Professional Documents

Culture Documents

Financial Asset at Fair Value Through Profit or Loss

Financial Asset at Fair Value Through Profit or Loss

Uploaded by

Johnallenson DacosinOriginal Description:

Copyright

Available Formats

Share this document

Did you find this document useful?

Is this content inappropriate?

Report this DocumentCopyright:

Available Formats

Financial Asset at Fair Value Through Profit or Loss

Financial Asset at Fair Value Through Profit or Loss

Uploaded by

Johnallenson DacosinCopyright:

Available Formats

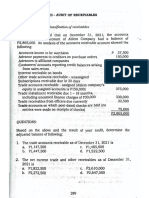

Financial Asset at Fair Value through profit or loss

1. On January 1, 2020, Giling-Giling Girls Company purchased the following trading securities:

Fair value

Cost Dec. 31, 2020

Docor Company Ordinary 600,000 650,000

Aguiflor Company preference 350,000 200.000

Manjares Company bonds 500,000 400,000

On October 1, 2021, the entity sold one-half of Docor Company ordinary for P375,000.

On December 31, 2021, the fair value of the remaining securities was P800,000.

Prepare journal entries to record the transactions.

2. Gerald Aguilar Company carried out the following transactions in bond investments held for

trading during the current year.

2021

July. 1 Purchased 5,000, P1,000, 12% bonds of Lea Erica Company at 104 plus accrued interest of

P150,000. The bonds pay interest semi-annually on April 1 and October 1.

July. 31 Purchased 2,000, P1,000, 12% bonds of Rizalinda Company at 98 plus accrued interest.

Semi-annual payment of interest, May 31 and November 30.

Dec. 1 Sold 2,000 of the Lea Erica bonds at 102 plus accrued interest.

Dec. 31 The following quotations were obtained:

Lea Erica bond 98

Rizalinda bond 99

Prepare journal entries to record the transactions.

You might also like

- Solved Refer To The Information For Dandy Candy Below Dandy Candy BoughtDocument1 pageSolved Refer To The Information For Dandy Candy Below Dandy Candy BoughtAnbu jaromiaNo ratings yet

- Bond ProblemsDocument27 pagesBond ProblemsCharity Laurente Bureros83% (6)

- Audit of InvestmentsDocument9 pagesAudit of InvestmentsGirlie SisonNo ratings yet

- 01 - Preweek Lecture and ProblemsDocument15 pages01 - Preweek Lecture and ProblemsMelody GumbaNo ratings yet

- Lecture 02Document2 pagesLecture 02sheenacgacitaNo ratings yet

- Quiz On InvestmentDocument3 pagesQuiz On InvestmentDan Andrei BongoNo ratings yet

- Practical Accounting 1Document6 pagesPractical Accounting 1Myiel AngelNo ratings yet

- Audprob Answer 2Document2 pagesAudprob Answer 2venice cambryNo ratings yet

- Pertemuan 12 - Investasi Obligasi PDFDocument21 pagesPertemuan 12 - Investasi Obligasi PDFayu utamiNo ratings yet

- Solved On January 1 2020 Perry Manufacturing Issued Bonds With ADocument1 pageSolved On January 1 2020 Perry Manufacturing Issued Bonds With AAnbu jaromiaNo ratings yet

- Handout in Financial Assets 2Document2 pagesHandout in Financial Assets 2Micaella GrandeNo ratings yet

- Prepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Document20 pagesPrepared By: Mohammad Muariff S. Balang, CPA, Second Semester, AY 2012-2013Pdf FilesNo ratings yet

- InvestmentDocument18 pagesInvestmentEmiaj Francinne MendozaNo ratings yet

- 4 Audit of Investments Docx Accounting Examination PDF Copy DownloadedDocument12 pages4 Audit of Investments Docx Accounting Examination PDF Copy DownloadedJANISCHAJEAN RECTONo ratings yet

- Long Quiz in Intermediate Accounting 1 PART 1aDocument4 pagesLong Quiz in Intermediate Accounting 1 PART 1aGillian mae Garcia0% (2)

- HI6028 Taxation Theory, Practice & Law: T2 2018 Individual Assignment (2500 Words)Document3 pagesHI6028 Taxation Theory, Practice & Law: T2 2018 Individual Assignment (2500 Words)Aduda Ruiz BenahNo ratings yet

