Professional Documents

Culture Documents

Orient - Table of Benefits

Orient - Table of Benefits

Uploaded by

d.deustacchioOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Orient - Table of Benefits

Orient - Table of Benefits

Uploaded by

d.deustacchioCopyright:

Available Formats

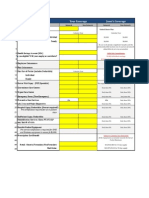

Table of Benefits for Dubai and Others Emirates

Group Name THALLIUM CONSULTING

Effective Date 27/May/22

Quote Release Date 0/Jan/00

Category A

Insurance Plan Plan5

Territorial Scope of Coverage Worldwide

Aggregate Annual Limit AED 250,000

Medical Network NEXTCARE RN3 (Out-patient is restricted to Clinics Only)

Room type Semi-Private

Consultation Limit Covered

Parent Accommodation for child under 18 years of age AED 150 / day

Accommodation of an accompanying person in the same room as per recommendation of

AED 150 / day

attending physician, subject to prior approval.

Home Nursing post Hospitalization Covered up to Maximum AED 7,500 per person per annum

Emergency road ambulance services to and from hospital by registered ambulance services

Covered

provider

Deductible per Consultation (will not be applicable for follow-up within 7 days for same treatment

20% max 50

and with same doctor)

Covered up to AAL

Prescribed Drugs & Medicines

Subject to 0% Co-pay

Diagnostics ( X-ray, MRI, CT-Scan, Ultra Sound& Endoscopy diagonistic services ) Covered up to AAL subject to 10% Co-pay

Covered up to the Annual limit subject to the following:

No waiting period applies if evidence of continuity of coverage (COC)

in UAE is provided; otherwise, the limit will be restricted to AED

150,000/- PPPA.

Pre-existing and/or ongoing chronic conditions should be declared as

Pre-existing & Chronic Conditions

per the medical application form (MAF) for all members above 60

years old and for all the groups below 20 members and is subject to

medical underwriting. Undeclared medical conditions will not be

covered during the policy period.

Any form of Cancer shall fall within the definition of Chronic

conditions.

Claims Settlement In-Patient:

1. UAE within the Network- Direct Billing 100% after applicable co-pay

2. Area of coverage as per Territorial Scope / Outside the Network / With or without prior approval of the 80% of actual costs or 80% of the UCR as per UAE network tariffs for

ceding company - Reimbursement basis only same or similar treatment whichever is less

Claims Settlement Out-Patient:

1. UAE within the Network - Direct Billing 100% after applicable co-pay

80% of actual costs or 80% of the UCR as per UAE network tariffs for

2. Area of coverage as per Territorial Scope / Outside the Network - Reimbursement basis only

same or similar treatment whichever is less

Reimbursement in Emergency Cases:

(emergency treatment must be notified within 24 hours if treatment was received within UAE)

Eligible Treatment 100% of incurred costs

UAE 100% of incurred costs

Inside Territorial Scope 100% of incurred costs

Outside Territorial Scope

Category A

Insurance Plan Plan5

AED 150 per night

Cash Indemnity for In-Patient Treatment post hospitlization up to max of 15 days, subject to

Applicable to all inpatient hospitalizations that are not submitted to

providing discharge summary or proof of hospitalization

the Insurance Company

Essential vaccinations and inoculations for newborns and children as stipulated in the DHA’s Inside Network: 100% Actual Cost

policies and its updates (currently the same as Federal MOH) Outside Network : UCR Basis

Physiotherapy ( Subject to pre-approval) 10 sessions per member per annum

Frequency restricted to:

Preventive services, vaccines and immunizations Diabetes: Every 3 years from age 30

High risk individuals annually from age 18

Diagnostic and treatment services for dental and gum treatments ( Emergency cases Only)

Dental emergency is any injury to your teeth or gums that can put you at a risk of permanent damage, such as Chipped or Covered

broken teeth, Knocked-out tooth ,Soft-tissue injuries and etc

Hearing and vision aids, and vision correction by surgeries and laser ( Emergency cases Only)

Hearing Emergencies include Object/insect in the ear , ruptued eardrum , sudden hearing loss and etc Covered

Vision Emergencies include bleeding or discharge from or around the eye, double vision and Loss of vision, total or partial, one

eye or both etc.

