Professional Documents

Culture Documents

Ifrs Vs Usgaap

Ifrs Vs Usgaap

Uploaded by

Prachi Jain0 ratings0% found this document useful (0 votes)

3 views2 pagesIFRS and USGAAP are the two main accounting standards used globally. IFRS is issued by the IASB and adopted globally, while USGAAP is issued by the FASB and adopted in the US. There are some key differences between the two standards in how they account for cash flows, inventory valuations, and non-current assets and liabilities. For example, IFRS requires different cash flow statement line items for dividends paid versus received, while USGAAP treats them the same. IFRS also allows for reversal of inventory write-downs up to previously recognized losses and uses multiple inventory cost flow methods, unlike USGAAP. Further differences exist for research and development costs, impairment testing

Original Description:

Original Title

Ifrs vs Usgaap

Copyright

© © All Rights Reserved

Available Formats

PDF, TXT or read online from Scribd

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentIFRS and USGAAP are the two main accounting standards used globally. IFRS is issued by the IASB and adopted globally, while USGAAP is issued by the FASB and adopted in the US. There are some key differences between the two standards in how they account for cash flows, inventory valuations, and non-current assets and liabilities. For example, IFRS requires different cash flow statement line items for dividends paid versus received, while USGAAP treats them the same. IFRS also allows for reversal of inventory write-downs up to previously recognized losses and uses multiple inventory cost flow methods, unlike USGAAP. Further differences exist for research and development costs, impairment testing

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

0 ratings0% found this document useful (0 votes)

3 views2 pagesIfrs Vs Usgaap

Ifrs Vs Usgaap

Uploaded by

Prachi JainIFRS and USGAAP are the two main accounting standards used globally. IFRS is issued by the IASB and adopted globally, while USGAAP is issued by the FASB and adopted in the US. There are some key differences between the two standards in how they account for cash flows, inventory valuations, and non-current assets and liabilities. For example, IFRS requires different cash flow statement line items for dividends paid versus received, while USGAAP treats them the same. IFRS also allows for reversal of inventory write-downs up to previously recognized losses and uses multiple inventory cost flow methods, unlike USGAAP. Further differences exist for research and development costs, impairment testing

Copyright:

© All Rights Reserved

Available Formats

Download as PDF, TXT or read online from Scribd

Download as pdf or txt

You are on page 1of 2

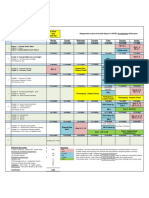

IFRS vs USGAAP differences for CFA Level 1

Kunal Doshi, CFA

IFRS – issued by IASB, is a reporting standard which is adopted globally.

USGAAP – issued by FASB, which is a reporting standard which is adopted by US-based

Companies.

Note: Although major differences between both are converged, some key differences as

displayed below, remain.

IFRS vs US-GAAP – Cash Flow Adjustments

IFRS USGAAP

Accounting Standard IASB FASB

Body

Cash Flow (Dividend CFO / CFF CFF

Paid)

Cash Flow (Dividend CFO / CFI CFO

Recd.)

Cash Flow (Interest Paid) CFO / CFF CFO

Cash Flow (Dividend CFO / CFI CFO

Recd.)

Cash Flow (Taxes Paid) CFO / CFI / CFF CFO

Reconciliation of Net Not Required Required

Income and CFO

IFRS vs US-GAAP – Inventory Adjustments

IFRS (Non-LIFO) USGAAP LIFO

Inventory Costs flow FIFO, Weighted Average, FIFO, Weighted Average,

method Specific Identification Specific Identification & LIFO

Inventory Valuation Lower of (Cost, NRV) Lower of (Cost,

Market/Replacement Cost)

Write-down reversal Allowed but till previously Not Allowed (however,

recognized loss only exception in certain

commodities)

Inventory Changes Should provide reason that the Must explain why the change

change will provide reliable in cost flow method is

and more relevant information preferable

YouTube Channel: Prof. Kunal R Doshi 1

IFRS vs USGAAP differences for CFA Level 1

IFRS vs US-GAAP – Non-Current Assets & Liabilities Adjustments

IFRS USGAAP

Research and Research Cost = Expensed Research Cost = Expensed

Development Costs Development Cost = Development Cost =

Capitalized Expensed

Software Development Before establishing Technical Before establishing Technical

Costs Feasibility = Expensed Feasibility = Expensed

Before establishing Technical Before establishing Technical

Feasibility = Capitalized Feasibility = Capitalized

Component Depreciation Required Allowed

Asset Valuation (for all Cost Model and Revaluation Cost Model only

assets) Model both allowed

Asset Valuation (for Cost Model and Fair Value Cost Model only

Investment Property) Model both allowed

Impairment Test Tested at least annually Tested only when events

indicate that firm is unable to

recover the carrying value

Impaired Condition Carrying Value > Recoverable Carrying Value > Future

Amount Undiscounted Cash Flow

Impairment Loss Carrying Value – Recoverable Carrying Value – Fair Value

Amount

Recoverable amount: If Fair Value is not present,

Max (NRV, Value in Use) then take Value in Use

Impairment Loss reversal Allowed but till previously Not Allowed (however,

recognized loss only allowed if Asset held for sale)