- Intermediate Accounting 1 FinalDocument5 pagesIntermediate Accounting 1 FinalCix SorcheNo ratings yet

- AC - IntAcctg1 Quiz 04 With AnswersDocument2 pagesAC - IntAcctg1 Quiz 04 With AnswersSherri Bonquin100% (1)

- Homework 6 - Long-Term Financial LiabilitiesDocument2 pagesHomework 6 - Long-Term Financial LiabilitiesCha PampolinaNo ratings yet

- InvestmentsDocument7 pagesInvestmentsIvan LandaosNo ratings yet

- Aec 22 - Take Home Long Quiz: Trading SecuritiesDocument4 pagesAec 22 - Take Home Long Quiz: Trading SecuritiesOriel Ricky GallardoNo ratings yet

- AP - InvestmentDocument7 pagesAP - InvestmentGrace Patricia TeopeNo ratings yet

- ACT1205 Audit of InvestmentDocument7 pagesACT1205 Audit of InvestmentAybe MarceloNo ratings yet

- 5 6145300324501422422 PDFDocument3 pages5 6145300324501422422 PDFBeverly MindoroNo ratings yet

- Notes ReceivablesDocument5 pagesNotes ReceivablesDianna DayawonNo ratings yet

- On December 31 2010 Sauder Associates Owned The Following PDFDocument1 pageOn December 31 2010 Sauder Associates Owned The Following PDFAnbu jaromiaNo ratings yet

- Corporation LectureDocument12 pagesCorporation Lecturejoyce jabileNo ratings yet

- Bonds ProblemDocument9 pagesBonds ProblemLouie De La TorreNo ratings yet

- Chapter 17 In-Class Exercises Intermediate AccountingDocument2 pagesChapter 17 In-Class Exercises Intermediate AccountingFoodlovesJNo ratings yet

- Sallys Struthers - ProblemDocument1 pageSallys Struthers - ProblemLlyod Francis LaylayNo ratings yet

- Problem 2Document1 pageProblem 2G-Malacas, Sheryn MaeNo ratings yet

- AC - IntAcctg1 Quiz 2Document4 pagesAC - IntAcctg1 Quiz 2john hellNo ratings yet

- AUD.2024 5. Substantive Tests of InvestmentsDocument4 pagesAUD.2024 5. Substantive Tests of InvestmentskrizmyrelatadoNo ratings yet

- Finals Bcacc MQCDocument12 pagesFinals Bcacc MQCLaurence BacaniNo ratings yet

- Latihan 2 Short-Term InvestmentsDocument13 pagesLatihan 2 Short-Term InvestmentsshanidaNo ratings yet

- Audit of Shareholders' EquityDocument1 pageAudit of Shareholders' EquityPanda ErarNo ratings yet

- 12 Altprob 7eDocument6 pages12 Altprob 7eAarti JNo ratings yet

- 6902 - Investment Property and Other InvestmentDocument3 pages6902 - Investment Property and Other InvestmentAljur SalamedaNo ratings yet

- 4 - Audit of InvestmentsDocument11 pages4 - Audit of InvestmentsSharmaine Clemencio0No ratings yet

- Discussion Aid 2 ABCDocument2 pagesDiscussion Aid 2 ABCJoleen DoniegoNo ratings yet

- ACCOUNTING 7 & 8 Midterm Quiz1Document3 pagesACCOUNTING 7 & 8 Midterm Quiz1John Mark PalapuzNo ratings yet

- Sample Problems - Bonds PayableDocument2 pagesSample Problems - Bonds PayableDump DumpNo ratings yet

- Exam 1 8Document9 pagesExam 1 8Kenneth DelacruzNo ratings yet

- Intermediate Accounting I - Investment Part 1Document3 pagesIntermediate Accounting I - Investment Part 1Joovs Joovho0% (3)

- Midterms - Assignment No. 1Document1 pageMidterms - Assignment No. 1cedrickNo ratings yet

- Biological Assets - Seatwork - 09.07.2020Document1 pageBiological Assets - Seatwork - 09.07.2020Lee SuarezNo ratings yet

- Audit Problem Investments Part 1Document3 pagesAudit Problem Investments Part 1Rio Cyrel CelleroNo ratings yet