Kidney Dialysis Treatment

Covered up to Maximum AED 20,000 per person per annum

Coverage for hemodialysis or peritoneal dialysis

Healthcare services for work illnesses and injuries as per Federal Law No.8 of 1980 concerning

Covered up to Maximum AED 10,000 per person per annum

the Regulation of Work Relations, as amended, and applicable laws in this respect

Adult Pneumococcal Conjugate Vaccine Covered as per DHA Adult Pneumococcal Vaccination guidelines

Cancer Treatment

Covered as per the Terms,Conditions and Exclusions of the program

Screening, Healthcare Services, Investigations and Treatments only for members enrolled under Patient

defined by DHA.

Support Program only

Hepatitis B & C Virus Screening and Treatment

Covered as per the Terms,Conditions and Exclusions of the program

Screening, Healthcare Services, Investigations and Treatments only for members enrolled under Patient

defined by DHA.

Support Program only

Influenza Vaccine Covered once per Annum

In-Patient, Out-Patient, and Emergency cover up to a maximum of

AED 10,000/- per person per annum.

Psychiatric and Mental Health 20% coinsurance payable by the insured per visit for Out-Patient

services.

No coinsurance is applicable if a follow-up vist is made within seven

days

Covered up to Maximum AED 10,000 per person per annum settled

Repatriation of Mortal Remains to the Country of Domicile:

on Reimbursement basis with no co-pay

This benefit gives members access through NEXtCARE mobile

application to world renowned providers to re-evaluate their earlier

diagnosis, medical history and treatment plan for non-emergency

Second Medical Opinion

cases.

Cardholder is entitled to use the Second Medical Opinion service two

times within the 12 months Policy validity period.

Category A

Insurance Plan Plan5

In-patient maternity services:

10% coinsurance payable by the insured,

Maximum benefit AED 10,000 per delivery

Requires prior approval from the insurance company or within 24

hours of emergency treatment

10% coinsurance payable by the insured

Out-patient maternity services:

10% coinsurance payable by the insured

maximum 8 visits are allowed (as per applicable network);

Maternity Services

Initial investigations to include:

- FBC and Platelets

- Blood group, Rhesus status and antibodies

- VDRL

- MSU & urinalysis

- Rubella serology

- HIV

- Hep C offered to high risk patients

- GTT if high risk

- FBS , random s or A1c for all due to high prevalence of diabetes in

UAE

Visits to include reviews, checks and tests in accordance with DHA

Antenatal Care Protocols

3 ante-natal ultrasound scans

Dental benefit Limited to AED 1,500/- subject to 20% Co-pay

C overs the following: Consultation & X-Ray, Scaling & Polishing, Tootth Extraction, Amalgam fillings, In-Network: Direct Billing

Temporary and/or permanent composite, fillings and root canal treatment only. Out of Network: Reimbursement

Optical benefit

C overs the following: Optical examinations conducted for the purpose of obtaining eye glasses or

upgrading existing lenses, Consultation by an ophthalmologist, Sight testing, Medication (included within

the optical benefit)

Not covered

Subject to following Sub Limits :

AED 300/- per pair per single vision lenses.

AED 400/- per pair per bifocal or tri-focal vision lenses.

AED 500/- per pair of contact lenses

Limited to AED 2,500 per person per annum

Alternative Medicines

20% coinsurance payable by the insured per visit.