Valuation Allowance for The amount of Valuation A Valuation allowance is

DTA allowance not separately recognized if DTA is unable

disclosed to reverse

Lease treatment for For finance and operating For a finance lease, the ROU

Lessee for Right of Use lease, the ROU is amortized on is amortized on SLM but for

Asset (ROU) SLM Operating lease ROU is

amortized by the amount of

decrease in the lease liability

Website: www.eduinvest.in

LinkedIn: https://www.linkedin.com/in/kunal-doshi-cfa-86142215/

YouTube Channel: Prof. Kunal R Doshi 2

You might also like

- Aca Masters FarDocument46 pagesAca Masters FarjessahyeNo ratings yet

- Business ValuationDocument34 pagesBusiness ValuationashishNo ratings yet

- Ifrs Usgaap NotesDocument38 pagesIfrs Usgaap Notesaum_thai100% (1)

- IFRS Vs US GAAPDocument8 pagesIFRS Vs US GAAPArpit MaheshwariNo ratings yet

- What Is IFRS?: 2009 & Earlier 2010 2011 2012 No AdoptionDocument5 pagesWhat Is IFRS?: 2009 & Earlier 2010 2011 2012 No AdoptionArsal AliNo ratings yet

- IRFS Vs GAAPDocument7 pagesIRFS Vs GAAP31231021989No ratings yet

- IFRS Vs US GAAP - 2024Document8 pagesIFRS Vs US GAAP - 2024AMARTYA KUMAR DAS PGP 2023-25 BatchNo ratings yet

- Last Unit AsseignmentDocument7 pagesLast Unit AsseignmentmmewamulugetaNo ratings yet

- ch12 PDFDocument9 pagesch12 PDFEmma Mariz GarciaNo ratings yet

- Fra PDFDocument27 pagesFra PDFNeeraj KumarNo ratings yet

- 5.07 Analysis of Long-Term Assets - AnswersDocument36 pages5.07 Analysis of Long-Term Assets - Answersgustavo eichholzNo ratings yet

- Long Lived Assets (Peserta)Document23 pagesLong Lived Assets (Peserta)bush0275No ratings yet

- ValuationDocument37 pagesValuationDivyam AgarwalNo ratings yet

- Discount RateDocument9 pagesDiscount RateNguyễn PhúcNo ratings yet

- AS 10 - Property Plant and Equipment: Recognition CriteriaDocument5 pagesAS 10 - Property Plant and Equipment: Recognition CriteriaAshutosh shriwasNo ratings yet

- Corporate Reporting - MFRS136 - Impairment of Assets - Dayana MasturaDocument26 pagesCorporate Reporting - MFRS136 - Impairment of Assets - Dayana MasturaDayana MasturaNo ratings yet

- The Philippine Financial Reporting Standards: PFRS Updates TrainingDocument74 pagesThe Philippine Financial Reporting Standards: PFRS Updates TrainingMara Shaira Siega100% (1)

- Pas 16 Property Plant and EquipmentDocument4 pagesPas 16 Property Plant and EquipmentKristalen ArmandoNo ratings yet

- Ifrs 9Document80 pagesIfrs 9Veer Pratab SinghNo ratings yet

- Mas 15Document11 pagesMas 15Christine Jane AbangNo ratings yet

- Key Differences Between US GAAP and IFRSDocument46 pagesKey Differences Between US GAAP and IFRSmohamedNo ratings yet

- For With God, Nothing Shall Be Impossible. (Luke 1:37) : Accounting ReviewerDocument7 pagesFor With God, Nothing Shall Be Impossible. (Luke 1:37) : Accounting ReviewerDebbie Grace Latiban LinazaNo ratings yet

- Assets PrintingDocument7 pagesAssets PrintingIrtiza AbbasNo ratings yet

- Nas 16Document33 pagesNas 16bhattag283No ratings yet

- Fixed Assets (FINAL)Document13 pagesFixed Assets (FINAL)Salman Saeed100% (1)

- Final Output in Applied Auditing 2: Submitted byDocument23 pagesFinal Output in Applied Auditing 2: Submitted bychosNo ratings yet

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting StandardsDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAP and International Accounting Standardsjoy26iNo ratings yet