- BondsDocument7 pagesBondsmerrycrispepito129No ratings yet

- Bonds 1Document7 pagesBonds 1Shaine MalunjaoNo ratings yet

- PROBLEM 31 Share CapitalDocument2 pagesPROBLEM 31 Share CapitalJean Dareel LimboNo ratings yet

- A Fire Occurred On 25th April 2021 in The Premises of A CompanyDocument8 pagesA Fire Occurred On 25th April 2021 in The Premises of A Companythella deva prasad100% (1)

- A Fire Occurred On 25th April 2021 in The Premises of A CompanyDocument7 pagesA Fire Occurred On 25th April 2021 in The Premises of A Companythella deva prasadNo ratings yet

- PNC MT Examination Finacc 3Document3 pagesPNC MT Examination Finacc 3joevitt delfinadoNo ratings yet

- Dirk Company Reported The Following Balances at December 31 2018Document1 pageDirk Company Reported The Following Balances at December 31 2018CharlotteNo ratings yet

- Summary of David Einhorn's Fooling Some of the People All of the TimeFrom EverandSummary of David Einhorn's Fooling Some of the People All of the TimeNo ratings yet

- Private Equity: Access for All: Investing in Private Equity through the Stock MarketsFrom EverandPrivate Equity: Access for All: Investing in Private Equity through the Stock MarketsNo ratings yet

- Using Economic Indicators to Improve Investment AnalysisFrom EverandUsing Economic Indicators to Improve Investment AnalysisRating: 3.5 out of 5 stars3.5/5 (1)

- Audit of Biological AssetsDocument3 pagesAudit of Biological AssetsJohnallenson DacosinNo ratings yet

- p2 Guerrero Ch10 CompressDocument1 pagep2 Guerrero Ch10 CompressJohnallenson DacosinNo ratings yet

- Lecture 03 FA at FV Through OCIDocument1 pageLecture 03 FA at FV Through OCIJohnallenson DacosinNo ratings yet

- Chapter 6 NGODocument1 pageChapter 6 NGOJohnallenson DacosinNo ratings yet

- Science 1 - John Allenson Dacosin - Bsa 2aDocument6 pagesScience 1 - John Allenson Dacosin - Bsa 2aJohnallenson DacosinNo ratings yet

- THEORY InventoryDocument1 pageTHEORY InventoryJohnallenson DacosinNo ratings yet

- Module 9-Dacosin, John Allenson DDocument6 pagesModule 9-Dacosin, John Allenson DJohnallenson DacosinNo ratings yet

- NGO Chapter 4 QUESTIONSDocument1 pageNGO Chapter 4 QUESTIONSJohnallenson DacosinNo ratings yet

- Ethics - Module 8Document4 pagesEthics - Module 8Johnallenson DacosinNo ratings yet

- Intercompany AssetsDocument1 pageIntercompany AssetsJohnallenson DacosinNo ratings yet

- Chapter 5 in HBO ReviewerDocument11 pagesChapter 5 in HBO ReviewerJohnallenson DacosinNo ratings yet

- AR ClassificationDocument3 pagesAR ClassificationJohnallenson DacosinNo ratings yet

- Activity Chapter 4Document27 pagesActivity Chapter 4Johnallenson DacosinNo ratings yet

- FA 2 ModuleDocument16 pagesFA 2 ModuleJohnallenson DacosinNo ratings yet

- General PrinciplesDocument11 pagesGeneral PrinciplesJohnallenson DacosinNo ratings yet

- Module 6Document51 pagesModule 6Johnallenson DacosinNo ratings yet

- CPAR Tax On Estates and Trusts Batch 91 HandoutDocument10 pagesCPAR Tax On Estates and Trusts Batch 91 HandoutJohnallenson DacosinNo ratings yet

- DeductionsDocument29 pagesDeductionsJohnallenson DacosinNo ratings yet

- Sale or Exchange of PropertyDocument7 pagesSale or Exchange of PropertyJohnallenson DacosinNo ratings yet

- RCF (Mp32diuuusl5 (XDocument57 pagesRCF (Mp32diuuusl5 (XJohnallenson DacosinNo ratings yet

- Activity CostDocument5 pagesActivity CostJohnallenson DacosinNo ratings yet