Covers the following: Chiropractic, Osteopathy, Homeopathy, and Ayurveda

No coinsurance is applicable if a follow-up vist is made within seven

days

Organ transplantation shall cover the organ transplantation as

recipient excluding any cost related to donor, and excluding the

Organ Transplant acquisition and organ cost

Organs covered are: heart, lung, kidney, pancreas, liver, Allogeneic &

autologous bone marrow.

Covered as per the Terms,Conditions and Exclusions defined by

New Born Cover

DHA.

This benefit gives members access through NEXtCARE mobile

application to a qualified doctor, for general medical advice and

instructions for self-care or recommendations on medications. For

Medical Advice Service “See A Doctor” (UAE)

users calling from the UAE only, the physician can issue a

prescription for the recommended medications. The service can only

be accessed during the validity period of the policy coverage.

This benefit can be covered subject to the following guidelines:

- Cost of In-Patient treatment at home country is 50% or less

Return Airfare Ticket compared to the cost of the same treatment and applicable network

for In-Patient treatment at home country charges in UAE

- Covered only for the patient (i.e. excluding accompanying persons)

- Only on reimbursement basis, and subject to pre-approval

- Covered up to a maximum of AED 3,000 for the round trip ticket

Cash benefit in case of death

- Applicable only to groups having at least 10 members

- Applicable only to members above age 1 year and below age 65 years only

- 100% of the cash benefit will be payable in the event of death of an Employee

- Only 50% of the cash benefit shall be payable in the event of death of an enrolled Spouse

- Only 25% of the cash benefit shall be payable in the event of death of an enrolled Child

Exclusions:

Life benefits will not be paid if the death was as a result of:

1) Active participation in war, riots, civil disturbances, terrorism, criminal acts, illegal acts or acts against any foreign The following cash benefit shall be payable to a member's declared

hostility, whether war has been declared or not. beneficiary in the event of death:

2) Intentionally caused diseases or self-inflicted injuries, including suicide

3) Chemical or biological contamination, radioactivity or any nuclear material contamination, including the AED 10,000

combustion of nuclear fuel.

4) Passive War Risk:

a) Being in a country, where the UAE government has recommended their citizens to leave (this criterion will apply

regardless of the insured person’s nationality) and advised against ‘all travel’ there; or

b) Travelling to or staying, for a period of more than 28 days per stay, in a country or an area where the UAE

government advise against all but essential travel;

The Passive War Risk exclusions apply regardless of whether the claim arises directly or indirectly as a

consequence of war, riots, civil disturbances, terrorism, criminal acts, illegal acts or acts against any foreign hostility,

whether war has been declared or not.

5) All military engineers during training are excluded, except for mandatory training of UAE nationals as per

government directives

Wellness Benefit Not Covered

Please note that in case benefits fall below the minimum required by DHA or the benefit which is not provided in this TOB and is required by DHA, then the cover under the policy will automatically

increase/include the benefit to the same level as requested by DHA

You might also like

- Health Insurance Ebook PDFDocument29 pagesHealth Insurance Ebook PDFPrashant Pote100% (1)

- Health ModelDocument41 pagesHealth ModelMayom Mabuong100% (4)

- 2022 Benefits GuideDocument32 pages2022 Benefits GuidelskjfasNo ratings yet

- Category B Emirates Insurance PDFDocument5 pagesCategory B Emirates Insurance PDFDonald HamiltonNo ratings yet

- PolicyDocument10 pagesPolicyKalyaniNo ratings yet

- Medgulf Nextcare Rn2 TobDocument4 pagesMedgulf Nextcare Rn2 Tobkcatolico00No ratings yet

- Plan 5 DXB - 20 - CopayDocument3 pagesPlan 5 DXB - 20 - CopayPrathibha SewwandiNo ratings yet

- Plan 2 DXB - 20 - CopayDocument3 pagesPlan 2 DXB - 20 - CopayPrathibha SewwandiNo ratings yet

