023 Revised Earnings Release INRPranav TalrejaNo ratings yet

- Adiwibowo 021122264Document36 pagesAdiwibowo 021122264wadi7188No ratings yet

- Managerial Economics-CIA 3Document8 pagesManagerial Economics-CIA 3ABHISHEKA SINGH 2127201No ratings yet

- Bajaj ElectricalsDocument14 pagesBajaj Electricalspriyabisht2999No ratings yet

- Goodwill Finance FM FinalDocument231 pagesGoodwill Finance FM Finalmeenal_smNo ratings yet

- Nestle India - Financial Model-1Document17 pagesNestle India - Financial Model-1Narendra WalujkarNo ratings yet

- 7E IntepretationDocument4 pages7E IntepretationNurin SyazarinNo ratings yet

- Paramount Textile PLC Ratio Analysis FinalDocument16 pagesParamount Textile PLC Ratio Analysis Finalraufun huda dipNo ratings yet

- Managerial Economics-Unit Economics CalculationDocument6 pagesManagerial Economics-Unit Economics CalculationABHISHEKA SINGH 2127201No ratings yet

- Radex Electric Co. Forecasting and InvestmentDocument3 pagesRadex Electric Co. Forecasting and InvestmentJacquin MokayaNo ratings yet

- FMV Kaveri Seed Company LTD 1690118132Document22 pagesFMV Kaveri Seed Company LTD 1690118132Anle17No ratings yet

- Madhuvanthi Raja-Accounts Minor 2Document11 pagesMadhuvanthi Raja-Accounts Minor 2madhuvanthi.rajaaNo ratings yet

- Airtel Financial StatmentsDocument7 pagesAirtel Financial StatmentsAbhishek PatilNo ratings yet

- Financial Model of Nestle India - 230819 - 233544Document18 pagesFinancial Model of Nestle India - 230819 - 233544habibaNo ratings yet

- Mergers Mid TermDocument4 pagesMergers Mid Termsuraj nairNo ratings yet

- Appendix Figure 1 Annual Lease Payments For AircraftDocument4 pagesAppendix Figure 1 Annual Lease Payments For AircraftbananahoverboardNo ratings yet

- Money and The MythDocument2 pagesMoney and The MythVanshica SahniNo ratings yet

- Himanshu Textile Sale For The Month of April 2022Document1 pageHimanshu Textile Sale For The Month of April 2022praveen jhaNo ratings yet

- Forecasting TechniquesDocument3 pagesForecasting Techniquespre.meh21No ratings yet

- Self Declaration Form Ay 2022-23-ArthisDocument7 pagesSelf Declaration Form Ay 2022-23-ArthisMurugesan JeevaNo ratings yet

- Bharti Airtel DCFDocument4 pagesBharti Airtel DCFPraveen BhatiaNo ratings yet

- ATM - GA - 4 - Basic Financial Functions 0211PGD072Document8 pagesATM - GA - 4 - Basic Financial Functions 0211PGD072Nimish kumarNo ratings yet

- FIN420 Financial AnalysisDocument13 pagesFIN420 Financial Analysisafiqh495No ratings yet

- Franchisee'S Ratio Analysis: Ratio Formula Year Ended 2019 2020 2021 2022 2023 Profitability RatiosDocument3 pagesFranchisee'S Ratio Analysis: Ratio Formula Year Ended 2019 2020 2021 2022 2023 Profitability RatiosDonna BatoNo ratings yet

- Profitabilty Ratio GRP 7Document1 pageProfitabilty Ratio GRP 7Lance Miko CondenoNo ratings yet

- Group 10Document22 pagesGroup 10Mohammed NazeerNo ratings yet

- Denge Kimya - Second Quarter ReportDocument32 pagesDenge Kimya - Second Quarter ReportAli SarwarNo ratings yet

- Hariharan A - F21143 - HCL - Capital BudgetingDocument3 pagesHariharan A - F21143 - HCL - Capital BudgetingJoseph JohnNo ratings yet

- 1t Chan Activity2Document14 pages1t Chan Activity2irish chanNo ratings yet

- CiplaDocument9 pagesCiplaShivam GoelNo ratings yet

- Shantanu FadmDocument12 pagesShantanu FadmHimanshuNo ratings yet

- Data Analysis UpdatedDocument11 pagesData Analysis UpdatedSarath Roy Sarath RoyNo ratings yet

- Particulars Year Ended 31 March, 2020: Income Statement For Birla Corporation LTDDocument24 pagesParticulars Year Ended 31 March, 2020: Income Statement For Birla Corporation LTDSomil GuptaNo ratings yet

- FMV Emami LTD 1690768735Document22 pagesFMV Emami LTD 1690768735Anle17No ratings yet