- Analysis of Financial StatementsDocument19 pagesAnalysis of Financial StatementsGautam MNo ratings yet

- Simplified Summary of Significant Differences Between US GAAP, Indian GAAPDocument7 pagesSimplified Summary of Significant Differences Between US GAAP, Indian GAAPishakc20070% (1)

- SS - 5-6 - Mindmaps - Financial ReportingDocument48 pagesSS - 5-6 - Mindmaps - Financial Reportinghaoyuting426No ratings yet

- Week 5 - Chapter 4Document45 pagesWeek 5 - Chapter 4AJNo ratings yet

- Bài 10 - Đo Lư NG MarketingDocument13 pagesBài 10 - Đo Lư NG MarketingNgọc TrâmNo ratings yet

- MAS-42O: Financial Statement Analysis: - T R S ADocument11 pagesMAS-42O: Financial Statement Analysis: - T R S AStefanie FerminNo ratings yet

- Prepared By: Jessy ChongDocument7 pagesPrepared By: Jessy ChongDaleNo ratings yet

- Expressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDocument3 pagesExpressed As A Percentage of The Value of Revenue or Sales.: Balance Sheet: Reports What The Organization Owns and OwesDGNo ratings yet

- Practice Questions - Financial Statement Analysis 2022Document36 pagesPractice Questions - Financial Statement Analysis 2022Mulundu BrianNo ratings yet

- Intangible AssetsDocument3 pagesIntangible Assetsgreat angelNo ratings yet

- Ind As - 16Document11 pagesInd As - 16OopsbymistakeNo ratings yet

- FAR 17 - Investment in PropertyDocument2 pagesFAR 17 - Investment in Propertymrsjeon0501No ratings yet

- Long Lived Assets L1Document37 pagesLong Lived Assets L1heisenbergNo ratings yet

- Financial Accounting Analysis Cheat SheetDocument1 pageFinancial Accounting Analysis Cheat SheetMinyu LvNo ratings yet

- Financial Ratio AnalysisDocument5 pagesFinancial Ratio AnalysisPhuoc TruongNo ratings yet

- Capital Budgeting NotesDocument2 pagesCapital Budgeting Noteszy jeiNo ratings yet

- What Is A Business Objective?Document5 pagesWhat Is A Business Objective?Anh Nguyễn đứcNo ratings yet

- OCI and Its Treatment in LawDocument24 pagesOCI and Its Treatment in LawCA TanishNo ratings yet

- 4 5787441562044597537 PDFDocument1 page4 5787441562044597537 PDFShayan TahseenNo ratings yet

- Property, Plant & Equipment: Measurement After RecognitionDocument49 pagesProperty, Plant & Equipment: Measurement After RecognitionPapa Ekow ArmahNo ratings yet

- FR-1 NotesDocument501 pagesFR-1 Noteshuma30417No ratings yet

- Ratio AnalysisDocument10 pagesRatio AnalysisUdayan KarnatakNo ratings yet

- 017 Strategy Chapter 9 Strategy Evaluation SlidesDocument32 pages017 Strategy Chapter 9 Strategy Evaluation SlidesNash AsanaNo ratings yet

- SBR笔记总结分享Document33 pagesSBR笔记总结分享Suet CheeNo ratings yet

- Accounting Standard Summary Notes Group IDocument15 pagesAccounting Standard Summary Notes Group ISrinivasprasadNo ratings yet

- ICAIEKM Material 180116Document57 pagesICAIEKM Material 180116INTER SMARTIANSNo ratings yet

- Valuation - Discounted Cash Flow Method With Case Studies: Bengaluru Branch of SIRC of ICAIDocument33 pagesValuation - Discounted Cash Flow Method With Case Studies: Bengaluru Branch of SIRC of ICAIpre.meh21No ratings yet

- CH 06 Decision MakingDocument10 pagesCH 06 Decision Makingamrita jothiNo ratings yet

- ValuationhandbookDocument30 pagesValuationhandbooksoumyakumarNo ratings yet

- AFFS w3Document21 pagesAFFS w3Thi Kim Ngan TranNo ratings yet

- Ratio AnalysisDocument13 pagesRatio Analysismuralib4u5No ratings yet

- Beyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkFrom EverandBeyond Earnings: Applying the HOLT CFROI and Economic Profit FrameworkNo ratings yet

- Chapter 3 Accounting EquationDocument3 pagesChapter 3 Accounting Equationbae joohyunNo ratings yet

- Answers To Chapter 8 Test Your Knowledge: AppendixDocument7 pagesAnswers To Chapter 8 Test Your Knowledge: AppendixMuhammad AmirNo ratings yet