- Basic Plan - PCP CDocument3 pagesBasic Plan - PCP Cmht1No ratings yet

- Family Care Product Table of Benefits (Valid For Dubai Based Members)Document4 pagesFamily Care Product Table of Benefits (Valid For Dubai Based Members)Kannan SrinivasanNo ratings yet

- Family Care Product Policyholder: SHAZIA KHALID (Quotation No. 1)Document4 pagesFamily Care Product Policyholder: SHAZIA KHALID (Quotation No. 1)Moksh SharmaNo ratings yet

- Dnirc Silk Road Plan ADocument4 pagesDnirc Silk Road Plan AMoksh SharmaNo ratings yet

- Benefits / Coverage Aggregate Annual LimitDocument6 pagesBenefits / Coverage Aggregate Annual LimitFAZILNo ratings yet

- Star Health Premier - Version 1.0 - Mar - 22Document33 pagesStar Health Premier - Version 1.0 - Mar - 22Anoop AravindNo ratings yet

- Silver DXB 0% (120923)Document7 pagesSilver DXB 0% (120923)arasakumar_mNo ratings yet

- Rak Mednet Emerald QuoteDocument6 pagesRak Mednet Emerald QuoteKeith Jireh CatolicoNo ratings yet

- Quotation ENHANCED 2 - PLAN 4 - Essential AafiyaDocument24 pagesQuotation ENHANCED 2 - PLAN 4 - Essential AafiyaMelody PacardoNo ratings yet

- NLGI - TOB Cat CDocument6 pagesNLGI - TOB Cat Cshylesh.raveendranNo ratings yet

- Below Limit Options Are Per Person in AED: Family Care Product #N/ADocument4 pagesBelow Limit Options Are Per Person in AED: Family Care Product #N/AcmthebossNo ratings yet

- HP Benefits 1104 1Document6 pagesHP Benefits 1104 1Anu Raj Anu RajNo ratings yet

- Family Care Product-DubaiDocument7 pagesFamily Care Product-DubaiatherNo ratings yet

- TOB FCP Dubai Dec 2022Document7 pagesTOB FCP Dubai Dec 2022JeffNo ratings yet

- Product Information - DHA Plans Table of BenefitsDocument8 pagesProduct Information - DHA Plans Table of BenefitsAhmedNo ratings yet

- Option 1 NAS Dependants Enhanced 1Document16 pagesOption 1 NAS Dependants Enhanced 1Sridhar BNo ratings yet

- Gold Plus DXB 20% (120923)Document7 pagesGold Plus DXB 20% (120923)ccmms6yngfNo ratings yet

- OMAN DHA Plus Table of Benefits (Individuals Dependants) Above 4000Document8 pagesOMAN DHA Plus Table of Benefits (Individuals Dependants) Above 4000Rayees RasheedNo ratings yet

- TakafulEmarat Silver AUHDocument6 pagesTakafulEmarat Silver AUHMuruga AnanthNo ratings yet

- GMC Benefit Manual - 22Document28 pagesGMC Benefit Manual - 22SwaNo ratings yet

- NLGI CHROME - Hospital AccessDocument4 pagesNLGI CHROME - Hospital Accessmht1No ratings yet

- IDA Policy - DetailsDocument3 pagesIDA Policy - DetailsRavinderNo ratings yet

- Option 2 NAS Dependants Enhanced 2Document10 pagesOption 2 NAS Dependants Enhanced 2Sridhar BNo ratings yet

- GMC Policy Terms and ConditionsDocument12 pagesGMC Policy Terms and Conditionssomya89No ratings yet

- Table of Benefits: DHA Plans - Healthcare InsuranceDocument6 pagesTable of Benefits: DHA Plans - Healthcare InsuranceShoeb MohammedNo ratings yet

- Schedule INDM202200111963 0.HomeLiteDocument51 pagesSchedule INDM202200111963 0.HomeLiteZeeshan HasanNo ratings yet