- Titan Financial ModelDocument15 pagesTitan Financial Modelyadhu krishnaNo ratings yet

- Cash FlowDocument6 pagesCash Flowmicahcoleen.cagampanNo ratings yet

- Bis PresentationDocument12 pagesBis PresentationPratiksha TiwariNo ratings yet

- FMV Avenue Supermarts LTD 1690769719Document22 pagesFMV Avenue Supermarts LTD 1690769719Anle17No ratings yet

- Davelouis LTD: Sales $24,750,000 $25,368,750 Costs and Expenses $8,910,000 $9,640,125 Tax (25%) $6,682,500 $7,230,094Document6 pagesDavelouis LTD: Sales $24,750,000 $25,368,750 Costs and Expenses $8,910,000 $9,640,125 Tax (25%) $6,682,500 $7,230,094Josué LeónNo ratings yet

- Money and The MythDocument11 pagesMoney and The MythpankajsinhaNo ratings yet

- Financial Stat Fin464Document23 pagesFinancial Stat Fin464Sadia Sultana SristyNo ratings yet

- CFM Excel JojoDocument30 pagesCFM Excel Jojoviedereen12No ratings yet

- Sales Report 2020 Vs 2021Document114 pagesSales Report 2020 Vs 2021Hongyi KaltimNo ratings yet

- BBG Adj HighlightsDocument1 pageBBG Adj HighlightsMaria Pia Rivas LozadaNo ratings yet

- SailashreeChakraborty 13600921093 FM401Document12 pagesSailashreeChakraborty 13600921093 FM401Sailashree ChakrabortyNo ratings yet

- Presented By-: Adarsh Kumar Singh Vivek Kushwaha Apurba Saha Vanamala Akhil Animesh ChhetriDocument12 pagesPresented By-: Adarsh Kumar Singh Vivek Kushwaha Apurba Saha Vanamala Akhil Animesh Chhetrisang kumarNo ratings yet

- Lupin Limited: Multinational Pharmaceutical CompanyDocument27 pagesLupin Limited: Multinational Pharmaceutical Companyrishabh bisaniNo ratings yet

- Hero Moto CorpDocument102 pagesHero Moto CorpMurtaza BadriNo ratings yet

- Correctional Officer Vacancy and Salary InformationDocument1 pageCorrectional Officer Vacancy and Salary InformationMarcus FlowersNo ratings yet

- COPIES FinancialDocument8 pagesCOPIES FinancialArboleda, Arvin John Luro.No ratings yet

- Smart Task 3Document8 pagesSmart Task 3Tushar GuptaNo ratings yet

- Horizontal and Vertical AnalysisDocument10 pagesHorizontal and Vertical AnalysisJannelle PanangitanNo ratings yet

- Shubham Question 2Document17 pagesShubham Question 2Shubham DeyNo ratings yet

- Reliance Financial Model (Done)Document5 pagesReliance Financial Model (Done)achal jainNo ratings yet

- Adani Total GasDocument13 pagesAdani Total GasShiv LalwaniNo ratings yet

- Year Total Market Size Target Market Share Yearly Revenue Yearly CostsDocument3 pagesYear Total Market Size Target Market Share Yearly Revenue Yearly CostsRiturajPaulNo ratings yet

- Form Remun 24 Sls v5 Feb - NUHDocument27 pagesForm Remun 24 Sls v5 Feb - NUHjukicen.vNo ratings yet

- Premium Calculator: Select PeriodDocument5 pagesPremium Calculator: Select PeriodDeep DkNo ratings yet

- Prodaja Po KvartalimaDocument2 pagesProdaja Po KvartalimaDuško PetrovićNo ratings yet

- PDJ 2008-BTDocument3 pagesPDJ 2008-BTVijendra Kumar DubeyNo ratings yet

- Vijendra Kumar Dubey: ObjectiveDocument2 pagesVijendra Kumar Dubey: ObjectiveVijendra Kumar DubeyNo ratings yet

- National Institute of Technology, Raipur: Unit - 1 Circuit Analysis (Ac and DC)Document1 pageNational Institute of Technology, Raipur: Unit - 1 Circuit Analysis (Ac and DC)Vijendra Kumar DubeyNo ratings yet

- Situation Reaction TestDocument4 pagesSituation Reaction Testlionheart112No ratings yet

- ACTRANDocument3 pagesACTRANVijendra Kumar DubeyNo ratings yet

- 15 Situations Which May Confuse You in SRT - SSB Interview Tips & Coaching - SSBCrackDocument14 pages15 Situations Which May Confuse You in SRT - SSB Interview Tips & Coaching - SSBCrackVijendra Kumar DubeyNo ratings yet