- Schedule-Of-Charge-2023 Trust Bank PLCDocument12 pagesSchedule-Of-Charge-2023 Trust Bank PLCfinancialsafetynetforbankersNo ratings yet

- CBK 2018 Annual ReportDocument120 pagesCBK 2018 Annual ReportLarry KivayaNo ratings yet

- 02 Financial EnvironmentDocument29 pages02 Financial EnvironmentJill Russelle AsuncionNo ratings yet

- "ABS" Project Case: "ABS" Is The First Project of The CU Company. The Economic Life of This Project Is 8Document16 pages"ABS" Project Case: "ABS" Is The First Project of The CU Company. The Economic Life of This Project Is 8islam hamdyNo ratings yet

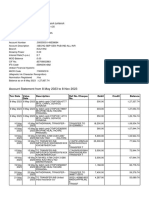

- Audu-Bida, Suleiman Hamza: Customer StatementDocument3 pagesAudu-Bida, Suleiman Hamza: Customer Statementyusuf nasiruNo ratings yet

- ECGCDocument19 pagesECGCSOUVIK ROY MBA 2021-23 (Delhi)No ratings yet

- Home Ownweship Part 2 - FinalDocument8 pagesHome Ownweship Part 2 - FinalAlthea Guila GorresNo ratings yet

- Overview of Financial Accounting in SAPDocument31 pagesOverview of Financial Accounting in SAPyashghodke83No ratings yet

- FY-7.6 Student Activity Packet - Google DocsDocument2 pagesFY-7.6 Student Activity Packet - Google Docstarikhero755No ratings yet

- 8-Week Web 2nd Half: Chapter 1 - Personal Finance Basics Chapter 2 - Career Chapter 3-Financial Statements and BudgetsDocument1 page8-Week Web 2nd Half: Chapter 1 - Personal Finance Basics Chapter 2 - Career Chapter 3-Financial Statements and BudgetsArianna KelawalaNo ratings yet

- ReqfgDocument2 pagesReqfgshaliena leeNo ratings yet

- Lili Monthly Statement 2022-08 2Document2 pagesLili Monthly Statement 2022-08 2Robert Wilson100% (1)

- Statement of Account - 171017 To 151117Document2 pagesStatement of Account - 171017 To 151117Anonymous 44AH37TUNo ratings yet

- Banks and Banking 1: What Kind of Services Do Banks Offer?Document4 pagesBanks and Banking 1: What Kind of Services Do Banks Offer?Karima MammeriNo ratings yet

- Ermenegildo Zegna N.V. (ZGN)Document2 pagesErmenegildo Zegna N.V. (ZGN)Carlos Suárez MatosNo ratings yet

- Unit 6 Money and BankingDocument70 pagesUnit 6 Money and BankingTrần Diệu MinhNo ratings yet

- Panjab University, Chandigarh: Online Payment SlipDocument1 pagePanjab University, Chandigarh: Online Payment SlipRahul RaoNo ratings yet

- What Are The Different Types of Banking TransactionsDocument5 pagesWhat Are The Different Types of Banking Transactionsbackupsanthosh21 dataNo ratings yet

- A Study On Comparative Analysis of Mutuful Fund Analysis in Icici BankDocument84 pagesA Study On Comparative Analysis of Mutuful Fund Analysis in Icici BankeswariNo ratings yet

- Internship Arif FinalDocument58 pagesInternship Arif Finalটিটন চাকমাNo ratings yet

- Interest Rates and Interest Charges: Capital One Application TermsDocument6 pagesInterest Rates and Interest Charges: Capital One Application TermsMohammad Azam khanNo ratings yet

- .II Sem III and IV NEP Syllabus 2023-24 Minor ChangesDocument132 pages.II Sem III and IV NEP Syllabus 2023-24 Minor ChangesPRITI RAJPUTNo ratings yet

- OSX FinancialAccounting ISM Ch14Document32 pagesOSX FinancialAccounting ISM Ch14eynullabeyliseymurNo ratings yet

- Executive Summary:: The Bank of PunjabDocument40 pagesExecutive Summary:: The Bank of PunjabLucifer Morning starNo ratings yet

- Quiz Financial MarketDocument3 pagesQuiz Financial MarketAmie Jane MirandaNo ratings yet

- Reverse Mortgage LoanDocument5 pagesReverse Mortgage Loanjiwrajka.shikharNo ratings yet

- DBG Y9 WT4 GHW4 G LHiDocument5 pagesDBG Y9 WT4 GHW4 G LHiamit06sarkarNo ratings yet

- Course Outline - Bsa 101 - Fundamentals of Acctng 1 - RBMDocument7 pagesCourse Outline - Bsa 101 - Fundamentals of Acctng 1 - RBMRoselyn Mangaron SagcalNo ratings yet