- MaxMed 2023 SILVER GROUP TOB Category CDocument14 pagesMaxMed 2023 SILVER GROUP TOB Category Cbaashii4No ratings yet

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithDocument4 pagesBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithlawrenziNo ratings yet

- Individual Medical Policy For Employees - Emed: Table of BenefitsDocument6 pagesIndividual Medical Policy For Employees - Emed: Table of Benefitsrahul sNo ratings yet

- Family Care Plan - Dubai & Northern EmiratesDocument6 pagesFamily Care Plan - Dubai & Northern Emiratesneelkant sharmaNo ratings yet

- Royal Sundaram General Insurance Co. Limited (Formerly Known As Royal Sundaram Alliance Insurance Company Limited)Document2 pagesRoyal Sundaram General Insurance Co. Limited (Formerly Known As Royal Sundaram Alliance Insurance Company Limited)Abhijit MohantyNo ratings yet

- Proposal For: Insurer: Date Created: Class Name:: Enhanced Plan - CareDocument7 pagesProposal For: Insurer: Date Created: Class Name:: Enhanced Plan - CareUSMAN MIRNo ratings yet

- Star Cancer Care Platinum One PagerDocument2 pagesStar Cancer Care Platinum One Pagerricky aliaNo ratings yet

- Cat A - TobDocument3 pagesCat A - Tobit cleancoNo ratings yet

- KfvnlefnvklfvfkiiDocument7 pagesKfvnlefnvklfvfkiiUSMAN MIRNo ratings yet

- Be Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithDocument4 pagesBe Your Own Superhero!: Don'T Let A Critical Illness Stop You. Be Financially Prepared WithursvinciNo ratings yet

- Category 3 - TOB 2Document7 pagesCategory 3 - TOB 2Krishna PrasathNo ratings yet

- Basic PlanDocument3 pagesBasic Planrahul sNo ratings yet

- MCI One Pager Version 1.0 Oct 2020Document1 pageMCI One Pager Version 1.0 Oct 2020naval730107No ratings yet

- Quotation For Health InsuranceDocument1 pageQuotation For Health InsuranceTheSyed GOCNo ratings yet

- Ne Plan 2 - 150K NextcareDocument6 pagesNe Plan 2 - 150K NextcareatherNo ratings yet

- TOB - SukoonDocument26 pagesTOB - SukoonKeith Jireh CatolicoNo ratings yet

- NAS - PLAN 3 - AUH (Yaqoot)Document6 pagesNAS - PLAN 3 - AUH (Yaqoot)nest.mariaNo ratings yet

- Table of Benefits-Oasis Investment2Document18 pagesTable of Benefits-Oasis Investment2ppdeepakNo ratings yet

- Tere MDF MadDocument19 pagesTere MDF MadJitendra BhatewaraNo ratings yet

- Group PolicyDocument14 pagesGroup PolicyMahesh DivakarNo ratings yet

- PolicySoftCopy 665566135Document13 pagesPolicySoftCopy 665566135Ольга МиличенковаNo ratings yet

- RAKEssentialMedicalPolicybrochure PDFDocument2 pagesRAKEssentialMedicalPolicybrochure PDFMohammed ShamilNo ratings yet

- Arogya Sanjeevani Policy From Future GeneraliDocument9 pagesArogya Sanjeevani Policy From Future GeneraliColin GeneraliNo ratings yet

- Product BrochureDocument10 pagesProduct Brochureathul.kcNo ratings yet

- Individual Medical Policy For Employees - Emed: Table of BenefitsDocument7 pagesIndividual Medical Policy For Employees - Emed: Table of Benefitskanikak97No ratings yet

- Oman Home TobDocument6 pagesOman Home TobAhmedNo ratings yet

- Leaflet PDFDocument9 pagesLeaflet PDFVyshak SamakNo ratings yet

- Investors' Individual Medical Policy - Imed: Table of BenefitsDocument7 pagesInvestors' Individual Medical Policy - Imed: Table of BenefitsRAJ KOTINo ratings yet