- Circuit BreakerDocument1 pageCircuit BreakerVijendra Kumar DubeyNo ratings yet

- Circuit BreakerDocument1 pageCircuit BreakerVijendra Kumar DubeyNo ratings yet

- ATT2100 & 2200 ManualDocument52 pagesATT2100 & 2200 ManualFranco SNo ratings yet

- Fire Safety Manager Course: Fire Extinguisher Theory, ServicingDocument34 pagesFire Safety Manager Course: Fire Extinguisher Theory, Servicingbobjuan84100% (2)

- Haryana With CommentsDocument148 pagesHaryana With Commentsmanojkumartomar7513No ratings yet

- Chemistry Project On Salivary AmylaseDocument16 pagesChemistry Project On Salivary AmylaseSurjyasnata Rath100% (2)

- Anthropocene102 595 PDFDocument17 pagesAnthropocene102 595 PDFTimothy CaldwellNo ratings yet

- T.l.e9 T1 Tools and Equipment Needed in Preparing AppetizersDocument38 pagesT.l.e9 T1 Tools and Equipment Needed in Preparing AppetizersRedginald CalderonNo ratings yet

- MLM Engineering Sample Two Storey Residential Building-WBS Item/Description 1 General RequirementsDocument12 pagesMLM Engineering Sample Two Storey Residential Building-WBS Item/Description 1 General RequirementsNiño EvangelioNo ratings yet

- IGCSE - 4 Forces and Energy - Set 1 - Energy, Work and Power - Theory, Part 1Document14 pagesIGCSE - 4 Forces and Energy - Set 1 - Energy, Work and Power - Theory, Part 1huxxiNo ratings yet

- Idol and Icon Big TimeDocument5 pagesIdol and Icon Big Timewojtek.stawarzNo ratings yet

- Lesson1 - CRS002 JNDocument13 pagesLesson1 - CRS002 JNHaifa KalantunganNo ratings yet

- Rock Reinforcement SDA SWX RFXDocument113 pagesRock Reinforcement SDA SWX RFXruben_david_a100% (1)

- Oil and Gas ExplorationDocument87 pagesOil and Gas ExplorationVanix DesuasidoNo ratings yet

- Contoh Format SoalDocument3 pagesContoh Format SoalAinol mardiyahNo ratings yet

- PPE Risk Assessment DocumentDocument5 pagesPPE Risk Assessment DocumentFarzanaNo ratings yet

- Operators GuideDocument380 pagesOperators Guideswapon kumar shillNo ratings yet

- Junos Release Notes 12.3r11 PDFDocument390 pagesJunos Release Notes 12.3r11 PDFHellman Roman Pinzon GarciaNo ratings yet

- Cashflow Project CimahiDocument50 pagesCashflow Project CimahiBrandy HarperNo ratings yet

- Definium Amx 700Document240 pagesDefinium Amx 700محمدعبدالخالق العلوانيNo ratings yet

- List of AGMs Promoted As GMs W.E.F. 25.06.2023Document2 pagesList of AGMs Promoted As GMs W.E.F. 25.06.2023Abhishek ChoubeyNo ratings yet

- 12AVR100ET: More Power - Less SpaceDocument2 pages12AVR100ET: More Power - Less SpaceNgân Hàng Ngô Mạnh TiếnNo ratings yet

- Sub Contractor at Nominated Subcontractor (NSC) Local Contractor Vs Domestic Contractor at - The CHAT-QSDocument11 pagesSub Contractor at Nominated Subcontractor (NSC) Local Contractor Vs Domestic Contractor at - The CHAT-QSLukman HakimNo ratings yet

- Panasonic Broadcast AJ-D455 Mechanical ArtsDocument26 pagesPanasonic Broadcast AJ-D455 Mechanical ArtskarkeraNo ratings yet

- Welding Code, or AWS D1.1, Structural Welding Code-Steel) To The Construction Division, MaterialsDocument10 pagesWelding Code, or AWS D1.1, Structural Welding Code-Steel) To The Construction Division, MaterialsDak KaizNo ratings yet

- Biodiesel Pilot PlatDocument30 pagesBiodiesel Pilot PlatKhairul AnwarNo ratings yet

- Cobiax Slab TechnologyDocument2 pagesCobiax Slab TechnologykomalNo ratings yet

- Yo Rub ADocument17 pagesYo Rub ARowland Anton Barkley57% (7)

- Chapter 1 - Electrolyte and Non-Electrolyte Solution - CKH2021Document23 pagesChapter 1 - Electrolyte and Non-Electrolyte Solution - CKH2021Lộc NguyễnNo ratings yet