- Nas - Plan 3 - Auh (Yaqoot)Document5 pagesNas - Plan 3 - Auh (Yaqoot)ccmms6yngfNo ratings yet

- Pharmacy Insurance BasicsDocument10 pagesPharmacy Insurance BasicsMarquita HunterNo ratings yet

- Policy Version-3Document59 pagesPolicy Version-3payalNo ratings yet

- Medical Benefits SummaryDocument1 pageMedical Benefits SummaryJanet Zimmerman McNicholNo ratings yet

- 26 07 2015 General StudiesDocument12 pages26 07 2015 General StudiesHarsha SekaranNo ratings yet

- Every DETAIL Matters To Your HEALTH.: Policy ContractDocument38 pagesEvery DETAIL Matters To Your HEALTH.: Policy Contractmaakabhawan26No ratings yet

- South Middleton School District, Teacher Contract NegotiationDocument18 pagesSouth Middleton School District, Teacher Contract NegotiationPennLiveNo ratings yet

- Introduction To 270/271: Health Care Eligibility Inquiry/ResponseDocument18 pagesIntroduction To 270/271: Health Care Eligibility Inquiry/ResponseNikhil SatavNo ratings yet

- Minneapolis Air ReserveDocument16 pagesMinneapolis Air ReserveCAP History LibraryNo ratings yet

- MCS New Hire GuideDocument45 pagesMCS New Hire GuideEsha ChaudharyNo ratings yet

- Individual and Family Plans Made SimpleDocument16 pagesIndividual and Family Plans Made SimpleShNo ratings yet

- Health - Individual Mediclaim Policy PDFDocument25 pagesHealth - Individual Mediclaim Policy PDFAlakh BhattNo ratings yet

- Project ReportDocument68 pagesProject ReportNazim UmarNo ratings yet

- Final Exam Spr2011Document5 pagesFinal Exam Spr2011Austin Holmes50% (4)

- JACAM Benefit OverviewDocument7 pagesJACAM Benefit OverviewStephenDohertyNo ratings yet

- Blue Cross Select BronzeDocument6 pagesBlue Cross Select Bronzeapi-285960909No ratings yet

- Are You Really Insured?: Text: Allan JardineDocument2 pagesAre You Really Insured?: Text: Allan JardineDarcy_92No ratings yet

- Group Medical Insurance: FaqsDocument4 pagesGroup Medical Insurance: FaqsVenugopal ChowdaryNo ratings yet

- 2021 Table Of Benefits 保险福利责任表 - TP Pension - BSH博西 - FMU - Intl Incl Canada 20210810Document32 pages2021 Table Of Benefits 保险福利责任表 - TP Pension - BSH博西 - FMU - Intl Incl Canada 20210810asdf dsafajsdcomNo ratings yet

- Going To Hospital GuideDocument32 pagesGoing To Hospital GuideSusan JackmanNo ratings yet

- Discovery 2020Document6 pagesDiscovery 2020BusinessTech100% (1)

- Rak Mednet Emerald QuoteDocument6 pagesRak Mednet Emerald QuoteKeith Jireh CatolicoNo ratings yet

- Cost Control in Health Care......................................Document11 pagesCost Control in Health Care......................................Rifat ParveenNo ratings yet

- C This Is Only A Summary.: Important Questions Answers Why This MattersDocument8 pagesC This Is Only A Summary.: Important Questions Answers Why This MattersChris DuffnerNo ratings yet

- Senior Citizen Red Carpet Brochure PDFDocument4 pagesSenior Citizen Red Carpet Brochure PDFCHRISTY JOSENo ratings yet

- Caremark Drug ListDocument10 pagesCaremark Drug ListRahul DocNo ratings yet

- Provider Search RequestDocument26 pagesProvider Search RequestREINALDONo ratings yet